Professional Documents

Culture Documents

Finance Cal

Finance Cal

Uploaded by

Mihir PatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Cal

Finance Cal

Uploaded by

Mihir PatelCopyright:

Available Formats

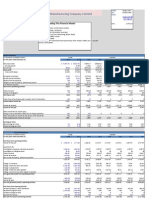

New Heritage Doll Company: Capital Budgeting

Exhibit 2 Selected Operating Projections for Design Your Own Doll ($ in thousands)

2010.00

Revenue

Revenue Growth

Production Costs

Fixed Production Expense (excl depreciation)

Variable Production Costs

Depreciation

Total Production Costs

Selling, General & Administrative

Total Operating Expenses

Operating Profit

2011.00

0.00

2012.00

6000.00

2013.00 2014.00 2015.00 2016.00 2017.00 2018.00 2019.00

14360.00 20221.60 21434.80 22720.90 24084.20 25529.30 27061.06

1.39

0.41

0.06

0.06

0.06

0.06

0.06

2020.00

28684.70

0.06

1201.00

1201.00

0.00

0.00

0.00

0.00

0.00

0.00

1650.00

2250.00

309.70

4209.70

1240.00

5449.70

1683.00 1716.60 1750.90 1786.00 1821.70 1858.10 1895.30

7651.00 11427.30 12181.60 12982.60 13833.00 14735.80 15694.30

309.70

309.70

436.20

462.40

490.10

519.50

550.70

9643.70 13453.60 14368.70 15231.00 16144.80 17113.40 18140.30

2922.00 4044.30 4286.90 4544.10 4816.80 5105.80 5412.20

12565.70 17497.90 18655.60 19775.10 20961.60 22219.20 23552.50

1933.20

16711.80

583.80

19228.80

5736.90

24965.70

-1201.00

0.00

550.30

1794.30

2723.70

2779.20

2945.80

3122.60

3310.10

3508.56

3719.00

0.03

59.17

12.18

33.67

0.03

59.17

12.27

33.80

0.03

59.17

12.63

33.94

0.03

59.17

12.72

33.94

0.03

59.17

12.72

33.94

0.03

59.17

12.72

33.94

0.03

59.17

12.72

33.94

0.03

59.17

12.72

33.94

0.03

59.17

12.72

33.94

309.70

309.70

2191.50

825.70

875.30

927.80

983.40

1042.50

1105.00

2012

2013

180.00

430.80

972.66

2327.89

345.62

785.96

502.72

1163.62

995.57

2381.03

4.43

-1385.47

2014

606.65

3278.12

1065.21

1627.07

3322.91

-941.88

2015

643.04

3474.79

1129.61

1734.72

3512.73

-189.82

2016

681.63

3683.28

1197.41

1838.81

3723.50

-210.76

2017

722.53

3904.28

1269.25

1949.14

3946.91

-223.41

2018

765.88

4138.54

1345.39

2066.08

4183.74

-236.83

2019

811.83

4386.86

1426.12

2190.06

4434.75

-251.02

2020

860.54

4650.06

1511.70

2321.47

4700.84

-266.08

2013

1794.30

717.72

1076.58

309.70

2014

2723.70

1089.48

1634.22

309.70

2015

2779.20

1111.68

1667.52

436.20

2016

2945.80

1178.32

1767.48

462.40

2017

3122.60

1249.04

1873.56

490.10

2018

3310.10

1324.04

1986.06

519.50

2019

3508.56

1403.42

2105.14

550.70

2020

3719.00

1487.60

2231.40

583.80

1386.28

1943.92

2103.72

2229.88

2363.66

2505.56

2655.84

2815.20

2012

2013

639.88

1386.28

4.43

-1385.47

-309.70

-309.70

0.00

334.61

-308.89

2014

1943.92

-941.88

-2191.50

2015

2103.72

-189.82

-825.70

2016

2229.88

-210.76

-875.30

2017

2363.66

-223.41

-927.80

2018

2505.56

-236.83

-983.40

2019

2655.84

-251.02

-1042.50

2020

2815.20

-266.08

-1105.00

-1189.46

1088.20

1143.82

1212.45

1285.33

1362.32

1444.12

2020

23674.53

25118.65

23716.43

Working Capital Assumptions:

Minimum Cash Balance as % of Sales

Days Sales Outstanding

Inventory Turnover (prod. cost/ending inv.)

