Professional Documents

Culture Documents

Acct 2020 Excel Budget Problem

Acct 2020 Excel Budget Problem

Uploaded by

api-253209987Copyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fstep Manual Investment Banking FinalDocument208 pagesFstep Manual Investment Banking FinalThiện Phong100% (3)

- Finance Department Notifications-2003 (165-204)Document40 pagesFinance Department Notifications-2003 (165-204)Humayoun Ahmad Farooqi67% (3)

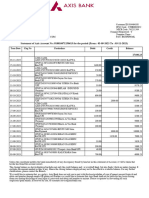

- Axis Bank StatmentDocument3 pagesAxis Bank Statmentssbajajbethua22No ratings yet

- FAP 3e 2021 PPT CH 9 Accounting For ReceivablesDocument46 pagesFAP 3e 2021 PPT CH 9 Accounting For Receivablestrinhnq22411caNo ratings yet

- L3 The Arbitrage Approach of Bond PricingDocument52 pagesL3 The Arbitrage Approach of Bond PricingVy HàNo ratings yet

- A86e0a2d F6a7 496d 86d5 5fa42fd63ea1 Gold StatementDocument3 pagesA86e0a2d F6a7 496d 86d5 5fa42fd63ea1 Gold StatementErkezhan NazarbekNo ratings yet

- Chapter 10 - Cash and Financial InvestmentsDocument2 pagesChapter 10 - Cash and Financial InvestmentsLouiza Kyla AridaNo ratings yet

- Corp LiquiDocument15 pagesCorp Liquijikee11No ratings yet

- FDI and FIIDocument17 pagesFDI and FIIsharathNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- Project Report Microfinance PDFDocument8 pagesProject Report Microfinance PDFkhageshNo ratings yet

- Annexure I (Scope of Audit - Concurrent Auditor)Document29 pagesAnnexure I (Scope of Audit - Concurrent Auditor)Niraj JainNo ratings yet

- CHR Report - 06 August 2023Document30 pagesCHR Report - 06 August 2023Venella PatrickNo ratings yet

- Bank StatementDocument4 pagesBank Statementvenkatarammana99No ratings yet

- Common Size Income StatementDocument7 pagesCommon Size Income StatementUSD 654No ratings yet

- Lecture 8 Chapter 21Document31 pagesLecture 8 Chapter 21yennhilenguyen1201No ratings yet

- Full Download pdf of (eBook PDF) Fundamentals of Investing, Global Edition 14th Edition all chapterDocument43 pagesFull Download pdf of (eBook PDF) Fundamentals of Investing, Global Edition 14th Edition all chapterbhurutmedini100% (3)

- CB ExerciseDocument2 pagesCB ExerciseJohn Carlos WeeNo ratings yet

- Accts FinalDocument9 pagesAccts Finalpriya singhNo ratings yet

- Mcgraw Hills Essentials of Federal Taxation 2019 10th Edition Spilker Test BankDocument48 pagesMcgraw Hills Essentials of Federal Taxation 2019 10th Edition Spilker Test Bankpandoratram2c2100% (29)

- Loan CalculatorDocument2 pagesLoan CalculatorNadeem KhalidNo ratings yet

- Forward and FuturesDocument24 pagesForward and FuturesasifanisNo ratings yet

- Cash Flow Statement Examples As Per Direct Method: Report Name Sap Report T-CodeDocument6 pagesCash Flow Statement Examples As Per Direct Method: Report Name Sap Report T-Codejainendra100% (1)

- Submission of Loc by Schools Comptt. 2019 PDFDocument9 pagesSubmission of Loc by Schools Comptt. 2019 PDFBaharul IslamNo ratings yet

- Electronic Bill PaymentDocument2 pagesElectronic Bill PaymentHeikkiNo ratings yet

- Exchange Rate 30 January 2024Document2 pagesExchange Rate 30 January 2024mail.bdoaa2022No ratings yet

- Result FileDocument42 pagesResult Fileclaudio pizziniNo ratings yet

- The Premier BankDocument1 pageThe Premier BankfgfdghfNo ratings yet

- Benjamin Mini-Mart CASH BOOK (Bank Columns) Date Particulars Fol Amounts$ Date Particulars Fol Amounts $Document8 pagesBenjamin Mini-Mart CASH BOOK (Bank Columns) Date Particulars Fol Amounts$ Date Particulars Fol Amounts $Christine Ramkissoon100% (1)

