Professional Documents

Culture Documents

Financial Performance Analysis-A Case Study

Financial Performance Analysis-A Case Study

Uploaded by

SamiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Performance Analysis-A Case Study

Financial Performance Analysis-A Case Study

Uploaded by

SamiCopyright:

Available Formats

Current Research Journal of Social Sciences 3(3): 269-275, 2011

ISSN: 2041-3246

Maxwell Scientific Organization, 2011

Received: March 05, 2011

Accepted: April 06, 2011

Published: May 25, 2011

Financial Performance Analysis-A Case Study

1

Amalendu Bhunia, 2Sri Somnath Mukhuti and 2Sri Gautam Roy

Fakir Chand College Under University of Calcutta, Diamond Harbour,

South 24-Parganas, Pin-743331, West Bengal, India

2

Indira Gandhi National Open University, New Delhi, India

Abstract: The present study aims to identify the financial strengths and weaknesses of the Indian public sector

pharmaceutical enterprises by properly establishing relationships between the items of the balance sheet and

profit and loss account. The study covers two public sector drug and pharmaceutical enterprises listed on BSE.

The study has been undertaken for the period of twelve years from 1997-98 to 2008-09 and the necessary data

have been obtained from CMIE database. The liquidity position was strong in case of both the selected

companies thereby reflecting the ability of the companies to pay short-term obligations on due dates and they

relied more on external funds in terms of long-term borrowings thereby providing a lower degree of protection

to the creditors. Financial stability of both the selected companies has showed a downward trend and

consequently the financial stability of selected pharmaceutical companies has been decreasing at an intense rate.

The study exclusively depends on the public sectors published financial data and it does not compare with

private sector pharmaceutical enterprises. This is a major limitation of the research. The study is of crucial

importance to measure the firms liquidity, solvency, profitability, stability and other indicators that the

business is conducted in a rational and normal way; ensuring enough returns to the shareholders to maintain

at least its market value. The study will help investors to identify the nature of Indian pharmaceutical industry

and will also help to take decision regarding investment.

Key words: Financial performance, indian pharmaceutical industry, multiple regressions, performance

indicators, public sector

Financial performance analysis is the process of

determining the operating and financial characteristics of

a firm from accounting and financial statements. The goal

of such analysis is to determine the efficiency and

performance of firms management, as reflected in the

financial records and reports. The analyst attempts to

measure the firms liquidity, profitability and other

indicators that the business is conducted in a rational and

normal way; ensuring enough returns to the shareholders

to maintain at least its market value.

Indian pharmaceutical industry has played a key role

in promoting and sustaining development in the vital field

of medicines. It boasts of quality producers and many

units have been approved by regulatory authorities in

USA and U.K. International companies associated with

this sector have stimulated, assisted and spearheaded this

dynamic development in the past 58 years and helped to

put India on the pharmaceutical map of the world. The

public sector has been the backbone of the Indian

economy, as it has acted as a strategic partner in the

nations economic growth and development. Public sector

enterprises possess strong prospects for growth because

they harness new business opportunities, and at the same

time expanding the scope of their current business.

INTRODUCTION

Finance always being disregarded in financial

decision making since it involves investment and

financing in short-term period. Further, also act as a

restrain in financial performance, since it does not

contribute to return on equity (Rafuse, 1996). A well

designed and implemented financial management is

expected to contribute positively to the creation of a

firms value (Padachi, 2006). Dilemma in financial

management is to achieve desired trade off

between

liquidity,

solvency and profitability

(Lazaridis et al., 2007). Management of working capital

in terms of liquidity and profitability management is

essential for sound financial recital as it has a direct

impact on profitability of the company (Rajesh and

Ramana Reddy, 2011). The crucial part in managing

working capital is required maintaining its liquidity in

day-to-day operation to ensure its smooth running and

meets its obligation (Eljelly, 2004). Ultimate goal of

profitability can be achieved by efficient use of resources.

It is concerned with maximization of shareholders or

owners wealth (Panwala, 2009). It can be attained through

financial performance analysis. Financial performance

means firm's overall financial health over a given period

of time.

Corresponding Author: Amalendu Bhunia, Fakir Chand College Under University of Calcutta, Diamond Harbour, South 24Parganas, Pin-743331, West Bengal, India. Tel: (0)9432953985

269

Curr. Res. J. Soc. Sci., 3(3): 269-275, 2011

performance of selected public sector drug &

pharmaceutical enterprises in India. More specifically, it

seeks to dwell upon mainly (i) to assess the short-term

and long-term solvency, (ii) to assess the liquidity and

profitability position and trend, (iii) to know the

efficiency of financial operations and (iv) to analyze the

factors determining the behavior of liquidity and

profitability. Keeping the above objectives in mind, the

following null and alternative hypotheses have been

formulated and tested statistically.

The ability of an organization to analyze its financial

position is essential for improving its competitive position

in the marketplace. Through a careful analysis of its

financial performance, the organization can identify

opportunities to improve performance of the department,

unit or organizational level. In this context researcher has

undertaken an analysis of financial performance of

pharmaceutical companies to understand how

management of finance plays a crucial role in the growth.

