Professional Documents

Culture Documents

NY Community Bancorp Is Asked 14 Qs by Fed On Its Protested Application To Acquire Astoria

NY Community Bancorp Is Asked 14 Qs by Fed On Its Protested Application To Acquire Astoria

Uploaded by

Matthew Russell Lee0 ratings0% found this document useful (0 votes)

361 views4 pagesAfter ICP's Protest of NYCB - Astoria Bank, Fed Asks 14 Questions

By Matthew R. Lee

NEW YORK, January 8 -- The lack of seriousness in US bank regulation grows from the relatively smaller to the largest banks like Goldman Sachs - and those in the middle, seeking to become a Systemically Important Financial Institution like New York Community Bancorp is, applying to buy Astoria Bank.

Now, after Inner City Press / Fair Finance Watch filed a timely protest, the Federal Reserve has asked NYCB 14 questions. Inner City Press has put the Additional Information letter online here, including a request to know which branches NYCB would close, how it would try to sell of Astoria's loans, etc. There should now be more fair lending questions.

NYCB's home mortgage lending is extremely disparate; its multi-family lending, some to slumlords, is no defense. Inner City Press / Fair Finance Watch has filed this with the Fed:

“On behalf of Inner City Press / Fair Finance Watch, this is a timely first comment opposing and requesting a complete copy of an and an extension of the FRB's public comment period on the Application by New York Community Bancorp ('NYCB') to acquire 100% of the voting shares of Astoria Financial Corp and indirectly acquire Astoria Bank.

The applicant NYCB in the New York City MSA in 2014 made 109 home purchase loans to whites -- and only THREE to African Americans. For refinance loans, NYBC in the the NYC MSA in 2014 made 27 loans to whites and only ONE to an African American.

While NYCB may attempt to minimize these severe disparities by pointing to multi-family loans, there are significant complaints about that lending; note also this account of the CFPB which lists the ostensibly mostly multi-family NYCB with more complaints against it than banks that are both larger and more “retail."

In the Nassau Suffolk (Long Island) MSA in 2014 NYCB made 107 home purchase loans to whites -- and only ONE to an African American, while denying African Americans 4.7 times more frequently than whites. For refinance loans, NYBC in the the Long Island MSA in 2014 made 52 loans to whites and only three to African Americans and only TWO to Latinos, while denying Latinos 2.32 times more frequently than whites.

In the Cleveland, Ohio MSA (where NYCB bought Ohio Savings), NYCB in 2014 made 17 refinance loans to whites in 2014 and only one to an African American, while denying African Americans, while denying African Americans three times more frequently than whites. Similar disparities exist for NYCB in New Jersey, Arizona and Florida -- ICP is requesting public hearings on this ill-conceived proposed merger.

As the Federal Reserve surely knows, this proposal was driving by activist investor pressure on Astoria (by Basswood Capital Management LLC); both institutions' securities fell significantly in price when it was announced. The price to consumers would include the closure of branches, disclosure of which should be demanded during the extended comment period and at the requested public hearing(s).

The comment period should be extended; evidentiary hearings should be held; and on the current record, the application should not be approved.”

Inner City Press / Fair Finance Watch, which also opposes NYCB's requests for approvals from the FDIC, New York and other regulators, has prepared this comparison of NYCB to other lenders:

“In the Nassau Suffolk (Long Island) MSA in 2014 NYCB made 107 home purchase loans to whites -- and only ONE to an African American, while denying African Americans 4.7 times more frequently than whites.”

While NYCB made 107 home purchase loans to whites for one to an African Americans (ratio of 107-to-1), the aggregated in 2014 for home purchase loans on Long Island had a ratio of 13.41 loans to whites for every loan to an African American (15,081 loans to whites, 1125 loans to African Americans). NYCB is eight times more disparate than other lenders.

Original Title

NY Community Bancorp Is Asked 14 Qs by Fed On Its Protested Application to Acquire Astoria

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAfter ICP's Protest of NYCB - Astoria Bank, Fed Asks 14 Questions

By Matthew R. Lee

NEW YORK, January 8 -- The lack of seriousness in US bank regulation grows from the relatively smaller to the largest banks like Goldman Sachs - and those in the middle, seeking to become a Systemically Important Financial Institution like New York Community Bancorp is, applying to buy Astoria Bank.

