Professional Documents

Culture Documents

Contractionary Monetary Policy

Contractionary Monetary Policy

Uploaded by

Bishawnath RoyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contractionary Monetary Policy

Contractionary Monetary Policy

Uploaded by

Bishawnath RoyCopyright:

Available Formats

Contractionary Monetary Policy:

A form of monetary policy in which a decrease in the money supply and a increase in interest

rates are used to correct the inflationary problems of a business-cycle expansion. In theory,

contractionary monetary policy can include an increase in the discount rate, and an increase in

reserve requirements. In theory, open market operations are the primary tool of contractionary

monetary policy. Contractionary monetary policy is often supported by contractionary fiscal

policy.

Contractionary monetary policy is a decrease in the quantity of money in circulation, with

corresponding increases in interest rates, for the expressed purpose of putting the brakes on an

overheated business-cycle expansion and to address the problem of inflation.

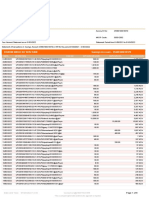

Contractionary Monetary Policy with Graph:

Asthemoneysupplyiscontracted,interest

ratesrise,investmentwillfall,

consumptionwillfallandnetexportswill

fall.

Peoplemakeaportfoliochoice.Peoplewill

choosetoholdmorebondsthantheydid

beforebecausethereturnonabondhas

risen(ihasgoneup).

i =people invest in dollar denominated asset. So, buy dollars = value of dollar rises

The Effects of Monetary Policy on Real GDP and the Price Level:

In panel the economy begins at point A, with real GDP at $14.2 trillion and

the price level at 102.

A contractionary monetary policy

causes aggregate demand to shift to

the left, from AD1 to AD , decreasing

real GDP from $14.2 trillion to $14.0

trillion and the price level from 102 to

100 (point B).

2

With real GDP back at its potential

level, the Fed can meet its goal of price

stability.

You might also like

- Resolution To Open Bank Acc. Final 1-3Document2 pagesResolution To Open Bank Acc. Final 1-3Reu EllarinaNo ratings yet

- Policy Responses To Ease Credit CrisisDocument13 pagesPolicy Responses To Ease Credit CrisisAmitNo ratings yet

- Monytary PolicyDocument20 pagesMonytary PolicyYuvraj SinghNo ratings yet

- Fiscal Policy Monetary PolicyDocument5 pagesFiscal Policy Monetary PolicyKhyell PayasNo ratings yet

- Principles of Economics 1Document10 pagesPrinciples of Economics 1peterNo ratings yet

- Monetary PolicyDocument18 pagesMonetary Policymodasra100% (2)

- Monetary Policy: Five Facts About Wikipedia That You May Not KnowDocument12 pagesMonetary Policy: Five Facts About Wikipedia That You May Not KnowGoutam ReddyNo ratings yet

- EconomicsDocument10 pagesEconomicsAyesha SanaNo ratings yet

- Monetary PolicyDocument16 pagesMonetary PolicyLara JacksonNo ratings yet

- RBI and Its Monetary Policy: Managerial Economics-IiDocument18 pagesRBI and Its Monetary Policy: Managerial Economics-IiPravin NisharNo ratings yet

- Assignment On Macroeconomics ShammyDocument10 pagesAssignment On Macroeconomics ShammyZahid RaihanNo ratings yet

- Monetary PolicyDocument17 pagesMonetary PolicyBernard OkpeNo ratings yet

- Introduction To Macroeconomics: Monetary Policy Is The Process by Which TheDocument20 pagesIntroduction To Macroeconomics: Monetary Policy Is The Process by Which ThehammanbukarNo ratings yet

- Monetary Policy Is The Process by Which The: o o o o o o o o o o o o o o oDocument15 pagesMonetary Policy Is The Process by Which The: o o o o o o o o o o o o o o oSantosh SinghNo ratings yet

- Monetary Policy Is The Process by Which TheDocument17 pagesMonetary Policy Is The Process by Which TheAvonpreet KaurNo ratings yet

- Lectures of Monetary PolicyDocument4 pagesLectures of Monetary PolicyMughees AhmedNo ratings yet

- Exchange-Rate Regime: FloatDocument15 pagesExchange-Rate Regime: FloatRuth LopesNo ratings yet