LITERATURE REVIEW

METHODOLOGY

Financial performance analysis is vital for the

triumph of an enterprise. Financial performance analysis

is an appraisal of the feasibility, solidity and fertility of a

business, sub-business or mission. Altman and

Eberhart (1994) reported the use of neural network in

identification of distressed business by the Italian central

bank. Using over 1,000 sampled firms with 10 financial

ratios as independent variables, they found that the

classification of neural networks was very close to that

achieved by discriminant analysis. They concluded that

the neural network is not a clearly dominant mathematical

technique compared to traditional statistical techniques.

Gepp and Kumar (2008) incorporated the time bias

factor into the classic business failure prediction model.

Using Altman (1968) and Ohlsons (1980) models to a

matched sample of failed and non-failed firms from

1980s, they found that the predictive accuracy of

Altmans model declined when applied against the 1980s

data. The findings explained the importance of

incorporating the time factor in the traditional failure

prediction models.

Campbell (2008) constructed a multivariate

prediction model that estimates the probability of

bankruptcy reorganization for closely held firms. Six

variables were used in developing the hypotheses and five

were significant in distinguishing closely held firms that

reorganize from those that liquidate. The five factors were

firm size, asset profitability, the number of secured

creditors, the presence of free assets, and the number of

under-secured secured creditors. The prediction model

correctly classified 78.5% of the sampled firms. This

model is used as a decision aid when forming an expert

opinion regarding a debtors likelihood of rehabilitation.

No study has incorporated the financial performance

analysis of the central public sector enterprises in Indian

drug & pharmaceutical Industry. Nor has any previous

research examined the solvency position, liquidity

position, profitability analysis, operating efficiency and

the prediction of financial health and viability of public

sector drug & pharmaceutical enterprises in India.

The present study covers two public sector drug &

pharmaceutical enterprises listed on BSE. The sample of

the companies has been selected on a convenient basis

and the necessary data have been obtained from CMIE

database and public enterprises survey. We select

Karnataka Antibiotics and Pharmaceuticals Ltd. (KAPL)

and Rajasthan Drugs and Pharmaceuticals Ltd. (RDPL).

The study has been undertaken for the period of twelve

years from 1997-98 to 2008-09. In order to analyze

financial performance in terms of liquidity, solvency,

profitability and financial efficiency, various accounting

ratios have been used. Various statistical measures have

been used i.e., A.M., S.D., C.V., linear multiple

regression analysis and test of hypothesis t-test.

RESULTS

Financial analysts often assess the firm's liquidity,

solvency, efficiency, profitability, operating efficiency

and financial stability in both short-term and long-term.

Ratio analysis provides relative measures of the

companys performance and can indicate clues to the

underlying financial position. For measuring financial

position and financial efficiency, appropriate level of

financial performance indicators are required with whom

comparison can be made. Generally liquid ratio, debtequity ratio, interest coverage ratio, inventory turnover

ratio, return on investment ratio and debt to net worth

ratio are highly useful in determining financial position,

financial performance and the financial stability or

otherwise of such management.

Liquid ratio: It is the ratio of liquid assets to current

liabilities. Liquid ratio is more rigorous test of liquidity

than the current ratio because it eliminates inventories and

prepaid expenses as a part of current assets. Usually a

high liquid ratio an indication that the firm is liquid and

has the ability to meet its current or liquid liabilities in

time and on the other hand a low liquidity ratio represents

that the firm's liquidity position is not good. Table 1 show

that liquid ratio is not satisfactory in the case of KAPL

and liquid ratio is more satisfactory in the case of RDPL

Objectives of the study: The main objectives of the

present work are to make a study on the overall financial

270

Curr. Res. J. Soc. Sci., 3(3): 269-275, 2011

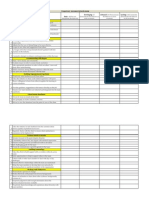

Table 1: Selected liquidity ratios

Liquid ratios

--------------------------------------------------------------------Year

KAPL

RDPL

Industry average

2001-02

0.68

1.06

0.82

2002-03

0.77

1.04

0.74

2003-04

0.92

1.04

0.70

2004-05

0.83

1.16

0.78

2005-06

0.65

1.13

0.84

2006-07

0.75

0.71

0.90

2007-08

0.75

0.79

0.78

2008-09

0.49

1.01

0.70

Mean

0.73

0.99

0.78

S.D.

0.13

0.16

0.07

C.V. (%)

17.81

16.16

8.74

CMIE database

Debt-equity ratios

----------------------------------------------------------------------------KAPL

RDPL

Industry average

0.11

0.42

0.73

0.06

0.55

0.70

0.01

0.43

0.66

0.07

0.41

0.72

0.18

0.64

0.75

0.29

0.81

0.63

0.21

1.34

0.59

0.17

1.12

0.78

0.14

0.72

0.70

0.09

0.35

0.06

64.29

48.61

8.57

Table 2: Selected profitability ratios

Return on investment ratios

--------------------------------------------------------------------Year

KAPL

RDPL

Industry average

2001-02

9.87

17.21

11.62

2002-03

13.85

25.51

13.38

2003-04

11.85

14.12

13.99

2004-05

12.61

6.66

12.51

2005-06

9.95

19.47

13.07

2006-07

10.59

16.62

15.58

2007-08

12.14

15.43

13.21

2008-09

12.46

20.32

8.77

Mean

11.67

16.92

12.77

S.D.

