Professional Documents

Culture Documents

3 The Accounting Equation and How It Stays in Balance

3 The Accounting Equation and How It Stays in Balance

Uploaded by

api-299265916Copyright:

Available Formats

You might also like

- 3 How To Prepare A Balance SheetDocument4 pages3 How To Prepare A Balance Sheetapi-299265916100% (1)

- Financial Ratio AnalysisDocument4 pagesFinancial Ratio Analysisapi-299265916100% (1)

- 5 Adjusting Entries For Prepaid ExpenseDocument4 pages5 Adjusting Entries For Prepaid Expenseapi-299265916No ratings yet

- Accounting EquationDocument3 pagesAccounting EquationSittie Asiyah Dimaporo AbubacarNo ratings yet

- 2 Basic Accounting EquationDocument3 pages2 Basic Accounting EquationStarlette Kaye BadonNo ratings yet

- The Accounting Equation and How It Stays in BalanceDocument14 pagesThe Accounting Equation and How It Stays in BalanceLovely Mae LacasteNo ratings yet

- Chapter 3 Double Entry BookkeepingDocument16 pagesChapter 3 Double Entry BookkeepingNgoni Mukuku100% (2)

- Acc EqDocument5 pagesAcc EqBianca BgnNo ratings yet

- Summary of Videos Part II - Bano, Chariel PDocument3 pagesSummary of Videos Part II - Bano, Chariel PbanscharielNo ratings yet

- Double Entry AccountingDocument22 pagesDouble Entry AccountingLaten Cruxy100% (1)

- Basic Accounting EquationDocument3 pagesBasic Accounting EquationMaria Charise TongolNo ratings yet

- Accounting EquationDocument18 pagesAccounting EquationPradeep Gupta100% (1)

- Accounting EquationDocument4 pagesAccounting EquationCarlo Leandro LaronNo ratings yet

- Accounting EquationDocument10 pagesAccounting EquationYasmin khanNo ratings yet

- Accountancy Notes ch-3Document11 pagesAccountancy Notes ch-3Ansh JaiswalNo ratings yet

- Chapter II A For ManagersDocument46 pagesChapter II A For ManagersAsħîŞĥLøÝåNo ratings yet

- Properaite and Corporate Transaction AccountingDocument41 pagesProperaite and Corporate Transaction Accountingroheed100% (1)

- Accounting EquationDocument14 pagesAccounting Equationadane bayeNo ratings yet

- Chapter 3: Accruals and Deferrals AgendaDocument48 pagesChapter 3: Accruals and Deferrals AgendaWei DengNo ratings yet

- Double Entry SystemDocument5 pagesDouble Entry SystemSamiul HasanNo ratings yet

- Brand Generation College Dep't of Accounting and Financial: Basic Accounts Work Level IIDocument31 pagesBrand Generation College Dep't of Accounting and Financial: Basic Accounts Work Level IIhundegemechu68No ratings yet

- Definition of Certain Accounting TermsDocument4 pagesDefinition of Certain Accounting TermsAbhishek SachdevaNo ratings yet

- Accounting EquationDocument3 pagesAccounting EquationRowena DizonNo ratings yet

- When To Debit and Credit in AccountingDocument8 pagesWhen To Debit and Credit in Accountinguser31415No ratings yet

- Chapter OneDocument3 pagesChapter OneomerNo ratings yet

- Accounting Equation Service Business 6Document21 pagesAccounting Equation Service Business 6udayraj_vNo ratings yet

- 01 - Basic ConceptsDocument20 pages01 - Basic ConceptsSyed Mudussir HusainNo ratings yet

- Important Concepts ExplainedDocument4 pagesImportant Concepts ExplainedRamanaNo ratings yet

- Study Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Document19 pagesStudy Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Sandhra SethurajNo ratings yet

- Describe How The Following Business Transactions Affect The Three Elements of The AccountingDocument3 pagesDescribe How The Following Business Transactions Affect The Three Elements of The AccountingUserNo ratings yet

- FABM Q3 L3. SLeM 3 - A L+OEDocument15 pagesFABM Q3 L3. SLeM 3 - A L+OESophia MagdaraogNo ratings yet

- ACCT 1026 Lesson 3 PDFDocument11 pagesACCT 1026 Lesson 3 PDFAnnie RapanutNo ratings yet

