Professional Documents

Culture Documents

77%(30)77% found this document useful (30 votes)

16K viewsEconomics Notes For BCOM

Economics Notes For BCOM

Uploaded by

talhaMust have to clear economics (bcom part 1) karachi university

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Juan Negosyante Blank Worksheets by Chinkee TanDocument9 pagesJuan Negosyante Blank Worksheets by Chinkee TanAbby Balendo100% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- UOK VoucherDocument1 pageUOK VouchertalhaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ma2 Specimen j14Document16 pagesMa2 Specimen j14talha100% (3)

- 2V0-21.19 - Professional VMware Vsphere 6.7Document2 pages2V0-21.19 - Professional VMware Vsphere 6.7Carlos Alan Pulido I.100% (1)

- Blaw R 16 Solved FINAL BackupDocument13 pagesBlaw R 16 Solved FINAL BackuptalhaNo ratings yet

- p3 Smart Noes (50 Pages Only)Document54 pagesp3 Smart Noes (50 Pages Only)Bilal Ayub100% (1)

- Abyssinia Bank ExamDocument5 pagesAbyssinia Bank Examgebremariammitiku100% (1)

- Finance and Economics For Engineers MME-308 Kris Harihara Class 4 - Elasticity of DemandDocument7 pagesFinance and Economics For Engineers MME-308 Kris Harihara Class 4 - Elasticity of DemandMadhujya SaikiaNo ratings yet

- (Two and A Half Centuries of The Galleon TradeDocument29 pages(Two and A Half Centuries of The Galleon TradeSanja StosicNo ratings yet

- Bharat Aluminium Co VS Kaiser Aluminium TechnicalDocument97 pagesBharat Aluminium Co VS Kaiser Aluminium TechnicalThankamKrishnanNo ratings yet

- So N Unit 9Document8 pagesSo N Unit 9Lam TrúcNo ratings yet

- Estimate For ManholeDocument4 pagesEstimate For Manholeaziz0% (1)

- Komatsu Bulldozer d31 d37 Ex PX 21 Shop ManualDocument20 pagesKomatsu Bulldozer d31 d37 Ex PX 21 Shop Manualbilly100% (53)

- Inner Circle Trader Ict Forex Ict NotesDocument110 pagesInner Circle Trader Ict Forex Ict NotesBurak AtlıNo ratings yet

- He Dressmaking Gr9 q1 Module-3Document16 pagesHe Dressmaking Gr9 q1 Module-3reymilyn zulueta100% (1)

- CEBU NegoSale Batch 64033 111822Document20 pagesCEBU NegoSale Batch 64033 111822Liz TomNo ratings yet

- MC6061-Service Marketing - Group Video Presentation - Assessment 01 - Sep-2020Document3 pagesMC6061-Service Marketing - Group Video Presentation - Assessment 01 - Sep-2020naveenNo ratings yet

- Performance Management Chapter 3 EvaDocument27 pagesPerformance Management Chapter 3 EvaYasichalew sefinehNo ratings yet

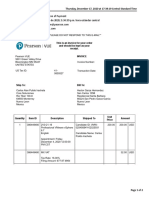

- Invoice To Mohammed Salman - #10-3896975Document1 pageInvoice To Mohammed Salman - #10-3896975Web TreamicsNo ratings yet

- Balance ScorecardDocument3 pagesBalance ScorecardEko Rochman NugrohoNo ratings yet

- King Ocean Services, LTD.: PEVGYE01742Document1 pageKing Ocean Services, LTD.: PEVGYE01742Keyla Elizabeth Baque SotomayorNo ratings yet

- Chapter 4 - Part 1 - Unincorporated BusinessDocument22 pagesChapter 4 - Part 1 - Unincorporated Business6153100% (1)

- Ie Electives Final Exam - RampulaDocument2 pagesIe Electives Final Exam - RampulaRampula mary janeNo ratings yet

- NPVDocument11 pagesNPVMaNi Rajpoot100% (1)

- ACST2001: Financial ModellingDocument42 pagesACST2001: Financial ModellingNam Nam NamNo ratings yet

- State of Maine Housing Production Needs Study - Full - Final V2Document72 pagesState of Maine Housing Production Needs Study - Full - Final V2NEWS CENTER MaineNo ratings yet

- Factsheet AMRT 2023 01Document4 pagesFactsheet AMRT 2023 01arsyil1453No ratings yet

- Valuation Report Nepal PDF FreeDocument18 pagesValuation Report Nepal PDF FreeSopan GochheNo ratings yet

- Edited ShortiesDocument12 pagesEdited ShortieszianaNo ratings yet

- Tle 8 Periodical Test 2NDDocument3 pagesTle 8 Periodical Test 2NDLeymar MagudangNo ratings yet

- Cambridge O Level: Accounting 7707/22 October/November 2021Document15 pagesCambridge O Level: Accounting 7707/22 October/November 2021FarrukhsgNo ratings yet

- Quote Template 2 WordDocument1 pageQuote Template 2 WordMostafa SayedNo ratings yet

- Yarn Manufacturing-II Lecture 1-12 Prof. DR Farooq Ahmed and Dr. Pardeep Kumar OnlineDocument113 pagesYarn Manufacturing-II Lecture 1-12 Prof. DR Farooq Ahmed and Dr. Pardeep Kumar OnlineDaniyal AhadNo ratings yet

- BY: Ynigesu Minchil Felekech Gizawu Selam Tesfaye Yohanis Petiros Ashenafi AshagrieDocument6 pagesBY: Ynigesu Minchil Felekech Gizawu Selam Tesfaye Yohanis Petiros Ashenafi AshagrieASHENAFI ASHAGRIENo ratings yet

Economics Notes For BCOM

Economics Notes For BCOM

Uploaded by

talha77%(30)77% found this document useful (30 votes)

16K views76 pagesMust have to clear economics (bcom part 1) karachi university

Original Title

Economics notes for BCOM

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMust have to clear economics (bcom part 1) karachi university

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

77%(30)77% found this document useful (30 votes)

16K views76 pagesEconomics Notes For BCOM

Economics Notes For BCOM

Uploaded by

talhaMust have to clear economics (bcom part 1) karachi university

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 76

oNOM,

“fe noes}

POL ,COH PART YER

( ACCORDING 10 THE NEW PATTERN )

Chapter-1- INTRODUCTION TO

ECNOMICS

Definition Of Economic By Different Economists:

In the words of Adam Smith: "Economics is a science of wealth”

Walter defined economics as: "Economics is that body of knowledge which related to

wealth.”

In the words of Mills: "Economics is the science of wealth in relation to mass*.

In short, the classical school of thought emphasized purely wealth. So we can say that,

“Economics studies the production, consumption, exchange and distribution of wealth.”

Robbins Definition of Economics

~ Prof. Lionel Robbins gave his definition of economics in his book “Nature and signifi-

cance of Economic Science” in the year 1932 .He defined economics as,

“Economics is the science that studies human behavior as a relationship between ends

and scarce means which have alternative uses.”

Robbins definition is based on:

1. Multiplicity of wants.

2. Scarcity of means

In other words, Robbins definition says that:

1, The ends are unlimited,

2. The means to achieve those ends are limited, and

3. The means are capable of alternative uses.

la ae ee ol BT hens mak ow

Chapter 1\- INTRODUCTION TO

ECNOMICS

ATTRIBUTES OF THE DEFINITION

Followings are some of the attributes of Robbins definition:

Multiplicity of Ends: As a matter of fact, never come to an end. They are always

unlimited. As soon as one want is satisfied, another comes forward. Thus it is the unli-

mitedness of a person wants that never stops him from working and keeps him engaged

in the work of earning money for the satisfaction of his wants.

2.Scarcity of Means: It refers to the limited resources due to which economic prob-

lems arise. But if the resources were unlimited, then consequently there would have no

economic problems and all the wants would have been satisfied. But it should be noted

that the means are scare with respect to their demand.