1.40

5.44

1.98

C.V. (%)

12.00

32.51

15.51

CMIE database

Debt to net worth ratios

----------------------------------------------------------------------------KAPL

RDPL

Industry average

0.06

0.48

0.74

0.06

0.55

0.73

0.007

0.43

0.52

0.07

0.41

0.46

0.18

0.64

0.58

0.29

0.81

0.26

0.21

1.34

0.59

0.17

0.94

0.70

0.13

0.70

0.57

0.10

0.32

0.16

76.92

45.71

28.07

indication of improper debt-equity management. A high

debt-equity ratio is observed in case of RDPL with an

average of 0.72, which means the company has been

aggressive in financing its growth with debt. Coefficient

of variation of debt-equity ratio of KAPL and RDPL is

64.29 and 48.61%, respectively, which shows more

consistency during the study period because coefficient of

variation of industry as a whole is 8.57%. Lower

variability in the debt-equity ratio indicates proper or

efficient management of debt-equity.

because the ratio is more than industry average. KAPL

have not been able to meet their matured current

obligations under the study period. Coefficient of

variation of liquid ratio of KAPL and RDPL is 17.81 and

16.16%, respectively, which shows less consistency

during the study period because coefficient of variation of

industry as a whole is 8.74%. Greater variability in the

liquid ratio indicates improper or inefficient management

of fund inasmuch.

Debt/equity ratio: The debt-to-equity ratio (D/E) is a

financial ratio indicating the relative proportion of

shareholders' equity and debt used to finance a company's

assets. The two components are often taken from the

firm's balance sheet or statement of financial position, but

the ratio may also be calculated using market values for

both, if the company's debt and equity are publicly traded,

or using a combination of book value for debt and market

value for equity financially. A high debt/equity ratio

generally means that a company has been aggressive in

financing its growth with debt. This can result in volatile

earnings as a result of the additional interest expense. This

can result in volatile earnings as a result of the additional

interest expense. A low debt/equity ratio usually means

that a company has been friendly in financing its growth

with debt and more aggressive in financing its growth

with equity. Table 2 shows that debt-equity ratio in case

of KAPL is very low as its average is 0.14. This is an

Interest coverage ratio: A ratio used to determine how

easily a company can pay interest on outstanding debt.

The interest coverage ratio is calculated by dividing a

company's Earnings Before Interest and Taxes (EBIT) of

one period by the company's interest expenses of the same

period. The lower the ratio, the more the company is

burdened by debt expense. When a company's interest

coverage ratio is lower, its ability to meet interest

expenses may be questionable and it indicates that the

company is not generating sufficient revenues to satisfy

interest expenses.

The interest coverage ratio is a measure of the

number of times a company could make the interest

payments on its debt with its earnings before interest and

taxes, also known as EBIT. The lower the interest

coverage ratio, the higher is the company's debt burden

and the greater the possibility of bankruptcy or default.

271

Curr. Res. J. Soc. Sci., 3(3): 269-275, 2011

Table 3: Selected solvency ratios

Interest coverage ratios

--------------------------------------------------------------------Year

KAPL

RDPL

Industry average

2001-02

1.34

1.98

1.18

2002-03

0.06

0.55

1.35

2003-04

25.24

8.93

1.63

2004-05

23.52

4.53

1.98

2005-06

0.18

0.64

0.97

2006-07

0.29

0.81

1.34

2007-08

11.40

4.96

1.56

2008-09

11.08

3.66

1.51

Mean

9.14

3.26

1.44

S.D.

10.53

2.89

0.31

C.V. (%)

115.21

88.65

21.53

CMIE database

Inventory turnover ratios

----------------------------------------------------------------------------KAPL

RDPL

Industry average

7.12

9.44

3.89

7.53

8.04

3.02

7.57

7.03

3.87

5.64

6.22

4.11

5.76

12.29

3.59

7.34

7.41

3.63

8.59

11.07

4.68

8.37

12.86

3.98

7.24

9.30

3.85

1.07

2.52

0.48

14.78

27.10

12.47

management of inventory. Whereas Coefficient of

variation of inventory-turnover ratio of KAPL is 14.78%

i.e., more than its grand industry C.V. that shows less

consistency and proper management of inventory as well.

For bond holders, the interest coverage ratio is supposed

to act as a safety gauge. It gives you a sense of how far a

companys earnings can fall before it will start defaulting

on its bond payments. For stockholders, the interest

coverage ratio is important because it gives a clear picture

of the short-term financial health of a business. Table 3

shows that interest coverage ratio in case of KAPL and

RDPL is more than industry averages as its averages are

9.14 and 3.26, respectively. This is an indication of debt

burden and the greater the possibility of bankruptcy.

Coefficient of variation of interest coverage ratio of

KAPL and RDPL is 115.21 and 88.65%, respectively,

which shows less consistency during the study period

because coefficient of variation of industry as a whole is

21.53%. Greater variability in the interest coverage ratio

indicates improper or inefficient management of debtfund.

Return on investment ratio: Return on investment ratio

is used by financial analysts to ascertain the best

investment plans. It is also an important tool used by

investors and shareholders, while making investment

decisions. Return on Investment ratio for a company

shows how much profit a company is making against the

investments made by the shareholders and the investors.

Return on Investment ratio is also used to compare

different investment options by an investment advisor. An

investment with a higher ROI ratio is more lucrative

option as compared to an investment with a lower ROI

ratio. An investment with a negative or lower ROI ratio is

most likely to be discontinued by the investors. Table 2

exemplifies that return on investment ratio of RDPL is

very higher as its average is11.67 than grand industry

averages of 12.77 and this ratio of KAPL is very lower as

its average is16.92 than grand industry averages of 12.77.

