Professional Documents

Culture Documents

Aktuálne Otázky Ekonomickej Teórie A Praxe V Medzinárodnom Podnikaní 2012

Aktuálne Otázky Ekonomickej Teórie A Praxe V Medzinárodnom Podnikaní 2012

Uploaded by

Jaroslav RadovicCopyright:

Available Formats

You might also like

- Metodika Pisania Skolskych PracDocument48 pagesMetodika Pisania Skolskych PracjonasotamaNo ratings yet

- Pisoňová M. - Školský ManažmentDocument228 pagesPisoňová M. - Školský ManažmentMS LIPANo ratings yet

- Podniková Ekonomika 4 - ManažmentDocument37 pagesPodniková Ekonomika 4 - ManažmentVyberovaTrieda100% (1)

- Teoria A Prax HP-VincurDocument214 pagesTeoria A Prax HP-VincurSamuel MiškovičNo ratings yet

- 146 808943 Financny Management SkriptaDocument147 pages146 808943 Financny Management SkriptaMirka RenacovaNo ratings yet

- RozpočtovanieDocument9 pagesRozpočtovanieValentína TuháNo ratings yet

- SPNOS200603Document64 pagesSPNOS200603Ingvar MelgaardNo ratings yet

- Skoly ManazmentuDocument8 pagesSkoly ManazmentuwjurkasNo ratings yet

- HP KnihaDocument160 pagesHP KnihaMartin Bodnar100% (1)

- 2013 Pokyny K Ziskaniu Zapoctu A Vzor Seminarnej PraceDocument9 pages2013 Pokyny K Ziskaniu Zapoctu A Vzor Seminarnej PraceMarek LukačovičNo ratings yet

- Meranie Konkurencieschopnosti SlovenskaDocument94 pagesMeranie Konkurencieschopnosti SlovenskaMartin KulichNo ratings yet

- Gramatika A Lexika V KontexteDocument39 pagesGramatika A Lexika V KontexteAlyssa KeyNo ratings yet

- MA ManamentvteriiapraxirgDocument13 pagesMA ManamentvteriiapraxirgAdam ĎurišNo ratings yet

- Ek Podniku-Zápočet-Gabaniova-8 12Document42 pagesEk Podniku-Zápočet-Gabaniova-8 12Polina HulanNo ratings yet

- Financna Matematika Ucebne TextyDocument36 pagesFinancna Matematika Ucebne TextyVyberovaTriedaNo ratings yet

- 1 Prednaska UPPDocument35 pages1 Prednaska UPPsofiavnk100% (1)

- Financovanie PodnikuDocument4 pagesFinancovanie PodnikuKatalin MátisNo ratings yet

- KnihaDocument304 pagesKnihaMatúš RévayNo ratings yet

- Bakalárska Praca - Kamila KučíkováDocument55 pagesBakalárska Praca - Kamila KučíkováKamila KučíkováNo ratings yet

- MANAŽMENT - Poznámky FINALDocument37 pagesMANAŽMENT - Poznámky FINALOndrej ŠomodiNo ratings yet

- Podnikové Financie - PrednáškyDocument37 pagesPodnikové Financie - Prednáškymysiak2912No ratings yet

- Štandardizované DielaDocument238 pagesŠtandardizované DielaGoldenDumpling --No ratings yet

- EkonomikaDocument31 pagesEkonomikaSamuel Flajs100% (2)

- Lisý Kniha VýcucDocument34 pagesLisý Kniha VýcucKristínaNo ratings yet

- PODNIKOVÁ EKONOMIKA PREDNášKADocument11 pagesPODNIKOVÁ EKONOMIKA PREDNášKAKatalin MátisNo ratings yet

- Ing, Tomáš Dudáš, PhD.Document24 pagesIng, Tomáš Dudáš, PhD.api-25911686No ratings yet

- Finanční Trhy: Regulácia Finančných Trhov V Európe (SK)Document14 pagesFinanční Trhy: Regulácia Finančných Trhov V Európe (SK)Marcel FilipNo ratings yet

- операч (автовосстановление)Document30 pagesоперач (автовосстановление)kannoenosko100% (1)

- Marcincin Belblavy - Hospodarska PolitikaDocument376 pagesMarcincin Belblavy - Hospodarska Politikajames_bond4966No ratings yet

- Medzinarodne Organizacie A Ich OrganyDocument18 pagesMedzinarodne Organizacie A Ich OrganykristinkahuNo ratings yet

- Hospodarsko Politicke RozhodovanieDocument6 pagesHospodarsko Politicke RozhodovanieMarek ChromekNo ratings yet

- ManagementDocument53 pagesManagementSam RafixNo ratings yet

- Milan FiľoDocument7 pagesMilan FiľoprojektnskNo ratings yet

- Ukazovatele Pre Zhodnotenie Efektivity Členstva SRDocument32 pagesUkazovatele Pre Zhodnotenie Efektivity Členstva SRSlovenský zväz pre chladiacu a klimatizačnú technikuNo ratings yet

- Zbornik Z-Medzinarodnej Vedeckej Konferencie 2012Document160 pagesZbornik Z-Medzinarodnej Vedeckej Konferencie 2012петроNo ratings yet

- Finalna TOB Pozvánka NahladDocument8 pagesFinalna TOB Pozvánka NahladRadoslav PonechalNo ratings yet

- Zbornik Regionalny Rozvoj 2012 PDFDocument166 pagesZbornik Regionalny Rozvoj 2012 PDFJaroslav RadovicNo ratings yet

- ProgramDocument67 pagesProgramДмитро МусевичNo ratings yet

- Sprievodca Svetom Vedeckeho PublikovaniaDocument296 pagesSprievodca Svetom Vedeckeho Publikovaniakamila5zboNo ratings yet

- IIR Zaznam SV 08112012Document4 pagesIIR Zaznam SV 08112012Slovenský zväz pre chladiacu a klimatizačnú technikuNo ratings yet

- Stiahnuť - 2023-08-01T201359.339Document2 pagesStiahnuť - 2023-08-01T201359.339Patrik baNo ratings yet

- Doc., Ing. Vladimír Choluj PHD.: Náčrt Metodologického Prístupu K Riešeniu Záverečnej PráceDocument16 pagesDoc., Ing. Vladimír Choluj PHD.: Náčrt Metodologického Prístupu K Riešeniu Záverečnej PrácePre budúce generácieNo ratings yet

- Volebny Program B. PuskarDocument4 pagesVolebny Program B. PuskarJakub MoravcikNo ratings yet

- OSE A ZDRAVIE XIII. 2022 1. Oznam 01Document4 pagesOSE A ZDRAVIE XIII. 2022 1. Oznam 01Piotr Sylwester WojdaNo ratings yet

- 13 Ops Burdova Anna - Projektove Vyucovanie Na Hodinach Nemeckeho JazykaDocument36 pages13 Ops Burdova Anna - Projektove Vyucovanie Na Hodinach Nemeckeho JazykaPeto DancoNo ratings yet

- Správa Zo Zahraničnej Pracovnej Cesty - OsnovaDocument2 pagesSpráva Zo Zahraničnej Pracovnej Cesty - OsnovaSlovenský zväz pre chladiacu a klimatizačnú technikuNo ratings yet

- Harmonogram Úvodu Do Štúdia Pre Študentov 1. R. Bc. Štúdia 13. A 14. 9. 2022 (Utorok, Streda)Document4 pagesHarmonogram Úvodu Do Štúdia Pre Študentov 1. R. Bc. Štúdia 13. A 14. 9. 2022 (Utorok, Streda)Kateryna PeshekhonovaNo ratings yet

- Dlhodobá Vízia Rozvoja Slovenskej SpoločnostiDocument244 pagesDlhodobá Vízia Rozvoja Slovenskej SpoločnostifilosskNo ratings yet

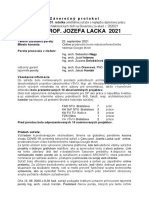

- LC 2021 Záverečný ProtokolDocument5 pagesLC 2021 Záverečný ProtokolJakub MoravcikNo ratings yet

- TEPLO 2021 Pozvanka 29092021Document7 pagesTEPLO 2021 Pozvanka 29092021Zuzana MoravčíkováNo ratings yet

- 1SJ Uvod Sylaby ZS 2021 2022Document5 pages1SJ Uvod Sylaby ZS 2021 2022София ИвановаNo ratings yet

- Sprava UEO SAV 2012Document135 pagesSprava UEO SAV 2012mrmigNo ratings yet

- Vplyv Hospodárskej Krízy Na Ekonomiku ČínyDocument106 pagesVplyv Hospodárskej Krízy Na Ekonomiku ČínyTibor ŠvardaNo ratings yet

- VPCH MazurekDocument7 pagesVPCH MazurekAKOMNo ratings yet

- TrencanskyDocument13 pagesTrencanskyTomi VicianNo ratings yet

- Študentské Dni Nitrianskych Univerzít 2022Document12 pagesŠtudentské Dni Nitrianskych Univerzít 2022Michal ŠimonekNo ratings yet

- RozvrhDocument51 pagesRozvrhPeter BuňaNo ratings yet

- Manažment V Praxi - ISO PDFDocument97 pagesManažment V Praxi - ISO PDF7netmaffiaNo ratings yet

- Pozvanka AvspDocument1 pagePozvanka Avspapi-245926832No ratings yet

Aktuálne Otázky Ekonomickej Teórie A Praxe V Medzinárodnom Podnikaní 2012

Aktuálne Otázky Ekonomickej Teórie A Praxe V Medzinárodnom Podnikaní 2012

Uploaded by

Jaroslav RadovicOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aktuálne Otázky Ekonomickej Teórie A Praxe V Medzinárodnom Podnikaní 2012

Aktuálne Otázky Ekonomickej Teórie A Praxe V Medzinárodnom Podnikaní 2012

Uploaded by

Jaroslav RadovicCopyright:

Available Formats

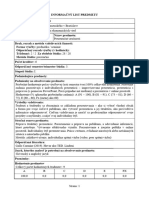

MEDZINRODN VEDECK KONFERENCIA

AKTULNE OTZKY EKONOMICKEJ TERIE A PRAXE

V MEDZINRODNOM PODNIKAN 2012

27. SEPTEMBRA 2012 V BRATISLAVE

INTERNATIONAL SCIENTIFIC CONFERENCE

CURRENT TOPICS OF ECONOMIC THEORY AND PRACTICE

IN INTERNATIONAL BUSINESS 2012

27TH SEPTEMBER 2012 IN BRATISLAVA

ZBORNK PRSPEVKOV Z MEDZINRODNEJ VEDECKEJ KONFERENCIE

THE PROCEEDINGS OF THE INTERNATIONAL SCIENTIFIC CONFERENCE

BRATISLAVA, 2012

Zostavil (editor): Hontyov, Kajetana; Sipko, Juraj (eds.)