3.Selection / Urgency of Wants: It is obvious that some of the wants are more urgent

for us as compared to others. Naturally, we go to satisfy our urgent needs/wants first

and then the remaining ones. Lf all the wants are same there would be no urgency to

fulfill then and hence no economic problem would arise.

4 Alternative Uses: According to the Robbins definition all the scars means are capable}

of alternative uses i.e. they can be put to a number of uses e.g. water can be used for

drinking as well as for cooking. The main problem arises that where the utilization

should be made first.

5,Human Science: Robbins in his definition has broadened the scope of economics.

According to him economics is the study of human behavior as a whole both with in and

out side the society. It does not restrict the subject matter within specific limits.

CRITICISM OF THE DEFINATON

Robin's definition also faces criticism from many economists. Some of the criticizing

point's areas follow:

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 1 - INTRODUCTION TO

ECNOMICS

1.Economics as a Positive Science: According to Robins, economics discovers only the

facts that give rise to certain problems and does not give suggestions as to how to

deal with human behavior that varies from man to man and from time to time. So it is

not a physical science, which deals with matter and energy and remains unchanged at

any place. Economics is therefore not a physical science. [t discovers causes / efforts

and suggestions.

2.Human Touch Missing: In Robbins definition the human touch is entirely missing. It

does not take in to account the systematic thinking, human sympathy, imagination and

the variety of human life.

3.Abstract and Complex: Robbins has made economics more abstract and complex and

hence difficult. This distracts from its utility for the common man. Utilities of econo-

» mics lie in being a concrete and realistic study.

4.Macro Concept: Another criticism on Robbins definition is that it ignores the macro

aspect. It has ignored the issues like employment, national income from its boundaries.

5.Does not Covers Economics of Growth: The economic growth theory or economic

development theory has been overlooked in Robbins definition. Economics of growth

explains how an economy grows and the factors, which bring about an increase in nati-

onal income and productivity of the economy. Robbins takes the resources as given and

discusses only their allocation.

MICRO ECONOMICS

The word “micro” means a millionth part. When we speak of micro-economics or the

micro approach, what we mean is that it is some small or component of the whole eco-

homy that we are analyzing. For example, behavior or that of an individual firm or what

happened in any particular industry. In micro economics what we study is that price of

aparticular product or of a particular factor of production and not the general price

level in the country.

(Cont...)

la adsl ee 2 ol lene etal as om oo ow

Chapter 1\- INTRODUCTION TO

ECNOMICS

Micro-economics theory studies the behavior of individual decision-making units such

as consumer, resources owner and business firms.

In micro economics we study following issues.

LIndividual consumer's behavior

2.One product's price.

3.One individual consumer's demand and his income.

4.Study of individual firm's location, cost, revenue, and profit.

5.Remuneration of individual factors of productions.

MACRO ECONOMICS

Macro-economics is concerned with aggregate and averages of the entire economy.

Such as national income, aggregate output, total employment, total consumption, saving

* and investment, aggregate demand, aggregate supply, general level of prices, etc. In

other words, in micro-economics, we study how these aggregates and averages of the

economy as a whole are determined and what causes fluctuations in them.

Macro-economics deals also with how an economy grows. In other words, it analyses

the chief determinants of economics development and various stages and processes of

economics growth. This part of economics theory has been largely developed in the las:

two-three decades.

NEEDS FOR INTEGRATING FOR BOTH MICRO AND MACRO ECONOMICS Or

BLENDING MICRO AND MACRO ECONIMICS

It may be emphasized that neither of the two approaches outlined above can alone

adequately help us in analyzing the working of the economic system. What is true of

“the parts may not be true of the whole and what is true of the whole may not apply to

the parts. It is very essential therefore to integrate the two approaches.

Now to apply the mact‘o-approach to such individuals industries would obviously be

wrong; and it would be equally wrong to apply the micro-analysis of these industries of

the economic system as a whole, (Cont...)

la ae ee ol BE Chen tak ay a ae oo Lb

Chapter 1.- INTRODUCTION TO

ECNOMICS

What is needed is a proper integration of the macro and micro approaches to such

problems. Which have no microelements involved and few micro problems that are with|

out micro aspects

Q- What are central problems of the economy? How are they solved ina free

market economy?

Ans-Free Market Economy:

Ina free market economy decision-making is decentralized, whereas in controlled

economy decision making is centralized. Free market economy is also known as price

mechanism. In this economy individual owns the factor of production and decide indivi-

dually how to use them. The price system, which is one characteristics of Market eco-

“ nomy, is only possible way to organize society. Price Mechanism or price system or

free market economy, is an economic system in which relative prices constantly change

to reflect changes in supply and demand of different commodities.

Problems Of Free Market Economy:

1.What and how much should be produced?

2.How should it be produced?

3.For whom the goods are produced?

4.Determination of money income?

*What And How Much Should Be Produced?

Ina free market economy or price system, the interaction of demand and supply for

each good determined as to what and how much to produce. Lf he highest price that

consumers are willing to pay for a commodity is less than the lowest cost at which a

good can be produced, then output will be negligible or zero.

Chapter 1 - INTRODUCTION TO

ECNOMICS

*How Should It Be Produced?

A firm can use various combinations of labor and capital to produce the same amount of

output. In price system, the least cost combination technique is chosen because it max-

imizes profit. Firms using this technique will be able to offer for sale their products at

a lower price and will make profit. The lower price will induce consumers to shift their

demand from the high priced goods to the low priced goods. The inefficient firms will be

forced to go out of business and in this way many firms will close their inefficient busi-

ness and will induce consumers to shift their demand from the high priced products to

the low priced products.

*For Whom The Goods Are Produced?

| Ina free market system, the choices about what is to be produced are made by the

individual firms, but this choice is determined by money incomes in the society. Those

people who will have higher income, they would command different commodities than

those who have less income.

*Determination Of Money Income?

When a person is selling his human resources i.e. labor services then his income is based

his wages, which he can get in the labor market. If a person owns land and capital then

rent of land and interest of his capital will determines his ability to buy consumer

products. If his income from interest and rent is less then his demand for goods, then

he will have less consumer goods.

Chapter 2)\- THEORY OF DEMAND

DEMAND: Demand is the power to purchase a product coupled with willingness to pur-

chase it. Ifa consumer holds only one of them, demand doest not exist.

Explanation: If a poor man wants to purchase a car then it is not demand because he

has wishes to purchase but not power. Similarly a rich man could purchase cycle; it is

also not a demand, because he has power but not wish.

LAW OF DEMAND

The law of demand states that; “If other things remain constant, when the price of

good increases, its demand decreases and when the price of good decreases its dem-

and increases.”

In short, there is an inverse or negative relationship between price and the quantity

demanded."

B Table Showing Law of Demand:

Price Per Kg (Wheat) Quantity Demanded

0

Increase Ine

Demand

s *

Decrease

2 + it ® cine

se

Price Per Kg

° 70 20 50 40 50

Quantity Demanded Of Wheat

la ae ee ol BT hens mak ow om onl

Chapter 2'- THEORY OF DEMAND

Explanation:

From the above schedule and graph, it is clear that, there is an inverse relationship

between price and quantity demanded because whenever prices of wheat are increased,

demand of wheat is going to decrease. As we have seen in above graph when price was

“1" the demand of wheat was “4- kg" and when price reached at "4" than its demand

was "10kg", so demand is going to be decreased when price increases.

ASSUMPTION OR LIMITATION OF THE LAW OF DEMAND

LIncome Remains Constant:The income of the consumer must remain constant for the

law of demand to hold. If there is a change in his income the result may not be in acc-

ordance with the Law of demand.

e 2.Taste, Habits And Fashion Should Not Change: It is also assumed that taste of the

consumer remains unchanged if there is a change in consumer taste along with changes

in price the law of demand may not hold.

3.Price Substitute Goods Should Remain Constant: To hold the law of the demand, it is

assumed that, the prices of substitute and complements should remains constant.