It indicates more wealth for the shareholders or investors

of RDPL. Coefficient of variation of return on investment

ratio of RDPL is 32.51%, which shows less consistency

during the study period because coefficient of variation of

industry as a whole is 15.51%. Coefficient of variation of

return on investment ratio of KAPL is 12.00%, which

shows more consistency during the study period because

coefficient of variation of industry as a whole is 15.51%.

Lesser variability in the return on investment ratio

indicates proper or efficient management of wealth.

Inventory turnover ratio: The inventory-turnover ratio

gives a general view on the inventories of a company. In

order to calculate it you should divide the annual

sales/cost of sales of the company by its inventory. If the

value of the inventory-turnover ratio is low, then it

indicates that the management team doesn't do its job

properly in managing inventories. This ratio should be

compared against industry averages. A low turnover

implies poor sales and, therefore, excess inventory. A

high ratio implies either strong sales or ineffective buying.

High inventory levels are unhealthy because they

represent an investment with a rate of return of zero. It

also opens the company up to trouble should prices begin

to fall. Table 3 shows that inventory-turnover ratio of

KAPL and RDPL during the period of study is very

satisfactory as its average are 7.24 and 9.30, respectively,

which is much higher than 3.85, grand industry average,

which is taken as standard. This is a sign of strong sales.

Coefficient of variation of inventory-turnover ratio of

RDPL is 27.10%, which shows less consistency during

the study period because coefficient of variation of

industry as a whole is 12.47%. Greater variability in the

inventory-turnover ratio indicates improper or inefficient

Debt to net worth ratio: Debt to net worth Ratio

measures is used in the analysis of financial statements to

show the amount of protection available to creditors. The

ratio equals total liabilities divided by total stockholders'

equity; also called debt to net worth ratio. A high ratio

usually indicates that the business has a lot of risk because

it must meet principal and interest on its obligations.

Potential creditors are reluctant to give financing to a

272

Curr. Res. J. Soc. Sci., 3(3): 269-275, 2011

Table 4: Multiple regression coefficients (a) of KAPL

Unstandardized Coefficients

-------------------------------------------Model

B

SE

1

Constant

10.400

5.935

LR

- 0.846

5.137

DER

- 63.907

37.891

ICR

- 0.019

0.069

ITR

0.542

0.520

DNWR

52.855

34.210

a. Dependent Variable

Model Summary

Model

1

R

0.842(a)

R2

0.710

Standardized Coefficients

Beta

1.752

- 0.077

- 4.165

- 0.143

0.414

3.607

t

0.222

- 0.165

- 1.687

- 0.276

1.043

1.545

Adjusted R2

-0.016

SE of the Estimate

1.41907

Sig.

0.884

0.234

0.808

0.407

0.262

profitability of the company decreased by 0.846 units,

which was statistically significant at 1% level. However,

when DER increased by one unit, the ROIR of the

company decreased by 63.907 units though the influence

of DER on ROIR was very significant. For one unit

increase in ICR, the profitability of the company

decreased by 0.019 units. Again, ITR increased by one

unit, ROIR increased by 0.542 which was statistically at

1% level. However, when DNWR increased by one unit,

the ROIR of the company increased by 82.855 units

though the influence of DNWR on ROIR was very

noteworthy.

The multiple correlation coefficient between the

dependent variable ROIR and the independent variables

LR, DER, ICR, ITR and DNWR taken together was

0.842. It indicates that the profitability was perfectly

influenced by its independent variables. It is also evident

from the value of R2 that 71% of variation in ROIR was

accounted by the joint variation in all the independent

variables. Coefficient of determination is negatively 1.6%

varied. Standard error of estimate is flawlessly associated

with regression analysis. Such a significant variation

could be justified as the impact of many other financial

performance indicators, which have not taken into the

study, in addition to the effect of the used in the study

company with a high debt position. However, the

magnitude of debt depends on the type of business.

Usually, book value is used to measure a firm's debt and

equity securities in calculating the ratio. Market value

may be a more realistic measure, however, because it

takes into account current market conditions. Table 2

exemplifies that debt to net worth ratio of KAPL and

RDPL during the period of study is lower and higher as its

averages are 0.13 and 0.70, respectively than 0.57, grand

industry average, which is in use as standard. It is an

indication less risk and more risk about debt obligations

of those companies. Coefficient of variation of debt to net

worth ratio of KAPL and RDPL is 76.92 and 45.71%

respectively, which shows less consistency during the

study period because coefficient of variation of industry

as a whole is 28.07%. Greater variability in the debt to net

worth ratio indicates improper or inefficient management

of financial risk.

Financial performance through multiple regressions:

In this section an attempt has been made to examine

composite impact of financial performance indicators on

profitability through the sophisticated statistical

techniques. Accordingly, multiple regression techniques

have been applied to study the joint influence of the

selected ratios indicating company's financial position and

performance on the profitability and the regression

coefficients have been tested with the help of the most

popular t test. In this study, LR, DER, ICR, ITR and

DNWR have been taken as the explanatory variables and

ROIR has been used as the dependent variable. The

regression model used in this analysis is ROIR = + 1LR

+ 2 DER + 3 ICR + 4 ITR + 5 DNWRR where , 1,

2, 3, 4, 5, are the parameters of the ROIR line.