- ACCT 1026 Lesson 3Document11 pagesACCT 1026 Lesson 3Daniel MadarangNo ratings yet

- Accounting Financial: General LedgerDocument8 pagesAccounting Financial: General LedgerSumeet KaurNo ratings yet

- Accounting ProjectDocument25 pagesAccounting ProjectLidianny CastilloNo ratings yet

- Week 1 - Accounting EquationDocument23 pagesWeek 1 - Accounting EquationJannyfaye RallecaNo ratings yet

- Accounting Equation: ModuleDocument13 pagesAccounting Equation: ModuleTushar SainiNo ratings yet

- Introduction To AccountingDocument2 pagesIntroduction To AccountingShahid MehmoodNo ratings yet

- Balance Sheet Analysis - TourismDocument10 pagesBalance Sheet Analysis - TourismMarieNo ratings yet

- Session 3 - ResumeDocument2 pagesSession 3 - ResumeVivi DuranNo ratings yet

- 11 Physics Notes Ch3Document29 pages11 Physics Notes Ch3Manish kumarNo ratings yet

- Introduction To Debits and CreditsDocument8 pagesIntroduction To Debits and CreditsMJ Dulin100% (1)

- Introduction To Debits and CreditsDocument16 pagesIntroduction To Debits and CreditsMeiRose100% (1)

- Acct 3Document12 pagesAcct 3Annie RapanutNo ratings yet

- FA1 Notes: (Business Transactions and Double Entry)Document24 pagesFA1 Notes: (Business Transactions and Double Entry)Waqas KhanNo ratings yet

- Financial Accounting & AnalysisDocument7 pagesFinancial Accounting & AnalysisMitaliNo ratings yet

- Accounting Adjusting EntryDocument20 pagesAccounting Adjusting EntryClemencia Masiba100% (1)

- Account TitlesDocument28 pagesAccount TitlesEfrelyn Grethel Baraya Alejandro100% (1)

- Lesson 1: Date Topics Activities or TasksDocument22 pagesLesson 1: Date Topics Activities or TasksKeeshia Mae Nashra ApilitNo ratings yet

- Accounting Equation For ACCADocument2 pagesAccounting Equation For ACCAtipu1sultan_1No ratings yet

- Double Entry Bookkeeping: 7 Step Guide To Processing Business AccountsDocument18 pagesDouble Entry Bookkeeping: 7 Step Guide To Processing Business AccountsChristy BascoNo ratings yet

- Fundamental Accounting Topic 3Document4 pagesFundamental Accounting Topic 3Hafiz AttaNo ratings yet

- SAP User Guide Accrual DeferalDocument48 pagesSAP User Guide Accrual DeferalwiwNo ratings yet

- Accounting Equation Lec 3rdDocument16 pagesAccounting Equation Lec 3rdWaqas KhanNo ratings yet

- Accounting EquationDocument23 pagesAccounting EquationGST TEAMNo ratings yet

- Individual Paper Accounting Equation Due 7-9-12Document6 pagesIndividual Paper Accounting Equation Due 7-9-12Constance Ben HamptonNo ratings yet

- Basic Accounting EquationDocument42 pagesBasic Accounting Equationlily smithNo ratings yet

- Accounting G10 - September 18, 2021Document4 pagesAccounting G10 - September 18, 2021wandeerNo ratings yet

- Accounting Equation: The Claim Has Two TypesDocument3 pagesAccounting Equation: The Claim Has Two TypesAmna YounasNo ratings yet

- Mba AssignmentsDocument8 pagesMba AssignmentsRamani RajNo ratings yet

- SSFABM1 ABM2000 Assignment1-3 ANSWERSDocument4 pagesSSFABM1 ABM2000 Assignment1-3 ANSWERSyannaNo ratings yet

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Financial TableDocument9 pagesFinancial Tableapi-299265916No ratings yet

- 3 Income Statement ExamplesDocument3 pages3 Income Statement Examplesapi-299265916100% (1)

- 2 Income Statement FormatDocument3 pages2 Income Statement Formatapi-299265916No ratings yet

- 4 Revenue AccountsDocument1 page4 Revenue Accountsapi-299265916No ratings yet

- 2 Liability AccountsDocument2 pages2 Liability Accountsapi-299265916No ratings yet