Days Payable Outstanding (based on tot. op. exp.)

Capital Expenditures

Net Working Capital (NWC)

Minimum Cash Balance

Account Receivables

Inventory

Payables

Total NWC

Change in NWC

4610.00

2010

0.00

2011

1000.00

-1000.00

Operating Cash Flow

EBIT

TAX (40% Corporate Tax)

Earning after Tax

Depreciation

2010

-1201.00

2011

0.00

-1201.00

0.00

0.00

2012

550.30

220.12

330.18

309.70

Total Operating Cash Flow

-1201.00

0.00

639.88

Free Cash Flow (FCF)

OCF

Change in NWC

Capital Expenditure

Tax Benefit (40% of R&D and marketing)

Total FCF

2010

-1201.00

0.00

-4610.00

Terminal Value at High risk

Cash flow after TV at high risk

Net Cash Flow

Project Growth Rate

2.90%

Risk Level

High

Rate

9.00%

Net Present Value

High Risk

6848.01

Internal Rate of Return IRR

High Risk

17.83

Payback Period

High Risk

10.06

Profitability Index

High Risk

1.01

-5811.00

2011

0.00

-1000.00

0.00

480.40

-519.60

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

-5811.00

-519.60

-6330.60

334.61

-5995.99

-308.89

-6304.87

-1189.46

-7494.33

1088.20

-6406.13

1143.82

-5262.32

1212.45

-4049.87

1285.33

-2764.54

1362.32

-1402.22

You might also like

- N26 - OverviewDocument25 pagesN26 - OverviewGajendra AudichyaNo ratings yet

- INTERACTIVE: FICO Credit ScoresDocument4 pagesINTERACTIVE: FICO Credit ScoresElise Smoll (Elise)No ratings yet

- New Heritage Doll Company Student SpreadsheetDocument4 pagesNew Heritage Doll Company Student SpreadsheetGourav Agarwal73% (11)

- The Future of The State - HobsbawmDocument12 pagesThe Future of The State - Hobsbawmimvivi99967% (3)

- New Heritage ExhibitsDocument4 pagesNew Heritage ExhibitsBRobbins12100% (16)

- NHDC Solution EditedDocument5 pagesNHDC Solution EditedShreesh ChandraNo ratings yet

- Hammond Manufacturing Company Limited: Guide of Reading This Financial ModelDocument4 pagesHammond Manufacturing Company Limited: Guide of Reading This Financial ModelHongrui (Henry) Chen100% (1)

- "Case Analysis-Cafés Monte Blanco: Building A Profit Plan": Managerial AccountingDocument8 pages"Case Analysis-Cafés Monte Blanco: Building A Profit Plan": Managerial Accountingvipul tutejaNo ratings yet

- New Heritage SolutionDocument3 pagesNew Heritage SolutionJosé Luis DíazNo ratings yet

- Amway Opportunity BrochureDocument12 pagesAmway Opportunity Brochurenani100% (2)

- FABM2 Q2 Module WS 2Document10 pagesFABM2 Q2 Module WS 2Mitch Dumlao100% (1)

- Impact of Fiscal Policy On Indian EconomyDocument24 pagesImpact of Fiscal Policy On Indian EconomyAzhar Shokin75% (8)

- FS Analysis PT 2 - AssignmentDocument13 pagesFS Analysis PT 2 - AssignmentKim Patrick VictoriaNo ratings yet

- Financial WorksheetDocument4 pagesFinancial WorksheetCarla GonçalvesNo ratings yet

- The Financial Model: InputDocument4 pagesThe Financial Model: InputCarla GonçalvesNo ratings yet

- Part 1: Estimate Fcfs and Compute NPVS, Irrs, Paybacks, and PisDocument5 pagesPart 1: Estimate Fcfs and Compute NPVS, Irrs, Paybacks, and Pisvenom_ftwNo ratings yet

