Professional Documents

Culture Documents

Question Six

Question Six

Uploaded by

Ks SengOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question Six

Question Six

Uploaded by

Ks SengCopyright:

Available Formats

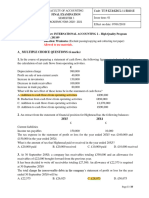

QUESTION SIX (August 2009)

(a)

Explain clearly why a cash flow statement is necessary even though it is the profit

figure for the year that is most important to any company.

(5 marks)

(b)

Catchup plc operates within the food wholesale sector distributing a range of top quality

spices and condiments to restaurants. The following financial statements relate to the

company for the past two years.

Balance sheet as at 31 March

Non-current assets (NBV)

Current assets

Inventory

Receivables

Total Assets

Equity and liabilities

Ordinary shares 5p

Share premium

Accumulated profit

Current liabilities

Trade payables

Dividends

Taxation

Bank overdraft

Income Statement for the year ending 31 March

2009

000

Gross profit

460 020

Less: expenses

316 920

Operating profit

143 100

Profit/(loss) on sale of non-current assets

(4 200)

Net profit before interest and tax

138 900

Less interest paid

30 000

Profit before taxation

108 900

Taxation

42 000

Profit after taxation

66 900

Dividends

60 000

2009

000

162 000

2008

000

141 000

42 000

57 300

99 300

261 300

33 000

52 200

85 200

226 200

63 000

22 500

32 400

117 900

30 000

52 500

25 500

108 000

42 600

48 000

42 000

10 800

143 400

261 300

46 500

25 500

39 000

7 200

118 200

226 200

2008

000

396 600

284 700

111 900

8 400

120 300

30 000

90 300

39 000

51 300

34 500

Retained profit for the year

6 900

16 800

You are provided with the following additional information:

1. A bonus issue of ordinary shares was made during the year to 31 March 2009 by

utilising 30 000 from the share premium account.

2. A summary of the companys non-current assets for the year ended 31 March 2009

was provided:

01.04.08

31.03.09

Balance b/d

Additions

Non-current Assets - cost

000

261 000

31.03.09

42 000

31.03.09

303 000

Disposals

Balance c/d

000

36 000

267 000

303 000

The non-current assets which were sold realised 7 200 000 which represented a loss on

disposal of 4 200 000 when compared to their net book value.

YOU ARE REQUIRED TO:

Produce a cash flow statement for the company for the year ended 31 March 2009 applying

IAS 7 format.

(20 marks)

TOTAL 25 Marks

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- AC100 Exam 2012Document17 pagesAC100 Exam 2012Ruby TangNo ratings yet

- Accounting-2009 Resit ExamDocument18 pagesAccounting-2009 Resit ExammasterURNo ratings yet

- 2010 LCCI Bookkeeping and Accounts Series 3Document8 pages2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- Accounting A2 Jan 2005Document11 pagesAccounting A2 Jan 2005Orbind B. ShaikatNo ratings yet

- 025 Za 2010Document13 pages025 Za 2010gurpreet_mNo ratings yet

- ABE Dip 1 - Financial Accounting JUNE 2005Document19 pagesABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- Book Keeping & Accounts/Series-3-2007 (Code2006)Document11 pagesBook Keeping & Accounts/Series-3-2007 (Code2006)Hein Linn Kyaw100% (3)

- Trial Q - V & PMDocument4 pagesTrial Q - V & PMANISAHMNo ratings yet

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Document8 pages2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyNo ratings yet

- Chapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document47 pagesChapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Study Unit 15 - Solution Q 1, 2 3Document5 pagesStudy Unit 15 - Solution Q 1, 2 3dumisaniNo ratings yet

- 2007 LCCI Level 2 Series 3 (HK) Model AnswersDocument12 pages2007 LCCI Level 2 Series 3 (HK) Model AnswersChoi Kin Yi Carmen67% (3)

- Management Control SystemDocument11 pagesManagement Control SystemomkarsawantNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- 6gbr 2006 Jun QaDocument6 pages6gbr 2006 Jun QaAnslem TayNo ratings yet

- Marking Scheme: Section ADocument8 pagesMarking Scheme: Section Aaegean123No ratings yet

- Analysis of Financial StatementsDocument33 pagesAnalysis of Financial StatementsKushal Lapasia100% (1)

- GPVADocument3 pagesGPVAAnnie Einna0% (1)

- Accounting Dec 2010Document2 pagesAccounting Dec 2010Faizal JohnNo ratings yet

- Accounting ApplicationsDocument8 pagesAccounting Applicationsaumit0099No ratings yet

- 3Q09 Results: October 28, 2009Document10 pages3Q09 Results: October 28, 2009Klabin_RINo ratings yet

- Management AccountingDocument12 pagesManagement AccountingKathlyn Ann MasilNo ratings yet

- n1510 - Questions - and - Ansqu Wers - 8Document7 pagesn1510 - Questions - and - Ansqu Wers - 8Abdul Rehman QaziNo ratings yet

- Week 6 AC and VC Additional ExampleDocument3 pagesWeek 6 AC and VC Additional Examplekokomama231No ratings yet