- Monetary PolicyDocument5 pagesMonetary PolicyManu SalaNo ratings yet

- Monetary PolicyDocument31 pagesMonetary PolicyGaurav JadhavNo ratings yet

- Monetary and Fiscal PolicyDocument22 pagesMonetary and Fiscal PolicydhawalraginiNo ratings yet

- Monetary Policy of ChinaDocument12 pagesMonetary Policy of Chinavenkatesh fmNo ratings yet

- C Is The Process by Which TheDocument15 pagesC Is The Process by Which TheaisparamanandamNo ratings yet

- FinalDocument5 pagesFinalJenifar SoheliNo ratings yet

- Economicanalysis 13019011738885 Phpapp01Document64 pagesEconomicanalysis 13019011738885 Phpapp01Anuj SharmaNo ratings yet

- Monetary Policy and Fiscal PolicyDocument13 pagesMonetary Policy and Fiscal PolicyAAMIR IBRAHIMNo ratings yet

- Inflation: Samir K MahajanDocument9 pagesInflation: Samir K MahajanKeval VoraNo ratings yet

- Bba 2 EcoDocument4 pagesBba 2 EcoNayan MaldeNo ratings yet

- Monetary Policy AssignmentDocument3 pagesMonetary Policy Assignmentapi-3810664No ratings yet

- Privatization Is The Process of Transferring OwnershipDocument17 pagesPrivatization Is The Process of Transferring OwnershipIndraveer SinghNo ratings yet

- Monetary Policy and Fiscal PolicyDocument5 pagesMonetary Policy and Fiscal PolicySurvey CorpsNo ratings yet

- Economics Macroeconomic Policy Monetary Policy Money SupplyDocument17 pagesEconomics Macroeconomic Policy Monetary Policy Money SupplyKathleenMusniNo ratings yet

- What Is "Monetary Policy?"Document2 pagesWhat Is "Monetary Policy?"sajjadNo ratings yet

- Monetary Policy and Its Influence On Aggregate Demand.Document16 pagesMonetary Policy and Its Influence On Aggregate Demand.Anonymous KNo ratings yet

- External Balance and Internal BalanceDocument4 pagesExternal Balance and Internal BalanceswatiNo ratings yet

- Fiscal Policy Vs Monetary PolicyDocument2 pagesFiscal Policy Vs Monetary PolicyAkash Ray100% (1)

- Monetary Policy Notes PDFDocument18 pagesMonetary Policy Notes PDFOptimistic Khan50% (2)

- Inflation Economics Study Material Amp NotesDocument5 pagesInflation Economics Study Material Amp NotesRaghav DhillonNo ratings yet

- The Effects of Monetary Policy On Inflation in Ghana.Document9 pagesThe Effects of Monetary Policy On Inflation in Ghana.Alexander DeckerNo ratings yet

- Banking OperationDocument5 pagesBanking OperationenobbeNo ratings yet

- Inflation, Fiscal and Monetary PolicyDocument4 pagesInflation, Fiscal and Monetary PolicyAisyah HaririNo ratings yet

- Yashasvi Sharma Public FinanceDocument18 pagesYashasvi Sharma Public FinanceYashasvi SharmaNo ratings yet

- Business Cycles and Stabilization LectureDocument4 pagesBusiness Cycles and Stabilization LectureShokunbi MoyoNo ratings yet

- Economics For Managers: Topic: Inflation, Measures To Control InflationDocument7 pagesEconomics For Managers: Topic: Inflation, Measures To Control InflationKingjo bastianNo ratings yet

- Develop Appropriate Values Like Consideration and Understanding During The Time of InflationDocument10 pagesDevelop Appropriate Values Like Consideration and Understanding During The Time of InflationLomyna MorreNo ratings yet

- Executive Summary: Monetary Policy: A Tool Kit For Global Crisis 2010Document54 pagesExecutive Summary: Monetary Policy: A Tool Kit For Global Crisis 2010Prachi SinghiNo ratings yet

- Monetary Policy Important TopicsDocument18 pagesMonetary Policy Important TopicsVijay BadhaniNo ratings yet