- Excel Setup and Imp FunctionsDocument28 pagesExcel Setup and Imp Functionskjvc0408No ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- Excel Setup and Imp FunctionsDocument27 pagesExcel Setup and Imp FunctionsAfzaal KaimkhaniNo ratings yet

- Finacial LabDocument3 pagesFinacial LabGarvit JainNo ratings yet

- Financial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsDocument7 pagesFinancial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsnikunjNo ratings yet

- Estimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Document5 pagesEstimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Somlina MukherjeeNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Financing Needs ExampleDocument13 pagesFinancing Needs ExampleReina FNo ratings yet

- FinancialsDocument2 pagesFinancialsSailesh RankaNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessHẬU ĐỖ NGỌCNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationahmed HOSNYNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessBacarrat BNo ratings yet

- Pro-Forma Income Statement & Percentage of Sales For Year 2020Document9 pagesPro-Forma Income Statement & Percentage of Sales For Year 2020Rehan ShariarNo ratings yet

- City of Maumelle City-Wide Revenue & Expenditures Summary: General FundDocument1 pageCity of Maumelle City-Wide Revenue & Expenditures Summary: General FundPreston LewisNo ratings yet

- 2. Excel Setup and Imp Functions (1)Document27 pages2. Excel Setup and Imp Functions (1)Vijay GuptaNo ratings yet

- Corpfin Case 2Document5 pagesCorpfin Case 2rthakkar97No ratings yet

- Shivam JN23PgDocument32 pagesShivam JN23Pggaurav.jain.25nNo ratings yet

- Trial 2021 FsaDocument2 pagesTrial 2021 FsaFarah Farah Essam Abbas HamisaNo ratings yet

- Net Present ValueDocument6 pagesNet Present ValueIshita KapadiaNo ratings yet

- Projected Income Statement: Particulars 2020 2021 2022 2023 2024Document3 pagesProjected Income Statement: Particulars 2020 2021 2022 2023 2024Wahidul Haque Khan SanielNo ratings yet

- Markaz-GL On Financial ProjectionsDocument10 pagesMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNo ratings yet

- 003 Cell-ReferenceDocument5 pages003 Cell-ReferenceThota VijaykumarNo ratings yet

- INR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.0Document7 pagesINR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.057 - Lakshita TanwaniNo ratings yet

- Maruti Suzuki Financial StatementDocument5 pagesMaruti Suzuki Financial StatementMasoud AfzaliNo ratings yet

- Income Stetement - TATA STEEL: INR (Crore) 2020A 2021A 2022E 2023E 2024EDocument6 pagesIncome Stetement - TATA STEEL: INR (Crore) 2020A 2021A 2022E 2023E 2024Edikshapatil6789No ratings yet

- Cma SreekumarDocument35 pagesCma Sreekumarapi-19728905No ratings yet

- Indicators: Operating Revenue 16,325.90 18,627.00 19,176.10 19,014.00 20,862.00Document24 pagesIndicators: Operating Revenue 16,325.90 18,627.00 19,176.10 19,014.00 20,862.00Ved Prakash GiriNo ratings yet

- SafariDocument49 pagesSafariwafaNo ratings yet

- Statements Projected Profit & LossDocument6 pagesStatements Projected Profit & LossApril Joy ObedozaNo ratings yet

- Marketing Plan With TPDocument5 pagesMarketing Plan With TPJanesha KhandelwalNo ratings yet

- Mayor's Office Budget January 1, 2012 - September 30, 2012Document4 pagesMayor's Office Budget January 1, 2012 - September 30, 2012dlebrayNo ratings yet

- Ratio Analysis - Team E - Last FinalDocument17 pagesRatio Analysis - Team E - Last Finalyarsuthit279No ratings yet

- Mon Sour Calaunan PROBLEM 16-7Document2 pagesMon Sour Calaunan PROBLEM 16-7monsour28No ratings yet

- Activity Data DashboardDocument9 pagesActivity Data DashboardAngel Yohaiña Ramos SantiagoNo ratings yet

- New Heritage Doll Capital BudgetingDocument9 pagesNew Heritage Doll Capital Budgetingpalmis20% (1)

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisEdeline MitrofanNo ratings yet