Joint impact of performance indicators on profitability

of RDPL: Multiple regression analysis of RDPL has been

tabulated in Table 5. Table 5 proves the power of

relationship between the dependent variable, ROIR and

all the independent variables taken together and the

impact of these independent variables on the profitability.

It was observed that for one unit increase in LR, the

profitability of the company increased by 9.681 units,

which was statistically significant at 1% level. However,

when DER increased by one unit, the ROIR of the

company increased by 16.205 units though the influence

of DER on ROIR was very significant. For one unit

increase in ICR, the profitability of the company

decreased by 0.108 units. Again, ITR increased by one

unit, ROIR decreased by 0.770 which was statistically at

1% level. However, when DNWR increased by one unit,

Joint impact of performance indicators on profitability

of KAPL: Multiple regression analysis of KAPL has been

tabulated in Table 4. Table 4 proves the potency of

relationship between the dependent variable, ROIR and

all the independent variables taken together and the

impact of these independent variables on the profitability.

It was observed that for one unit increase in LR, the

273

Curr. Res. J. Soc. Sci., 3(3): 269-275, 2011

Table-5: Multiple regression coefficients (a) of RDPL

Unstandardized Coefficients

---------------------------------------------Model

B

Std. Error

1

(Constant)

5.085

10.431

LR

9.681

10.422

DER

16.205

41.225

ICR

- 0.108

0.312

ITR

- 0.770

0.689

DNWR

- 9.992

44.327

a. Dependent Variable: ROIR

Model Summary

Model

1

R

0.829

R2

0.688

Standardized Coefficients

Beta

0.488

1.122

3.658

- 0.228

- 1.164

- 2.213

t

0.711

0.929

0.393

- 0.347

- 1.118

- 0.225

Adjusted R2

-0.874

SE of the Estimate

2.02696

the ROIR of the company decreased by 9.992 units

though the influence of DNWR on ROIR was very

noteworthy.

The multiple correlation coefficient between the

dependent variable ROIR and the independent variables

LR, DER, ICR, ITR and DNWR taken together was 82.9.

It indicates that the profitability was perfectly influenced

by its independent variables. It is also evident from the

value of R2 that 68.8% of variation in ROIR was

accounted by the joint variation in all the independent

variables. Coefficient of determination is negatively

87.4% varied indicates that the regression line partially

fits the data. Standard error of estimate is flawlessly

associated with regression analysis. Such a significant

variation could be justified as the impact of many other

financial performance indicators, which have not taken

into the study, in addition to the effect of the used in the

study.

Sig.

0.523

0.762

0.787

0.465

0.859

The drug and pharmaceutical enterprises selected

have been taken from CMIE database. The study

covers a period of only twelve years from 1998 to

2009. The data collected is only for ten companies

and this might not be true representation of the

population. This is a major limitation of the research.

ACKNOWLEDGMENT

This is my proud privilege of expressing my deepest

sense of gratitude and indebtedness to the Chairman,

University Grant Commission (ERO), India for funding

me to complete the research project work and valuable

suggestions at every stage of this study. I thank the Chief

Librarian of the Indian Institute of Management (IIMC),

Kolkata for having given me the required information that

has formed the basis of this study. I am indebted to the

Principal, teachers of the Department of Commerce, Fakir

Chand College, Diamond Harbour, for their constant

support, inspiration and suggestions.

CONCLUSION

From the study of the financial performance of the

select pharmaceutical it can be concluded that the

liquidity position was strong in case of KAPL and it was

so poor in case of RDPL thereby reflecting the ability of

the companies to pay short-term obligations on due dates.

Long-term solvency in case of KAPL is lower which

shows that companies relied more on external funds in

terms of long-term borrowings thereby providing a lower

degree of protection to the creditors.

Financial stability ratios in the vein of debt to net

worth ratio in case of RDPL have showed a downward

trend and consequently the financial stability has been

decreasing at an intense rate.

The Indian pharmaceutical industry will witness an

increase in the market share. The sector is poised not only

to take new challenge but to sustain the growth

momentum of the past decade.

REFERENCES

Altman, E., 1968. Financial ratios, discriminant analysis

and the prediction of corporate bankruptcy. J.

Finance, pp: 589-609.

Altman, E.I. and A.C. Eberhart, 1994. Do seniority

provisions protect bondholder investments. J.

Portfolio Manage., Summer, 20(4): 179-194.

Campbell, J., J. Hilscher and J. Szilagyi, 2008. In search

of distress risk. J. Finan., 63(6): 2899-2939.

Eljelly, A., 2004. Liquidity-profitability trade off: An

empirical investigation in emerging market. Int. J.

Comm. Manage., 14(2): 48-58.

Gepp, A. and K. Kumar, 2008. The role of survival

analysis in financial distress prediction. Int. Res. J.

Finan. Econ., 16: 13-34.

Lazaridis, I., 2007. Relationship between working capital

working capital management and profitability of

listed companies in the athens stock exchange. J.

Finan. Manage. Anal., 19(1): 26-35.

Ohlson, J.A., 1980. Financial ratios and the probabilistic

prediction of bankruptcy. J. Account. Res., 18(1):

109-131.

LIMITATIONS OF THE STUDY

The study suffers from certain limitations.

C Study exclusively depends on the published financial

data, so it is subject to all limitations that are inherent

in the condensed published financial statements.