4.Mo Change In Future Expectation: The consumer's products expectations regarding

the future behavior of the market should not change. If the expectations change, the

law of demand may not hold.

5,Weather Should Remain Constant: During winter season, utility of woolen clothes

goes up; even though they might be very expensive its mean that weather should rem-

gins constant to fulfilling the law of demand,

6.Population Growth: If number of consumers is greater, demand for goods and services|

will increase and is number of consumer is less in number, demand will decrease, So to

hold the law of demand population should remain constant.

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 2.- THEORY OF DEMAND

EXTENSION AND CONTRACTION OF DEMAND

(Change Th Quantity Bemanded)

Extension and contraction of demand occurs to change. in the price of the respective.

commodities. "Extension" means that there is an increase in the quantity of the good

purchased due to a fall in its price. "Contraction" means that there is decrease in

demand of the good due to the rise in its price.

Price Of Good Quantity Demanded

3 Rs 10Rs

10Rs 5Rs

Extension

a0

Price

w

Rcon fraction

7

Quantity Demanded Kg

i ay ae tn A ah ht tt ol |

Chapter 2\- THEORY OF DEMAND

RISE AND FALL IN DEMAND

(Change In Demand)

When change in demand occurred by other factors than price will be called as rise and

fall in demand. Those factors may be change in income, fashion, population, etc. Follo-

wing changes are. explained as under:

‘Rise In Demand: When price of any commodity not change, but unity of demand chan-

ge, means increases, that will be called as “Rise in demand".

Schedule Showing “Rise in Demand”:

Price Quantity Demanded

Rs. 10 Pa Kg 100Kg

Rs. 10 Pa Kg 200Kg

Rs. 10 Pa Kg 300Kg

Rs. 10 Pa Kg 400 Kg

Rs. 10 Pa Kg 300Ke

Quantity Demanded Ke

la ae ee ol BT hens mak ow

Chapter 2\- THEORY OF DEMAND

‘Fall In Demand: When price of any commodity remain unchanged, but quantity of

demand decreases, so this change. in demand is known as fall in demand.

Schedule Showing “Fall in Demand”:

Price Quantity Demanded

Rs. 10Pa Kg 400 Kg

Rs. 10Pa Kg 300 Kg

Rs. 10 Pa kg 200 Kg

Rs. 10 Per kg 100 Kg

Rs. 10 Per Kg 30Kg

Quantity Demanded Ke

Chapter 2.- THEORY OF DEMAND

“Fall In Demand: When price of any commodity remain unchanged, but quantity of

demand decreases, so this change in demand is known as fall in demand.

Schedule Showing “Fall in Demand":

Price Quantity Demanded

Re 10 Par Kg 400 Kg

Rs. 10 Par Kg 300 Kg

Rs. 10 PaKg 200Kg

Rs. 10 Pa Kg 100Kg

Rs. 10 PaKg 50Kg

Price

200 300

Quantity Demanded Kg

ee ae el TT lee te imal

Chapter 2 - THEORY OF DEMAND

ELASTICITY OF DEMAND

The law of demand state that as the price of a certain good goes up, its quantity

demanded decreases with other factors remaining the same. One short coming of this

statement is that it does not explain that how much of an increase or decrease in

quantity demanded occurs due to a change in price. The elasticity of demand occurs

due to a change in price.

The elasticity of demand explains the percentage change in quantity demanded in

response to change in price.

There are various kinds of elasticity of demand:

1 Price elasticity

2, Income elasticity

3. Cross elasticity

4, Substitution elasticity

PRICE ELASTICITY OF DEMAND:

“Tt is the degree of responsiveness in the quantity demand of product to a change in

its price."

Price elasticity of demand can be measured with the help of any of the following three

methods:

‘Total Outlay method

“Percentage method

‘Geometric method

“TOTAL OUTLAY METHOD:

“In this method, we compare the total outlay of the consumer before and after varia-

tion in price.”

Here Elasticity of demand is expressed in three ways:

ayUnity

b)Greater than unity

‘c)Less than unity

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 2.- THEORY OF DEMAND

a)Elasticity Equal To Unity: If the quantity demanded of a product changes due to a

change in price and the total outlay of the consumer remains constant then the elast-

icity of demand will be equal to unity.

b)Elasticity More Than Unity: If the quantity demanded of a product rises due toa

change in price and the total outlay of the consumer increases then the elasticity of

demand will be more than unity.

c)Elasticity Less Than Unity: If a fall in the price results in the quantity demanded

for the product to increase and the total outlay of the consumer to fall, elasticity of

demand would be less than unity.

“PERCENTAGE METHOD: The previous method gives only a rough measure of ela-

sticity of demand. But with the percentage method we are able to be more precise as

to how much elastic the demand is:

This method is applies in two cases:

a)Point elasticity of demand

b)Are elasticity of demand

a)Point Elasticity Of Demand: When elasticity of demand is measured for a very

small change in price.

Percentage change in Qty Demand

Ed =

Percentage change in Price

ie.

AQ a

Ed= x

AP Q

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 2\- THEORY OF DEMAND

b)Are Elasticity OF Demand: When elasticity of demand is to be measured for a signi

ficant change in price.

Percentage change in Qty Demand

Ed=

Percentage change in Price

Ql-Qo Pl+ Po

Ed = *

Ql + Qo PI-P

“GEOMETRIC METHOD: This method enables us to measure elasticity of demand

~ at any point on the demand curve. In the above diagram we have purposely derived a

demand curve at which the tangent (MN) indicates that elasticity o demand =1 at point

A. If the point were to be lower then elasticity of demand will be < 1 and if the point

were to be any where between MA, then elasticity will be > 1

M

o O1 N = w!

Demand

i ay eae tn A ah Ch tt ol |

Chapter 2.- THEORY OF DEMAND

INCOME ELASTICTY OD DEMAND.

If other things remain constant, elasticity of demand regarding income is the degree

of change in the quantity demanded of a product in response to change in income.

Formula: Percentage change in Qty Demand

a — a,

Percentage change in Price

AQ y

Ed = x

AY Q

Income elasticity of demand may effect in two ways.

Normal Goods: In the case of normal goods, when income increases the quantity deman-

ded also increases. Hence, it will result in positive elasticity of demand,

“Inferior Goods: In the case of inferior goods, when income increases quantity demanded

falls because people will now have the purchasing power to buy better goods. Hence, it

will result in negative income elasticity of demand.

CROSS ELASTICTY OF DEMAND.

Cross elasticity of demand may be defined as:

“The degree of responsiveness of demanded for a commodity to change in price of

related goods.”

These related goods can either be substitute of the said product or there may be

complementary to the product concerned,

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 3 THEORY OF SUPPLY

SUPPLY:"Any commodity which is brought for sale in the market in a certain price, in

a certain quantity and for a certain time period, is called SUPPLY“

LAW OF SUPPLY: The law of supply states that:

“If other factors remaining constant, when the price of a commodity increases, its

quantities supplied increases and when the price of a commodity decreases, its quanti-

ty supplied also decreases.”

So, there is a positive and direct relationship between price and supply.

Qs = f (p). (Supply is the function of Price)

Schedule

Price (Rs.) Quantity Supplied

TRs Ey

SRs. 80

12 Rs 120

16 Rs. 160

Explanation: From the above table we know that as, we increased the price out supply|

also increased that is when price was "4" it supply was “40" as we increased the price.

resulted its supply was also increased when price reached at 16 then the quantity of

supply touched at 160. The above graph represents the positive relation between price

and supply because both are directly proportional. When the price of a particular com-

modity increases, its quantity supply also increase and the curve will move from left to

right upward.

la ae ee ol BT hens mak ow

Chapter 3 THEORY OF SUPPLY

S$ = Supply Curve

slop

Directly Proportional

Price (Rs)

40 80 120 160

Quantity Supplied

ASSUMPTION OF THE LAW OF SUPPLY

1,Constant Cost Of Production:

For the explanation of the law of supply, the cost of production is assumed to remain

constant. If the cost of production sere to fall, the supply would increase even though

there is not change in price and the Law of supply does not hold.

