Professional Documents

Culture Documents

Untitled

Untitled

Uploaded by

api-2385389320 ratings0% found this document useful (0 votes)

137 views5 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

137 views5 pagesUntitled

Untitled

Uploaded by

api-238538932Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 5

COUNCILMEMBER DAVID ALVAREZ

City of San Diego

Council District Eight

MEMORANDUM

DATE: January 25, 2016

TO: Councilmember Mark Kersey, Chair, Infrastructure Committee

FROM: Councilmember David Alvarez

SUBJECT: Alternative Infrastructure Proposal

The City Council is scheduled to discuss the potential ballot measure related to the Rebuild San

Diego charter amendment on Tuesday, January 26, 2016. | appreciate your efforts to bring forward a

discussion of a conceptual proposal on this issue. As with any initial proposal for a charter

amendment, there are several areas of concem that need to be addressed before the Council takes

action.

| would propose a more aggressive timeline of ten years that relies on a combination of property tax

increment, debt service savings, and use of general fund savings realized through City government

efficiencies. This proposal, outlined below, would realize over $800 milion in funding over a 10-year

period, providing our neighborhoods with the resources they need now- not 30 years from now.

Additionally, it reduces the City’s long term debt, does not depend on unreliable pension savings

projections, provides proper oversight and monitoring needed to ensure that the infrastructure

strategy is followed and could be implemented immediately via the City's municipal code instead of a

charter amendment.

Plan to Increase Capacity for Project Delivery Must Accompany Any Funding Proposal

The City has exhibited a consistent inability to spend money generated via bonds and general

revenue for infrastructure projects, despite many reforms made to the CIP process over the years.

The IBA, in her analysis of the Rebuild San Diego proposal, has noted that the current project

capacity (the ability to complete projects) does not exist, and has raised this concern in earlier

analyses of the City's infrastructure backlog. In her analysis of the Rebuild San Diego Proposal she

found that currently staff can only complete $300-350M annually in projects, but the CIP outlook

projects $560M in annual capital projects spending. She also noted in her review of the 5-Year

Outlook that it will be “critically important to develop staff and external project delivery resources to

effectively manage the increased annual volume of infrastructure projects in the Outlook.” Identifying

funding that cannot be spent in a timely fashion does not accomplish the goal of building new

projects, it simply ties up tax dollars, some of which is bond money on which the City pays interest. It

is critical that with any funding plan, a concurrent plan to address capacity for project delivery is also

created and provided to the Council.

30 Years is Far Too Long to Wai

The City has a $1.7 billion dollar backlog of unfunded infrastructure needs over the next five years.

The current proposal does little to impact the overall backlog. Any plan passed by the City Council to

address the infrastructure backlog must be accelerated and implemented faster than 30 years. By

taking three decades to address this problem, we are forcing San Diegans to wait far too long to see

the infrastructure repair and construction of much needed facilities that have already been put off for

decades. Sales tax, pension savings and revenue estimates beyond a 10-year timeframe are

unreliable for purposes of delivering a dependable funding source to communities throughout San

Diego. In fact, according to the City’s FY15 Comprehensive Annual Financial Report (CAFR), “an

additional $36,800,000 would be required annually over the next ten years to bring all City streets to

an average OCI of 70° (FY15 CAFR, p. 48). Our neighborhoods need help now- not 30 years from

now.

Future Borrowing Only Decreases Available Funding Over Time

The current proposal does not address the long term debt created by bonds planned in the next five

years. Savings from avoiding issuing additional bonds, which carry interest charges and creates debt

service payments for decades to come, could result in $139.8M in available infrastructure funding

over the next ten years.

+$139.8M increase in funding

Property Tax Increment Revenue is a More Reliable Option

According to the State Legislative Analyst's Office, property tax increment revenue is a less volatile

revenue source over time than other tax revenue. By utilizing property tax increment, the City would

have approximately $226M more in the next ten years to allocate towards infrastructure projects.

According to the IBA’s projections, property tax increment revenue generates $541.4M over 10 years,

assuming steady growth, as demonstrated in the graph below (see attachment #1 provided by the

IBA):

ty Growth

+$226.5M increase in funding

Pension Savings as a Reliable Funding Source

The proposal critically misunderstands the idea of pension savings through actuarial analysis. There

is no guarantee that after any given point in time, 2028 for example, that there will be any drop-off in

pension payments. The proposal seems to conclude there will be savings based on an example

presented with several disclaimers in the SDCERS actuarial report. The IBA’s report noted that no.

savings can be counted on in the first ten years. Pension system savings should not be considered as

a reliable infrastructure funding source.