- 5 Expense AccountsDocument2 pages5 Expense Accountsapi-299265916No ratings yet

- 2 Qualitative Characteristics of Financial InformationDocument2 pages2 Qualitative Characteristics of Financial Informationapi-299265916No ratings yet

- 6 Adjusting Entry For Depreciation ExpenseDocument3 pages6 Adjusting Entry For Depreciation Expenseapi-299265916No ratings yet

- 4 Accounting PrinciplesDocument3 pages4 Accounting Principlesapi-299265916No ratings yet

- Post-Closing Trial BalanceDocument4 pagesPost-Closing Trial Balanceapi-299265916100% (2)

- 1 Asset AccountsDocument3 pages1 Asset Accountsapi-299265916No ratings yet

- 2 How To Prepare A Statement of OwnerDocument4 pages2 How To Prepare A Statement of Ownerapi-299265916No ratings yet

- Reversing Entries Part 1Document3 pagesReversing Entries Part 1api-299265916100% (1)

- Closing EntriesDocument4 pagesClosing Entriesapi-299265916100% (1)

- 3 Standards of Ethical Conduct For Management AccountantsDocument2 pages3 Standards of Ethical Conduct For Management Accountantsapi-299265916No ratings yet

- 8 Adjusted Trial BalanceDocument3 pages8 Adjusted Trial Balanceapi-299265916100% (1)

- 1 How To Prepare An Income StatementDocument4 pages1 How To Prepare An Income Statementapi-299265916No ratings yet

- 7 Adjusting Entry For Bad Debts ExpenseDocument2 pages7 Adjusting Entry For Bad Debts Expenseapi-299265916No ratings yet

- 2 Adjusting Entry For Accrued RevenueDocument2 pages2 Adjusting Entry For Accrued Revenueapi-299265916No ratings yet

- 3 Adjusting Entry For Accrued ExpensesDocument2 pages3 Adjusting Entry For Accrued Expensesapi-299265916No ratings yet

- 2 Rules of Debit and CreditDocument3 pages2 Rules of Debit and Creditapi-2992659160% (1)

- 5 Journal Entries More ExamplesDocument4 pages5 Journal Entries More Examplesapi-299265916No ratings yet

- 6 Posting To The LedgerDocument3 pages6 Posting To The Ledgerapi-299265916No ratings yet

- 4 Journal EntriesDocument2 pages4 Journal Entriesapi-299265916No ratings yet

- 3 Chart of AccountsDocument3 pages3 Chart of Accountsapi-299265916No ratings yet

- 8 Correcting EntriesDocument3 pages8 Correcting Entriesapi-299265916No ratings yet

- 1 Understanding and Analyzing Business TransactionsDocument2 pages1 Understanding and Analyzing Business Transactionsapi-299265916No ratings yet

3 The Accounting Equation and How It Stays in Balance

3 The Accounting Equation and How It Stays in Balance

Uploaded by

api-299265916Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 The Accounting Equation and How It Stays in Balance

3 The Accounting Equation and How It Stays in Balance

Uploaded by

api-299265916Copyright:

Available Formats

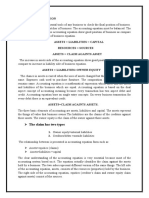

The Accounting Equation and How It Stays in Balance

The accounting equation is the unifying concept in accounting that shows the relationships between and

among the accounting elements: assets, liabilities, and capital.

In this lesson (and the next ones), you will learn about the basic accounting equation and how it stays in

balance.

Basic Accounting Equation

The basic accounting equation is:

Assets = Liabilities + Capital

When a business is put up, its resources (assets) come from two sources: contributions by owners

(capital) and those acquired from creditors or lenders (liabilities). In other words, all assets initially come

from liabilities and owners' contributions.

As business transactions take place, the values of the accounting elements change. The accounting

equation nonetheless always stays in balance.

Every transaction has a two-fold effect. Meaning, at least two accounts are affected. Let's illustrate all of

that through these examples.

Assume the following transactions:

1. Mr. Alex invested $20,000 to start a printing business,

2. The company obtained a loan from a bank, $30,000,

3. The company purchased printers and paid a total of $1,000.

How will the transactions affect the accounting equation?