Now, after Inner City Press / Fair Finance Watch filed a timely protest, the Federal Reserve has asked NYCB 14 questions. Inner City Press has put the Additional Information letter online here, including a request to know which branches NYCB would close, how it would try to sell of Astoria's loans, etc. There should now be more fair lending questions.

NYCB's home mortgage lending is extremely disparate; its multi-family lending, some to slumlords, is no defense. Inner City Press / Fair Finance Watch has filed this with the Fed:

“On behalf of Inner City Press / Fair Finance Watch, this is a timely first comment opposing and requesting a complete copy of an and an extension of the FRB's public comment period on the Application by New York Community Bancorp ('NYCB') to acquire 100% of the voting shares of Astoria Financial Corp and indirectly acquire Astoria Bank.

The applicant NYCB in the New York City MSA in 2014 made 109 home purchase loans to whites -- and only THREE to African Americans. For refinance loans, NYBC in the the NYC MSA in 2014 made 27 loans to whites and only ONE to an African American.

While NYCB may attempt to minimize these severe disparities by pointing to multi-family loans, there are significant complaints about that lending; note also this account of the CFPB which lists the ostensibly mostly multi-family NYCB with more complaints against it than banks that are both larger and more “retail."

In the Nassau Suffolk (Long Island) MSA in 2014 NYCB made 107 home purchase loans to whites -- and only ONE to an African American, while denying African Americans 4.7 times more frequently than whites. For refinance loans, NYBC in the the Long Island MSA in 2014 made 52 loans to whites and only three to African Americans and only TWO to Latinos, while denying Latinos 2.32 times more frequently than whites.

In the Cleveland, Ohio MSA (where NYCB bought Ohio Savings), NYCB in 2014 made 17 refinance loans to whites in 2014 and only one to an African American, while denying African Americans, while denying African Americans three times more frequently than whites. Similar disparities exist for NYCB in New Jersey, Arizona and Florida -- ICP is requesting public hearings on this ill-conceived proposed merger.

As the Federal Reserve surely knows, this proposal was driving by activist investor pressure on Astoria (by Basswood Capital Management LLC); both institutions' securities fell significantly in price when it was announced. The price to consumers would include the closure of branches, disclosure of which should be demanded during the extended comment period and at the requested public hearing(s).

The comment period should be extended; evidentiary hearings should be held; and on the current record, the application should not be approved.”

Inner City Press / Fair Finance Watch, which also opposes NYCB's requests for approvals from the FDIC, New York and other regulators, has prepared this comparison of NYCB to other lenders:

“In the Nassau Suffolk (Long Island) MSA in 2014 NYCB made 107 home purchase loans to whites -- and only ONE to an African American, while denying African Americans 4.7 times more frequently than whites.”

While NYCB made 107 home purchase loans to whites for one to an African Americans (ratio of 107-to-1), the aggregated in 2014 for home purchase loans on Long Island had a ratio of 13.41 loans to whites for every loan to an African American (15,081 loans to whites, 1125 loans to African Americans). NYCB is eight times more disparate than other lenders.

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

361 views4 pagesNY Community Bancorp Is Asked 14 Qs by Fed On Its Protested Application To Acquire Astoria

NY Community Bancorp Is Asked 14 Qs by Fed On Its Protested Application To Acquire Astoria

Uploaded by

Matthew Russell LeeAfter ICP's Protest of NYCB - Astoria Bank, Fed Asks 14 Questions

By Matthew R. Lee

NEW YORK, January 8 -- The lack of seriousness in US bank regulation grows from the relatively smaller to the largest banks like Goldman Sachs - and those in the middle, seeking to become a Systemically Important Financial Institution like New York Community Bancorp is, applying to buy Astoria Bank.

Now, after Inner City Press / Fair Finance Watch filed a timely protest, the Federal Reserve has asked NYCB 14 questions. Inner City Press has put the Additional Information letter online here, including a request to know which branches NYCB would close, how it would try to sell of Astoria's loans, etc. There should now be more fair lending questions.

NYCB's home mortgage lending is extremely disparate; its multi-family lending, some to slumlords, is no defense. Inner City Press / Fair Finance Watch has filed this with the Fed:

“On behalf of Inner City Press / Fair Finance Watch, this is a timely first comment opposing and requesting a complete copy of an and an extension of the FRB's public comment period on the Application by New York Community Bancorp ('NYCB') to acquire 100% of the voting shares of Astoria Financial Corp and indirectly acquire Astoria Bank.

