Professional Documents

Culture Documents

Investments For Accounting Summary

Investments For Accounting Summary

Uploaded by

myzevelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investments For Accounting Summary

Investments For Accounting Summary

Uploaded by

myzevelCopyright:

Available Formats

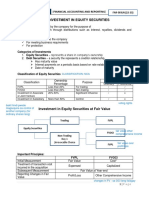

INVESTMENTS – Passive (Market Value)

Measuring and

Effect of Unrealized Holding Gains and

Investment Category Reporting Method

Losses On . . .

Debt Passive, Held-to-maturity Amortized cost Type of Investment

Debt Passive, Not-held-to-maturity Market value Investment Definition Account Equity Net Income

Actively traded Reported on

Stock Passive Market value Trading Allowance

for potential N/A the Income

Stock Significant influence Equity Securities

profit.

Account

Statement

Stock Control Consolidated statement Not actively

Securities Reported

traded, held for Allowance

Available for as part of N/A

investment Account

Sale equity

Income Statement returns.

Trading Securities

Effects Securities Available for Sale

Realized Gains Sales Price > Cost Sales Price > Cost

Realized Losses Sales Price < Cost Sales Price < Cost

Unrealized Gains Adjusted at

N/A

and Losses Year-end

Balance Sheet

Trading Securities

Effects Securities Available for Sale

Unrealized Gains Adjusted at

N/A

and Losses Year-end

Unrealized

Unrealizedholding

holdinggains

gains

and

and losses arerecorded.

losses are recorded.

Date of Future measurement

acquisition date

Investment is Investment carrying

initially recorded amount is adjusted to

at cost. current market value.

INVESTMENTS – Significant Influence (Equity Method)

Adjusting Effect on

NOTE:

Item Realized

Investment gains and losses

Account go on the

Dividends Income Statement.

Reduce investment

for dividends received.

Investee Increase investment

Net Income by our proportionate

share.

Investee Decrease investment

Net Loss by our proportionate

share.

Operating

Operatingactivities:

activities:

Gain

Gainononsale

saleofofinvestment

investment(subtract

(subtractfrom

fromnetnetincome)

income)

Loss on sale of investment (add to net

Loss on sale of investment (add to net income) income)

Equity

Equityininearnings

earningsofofinvestee

investee(subtract

(subtractfrom

fromnet

netincome)

income)

Dividends from investee (add to net

Dividends from investee (add to net income)income)

Unrealized

Unrealizedholding

holdinggains

gainstrading

tradingsecurities

securities(subtract

(subtractfrom

fromnet

netincome)

income)

Unrealized holding losses trading securities (add to net

Unrealized holding losses trading securities (add to net income) income)

Investment carrying amount is adjusted for dividends rece

share of the investee’s income.

(Investment for Accounting - Summary)

You might also like

- CH 5 - AdjustmentsDocument24 pagesCH 5 - Adjustmentsmuhamad elmiNo ratings yet

- Chapter 1 Accounting For Intercorporate InvestmentsDocument42 pagesChapter 1 Accounting For Intercorporate InvestmentsAndrea Galeazzi RosilloNo ratings yet

- 01 Course Notes On InvestmentsDocument6 pages01 Course Notes On InvestmentsMaxin TanNo ratings yet

- Chapter 05Document36 pagesChapter 05Irfan AdhityoNo ratings yet

- CHAP001 2eDocument47 pagesCHAP001 2eeren rasteNo ratings yet

- Notes Materi InvestmentDocument8 pagesNotes Materi InvestmentaliciakarleyinNo ratings yet

- Financial Assets at Fair ValueDocument2 pagesFinancial Assets at Fair ValueNicole Allyson AguantaNo ratings yet

- Lecture 1.3 - SlidesDocument14 pagesLecture 1.3 - Slidessfalcao91No ratings yet