274

Curr. Res. J. Soc. Sci., 3(3): 269-275, 2011

Padachi, K., 2006. Trends in working capital management

and its impact on firms performance: An analysis of

mauritian small manufacturing firms. Int. Rev. Bus.

Res., 2(2): 45-56.

Panwala, M., 2009. Dimensions of liquidity managementA case study of the Surat Textiles Traders Cooperative Bank Ltd., J. Account. Res., 2(1): 69-78.

Rajesh, M. and N.R.V. Ramana Reddy, 2011. Impact of

working capital management on firms profitability.

Global J. Finan. Manage., 3(1): 151-158.

Rafuse, M.E., 1996. Working capital management: An

urgent need to refocus. J. Manage. Decis., 34(2):

59-63.

275

You might also like

- Case Study CostcoDocument3 pagesCase Study CostcoAndi FirmanataNo ratings yet

- 319 Question BankDocument142 pages319 Question BankElla67% (3)

- Determinants of Corporate Financial PerformanceDocument17 pagesDeterminants of Corporate Financial PerformanceIulia Balaceanu100% (1)

- GRNI Reconciliation ProcessDocument2 pagesGRNI Reconciliation ProcessMaheshNo ratings yet

- Financial Performance AnalysisDocument8 pagesFinancial Performance AnalysisJanus GalangNo ratings yet

- Financial Performance of Indian Pharmaceutical IndustryDocument15 pagesFinancial Performance of Indian Pharmaceutical IndustryRupal MuduliNo ratings yet

- "A Study On Impact of Stress On Employee Absenteeism" at ST John'S Hospital KattappanaDocument3 pages"A Study On Impact of Stress On Employee Absenteeism" at ST John'S Hospital KattappanaAnandu PillaiNo ratings yet

- FRONTDocument3 pagesFRONTAnandu PillaiNo ratings yet

- FinancialPerformanceAnalysis GIMDocument16 pagesFinancialPerformanceAnalysis GIMdemionNo ratings yet

- Financial Performance of Indian Pharmaceutical Industry - A Case StudyDocument25 pagesFinancial Performance of Indian Pharmaceutical Industry - A Case Studyanon_544393415No ratings yet

- Financial Performance, Consistency & Sustainability Analysis Featuring Dupont Method: Square Pharmaceuticals LTDDocument5 pagesFinancial Performance, Consistency & Sustainability Analysis Featuring Dupont Method: Square Pharmaceuticals LTDShahinNo ratings yet

- Project ODYSSIA NewDocument96 pagesProject ODYSSIA Newmanesh100% (2)

- 09 - Chapter 2Document32 pages09 - Chapter 2Apoorva A NNo ratings yet

- UntitledDocument68 pagesUntitledSurendra SkNo ratings yet

- Financial Statement Analysis DR ReddyDocument84 pagesFinancial Statement Analysis DR Reddyarjunmba119624100% (1)

- 1.6 Review of LiteratureDocument8 pages1.6 Review of LiteratureMaha LakshmiNo ratings yet

- Intoducation To LastDocument20 pagesIntoducation To LastBekar JibonNo ratings yet

- Ratio Analysis of Shree Cement and Ambuja Cement Project Report 2Document7 pagesRatio Analysis of Shree Cement and Ambuja Cement Project Report 2Dale 08No ratings yet

- BushraDocument75 pagesBushraDhakeerath KsdNo ratings yet

- Chapter - 1 Introduction: 1.1 Background of The StudyDocument78 pagesChapter - 1 Introduction: 1.1 Background of The StudyPRIYA RANANo ratings yet

- Mariya 888Document48 pagesMariya 888jacob tomsNo ratings yet

- Financial Performance Analysis Through Position Statements of Selected FMCG CompaniesDocument8 pagesFinancial Performance Analysis Through Position Statements of Selected FMCG Companiesswati jindalNo ratings yet

- Literature Review Analysis of Recorded Facts of Business PDFDocument8 pagesLiterature Review Analysis of Recorded Facts of Business PDFMohammed YASEENNo ratings yet

- A Project Report On Ratio AnalysisDocument22 pagesA Project Report On Ratio Analysisanon_80156868480% (5)

- Impact of Capital Structure On The Operating PerfoDocument7 pagesImpact of Capital Structure On The Operating PerfovtrzerafpsNo ratings yet

- Review of The Literature ProfitabilityDocument17 pagesReview of The Literature Profitabilitysheleftme100% (3)

- Maheshwar FPDocument15 pagesMaheshwar FPkhayyumNo ratings yet

- Relationship Management Project FullyDocument37 pagesRelationship Management Project Fullygkvimal nathanNo ratings yet

- Literature ReviewDocument3 pagesLiterature ReviewRohit Aggarwal100% (2)

- Phamaceuticals IndustryDocument62 pagesPhamaceuticals IndustryABC Computer R.SNo ratings yet

- Report On Financial Performance of MetconDocument70 pagesReport On Financial Performance of MetconJosemon Paulson100% (1)

- FMCGDocument15 pagesFMCGRicha ChandraNo ratings yet

- Article 4Document3 pagesArticle 4Bilal FarhanNo ratings yet

- A Study On Financial Analysis Through Comparative Statements - With Special Reference To HPCLDocument7 pagesA Study On Financial Analysis Through Comparative Statements - With Special Reference To HPCLsubhaseduNo ratings yet