Let us take a look at transaction #1:

Transaction

1. Owner's investment

Assets

20,000.00 =

Liabilities

Capital

20,000.00

Again, every transaction has a two-fold effect. In the above transaction, Assets increased as a result of

the increase in Cash. At the same time, Capital increased due to the owner's contribution. Remember that

capital is increased by contribution of owners and income, and is decreased by withdrawals and

expenses. No liability is affected hence, stays at zero.

Let's continue with transaction #2:

Transaction

Assets

1. Owner's investment

20,000.00 =

2. Loan from bank

30,000.00 =

Liabilities

Capital

20,000.00

30,000.00 +

In transaction #2, the company received cash. Thus, the value of total assets is increased. At the same

time, it incurred in an obligation to pay the bank. Therefore, liabilities are increased. The liability in this

case is recorded as Loans Payable.

Notice that the accounting equation is still equal (balanced).

Let's add transaction #3:

Transaction

Assets

1. Owner's investment

20,000.00 =

2. Loan from bank

30,000.00 =

3. Purchased printers

1,000.00

=

(1,000.00)

Liabilities

Capital

20,000.00

30,000.00 +

-

The company acquired printers, hence, an increase in assets. However, the company used cash to pay

for the printers. Thus, it also results in a decrease in assets. Transaction #3 results in an increase in one

asset (Service Equipment) and a decrease in another asset (Cash).

For those who are new to accounting format: The parentheses "()" around the 1,000 amount above

means "minus" or "less".

Liabilities and capital are not affected. Still, the equation in the third transaction is equal.In this case, it

has zero effect on both sides.

At this point, the balance of total assets is $50,000. The combined balance of liabilities and capital is also

at $50,000.

The accounting equation is (and should always be) in balance.

You might also like

- 3 How To Prepare A Balance SheetDocument4 pages3 How To Prepare A Balance Sheetapi-299265916100% (1)

- Financial Ratio AnalysisDocument4 pagesFinancial Ratio Analysisapi-299265916100% (1)

- 5 Adjusting Entries For Prepaid ExpenseDocument4 pages5 Adjusting Entries For Prepaid Expenseapi-299265916No ratings yet

- Accounting EquationDocument3 pagesAccounting EquationSittie Asiyah Dimaporo AbubacarNo ratings yet

- 2 Basic Accounting EquationDocument3 pages2 Basic Accounting EquationStarlette Kaye BadonNo ratings yet

- The Accounting Equation and How It Stays in BalanceDocument14 pagesThe Accounting Equation and How It Stays in BalanceLovely Mae LacasteNo ratings yet

- Chapter 3 Double Entry BookkeepingDocument16 pagesChapter 3 Double Entry BookkeepingNgoni Mukuku100% (2)

- Acc EqDocument5 pagesAcc EqBianca BgnNo ratings yet

- Summary of Videos Part II - Bano, Chariel PDocument3 pagesSummary of Videos Part II - Bano, Chariel PbanscharielNo ratings yet

- Double Entry AccountingDocument22 pagesDouble Entry AccountingLaten Cruxy100% (1)

- Basic Accounting EquationDocument3 pagesBasic Accounting EquationMaria Charise TongolNo ratings yet

- Accounting EquationDocument18 pagesAccounting EquationPradeep Gupta100% (1)

- Accounting EquationDocument4 pagesAccounting EquationCarlo Leandro LaronNo ratings yet

- Accounting EquationDocument10 pagesAccounting EquationYasmin khanNo ratings yet

- Accountancy Notes ch-3Document11 pagesAccountancy Notes ch-3Ansh JaiswalNo ratings yet

- Chapter II A For ManagersDocument46 pagesChapter II A For ManagersAsħîŞĥLøÝåNo ratings yet

- Properaite and Corporate Transaction AccountingDocument41 pagesProperaite and Corporate Transaction Accountingroheed100% (1)

- Accounting EquationDocument14 pagesAccounting Equationadane bayeNo ratings yet

- Chapter 3: Accruals and Deferrals AgendaDocument48 pagesChapter 3: Accruals and Deferrals AgendaWei DengNo ratings yet

- Double Entry SystemDocument5 pagesDouble Entry SystemSamiul HasanNo ratings yet

- Brand Generation College Dep't of Accounting and Financial: Basic Accounts Work Level IIDocument31 pagesBrand Generation College Dep't of Accounting and Financial: Basic Accounts Work Level IIhundegemechu68No ratings yet