-No change in funding

Increasing Government Efficiencies Frees Up Funding for Infrastructure

The City bureaucracy can be further streamlined to create service and cost efficiencies. Identifying

savings in the budget from efficiencies that are equal to 1 cent of every dollar of general fund

expenditures over 10 years (non-cumulative) could result in up to $132.5 million that could be

invested in infrastructure (illustrated in the chart below).

1,260.0 | 1,278.4] 1,292.3 | 1,306.2 | 1,317.0 | 1,331.7 | 1,346.3 | 1,358.9 | 1,372.4 | 1,386.6

[126] 128) 129) 134] 132| 133] 135| 136| 138] 139

+§132.5M increase in funding

Fyi7_[Fyis | Fyi9 |Fy20 |Fy21_|Fy22 |Fy23 |Fy24 | FY25 | FY26 Tora]

132.6 |

Monitoring and Oversight of Progress is Critical to Success

To ensure that the infrastructure backlog is reduced in a meaningful way, itis critical that an

independent monitoring and oversight mechanism be created. | would propose that the Independent

Budget Analyst and City Auditor be tasked with an annual analysis and report to the City Council

regarding the City's progress in completing the needed repairs and building the projects identified in

the City's infrastructure backlog. Department staff should be required to provide monthly updates to

the IBA and City Auditor to ensure that adequate monitoring of project progress is achieved. To

ensure the City allocates and spends the proper amount of money on infrastructure projects, as

planned by this strategy, a clause could be included that eliminates the policy if there is a failure to

meet plan goals within the ten year time period

City Charter Amendment Is Not Needed

It may be prudent to consider whether implementing this policy via the municipal code is a better way

to move forward. If this proposal passes as an amendment to the City Charter, it will be difficult to

address any unintended consequences that may arise in future years. However, if placed into the

municipal code, future City Councils would need to actively engage in a strategy to deny communities

the much needed infrastructure projects promised through this plan. Avoiding the cost of a ballot

measure would also save taxpayer dollars, which in turn could be invested in capital improvement

projects in FY17.

+TBD additional funding in avoided costs

Establishing a More Robust Public Process

Regarding the public process on this item, the Rebuild San Diego proposal was first conceptually

presented at the Infrastructure Committee last month and was just analyzed by the IBA last week,

who suggested other options to choose from. In order to ensure that the right plan is put into place, |

would suggest that this issue of great importance be given its proper vetting through additional

Infrastructure Committee, Charter Review Committee and City Council hearings. Taking a few extra

weeks now to ensure this is the right plan is better than passing and implementing a flawed plan that

could have been improved by greater public participation

Conclusion

In total, this alternative plan would create $813.7M for infrastructure projects over ten years without

raising taxes or issuing new forms of long-term debt, as exhibited in the chart below:

10-Year Infrastructure Investment Plan Funding

Property Tax Increment-(baseline plus cap) _ $541,451,404

Debt Service Savings oa $139,800,000

Government Efficiency Savi $132,500,000

TOTAL 7 | _$813,751,404

| would request that this proposal be considered by the Infrastructure Committee before the Council

takes action on the current proposal. Additional analysis of this and other options available to the City

to address this problem should be considered by the Infrastructure Committee and analyzed by the

Independent Budget Analyst, prior to being considered by the City Council. | very much share your

concern that the City must act now to fund neglected infrastructure needs and hope that the ideas

outlined above will improve the current proposal. Please let me know if you have any questions

regarding the proposal contained in this memorandum.

CC: Honorable City Councilmembers

Honorable Mayor Kevin Faulconer

Honorable City Attomey Jan Goldsmith

Eduardo Luna, City Auditor

Andrea Tevlin, Independent Budget Analyst

PROPERTY TAX

Baseline GF Growth 2.00%

Infrastructure Cap 3.50%

Year Baseline General Fun New General Fund Re New infrastructure Revenue Excess GF Revenue