- Bigpic 2Document1 pageBigpic 2abeernabilabdNo ratings yet

- Lecture Financial Accounting (8 - E) - Appendix E - Robert Libby, Patricia A. Libby, Daniel G. Short - 1130794Document18 pagesLecture Financial Accounting (8 - E) - Appendix E - Robert Libby, Patricia A. Libby, Daniel G. Short - 1130794Đức DramaNo ratings yet

- Tugas Manajemen Keuangan (Working Capital)Document7 pagesTugas Manajemen Keuangan (Working Capital)anaNo ratings yet

- FINACC1 - Investment in Equity and Debt Instruments PDFDocument4 pagesFINACC1 - Investment in Equity and Debt Instruments PDFJerico DungcaNo ratings yet

- Financial Mix RatiosDocument7 pagesFinancial Mix RatiosansanandresNo ratings yet

- FAR-Lecture 3Document9 pagesFAR-Lecture 3wingsenigma 00No ratings yet

- Chap 001Document41 pagesChap 001abel JemalNo ratings yet

- International Standards ConvergenceDocument5 pagesInternational Standards ConvergenceAbid WaheedNo ratings yet

- Chapter 1 - Equity InstrumentsDocument1 pageChapter 1 - Equity InstrumentsHussna Al-Habsi حُسنى الحبسيNo ratings yet

- Income Tax Summary - Retail InvestorDocument8 pagesIncome Tax Summary - Retail InvestorCricket KheloNo ratings yet

- Reviewer - Intermediate Accounting Part 3Document6 pagesReviewer - Intermediate Accounting Part 3Derek Dale Vizconde NuñezNo ratings yet

- Mind Map Pert 3Document1 pageMind Map Pert 317HARISA SETYA HANDININo ratings yet

- 财务、企业理财、权益、其他Document110 pages财务、企业理财、权益、其他Ariel MengNo ratings yet

- 2017 Accounting Examination PaperDocument30 pages2017 Accounting Examination PaperAccount NiceNo ratings yet

- COMM1140 Ratio ListDocument2 pagesCOMM1140 Ratio Listyifeiwang2006No ratings yet

- 香港会计报表 中英文对比Document9 pages香港会计报表 中英文对比sandywhgNo ratings yet

- Stracos Notes 1Document1 pageStracos Notes 1bangtan sonyeondanNo ratings yet

- Income Statement: Divisions For Revenue, Cost of SalesDocument5 pagesIncome Statement: Divisions For Revenue, Cost of SalesMelissa SiscarNo ratings yet

- FIN - Chap 4 - Analyzing Financial StatementsDocument1 pageFIN - Chap 4 - Analyzing Financial Statementsduyennthds170525No ratings yet

- Financial Statement Analysis RatiosDocument4 pagesFinancial Statement Analysis RatiosAmelieNo ratings yet

- UEU Penilaian Asset Bisnis Pertemuan 14Document67 pagesUEU Penilaian Asset Bisnis Pertemuan 14Saputra SanjayaNo ratings yet

- Intercorporate Investments PDFDocument1 pageIntercorporate Investments PDFMohaiminul Islam ShuvraNo ratings yet

- 008 EBIT-and-EBITDADocument7 pages008 EBIT-and-EBITDAcaparvez25100% (1)

- Accounting RatiosDocument9 pagesAccounting RatiosRonnie Vond McRyttsson MudyiwaNo ratings yet

- Company Valuation - Course NotesDocument10 pagesCompany Valuation - Course NotesAfonsoNo ratings yet

- Chapter 5 Review Questions and ProblemsDocument11 pagesChapter 5 Review Questions and ProblemsLars FriasNo ratings yet

- Earnings Per Share (EPS) : Accounting Topics CPA Exam QuizzesDocument6 pagesEarnings Per Share (EPS) : Accounting Topics CPA Exam QuizzesHassleBustNo ratings yet

- Intermediate AccountingDocument7 pagesIntermediate AccountinglqviettNo ratings yet

- ROIROEROADocument1 pageROIROEROARahul MalikNo ratings yet

- Unit 2Document17 pagesUnit 2hassan19951996hNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSfenildivyaNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisSHENo ratings yet