- Financial Accounting: Formation 2 Examination - April 2008Document11 pagesFinancial Accounting: Formation 2 Examination - April 2008Luke ShawNo ratings yet

- Practical Accounting Problems 1Document4 pagesPractical Accounting Problems 1Eleazer Ego-oganNo ratings yet

- MAS Prob3Document2 pagesMAS Prob3Mary Grace Vhincelle DeeNo ratings yet

- Sebi MillionsDocument2 pagesSebi MillionsNitish GargNo ratings yet

- Bkaf 3123 Analysis and Use of Financial Statements SEMESTER 2 SESI 2015/2016 Tutorial 4 DUE DATE: 18 May 2016 (BEFORE 12.00 NOON)Document3 pagesBkaf 3123 Analysis and Use of Financial Statements SEMESTER 2 SESI 2015/2016 Tutorial 4 DUE DATE: 18 May 2016 (BEFORE 12.00 NOON)Mìthßæn GèñésæñNo ratings yet

- 2011 06-11-14!07!07 Master Analysis CarlucciosDocument13 pages2011 06-11-14!07!07 Master Analysis Carlucciosthrust_xoneNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Group Members: 1) FENG Shile (54052978) 2) 3) : Semester B 2015-2016 Department of Accounting Group Project CB2101/T01Document5 pagesGroup Members: 1) FENG Shile (54052978) 2) 3) : Semester B 2015-2016 Department of Accounting Group Project CB2101/T01Ong Ming KaiNo ratings yet

- Common SizeDocument1 pageCommon SizeAnshul GargNo ratings yet

- M17EFA - Seminar Questions Profitability Ratios WK4Document3 pagesM17EFA - Seminar Questions Profitability Ratios WK4a.saymaa.93No ratings yet

- Q4 Q1 Q2 Sales 200000 300000 400000 Purchase 126000 186000 246000Document6 pagesQ4 Q1 Q2 Sales 200000 300000 400000 Purchase 126000 186000 246000Shakib ArafatNo ratings yet

- Given:: Problem 6 - 21: Prepare & Reconcile Variable Costing StatementsDocument13 pagesGiven:: Problem 6 - 21: Prepare & Reconcile Variable Costing StatementsimjiyaNo ratings yet

- Week 1 Problem Sept 13Document2 pagesWeek 1 Problem Sept 13mustdownloadNo ratings yet

- Tutorial 1-Financial AnalysisDocument3 pagesTutorial 1-Financial AnalysisOh Yi ZeNo ratings yet

- MAS Compilation of QuestionsDocument6 pagesMAS Compilation of Questionsgon_freecs_4No ratings yet

- 29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2Document10 pages29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2uthanh2209No ratings yet

- Of Shares Of: ST ND RDDocument6 pagesOf Shares Of: ST ND RDKingChryshAnneNo ratings yet

- Accounting Accn3: General Certificate of Education Advanced Level Examination June 2010Document8 pagesAccounting Accn3: General Certificate of Education Advanced Level Examination June 2010Sam catlinNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- The Financials of Abc LTD Is Given Below:: Minicase - Marks 10Document1 pageThe Financials of Abc LTD Is Given Below:: Minicase - Marks 10syed_s_22No ratings yet

- Albion Technology & General VCT PLCDocument70 pagesAlbion Technology & General VCT PLCalbionventuresNo ratings yet

- Accounting Day 6Document3 pagesAccounting Day 6Benjamin0% (1)

- AccountingDocument8 pagesAccountingHaniyaAngelNo ratings yet

- Taxation (United Kingdom) : Monday 6 June 2011Document14 pagesTaxation (United Kingdom) : Monday 6 June 2011tayabkhalidNo ratings yet

- Martin Engegren Sony Ericsson q1 2009Document9 pagesMartin Engegren Sony Ericsson q1 2009martin_engegrenNo ratings yet

- Body ShopDocument8 pagesBody ShopShopan J. Endrawan75% (4)

- 08MBA14 May - June 2010Document3 pages08MBA14 May - June 2010nitte5768No ratings yet

- Financial Projection TemplateDocument88 pagesFinancial Projection TemplateChuks NwaGodNo ratings yet

- Food Service Contractor Revenues World Summary: Market Values & Financials by CountryFrom EverandFood Service Contractor Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Food-Processing Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandFood-Processing Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryFrom EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Gasoline Station Revenues World Summary: Market Values & Financials by CountryFrom EverandGasoline Station Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- General-Line Sporting Goods Store Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral-Line Sporting Goods Store Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Cosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryFrom EverandCosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- January 2018: Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument12 pagesJanuary 2018: Sunday Monday Tuesday Wednesday Thursday Friday SaturdayKs SengNo ratings yet

- War 3 SkinsDocument16 pagesWar 3 SkinsKs SengNo ratings yet

- Happy Father'S Day!: With Warmest Thoughts and Wishes Today and Every DayDocument1 pageHappy Father'S Day!: With Warmest Thoughts and Wishes Today and Every DayKs SengNo ratings yet

- Happy Mother's DayDocument2 pagesHappy Mother's DayKs SengNo ratings yet