Zbornk prspevkov z medzinrodnej vedeckej konferencie

-Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

The Proceedings of the International Scientific Conference - Current Topics of

Economic Theory and Practice in International Business 2012

Bratislava: Paneurpska vysok kola, Fakulta ekonmie a podnikania, 2012. 218 s.

ISBN 978-80-89453-02-3

Za obsahov strnku prspevkov zodpovedaj jednotliv autori.

Rukopis nepreiel jazykovou pravou.

MEDZINRODN VEDECK KONFERENCIA

AKTULNE OTZKY EKONOMICKEJ TERIE A PRAXE

V MEDZINRODNOM PODNIKAN 2012

27. SEPTEMBRA 2012 V BRATISLAVE

INTERNATIONAL SCIENTIFIC CONFERENCE

CURRENT TOPICS OF ECONOMIC THEORY AND PRACTICE

IN INTERNATIONAL BUSINESS 2012

27TH SEPTEMBER 2012 IN BRATISLAVA

ZBORNK PRSPEVKOV Z MEDZINRODNEJ VEDECKEJ KONFERENCIE

THE PROCEEDINGS OF THE INTERNATIONAL SCIENTIFIC CONFERENCE

BRATISLAVA, 2012

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Fakulta ekonmie a podnikania, Paneurpska vysok kola, Bratislava 2012

Faculty of Economics and Business, Pan European University, Bratislava 2012

Paneurpska vysok kola

Fakulta ekonmie a podnikania

organizuj

medzinrodn vedeck konferenciu

Aktulne otzky ekonomickej terie a praxe

v medzinrodnom podnikan 2012

Pan European University

Faculty of Economics and Business

organize

An International Scientific Conference

Current Topics of Economic Theory and Practice

in International Business 2012

Bratislava, 2012

4

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Medzinrodn programov vbor konferencie / International Program

Committee

prof. Stefan Bojnec, Universita Primorska, Koper, Slovinsko

prof. Ruslan Grinberg, RAV, Moskva, Rusko

prof. Kajetana Hontyov, dekanka FEP PEV, Bratislava, SR

prof. Jlius Horvth, CEU, Budapest, HU

prof. Ladislav Kabt, FEP PEV, Bratislava, SR

prof. Frantiek Ochrana, Karlova univerzita, Praha, R

prof. Alexander Rubintejn, RAV, Moskva, Rusko

prof. Jana Stvkov, Mendelova univerzita, Brno, R

Organizan vbor konferencie / Organizing Committee

doc. Juraj Sipko, FEP PEV - predseda

Ing. Jana Bednrikov

Ing. Ondrej Beu

Ing. Zuzana Godrov

Marta Heribanov

Ing. Hana Jankov

Ing. Monika Kurtov

Recenzenti / Articles reviewed by

doc. Ing. Tom Dud, PhD.

prof. Ing. Kajetana Hontyov, CSc.

doc. Ing. Milan Horniaek, CSc.

Dr.h.c. prof. Ing. Ladislav Kabt, CSc.

doc. Ing. Pavol Molnr, CSc.

prof. RNDr. Frantiek Ochrana, DrSc.

doc. Ing. Jan Pavel, PhD.

doc. Ing. Juraj Sipko, PhD., MBA

prof. RNDr. Beata Stehlkov, CSc.

prof. Ing. Eduard Urban, PhD.

doc. Ing. Leo Vtek, PhD.

doc. Ing. Mria Zbkov, CSc.

Plenrne zasadnutie / Plenary session / Invited speakers

RNDr. Frantiek Hajnovi vskumn pracovnk NBS / Researcher NBS

prof. Ing. Peter Stank, CSc. Ekonomick stav SAV / Institute of Economic Research SAS

prof. Ing. Milan ikula, DrSc.- riadite Ekonomickho stavu SAV / Director of the Institute

of Economic Research SAS

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Sekcie / Sections

Sekcia A: Ekonomick krza a podnikanie v priestore E (rokovac jazyk anglick /

slovensk)

Section A: Economic Crisis and Business in the EU Area (conference language English /

Slovak)

Vedci sekcie:

doc. Ing. Juraj Sipko, PhD. MBA

Rapporteuri:

Ing. Monika Sobekov Majkov, PhD.

doc. Ing. Tom Dud, PhD.

Sekcia B: Doktorandsk sekcia (rokovac jazyk anglick)

Section B: Doctoral Students Section (conference language English)

Vedci sekcie:

prof. Ing. Eduard Urban, PhD.

Rapporteuri:

Ing. Monika Kurtov

Ing. Jana Bednrikov

Kontakty / Contacts

e-mail: konferenciafep@uninova.sk

telefn: +421 2 682 036 16, +421 2 682 036 06

adresa:

Refert pre vedeck innos a zahranin vzahy

Ing. Zuzana Godrov

Fakulta ekonmie a podnikania

Paneurpska vysok kola

Tematnska 10

851 05 Bratislava

Miesto konania konferencie / Conference Location

Paneurpska vysok kola

Fakulta ekonmie a podnikania

Tematnska 10

851 05 Bratislava

aula a posluchrne / Aula and lecture rooms

Termn konania konferencie: 27. septembra 2012 / Conference date: 27th September 2012

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Program konferencie / Conference Program

Pan European University in Bratislava

Faculty of Economics and Business

Paneurpska vysok kola v Bratislave

Fakulta ekonmie a podnikania

Program and timing of the international scientific conference/Program a asov rozpis

medzinrodnej vedeckej konferencie

Current Topics of Economic Theory and Practice

in International Business 2012/ Aktulne otzky ekonomickej terie a praxe v

medzinrodnom podnikan 2012

September 27th 2012/ 27. september 2012

9:30 - 10:00

10:00 - 11:50

10:00 - 10:30

10:30 -11:00

11:00 - 11:20

11:20 - 11:50

Registration/ Registrcia

The plenary session/ Rokovanie v plne

Small Aula - Ground Floor/ Mal Aula - Przemie

ikula Milan

The Need of Contentual and Methodological Innovation of Economic

Science

Potreba obsahovej a metodologickej inovcie ekonomickej vedy

Stank Peter

Globalisation and its Implications

Globalizcia a jej dsledky

Coffee Break/ Prestvka

Hajnovi Frantiek

The Current Problems of Eurozone Debt Crisis: Critical Indebtedness and

Limits of its Solutions

Sasn problmy zadenia eurozny: kritick zadenie a limity jeho

rieenia

Conclusion of plenary session/ Ukonenie rokovania v plne

12:00 - 13:00

LUNCH BREAK/ OBEDAJIA PRESTVKA

13:30 - 16:20

A - Session/ Sekcia A

Ekonomick krza a podnikanie v priestore E/ Economic Crisis and

Business in the EU Area

Aula Maxima - Ground floor/ Vek Aula - przemie

Conference language English/Slovak /

Rokovac jazyk anglick/slovensk

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Chairman/ Vedci sekcie - doc. Ing. Pavol Molnr, CSc.

Rapporteur/ Reportr - Ing. Monika Sobekov Majkov, PhD.

doc. Ing. Tom Dud, PhD.

13:30-13:45

13:45-14:00

14:00-14:15

14:15-14:30

14:30-14:45

14:45-15:00

15:00 - 15:20

15:20-15:35

15:35-15:50

15:50-16:05

16:05-16:20

Bartes Frantiek

Competitive Intelligence and International Business

Competitive Intelligence a mezinrodn podnikn

Dud Tom

The Impact of the Global Economic Crisis on the Public Finances of Central

and Eastern European Countries

Vplyv globlnej hospodrskej krzy na verejn financie ttov v regine

strednej a vchodnej Eurpy

Kubtov Kvta

Changes in the Tax Mix of the Slovak Republic and the Czech Republic in

the Period of Crisis

Zmny daovho mixu Slovenska a R v obdob krize

Lakov Anna - Remiov Anna

Patterns of Effective Leadership Behaviour from the Perspective of

Managerial Ethics

Vzory efektvneho vedenia ud z perspektvy manarskej etiky

Molnr Pavol - Dolinsk Martin

Environmental Issues as a Space for the Total Impact Applications

Environmentlna problematika ako priestor pre komplexn uplatnenie novej

(navrhovanej) metriky

Pavel Jan

How does the Participation of Foreign Companies Affect the Results of

Public Contracts in the Slovak Republic?

Jak ovlivuje ast zahraninch firem vsledky veejnch zakzek na

Slovensku?

Coffee Break/ Prestvka

Sobekov Majkov Monika

The Analysis of the Access of Small and Medium Sized Enterprises to

Finance in European Union

Analza prstupu malch a strednch podnikov EU k finannm zdrojom

Vtek Leo

State Aid Measurement and Development in the Developed Countries

Men a vvoj veejn podpory podnik ve vysplch zemch

Zbkov Mria

Crisis In the Construction Industry and the Perspective of Social Housing in

Market-Oriented Economy

Krza v odvetv stavebnctva a perspektvy socilneho bvania v trhovo

orientovanej ekonomike

Stehlkov Beta

Education through the Prism of Statistics

Vzdelvanie cez prizmu tatistiky

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

13:30 - 16:05

B - Session/ Sekcia B

Doktorandsk sekcia/ Doctoral Student's Section

Room no. 4 - 1st Floor/ Posluchre . 4 - 1.poschodie

Conference language English/ Rokovac jazyk anglick

Chairman/ Vedci sekcie - prof. Ing. Eduard Urban, PhD.

Rapporteur/Reportr - Ing. Jana Bednrikov

Ing. Monika Kurtov

13:30 - 13:45

Kittler Maria Sofia

Fraud Prevention Strategy for Hospitality Management

Stratgia prevencie podvodov pre manament cestovnho ruchu

13:45 - 14:00

Bednrikov Jana

The Inter-Regional Migration Flows

Medzireginlne migran toky

Beu Ondrej

Regional Disparities and their Impact on Incomes in Slovakia

Regionlne disparity a ich dopad na regionlne prjmy na Slovensku

Cr Tom

Performance of Mutual Funds

O vkonnosti podielovch fondov

Hudkov Jarmila

The analysis of impact of European institutional provisions

Analza vplyvu eurpskych intitucionlnych opatren

Coffee Break/ Prestvka

Kurtov Monika

The Debt Crisis in Eurozone Countries and Influence to Enterprise Sector

14:00 - 14:15

14:30 - 14:45

14:45 - 15:00

15:00 - 15:20

15:20-15:35

15:35-15:50

15:50-16:05

Dlhov krza ttov eurozny a vplyv na podnikatesk sektor

Maurer Walter

Global Economy and its Influence to International Mergers and

Acquisitions Activities

Globlna ekonomika a jej vplyv na aktivity medzinrodnch zlen a

akvizci

Stupkov Angelika, Ing.