- Liquidity Management Techniques: Pooling and Cash ConcentrationDocument30 pagesLiquidity Management Techniques: Pooling and Cash Concentrationdarshanzamwar0% (1)

Acct 2020 Excel Budget Problem

Acct 2020 Excel Budget Problem

Uploaded by

api-253209987Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acct 2020 Excel Budget Problem

Acct 2020 Excel Budget Problem

Uploaded by

api-253209987Copyright:

Available Formats

MANAGERIAL ACCOUNTING - Fourth Edition

Solutions Manual

WASATCH MANUFACTURING

Master Budget

For the Quarter Ended March 31

Unit sales

Unit selling price

Total sales Revenue

Sales Budget

December

January

8,444

8,900

$

9.00 $

9.00

$ 76,000 $

80,100

February

9,900

$

9.00

$

89,100

March

9,200

$

9.00

$ 82,800

April

9,500

$

9.00

$ 85,500

March

20,700

66,825

87,525

1st Quarter

$ 63,000

$ 183,900

$ 246,900

March

9,200

1,425

10,625

1,380

9,245

1st Quarter

28,000

1,425

29,425

1,335

28,090

May

8,600

$

9.00

$ 77,400

Wasatch Manufacturing

Cash Collections Budget

For the Quarter Ended March 31

Cash collections (25%)

Credit collections (75%)

Total collections

$

$

$

January

20,025

57,000

77,025

Month

February

$

22,275

$

60,075

$

82,350

$

$

$

Wasatch Manufacturing

Production Budget

For the Quarter Ended March 31

Unit sales

Plus: Desired ending inventory

Total needed

Less: Beginning inventory

Units to produce

January

8,900

1,485

10,385

1,335

9,050

Month

February

9,900

1,380

11,280

1,485

9,795

Wasatch Manufacturing

Chapter 9: The Master Budget

Page 1 of 6

MANAGERIAL ACCOUNTING - Fourth Edition

Solutions Manual

Direct Materials Budget

For the Quarter Ended March 31

Units to be produced

Multiply by: Quantity of DM needed per unit (lbs.)

Quantity of DM needed for production (lbs.)

Plus: Desired ending inventory of DM (lbs.)

Total quantity of DM needed (lbs.)

Less: Beginning inventory of DM (lbs.)

Quantity of DM to purchase (lbs.)

Multiply by: Cost per pound

Total cost of DM purchases

Unit sales

Desired End Inventory (15%)

Total Needed

Beginning Inventory

Units to produce

DM needed per unit

DM needed for production

10% of DM

January

9,050

2

18,100

1,959

20,059

1,810

18,249

$

1.50

$

27,374

April

9,500

1,290

10,790

1,380

9,410

2

18,820

1,882

Month

February

9,795

2

19,590

1,849

21,439

1,959

19,480

$

1.50

$

29,220

Chapter 9: The Master Budget

$22,000

$8,212

$30,212

1st Quarter

28,090

2

56,180

1,882

58,062

1,810

56,252

$

1.50

$ 84,378

March

1st Quarter

May

8,600

Wasatch Manufacturing

Cash Payments for Direct Material Purchases Budget

For the Quarter Ended March 31

Month

January

February

December purchases (from A/P balance sheet)

January purchases

February purchases

March purchases

Total cash payments

March

9,245

2

18,490

1,882

20,372

1,849

18,523

$

1.50

$ 27,785

$19,161

$8,766

$27,927

$20,454

$8,335

$28,789

$22,000

$27,374

$29,220

$8,335

$86,929

Page 2 of 6

MANAGERIAL ACCOUNTING - Fourth Edition

Solutions Manual

Wasatch Manufacturing

Cash Payments for Direct Labor Budget

For the Quarter Ended March 31

Month

January

February

Units to be produced

(from production budget)

