Professional Documents

Culture Documents

Module 10

Module 10

Uploaded by

api-2989431560 ratings0% found this document useful (0 votes)

40 views11 pagesThis document discusses time series analysis and forecasting techniques. It provides examples of using simple exponential smoothing to forecast demand. In one example, given a previous forecast of 70 and actual demand of 60, the forecast for the next period is calculated as 67 using an alpha of 0.3. Another example calculates the demand forecast for 2012 as 892 given a 2011 forecast of 910 and actual demand of 850, using an alpha of 0.3. The document also discusses using moving averages, exponential smoothing, naive forecasting, and linear regression to forecast demand for the month of September based on historical monthly demand data.

Original Description:

Original Title

module 10

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses time series analysis and forecasting techniques. It provides examples of using simple exponential smoothing to forecast demand. In one example, given a previous forecast of 70 and actual demand of 60, the forecast for the next period is calculated as 67 using an alpha of 0.3. Another example calculates the demand forecast for 2012 as 892 given a 2011 forecast of 910 and actual demand of 850, using an alpha of 0.3. The document also discusses using moving averages, exponential smoothing, naive forecasting, and linear regression to forecast demand for the month of September based on historical monthly demand data.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

40 views11 pagesModule 10

Module 10

Uploaded by

api-298943156This document discusses time series analysis and forecasting techniques. It provides examples of using simple exponential smoothing to forecast demand. In one example, given a previous forecast of 70 and actual demand of 60, the forecast for the next period is calculated as 67 using an alpha of 0.3. Another example calculates the demand forecast for 2012 as 892 given a 2011 forecast of 910 and actual demand of 850, using an alpha of 0.3. The document also discusses using moving averages, exponential smoothing, naive forecasting, and linear regression to forecast demand for the month of September based on historical monthly demand data.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 11

Essential Quantitative Skills for

Business

Module (10)

Time Series

Analysis

By : ALI ADEL ALI ALI IBRAHIM

Time Series Analysis

Problem#1:

Given an actual demand of 60 for a period

when forecast of 70 was anticipated, and an

alpha of 0.3, what would the forecast for the

next period be using simple exponential

smoothing?

Time Series Analysis

Solution#1:

F = (1-0.3)(70)+0.3(60) = 67

Time Series Analysis

Problem#2:

Suppose you have been asked to generate a demand

forecast for a product for year 2012 using an exponential

smoothing method. The forecast demand in 2011 was

910. The actual demand in 2011 was 850. Using this data

and a smoothing constant of 0.3, which of the following is

the demand forecast for year 2012?

A) 850

B) 885

C) 892

D) 925

E) 930

Time Series Analysis

Solution#2:

F = (1-0.3)(910)+0.3(850) = 892

Time Series Analysis

Problem#3:

Use exponential smoothing to forecast this

periods demand if = 0.2, previous actual

demand was 30, and previous forecast was 35.

A) 29

B) 31

C) 34

D) 36

E) 37

Time Series Analysis

Solution#3:

F = (1-0.2)(35)+0.2(30) = 34

Time Series Analysis

Problem#4:

Given the following demand data

Month

Feb Mar Apr May Jun

Demand 19 18 15 20 18 22 20

Jul Aug

a) Draw the data.

b) Forecast for September using Five period moving average.

c) Forecast for September using Exponential smoothing. Alpha

is 0.2 and forecast for march was 19.

d) Forecast for September using Nave method

e) Compute MAD for Nave Method and Exponential

Smoothing. Which one is preferred? Nave Method and

Exponential Smoothing?

f) Forecast for September using Linear Regression

Time Series Analysis

Solution#4:

Time Series Analysis

Solution#4:

F8 =MA7= (A7+A6+A5+A4+A3)/5 = (20+22+18+20+15)/5

F8 =MA7= 19

Time Series Analysis

Solution#4:

You might also like

- R06 Time-Series AnalysisDocument16 pagesR06 Time-Series AnalysisIndonesian Pro0% (2)

- Statistiek 1920 HER ENG CovDocument8 pagesStatistiek 1920 HER ENG CovThe PrankfellasNo ratings yet

- Set 1Document2 pagesSet 1Sravya Sri0% (10)

- Question Paper OM, EPGP-13 (Sec B)Document5 pagesQuestion Paper OM, EPGP-13 (Sec B)Akshay SinghNo ratings yet