- 4212 Statement of Cashflows Powerpoint Diagrams 16x9Document7 pages4212 Statement of Cashflows Powerpoint Diagrams 16x9Anas ShayebNo ratings yet

- Advanced Financial Accounting-Mind Map Chap 2Document1 pageAdvanced Financial Accounting-Mind Map Chap 2Anime ClipNo ratings yet

- LLH9e Ch03 SolutionsManual FINALDocument68 pagesLLH9e Ch03 SolutionsManual FINALIgnjat100% (1)

- Audit of Investment-LectureDocument15 pagesAudit of Investment-LecturemoNo ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting StandardsDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting Standardsjoy26iNo ratings yet

- Basics of AccountingDocument43 pagesBasics of Accounting6pdqqsf59rNo ratings yet

- Analyzing Earnings QualityDocument6 pagesAnalyzing Earnings QualityLiew Chee KiongNo ratings yet

- 2.3 - Lecture Notes - Partnership OperationsDocument12 pages2.3 - Lecture Notes - Partnership OperationsKatrina Regina BatacNo ratings yet

- Chap 005Document28 pagesChap 005abel JemalNo ratings yet

- Acc101 Am14 - Eleria - Financial Reporting CorporationDocument21 pagesAcc101 Am14 - Eleria - Financial Reporting CorporationChristian Gerard Eleria ØSCNo ratings yet

- Fra Cheating QuestionsDocument18 pagesFra Cheating Questions13664No ratings yet

- Capital vs. Revenue Income/ExpenditureDocument9 pagesCapital vs. Revenue Income/ExpenditureViren DeshpandeNo ratings yet

- WST Cash Flow MetricsDocument2 pagesWST Cash Flow MetricsGabriel La MottaNo ratings yet

- Company ValuationDocument10 pagesCompany ValuationJia MakhijaNo ratings yet

- Solution Manual Chapter 4 Intermediate Accounting - KIYOSIDocument13 pagesSolution Manual Chapter 4 Intermediate Accounting - KIYOSIIndra AminudinNo ratings yet

- Chap 8 - ROIC PADocument28 pagesChap 8 - ROIC PAWindyee TanNo ratings yet

- 28 Diff Bet Usgaap Igaap IfrsDocument7 pages28 Diff Bet Usgaap Igaap IfrsRohit BeniwalNo ratings yet

- Review Slides #4Document44 pagesReview Slides #4Hobby BoxNo ratings yet

- ACC1002X Cheat Sheet 2Document2 pagesACC1002X Cheat Sheet 2Paul DavisNo ratings yet

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsFrom EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNo ratings yet

- ROE and ROA Ratios For Accounting SummaryDocument3 pagesROE and ROA Ratios For Accounting SummarymyzevelNo ratings yet

- Ratios For Accounting SummaryDocument2 pagesRatios For Accounting SummarymyzevelNo ratings yet

- Cash Flows For AccountingDocument1 pageCash Flows For AccountingmyzevelNo ratings yet

- Bonds For AccountingDocument1 pageBonds For AccountingmyzevelNo ratings yet

- MSL 873: Security Analysis and Portfolio Management Minor AssignmentDocument9 pagesMSL 873: Security Analysis and Portfolio Management Minor AssignmentVasavi MendaNo ratings yet

- The Political Environment A Critical Concern Chapter 6Document44 pagesThe Political Environment A Critical Concern Chapter 6Gabriela PachecoNo ratings yet

- 9.0 Re-Insurance: Difference Between Reinsurance and CoinsuranceDocument15 pages9.0 Re-Insurance: Difference Between Reinsurance and Coinsuranceroger basuNo ratings yet

- MAS II (Unit 1-4)Document40 pagesMAS II (Unit 1-4)lena cpaNo ratings yet

- Impact of Corona Virus in Bangladesh: General InformationDocument6 pagesImpact of Corona Virus in Bangladesh: General InformationNasif HassanNo ratings yet

- Principles of Marketing: Developing New Products and Managing The Product Life CycleDocument35 pagesPrinciples of Marketing: Developing New Products and Managing The Product Life CycleTrần Nhật NguyênNo ratings yet