Reform of the Global Financial Architecture

Reforma svetovej finannej architektry

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Obsah / Contents

Program konferencie/ Conference Program ..........................................................................7

vodn slovo/ Editorial ..........................................................................................................12

Zvery z rokovan sekci/ Section Summary .......................................................................14

Plenrne zasadnutie/ Plenary Session ................................................................................... 17

Frantiek Hajnovi

The Current Problems of Eurozone Debt Crisis: Critical Indebtednes and Limits of its Solutions ...................... 18

Sasn problmy dlhovej krzy eurozny: kritick zadenos a limity jej rieenia

Peter Stank

The Global Crisis and Society ................................................................................................................................ 28

Globlna krza a kriminalizcia ekonomiky a spolonosti

Milan ikula

Systmov charakter globlnej krzy a potreba obsahovej a metodologickej inovcie ekonomickej vedy .......... 33

Sekcia A: Ekonomick krza a podnikanie v priestore E

Section A: Economic Crisis and Business in the EU Area

Frantiek Bartes

Competitive Intelligence and International Business............................................................................................. 45

Competitive Intelligence a mezinrodn podnikn

Tom Dud

The Impact of the Global Economic Crisis on the Public Finances of Central and Eastern European

Countries ................................................................................................................................................................ 52

Vplyv globlnej hospodrskej krzy na verejn financie ttov v regine strednej a vchodnej eurpy

Kvta Kubtov

Changes in the Tax Mix of the Slovak Republic and the Czech Republic in the Period of Crisis ......................... 59

Zmny daovho mixu Slovenska a R v obdob krize

Pavol Molnr, Martin Dolinsk

Environmental Issues as a Space for the Total Impact Applications ..................................................................... 64

Environmentlna problematika ako priestor pre komplexn uplatnenie novej (navrhovanej) metriky

Frantiek Ochrana

Impact of the Financial Crisis on Public Finances Czech Republik. Growth Risk Aversion of Investors to

Increase Interest Rates on Government Bonds ...................................................................................................... 73

Dopady finann krize na veejn finance R a na rst rizikov averze investor k nrstu rokov sazby

z vldnch dluhopis

10

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Jan Pavel

How Does the Participation of Foreign Companies Affect the Results of Public Contracts in the Slovak

Republic?........................................................................................................................................................... ....83

Jak ovlivuje ast zahraninch firem vsledky veejnch zakzek na Slovensku?

Anna Remiov, Anna Lakov

Patterns of Effective Leadership Behaviour from the Perspective of Managerial Ethics ..................................... 89

Vzory efektvneho vedenia ud z perspektvy manarskej etiky

Juraj Sipko

Why greece is a victim of the debt crisis ................................................................................................................ 99

Preo je grcko obeou dlhovej krzy

Monika Sobekov Majkov

The Analysis of the Small and Medium Sized Enterprises Access to Finance in European Union ..................... 106

Analza prstupu malch a strednch podnikov eu k finannm zdrojom

Beta Stehlkov

Education Through the Prism of Statistics............................................................................................................115

Vzdelvanie cez prizmu statistiky

Leo Vtek

State Aid Measurement and Development in the Developed Countries............................................................. 122

Men a vvoj veejn podpory podnik ve vysplch zemch

Mria Zbkov

Crisis in the Construction Industry and the Perspective of Social Housing in Market- Oriented Economy..... 131

Krza v odvetv stavebnctva a perspektvy socilneho bvania v trhovo orientovanej ekonomike

Sekcia B: Doktorandsk sekcia

Section B: Doctoral Students Section

Jana Bednrikov

The Inter- Regional Migration Flows................................................................................................................. 138

Medziregionlne migran toky

Ondrej Beu

Regional Disparities and Their Impact on Regional Incomes in Slovakia .......................................................... 145

Regionlne disparity a ich dopad na regionlne prjmy na Slovensku

Tom Cr

Performance of Mutual Funds ............................................................................................................................. 152

O vkonnosti podielovch fondov

11

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Jarmila Hudkov

The Analysis of Impact of Europe Institutional Provisions ................................................................................ 159

Analza vplyvu eurpskych intitucionlnych opatren

Hana Jankov

Hedge Funds Regulation ...................................................................................................................................... 167

Regulcia hedovch fondov

Maria Sofia Kittler

Internal control: a fraud prevention strategy........................................................................................................175

Peter Kuba

Customer Satisfaction Survey Connection with the Present European Situation in Automotive Industry...........178

Prieskum spokojnosti zkaznka v svislosti so sasnou situciou v eurpskom automobilovom priemysle

Monika Kurtov

The Debt Crisis in Eurozone Countries and Influence to Enterprise Sector.........................................................194

Dlhov krza ttov eurozny a vplyv na podnikatesk sektor

Juraj Lazov

Convergence and Divergence in Gloval Economic Development........................................................................202

Konvergencie a divergencie v svetovom ekonomickom vvoji

Walter Maurer

Global Economy And Its Influence On International Mergers And Acquisitions Activities ................................ 209

Angelika Stupkov

Reform of the Global Financial Architecture........................................................................................................213

Reforma svetovej finannej architektry

12

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Ven dmy a pni,

Ven kolegyne, kolegovia, mil tudenti a hostia,

stretvame sa na alom ronku vedeckej konferencie Fakulty ekonmie a podnikania PEV

venovanej aktulnym otzkam ekonomickej terie a praxe v medzinrodnom podnikan.

Doterajie ronky konferencie ukzali, e akademick komunita, ktor reprezentuje nau

fakultu a jej spolupracovnkov, cti nielen potrebu, ale takmer povinnos vyjadri sa

k teoretickm i praktickm problmom, ktor so sebou nesie globalizujce sa podnikatesk

prostredie.

Takmer denne sme svedkami toho, ako sa stretvaj a vzjomne speria podnikatesk

zujmy krajn, podnikateskch skupn i jednotlivcov, oficilne i neoficilne, v zmysle

pravidiel, ale aj na hrane zkona a ako a snaia sa zska pre svoje psobenia maximlny

produkne, marketingovo i finanne najvhodnej priestor. Tieto snahy v mnohch situcich

pripomnaj antagonistick hru, v ktorej vaz nemus by ten, kto ponka spoloensky

najviac oceovan efekty, ale ani ten, kto prichdza s najlepmi alternatvami vroby

a exploatcie zdrojov v najirom slova zmysle.

Snahy o hranin vyuvanie prrodnch i udskch zdrojov ved astnkov tohto boja

o podnikatesk prostredie k postupom, ktor nie s vdy konzistentn s ciemi a zmermi

strategickho, dlhodobo udratenho rozvoja spolonosti a so zujmami a oakvaniami jej

obanov.

Feti ekonomickho rastu asto prekrva jeho zkladn lohy a to zvyovanie ivotnej

rovne obyvatestva. Mme dostatok tatistickch dajov na to, aby sme dokumentovali

skutonos, e ekonomick rast, asto aj mimoriadne vrazn, nepriniesol do spolonosti to,

o sa od neho oakvalo jeho dopady na ivotn rove obyvatestva, resp. na kvalitu ich

ivota nie s vdy presvediv.

Aj preto vznikla sprva Stiglitz-Sen-Fittousi komisie, aj preto sa viacer medzinrodn

organizcie a intitcie, nevynmajc ani Eurpsku niu, ale hlavne cel rad akademickch

pracovsk venuj skmaniu dopadov ekonomickho rastu na kvalitu ivota spolonosti.

Aj preto vznikla a psob iniciatva Za lep ivot na pde OECD, aj preto sa organizuj

diskusn platformy na pde E, i v rmci OSN. Snahy o meranie dopadov ekonomickho

rastu na kvalitu ivota obyvatestva toti nie s iba akademickm zhumienkom, ale s aj

nstrojom spolonosti na usmerovanie tohto vvoja v slade so zmermi jej dlhodobho

rozvoja.

Aj preto sa astejie stretvame s odkazovanm na architektov merania vsledkov

ekonomickho rastu, osobitne na prof. Kuznetsa a na jeho varovanie, e ukazovate HDP nie

je irokospektrlne aplikovatenm nstrojom merania spenosti ekonomickho rastu

z pohadu kvality ivota a e tieto funkcie mu ani neprinleia.

Aj preto sa oraz astejie stretvame s problmami a otznikmi, ktor nastouje

medzinrodn, globalizovan podnikatesk prostredie a tvrd formy jeho trhovej sae.

Aj preto sa vak na druhej strane stretvame s odkazmi na princpy a alternatvy spoloensky

zodpovednho podnikania s poukazovanm na ich dobr vsledky v rznych krajinch sveta.

Problmy a otzniky v oblasti medzinrodnho podnikania, ktor aia Slovensko a jeho

obyvateov maj popri veobecne znmych problmoch aj svoje pecifik a preto je potrebn

im venova patrin pozornos. Legislatvna istota tohto prostredia, rovnos v prstupe

k informcim pre malch i vekch podnikateov, pre podnikateov domcich

i zahraninch by nemala unikn naej spolonej pozornosti.

Verm, e aj dnen konferencia ponka vhodn priestor na to, aby sa v tomto prostred

prezentovali nzory a podnety, ktor pomu tieto a mnoh alie problmov oblasti lepie

pochopi a sn aj pomc pri ich rieen.

13

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Ven prtomn, mil priatelia, kolegyne a kolegovia, dmy a pni, v mene vedenia Fakulty

ekonmie a podnikania a organiztorov dnenej konferencie vs vetkch, vtame na pde

naej fakulty.

Vau as si vysoko vime a akujeme, e spoluvytvrate program i histriu naej

konferencie.

Rokovaniu konferencie elme pln pracovn i spoloensk spech.

Dr.h.c. prof. Ing. Ladislav Kabt, CSc.

14

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Zvery z rokovania sekci / Section summary

Tohtoron Medzinrodn vedeck konferencia organizovan Paneurpskou vysokou

kolou, Fakultou ekonmie a podnikania bola orientovan na analzu sasnch aktulnych

otzok vvoja, pre ktor je charakteristick nerovnomern ekonomick rast vo svetovej

ekonomike spojen s prehlbujcou sa dlhovou krzou v priemyselne vyspelch ttoch, ale

tie v ttoch eurozny a neukonenou retrukturalizciou bankovho sektora hlavne

v niektorch priemyselne vyspelch ttoch, ale tie socilnymi nepokojmi v niektorch

reginoch. astnci konferencie prezentovali vsledky svojej vedecko-vskumnej innosti

od poslednej, minuloronej konferencie. Konferencia bola rozdelen na dve asti: plenrne

zasadnutie a rokovanie v sekcich.