- Fiscal PolicyDocument4 pagesFiscal Policyrahulpandey29No ratings yet

- Task 9Document2 pagesTask 9Danielle UgayNo ratings yet

- Fiscal PolicyDocument4 pagesFiscal PolicyAthos MuxiNo ratings yet

- Measures of InflationDocument6 pagesMeasures of InflationAnushkaa DattaNo ratings yet

- Fiscal and Monetary PolicyDocument11 pagesFiscal and Monetary PolicyNahidul IslamNo ratings yet

- Monetary PolicyDocument6 pagesMonetary Policypremsid28No ratings yet

- Monetary Policy Is The Process by Which The Monetary Authority of A CountryDocument35 pagesMonetary Policy Is The Process by Which The Monetary Authority of A CountryDolly ApolinarioNo ratings yet

- Monetary PolicyDocument18 pagesMonetary Policyandrew.collananNo ratings yet

- Effects: NegativeDocument14 pagesEffects: Negativehsn1234No ratings yet

- Fiscal Policy and Monetary WorldDocument13 pagesFiscal Policy and Monetary WorldSatyam KanwarNo ratings yet

- Chapter 23. Monetary Policy: A Summing Up: I. Motivating QuestionDocument5 pagesChapter 23. Monetary Policy: A Summing Up: I. Motivating QuestionAhmad AlatasNo ratings yet

- Monetary PolicyDocument9 pagesMonetary PolicyNathan MacayananNo ratings yet

- Introduction of Monetary Policy: MeaningDocument35 pagesIntroduction of Monetary Policy: MeaningDeepak DahiyaNo ratings yet

- Inflation-Conscious Investments: Avoid the most common investment pitfallsFrom EverandInflation-Conscious Investments: Avoid the most common investment pitfallsNo ratings yet

- Preserving Wealth in Inflationary Times - Strategies for Protecting Your Financial Future: Alex on Finance, #4From EverandPreserving Wealth in Inflationary Times - Strategies for Protecting Your Financial Future: Alex on Finance, #4No ratings yet

- Investing Money For Training and Development Gives Significant Returns To OrganizationDocument23 pagesInvesting Money For Training and Development Gives Significant Returns To OrganizationBishawnath RoyNo ratings yet

- Bold Option in Multiple Choice Is The Correct Answer, Which Will Not Be Given in Actual QuestionDocument9 pagesBold Option in Multiple Choice Is The Correct Answer, Which Will Not Be Given in Actual QuestionBishawnath RoyNo ratings yet

- BextexDocument14 pagesBextexBishawnath RoyNo ratings yet

- Comparison Betwen VAT Act 1991 and VAT and SD Act 2012Document10 pagesComparison Betwen VAT Act 1991 and VAT and SD Act 2012Mohsena MunnaNo ratings yet

- Balanced ScorecardDocument17 pagesBalanced ScorecardBishawnath Roy0% (1)

- 1 Defining Marketing For The 21 Century: Kotler KellerDocument26 pages1 Defining Marketing For The 21 Century: Kotler KellerBishawnath RoyNo ratings yet

- Meghnadbodh Kabya by Michel Madhusudan DuttaDocument104 pagesMeghnadbodh Kabya by Michel Madhusudan DuttaBishawnath RoyNo ratings yet

- Arguments About ValuesDocument7 pagesArguments About ValuesBishawnath RoyNo ratings yet

- Songs of Innocence and of ExperienceDocument52 pagesSongs of Innocence and of ExperienceBishawnath RoyNo ratings yet

- BD ChinaDocument25 pagesBD ChinaBishawnath RoyNo ratings yet

- Freedom, Government and RightsDocument9 pagesFreedom, Government and RightsBishawnath RoyNo ratings yet

- Kumar Roy: InternDocument2 pagesKumar Roy: InternBishawnath RoyNo ratings yet

- File Downloads Size ModifiedDocument2 pagesFile Downloads Size ModifiedBishawnath RoyNo ratings yet

- Crossing of Cheques 1223537775987301 9Document16 pagesCrossing of Cheques 1223537775987301 9siddharthasaha8570No ratings yet

- Citibank Cash Rebate SMS Program ("Program") Terms and Conditions 1. DefinitionsDocument3 pagesCitibank Cash Rebate SMS Program ("Program") Terms and Conditions 1. DefinitionsRajkumar VaikhariNo ratings yet