2.Constant Price Of Capital Goods:

Capital goods are used to produce more goods. Examples of such goods are machinery,

agricultural equipment etc. If the prices of capital goods falls, the cost of production

would also fall, this will result in an increase in supply,

3.Constant Technology;

For example in the agricultural sector, electrical machines have introduced to obtain

more output this results in the reduced cost of production as less money is used to

pay for labor, hence, price falls where as, with the use of modern equipment, supply

increases and thus Las of supply does not hold.

le ee ee ol BT hens ak ow

CHAPTER 4- CONSUMPTION

AND CONSUMER BEHAVIOUR

UTILTIY

“Utility is defined as the satisfaction which is derived from the consumption of some

goods or services.”

VARIOUS CONCEPTS OF UTILITY

‘Tnitial Utility: Initial utility is the satisfaction which obtains from the consumption of

the first unit of commodity. For example when a person consumed first unit of apple

then he obtains utility is called initial utility.

“Positive Utility: When the level of satisfaction increases unit of commodity that situ-

ation of utility is called positive utility.

- Zero Utility: When a consumer does not obtain utility from the consumption of com-

modity is called zero utility.

“Negative Utility: When the consumption of commodity gives harm instead of utility in

consumer is called negative utility.

*Marginal Utility: It is the amount of added utility obtained from one unit increases in

consumption marginal utility means the quantity of satisfaction which is obtained from

the consumption of additional unit of commodity.

“Total Utility: It is utility which is obtained from the consumption of all units of com-

modity. Where marginal utility is zero, total utility will be maximum.

LAW OF DIMINISHING MARGINAL UTILITY

This law describes a familiar and fundamental tendency of human behavior.

"The additional benefit which a person derives from an increase of his stock of a thing

diminishes with every increase in the stocks that he already has”. (Cont...)

le ee ee ol BT lene mak ow om onl

CHAPTER 4- CONSUMPTION

AND CONSUMER BEHAVIOUR

This law based upon two facts

1. Total wants of a man are unlimited but each single want can be satisfied. As a man

gets more and more of a commodity the desire of his want for that good goes on fail-

ing. A paint is reached when consumer no longer want any more units of that good.

2. Different goods are not perfect substitutes for each other in the satisfaction of

various particular wants. As such marginal utility will decline as the consumer gets ad-

ditional units of a specific good.

Schedule Showing Law Of Diminishing Marginal Utility:

Units Of Apples Total Utility Marginal Utility

Consumed

1 10 10

2 18 8

3 24 6

4 28 4

5. 30 2

6 30 0

7 28 2

Explanation of the Law:

Suppose a man is very thirsty. He goes to market and buy a glass of sweet water. The

glass of water gives him immense pleasure or says first glass of water is great utility

for him. If he takes second glass utility is than first one. And if he increases the glass

of water will reach at the stage where he feel negative increase or say utility is decl-

ined.

Simply we say ina given span of time the more use of product the lesser will be the

utility.

la ae ee ol BE hens tak ae om oom oo Lb

CHAPTER 4- CONSUMPTION

AND CONSUMER BEHAVIOUR

Dramatically Representation:

Marginal Utilicp

Units Of Apples

The above graph is negative, because there is an inverse relation between consumption

and marginal utility.

Assumption of the Law:

Assumption of law of diminishing utility are:

1. Rational behavior of consumer

2. Constant marginal utility of money

3. Diminishing marginal utility

4. Utility is additive

5. Consumption to be continuous

6. Suitable quantity of a commodity

7. Characteristics of the consumer does not change

8. No change of fashion, customer, tastes

9. No change in the price of commodity

le le ee ol ET lene mak ow

Chapter 5- INDIFFERENCE CURVE

INDIFFERENCE CURVE

An indifference curve may be defined as:

“A graphic representation of different combination of two goods which yield the same

evel of satisfaction to the consumer.”

Graphical Representation:

Combination Commodity x Commodity y

A i 7

B 2 4

C 3 2

D 4 1

7 A

6

Fal

3

8

B

4

o

o 3

2 c

1 D

oo A ae Hh A BT Sa emt em oon ll

Chapter 5- INDIFFERENCE CURVE

Tn above example all the four combinations provide same level of satisfaction to cons-

umer therefore consumer becomes indifference as to which combination he should

choose. This tendency when shown with the help of a graph is known as indifference

curve. On one IC whatever may be the point level of satisfaction will be the same.

PROPERTIES OF INDIFFERENCE CURVE

We note the few properties of indifference curve.

LDownward Sloping To The Right Or Negatively Slopped:

An indifference curve slopes downwards from left to right. It is because when the

consumer decides to have more units of one of the two goods, he will have to reduce

the number of units of another good, if he is to remain on the same indifference curve.

Looking at the diagram below:

an

GOOD Y

a

wo

GOOD X

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 5- INDIFFERENCE CURVE

2.Two Indifference Curve Never Intersect Each Other

The second condition of indifference curve. is that no two such curves will ever cut

each other. It can be explained by the diagram:

¥

Apples

Q

a Il

Icz

oO Mangoes x

In the above diagram C lies on the both indifference curves, which is in turn means

that C is equal to both A and B at a time, which represent different level of satisfa-

ction.

3. Convex to the origin

Convexity means we use more and more of good X and Y less and less of good Y. The.

marginal rate of substitution of x for y goods falling.

As we see that the marginal rate of substitution (MRS) of many for apples falls while

the MRS of mangoes for apples remains constant and MRS of mangoes for apples incr-

ease which is not happen in general.

le ee ee ol BT lene mak ow

Chapter 5- INDIFFERENCE CURVE

Hence it is proved that Indifference Curve is convex to the origin.

0 1 2 2 -d ?

GOOD X

4.Higher The Indifference Curve Higher The Level Of Satisfaction:

Higher the indifference curve, higher the satisfaction, and lower the indifference

curve, lower the satisfaction.

g GOOD X

a al be oh hee tems ae a oom ons

Chapter 5- INDIFFERENCE CURVE

In the diagram on X-axis goods x and on Y-axis good y is taken. [C1, I€2, C3 is three

different ICs. IC1 gives satisfaction, than IC2. In the same way the satisfaction inc-

reases as we move on the higher ICs.

Consumer's Equilibrium, by Indifference Curve Technique

“Consumer's equilibrium refers to the position of deriving maximum satisfaction with

his given money income and given prices of goods in the market”.

Conditions OF Equilibrium Or Assumptions For Equilibrium

Consumer is rational and tries to maximize his satisfaction.

“Income of the consumer is fixed and given.

» ‘Prices of X and Y are given in the market and consumer cannot change. them.

“Units of X and ¥ are same in quantity and are not divisible.

Now suppose,

*Income of consumer is Rs. 20

“Price of commodity X is Rs. 2.and consumer can purchase max. 10 units of X.

“Price of commodity X is Rs. land consumer can purchase max. 20 units of Y.

*Consumer budget line is AB.

*Consumer spends 10 Rs. On purchasing 5 units of X commodity.

*Consumer spends 10 Rs. On purchasing 10 units of Y commodity.

*Consumer's equilibrium will be on point Ewhere [C2 touches the budget line AB.

ani ah SM htt mo

Chapter 5- INDIFFERENCE CURVE

Consumer's equilibrium can be explained by means of the following diagram.

4,

S 15)

2

>

o E

1d

os C3

$ IC2

tl

5 198 1s 20

GOOD X

Tn graph, IC-3 provides a higher satisfaction but it is above budget line AB and is be-

yond the reach of a consumer. IC-1 is below the budget line AB and is the lowest one,

which provides less satisfaction. AC-1 provides more satisfaction. This curve is also

tangent on budget line at E, here the consumer will purchase both X and Y goods and

will spend all his income and will obtain maximum possible satisfaction and will be in

Equilbirum position,

MARGIANL RATE OF SUBSTITUTION

Marginal rate of Substitution (MRS) shows how much of one commodity is substituted

for how much of another MRS is an important tool of indifference curve.