Poas plenrneho zasadnutia referujci poukzali na cel rad novch teoretickometodologickch prstupov k sasnej ekonomickej teri ako vednej disciplne. astnci

konferencie sa vyjadrili tie kriticky alebo oponovali, e prevldali nzory v ekonomickej

terii, ktor upozorovali na mon rizik ekonomickho vvoja pred vznikom svetovej

finannej krzy. Poas plenrneho zasadnutia referujci poukzali na cel rad problmov

a monch rizk sasnho ekonomickho, socilneho a politickho vvoja, ktor s

vsledkom dlhodobo nerieench problmov a ktor viedli k sasnej finannej

a hospodrskej krze. V plne bol

komplexne zhodnoten a analyzovan jeden

z najdleitejch problmov sasnho vvoja v ttoch eurozny t.j. rieenie fiklnej

udratenosti. Na zklade kvantitatvnej analzy referujci zhodnotil vvoj rozpotovej

politiky eurozny v minulosti, poukzal na hranice vldneho zadlenia v tomto regine

a zhodnotil tie opatrenia, ktor prijala Eurpska nia na odvrtenie rozpotovch a dlhovch

problmov.

Po vystpeniach v plne pokraovali rokovania v dvoch sekcich, z toho jedna sekcia

bola pre mladch vedeckch pracovnkov - doktorandov. Vystpenie mono rozdeli na tie,

ktor mali makroekonomick charakter a vystpenia, ktor boli orientovan na medzinrodn

podnikanie. V oblasti venovanej makroekonomike sa referujci sstredili hlavne na

nepriazniv vvoj v oblasti verejnch financi a poukzali na neukonen proces

retrukturalizcie bankovho sektora a jej reformu v rmci prijatej koncepcie Basel III.

Referujci sa venovali aktulnemu vvoju v oblasti verejnch financi a jej

udratenosti. Analyzovali vplyv svetovej finannej krzy a nsledne svetovej recesie na

zhorujci sa vvoj v oblasti verejnch financi, hlavne v narastajcom verejnom dlhu.

Referujci na zkladne empirickch dajov dospeli k zverom, e s prehlbujcou sa dlhovou

krzou v ttoch eurozny mono oakva aj pokles relneho rastu HDP a to me vraznou

mierou ovplyvni aj medzinrodn podnikanie.

Niektor prspevky boli zameran aj na porovnanie daovho systmu v SR a v R

poas svetovej finannej krzy a recesie. Na zklade komplexnej analzy referujca dospela

k zveru, e sa znili daov kvty v oboch ttoch a e dolo k istmu zbleniu v rmci

dvoch skmanch ttov. V tejto oblasti boli prezentovan aj najvie rozdiely v daovom

systme medzi obidvoma ttmi, hlavne v oblasti DPH.

Pri analze verejnch zkaziek autor prspevku poukzal na fakt, e na Slovensku

v sasnosti vyhrvaj verejn zkazky zahranin subjekty iba v 3 % prpadov. Priom vo

svojej analze dospel k zveru, e as zahraninch firiem nem vplyv na poet

predloench ponk, priom zahranin firmy sa vo vej miere hlsia do verejnch sa,

o ktor maj slovensk firmy iba limitovan zujem. V oblasti poskytovania ttnej pomoci

referujci na zklade novej metodiky Eurostatu dospel k zveru, e nie je mon tvrdi, e na

verejn podporu podnikov doplcaj daov poplatnci, kee dnes nie je mon odhadn

straty/vnosy z retrukturalizcie podnikov.

15

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

V oblasti medzinrodnho podnikania astnci konferencie vzhadom na zloit

vonkajie ekonomick prostredie poukzali na vznam strategickch rozhodovan

v medzinrodnom podnikan. V tejto svislosti zdraznili vznam vasnch informcii a ich

vplyv na strategick rozhodovanie. V svislosti so svetovou finannou krzou bol

prezentovan aj sasnosti narastajci trend v realizci fzi a skupovania podnikov a firiem.

Na konferencii boli tie prezentovan vzory efektvneho vedenia ud z perspektvy

manarskej etiky. Autorka na zklade realizovanho dotaznkovho prieskumu dospela

k zveru, e pri skman kovch povahovch t ldrov z radov slovenskch tudentov

vysokch kl, tudenti v dotaznku najviac uprednostnili charizmatick tl vedenia ud,

priom hlb vskum odhalil kov vlastnosti ako zmysel pre diplomaciu, vizionrstvo,

inpiratvnos, obetavos, rozhodnos, alebo schopnos organizova.

Na konferencii bola prezentovan problematika ochrany ivotnho prostredia pre mal

a stredn podniky. Autori predstavili vlastn model aplikovaten v konkrtnom podniku.

Zverom mono kontatova, e prezentovan vsledky na medzinrodnej vedeckej

konferenci mu by cennm nmetom pre aliu vedeck a odborn diskusiu a mu tie

sli v niektorch prpadoch ako podklad pri koncipovan hospodrskej politiky

v podmienkach Slovenska.

Fakulta ekonmie a podnikania Paneurpskej vysokej koly m zmer aj naalej

pokraova v organizovan medzinrodnch vedeckch konferenci s cieom prezentcie

vsledkov vedecko-vskumnej innosti. Taktie m zujem poskytn priestor pri rieen

a analze aktulnych otzok sasnho teoretickho poznania v konfrontci s poiadavkami

hospodrskej praxe, ktor svisia so sasnm zloitm hospodrskym vvojom v oblasti

makro- a mikroekonomickej a ich vplyvu na medzinrodn podnikanie.

doc. Ing. Juraj Sipko, PhD. MBA

16

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Plenrne zasadnutie

Plenary session

17

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

SASN PROBLMY DLHOVEJ KRZY EUROZNY:

KRITICK ZADENOS A LIMITY JEJ RIEENIA

THE CURRENT PROBLEMS OF EUROZONE DEBT CRISIS: CRITICAL

INDEBTEDNESS AND LIMITS OF ITS SOLUTIONS

Frantiek Hajnovi

Abstract:

Paper is devoted to the particular problems of the current Eurozone debt crisis. First, we

explain the dynamics of the Eurozone debt and its componnets: the snow-ball effect and the

primary balance. Then, based on the empirical analysis suported by the panel estimation of

the simultaneous model, we describe and asses the budget policy of Eurozone countries.

Subsequent empirical analysis then helps us to derive limit for the Eurozone debt and

respective space for financing debt in the eurozone. Policy recomendations for strenghten

SGP are provided.

Keywords: Governemnt budget, deficit, debt, Eurozone, critical (level of) debt, Stability and

growth pact

JEL klasifikcia: H61, H63, H63

vod

Sasn dlhov krza postavila vldy eurozny a a euroznu ako celok pred vne problmy.

Je nevyhnutn, aby v procese hadania rieen a vchodsk z nej a ako predpoklad budceho

stabilnejieho vvoja nala eurozna spsob, ako v budcnosti preds situcii, ke vysok

zadlenie niektorch krajn eurozny ohrozuje nielen finann stabilitu tchto krajn, ale

stabilitu eurozny ako celku. Bude pritom nevyhnutn njs odpove na viacer otzky.

V prspevku sa budeme venova dvom z nich:

Ak boli reakcie rozpotov jednotlivch krajn eurozny (a eurozny ako celku) na

deficit a dlh? Boli tieto reakcie dostaton, aby garantovali smerovanie rozpotov

k vyrovnanmu rozpotu? Boli tieto reakcie dostaton, aby dlhy nerstli a aby dlhy

vysoko zadlench krajn smerovali pod hranicu 60% HDP?

Ako reagovali vldy eurozny na samotn zadlenie? Boli tieto reakcie dostaton,

aby ben hospodrenie primrna bilancia kompenzovala nabaovanie dlhu? Pri

akej rovni dlhu je snaha o brzdenie dlhu lepm hospodrenm rozpotu u neinn

v dsledku negatvnych inkov samotnch spor v benom hospodren rozpotu na

agregtny dopyt a ekonomick rast?

Na zver prspevku zhodnotme doterajie silie vld eurozny pri rieen sasnej dlhovej

krzy a vyjadrme sa vo veobecnej rovine tie ku krokom ECB, ktor zohrva vznamn

lohu v stabilizcii situcie, asto za cenu krokov, ktor s v stabilizovanch podmienkach

hodnoten ako menej obvykl, alebo netandardn. V plnom zvere sa vyjadrme tie

k opatreniam v oblasti fiklenj politiky, ktor maj sprsni podmienky rozpotovho

hospodrenia krajn eurozny tak, aby sa naplnili jeho ciele: nasmerova rozpoty

k vyrovanmu hospodreniu a nasmerova dlhy pod hranicu 60% HDP.

Literatra, ktor sa vyjadruje k sasnej dlhovej krze je vemi rozsiahla. Vzhadom na

limitovan rozsah tohto prspevku vak odkeme itatea na prce autora (Hajnovi, 2010)

18

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

a (Hajnovi et all., 2012), kde je mon njs ir zoznam prc, vzahujci sa k predmetu

tohoto prspevku. Charakteristiku krokov ECB potom robme najm na zklade kalendra

krzy, ktor je dostupn na strnke ECB a NBS. Vyjadrenie k opatreniam, ktor sprsuj

pravidl pre rozpotov hospodrenie vld v E a v eurozne potom opierame o veobecne

dostupn informcie o tchto krokoch na strnkach E a o vsledky hore uvedench prc

autora.

1. Vvoj dlhu v eurozne dynamika dlhu a jej zloky

Dynamika zadlenia sa riadi vzahom, ktor umouje rozloi zmeny zadlenia na zloku,

ktor sa vzahuje na rokov nklady dlhu a zloku, ktor vyjadruje vsledok benho

hospodrnia:

dt= (it gt) * dt-1 PBt - at

pb

i

g

d

a

(1)

Primrna bilancia, % nominlneho HDP

implicitn priemern rok na dlh

tempo rastu nominlneho HDP

dlh, % nominlneho HDP

Priame, jednorazov zmeny dlhu (revalucie, odpustenie dlhu,

jednorazov spltky)

Vraz (it gt) * dt-1 predstavuje upraven rokov nklad dlhu. Vyjadruje tzv. efekt snehovej

gule (snow-ball effect). Ke rok na dlh je vy ako tempo rastu (nominlneho) HDP, dlh m

tendenciu sa nabaova a na jeho stabilizciu je potrebn dosahova prebytky v benom

hospodren rozpotu (primrnej bilancii). Ke je rok ni ako tempo rastu nominlneho

HDP dochdza k tzv. vyrastaniu z dlhu a dlh je mon stabilizova aj vtedy, ke je ben

hospodrenie deficitn. Pribline plat, e vyspel ekonomiky rast (relne aj nominlne)

pomaly a preto aj pri nzkych rokovch sadzbch mlokedy z dlhu vyrastaj, skr ho

nabauj. V benom hospodren preto musia asto vytvra prebytky. Rozvjajce sa,

dobiehajce ekonomiky rast obvykle relne a nominlne rchlejie z dlhu vyrastaj

a v benom hospodren pravidla vytvraj deficit. Naprklad Slovensko rstlo pred krzou

nominlne tempami a 10-12% rone. To mu, po znen rokov, ktormi financovalo svoje

vldne dlhy, umonilo nielen rchlo vyrasta z dlhu, ale napriek deficitu v benom

hospodren zniova vldnu zadlenos.

