Professional Documents

Culture Documents

Tds Details For The Financial Year 2014-15: This Report Is Generated On 02-Feb-2015 18:19:38 PM

Tds Details For The Financial Year 2014-15: This Report Is Generated On 02-Feb-2015 18:19:38 PM

Uploaded by

sanat kr pratiharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tds Details For The Financial Year 2014-15: This Report Is Generated On 02-Feb-2015 18:19:38 PM

Tds Details For The Financial Year 2014-15: This Report Is Generated On 02-Feb-2015 18:19:38 PM

Uploaded by

sanat kr pratiharCopyright:

Available Formats

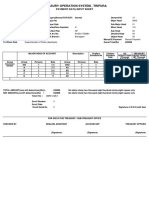

TDS DETAILS FOR THE FINANCIAL YEAR 2014-15

This report is generated on 02-Feb-2015 18:19:38 PM

CIF Number

85774238601

Customer Name

SANAT PRATIHAR

Tax Year

2014-15

Total tax Projected

28.00

TDS Exemption

Total tax paid

0.00

Submit 15H/15G

Concession Rate

0.00

Concession Rate Certificate

Concession Surcharge

0.00

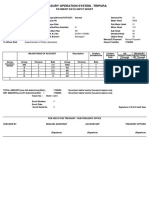

Account Number

33113584154

Branch Code

07830

Income tax projected

0.00

Income tax paid

0.00

Surcharge projected

0.00

Surcharge paid

0.00

Cess projected

0.00

Cess paid

0.00

Interest projected

0.00

Interest paid

0.00

Account Number

33746247378

Branch Code

07830

Income tax projected

28.00

Income tax paid

0.00

Surcharge projected

0.00

Surcharge paid

0.00

Cess projected

1.00

Cess paid

0.00

Interest projected

Account Number

273.00

33800852281

Interest paid

867.00

Branch Code

07830

Income tax projected

0.00

Income tax paid

0.00

Surcharge projected

0.00

Surcharge paid

0.00

Cess projected

0.00

Cess paid

0.00

Interest projected

0.00

Interest paid

113.00

Branch Code

07830

Account Number

33854182857

Income tax projected

0.00

Income tax paid

0.00

Surcharge projected

0.00

Surcharge paid

0.00

Cess projected

0.00

Cess paid

0.00

Interest projected

0.00

Interest paid

150.00

Branch Code

07830

Account Number

33990618967

Income tax projected

0.00

Income tax paid

0.00

Surcharge projected

0.00

Surcharge paid

0.00

Cess projected

0.00

Cess paid

0.00

Interest projected

0.00

Interest paid

4.00

Account Number

34073660084

Branch Code

07830

Income tax projected

0.00

Income tax paid

0.00

Surcharge projected

0.00

Surcharge paid

0.00

Cess projected

0.00

Cess paid

Interest projected

0.00

Interest paid

94.00

Branch Code

07830

Account Number

34337312891

0.00

Income tax projected

0.00

Income tax paid

0.00

Surcharge projected

0.00

Surcharge paid

0.00

Cess projected

0.00

Cess paid

0.00

Interest projected

0.00

Interest paid

23.00

* Interest Paid + Accrued Interest portion considered to be taxable on 31 st March.

Disclaimer:

For producing to Income tax Department this certificate needs to be sealed and signed by home branch.

The effect of the interest paid to you in the current year is not reflected in all the projected data.

You might also like

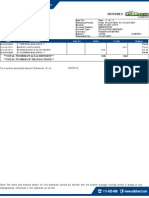

- Statement of AccountDocument3 pagesStatement of AccountComfort NdzumeniNo ratings yet

- Tata Business Support Services LTD: 00082737 Karunya SDocument1 pageTata Business Support Services LTD: 00082737 Karunya Skarunteza50% (2)

- Vat NotesDocument7 pagesVat NotesZulqarnainNo ratings yet

- CIF Number 75019817403 Customer Name Praveen Subrahmanian: Tds Details For The Financial Year 2013-14Document1 pageCIF Number 75019817403 Customer Name Praveen Subrahmanian: Tds Details For The Financial Year 2013-14Praveen SubrahmanianNo ratings yet