As we see that when our consumer has 15 apples and no mangoes he will prepared to

forgot 4 apples for 1 mango and yet remain at the same level of satisfaction.

In his second combination he will be prepared to accept 4 apples for the loss may be

defined as the amount of apples that is scarified for obtaining one mango or it may also|

be defined as the amount for the loss of one mango so that he may remain at the same.

level of satisfaction.

la le ee ol I BE Chen te tak ae a aoe oo Lb

Chapter 5- INDIFFERENCE CURVE

In Hick's Word

We may define Marginal rate of Substitution of X for ¥ as the quantity of ¥. Which

would just compensate the consumer for the loss of the marginal unit of X.

It's a common observation that as we come to have more and more of one good, we

shall be prepared to foryo less and less of the other. It is simply says that MRS of

good X for good Y will falls as we have more of x and less of Y which we see clearly in

other combination and get ratios (3 : 1, 2:1,1: 1)

LAW OF MARGINAL RATE OF SUBSTITUTION

Marginal rate of substitution goes on decreasing therefore it is called *Law of dimin-

ishing marginal rate of substitution.” If a person has more unit of good X then he goes

‘on losing interest in X and in latter transaction he will be prepared to give away less

units of ¥ for the exchange of X. Hence MRS of X for Y diminishes as the consumer

has more of X and less of Y.

In the table given below in combination B, consumer is willing to give away 3 Ys for one

&, but in transaction C for one more X, he is ready to exchange it with only two Y,

whereas in the last transaction, he is ready to exchange for additional X, with only

one Y, it means the rate of exchange is continuously diminishing and the only reason is

reducing the stock of Y, the importance of Y is now increasing for him and he is not

willing to give away or exchange it with same number of commodity X.

Combinations xX bg MLR.S Of X for Y

A i 7

B 2 4 13

¢ 3 2 12

D 4 1 11

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 5- INDIFFERENCE CURVE

B (1:3)

GOOD Y

(12)

D (1:2)

GOOD xX

INCOME EFFECT

"Income effect may be defined as a measure of the change in the consumer's equilibr-

ium and in the quantity of goods purchased, solely due to.a change in his money income;

price of goods remaining constant.”

An increase in income of a consumer makes him to buy more of X and Y goods provide

prices of both of them do not change. In the same way decrease in income causes him

to buy less of X and Y. When income of a person increases, prices remaining the same,

he purchases more units of X and Y, his satisfaction and welfare increases and vice

versa. This situation is called Positive Income Effect.

Income Effect for Normal Goods

Tn case when both goods are normal, income effect is explained with help of diagram:

Income Max. units of | Max. units of Budget Line Equilibrium

x ¥ Point

10 10 10 AA

20 20 20 BB

3 5 CC

le le ee ol ET lene mak ow on onl

Chapter 5- INDIFFERENCE CURVE

Normal Goods

ICC Fncome

ConsumptionCurve

ce Ave

Goupx

In the above diagram consumer has initial income level of Rs. 10 and he can purchase.

maximum 10 units of X and 10 units ¥ with budget line of AA and equilibrium will be on

E where IC2 touches budget line AA. If income is increasing from 10 to 20 equilibrium

will move on point El where IC3 touches budget BB. While income decreases from 10

to 5, the consumer equilibrium will move downward on point E2 where [C1 touches bud-

get lines CC.

Income Effect for Inferior Goods:

It is matter of common observation that when.a person's income is low, he is obliged to|

use inferior goods for subsistence, but as his income raises gradually, he uses less and

less of inferior goods, which are substitute for the superior ones, this the income is

negative or unfavorable in case of inferior goods, as illustrated in figure below:

Chapter 5- INDIFFERENCE CURVE

a

&

INFERIOR GOOD

be

soca

A 5 oe

GOOD "X" SUPERIOR

~ The inferior good is ¥, so that the ICC is inclined towards OX on which units of X are

_ measured, showing that income increases, less and less of good Y is being bought.

PRICE EFFECT

“Price effect may be defined as the measure of a change in the consumer's equilibrium

and the resulting change in the price of that commodity only; price of the other comm-

odity and money income of the consumer remaining constant.”

Explanation:

Suppose consumer income = Rs. 10

Price of y per unit = Rs. 1

Price of x per unit = Rs. 2,1,1

POC (Price

= Consumption

‘Cunve

Chapter 5- INDIFFERENCE CURVE

In this condition consumer equilibrium will be on E where IC2 touches budget line AA.

Now we assume that price reduced from Rs 2 to Rs 1 nownew. budget line will be AB

consumer's equilibrium will be El where 1C3 touches budget line AB, and if price X

increases from Rs. 2 to Rs. 4 the budget line will be AC and consumer's equilibrium will

move on E2 where IC1 touches AC budget line. Price consumption curve PCC is obtain

by joining all equilibrium points of different curves.

SUBSTITUION EFFECT

Substitution effect may be defined as a measure of the change in the quantity of goods

purchases which is solely due to a change in relative prices, real income of the consumer

remaining constant.”

Explanation:

Income Price X Price Y Budget Line

Rs. 10 2 1 AA

Rs. 10 1 1 AB

In this figure, initial income of consumer is Rs. 10 and price of X=2 and

Price of Y=1 and consumer can purchase 5 units of ¥ and 2.5 units of X

with equilibrium at £1, When price of X = 1 reduces, the equilibrium of

consumer shifted to E2 and the difference between El and E2 is

showing the substitution effect.

Gi

SA

GOOD X

Chapter 5- INDIFFERENCE CURVE

Q- Price effect is combination of income effect and substitution effect. Explain

and illustrate.

Price Effect = Income Effect + Substitution Effect

‘As we known that, when ever prices of good decreases then two effects are incurred

on its demand that is income effect and substitution effect. Due to decrease in prices}

of good, purchasing power of a consumer increases which is called "INCOME EFFECT".

While on the other hand consumer will substitute cheaper good for expensive good,

this is called the Substitution Effect.

Explanation with The Help Of Diagram:

GOODY

IC @

GOOD X

In the above diagram the basic equilibrium on point El. Where consumer purchases 3

units of X good on budget line “AA”. When prices of X falls then new budget line will

be "AB". New equilibrium will be on point E3 and consumer purchasing will be 9 units.

In this condition price effect is:

Price Effect or Total Effect = x3 - x1

29-3,

Price Effect or Total Effect = 6

le le ee ol BT hens mak ow om onl

Chapter 5- INDIFFERENCE CURVE

The Substitution Effect:

To determine substitution effect we draw an imaginary budget constraint *CC" which

is parallel to AB budget line, and touches to IC1. The consumer will not stay on point

EI because X good is cheaper than Y so, consumer will move from El to E2 to purchase

more units of good X, this shows the substitution effect.

In this case substitution effect will be: x2 - x1

=5-3=2

Income Effect:

The change ii ome is due to the change in price of X, which allows a consumer to

buy more with in the same budget. Now the equilibrium of a consumer will move from

32 to E3 and consumer increase the purchasing of X good from 5 to 9 as that increase

_ in income. So income effect will

x3 - x2

=9-5:-4

Price Effect = Substitution Effect + Income Effect

6 2

Chapter'6 - Laws Of Return

Laws of Return

There are three laws of returns known to economists:

1. law of Increasing return

2. Law of Diminishing return

3. Law Of Constant Return

Law of Increasing Return:

It is defined as:

Other things remain the same, if an increase of a variable factor (labor and capital)

on fixed factor (land) output will increase. This tendency in production is known as law

of increasing returns”.