- SAS® Life Science Analytics Framework: Solutions Platforms ServicesDocument6 pagesSAS® Life Science Analytics Framework: Solutions Platforms ServiceschakriNo ratings yet

- Segment and Interim Financial Reporting: Answers To QuestionsDocument25 pagesSegment and Interim Financial Reporting: Answers To QuestionsainopeNo ratings yet

- EIC-Certificate-flyer ExportImport CertificateDocument2 pagesEIC-Certificate-flyer ExportImport CertificateSTEPHANIE YAPNo ratings yet

- Commercial Dispatch Eedition 10-8-20 PDFDocument12 pagesCommercial Dispatch Eedition 10-8-20 PDFThe DispatchNo ratings yet

- Chapter 3. Solution Exercises Income StatementDocument13 pagesChapter 3. Solution Exercises Income StatementHECTOR ORTEGANo ratings yet

- Quiz Maceda LawDocument3 pagesQuiz Maceda LawchmaburdeosNo ratings yet

- 20 Pip ChallangeDocument3 pages20 Pip ChallangeHARJEET singhNo ratings yet

- Academic Activism For Inclusive Business Through Critical Realist Institutional EntrepreneurshipDocument25 pagesAcademic Activism For Inclusive Business Through Critical Realist Institutional EntrepreneurshipBenito TeehankeeNo ratings yet

- Local Media7317823616470129558Document2 pagesLocal Media7317823616470129558Jeffrey RegondolaNo ratings yet

- NCR PrimerDocument16 pagesNCR PrimerFerdinand Mark MeloNo ratings yet

- Emebet Tesema The Proposal Focuses On Effectiveness of Inventory Management Practice in CaseDocument29 pagesEmebet Tesema The Proposal Focuses On Effectiveness of Inventory Management Practice in Caseyedinkachaw shferawNo ratings yet

- Module 13 Partnership DissolutionDocument14 pagesModule 13 Partnership DissolutionShaira Mae DausNo ratings yet

- Franchise - Additional ProblemsDocument2 pagesFranchise - Additional ProblemsFrancisco PradoNo ratings yet

- CCP-Actual Test Module BDocument50 pagesCCP-Actual Test Module BAmr ElsisiNo ratings yet

- 2 - 1 - The Global Economic and Finance EnvironmentDocument13 pages2 - 1 - The Global Economic and Finance EnvironmentNurul fadhilah AtthahirahNo ratings yet

- ABC - Class ExerciseDocument1 pageABC - Class ExerciseIMRAN MASUDNo ratings yet

- Gradiva Predmet Makroekonomija 1Document226 pagesGradiva Predmet Makroekonomija 1andrejsrNo ratings yet

- Proposed Business Plan For Drinks RetailDocument12 pagesProposed Business Plan For Drinks Retailtawanda100% (1)

- R2D - Mulyani Arti Moko - UAS - B.IngDocument5 pagesR2D - Mulyani Arti Moko - UAS - B.IngAldi JaelaniNo ratings yet

- This - Thread - Goes - Over - Thread - by - Dodgysdd - Apr 1, 23 - From - RattibhaDocument24 pagesThis - Thread - Goes - Over - Thread - by - Dodgysdd - Apr 1, 23 - From - RattibhaDaniel EduahNo ratings yet

- Activity 4 Bank Reconciliation PDFDocument4 pagesActivity 4 Bank Reconciliation PDFSharmin ReulaNo ratings yet

- Fundamental Issues in Strategy: Time To Reassess?: Teece, D. J. 2020Document11 pagesFundamental Issues in Strategy: Time To Reassess?: Teece, D. J. 2020Uc UcNo ratings yet

- ElectricityToday - Jul 27 2023Document8 pagesElectricityToday - Jul 27 2023jonazakNo ratings yet

- Lean Production As A Tool For Green Production TheDocument5 pagesLean Production As A Tool For Green Production ThekamalashrafhkNo ratings yet