- TDS39229 2021Document1 pageTDS39229 2021Alika DebNo ratings yet

- Show Pdfs - Aspx PDFDocument1 pageShow Pdfs - Aspx PDFErminioNo ratings yet

- QUA05891 SepSalarySlipwithTaxDetailsDocument1 pageQUA05891 SepSalarySlipwithTaxDetailssrajput66No ratings yet

- CIF Number 85121020802 Customer Name Talikota Karthik: Tds Details For The Year 2020-21Document1 pageCIF Number 85121020802 Customer Name Talikota Karthik: Tds Details For The Year 2020-21Karthik TNo ratings yet

- 2014 TaxReturnDocument25 pages2014 TaxReturnNguyen Vu Cong100% (1)

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2015Document2 pagesRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2015mashudiNo ratings yet

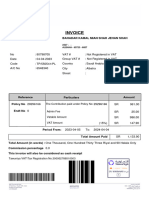

- Invoice TawuniyaDocument1 pageInvoice TawuniyaMudassar NazarNo ratings yet

- Pillay Naidoo 56 Vaalboskat Street Hesteapark Ext 8 Pretoria Noord 0182Document4 pagesPillay Naidoo 56 Vaalboskat Street Hesteapark Ext 8 Pretoria Noord 0182Spoton AutomotiveNo ratings yet

- Tax Codes: Tax Calculation Includes Tax Authority Effective Date Tax Code Freight Percent Misc Discount VAT Tax TypeDocument202 pagesTax Codes: Tax Calculation Includes Tax Authority Effective Date Tax Code Freight Percent Misc Discount VAT Tax TypeSaurav Singh NerNo ratings yet

- Inka S.A.C.: Libro Mayor Al Mes de Enero Nuevos SolesDocument3 pagesInka S.A.C.: Libro Mayor Al Mes de Enero Nuevos SolesShirlyJacOrNuNo ratings yet

- Zone 4: 145.00 Acct. No. Domestic Courier AA1918538Document1 pageZone 4: 145.00 Acct. No. Domestic Courier AA1918538Alen Matthew AndradeNo ratings yet

- Fri Aug 28 12:10:01 IST 2009 Please Send Your QueriesDocument1 pageFri Aug 28 12:10:01 IST 2009 Please Send Your QueriesChristopher CampbellNo ratings yet

- MergedDocument185 pagesMergedIQBAL MAHMUDNo ratings yet

- BSNL Mobile Bill: Current Invoice Details RsDocument1 pageBSNL Mobile Bill: Current Invoice Details Rsraks1010No ratings yet

- Tax Invoice Tax Invoice: Venturehaven Pte LTDDocument2 pagesTax Invoice Tax Invoice: Venturehaven Pte LTDisty5nntNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2015Document1 pageRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2015DesiNo ratings yet

- Pengesahan Penerimaan E-Be Bagi Tahun Taksiran 2015Document1 pagePengesahan Penerimaan E-Be Bagi Tahun Taksiran 2015Hafidz JamilNo ratings yet

- Account Statement From 2 Nov 2015 To 1 Feb 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 2 Nov 2015 To 1 Feb 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceGirish ChowdaryNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Payment ReceiptDocument2 pagesPayment Receiptayushrunda4No ratings yet

- Personalize Page: Earnings Statement Earnings StatementDocument2 pagesPersonalize Page: Earnings Statement Earnings StatementRodney PerryNo ratings yet

- State Bank of IndiaDocument2 pagesState Bank of Indiaavinash35No ratings yet

- VAT Presentation To The General PublicDocument27 pagesVAT Presentation To The General PublicJoette PennNo ratings yet

- Form 24G Statement Statistic ReportDocument1 pageForm 24G Statement Statistic ReportshaileshNo ratings yet

- Monthly: 0.06 Total Withdrawals & Deposits 0.62 Total Number of Transactions 2Document1 pageMonthly: 0.06 Total Withdrawals & Deposits 0.62 Total Number of Transactions 2Talha MehmoodNo ratings yet