Nasledujce grafy dokumentuj vvoj zadlenia v eurozne a zloky jeho dynamiky.

Predovetkm je zrejm, e eurozna zadlenie dlhodobo zniovala. Dialo sa tak najm pred

vznikom eurozny a nsledne v obdob konjunktry pred sasnou krzou. V obdob

cyklickho spomalenia po vzniku eurozny rove dlhu vzrstla a explodovala v obdob

hlbokej recesie poas sasnej krzy.

19

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Obr. 1 Vvoj zadlenia eurozny, 1996-2011, % HDP

Zadlenie eurozny, % HDP

88

84

80

76

72

68

64

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

Zdroj: Eurostat

Vvoj dlhu vysvetuje nasledujci graf. Z neho vyplva, e rokov nklady na financovanie

dlhu sa v uvedenom obdob prevane zniovali sved o tom zmenujca sa medzera medzi

celkovou a primrnou bilanciou hospodrenia rozpotov eurozny. Prjmy (ich podiel na

HDP) sa zniovali, priom kolsanie zodpoved benmu oakvaniu podiel sa zvyoval

v obdob konjunktry a znioval v obdob spomalenia alebo recesie. Skuton problm pre

vsledok hospodrenia predstavuj vdavky tie nie je mon okamite prispsobi

cyklickm alebo krzovm vkyvom ekonomiky a preto sa (ich podiel) v obdob spomalenia

a v recesii ich podiel na HDP vznamne zvyuje, o roztvra nonice medzi prjmami

a vdavkami a zvyuje zadlenie (podiel dlhu HDP). Prve to sa stalo v sasnej krze.

Uveden vvoj m ekonomick a socilnu logiku vdavky (ich objem) psobia ako

stabiliztor socilnej situcie a tie proticyklicky ako (automatick) stabiliztor ekonomickej

aktivity. Sasne sa tm ale destabilizuje rozpotov situcia a najm narast zadlenie.

Ekonomick politika je teda vystaven dileme stabilita ekonomiky, alebo stabilita rozpotu?

Obr. 2 Vvoj hospodrenia rozpotov eurozny, 1996-2011, % HDP.

52

51

50

49

48

-2

47

-4

46

-6

45

-8

44

-10

1996

1998

2000

2002

2004

2006

Prjmy, % HDP

Vdavky, % HDP

ist piky, % HDP

Primrna bilancia, % HDP

Zdroj: Eurostat

20

2008

2010

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Obr. 3 Zloky dynamika zadlenia eurozny

rok, Y/Y, %

Tempo rastu HDP, Y/Y, %

-2

-4

1996

1998

2000

2002

2004

2006

2008

2010

1996

1998

Nabaovanie dlhu, Y/Y, %

2000

2002

2004

2006

2008

2010

2008

2010

Primrna bilancia, %

5

2

4

3

0

2

1

-2

0

-1

-4

1996

1998

2000

2002

2004

2006

2008

2010

1996

1998

2000

2002

2004

2006

Zdroj: Eurostat

Ako sme uviedli, dynamiku dlhu je mon analyzova poda vzahu (1). Z priebehu

jednotlivch zloiek dynamiky dlhu vyplva, e implicitn rokov sadzby na vldne dlhy

v eurozne prudko klesali a v priebehu sledovanho obdobia sa znili viac ako dvojnsobne

z viac ako 7% na pribline 3,5%. A na obdobie sasnej krzy bol pomerne stabilizovan rast

nominlneho HDP 4-5%. To umonilo, aby sa, ako vyplva z prslunho grafu,

nabaovanie dlhu zniovalo z 3% HDP na nulu, ba dokonca aby eurozna z dlhu zaala

vyrasta. Bohuia, tto prleitos na zniovanie zadlenia nebola krajinami eurozny

celkom vyuit, kee potrebn prebytky primrnej bilancie sa, nielen poas krzy, nedarilo

udra.

2. Smerovali rozpoty v eurozne k plneniu Maastrichtskch kritri?

Od prepuknutia globlnej krzy na jese v roku 2008 a jej prenesenia do rozpotov a zadlenia

v niektorch krajinch eurozny uplynul relatvne krtky as. Reakcia na krzu si vyiadala

cel rad opatren a krza samotn mala na rozpoty devastujce dopady. Dnes je predasn,

vzhadom na krtke obdobie od prepuknutia krzy, hodnoti inky krzy a najm prijat

opatrenia. Je ale mon posdi reakcie rozpotov na deficity a dlhy v minulosti (do roku

2008). V citovanej prci (Hajnovi, 2012) boli tieto reakcie analyzovan pre 27 krajn E.

V predloenom prspevku budeme tieto reakcie hodnoti na zklade analzy za krajiny

eurozny (EU 161) v obdob od roku 1995 do roku 2008.

V analze sme si poloili jednoduch otzky:

Reagovali prjmy a vdavky benho roku v rozpotoch krajn eurozny na vsledky

hospodrenia (bilanciu, deficit) v minulom roku?

Reagovali prjmy a vdavky benho roku v rozpotoch krajn eurozny na rove

dlhu na konci minulho roku?

Ak alie faktory ovplyvovali prjmy a vdavky v benom roku?

1

Zahrnuli sme aj Slovensko, ktor sa lenom eurozny stalo od 1. 1. 2009, ale do eurozny smerovalo viac

rokov predtm.

21

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Ako sa d interpretova zisten reakcia rozpotov z hadiska smerovania

k vyrovnanmu rozpotu?

Ako sa d interpretova zisten rekcia rozpotov z hadiska dosiahnutia

Maastrichtskho kritria pre dlh (60% HDP)?

Ako sa daj interpretova alie analzou zisten skutonosti?

Analza sa opierala o simultnny model pre prjmy a vdavky rozpotu, ktor vysvetuje

rove prjmov (% prjmov na nominlnom HDP) a rove vdavkov (% HDP) v zvislosti

na bilancii rozpotu (% HDP) a rovni dlhu (% HDP) v predolom obdob. rove prjmov

a vdavkov v modeli je ovplyvnen ekonomickm cyklom (odchlkou skutonho relneho

HDP od potencilu, tzv. output gapom). Prjmy benho obdobia vplvaj (s pouit) na

vdavky benho obdobia a vdavky benho obdobia sa premietaj do prjmov benho

obdobia (bliie: Hajnovi, 2010).

Nasledujci Obrzok 4 schematicky dokumentuje zkladn vsledok odhadu modelu. Strune

budeme interpretova jeho zkladn prvky:

Prjmy rozpotu reaguj na zisten deficit v slade s benm oakvanm. Vy

deficit zvyuje silie vldy o zlepenie vsledku hospodrenia zvenm prjmov

prjmy sa zvia o 0,204% HDP s kadm p.b. o ktor je deficit vy ako

Maastrichtsk hranica -3% HDP1.

Podobne v slade s oakvanm, avak opane a silnejie, reaguj vdavky. Vy

deficit spsobuje, e vdavky sa v nasledujcom roku znia a to tak, e s kadm p.b.

o ktor je deficit vy ako Maastrichtsk hranica -3% HDP sa vdavky

v nasledujcom roku znia o 0,428 p.b.

Vemi slab je reakcia prjmov na dlh. rove dlhu vyia od Maastrichtskej hranice o

10 p.b., sa v nasledujcom roku prejav na prjmoch len nepatrne tie sa zvia len

o 0,1 p.b.

Vrazne silnejia je reakcia vdavkov na dlh. Tie sa v nasledujcom roku zvia o 0,9

p.b. za kadch 10 p.b. o ktor je dlh vy ako 60% HDP

Naopak, ke je deficit men ako -3% HDP, prjmy sa v nasledujcom roku zniuj.

22

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Obr. 4 Krtkodob reakcie prjmov a vdavkov rozpotu na deficit a dlh

Ae=

+0,214

(Prjmy)

%HDP

0,165

0,099

0,204

Dlh (t-1),

%HDP

0,010

-0,079

Cyklus

0,306

-0,231

(Vdavky)

%HDP

Deficit (t-1)

%HDP

-0,428

Ax= -0,747

Zdroj: Na zklade modelu, Hajnovi 2010

Vyie prjmy maj spsobia, e ete v danom roku sa zvia aj vdavky a to tak, e

zvenie prjmov o 1 p.b. spsob zvenie vdavkov o 0,306 p.b. Dvody mu by

rzne od jednoduchho vyuitia prleitosti na zvenie vdavkov, naprklad pred

vobami, a po zloitejie naprklad v prpade, ke prjmy s vyie v dsledku

vyej inflcie a vdavky alebo ich as (mzdy, dchodky...) sa valorizuj poda

inflcie.

Podobne, vyie vdavky spsobia, e ete v danom roku sa zvia aj prjmy a to tak,

e zvenie vdavkov o 1 p.b. spsob ete v danom roku zvenie prjmov rozpotu

o 0,165 p.b. Je to spsoben najm tm, e vyie vdavky sa ete v danom roku

premietnu do prjmov a spotreby v domcej ekonomike1 a do vych dan a odvodov.

Zmeny prjmov a vdavkov s spsoben aj cyklickm vvojom ekonomiky. Km

prjmy, najm z dan a odvodov, poas konjunktry zvyuj svoj podiel na HDP,

podiel vdavkov kles rast ich objemu zaostva za rastom dchodkov (HDP)

v ekonomike. Funguje tzv. automatick stabilizcia. Podiel prjmov na HDP je vy

o 0,099 p.b. ke je produkn medzera (konjunktra) vyia o 1 p.b. Naopak, podiel

vdavkov na HDP je vtedy o 0,231 p.b. ni. V konjunktre sa teda vytvra prebytok

alebo sa zmenuje deficit (o brzd dopyt a zmenuje prehrievanie) a, naopak,

v recesnej fze cyklu (vo fze spomalenia) sa deficit zvyuje, o brzd spomalenie.

Celkovo sa tak zmieruje ekonomick cyklus.