- Definition of Certain Accounting TermsDocument4 pagesDefinition of Certain Accounting TermsAbhishek SachdevaNo ratings yet

- Accounting EquationDocument3 pagesAccounting EquationRowena DizonNo ratings yet

- When To Debit and Credit in AccountingDocument8 pagesWhen To Debit and Credit in Accountinguser31415No ratings yet

- Chapter OneDocument3 pagesChapter OneomerNo ratings yet

- Accounting Equation Service Business 6Document21 pagesAccounting Equation Service Business 6udayraj_vNo ratings yet

- 01 - Basic ConceptsDocument20 pages01 - Basic ConceptsSyed Mudussir HusainNo ratings yet

- Important Concepts ExplainedDocument4 pagesImportant Concepts ExplainedRamanaNo ratings yet

- Study Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Document19 pagesStudy Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Sandhra SethurajNo ratings yet

- Describe How The Following Business Transactions Affect The Three Elements of The AccountingDocument3 pagesDescribe How The Following Business Transactions Affect The Three Elements of The AccountingUserNo ratings yet

- FABM Q3 L3. SLeM 3 - A L+OEDocument15 pagesFABM Q3 L3. SLeM 3 - A L+OESophia MagdaraogNo ratings yet

- ACCT 1026 Lesson 3 PDFDocument11 pagesACCT 1026 Lesson 3 PDFAnnie RapanutNo ratings yet

- ACCT 1026 Lesson 3Document11 pagesACCT 1026 Lesson 3Daniel MadarangNo ratings yet

- Accounting Financial: General LedgerDocument8 pagesAccounting Financial: General LedgerSumeet KaurNo ratings yet

- Accounting ProjectDocument25 pagesAccounting ProjectLidianny CastilloNo ratings yet

- Week 1 - Accounting EquationDocument23 pagesWeek 1 - Accounting EquationJannyfaye RallecaNo ratings yet

- Accounting Equation: ModuleDocument13 pagesAccounting Equation: ModuleTushar SainiNo ratings yet

- Introduction To AccountingDocument2 pagesIntroduction To AccountingShahid MehmoodNo ratings yet

- Balance Sheet Analysis - TourismDocument10 pagesBalance Sheet Analysis - TourismMarieNo ratings yet

- Session 3 - ResumeDocument2 pagesSession 3 - ResumeVivi DuranNo ratings yet

- 11 Physics Notes Ch3Document29 pages11 Physics Notes Ch3Manish kumarNo ratings yet

- Introduction To Debits and CreditsDocument8 pagesIntroduction To Debits and CreditsMJ Dulin100% (1)

- Introduction To Debits and CreditsDocument16 pagesIntroduction To Debits and CreditsMeiRose100% (1)

- Acct 3Document12 pagesAcct 3Annie RapanutNo ratings yet

- FA1 Notes: (Business Transactions and Double Entry)Document24 pagesFA1 Notes: (Business Transactions and Double Entry)Waqas KhanNo ratings yet

- Financial Accounting & AnalysisDocument7 pagesFinancial Accounting & AnalysisMitaliNo ratings yet

- Accounting Adjusting EntryDocument20 pagesAccounting Adjusting EntryClemencia Masiba100% (1)

- Account TitlesDocument28 pagesAccount TitlesEfrelyn Grethel Baraya Alejandro100% (1)

- Lesson 1: Date Topics Activities or TasksDocument22 pagesLesson 1: Date Topics Activities or TasksKeeshia Mae Nashra ApilitNo ratings yet

- Accounting Equation For ACCADocument2 pagesAccounting Equation For ACCAtipu1sultan_1No ratings yet

- Double Entry Bookkeeping: 7 Step Guide To Processing Business AccountsDocument18 pagesDouble Entry Bookkeeping: 7 Step Guide To Processing Business AccountsChristy BascoNo ratings yet

- Fundamental Accounting Topic 3Document4 pagesFundamental Accounting Topic 3Hafiz AttaNo ratings yet

- SAP User Guide Accrual DeferalDocument48 pagesSAP User Guide Accrual DeferalwiwNo ratings yet

- Accounting Equation Lec 3rdDocument16 pagesAccounting Equation Lec 3rdWaqas KhanNo ratings yet