Explanation of Law by Schedule:

Variable Factor Total Return (kg) Marginal Return (kg)

1 100 100

2 120

3 140

4 160

6

we} Increasing

Return a

awe _

a In the above diagram marginal return is measured

aA

, ‘on y-axis while no. of labor of variable factor on

x-axis. Marginal return is increasing from 1 labor

to 5th labor. Marginal return curve shows increas-

ing return because this curve is upward slopping

from left to right.

zg

Marginal Return

22

ia OP wm Fe

Units Of Labor & Capitat

iste i ee al TT eee oak

Chapter 6 - Laws Of Return

Law of Constant Return:

It is defined as:

“Other things remain the same, if an increase of variable factor on fixed factar: output]

will increase in the same proportion of every variable factor. Means Marginal Return

will remain unchanged".

Explanation of Law by Schedule:

Variable Factor Total Return (kg) Marginal Return (kg)

1 100. 100,

100

100

100

100

100

230,

In the above diagram marginal return is

. measured on y-axis while no. of labor of

— ha a eh ee variable factor on x-axis. As the no. of

Units Of Labor & Capital labors is increased marginal return is

increased but in the same proportionate,

shows marginal return.

ee ae el TT lee te imal om onl

Explanation of Law By Schedule:

Chapter 6 - Laws Of Return

Law of Diminishing Marginal Return

Marshall stated the law of diminishing marginal returns in the following words:

"An increase in capital and labor applied in the cultivation of land causes in general less

than proportionate increase in the amount of produce raised, unless it happens to

coincide with an improvement in the art of agriculture".

Variable Factor Total Return (kg) Marginal Return (kg)

1 200 200

2 380 180

340 160

680 140

> 800. 120

From the above table we can find out that when the farmer applies first unit of capital

* and labor the production is 200 kg. And after that he applies 2nd, 3rd, 4th, and 5th

unit similarly. The 2nd column of total return is showing increasing trend as 380,540,

680, and 600 respectively. While 3rd column of marginal return diminishing as the

number of labor and capital increased. After applying 3rd unit marginal return is decr-

eased again from 180kg to 160kg and so on.

Diminishing

Rem

:

Marginat Return

3

Ne In the above diagram marginal return is measured

on y-axis while no. of labor of variable factor on

x-axis. The downward sloping curve represents the

law of diminishing marginal return.

ak a

Units Of Labor & Capitat

i a a aie en

Chapter 7— PERFECT COMPETITION

PERFECT COMPETITION:

Perfect competition describes a market structure whose assumptions are extremely

strong and highly unlikely to exist in most real-time and real-world markets. The reali-

ty is that most markets are imperfectly competitive.

Conditions/ Assumptions/ Features/ Characteristics Of Perfect Competition

Perfect competition is said to exist when the following conditions are satisfied.

-Number Of Sellers And Buyers Is Very Large:The first condition is that there should

be operating in market, a large number of sellers and buyers.

“Products are homogenous: The second condition ensures that all firms producing goods

» which are accepted by consumer or buyers as homogenous or identical.

“Perfect Knowledge About Market: Another assumption of Perfect competition is that

the purchaser and sellers should be fully aware of the price that are being offered

and accepted.

*Free Entry Or Exit: The fourth condition of Perfect competition requires that there

must be absolute freedom for the entry of exit of the firms, in the long-run.

“Mobilizes Of Factor Of Production: Perfect mobility of factor of production is essen-

tial in order to enable the firms to adjust their supply to demand.

“No Externalities: No externalities arising from production and/ or consumption which

lie outside the market.

EQUILIBRIUM OF FIRM

A firm is in equilibrium position when it is earning maximum money profit by using its

maximum capacity.

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 7— PERFECT COMPETITION

Equilibrium of Firm In Short-Run Under Perfect Competition

Short run is a period in which variable factors like labor can be altered while fixed fact

or can not be changed. In short run two costs exist, that is variable and fixed cost.

A firm faces three different types of situations in short-run under perfect competition,

SUPER NORMAL PROFIT/ ABNORMAL PROFIT:

In the condition of super normal profit average total cost ATC is lower than the market

prices and the gap between ATC and market price represent profit area.

Super normal profit can be explained with the help of diagram.

Me

arc

Pp £ MR =AR = Price

| SS

a 2

Cast / Revenite

@| ouput

In the above diagram x-axis represent the total output of the firm while revenue and

cost are marked on y-axis. We can extract the following from the diagram:

“OM — = Output of firm

OP = Price per unit received by selling the units.

“OT = Cost per unit

"OTQM =Total cost

*OPEM = Total revenue

“Profit = Total revenue - Total cost

“Profit = OPEM- OTQM

la ae ee ol BT hens mak ow

Chapter 7— PERFECT COMPETITION

Profit Area = TPEQ

Point "E" showing the equilibrium point where MC cuts marginal revenue and average

cost curve. from below. We can say that in this condition (TR > TC) total revenue is

greater than total cost.

CONDITION OF LOSSES:

Under the condition of loss, the average total cost ATC is greater than market price

and gap between ATC and market price represents losses.

The position of firm's loss can be illustrated with the help of diagram.

Mc

mn

ate

2

ave

AR MR=Price

= |e

s

5 |/—__

a

©

¥

&

o

}—-}__|_ a_i

oe Onput M

In the above diagram x-axis represent the total output of the firm while revenue and

cost are marked on y-axis. We can extract the following from the diagram:

“OM — = Output of firm

‘OP __ = Price per unit received by selling the units.

‘OT = Cost per unit

*OTQM =Total cost

“OPEM = Total revenue.

*Profit. = Total cost -Total revenue.

“Profit =OTQM- OPEM

le ae ee ol BT Chen ee mak ow

Chapter 7— PERFECT COMPETITION

Profit Area = PTQE

Point “E" showing the equilibrium point where MC cuts marginal revenue and average

cost curve from below. We can say that in this condition (TC > TR) total cost is greater

than total revenue.

NO PROFIT/ NO LOSS OR NORMAL PROFIT

In this condition firm gets normal profit or no profit no loss or at break even point. Be-

couse firm's total cost is equals to firm's total revenue.

We can explain this condition with the help of diagram.

mc

s

5

é

&

g

S

Ontpat Mf

In the above diagram x-axis represent the total output of the firm while revenue and

cost are marked on y-axis. We can extract the following from the diagram:

‘OM = Output of firm

“OP Price per / Cost per unit.

‘OPEM = Total revenue/ Total cost

Total cost = Total revenue Or No Profit No Loss

Point “E", showing the equilibrium point where marginal cost cuts marginal revenue

Chapter 7— PERFECT COMPETITION

Equilibrium Of Firm In Long-Run Under Perfect Competition

Tn long-run all cost are variable. Because in long run firm can change their fixed factors

like land and labor. Under perfect competition, long-run equilibrium occurs when economic

profits are zero.

In an industry with economic losses some firms will exit. As those firms leave, the market

price rises. At zero economic profit firm will stop exiting from market.

Long run equilibrium of firm can be explained by the following diagram:

AR> MR-Price

PR

Cost Revenne

t ¢ BA

Output

At price PI firm is earning super normal profit. New firms will enter in the market and

supply will increase therefore prices will decrease and super normal profit will also come!

down,

At price P2 firm is earning zero profit or normal profit where its marginal cost (MC)

marginal revenue (MR) average cost (AC) are equal. New firms will not enter in the

market and existing firms will not leave,

At price P3 where price is low, firm is running into losses. Some firms will exit from the

market and supply will decrease and price will increase.

So in the long run equilibrium occurs when economic profit are zero or where marginal

cost equals to marginal revenue and average cost.

ani ah SM htt mo

Chapter 7— PERFECT COMPETITION

MONOPOLY

The single supplier of a good, service or resource that has no close substitute. Mono-

poly arises existence of barriers preventing the entry of new firm.

EQUILIBRIUM OF FIRM UNDER MONOPOLY

A firm is in equilibrium position when it is earning maximum money profit.