- V!s!t!l!ty Statement of Financial Performance Table 1Document15 pagesV!s!t!l!ty Statement of Financial Performance Table 1Carl Toks Bien InocetoNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- FM 2 AssignmentDocument4 pagesFM 2 AssignmentTestNo ratings yet

- Lapkeu GTGDocument3 pagesLapkeu GTGIndira GabriellaNo ratings yet

- Finance - WK 4 Assignment TemplateDocument31 pagesFinance - WK 4 Assignment TemplateIsfandyar Junaid50% (2)

- Edited FSDocument40 pagesEdited FShello kitty black and whiteNo ratings yet

- DivisionProfitability Q8Document2 pagesDivisionProfitability Q8Homayoun MoghaddampourNo ratings yet

- Business Service Center Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Service Center Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueFrom EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueRating: 1 out of 5 stars1/5 (1)

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Collection Agency Revenues World Summary: Market Values & Financials by CountryFrom EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Traveler Accommodation Revenues World Summary: Market Values & Financials by CountryFrom EverandTraveler Accommodation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Cyber Risk Communication To Executives Board Members 1617280324Document10 pagesCyber Risk Communication To Executives Board Members 1617280324ferNo ratings yet

- Ra 7796 TesdaDocument8 pagesRa 7796 TesdaMae SiapnoNo ratings yet

- Job Order CostingDocument40 pagesJob Order CostingKristel Abuana100% (1)

- Lesson 5-Session-GuideDocument6 pagesLesson 5-Session-GuideElaine UnoNo ratings yet

- THETAN ARENA ROI CALCU - JQCryptoDocument10 pagesTHETAN ARENA ROI CALCU - JQCryptoMikhail Roy Dela CruzNo ratings yet

- P6-18 Unrealized Profit On Upstream SalesDocument4 pagesP6-18 Unrealized Profit On Upstream Salesw3n123No ratings yet

- Toyota Forklift ManualDocument12 pagesToyota Forklift Manualfabio andres albor del villarNo ratings yet

- MACHETE COMPLAN UpdatedDocument30 pagesMACHETE COMPLAN UpdatedRonald MacheteNo ratings yet

- Industrial Relations and Labour LawsDocument15 pagesIndustrial Relations and Labour LawsMukesh Kumar YadavNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 14Document28 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 14jasperkennedy091% (11)

- Consumer Behavior Towards Mysore Sandal SoapsDocument68 pagesConsumer Behavior Towards Mysore Sandal Soapsrutvik08080867% (3)

- Family Business ManagementDocument3 pagesFamily Business ManagementJay KrishnaNo ratings yet

- CRM AssignmentDocument3 pagesCRM AssignmentDiksha VashishthNo ratings yet

- Management Accounting II: Assignment PresentationDocument6 pagesManagement Accounting II: Assignment PresentationPui YanNo ratings yet

- My Personal Learning PaperDocument4 pagesMy Personal Learning PapertimbbiboNo ratings yet

- Anas Assignment 1Document15 pagesAnas Assignment 1Laiba HassanNo ratings yet

- Samara University College of Business and Economics: Department of Management EntrepreneurshipDocument54 pagesSamara University College of Business and Economics: Department of Management Entrepreneurshipfentaw melkie100% (1)

- Format in The Preparation of Project Proposal: A. Identifying InformationDocument2 pagesFormat in The Preparation of Project Proposal: A. Identifying InformationMSWDO STA. MAGDALENANo ratings yet

- Scope and RelevanceDocument8 pagesScope and RelevanceParul JainNo ratings yet

- Case Study #9 - A RenovationDocument6 pagesCase Study #9 - A RenovationAssignment HelpNo ratings yet

- Memorandum of Agreement 22Document3 pagesMemorandum of Agreement 22Rodnel MonceraNo ratings yet

- Global Aviation Human Resource Management ContempoDocument15 pagesGlobal Aviation Human Resource Management ContempoYonas BEZUNo ratings yet

- 1.) Place of Incorporation TestDocument91 pages1.) Place of Incorporation TestAllijah Trish HernandezNo ratings yet

- Hyundai Motor India ParkDocument30 pagesHyundai Motor India ParkMir HassanNo ratings yet