- PTI Financial Statement For Financial Year 2013-14Document7 pagesPTI Financial Statement For Financial Year 2013-14PTI Official100% (3)

- PRODUCT DISCLOSURE SHEET (Islamic Mortgage) : 1. What Is This Product About?Document12 pagesPRODUCT DISCLOSURE SHEET (Islamic Mortgage) : 1. What Is This Product About?Azamuddin JasrelNo ratings yet

- PDF DocumentDocument12 pagesPDF Documentksa966ikNo ratings yet

- Promissory Note TemplateDocument1 pagePromissory Note TemplateJhoana Parica FranciscoNo ratings yet

- Chapter-4 RETAIL LENDING SCHEMES PDFDocument64 pagesChapter-4 RETAIL LENDING SCHEMES PDFNanda KishoreNo ratings yet

- Wahyu Dian Tri Handayani - 19.05.52.0044 - Tugas Audit BankDocument4 pagesWahyu Dian Tri Handayani - 19.05.52.0044 - Tugas Audit BankWahyu Dian Tri HNo ratings yet

- e-StatementBRImo 805901002844500 Mar2024 20240531 110828Document2 pagese-StatementBRImo 805901002844500 Mar2024 20240531 110828aldopranata229No ratings yet

- Welingkar MBA Project List Distance Education 2013Document1 pageWelingkar MBA Project List Distance Education 2013aparna158No ratings yet

- Truth in Lending HandbookDocument225 pagesTruth in Lending HandbookHelpin HandNo ratings yet

- FIM-Module II-Banking InstitutionsDocument11 pagesFIM-Module II-Banking InstitutionsAmarendra PattnaikNo ratings yet

- Report 31032018Document825 pagesReport 31032018VikasNo ratings yet

- TC - cb5 Quantum ParadeDocument14 pagesTC - cb5 Quantum Paradeazrael.arhamNo ratings yet

- Retail 2Document32 pagesRetail 2Pravali SaraswatNo ratings yet

- Mohamed Yusuf Ali C.VDocument4 pagesMohamed Yusuf Ali C.VMohamedNo ratings yet

- Work Order With Due Date-1Document138 pagesWork Order With Due Date-1Reynaldo EstomataNo ratings yet

- Saln 1994 FormDocument3 pagesSaln 1994 FormJulius RarioNo ratings yet

- Department of Education: Learning Activity Sheet in Business MathematicsDocument14 pagesDepartment of Education: Learning Activity Sheet in Business MathematicsJanna GunioNo ratings yet

- CH1 ROBLES & EMPLEO Intermediate Accounting Vol. 1Document39 pagesCH1 ROBLES & EMPLEO Intermediate Accounting Vol. 1Aiki VillorenteNo ratings yet

- HNB Routing PDFDocument1 pageHNB Routing PDFEmannuel OntarioNo ratings yet

- Students Perception Towards Digital Payment System-A Study With A Special Reference To Mangalore UniversityDocument20 pagesStudents Perception Towards Digital Payment System-A Study With A Special Reference To Mangalore UniversityKrestyl Ann GabaldaNo ratings yet

- Money and Banking SystemDocument65 pagesMoney and Banking SystemfabyunaaaNo ratings yet

- RTGS FormDocument1 pageRTGS FormpayablesNo ratings yet

- Summer Internship Project HDFC Bank PDFDocument109 pagesSummer Internship Project HDFC Bank PDFarunima100% (1)

- Savings Account - 25480100018370 Dharm Singh So Shiv RamDocument8 pagesSavings Account - 25480100018370 Dharm Singh So Shiv RamParveen SainiNo ratings yet

- Zoiba 42 UBL BANKDocument61 pagesZoiba 42 UBL BANKRana HaseebNo ratings yet

- Standard Pre Disbursement Conditions PDFDocument6 pagesStandard Pre Disbursement Conditions PDFVipen MahajanNo ratings yet

- Project LEAP - Purchase Report: Lead Sourcing InformationDocument4 pagesProject LEAP - Purchase Report: Lead Sourcing InformationPavan Singh RajputNo ratings yet