The applicant NYCB in the New York City MSA in 2014 made 109 home purchase loans to whites -- and only THREE to African Americans. For refinance loans, NYBC in the the NYC MSA in 2014 made 27 loans to whites and only ONE to an African American.

While NYCB may attempt to minimize these severe disparities by pointing to multi-family loans, there are significant complaints about that lending; note also this account of the CFPB which lists the ostensibly mostly multi-family NYCB with more complaints against it than banks that are both larger and more “retail."

In the Nassau Suffolk (Long Island) MSA in 2014 NYCB made 107 home purchase loans to whites -- and only ONE to an African American, while denying African Americans 4.7 times more frequently than whites. For refinance loans, NYBC in the the Long Island MSA in 2014 made 52 loans to whites and only three to African Americans and only TWO to Latinos, while denying Latinos 2.32 times more frequently than whites.

In the Cleveland, Ohio MSA (where NYCB bought Ohio Savings), NYCB in 2014 made 17 refinance loans to whites in 2014 and only one to an African American, while denying African Americans, while denying African Americans three times more frequently than whites. Similar disparities exist for NYCB in New Jersey, Arizona and Florida -- ICP is requesting public hearings on this ill-conceived proposed merger.

As the Federal Reserve surely knows, this proposal was driving by activist investor pressure on Astoria (by Basswood Capital Management LLC); both institutions' securities fell significantly in price when it was announced. The price to consumers would include the closure of branches, disclosure of which should be demanded during the extended comment period and at the requested public hearing(s).

The comment period should be extended; evidentiary hearings should be held; and on the current record, the application should not be approved.”

Inner City Press / Fair Finance Watch, which also opposes NYCB's requests for approvals from the FDIC, New York and other regulators, has prepared this comparison of NYCB to other lenders:

“In the Nassau Suffolk (Long Island) MSA in 2014 NYCB made 107 home purchase loans to whites -- and only ONE to an African American, while denying African Americans 4.7 times more frequently than whites.”

While NYCB made 107 home purchase loans to whites for one to an African Americans (ratio of 107-to-1), the aggregated in 2014 for home purchase loans on Long Island had a ratio of 13.41 loans to whites for every loan to an African American (15,081 loans to whites, 1125 loans to African Americans). NYCB is eight times more disparate than other lenders.

Copyright:

© All Rights Reserved

You are on page 1of 4

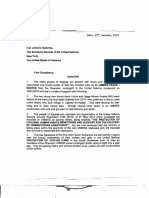

FEDERAL RESERVE SYSTEM

January 8, 2016

‘Mrk F. Ment, Bo.

Sullivan & Cromwell LLP

125 Broad Stost

‘New York, New York 10004

Deer Mr. Mating:

‘This lotr rofrs to the notice filed by New York Community Bancorp, ln,

Westbury, Now Yark, (*NYCB"), to acquire 100 percent ofthe voting shares of Astoria

Financial Corporation, Lake Success, New York (“AFC"), and thereby indirectly woquite Astor,

Bonk, Long Islnd City, New York, (“Astoria”) pursuant to setion 4 ofthe Bark Holding

‘Company Act of 1956 (“BHC Act"). Based on out review ofthe notice, the following additional,

{nfoumation is requested. Supporting documentation, as appropriate, shouldbe provided.

1, Provide an updated balance sheet, iacome statement ad capital ratios for NYCB reflective

cof both yeer-end 2015 results and te recent balance sheet restructare announced on

December 29,2015, which resulted in, among other things, a $10.4 bilion prepayment of

‘wholesale borrowings.

2, Provide a copy of the most recent DFAST results for NYCB ard AFC. Discuss DFAST

planning for 2016, focusing on how the AFC organization would be incorporated into

DFAST requirements, Provide fll copies of al capita plans and intemal sess tests andlor

sensitivity analyses conducted in connection with this proposn. Inchide details of all,

soenatios used.

3. Discuss in detail how and when NYCB plans to incomporate CCAR testing requirements,

Tcl a discussion of koy milestones achieved, and significant items that remain

‘utstsaing

4. Confirm or clasity, as appropsits, whether the stes esting results included inthe iii

submission donot include the contemplated transaction.