- Tax Data Card 30 June 2014Document9 pagesTax Data Card 30 June 2014api-300877373No ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Bulacan Hub: 2,772.65 Acct. No. Sea Freight - LCL AA3852190Document1 pageBulacan Hub: 2,772.65 Acct. No. Sea Freight - LCL AA3852190Alen Matthew AndradeNo ratings yet

- ReportDocument1 pageReportdeclerckclever5No ratings yet

- Treasury Operation System, Tripura: Payment Data Input SheetDocument1 pageTreasury Operation System, Tripura: Payment Data Input SheetRicky DebbarmaNo ratings yet

- Tarn Taran,,, Tarn Taran,, India, 143401Document1 pageTarn Taran,,, Tarn Taran,, India, 143401Kumari AnshuNo ratings yet

- Salary Slip (31705442 November, 2015) PDFDocument1 pageSalary Slip (31705442 November, 2015) PDFنایاب یونسNo ratings yet

- Sales Tax W.H 11-2015Document3 pagesSales Tax W.H 11-2015Shahid NawabNo ratings yet

- VV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Contact CentreDocument3 pagesVV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Contact Centrebra9tee9tiniNo ratings yet

- NS 200 Bajaj FinanceDocument2 pagesNS 200 Bajaj FinanceSaravanan Mudlock100% (1)

- Tax Invoice / Statement of AccountDocument1 pageTax Invoice / Statement of AccountGuadalupe Trejo SanchezNo ratings yet

- Estado de Cuenta Clinica Ginecologia y ObstetriciaDocument1 pageEstado de Cuenta Clinica Ginecologia y ObstetriciaLuz Mary MarquezNo ratings yet

- Salesforce Invoice 29376201Document2 pagesSalesforce Invoice 29376201Tino MarcosNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Adj 655 21 HO04357 0Document1 pageAdj 655 21 HO04357 0todoparamicasorioNo ratings yet

- BSNL Mobile Bill: Current Invoice Details RsDocument1 pageBSNL Mobile Bill: Current Invoice Details Rsk v reddyNo ratings yet

- Sample of A Tax - ClearanceDocument1 pageSample of A Tax - ClearanceChris KerorNo ratings yet

- Treasury Operation System, Tripura: Payment Data Input SheetDocument1 pageTreasury Operation System, Tripura: Payment Data Input SheetRicky DebbarmaNo ratings yet

- Invoice (3) BookDocument1 pageInvoice (3) BookNumerologist PankajNo ratings yet

- Rose Ltd.'s Income Tax Computation - Year of Assessment 2013Document2 pagesRose Ltd.'s Income Tax Computation - Year of Assessment 2013rachna357No ratings yet

- GSM Invoice April BSNLDocument1 pageGSM Invoice April BSNLPraveen KumarNo ratings yet

- Account Statement FOR THE PERIOD 01-Jan-2015 TO 31-Mar-2015Document4 pagesAccount Statement FOR THE PERIOD 01-Jan-2015 TO 31-Mar-2015Kirti VyasNo ratings yet

- Pavan Vijay Anand Pay SlipDocument13 pagesPavan Vijay Anand Pay SlipPavan KumarNo ratings yet

- Treasury Operation System, Tripura: Payment Data Input SheetDocument1 pageTreasury Operation System, Tripura: Payment Data Input SheetRicky DebbarmaNo ratings yet

- C Inetpub Wwwroot Tripura - Working Pdfreport myPdfReport PDFDocument1 pageC Inetpub Wwwroot Tripura - Working Pdfreport myPdfReport PDFRicky DebbarmaNo ratings yet

- E BillDocument2 pagesE BillJanakantha SenewirathnaNo ratings yet

- 2015 Noa Elena - 1Document1 page2015 Noa Elena - 1Ded MarozNo ratings yet

- C SSTSNJ Z2 TM Ibi 29Document4 pagesC SSTSNJ Z2 TM Ibi 29Rakesh ParaliyaNo ratings yet