Multiply by: Direct labor hours per unit

Total direct labor hours required

Multiply by: Direct labor rate per hour

Total direct labor costs

8,900

0.03

267

$13

$3,471

9,900

0.03

297

$13

$3,861

March

9,200

0.03

276

$13

$3,588

1st Quarter

28,000

0.03

840

$13

$10,920

Wasatch Manufacturing

Chapter 9: The Master Budget

Page 3 of 6

MANAGERIAL ACCOUNTING - Fourth Edition

Solutions Manual

Cash Payments for Manufacturing Overhead Budget

For the Quarter Ended March 31

Month

January

February

March

1st Quarter

Units to be produced

(from production budget)

Variable MOH Costs:

Total Variable Operating Expenses ($1.40 per unit)

12,460

13,860

12,880

39,200

Fixed MOH Costs:

Factory Rent

Other Fixed MOH

Total Fixed MOH

$

$

$

6,500

2,100

8,600

$

$

$

6,500

2,100

8,600

$

$

$

6,500

2,100

8,600

$

$

$

19,500

6,300

25,800

Total cash payments for manufacturing overhead

21,060

22,460

21,480

65,000

8,900

9,900

9,200

Wasatch Manufacturing

Cash Payments for Operating Expenses Budget

For the Quarter Ended March 31

Month

January

February

March

28,000

1st Quarter

Units to be produced

(from sales budget)

Variable Operating Expenses:

Variable Operating Expenses ($1.20 per unit)

10,680

11,880

11,040

33,600

Fixed Operating Expenses:

Fixed Operating Expenses

Total Cash Payments for Operating Expenses

$

$

1,400

12,080

$

$

1,400

13,280

$

$

1,400

12,440

$

$

4,200

37,800

8,900

9,900

9,200

28,000

Combined Cash Budget

Cash Balance, Beginning

Chapter 9: The Master Budget

January

$

6,000

Month

February

$

5,202

March

$

5,224

1st Quarter

$

6,000

Page 4 of 6

MANAGERIAL ACCOUNTING - Fourth Edition

Plus: Cash Collections

Total Cash Available

Less Cash Payments:

DM Purchases

Direct Labor

Manufacturing Overhead costs

Operating Expenses

Tax Payment

Equipment Purchases

Total Cash Payments

Ending Cash before Financing

Financing:

Borrowings

Repayments

Interest Payments

Total Financing

Cash Balance, Ending

Chapter 9: The Master Budget

Solutions Manual

$

$

77,025

83,025

$

$

82,350

87,552

$

$

87,525

92,749

$ 246,900

$ 252,900

$

$

$

$

30,212

3,471

21,060

12,080

28,789

3,588

21,480

12,440

15,000

81,823

1,202

27,927

3,861

22,460

13,280

10,800

6,000

84,328

3,224

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

4,000

70,297

22,451

$ 86,929

$ 10,920

$ 65,000

$ 37,800

$ 10,800

$ 25,000

$ 236,449

$ 16,451

4,000

-6000

-150

-6150

16,301

$

$

$

$

$

4000

5,202 $

2000

2000

5,224 $

6,000

(6,000)

(150)

(150)

16,301

Page 5 of 6

MANAGERIAL ACCOUNTING - Fourth Edition

Solutions Manual

Budgeted Manufacturing Cost per Unit

Direct materials cost per unit: 2lbs x $1.50

Direct labor cost per unit: (0.03 labor hours per unit at $13 per labor hour)

Variable manufacturing costs per unit: $1.20

Fixed manufacturing overhead per unit 2lbs x $0.60 per unit

Cost of manufacturing each unit

$

$

$

$

$

3.00

0.39

1.20

0.60

5.19

Budgeted Income Statement

Sales Revenue

Less: Cost of Goods Sold

Gross Profit

Less: Operating Expenses

Less: Depreciation Expense

Operating Income

Less: Interest Expense

Less: Income Tax Expense @ 28%

Net Income

Chapter 9: The Master Budget

$ 252,000

(145,320)

$ 106,680

$ (37,800)

$

(5,200)

$ 63,680

$ (10,800)

$ (14,806)

$ 38,074

Page 6 of 6

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fstep Manual Investment Banking FinalDocument208 pagesFstep Manual Investment Banking FinalThiện Phong100% (3)