5, Diseuss i detail the plan to sel of approximately $1 bilion of Astoria loan in connection

‘with the proposed tamsacion, Indicate what actions NYCB would tke if amarket fr these

Joans is not avsilable, not saficiently liquid, or otherwise not arate,

6. On page 23 ofthe notice, NYCB states: Because of the complementary nlure ofthe

businesses of NYCB and Astoria [NYCB] anticipates thatthe products and services Astoria

currently offers will continue to be offered afer the closing either in their current frm, a in

the form in which NYCB provides such products and services” Indicate any products or

services curcenly offered by Astoria that NYCB contemplates would no longer be ofTxe

‘nits current form, Tn aditon, describe the features ofthe Astoria products or services to

be replaced, as well asthe NYCB replacement products and services.

7. Onppage 2 ofthe notice, NYCB indicated that it was conducting an snalyis ofthe ro-

forma combined branch network by the end of Jenuary. When available, provide alist of

‘ranches contemplated tobe closed in connection with this peopl, Ia addlton, provide

any branch analysis used to suppart any such closures

8, Provide the dots supporting the pro forma modified Liquidity Coverage Ratio LCR”)

calelation included in the submission, which indieates that NYCB would need to purchase

spproximately $2 billion io high quality liquid assets. Discuss potential sources to obtain

‘these asses, Inudton, discus in detail NYCB's plans to be compliant with the modified

‘LOR requirement in 2016, inluding milestones achieved and items that rem outstanding

9 Discuss in detail the Commercial Real Estate (“CRE”) and Multifamily concentrations of

the proposed combined organization, Describe in detail how these concentrations would be

managed according to SR 15-17 "Statement on Prudent Risk Management of Commercial

‘eal Estate Lending.”

10, Seotion 5.246 of the Agreement and Pan of Merger, dated

October 28, 2015 (Agreement), between NYCB and AFC, prohibits AFC from allowing

any of its usin including Astoria, fom making any extensions of credit in excess of

{$10,000,000 ina single ansaction, except pursuant to existing comasiznents, withost

[NYCB's prior writen consent. With respect to tis provision, indicate the fellowing:

‘The toil number and ital doll amount of al extensions of credit made by

Astoria over the ast calendar year;

'. ‘The total number and total dollar amount of al extensions of credit made by

Astoria in excess of $10,000,000 over the las ealemisr yea, and

‘The numb of times that NYCB has reviewed proposed extension of eredit by

‘Asovia pursuant tothe Agreement. State the sumbe of ines that NYC bas not

provided its consent, and desribe the reasons why NYCB refused to provide

consent in thse cases.

11. Seoton 6.2(@) ofthe Agreement requires AFC to cause its subsidiaries, including Astoria, to

make available to NYCB thir properties, books, contracts, commitments, and records, with

2

certain exceptions. Describe the information provided by Astoria to NYCB to date in

secordance wit the terms of tis provision, In your response, confim or elf, as

appropriate, whether ether purty provides reports or other materials given ots board of

Aiectors or senior management to the other party before such meeting actually occurs,

12, Please canfirm whether NYCB must obtain ay approvals or eonsons from the Federal

Deposit Insurance Corporation pursuant to the loss-shareagroements forthe AmTrust Bank

and Desert Hills Bank acquisitions. If yes, indeate the status of obtaining such approvals or

‘consents

13. Inthe response to Item 13 stom Forma FR Y-3, discuss why NYCB responded “Jo the best.

‘of the Applicants knowledge, none ofthe existing or proposed principals ofthe Applicant

is also a principal of ay other depository institution or depository instition holding

“company.” Describe the process by which NYVCB tees potential management interlocks.

14, On page | ofthe Pretiminary Statement to the notice, NYC states that “[fhllowing the

Bank Merger allo the subsidiaries of [Astor] wil become direct suis of New

‘York Community Bank], the shares of which INYCB} ean bold pursuant to Seton 46XS)

‘ofthe BHC Act and Section 225.22(¢) of Regulation ¥." However, on pages 2 and3 of

Public Exit 1 to the notice, NYC requests hit the Hoard approve NYC's indirect

sequin of Astra Federal Mortgage Corp (“AF Mortgage") and Fiat Service Comp,

(CFidas”) parmant fo section 4(0(8) ofthe BIC Act. Pleas clarify the authority upon

Which NYCB would rely to hol the shares of AP Mortgage and Fiata upon consummation

ofthe proposed merger.