- Invoice: 41512/001/15 2015 Oct-15 To 07 Dec-15 First Partial PaymentDocument6 pagesInvoice: 41512/001/15 2015 Oct-15 To 07 Dec-15 First Partial PaymentHaleem Ur Rashid BangashNo ratings yet

- By Prince Singh Solid State Chemical Bonding: Final Touch Revision For Iit Jee Main Physical & Inorganic ChemistryDocument13 pagesBy Prince Singh Solid State Chemical Bonding: Final Touch Revision For Iit Jee Main Physical & Inorganic Chemistrysanat kr pratiharNo ratings yet

- (TGX) Downloaded FromDocument1 page(TGX) Downloaded Fromsanat kr pratiharNo ratings yet

- Merchant VeniceDocument173 pagesMerchant Venicereader_no_junk73% (11)

- প্রবাহী তড়িতDocument4 pagesপ্রবাহী তড়িতsanat kr pratiharNo ratings yet

- (TGX) Downloaded From Torrentgalaxy - ToDocument1 page(TGX) Downloaded From Torrentgalaxy - Topavan kurapatiNo ratings yet

- T. R. Form No. 26 (T.R. 4.135 Sub-Rule (1) and Explanation 1 and T.R. 4.137)Document5 pagesT. R. Form No. 26 (T.R. 4.135 Sub-Rule (1) and Explanation 1 and T.R. 4.137)sanat kr pratiharNo ratings yet

- DPP Conic Sections-385Document21 pagesDPP Conic Sections-385sanat kr pratiharNo ratings yet

- ResPaper ICSE Prelims 2016 English Paper 2 English Literature Deepti Convent School KoraputDocument4 pagesResPaper ICSE Prelims 2016 English Paper 2 English Literature Deepti Convent School Koraputsanat kr pratiharNo ratings yet

- Item 0 20180516015421505Document8 pagesItem 0 20180516015421505sanat kr pratiharNo ratings yet

- ResPaper ICSE Prelims 2016 English Paper 2 English Literature The Chanda Devi Saraf School CDS NagpurDocument5 pagesResPaper ICSE Prelims 2016 English Paper 2 English Literature The Chanda Devi Saraf School CDS Nagpursanat kr pratiharNo ratings yet

- ResPaper ICSE Prelims 2016 English Paper 2 English Literature Hiranandani Foundation School HFS Powai MumbaiDocument4 pagesResPaper ICSE Prelims 2016 English Paper 2 English Literature Hiranandani Foundation School HFS Powai Mumbaisanat kr pratiharNo ratings yet

- Class X ICSE Exam 2016: English Paper 2 (English Literature) (Don Bosco)Document3 pagesClass X ICSE Exam 2016: English Paper 2 (English Literature) (Don Bosco)sanat kr pratiharNo ratings yet

- 10th Acid Base and Salt Cbse Test Paper - 03Document1 page10th Acid Base and Salt Cbse Test Paper - 03sanat kr pratiharNo ratings yet

- Language of Chemistry' PDFDocument13 pagesLanguage of Chemistry' PDFsanat kr pratiharNo ratings yet

- ResPaper ICSE Prelims 2016 English Paper 2 English Literature Mahavir Institute of Education and Research MIER KolkataDocument4 pagesResPaper ICSE Prelims 2016 English Paper 2 English Literature Mahavir Institute of Education and Research MIER Kolkatasanat kr pratiharNo ratings yet

- ResPaper ICSE Prelims 2015 English Paper 2 English Literature SMT Lilavatibai Podar High School LPHS MumbaiDocument4 pagesResPaper ICSE Prelims 2015 English Paper 2 English Literature SMT Lilavatibai Podar High School LPHS Mumbaisanat kr pratiharNo ratings yet

- Lilavatibai Podar ICSE: English Literature Prelim Paper 2015Document4 pagesLilavatibai Podar ICSE: English Literature Prelim Paper 2015sanat kr pratiharNo ratings yet

- The Shri Ram School Aravali ICSE Revision Paper 2015: LiteratureDocument16 pagesThe Shri Ram School Aravali ICSE Revision Paper 2015: Literaturesanat kr pratiharNo ratings yet