1$ 4700685739 $ 18,990,771 $ 14,489,864 $ 19,548,937

2$ 470068579 § 28,771,958 § 22,332,899 § 24,508,776

3$ 470068579 $ 38,748,768 $ 30,597,159 27,400,766

4$ 470,068,579 $48,925,115 $ 39,300,220 $ 25,985,053,

5$ 470068579 $ $9,304,989 § 48,460,736. $ 21,010,739,

6 $ 470,058,579 $ 69,892,461 $ 58,097,466 15,757,665

7$ 470,068,579 $ 80,691,681 $ 68,230,293 § 10,171,021

8$ 470,068,579 $ 91,705,887 $ 78,879,757 $ 4,235,391

9$ 470,068,579 $ 102,942,396. $ 88,001,904 $ -

10 $ 470,068,579 $ 114,402,615. $ 193,067,006 $ -

11 $ 470,068,579 $ 126,092,039 $ 98,316,037 $ :

12 $ 470,068,579 $ 138,015,252 $ 103,754,782 $ :

13 § 470,068,579 $ 150,176,928 $ 109,389,029. $ :

14 $ 470,068,579 $ 162,581,838 $ 15224982 § :

15 $ 470,068,579 $ —175,234847 $ 121,268,859 $ :

16 $ 470,068,579 $ 188,140,915. $ 127,527,098 $

17 $ 470,068,579 $ 201,305,305. $ 136,006,323 $

18 $ 470,068,579 $ 214,732,579 $ 140,713,309 §

19.$ 470,058,579 § 228,428,602 $ 107,655,189. $

20 $ 470,068,579 $ 242,398,545. $ 154,839,054 $

21$ 470,068,579 § 255,607,888 $ 162,272,366 $

22$ 470,068,579 § 271,182,217 $ 169,952,758 $

23.$ 470,068,579 § 285,007,233 $ a77sigoai $

24 $ 470,068,579 § 301,128,750 $ 186,146,412 $

25.$ 470,068,579 § 316,552,696. $ 194,656,059 $

26 $ 70,068,579 § 332,285,122 $ 203,455,567 $

27 $ 70,068,579 § 348,332,196. $ 212,853,724 $

28 $ 470,068,579 § © -364,700201 $ 221,959,571 $

28.$ 470,068,579 § 381,305,587 $ 231,682,404 $

30$ 470,068,579 § 398,024,870 $ 241,731,785 $ F

TOTAL $ 14,102,057370 § — 5,738,241,060 $ 3,796.490,782 $ 148,578,348,

Steady Growth

$500.00 00

3.000 00000

$500.00 000

*

12.345 67 8 9 s0uia23s.aasue37i8192021222824252627282020

aces OF Revenue

1 rating General Fund Revenue

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Alvarez On City 'S Living Wage Ordinance Vote: For Immediate Release Contact: February 2, 2016 Lisa Schmidt 619-210-9499Document1 pageAlvarez On City 'S Living Wage Ordinance Vote: For Immediate Release Contact: February 2, 2016 Lisa Schmidt 619-210-9499api-238538932No ratings yet

- For Immediate Release Contact: March 15, 2016 Lisa Schmidt 619-210-9499Document1 pageFor Immediate Release Contact: March 15, 2016 Lisa Schmidt 619-210-9499api-238538932No ratings yet

- Environment Committee Approves Program To Assist Ratepayers With Water BillsDocument1 pageEnvironment Committee Approves Program To Assist Ratepayers With Water Billsapi-238538932No ratings yet

- Councilmember David Alvarez District 8: News ReleaseDocument1 pageCouncilmember David Alvarez District 8: News Releaseapi-238538932No ratings yet

- Alvarez On Rebuild San Diego Ballot Measure: For Immediate Release Contact: March 8, 2016 Lisa Schmidt 619-210-9499Document1 pageAlvarez On Rebuild San Diego Ballot Measure: For Immediate Release Contact: March 8, 2016 Lisa Schmidt 619-210-9499api-238538932No ratings yet

- Alvarez On Proposed Chargers Stadium Plan: For Immediate Release Contact: March 23, 2016 Kevin Smith 619-675-4458Document1 pageAlvarez On Proposed Chargers Stadium Plan: For Immediate Release Contact: March 23, 2016 Kevin Smith 619-675-4458api-238538932No ratings yet

- Councilmember David Alvarez City of San Diego StatementDocument1 pageCouncilmember David Alvarez City of San Diego Statementapi-238538932No ratings yet

- Storm Channel Update at Environment Committee: For Immediate Release Contact: January 27, 2016 Lisa Schmidt 619-210-9499Document1 pageStorm Channel Update at Environment Committee: For Immediate Release Contact: January 27, 2016 Lisa Schmidt 619-210-9499api-238538932No ratings yet