Please address your response tothe undorsgned, However, ofailitate

_moce tinnely distribution ofthe information within the Federal Reserve System, pease send

the original nd four copies of the response to Mr. Ivan Hurwitz, vive pesidentof the Federal

Reserve Bank of Now York, and provide a copy ofthe public portion ofthe response directly to

the commenter, Fat Finance Watch, C/O Matthew R. Lee, Fsq., PO Box 20047 New York, New

‘York, 10017.

Inoorder to fciitate timely processing of the notice, your response should be

received by Janvary 2, 2016. Any information for which you desire confidential treatment

should be so labeled and separately bound in accordance with 12 CFR 261.15

Ifyou have aay questions regarding tis letter, please call Julia Sparks ofthe

‘Board's Division of Benking Supervision and Regulation at (202) 457-3805, or Seott Tkacz of

the Board's Legal Division at (202) 452-2744

Very truly yours,

Mill f bo

Michael J. Sexton

Associate Director

Matthow R. Lee, Bs

Fair Finance Watch

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- On OneCoin, Cooperator Konstantin Ignatov's Plea Agreement For 5K1 LetterDocument6 pagesOn OneCoin, Cooperator Konstantin Ignatov's Plea Agreement For 5K1 LetterMatthew Russell Lee100% (5)

- Jona Rechnitz Is Sued For Fraud After Got 10 Month Sentence As Cooperator in SDNYDocument36 pagesJona Rechnitz Is Sued For Fraud After Got 10 Month Sentence As Cooperator in SDNYMatthew Russell Lee100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Document: Two Weeks Before 6ix9ine Sentencing US Calls Him A Complete Cooperator Under 5K1: 11-Page Letter LetterDocument11 pagesDocument: Two Weeks Before 6ix9ine Sentencing US Calls Him A Complete Cooperator Under 5K1: 11-Page Letter LetterMatthew Russell Lee100% (1)

- Exclusive UN Leaks: in Corrupt UN of Guterres Bakhshish Scams at Office of South South Cooperation Travel WasteDocument34 pagesExclusive UN Leaks: in Corrupt UN of Guterres Bakhshish Scams at Office of South South Cooperation Travel WasteMatthew Russell LeeNo ratings yet

- Transcript of Avenatti, Geragos and Nike Lawyer Scott Wilson of Boies Schiller, March 21, 2019 Inner City Press Covers SDNY TrialDocument48 pagesTranscript of Avenatti, Geragos and Nike Lawyer Scott Wilson of Boies Schiller, March 21, 2019 Inner City Press Covers SDNY TrialMatthew Russell Lee100% (2)

- UNESCO 6th Executive Board Meeting, Publishing by Inner City PressDocument1 pageUNESCO 6th Executive Board Meeting, Publishing by Inner City PressMatthew Russell LeeNo ratings yet

- Before Molotov Cocktails Rahman Interview Now $102000 Raised, Here Is Mattis Amicus Brief Before June 23 2CIRDocument27 pagesBefore Molotov Cocktails Rahman Interview Now $102000 Raised, Here Is Mattis Amicus Brief Before June 23 2CIRMatthew Russell Lee100% (1)

- UN of Guterres Lies About Hiring Freeze, Memo HereDocument7 pagesUN of Guterres Lies About Hiring Freeze, Memo HereMatthew Russell LeeNo ratings yet

- In CIA Leak Trial US Drops Court 2 Against Schulte Admits Jeopardy Has Attached by Matthew Russell Lee, Exclusive PatreonDocument9 pagesIn CIA Leak Trial US Drops Court 2 Against Schulte Admits Jeopardy Has Attached by Matthew Russell Lee, Exclusive PatreonMatthew Russell LeeNo ratings yet

- UN Fraud Under Guterres Has Fake Country Monte de Agrella Telling Press To Change Its Story, On This DocumentDocument2 pagesUN Fraud Under Guterres Has Fake Country Monte de Agrella Telling Press To Change Its Story, On This DocumentMatthew Russell Lee0% (1)