- Accounting EquationDocument23 pagesAccounting EquationGST TEAMNo ratings yet

- Individual Paper Accounting Equation Due 7-9-12Document6 pagesIndividual Paper Accounting Equation Due 7-9-12Constance Ben HamptonNo ratings yet

- Basic Accounting EquationDocument42 pagesBasic Accounting Equationlily smithNo ratings yet

- Accounting G10 - September 18, 2021Document4 pagesAccounting G10 - September 18, 2021wandeerNo ratings yet

- Accounting Equation: The Claim Has Two TypesDocument3 pagesAccounting Equation: The Claim Has Two TypesAmna YounasNo ratings yet

- Mba AssignmentsDocument8 pagesMba AssignmentsRamani RajNo ratings yet

- SSFABM1 ABM2000 Assignment1-3 ANSWERSDocument4 pagesSSFABM1 ABM2000 Assignment1-3 ANSWERSyannaNo ratings yet

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Financial TableDocument9 pagesFinancial Tableapi-299265916No ratings yet

- 3 Income Statement ExamplesDocument3 pages3 Income Statement Examplesapi-299265916100% (1)

- 2 Income Statement FormatDocument3 pages2 Income Statement Formatapi-299265916No ratings yet

- 4 Revenue AccountsDocument1 page4 Revenue Accountsapi-299265916No ratings yet

- 2 Liability AccountsDocument2 pages2 Liability Accountsapi-299265916No ratings yet

- 5 Expense AccountsDocument2 pages5 Expense Accountsapi-299265916No ratings yet

- 2 Qualitative Characteristics of Financial InformationDocument2 pages2 Qualitative Characteristics of Financial Informationapi-299265916No ratings yet

- 6 Adjusting Entry For Depreciation ExpenseDocument3 pages6 Adjusting Entry For Depreciation Expenseapi-299265916No ratings yet

- 4 Accounting PrinciplesDocument3 pages4 Accounting Principlesapi-299265916No ratings yet

- Post-Closing Trial BalanceDocument4 pagesPost-Closing Trial Balanceapi-299265916100% (2)

- 1 Asset AccountsDocument3 pages1 Asset Accountsapi-299265916No ratings yet

- 2 How To Prepare A Statement of OwnerDocument4 pages2 How To Prepare A Statement of Ownerapi-299265916No ratings yet

- Reversing Entries Part 1Document3 pagesReversing Entries Part 1api-299265916100% (1)

- Closing EntriesDocument4 pagesClosing Entriesapi-299265916100% (1)

- 3 Standards of Ethical Conduct For Management AccountantsDocument2 pages3 Standards of Ethical Conduct For Management Accountantsapi-299265916No ratings yet

- 8 Adjusted Trial BalanceDocument3 pages8 Adjusted Trial Balanceapi-299265916100% (1)

- 1 How To Prepare An Income StatementDocument4 pages1 How To Prepare An Income Statementapi-299265916No ratings yet

- 7 Adjusting Entry For Bad Debts ExpenseDocument2 pages7 Adjusting Entry For Bad Debts Expenseapi-299265916No ratings yet

- 2 Adjusting Entry For Accrued RevenueDocument2 pages2 Adjusting Entry For Accrued Revenueapi-299265916No ratings yet

- 3 Adjusting Entry For Accrued ExpensesDocument2 pages3 Adjusting Entry For Accrued Expensesapi-299265916No ratings yet

- 2 Rules of Debit and CreditDocument3 pages2 Rules of Debit and Creditapi-2992659160% (1)

- 5 Journal Entries More ExamplesDocument4 pages5 Journal Entries More Examplesapi-299265916No ratings yet

- 6 Posting To The LedgerDocument3 pages6 Posting To The Ledgerapi-299265916No ratings yet

- 4 Journal EntriesDocument2 pages4 Journal Entriesapi-299265916No ratings yet

- 3 Chart of AccountsDocument3 pages3 Chart of Accountsapi-299265916No ratings yet

- 8 Correcting EntriesDocument3 pages8 Correcting Entriesapi-299265916No ratings yet

- 1 Understanding and Analyzing Business TransactionsDocument2 pages1 Understanding and Analyzing Business Transactionsapi-299265916No ratings yet