- pdf24 MergedDocument36 pagespdf24 Mergednavneet kalantriNo ratings yet

- Edited Tutorial Earned Value QuestionDocument6 pagesEdited Tutorial Earned Value Questionnaderaqistina23No ratings yet

- Sapient Problem StatementDocument3 pagesSapient Problem Statementsomil duaNo ratings yet

- Production and Operation Management: NAME: - ERP: - DATEDocument3 pagesProduction and Operation Management: NAME: - ERP: - DATEMahnoor AmjadNo ratings yet

- Forecasting in Business (PPT) - 092138Document53 pagesForecasting in Business (PPT) - 092138tetteh godwinNo ratings yet

- First Term Assignment COMM 2055: Question 1 (Module 1)Document4 pagesFirst Term Assignment COMM 2055: Question 1 (Module 1)Wenli FuNo ratings yet

- Reading 2 Time-Series AnalysisDocument47 pagesReading 2 Time-Series Analysistristan.riolsNo ratings yet

- Industrial Engineering 2009 by S K Mondal PDFDocument217 pagesIndustrial Engineering 2009 by S K Mondal PDFAshok DargarNo ratings yet

- Cse3090y 2020 2Document9 pagesCse3090y 2020 2Khritish BhoodhooNo ratings yet

- Industrial Engineering by S K Mondal (Marinenotes - Blogspot.com)Document318 pagesIndustrial Engineering by S K Mondal (Marinenotes - Blogspot.com)Abilasha VediappanNo ratings yet

- MBA MS 08 English December 2019Document4 pagesMBA MS 08 English December 201916kuldeepgautamNo ratings yet

- Ch02 Project Evaluation and Programme ManagementDocument40 pagesCh02 Project Evaluation and Programme Managementlioofficial.meNo ratings yet

- 4th Sem. Asst. 2018-19Document18 pages4th Sem. Asst. 2018-19GOPAL SHARMANo ratings yet

- Math - T (5) QDocument24 pagesMath - T (5) Q水墨墨No ratings yet

- 2011 BSP320 Test1Document4 pages2011 BSP320 Test1tambomalitaNo ratings yet

- End20 Highlighted MCQ ANSDocument11 pagesEnd20 Highlighted MCQ ANS36rajnee kantNo ratings yet

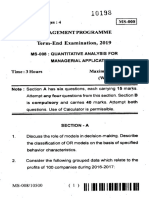

- Programme Term-End Examination, 2019: No. of Printed Pages: 4Document4 pagesProgramme Term-End Examination, 2019: No. of Printed Pages: 4athiraNo ratings yet

- MT 1 f00 604 SolnDocument10 pagesMT 1 f00 604 SolnMohitNo ratings yet

- Gujarat Technological UniversityDocument4 pagesGujarat Technological UniversityJigneshNo ratings yet

- ForecastingDocument50 pagesForecastingMartinus Bagus WicaksonoNo ratings yet

- BAIT3153 Tutorial 1-8 QuesDocument9 pagesBAIT3153 Tutorial 1-8 QuesLUDWIG CHEWNo ratings yet

- MT 1 w02 604 SolnDocument9 pagesMT 1 w02 604 SolnRachel Pacis Renti CruzNo ratings yet

- Gre 502 2020Document4 pagesGre 502 2020ajiejohn56No ratings yet

- WBS-2-Operations Analytics-W1S5-Practice-Problems-SolutionsDocument6 pagesWBS-2-Operations Analytics-W1S5-Practice-Problems-SolutionsrpercorNo ratings yet

- QAM-III - Mukesh Mehlawat (F, G, H, I)Document3 pagesQAM-III - Mukesh Mehlawat (F, G, H, I)206Ishu GuptaNo ratings yet

- Fin304 (Mid-Sem Answers 2021)Document9 pagesFin304 (Mid-Sem Answers 2021)sha ve3No ratings yet

- CH 3 Aggregate Planning Part IIDocument32 pagesCH 3 Aggregate Planning Part IIVINAY BETHANo ratings yet

- Iima Teaching Note MertonDocument8 pagesIima Teaching Note MertonHarshal NaikNo ratings yet

- Statistics and Optimization Techniques 2021 Q PAPERDocument3 pagesStatistics and Optimization Techniques 2021 Q PAPERDr Praveen KumarNo ratings yet