- The Committee On The Environment of The City Council of The City of San DiegoDocument3 pagesThe Committee On The Environment of The City Council of The City of San Diegoapi-238538932No ratings yet

- Councilmember David Alvarez Statement: City of San Diego - District 8Document1 pageCouncilmember David Alvarez Statement: City of San Diego - District 8api-238538932No ratings yet

- Councilmember David Alvarez Statement: City of San Diego - District 8Document1 pageCouncilmember David Alvarez Statement: City of San Diego - District 8api-238538932No ratings yet

- Alvarez On Rebuild San Diego Proposal: For Immediate Release Contact: February 9, 2016 Lisa Schmidt 619-210-9499Document1 pageAlvarez On Rebuild San Diego Proposal: For Immediate Release Contact: February 9, 2016 Lisa Schmidt 619-210-9499api-238538932No ratings yet

- Councilmember David Alvarez District 8: News ReleaseDocument1 pageCouncilmember David Alvarez District 8: News Releaseapi-238538932No ratings yet

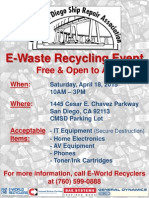

- E-Waste Recycling Event: Free & Open To AllDocument1 pageE-Waste Recycling Event: Free & Open To Allapi-238538932No ratings yet

- City of San Diego: Councilmember David Alvarez MemorandumDocument1 pageCity of San Diego: Councilmember David Alvarez Memorandumapi-238538932No ratings yet

- H S C O S T, M 31, 2015 C C D: Oliday Chedule For ITY Ffices and ErvicesDocument2 pagesH S C O S T, M 31, 2015 C C D: Oliday Chedule For ITY Ffices and Ervicesapi-238538932No ratings yet

- Councilmember David Alvarez Councilmember Todd Gloria News ReleaseDocument1 pageCouncilmember David Alvarez Councilmember Todd Gloria News Releaseapi-238538932No ratings yet

- News Release: State Route 905 Overnight ClosuresDocument1 pageNews Release: State Route 905 Overnight Closuresapi-238538932No ratings yet

- Alvarez and Community Demand A Better Budget For San DiegansDocument1 pageAlvarez and Community Demand A Better Budget For San Diegansapi-238538932No ratings yet

- The Committee On The Environment of The City Council of The City of San DiegoDocument3 pagesThe Committee On The Environment of The City Council of The City of San Diegoapi-238538932No ratings yet

- Alvarez On One Paseo Referendary Petition Vote: SAN DIEGO (May 21, 2015) - Councilmember Alvarez Has Issued TheDocument1 pageAlvarez On One Paseo Referendary Petition Vote: SAN DIEGO (May 21, 2015) - Councilmember Alvarez Has Issued Theapi-238538932No ratings yet

- C S D Councilmember Myrtle Cole, District Four Councilmember David Alvarez, District Eight Council President PRO TEM Marti Emerald, District NineDocument10 pagesC S D Councilmember Myrtle Cole, District Four Councilmember David Alvarez, District Eight Council President PRO TEM Marti Emerald, District Nineapi-238538932No ratings yet

- COMM22 Grand Opening Held Today: Councilmember David Alvarez City of San Diego News ReleaseDocument1 pageCOMM22 Grand Opening Held Today: Councilmember David Alvarez City of San Diego News Releaseapi-238538932No ratings yet

- SAN DIEGO (April 28, 2015) - Councilmember Alvarez Has Issued TheDocument1 pageSAN DIEGO (April 28, 2015) - Councilmember Alvarez Has Issued Theapi-238538932No ratings yet

- Alvarez Announces Park Launch and Renaming: News ReleaseDocument2 pagesAlvarez Announces Park Launch and Renaming: News Releaseapi-238538932No ratings yet

- SAN DIEGO (March 24, 2015) - Councilmember Alvarez Has Issued TheDocument1 pageSAN DIEGO (March 24, 2015) - Councilmember Alvarez Has Issued Theapi-238538932No ratings yet

- News Advisory: For Immediate Release Contacts: February 3, 2015 Lisa Schmidt 619-210-9499 Katie Keach 619-847-8274Document1 pageNews Advisory: For Immediate Release Contacts: February 3, 2015 Lisa Schmidt 619-210-9499 Katie Keach 619-847-8274api-238538932No ratings yet

- Bayshore Bikeway Barrio Logan Segment Community Meeting: RescheduledDocument1 pageBayshore Bikeway Barrio Logan Segment Community Meeting: Rescheduledapi-238538932No ratings yet