Professional Documents

Culture Documents

Ethilbenzen Cost

Ethilbenzen Cost

Uploaded by

JonesHutauruk0 ratings0% found this document useful (0 votes)

32 views2 pagesBreak even point occurs when the total annual product cost equals the total annual

sales. The total annual product cost is the sum of the fixed cost (including fixed charges,

overhead and general expenses) and direct production cost for ‘n’ units per year. The

total annual sale is the product of the number of units and the selling price per unit.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBreak even point occurs when the total annual product cost equals the total annual

sales. The total annual product cost is the sum of the fixed cost (including fixed charges,

overhead and general expenses) and direct production cost for ‘n’ units per year. The

total annual sale is the product of the number of units and the selling price per unit.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

32 views2 pagesEthilbenzen Cost

Ethilbenzen Cost

Uploaded by

JonesHutaurukBreak even point occurs when the total annual product cost equals the total annual

sales. The total annual product cost is the sum of the fixed cost (including fixed charges,

overhead and general expenses) and direct production cost for ‘n’ units per year. The

total annual sale is the product of the number of units and the selling price per unit.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

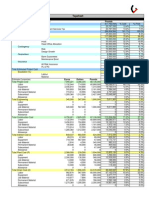

DIRECT PRODUCTION COST

COST (In Crores)

Raw materials (rm)

0.3X

Operating labor (ol)

0.15X

Supervision labor (sl)

0.025X

Utilities

0.15X

Maintenance and repairs (6% of FCC)

8.6178

Operating supplies

1.29267

Lab charges

0.0225X

Patent and royalties

0.05X

Total = 9.91047 + 0.6975X

FIXED CHARGES

COST (In Crores)

Depreciation

14.363

Local taxes

4.3089

Insurance

1.4363

Plant overhead cost (15%{rm+ol+sl})

0.07125X

Total = 20.1082 + 0.07125X

Fixed charge = 16% of TPC (let)

20.1082 + 0.07125X = 0.16X

X = 226.57 crores

GENERAL EXPENSES

Administrative cost (25% ol)

0.0375X

Distribution & selling cost

0.15X

R & D cost

0.05X

Total = 0.2375X

Total product cost = manufacturing cost + general expenses

= (30.1082 + 0.76875X) + 0.2375X

= 30.1082 + 1.00625X

X = 226.57 crores

Therefore general expenses = 53.4 crores

Therefore manufacturing cost = 204.2 crores or Direct production cost

BREAK EVEN ANALYSIS

Break even point occurs when the total annual product cost equals the total annual

sales. The total annual product cost is the sum of the fixed cost (including fixed charges,

overhead and general expenses) and direct production cost for n units per year. The

total annual sale is the product of the number of units and the selling price per unit.

Cost price of ethyl benzene per kg = 226.57x107/1x107 = 226.57 or Rs. 227

Assuming a profit margin of 10% so selling price of the product = Rs. 250

Gross annual earnings = total annual sales total annual product cost

= Rs. 23 crores

Net annual earnings = gross annual earnings income tax

= 23 40%of 23 = 13.8 crores

Pay back period = total capital investment

Net annual earnings

= 179.54/ 13.8 = 13 years (approx)

Rate of return = net profit

FCC

= 13.8/143.63 = 9.6%

You might also like

- FORMALDEHYDE Cost EstimationDocument5 pagesFORMALDEHYDE Cost EstimationPradeep Munna100% (2)

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentRamalu Dinesh ReddyNo ratings yet

- Ethylene 2520oxide Cost 2520Estimation&EconomicsDocument14 pagesEthylene 2520oxide Cost 2520Estimation&EconomicsBelema Thomson100% (1)

- Typical Equipment Capacity Delivered Capital Cost Correlations.Document1 pageTypical Equipment Capacity Delivered Capital Cost Correlations.JonesHutaurukNo ratings yet

- Fixed ChargeDocument2 pagesFixed ChargeYosi ZoyaNo ratings yet

- FIxedcapitalDocument1 pageFIxedcapitalAlan DevilNo ratings yet

- Pertemuan 07 Rancangan Pabrik (18 November 2015)Document21 pagesPertemuan 07 Rancangan Pabrik (18 November 2015)Sania Daniati ArifinNo ratings yet

- Recapitulatie: Material Manopera UtilajDocument2 pagesRecapitulatie: Material Manopera UtilajRodica_Simion_acm4No ratings yet