- VirgilGriffith1indictmentJan20icp PDFDocument5 pagesVirgilGriffith1indictmentJan20icp PDFMatthew Russell LeeNo ratings yet

- UNSG Memo: As UN Cries Poor Guterres Hired Zoe Paxton Now His Memo Leaked To Banned Inner City PressDocument6 pagesUNSG Memo: As UN Cries Poor Guterres Hired Zoe Paxton Now His Memo Leaked To Banned Inner City PressMatthew Russell LeeNo ratings yet

- Nike Draft, Avenatti As Gary Franklin's Counsel, Published by Inner City PressDocument4 pagesNike Draft, Avenatti As Gary Franklin's Counsel, Published by Inner City PressMatthew Russell LeeNo ratings yet

- From OneCoin Trial, Mark Scott's Post Arrest StatementDocument41 pagesFrom OneCoin Trial, Mark Scott's Post Arrest StatementMatthew Russell LeeNo ratings yet

- Week Before 6ix9ine Sentencing His Lawyer Asks For Time Served Citing Trial Danger by Matthew Russell Lee, Patreon Scope ThreadDocument8 pagesWeek Before 6ix9ine Sentencing His Lawyer Asks For Time Served Citing Trial Danger by Matthew Russell Lee, Patreon Scope ThreadMatthew Russell LeeNo ratings yet

- Jeffrey Epstein IndictmentDocument14 pagesJeffrey Epstein IndictmentLaw&Crime100% (6)

- UN Briber Vivi Wang Hides Her Sentencing Submission To SDNY For Impunity Like UNSG Guterres CorruptDocument10 pagesUN Briber Vivi Wang Hides Her Sentencing Submission To SDNY For Impunity Like UNSG Guterres CorruptMatthew Russell LeeNo ratings yet

- FOIA Fee Waiver Denied by OCC Otting To Inner City Press For WSFS Bank Merger ApplicationDocument2 pagesFOIA Fee Waiver Denied by OCC Otting To Inner City Press For WSFS Bank Merger ApplicationMatthew Russell LeeNo ratings yet

- Harvey Weinstein Assistant WhatsApp Messages Emerge in in SDNY in Sex Trafficking CaseDocument14 pagesHarvey Weinstein Assistant WhatsApp Messages Emerge in in SDNY in Sex Trafficking CaseMatthew Russell LeeNo ratings yet

- In Money Laundering Cover Up Federal Reserve Withholds 133 Pages About BB&T Releases 1 PageDocument2 pagesIn Money Laundering Cover Up Federal Reserve Withholds 133 Pages About BB&T Releases 1 PageMatthew Russell LeeNo ratings yet

- For UNSC El Salvador Runs Against ST Vincent, Letter Here, Like Estonia Against Romania in Corrupt UN of GuterresDocument2 pagesFor UNSC El Salvador Runs Against ST Vincent, Letter Here, Like Estonia Against Romania in Corrupt UN of GuterresMatthew Russell LeeNo ratings yet

- Exclusive: UN Guterres Plan To Cut Uganda Jobs Pushed by China Amid His CEFC Links Servicing FrancAfrique From MontrealDocument25 pagesExclusive: UN Guterres Plan To Cut Uganda Jobs Pushed by China Amid His CEFC Links Servicing FrancAfrique From MontrealMatthew Russell Lee100% (1)

- Exclusive Leak: in Corrupt UN of Guterres Hiring Scams in Office of South South Cooperation Travel WasteDocument5 pagesExclusive Leak: in Corrupt UN of Guterres Hiring Scams in Office of South South Cooperation Travel WasteMatthew Russell LeeNo ratings yet

- From South Sudan UN Guterres Is Petitioned, Here, About Murder of Civilians He Covered Up Censoring PressDocument2 pagesFrom South Sudan UN Guterres Is Petitioned, Here, About Murder of Civilians He Covered Up Censoring PressMatthew Russell LeeNo ratings yet

- UN Soft-Launches Scam Safe Space Report (NOW HERE) After UN Guterres Did Nothing On UNAIDS Sidibe UNFPA PalacioDocument74 pagesUN Soft-Launches Scam Safe Space Report (NOW HERE) After UN Guterres Did Nothing On UNAIDS Sidibe UNFPA PalacioMatthew Russell Lee100% (1)