- Finance Department Notifications-2003 (165-204)Document40 pagesFinance Department Notifications-2003 (165-204)Humayoun Ahmad Farooqi67% (3)

- Axis Bank StatmentDocument3 pagesAxis Bank Statmentssbajajbethua22No ratings yet

- FAP 3e 2021 PPT CH 9 Accounting For ReceivablesDocument46 pagesFAP 3e 2021 PPT CH 9 Accounting For Receivablestrinhnq22411caNo ratings yet

- L3 The Arbitrage Approach of Bond PricingDocument52 pagesL3 The Arbitrage Approach of Bond PricingVy HàNo ratings yet

- A86e0a2d F6a7 496d 86d5 5fa42fd63ea1 Gold StatementDocument3 pagesA86e0a2d F6a7 496d 86d5 5fa42fd63ea1 Gold StatementErkezhan NazarbekNo ratings yet

- Chapter 10 - Cash and Financial InvestmentsDocument2 pagesChapter 10 - Cash and Financial InvestmentsLouiza Kyla AridaNo ratings yet

- Corp LiquiDocument15 pagesCorp Liquijikee11No ratings yet

- FDI and FIIDocument17 pagesFDI and FIIsharathNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- Project Report Microfinance PDFDocument8 pagesProject Report Microfinance PDFkhageshNo ratings yet

- Annexure I (Scope of Audit - Concurrent Auditor)Document29 pagesAnnexure I (Scope of Audit - Concurrent Auditor)Niraj JainNo ratings yet

- CHR Report - 06 August 2023Document30 pagesCHR Report - 06 August 2023Venella PatrickNo ratings yet

- Bank StatementDocument4 pagesBank Statementvenkatarammana99No ratings yet

- Common Size Income StatementDocument7 pagesCommon Size Income StatementUSD 654No ratings yet

- Lecture 8 Chapter 21Document31 pagesLecture 8 Chapter 21yennhilenguyen1201No ratings yet

- Full Download pdf of (eBook PDF) Fundamentals of Investing, Global Edition 14th Edition all chapterDocument43 pagesFull Download pdf of (eBook PDF) Fundamentals of Investing, Global Edition 14th Edition all chapterbhurutmedini100% (3)

- CB ExerciseDocument2 pagesCB ExerciseJohn Carlos WeeNo ratings yet

- Accts FinalDocument9 pagesAccts Finalpriya singhNo ratings yet

- Mcgraw Hills Essentials of Federal Taxation 2019 10th Edition Spilker Test BankDocument48 pagesMcgraw Hills Essentials of Federal Taxation 2019 10th Edition Spilker Test Bankpandoratram2c2100% (29)

- Loan CalculatorDocument2 pagesLoan CalculatorNadeem KhalidNo ratings yet

- Forward and FuturesDocument24 pagesForward and FuturesasifanisNo ratings yet

- Cash Flow Statement Examples As Per Direct Method: Report Name Sap Report T-CodeDocument6 pagesCash Flow Statement Examples As Per Direct Method: Report Name Sap Report T-Codejainendra100% (1)

- Submission of Loc by Schools Comptt. 2019 PDFDocument9 pagesSubmission of Loc by Schools Comptt. 2019 PDFBaharul IslamNo ratings yet

- Electronic Bill PaymentDocument2 pagesElectronic Bill PaymentHeikkiNo ratings yet

- Exchange Rate 30 January 2024Document2 pagesExchange Rate 30 January 2024mail.bdoaa2022No ratings yet

- Result FileDocument42 pagesResult Fileclaudio pizziniNo ratings yet

- The Premier BankDocument1 pageThe Premier BankfgfdghfNo ratings yet

- Benjamin Mini-Mart CASH BOOK (Bank Columns) Date Particulars Fol Amounts$ Date Particulars Fol Amounts $Document8 pagesBenjamin Mini-Mart CASH BOOK (Bank Columns) Date Particulars Fol Amounts$ Date Particulars Fol Amounts $Christine Ramkissoon100% (1)

- Liquidity Management Techniques: Pooling and Cash ConcentrationDocument30 pagesLiquidity Management Techniques: Pooling and Cash Concentrationdarshanzamwar0% (1)