- Chlorobenzene Cost 2520Estimation&EconomicsDocument5 pagesChlorobenzene Cost 2520Estimation&EconomicsMaribel ArcaniNo ratings yet

- Cost EstDocument6 pagesCost Estchaitanya_scribdNo ratings yet

- Analisis EkonomiDocument71 pagesAnalisis EkonomiAdiyat AdiNo ratings yet

- Berdasarkan Buku Timmerhaus Dan KusnarjoDocument3 pagesBerdasarkan Buku Timmerhaus Dan KusnarjoDelyana RatnasariNo ratings yet

- Econmic Analysis: Basic of Economic AnalysisDocument6 pagesEconmic Analysis: Basic of Economic AnalysisUjalaNo ratings yet

- Acetaldehyde Cost 2520Estimation&EconomicsDocument8 pagesAcetaldehyde Cost 2520Estimation&EconomicsShivam TrivediNo ratings yet

- Acetaldehyde Cost 2520Estimation&EconomicsDocument8 pagesAcetaldehyde Cost 2520Estimation&Economicsapi-3714811100% (1)

- Cost Estimation and Economic AnalysisDocument8 pagesCost Estimation and Economic AnalysisHarsh SrivastavaNo ratings yet

- ACC 100 B Quiz 4 AnswersDocument1 pageACC 100 B Quiz 4 AnswersHelaena Ruvie Quitoras PallayaNo ratings yet

- Plant DesignDocument20 pagesPlant DesignetayhailuNo ratings yet

- Acrylic 2520acid Cost 2520Estimation&EconomicsDocument5 pagesAcrylic 2520acid Cost 2520Estimation&EconomicsmasterNo ratings yet

- Sulfuric 2520acid Cost 2520Estimation&EconomicsDocument8 pagesSulfuric 2520acid Cost 2520Estimation&Economicsu10ch019No ratings yet

- 750 Topsheet (Incl Currencies)Document1 page750 Topsheet (Incl Currencies)Satria Pinandita100% (1)

- CFFFFDocument6 pagesCFFFFAliyanKhanNo ratings yet

- Toluene Cost Estimation&EconomicsDocument10 pagesToluene Cost Estimation&EconomicssapooknikNo ratings yet

- Final Project Cost12Document3 pagesFinal Project Cost12Muhammad Ammar GhaniNo ratings yet

- Cumene Cost 2520Estimation&EconomicsDocument7 pagesCumene Cost 2520Estimation&EconomicssyazwanjohnmazlanNo ratings yet

- Cost EstimationDocument8 pagesCost EstimationMuhammad Husnain ArshadNo ratings yet

- CH 9 - 2Document14 pagesCH 9 - 2Abdo ShaheenNo ratings yet

- Analysis PVD Supply - NCTDocument1 pageAnalysis PVD Supply - NCTMahibul HasanNo ratings yet

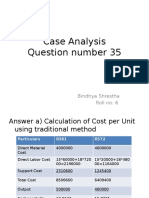

- Case Analysis Question Number 35: Bindhya Shrestha Roll No: 6Document10 pagesCase Analysis Question Number 35: Bindhya Shrestha Roll No: 6Anusha NeupaneNo ratings yet

- Capcost 2008Document14 pagesCapcost 2008Makon ClineNo ratings yet

- Own Capital 1,95500 Term Loan 1,50000 Working Capital Loan 4,36500Document2 pagesOwn Capital 1,95500 Term Loan 1,50000 Working Capital Loan 4,36500pradip_kumarNo ratings yet

- Perhitungan Total Capital InvestmentDocument5 pagesPerhitungan Total Capital InvestmentElsagita SiagianNo ratings yet

- Lampiran C Biaya Investasi: Fixed Capital Invetment (FCI) Direct CostDocument8 pagesLampiran C Biaya Investasi: Fixed Capital Invetment (FCI) Direct CostNoris SaputraNo ratings yet

- Divinylbenzene (Do Not Copy Blindly), Cost and EstimationDocument4 pagesDivinylbenzene (Do Not Copy Blindly), Cost and EstimationMehul DeshpandeNo ratings yet

- Capcost 2008Document15 pagesCapcost 2008Paulina BarrientosNo ratings yet

- Solution SWAIDocument2 pagesSolution SWAIgeneral.abbyNo ratings yet

- Cost Sheet TemplatesDocument26 pagesCost Sheet TemplatessukeshNo ratings yet

- Sample Calculation For Exchanger E-101Document12 pagesSample Calculation For Exchanger E-101Apih IbrahimNo ratings yet