- The Fundamental Analysis of Indonesian Stock Return (Case Study: Listed Public Companies in Sub Sector Food and Beverage For The Period 2003 2012)Document10 pagesThe Fundamental Analysis of Indonesian Stock Return (Case Study: Listed Public Companies in Sub Sector Food and Beverage For The Period 2003 2012)WENING RESTIYANINo ratings yet

- Working Capital ManagementDocument8 pagesWorking Capital ManagementHarish.PNo ratings yet

- Financial Performance MbaDocument92 pagesFinancial Performance MbaIqbalNo ratings yet

- Financial Performance Analysis of Corporation BankDocument8 pagesFinancial Performance Analysis of Corporation BankManjunath ShettyNo ratings yet

- Literature Review Financial Ratios AnalysisDocument8 pagesLiterature Review Financial Ratios Analysisfyh0kihiwef2100% (1)

- Final Report PDFDocument39 pagesFinal Report PDFChandrashekar BNNo ratings yet

- Ijrti1706020 PDFDocument6 pagesIjrti1706020 PDFSACHIN GNo ratings yet

- Ratio AnalysisDocument80 pagesRatio AnalysisMrutyunjaya YaligarNo ratings yet

- Sai Naik ProjectDocument78 pagesSai Naik ProjectSAIsanker DAivAMNo ratings yet

- Financial Analysis of PNBDocument73 pagesFinancial Analysis of PNBPrithviNo ratings yet

- Measuring Financial Performance of A PharmacyDocument12 pagesMeasuring Financial Performance of A PharmacyKhondoker ShidurNo ratings yet

- "A Study of Financial Statement Analysis Through Ratio Analysis at Sids Farm Pvt. LTDDocument14 pages"A Study of Financial Statement Analysis Through Ratio Analysis at Sids Farm Pvt. LTDAbdul WadoodNo ratings yet

- Working CapitalDocument43 pagesWorking CapitalSaisanthosh Kumar SharmaNo ratings yet

- ArticleDocument13 pagesArticlek.karthikeyanNo ratings yet

- University School of Business Studies Talwandi Sabo: SynopsisDocument10 pagesUniversity School of Business Studies Talwandi Sabo: SynopsisInder Dhaliwal KangarhNo ratings yet

- 06 Chapter 1Document26 pages06 Chapter 1Amrit VallahNo ratings yet

- 06 - Chapter 1 PDFDocument26 pages06 - Chapter 1 PDFwawa1303No ratings yet

- DevaDocument15 pagesDevagokulraj0707cmNo ratings yet

- Financial Statement Analysis of HeteroDocument103 pagesFinancial Statement Analysis of Heteroaurorashiva1No ratings yet

- ComparativeDocument91 pagesComparativeSaisanthosh Kumar SharmaNo ratings yet

- Review of LiteratureDocument27 pagesReview of LiteratureKayam BalajiNo ratings yet

- Ratio Analysis 1 SeminarDocument13 pagesRatio Analysis 1 SeminarSHAIK IMRANNo ratings yet

- 25-11-2023-1700920501-7-Ijfm-3. Ijfm - A Project Report On Financial Analysis of Reliance Industries Limited Through Comparative Balance SheetsDocument10 pages25-11-2023-1700920501-7-Ijfm-3. Ijfm - A Project Report On Financial Analysis of Reliance Industries Limited Through Comparative Balance SheetsAbhay ShuklaNo ratings yet

- Resarch Proposal FinalDocument10 pagesResarch Proposal FinalRamesh BabuNo ratings yet

- Chapter-1 Introduction of The Study: A Study On Financial Performance by Ratio AnalysisDocument47 pagesChapter-1 Introduction of The Study: A Study On Financial Performance by Ratio Analysisjayan panangadanNo ratings yet

- DR +Khushbu+JainDocument6 pagesDR +Khushbu+JainSonali MoreNo ratings yet

- Ksfe MINI PROJECT 2016Document47 pagesKsfe MINI PROJECT 2016jayan panangadanNo ratings yet

- Nilutpul SirDocument11 pagesNilutpul SirTarekNo ratings yet

- Human Rights PDFDocument7 pagesHuman Rights PDFRenjul ParavurNo ratings yet

- IROAMSDocument1 pageIROAMSRenjul Paravur100% (1)

- CR PCDocument5 pagesCR PCRenjul ParavurNo ratings yet

- April 2014 Current Affairs Study MaterialDocument11 pagesApril 2014 Current Affairs Study MaterialRenjul ParavurNo ratings yet

- Civil Excise Officer Cat No. 538-2019 PDFDocument14 pagesCivil Excise Officer Cat No. 538-2019 PDFRenjul ParavurNo ratings yet

- March 2014 Current Affairs Study MaterialDocument10 pagesMarch 2014 Current Affairs Study MaterialRenjul ParavurNo ratings yet

- 1 Developed by Verified By: Syllabus & Curriculum For Advanced Course in Msoffice (E-Vidya)Document15 pages1 Developed by Verified By: Syllabus & Curriculum For Advanced Course in Msoffice (E-Vidya)Ashish TripathiNo ratings yet

- Basic Computer Terms With Pictures - Gr8AmbitionZDocument7 pagesBasic Computer Terms With Pictures - Gr8AmbitionZRenjul Paravur100% (1)