V reakcii prjmov a vdavkov sa prejavuje aj autonmny prvok. Ten je vyjadren

koeficientmi Ax a Ae, ktorch zjednoduen interpretcia je nasledovn. Bez ohadu

na deficit a dlh, ekonomick cyklus a skuton zmeny prjmov a vdavkov sa

v zmench prjmov prejavuje tendencia k ich zniovaniu (o 0,747 p.b. rone)

a v zmench vdavkov tendencia k ich zvyovaniu (o 0,214 p.b. rone). Celkovo tak

m v sebe rozpotov proces eurozny tendenciu k trukturlnemu zvyovaniu

deficitu o takmer 1 p.b. rone (0,961 p.b.)

Vyie vdavky sa v otvorenej ekonomike premietnu aj do zahraniia

23

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Schma na Obrzku 4 ilustruje bezprostredn krtkodob reakcie za euroznu ako celok.

Konsolidan reakcia rozpotu spolu na strane prjmov aj vdavkov poda uvedench

odhadov je:

na deficit:

0,632 p.b. pri deficite vyom o 1 p.b.

na dlh:

0,8 p.b. pri dlhu vyom o 10 p.b.

na cyklus:

0,33 p.b. pri konjunktre (produknej medzere) 1 p.b.

Vzhadom na vzjomn zvislos zmien rozpotu na strane prjmov a vdavkov je posdenie

dlhodobej reakcie zloitejie.1 Nebudeme sa mu na tomto mieste venova. Namiesto toho

chceme poukza na dva problmy, ktor vyplvaj z odhadov.

Uveden tendencia k trukturlnemu zniovaniu deficitu je vak, ako vyplva z odhadov,

priebene tlmen reakciou rozpotu na deficit a dlh. Tto reakcia toti ochabuje, ke je deficit

alebo dlh ni ako zodpovedajce Maastrichtsk limity. To spsobuje, e fiklne ciele,

vyten sasnmi sprsnenmi pravidla pre Pakt stability a rastu by nemuseli by pri

nezmenench reakcich rozpotu dosiahnut. Konkrtne, ak by dlh dosahoval 60% HDP (a

rozpoet by na dlh nereagoval vbec), ekonomika by bola na potencili, potom by tendencia

k trukturlnemu zniovaniu deficitu nestaila na to, aby deficit klesol pod hranicu pribline

1% HDP, lebo takto lep deficit by spsobil sasne ochabnutie konsolidanho silia

vldy (vld eurozny celkom). Na smerovanie k vyrovnanmu hospodreniu by bolo potrebn

zlepi trukturlne zlepovanie rozpotu, alebo zmeni reakciu na lep vsledok

hospodrenia ako je Maastrichtom predpsan hranica -3% HDP.

trukturlna zloka hospodrenia je pre kad krajinu v eurozne in. Tak naprklad Grcko

m hospodrenie trukturlne nastaven na rast deficitu o viac ako 6% rone2 . Napriek

brzdeniu vdavkov a napriek zvyovaniu prjmov v reakcii na deficit a na vysok dlh Grcko

nie je celkovo schopn dostatone brzdi deficit a najm dlh. Naopak, Slovensko m vaka

silnmu brzdeniu vdavkov, napriek pomerne laxnmu prstupu k prjmom (ich podiel na

HDP sa dlhodobo znioval) celkovo len nepatrne horiu autonmnu konsolidan reakciu ako

eurozna. Problm vak predstavuje skutonos, e nzka rove dlhu implicitne (poda

modelu) zmieruje snahu o zniovanie deficitu. Pokraovanie takejto rozpotovej politiky

me vak v budcnosti narazi na prli nzku rove prjmov (a vdavkov) a teda na aksi

doln hranicu pre zniovanie vdavkov.

Z odhadov reakcie rozpotov na dlh vyplva, e tto reakcia je pomerne siln. Prjmy na dlh

nereaguj v krtkom obdob takmer vbec3, vdavky vak reaguj pomerne silno. Sprsnen

Pakt predpoklad, e krajiny, ktor maj dlh vy ako 60% HDP bud zniova zadlenie

o 1/20, teda 5% z rovne, presahujcej 60%. Poda nho odhadu vak celkov reakcia na dlh

bola silnejia, predstavovala a 8% z tejto dlhovej medzery.

Jeden z problmov, ktor m uveden sprvanie reakcia na dlh a deficit spova v tom, e

v sprvan krajn nad a pod Maastrichtskmi kritriami je symetria. Asymetriu sa nm

nepodarilo potvrdi. T je ale iastone vyjadren v sprsnenom Pakte tm, e bez ohadu

na dosiahnut vsledok by mala krajina dosahova sstavn zlepovanie v hospodren

verejnch financi (o 0,5% HDP rone). Podobne by bolo treba zabezpei aj asymetriu

v dynamike dlhu tak, e okrem povinnho zniovania dlhu v krajinch s vysokm dlhom by

1

D sa ukza, e celkov dlhodob konsolidan reakcia je silnejia

Tieto poznatky umouj odhady tzv. fixnch efektov pre krajiny eurozny, ktor tu neuvdzame. Tie odliuj

(krtkodob) reakcie prjmov a vdavkov jednotlivch krajn od eurozny ako celku.

3

Prslun parameter je nielen mal, ale jeho odhad nie je ani tatisticky vznamn

2

24

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

bolo potrebn zakotvi v sprsnenom pakte aj nezvyovanie dlhu, alebo limit ni ako 60%

v krajinch s dlhom nim ako 60%. To by celkovo posilnilo oddlovanie vldnych

rozpotov eurozny.

3. M eurozna priestor na financovanie vldnych dlhov?

Sasn napt situcia pri financovan vldnych dlhov niektorch krajn eurozny printila

vldy eurozny spoji sily pri financovan vldnych dlhov tak, aby sa vysoko zadlen krajiny

vyhli pri (re)financovan dlhov vysokm, asto pekulatvnym trhovm rokovm sadzbm,

ktor by spsobili neudratene rchle nabaovanie ich dlhu. Viacer krajiny (rsko,

Portugalsko, Taliansko a najm Grcko) preto vyuili (re)financovanie dlhu za zvhodnench

netrhovch podmienok, o im umonilo spomali nabaovanie dlhu a zska as na prijatie

potrebnch opatren na zlepenie benho hospodrenia ich vldnych rozpotov. Takto

politika spolu s uvonenm menovej politiky a almi krokmi ECB predstavuje v sasnosti

nstroj na upokojenie situcie. Vyuva silu a dveru, ktor m eurozna ako celok a jej

priestor na financovanie zadlenia, tzv. fiklny priestor. Ak vek je tento priestor?

Zodpovedanie tejto otzky je mon po uren hornej hranice zadlenia, akhosi limitnho

dlhu, ktor me erpa eurozna. V prci (Ostry a i., 2010) bol navrhnut prstup, ktor

umouje takto limit uri. Jeho podstatou je nasledujca vaha:

Vldy reaguj na zadlenie tm, e vsledkom benho hospodrenia primrnou

bilanciou - kompenzuj nabaovanie dlhu, tak ako to charakterizuje vzah (1) hore. Na

to, aby dlh nerstol spravidla treba, aby sa primrna bilancia zlepovala s rastcim

dlhom.

Uveden autori predpokladali, e primrna bilancia, reakcia na dlh je nelinernou

funkciou rovne dlhu, priom tto reakcia v nejakom bode (pri uritej rovni dlhu

dosahuje svoj vrchol a nsledne slabne. To vyjadruje pozorovan skutonos, e

hospodrenie nie je mon zlepova donekonena, lebo za uritou hranicou takto

snaha spsobuje tak oslabenie dopytu v ekonomike, ktor ju spomal, alebo uvrhne

dokonca do recesie 1 . Vyjadruje to vak tie fakt, e zlepenie alebo prebytok

hospodrenia rozpotu m politick nklady a tak za uritou hranicou slabne politick

va, schopnos a zmysluplnos takhoto silia.

Za normlnych okolnost je mon oakva, e nabaovanie dlhu bude narasta

s rastcim dlhom pribline linerne. Len pri vysokch rovniach dlhu sa me sta, e

veritelia zan posudzova alie financovanie dlhu ako rizikov a nabaovanie dlhu

prudko vzrastie.

Pribline linerna iara nabaovania dlhu a konkvna krivka reakcie na dlh sa obvykle

pretn v dvoch bodoch. V prvom bode (tzv. bod udratenho zadlenia) vlda

stupuje svoju snahu nedovoli alie narastanie dlhu, km v druhom bode, naopak,

svoje silie vzdva a vysiela tak signl, e je ochotn pripusti nesplcanie dlhu.

Tento (druh) bod nazvame kritickm zadlenm, limitom pre dlh.

Rozdiel medzi aktulnym zadlenm a kritickm zadlenm nazvame fiklny

priestor. Vyjadruje (teoretick) priestor na alie financovanie vldneho dlhu.

V (Hajnovi a i., 2012) bol uveden prstup modifikovan a aplikovan na podmienky

eurozny.

Ako sme uviedli, reakcia na dlh je nedostaton, ke

1

Formlne nie je naprklad mon dosiahnu prebytok vy ako 100% HDP.

25

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

(it gt) * dt-1 > Pb,

teda, ke primrna bilancia nekompenzuje nabaovanie dlhu. Nasledujci Obrzok 5 ukazuje

situciu, ktor bola identifikovan pre euroznu.

Obr. 5 Reakcia na dlh a nabaovanie dlhu v eurozne, 1995-2008

14

12

10

8

6

4

2

0

-2

-4

0

20

40

60

80

100

120

140

160

180

Dlh, % HDP

Reakn funkcia, % HDP

Nabaovanie dlhu, % HDP

Zdroj: Odhad na zklade (Hajnovi a i., 2012)

Z vsledkov odhadu vyplva, e udraten rove dlhu pre euroznu, ako vyplva

z dlhodobej reakcie na dlh, z rokovch nkladov a z tempa rastu eurozny (odhad bol

uroben na dajoch z obdobia 1995-2008) je pribline 70% HDP. Je to viac ako

Maastrichtsk limit a sved to o tom, e reakcia a modifikovan nkladov pomery

v eurozne v minulosti (pred krzou) nezabezpeovali plnenie Maastrichtskho kritria pre

dlh. D sa vak ukza, e v uvedenom obdob rokov sadzby (a nklady) klesali a pri

zohadnen nich rokovch sadzieb na konci obdobia by sa iara nabaovania dlhu otoila

smerom nadol a udraten rove dlhu by sa dostala dokonca pod hranicu 60% (pribline

do intervalu medzi 50-55%).

Graf tie ukazuje, e v intervale od 120 do 130% HDP dochdza v reakcii na dlh k obratu

a zadlenie pribline 155% HDP predstavuje (teoretick) kritick hranicu dlhu eurozny.