- Costing and Project EvaluationDocument11 pagesCosting and Project EvaluationGunalan RNo ratings yet

- Descripcion Red Primaria Total S/. Obras Civiles 86,372.47 Red SecundariaDocument1 pageDescripcion Red Primaria Total S/. Obras Civiles 86,372.47 Red SecundariaPedro BartolomeNo ratings yet

- EconDocument16 pagesEconvivek3790No ratings yet

- Management Accounting and Control Systems Report On: Cost Sheet and Break Even AnalysisDocument9 pagesManagement Accounting and Control Systems Report On: Cost Sheet and Break Even AnalysisHavish P D SulliaNo ratings yet

- Manufacturing Account Worked Example Question 16Document5 pagesManufacturing Account Worked Example Question 16Roshan RamkhalawonNo ratings yet

- Cost EstimationDocument7 pagesCost Estimationrubesh_rajaNo ratings yet

- Harga Free On Board Harga Cost and Freight Harga Cost Insurance FreightDocument15 pagesHarga Free On Board Harga Cost and Freight Harga Cost Insurance FreighttrusheroNo ratings yet

- Capital Investment Revenue Cost (RM)Document2 pagesCapital Investment Revenue Cost (RM)aimanjamelNo ratings yet

- Capital Investment2Document2 pagesCapital Investment2aimanjamelNo ratings yet

- AFAR First Preboard 93 - SolutionsDocument12 pagesAFAR First Preboard 93 - SolutionsEpfie SanchesNo ratings yet

- Costing SheetDocument5 pagesCosting SheetDkPrinceNo ratings yet

- Cost/Month Unit Cost (Peso/ Pack) % To TotalDocument3 pagesCost/Month Unit Cost (Peso/ Pack) % To TotalAnn Tupaz GumbanNo ratings yet

- Annual Production Cost: Table 1 Typical Factors For Estimation of Project Fixed Capital CostDocument3 pagesAnnual Production Cost: Table 1 Typical Factors For Estimation of Project Fixed Capital Costrustam effendyNo ratings yet

- 4-FCT ExercisesDocument7 pages4-FCT ExercisesDinh Thuy HuyenNo ratings yet

- Prelim DataDocument10 pagesPrelim DatajerrenjgNo ratings yet

- Chapter19 - AnswerDocument27 pagesChapter19 - AnswerxxxxxxxxxNo ratings yet

- Cost Accounting - Case-Daniel DobbinsDocument1 pageCost Accounting - Case-Daniel DobbinsRatin Mathur100% (4)

- Hitungan Aurora - PowerRanger2Document6 pagesHitungan Aurora - PowerRanger2Subbagian Rumah Tangga Kanwil DJBC SumutNo ratings yet

- Operating Cost EthylbenzeneDocument2 pagesOperating Cost EthylbenzeneJonesHutaurukNo ratings yet

- Operating Cost Ethylbenzene 1Document1 pageOperating Cost Ethylbenzene 1JonesHutaurukNo ratings yet

- Product Profile of AromaticsDocument1 pageProduct Profile of AromaticsJonesHutaurukNo ratings yet

- John Calvin and The Reformation in GenevaDocument15 pagesJohn Calvin and The Reformation in GenevaJonesHutaurukNo ratings yet

- AppendixDocument349 pagesAppendixLufya AdellaNo ratings yet

- AppendixDocument139 pagesAppendixItonamyRitongaNo ratings yet

- Solution Manual 2.1 - 2.17 KernDocument2 pagesSolution Manual 2.1 - 2.17 KernJonesHutauruk100% (1)

- Comparative Study of Adsorptive Removal of Congo Red and Brilliant Green Dyes From Water Using Peanut ShellDocument5 pagesComparative Study of Adsorptive Removal of Congo Red and Brilliant Green Dyes From Water Using Peanut ShellJonesHutaurukNo ratings yet

- Solution Manual 1.45-1.46 KernDocument2 pagesSolution Manual 1.45-1.46 KernJonesHutaurukNo ratings yet

- Acetone CPDocument6 pagesAcetone CPJonesHutaurukNo ratings yet

- Daftar Pustaka: Universitas Sumatera UtaraDocument3 pagesDaftar Pustaka: Universitas Sumatera UtaraJonesHutaurukNo ratings yet