- Consumerism and Ethics in Retailing: Renjul.kDocument16 pagesConsumerism and Ethics in Retailing: Renjul.kRenjul ParavurNo ratings yet

- S4 SyllabusDocument6 pagesS4 SyllabusRenjul ParavurNo ratings yet

- ProjectDocument83 pagesProjectRenjul Paravur0% (1)

- Changing Role of HRDDocument10 pagesChanging Role of HRDRenjul Paravur100% (1)

- Choice of Interest Rate Term Structure Models For Pricing and Hedging Bermudan Swaptions - An ALM PerspectiveDocument41 pagesChoice of Interest Rate Term Structure Models For Pricing and Hedging Bermudan Swaptions - An ALM PerspectiveRenjul ParavurNo ratings yet

- Example: Currency Forward ContractsDocument23 pagesExample: Currency Forward ContractsRenjul ParavurNo ratings yet

- Capacity To Contract 1212049123366357 8Document21 pagesCapacity To Contract 1212049123366357 8Renjul ParavurNo ratings yet

- Business LawDocument9 pagesBusiness LawRenjul ParavurNo ratings yet

- 1 4capacity 091107063429 Phpapp02Document44 pages1 4capacity 091107063429 Phpapp02Vikram AdityaNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. ZenderRenjul ParavurNo ratings yet

- Capacity of PartiesDocument23 pagesCapacity of PartiesRenjul ParavurNo ratings yet

- MW5 Star 1 BGDocument2 pagesMW5 Star 1 BGRenjul ParavurNo ratings yet

- Ethics in RetailingDocument16 pagesEthics in RetailingRenjul Paravur100% (2)

- Jas Os 2Document1,559 pagesJas Os 2Renjul ParavurNo ratings yet

- Saima Luxuary Homes Sbca NocDocument2 pagesSaima Luxuary Homes Sbca NocNajeeb UllahNo ratings yet

- Oracle Inventory Copy Inventory Organization Implementation GuideDocument23 pagesOracle Inventory Copy Inventory Organization Implementation GuideSameer MohammedNo ratings yet

- Chap013.ppt Scheduling OperationsDocument23 pagesChap013.ppt Scheduling OperationsSaad Khadur Eilyes100% (1)

- CFA L1 3 Month ScheduleDocument9 pagesCFA L1 3 Month ScheduleSakura2709No ratings yet

- Mortgage Math 1050Document5 pagesMortgage Math 1050api-248061121No ratings yet

- Data WarehousingDocument16 pagesData WarehousingRaman SinghNo ratings yet

- David Stieper - Candidate Profile - DailyHerald 2-14-2014Document2 pagesDavid Stieper - Candidate Profile - DailyHerald 2-14-2014jjknightNo ratings yet

- Turtle Map CMDocument6 pagesTurtle Map CMmtechewitNo ratings yet

- Real Estate Seminar 21 07 2012 CA Naresh Seth PDFDocument43 pagesReal Estate Seminar 21 07 2012 CA Naresh Seth PDFRipujoy BoseNo ratings yet

- Foreign Employment & RemittanceDocument16 pagesForeign Employment & RemittancebibekNo ratings yet

- Institute of Management, Nirma University: MBA (Full-Time) 2019-2021Document25 pagesInstitute of Management, Nirma University: MBA (Full-Time) 2019-2021SakshiTibrewalaNo ratings yet

- Atul's ResumeDocument3 pagesAtul's Resumejapulin9No ratings yet

- Wair Ip-6 PDFDocument2 pagesWair Ip-6 PDFJMNo ratings yet

- What Is The Difference Between Bussiness Plan and Project ProposalDocument6 pagesWhat Is The Difference Between Bussiness Plan and Project ProposalshumetNo ratings yet

- Quality StatementsDocument1 pageQuality StatementsSenthil KumarNo ratings yet

- Competency Assessment QuestionnaireDocument2 pagesCompetency Assessment QuestionnairekurutalaNo ratings yet

- Labour Law-II DR - Nilamani DasDocument9 pagesLabour Law-II DR - Nilamani DasSid'Hart MishraNo ratings yet

- Arch IdDocument264 pagesArch Idsvnrao123No ratings yet

- CV Karntimon - YDocument4 pagesCV Karntimon - Yichigosonix66No ratings yet

- Arabian Petroleum - IntroductionDocument13 pagesArabian Petroleum - Introductionmanan18No ratings yet

- Business Plan Vegetable Lumpia DRAFTDocument9 pagesBusiness Plan Vegetable Lumpia DRAFTCristel CadayongNo ratings yet

- Mba 2nd Sem Result 2010 AdmittedDocument22 pagesMba 2nd Sem Result 2010 AdmittedAnonymous nTxB1EPvNo ratings yet

- Creators Newsletter - Autumn 2017Document3 pagesCreators Newsletter - Autumn 2017api-247802596No ratings yet

- Bourse Stock ExchangeDocument20 pagesBourse Stock ExchangeSiva IddipilliNo ratings yet

- PT Southern Tri Star Vendor Audit Checklist (ISO 9001:2015) Galvanize ProductDocument3 pagesPT Southern Tri Star Vendor Audit Checklist (ISO 9001:2015) Galvanize ProductLenvin100% (1)

- Mongolia's Trade AnalysisDocument3 pagesMongolia's Trade AnalysisSeren TsekiNo ratings yet

- Sans 10403Document43 pagesSans 10403Khanyo100% (2)