The condition of equilibrium is:

MR = MC

Marginal revenue = Marginal cost

Short-Run Equilibrium under Monopoly:

Tt is generally a wrong concept that monopoly firm in every situation of market earned

Super normal profit. Practically a monopoly firm faces three types of situation:

*Super Normal Profit (TR > TC)

“Normal Profit (TR=TC)

Losses (TR« TC)

SUPER NORMAL PROFIT/ ABNORMAL PROFIT:

In short run the monopoly firm faces the situation of super normal profit which can

easily explained by diagram.

Chapter 7— PERFECT COMPETITION

In diagram on x-axis the quantity produced and on Y axis revenue and cost curves are

measured. The AR & MR curve show average and marginal revenue respectively. AC and

MC are average and marginal cost curves of a firm respectively.

At point E, MR = MC and condition of equilibrium is fulfilling.

From equilibrium point E, a perpendicular is drawn which cuts x-axis , and

‘OP = Price per unit

‘OT = Cost per unit

*OM = Output of the firm

*‘OPSM = Total revenue

‘OTQM = Total cost

Total Revenue > Total Cost

Super normal profit = TR - TC

‘TPSQ = Profit area

BNO PROFIT/ NO LOSS OR NORMAL PROFIT

In short run the monopoly firm also faces the normal profit situation which can easily

explained by the diagram.

r Ata point where firm total revenue is equal to

_-“T total cost firm is achieving normal profit. In other

L~ words in this &ituafion firm just covering all it's

sl lost.

4r Indiagram the distance OM show equilibrium

production and MS show average revenue and

average cost. Now:

“The area of rectangle OPSM = TR = Total Revenue

“The area of rectangle OPSM = TC = Total Cost

Ni ms

ae Because a single rectangle show the total cost

and total revenue so,

TR= TC

la aiid ee 2 ol lees tah as om oe on ow bl

Cost / Revenue

Mw

Output

Chapter 7— PERFECT COMPETITION

CONDITION OF LOSSES:

In short run the monopoly firm faces the situation of losses which can easily explained

Cost Revenue

Output

MR

‘In diagram on x-axis the quantity produced and on Y axis revenue and cost curves are

measured. The AR & MR curve show average and marginal revenue respectively. AC

and MC are average and marginal cost curves of a firm respectively.

At point E, MR = MC and condition of equilibrium is fulfilling.

From equilibrium point E, a perpendicular is drawn which cuts x-axis , and

“OP = Price per unit

*OT = Cost per unit

+OM = Output of the firm

“OPSM = Total revenue

*OTQM = Total cost

Total Revenue < Total Cost

PTSQ =. Profit area

la ae ee ol BT hens mak ow

Chapter 7— PERFECT COMPETITION

MONOPOLY

The single supplier of a good, service or resource that has no close substitute. Mono-

poly arises existence of barriers preventing the entry of new firm.

EQUILIBRIUM OF FIRM UNDER MONOPOLY

A firm is in equilibrium position when it is earning maximum money profit.

The condition of equilibrium is:

MR = MC

Marginal revenue = Marginal cost

Short-Run Equilibrium under Monopoly:

Tt is generally a wrong concept that monopoly firm in every situation of market earned

Super normal profit. Practically a monopoly firm faces three types of situation:

+Super Normal Profit (TR > TC)

“Normal Profit (TR=TC)

Losses (TR« TC)

SUPER NORMAL PROFIT/ ABNORMAL PROFIT:

In short run the monopoly firm faces the situation of super normal profit which can

easily explained by diagram.

a

Chapter 7— PERFECT COMPETITION

CONDITION OF LOSSES:

In short run the monopoly firm faces the situation of losses which can easily explained

Cost Revenue

Output

MR

‘In diagram on x-axis the quantity produced and on Y axis revenue and cost curves are

measured. The AR & MR curve show average and marginal revenue respectively. AC

and MC are average and marginal cost curves of a firm respectively.

At point E, MR = MC and condition of equilibrium is fulfilling.

From equilibrium point E, a perpendicular is drawn which cuts x-axis , and

“OP = Price per unit

*OT = Cost per unit

+OM = Output of the firm

“OPSM = Total revenue

*OTQM = Total cost

Total Revenue < Total Cost

PTSQ =. Profit area

la ae ee ol BT hens mak ow

Chapter 8— MONOPOLISTIC

COMPETITION

“A market type in which a large number of firms compete with one another by making

similar but slightly different products”.

Equilibrium Of Firm In Short-Run Under Monopolistic Competition

Short run is a period in which variable factor like labor can be altered while fixed factor

cannot be changes. In short run two costs exist, that is variable and fixed cost.

SUPER NORMAL PROFIT/ ABNORMAL PROFIT:

In this condition average revenue (AR) or market price is above than average cost (AC).

his can be explained by the following diagram.

(C

¢ AC

| PRON | The AR & MR curve show average and

P ™ marginal revenue respectively. AC and MC

are average and marginal cost curves of a

AR

firm respectively.

At point E, MR = MC and condition of equ-

ilibrium is fulfilling.

From equilibrium point E, a perpendicular is

drawn which cuts x- axis

Output OP= Price per unit

OT= Cost per unit

OM = Output

OPSM = Total revenue

OTQM = Total cost

Total revenue > Total cost

Profit area = TPSQ

la vais ee 2 ol ED ilen me tah ow

Chapter 8— MONOPOLISTIC

COMPETITION

NO PROFIT/ NO LOSS OR NORMAL PROFIT

At a point where firm total revenue is equal to total cost firm is achieving normal profi

In other words, at this situation firm just covering all its cost.

This situation can be explained by the following diagram.

" ATO

-

if

/ This can be explained by the following diagram:

Ss f

SX

~

OP= Price per unit and cost per unit

OPSM = Total revenue and Total cost

Total revenue = Total cost

x

5

é

&

s

So the firm is neither getting profits nor lasses

or firm is in normal profit.

Oo] Output Mt

CONDITION OF LOSSES:

In this condition average revenue (AR) or market price is less than average cost (AC).

This can be explained by the following diagram:

we Are

[-—~ OP Price per unit

OT= Cost per unit

OM = Output

OPQM = Total revenue

OTSM = Total cost

Total revenue< Total cost

Loss area = PTSQ

Chapter 8- MONOPOLISTIC

COMPETITION

In the above case, firm is meeting some part of its expenses i.e. Out of total cost of

OANK, it is getting OAML only. Tf firm stops its production, in short run, it will loose

much because the firm will have to bear all fixed expenses. In short run firm will cont-

inue to do business and shall bear some cost, with the hope of better prospects in

future.

Equilibrium of Firm In Long-Run Under Monopolistic Competition

“Profit encourages new firms to enter market.

‘New entries shift the demand curve for existing firms to the left.

+Long-run equilibrium occurs when new firms see no further incentive to enter.

‘Firm cannot continue business in losses in the long period of time.

» Price = AR

AR= is not equal to MR

MR= MC (For determination of output this requirement is a must).

This can be explained by the following diagram.

x

OP= Price per unit and cost per unit.

OPQM = Total cost and total revenue

a

Point "E" shows the equilibrium point where

marginal cost cuts marginal revenue,

Cost Revenue

Output

ai ah Sh ttc meno

ise

goles

Chapter 1— National Income

National Income:

“The national income of country during a given period of time usually one year, signifies

the net monetary value of the output, consisting of goods and services produced. Gene-

rally speaking it is the aggregate or sum of income of all factors of production of a

country."

CONCEPTS OF NATIONAL INCOME

Following are the various concepts with which national income is looked upon.

1. Gross Domestic Product: (6.D.P):

Gross domestic product is defined as:

“The total market value of all final goods and services produced with the help of factor

_ of production during one year in any country."

Mean the output produced within Pakistan by Pakistani's and foreign firms by using

country's resources. “Gross” means that depreciation of capital is not subtracted out

_ GDP = GNP - Net factor income from abroad

2. Gross National Product (6.N.P):

Gross national product is defined as:

“The total market value of all final goods and services produced with the help of national]

factors of production of any country inside or outside the country during one year."

For example profits of Pakistani citizen owned factories/business operating in Dubai,

U.K, op Africa when sent to Pakistan will be included in the GNP of Pakistan.