- Lal Bahadur Shastri Institute of Management, Delhi: PGDM - (General/R&BA/Finance Term-III) End-Term Exam, April 2021Document4 pagesLal Bahadur Shastri Institute of Management, Delhi: PGDM - (General/R&BA/Finance Term-III) End-Term Exam, April 2021Nishit SrivastavNo ratings yet

- Homework 3 SolDocument3 pagesHomework 3 SolgraceNo ratings yet

- Bba V Production & Operation ManagementDocument3 pagesBba V Production & Operation Managementmunna michealNo ratings yet

- Om Iii IatDocument3 pagesOm Iii IatAbijith K SNo ratings yet

- Group Assignment - QsDocument6 pagesGroup Assignment - QsSyazwan Lagenda Bola SepakNo ratings yet

- Tutorial Earned Value QuestionDocument6 pagesTutorial Earned Value QuestionnailofarNo ratings yet

- Final Exam: Mathematics For Engineers (W2021)Document8 pagesFinal Exam: Mathematics For Engineers (W2021)spppppNo ratings yet

- Assignment Unit1Document2 pagesAssignment Unit1Akhil DayaluNo ratings yet

- 2019 SA Feb-19Document18 pages2019 SA Feb-19vishwas kumarNo ratings yet

- Data AnalysisDocument5 pagesData AnalysisHadia ShamsNo ratings yet

- POM Model Question PaperDocument3 pagesPOM Model Question PaperKailas Sree ChandranNo ratings yet

- Assignment-Project ManagementDocument2 pagesAssignment-Project ManagementAnu KrishnaNo ratings yet

- MWR-01 Assignment (PGCIPWS)Document4 pagesMWR-01 Assignment (PGCIPWS)Amit YadavNo ratings yet

- MBA Exam - SGDocument9 pagesMBA Exam - SGaliaa alaaNo ratings yet

- Aggregate Planning Part II EditedDocument33 pagesAggregate Planning Part II EditedBüşra TurgunNo ratings yet

- Past Paper - 201005 MayDocument13 pagesPast Paper - 201005 MayPeggy Chan0% (1)

- 27.12.10h15 KTLTC De-1Document6 pages27.12.10h15 KTLTC De-1LinaNo ratings yet

- PAM 1st Sem Final-2016 (03.09.16)Document2 pagesPAM 1st Sem Final-2016 (03.09.16)Sarjeel Ahsan NiloyNo ratings yet

- Mba202 - Financial ManagementDocument3 pagesMba202 - Financial ManagementArvind KNo ratings yet

- Assignment IDocument4 pagesAssignment IChristina SparksNo ratings yet

- BCA SEMESTER-IV Assignments 2021-22Document16 pagesBCA SEMESTER-IV Assignments 2021-22Divya KumariNo ratings yet

- SPM Tutorial 01Document4 pagesSPM Tutorial 01WEI SHEUNG CHENNo ratings yet

- 2017 Final ExamDocument24 pages2017 Final ExamBi11y 1eeNo ratings yet

- Optimization Techniques-I Paper: OR-305/SC-304 (Semester-Iii)Document4 pagesOptimization Techniques-I Paper: OR-305/SC-304 (Semester-Iii)Jaskaran SinghNo ratings yet

- Revised 202101 Tutorial STUDENTS VERSION UBEQ1013 Quantitative Techniques IDocument53 pagesRevised 202101 Tutorial STUDENTS VERSION UBEQ1013 Quantitative Techniques IPavitra RavyNo ratings yet

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- Blue Prism Developer Certification Case Based Practice Question - Latest 2023From EverandBlue Prism Developer Certification Case Based Practice Question - Latest 2023No ratings yet

- Module InteractionDocument3 pagesModule Interactionapi-298943156No ratings yet

- Blended Syllabus TemplateDocument4 pagesBlended Syllabus Templateapi-298943156No ratings yet

- M Schedule TemplateDocument1 pageM Schedule Templateapi-298943156No ratings yet

- Module 7Document9 pagesModule 7api-298943156No ratings yet

- Module 9Document5 pagesModule 9api-298943156No ratings yet

- Module 6Document7 pagesModule 6api-298943156No ratings yet

- Module 4Document5 pagesModule 4api-298943156No ratings yet

- Module 5Document5 pagesModule 5api-298943156No ratings yet

- Module 3Document6 pagesModule 3api-298943156No ratings yet

- Module 1Document10 pagesModule 1api-298943156No ratings yet