Teoretick preto, lebo v skutonosti u pri priblen sa k vrcholu v reakcii veritelia

pravdepodobne zvia rizikov mare (otoia iaru nabaovania dlhu prudko smerom nahor),

o spsob, e kritick rove dlhu sa posunie vrazne smerom k nim rovniam dlhu. Tto

reakcia veriteov, niekedy prestrelen, me dokonca spsobi, e sasn reakcia na dlh

(modr krivka) nemus postaova (!) a vldy eurozny bud musie prikroi k urchlenej

konsolidcii rozpotovej situcie, k prijatiu trukturlnych opatren, ktor posun reakn

funkciu smerom nahor a vytvoria (obnovia) priestor na alie financovanie dlhu.

Sasn rove dlhu v eurozne, pribline 87% HDP, preto, napriek hypotetickmu priestoru

na financovanie neme zvdza k uspokojeniu. Identifikovan pribline 30-40%-n priestor

na rast dlhu (cca 3-4 triliny EUR), ktor vychdza z ekonomickch podmienok pred krzou

je okrem inho zneisten okolnosami, ktor nastali po prepuknut krzy:

26

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Znen vhad pre rast ekonomiky eurozny (ni rast potencilneho produktu). To

spsobuje otoenie iary nabaovania dlhu smerom nahor a sasne posun reaknej

funkcie smerom nadol.

Neistota pri rozhodovan o spolonom financovan dlhov (eurobondy, eurovaly,

financovanie ECB...). To spsobuje, e reakn funkcia sa posva smerom nadol.

Ak realisticky posudzujeme priestor na alie zadlovanie eurozny s prihliadnutm na

uveden zmeny a neistoty, dospejeme pravdepodobne k menej optimistickmu

honoteniu monost eurozny vyriei sasn krzu spolonm financovanm dlhov

eurozny. Tento priestor odhadujeme na pribline 20-25% HDP eurozny, teda

pribline 2-2,5 trilinov EUR. Vek as tohto priestoru sa u vyuila.

Zver

V prspevku sme ukzali, e dlhov problm eurozny m svoj pvod v tom, ako reagovali

rozpoty jednotlivch krajn eurozny na deficit a dlh. Na zklade identifikcie tejto reakcie

pomocou modelu kontatujeme, e sprsnen Pakt rastu a stability predstavuje sprvnu

reakciu na deficit a dlhov problmy. Sasne vak upozorujeme, e je potrebn, aby pri

obmedzovan deficitu aj dlhu Pakt zdraznil potrebu asymetrie v konsolidcii:

krajiny, ktor maj deficit vysok ho musia zniova, ale aj krajiny, ktor ho maj

ni ako 3% HDP musia smerova k vyrovnanmu rozpotu,

krajiny, ktor maj dlh vy ako je limit (60% HDP) ho musia zniova tempom

najmenej 5% z dlhovej medzery za rok. Sasne vak aj krajiny, ktor maj dlh pod

hranicou 60% musia dlh zniova, alebo ich dlh nesmie prekroi nejak hranicu

niiu ako 60% HDP.

V alej asti prspevku sme ukzali, e reakcia eurozny na dlh vytvra priestor (fiklny

priestor) na alie financovanie dlhov aj problmovch krajn v eurozne. Sasne vak

upozorujeme, e tento priestor je ohranien sasnmi krzovmi problmami, priom jeho

vekos odhadujeme na 20-25% HDP eurozny (2-2,5 trilina EUR). Znan as tohto

priestoru bola u vyuit, alebo m by vyuit na stabilizciu dlhovej situcie tzv. eurovalom

a operciami ECB.

Literatra

HAJNOVI F. (2010): Deficit and debt in the EU27 fiscal policies. Financial Stability report

for the 1st half 2010, NBS, 2010

HAJNOVI, F. a i. (2012): Konsolidan silie vldy a kritick hranica vldneho zadlenia

v E a na Slovensku. (Metda odhadu, analza a interpretcia). WP, NBS, 2012

OSTRY, J. D. et all. (2010): Fiscal space. IMF, Staff position note, Sep. 2010

OSTRY, J.D. et all. (2011) : Fiscal Fatigue, Fiscal Space and Debt Sustainability in Advanced

Economies. NBER, WP 16782, Feb. 2011

27

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

GLOBLNA KRZA A KRIMINALIZCIA EKONOMIKY

A SPOLONOSTI 1

THE GLOBAL CRISIS AND ECONOMY AND SOCIETY

Peter Stank*

V sasnosti sme konfrontovan s prlevom informci, ktor hovoria o v podstate

kriminlnom charaktere mnohch sektorov nrodnch ekonomk, ale, bohuia, ide aj

o nadnrodn problm. Formlne, z hadiska rozsahu informci, ako keby sa koncentrovali

na problmy finannho sektora:

Ide naprklad o ovplyvovanie kovch, diskontnch a rokovch sadzieb centrlnych

bnk (prpad LIBOR London Interbank Offered Rate).

Ide o obchodovanie na komoditnch trhoch, predovetkm pekulatvne obchodovanie vo

vzbe na bankov sektor a investorsk skupiny.

Je to obrovsk nrast morlneho hazardu pri poskytovan verov, nielen hypotekrnych,

ale znova aj pri veroch v podnikovej sfre.

Zisuje sa, e stle v poet bnk v skutonosti prepiera pinav drogov peniaze alebo

peniaze z kriminlnej ekonomiky, priom ide o miliardov sumy.

Ukazuje sa, e bankov sektor mnohokrt siaha ku kartelovm dohodm, ktor vytvraj

nekorektn podmienky (napr. pri verovan obyvatestva alebo podnikovej sfry), priom

tt s tichm shlasom toleruje tieto kartelov dohody. Pokia bankov sektor kupuje

ttne dlhopisy.

Musme si poloi otzku, i tento vvoj vo finannom sektore je reakciou na finann

a bankov krzu v rokoch 2008 2011, alebo je len odkrytm skutonch procesov, ktor vo

finannom a bankovom sektore existovali dvno. Dnes, ke sa ukazuje, e dochdzalo

k prave LIBOR-u dohodou medzi Anglickou centrlnou bankou a komernmi bankami,

dochdzalo nielen k navyovaniu rokovch sadzieb (napr. vo vzbe na poskytovan

hypotekrne very alebo very podnikovej sfry), ale aj k neoprvnenmu navyovaniu

verovch podmienok pre vetky subjekty v ekonomike, kee od diskontnch sadzieb

kovej centrlnej banky sa odvjaj aj diskontn sadzby a rokov podmienky ostatnch

komernch bnk. Pokia vak tieto komern banky spolupracovali s centrlnou bankou,

vznik otzka, nakoko mono relne veri bankovmu dohadu nad bankovm sektorom,

ktor vykonva centrlna banka, po druh, nakoko s korektn skuton vsledovky

v bankovom sektore. Z tohto hadiska potom otzka vykazovanch strt vzbudzuje

pochybnosti. Ak sa toti v roku 2008 pri rozbehu finannej krzy hovorilo o nutnosti

zasanova bankov sektor, pretoe jeho kolaps by mal nepredstaviten dsledky, dolo

k vraznmu erpaniu finannch prostriedkov zo ttnych rozpotov na sanovanie

bankovho sektora.

Odhaduje sa, e celkov rozsah sananch opatren v Eurpskej nii a v Spojench

ttoch americkch v rokoch 2008 a 2012 presiahol hodnotu 12,5 bil. USD. Pokia je tto

cifra sprvna, znamen to, e toto znamenalo navenie zadlenosti jednotlivch krajn, ktor

sanovali bankov sektor. Dnes, vo vzbe na dlhov krzu, vak vznik oprvnene otzka, i to

* Tento prspevok je sasou rieenia projektu VEGA . 2/0004/12 Paradigmy budcich zmien v 21. storo

(geopolitick, ekonomick a kultrne aspekty).

1

prof. Ing. Peter Stank, CSc., Ekonomick stav SAV, ancov 56, 811 05 Bratislava;

e-mail: peter.stanek@savba.sk

28

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

bol skuton rozmer potreby, a i bankov sektor prostriedky, ktor dostal na sanciu, pouil

naozaj v zmysle opatren, ktor mal realizova.

Pochybnosti vzbudzuje skutonos, e naprklad vek as americkch bnk, ale tka

sa to aj asti eurpskych bnk, ktor boli sanovan, dokzala v priebehu jednho roka vrti

poian peniaze. Bu teda objem katastrofy nebol tak rozsiahly a banky ho nadsadili, alebo

sa znova vrtili k pekulatvnym obchodom, k tm, ktor realizovali u pred krzou a na

zklade pekulatvnych obchodov boli schopn v relatvne krtkom ase vrti poian

finann prostriedky.

Otzka, ktor znie: i bolo treba sanova bankov sektor je prv relevantn. Druh

ak boli schopn v takom obrovskom rozsahu vrti poian finann zdroje v priebehu

jednho roku, ak je skuton sila finannch tokov, ktor prebiehaj cez bankov sektor.

Ukazuje sa, e prepojenos finannho bankovho sektora, komoditnch trhov, investorskch

skupn, hedovch fondov, daovch rajov je obrovsk. Svis to aj s tm, e stle viac finannch operci je uskutoovanch cez daov raje alebo oblasti so zvltnym reimom.

Ak dnes odhadujeme celkov rozsah daovch (vznamnch) rajov na vye 860,

znamen to, e nepredstavuj len oblasti, kde je jednopercentn zdanenie, ale znamenaj

oblasti, ktor vyhovuj mnohm ekonomickm subjektom z hadiska uskutoovania finannch transferov.

Dnes sme svedkami aj narastajceho rozsahu kriminlnych krokov, ktor

uskutouje aj podnikov sfra. Ide o niekoko stratgi, ktor vznamnm spsobom menia

vzah medzi podnikovou sfrou, jej domicilom a rozsahom daovch odvodov, ktor musia

tieto subjekty v materskej krajine realizova. Aj v Eurpskej nii zana doslova regata

presunu finannch a podnikovch centier do daovch rajov. Ide nielen o to, e sa presvaj

centr, naprklad z tradinej E 15, do novch lenskch ttov E, ktor maj niie

korportne dane, ale dochdza aj k presunu z tchto novch lenskch ttov E do daovch

rajov Cyprus, Maldivy, Bahamy, Belize a podobne.

V skutonosti to meme ukza na samotnej Slovenskej republike. Pred piatimi

rokmi prenieslo zdaovacie miesto a teda hedge office do daovch rajov asi 800 subjektov,

pred troma rokmi u to bolo 2 600 subjektov a minul rok (2011) u to bolo 3 800 subjektov.