GNP = GDP = Net factor income from abroad

Chapter 1— National Income

3. Net National Product or'National Income At Market Price (N.NLP):

NP can be calculated by deducting depreciation on capital during the year.

When charges of depreciation are deducted from GNP, we get net national product. It

means the market value of all final goods and services after providing depreciation. It

is also called National Income at Market Price.

NNP = GNP - Depreciation on capital

4. National Income Or National Income At Factor Cost (N.I):

National income at factor cost means the sum of all income earned by factors of prod-

uction that is land, labor, capital and organization. The difference between national

income at factor cost and NNP arises from the fact that indirect taxes and subsidies

cause market price of output to be different from the factor incomes resulting from

it.

National Income = NNP - Indirect Taxes + Subsidies

5. Personal Income (P.I):

“National income is that income which is actually received by all individuals living in an

economy during a period of one year from all possible resources."

Personal income included all income received whether earned or unearned.

Tt can be written as:

Personal Income = National Income - Social Security Contribution - Cooperate

Income Taxes - Undistributed Corporate Profits + Transfer Payments

6. Disposable Personal Income (D.P.I):

After a good part of personal income is paid to government in the form of direct tax

or personal taxes like income tax, personal property taxes etc., what remains from

personal income is called disposable personal income.

Disposable Personal Income ='Personal Income =Personal/Direct taxes

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 1— National Income

MEASUREMENT OF NATIONAL INCOME

To calculate or measure national income the following three methods are generally used:

1. Output or Production Method

2. Income Method

3. Expenditure or Outlay Method

1. Net Output Or Production Method:

For calculating national income under this method the net output or the production of

various commodities is estimated and evaluated at the market prices. For this purpose

we take two steps:

Firstly we estimate the monetary value of all goods that are produced internally. The

production or output of different sections of the economy i.e. agricultural, manufact-

* uring, trade, commerce, transport etc is analyzed after deducting the depreciation

charges.

Secondly: we consider the foreign business transactions that were performed during

the financial year. In this regards we only consider the difference between exports and

imports. These two aggregate are then summoned up to get the gross domestic product

which in turn is deducted from the total revenue earned to arrive at national income.

The production method is the most direct method for calculating national income. It's

equation can be written as:

National Income = Ne epee on Capitals - Indirect Taxes «

Exports - Imports

PRECATIONS:

* Avoid Double Counting: Double counting should be avoided while calculating national

income, because if it is done the value of goods will be counted twice. So national income

will be overestimated,

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 1— National Income

* Depreciation Allowance: While calculating national income, depreciation on capitals

should be deducted.

* Self Used Product: Goods which are used by the person who produce for himself are

not included in national income. For example, shoes by cobblers, furniture by carpent-

er etc,

2. Income Method: “According to this method national income is definable. as the total

of factor warnings (wages, interest, rent, profit) that are the cost of factor of produ-

ction of society final goods."

Under this method the national income is estimated by summing up income that arrives

factor of production provided by the national residents. The rate at which the

national factor is distributed among the various factors of production is estimated.

This method of calculating national income is quite complex.

- Equation wise the method can represent national income as:

National Income = Rental Income + Wages + Interest + Profit

PRECAUTIONS:

* Double Counting Must Be Avoided: Transfer payments like pension, gifts, zakat are

not included. Price received from sale of old house is also not included in national

income because these payments already calculated in different times.

+ Illegal Earning: Income through illegal activities should not be included in national

income like smuggling or gambling.

3. Expenditure Or Out Lay Method: The expenditure approach is the most popular

national output accounting method. It focuses on finding the total output of a nation by

finding the total amount of meney spent. This too is acceptable because like income, th

total value of all goods is equal to the total amount of money spent on goods. The basic

formula for domestic output is to combines all different areas in which money is spent

within the region, and then combining them to find the total output.

GDP= C+I+G+(X-M) (Cont...)}

le ae ee ol BT Chen ee ak ow oo ol

Chapter 1— National Income

Where:

C = Household consumption expenditure

I = Gross private domestic investment

G = Government consumption

X= Gross exports of goods and services

M = Gross imports of goods and services

PRECAUTIONS:

* Only final expenditure must be taken into account, initial expenditure are not

included.

+ Government's spending on transfer payments (pension, old age benefits etc.)

must be excluded.

* International transactions must be adjusted, means received from export

should be included and payment for import excluded.

Chapter 2— DETERMINANTS OF

NATIONAL INCOME

Consumption Function:

Consumption means the amount spend on consumption at a given level of income, but

consumption function or propensity to consume (P.C) means the whole of the schedule

showing consumption expenditure at various levels of national income. This shows how

consumption varies with the variation in income. It is a functional relationship between

total consumption and national income.

AVERAGE PROPENSITY TO CONSUME (A.P.C):

Average propensity to consume means consumption divided by the disposable income.

It is arelationship between total consumption and total income. If income is Rs.100 and

out of it Rs.80 are consumed then APC will be as under:

A.P.C = Total Consumption

Total Income

Rs. 80

=0.8 or 80%

Rs. 100

MARGINAL PROPENSITY TO CONSUME (M.P.C):

Marginal propensity to consume is the ratio of the change in consumption due to change

in income. It measures the incremental change in consumption as a result of a given

increment in income. If income increases from Rs.100 to Rs.200 and consumption from

Rs.80 to Rs.150 then MPC will be:

Chapter 2— DETERMINANTS OF

NATIONAL INCOME

Income (1) | Consumption | APC=CY MPC =

© AC/AY

170 170/151

200/200 =1 20/50 = 0.6

=09 23/50=0.5

20/50 = 0.4

200)— — a ee

&

g

CONSUMPTION

300

100 130-200

NATIONAL INCOME

‘In the above schedule we can observe that as income increases consumption also incre:

ases but not as equal to income. So we can say that when APC decreases, MPC also de-

creases but MPC decreases at a faster rate than APC.

250

Chapter 2— DETERMINANTS OF

NATIONAL INCOME

FACTORS WHICH INFLUENCE CONSUMPTION FUNCTION

OR

DETERMINANTS OF CONSUMPTION FUNCTION

The consumption and saving decision may on the following basis:

* Effects of Changes In Expected Future Income: Expected future income is an impo}

tant factor affecting consumption and saving decision. For example an individual who is

currently not employed but who has a contract of high paying job, will consume more

today than another unemployed person.

* Wealth: At an individual level, an increase in wealth may raise MPC because less savi

- is needed.

* Government Policy: By taxation and public spending, the government can influence the|

level of consumption. An increase in direct taxation lowers disposable income and there-

by reduces the capacity for consumption.

* The Rate Of Interest: The cheaper the rate of interest and the greater the availa-

bility of credit, the more likely it is that consumption will occur.

* Price Expectation: In certain circumstances, when price raises are anticipated, cons-

umption might be brought forward. This temporarily raises MPC.

* Liquidity Preference: Is people prefer to keep their income liquid form, consumption

is reduced correspondingly,

* Future Needs: People reduce their present consumption to save resources for old

children’s reduction and construction of houses etc. If such needs are more than their

present consumption will reduce.

la ae ee ol BE hens tak ae om oom oo Lb

Chapter 2— DETERMINANTS OF

NATIONAL INCOME

SAVING FUNCTION OR PROPENSITY TO SAVE

It is the positive relation between household saving and household disposable income.

Tt is a function relationship between the total savings and national income.

AVERAGE PROPENSITY TO SAVE(A.P.S):

Average propensity to save means savings divided by the disposable income. It is rela-

tionship between total savings and total income.

AP.S= Total Savings

Total Income

Rs.20

= 02 or 20%

Rs.100

MARGINAL PROPENSITY TO SAVE (M.S):

This is the ratio of change in saving resulting from a change in income. It is the flip

side of the marginal propensity to consume. If income increases from Rs.100 to Rs.200

and saving from Rs.20 to Rs.50 then MPS will be:

MPS= AS