Dnes (2012) je to vye 4 200 subjektov, ktor preniesli zdaovacie miesto zo Slovenskej

republiky do oblasti so zvltnym daovm reimom a tm celkovo pripravili Slovensk

republiku z hadiska vberu dan o viac ako 1,5 mld. eur. Nieo podobn sa deje aj v alch

krajinch.

Dochdza teda k obrovskmu transferovaniu v zmysle zkona, zdaovacch miest

mimo jurisdikcie materskch krajn. Vsledkom tejto situcie je potom narastajci objem

finannch tokov, ktor s realizovan do daovch rajov.

Vznik vraznejia diera v rozpotovch prjmoch a vsledkom je prehlbovanie

rozpotovho deficitu, pretoe rozsah vdavkov nie je mon redukova takm rchlym

spsobom ako narast poet subjektov, ktor unikaj do daovch rajov. Samozrejme, tento

vvoj je odlin v jednotlivch lenskch ttoch E. Avak, bada obecn trend k tomuto

smerovaniu. Ak teda doteraz, a mono poveda v 60., 70. a sasti 80. rokoch hlavnm

zdrojom prjmu nrodnch rozpotov bola da z prjmov fyzickch a prvnickch osb,

v sasnosti vznam dane z prjmov fyzickch osb stagnuje a z prjmov prvnickch osb

vrazne kles.

Preto dochdza k posilovaniu vberu dane z pridanej hodnoty a alch nepriamych

alebo majetkovch dan. Ako keby nrodn vldy rezignovali na zastavenie tohto niku

a zrove rezignovali na monos relne vymha daov prjmy od podnikateskch

subjektov. Samozrejme, nehovorme o malch a strednch podnikoch. Hovorme o kovch

gigantoch, ktor rozhodujcim spsobom ovplyvuj nrodn ekonomiku. Tu vak

upozorujeme na zsadn fenomn. Veobecne sa v ekonomickej terii v 80. a 90. rokoch

29

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

minulho storoia tvrdilo, e vek transnacionlne giganty s dinosaury, ktor vymr,

vznikn von sieov podniky a v podstate rozhodujcimi bud iba mal a stredn podniky.

V skutonosti vak vvoj prebehol plne in.

Vek transnacionlne korporcie sa sprunili vyuitm outsourcingu a offshoringu

a vraznm spsobom znili rozsah na ne viazanej zamestnanosti. Rozvinuli

subkontraktorsk systm, vraznm spsobom zvili ziskov mare a o je najdleitejie,

preniesli problm konkurencieschopnosti na subkontraktorsk systmy. Vek korporcie

nielen nezanikli, ale ich ziskov mara rone rstla o 10 12 15 %; stali sa kovmi

faktormi urujcimi spenos alebo nespenos nrodnej ekonomiky, a to sa tka aj takch

ekonomk ako je Nemecko, Franczsko, Vek Britnia a podobne. Zrove s to subjekty,

ktor sa plne vymkli akejkovek daovej kontrole. V tomto slova zmysle teda vznikla

paradoxn situcia, e kov hri, ktor uruj spenos ekonomiky, rozsah jej exportu

a zapojenia do globlnej ekonomiky, s zrove tmi, ktor zsadnm spsobom

neprispievaj k napaniu prjmov ttneho rozpotu, ale o to viacej iadaj investin

stimuly pod heslom udrania alebo tvorby pracovnch miest.

Vznik teda historick paradox, kde na jednej strane t, ktor maj napa ttny

rozpoet prevedenm kreatvneho spsobu zdaovania, odviedli prostriedky mimo nrodnej

ekonomiky, ale na druhej strane zrove od nrodnej ekonomiky poaduj investin stimuly,

prspevky na pracovn miesta, kolenie pracovnkov, a mnohokrt, a to treba poveda

otvorene, aj urit ubovu v oblasti ekologickch noriem, pracovnch predpisov a podobne.

Nrodn vldy pod tlakom tvorby alebo udrania pracovnch miest ustupuj

transnacionlnym korporcim a tieto, celkom logicky, z toho zskavaj mocensk, ale aj

ekonomick pozcie.

Zrove prieskumy, ktor naprklad uskutonila KPMG, v spoluprci s Eurostatom

a s niektormi almi intitciami, ukzali zaujmav vvoj. Rozsah podnikovej korupcie je

vo vine krajn odhadovan zhruba na dvojnsobok korupcie vo verejnom sektore. Zrove

rozsah strt z vntropodnikovej kriminality, insiderskch informci a nekorektnho

fungovania v rmci podnikov sa len za Eurpsku niu odhaduje rone v rozsahu 1,5 bil. eur.

Optovne vznik zsadn a zaujmav paradox. Eurpske podniky vo veobecnosti

vykazuj ziskov maru na rovni niekoko percent: 2 4 %. Tto ziskov mara je poda

ich vyjadrenia prli nzka na to, aby mohli zsadnm spsobom ovplyvova rast miezd, ale

zrove je aj prli nzka na to, aby sa mohli spoluzastova naprklad na financovan

kultry, vzdelvania, zdravotnctva, regionlneho rozvoja a podobne.

Zrove vieme, e plat eurpska smernica o socilnej spoluzodpovednosti

transnacionlnych firiem, ktor hovor, e transnacionlne firmy sa maj v mieste svojej

poboky spolupodiea na financovan zdravotnch, kolskch a kultrnych systmov a

podobne. Ale tie ist firmy vytvraj situciu, v ktorej oficilne vykzan zisk sa pohybuje na

rovni niekokch percent. Vznik teda otzka, i im nevad rozsah vntropodnikovej

kriminality, pretoe nejde o kriminalitu optovne v malch a strednch firmch ale ide

predovetkm o korupn a insidersk informcie vo vekch transnacionlnych firmch.

V takomto prpade nielene neprispievaj do daovch systmov, ale zsadnm spsobom

rozvracaj podnikatesk prostredie a o je najhorie, v podstate pouvaj tolerovanie

nekorektnch finannch transferov k tomu, e vlastne ich ziskov mara neumouje

napa eurpske smernice OECD o socilnej spoluzodpovednosti vekch firiem.

Eurpska nia prijma urit opatrenia (napr. v energetike je to unbundling), ktor

maj obmedzi moc vekch nrodnch alebo nadnrodnch hrov. V skutonosti tto hri

doku perfektne obs vetky dopady, ktor vyplvaj naprklad z unbundlingu a naopak,

liberalizcia energotrhu vystila do ete vej koncentrcie. Pokia dochdza k takmu

vekmu rozsahu vntropodnikovej kriminality a vedenia podnikov sa s tm vysporadvaj

vemi mierne, vznik teda zsadn otzka, komu nzka miera ziskovosti vyhovuje.

30

Aktulne otzky ekonomickej terie a praxe v medzinrodnom podnikan 2012

Current Topics of Economic Theory and Practice in International Business 2012

Na jednej strane s to akcionri, ktor poaduj dividendy a na druhej strane je to

pikov manament, ktor tieto dividendy akcionrom zabezpe. Akcionri sa neptaj,

akm spsobom sa zskaj zdroje, z ktorch s vyplaten dividendy, i naprklad vznikli tm,

e pikov manament obchodoval s majetkom podniku a as z tchto ziskov transferoval

do dividend, akcionri sa neptaj na zodpovednos systmu vrcholovch manamentov.

A pokia dochdza k situcii, ktor je naprklad dnes odhaovan vo finannom

sektore, znamen to, e pikov manari, pokia zabezpeia akcionrom dividendy, mu

dlhodobo uskutoova nekorektn finann transfery a opercie naprklad aj po dohode s

centrlnou bankou. V takomto prpade sa lovek neubrni dojmu, e finann sektor sm

generuje kov rizikov faktory, ktor sa skr i neskr spravidla prejavia v globlnej krze.

Podnikov sektor, ktor by mal sm stri svoje vntorn know-how, svoju ziskov

maru, svoje financie, takisto toleruje urit mieru nekorektnho jednania. Zoberme, e 1,5

bil. eur pri celkovom rozsahu HDP eurozny, na rovni zhruba 7,5 bil. znamen obrovsk

rozsah strt. Problm je nielen v tom, e podniky vyku tento rozsah strt, ale na zklade

nzkej mare a rozsahu strt argumentuj, e nemu zvyova mzdy, e sa nemu

spolupodiea na alch aktivitch ako je financovanie vskumu a podobne. To nech riei

tt. A takto vznik zsadn diskrepancia a je jedno, i hovorme o stave ttneho rozpotu

alebo o stave rozpotu verejnho sektora. Tie subjekty, ktor by mali napa prjmov

strnku, podnikaj vetky dostupn opercie na hrane zkona s tm, aby do ttneho rozpotu

neprispievali. T, ktor maj najmenie prjmy, musia do ttneho rozpotu prispieva najviac,

a to bu priamo (odvodom z prjmov fyzickch osb) alebo nepriamo (cez vvoj dane

z pridanej hodnoty, spotrebnch dan a pod.).

Je pritom paradoxn, e vlastne transfer z korportnych dan na nepriame dane (ako s

dane z pridanej hodnoty, spotrebn dane a pod.) mal by argumentom pre tzv. spravodliv

zdaovanie spotreby teda kto vea spotrebva nech plat vysok da. V skutonosti vak

dochdza, paradoxne, k inej situcii, pretoe miera spotreby je diferencovan, a o je vemi

dleit, spolonos zaloen na spotrebe me generova prjmy ttneho rozpotu

vyplvajce zo zdaovania spotreby. Avak, pokia tto spotreba sa realizuje mimo teritria

materskej krajiny, o v prpade transnacionlov je viac ako je obvykl, dochdza

k paradoxnmu javu, e spotreba neprispieva k napaniu ttneho rozpotu, hoci zavedenie

nepriamych dan bolo motivovan prve istotou zdanenia spotreby.

Spotreba obyvatestva je stle viac limitovan stagnciou miezd. Dnes sa sce hovor,

e stagncia miezd je produktom krzy a etrenia v podnikovej sfre, avak vznik paradoxn

otzka: ak etria na pracovnkoch, preo neetria a neeliminuj vntropodnikov

kriminalitu.1Kde tieto finann zdroje mizn, pokia ziskov mara je na rovni 2,5 3 %?

Ako to, e sa dostvaj mimo dohadu nrodnch daovch a poisovacch systmov?

V takomto prpade to potom znamen, e vvoj ziskovosti v podnikovej sfre nem iadnu

relevantn vzbu na vvoj prjmov ttneho rozpotu. Ak vvoj prjmov m zvisie od dane

z pridanej hodnoty a od spotrebnch dan, vek as podvodov v oblasti dan sa odohrva

prve u dane z pridanej hodnoty (neoprvnen vrtky a pod.).

Avak tu vznik aj al vntorn paradox. tt m 30 a 60 dn na vrtenie