Professional Documents

Culture Documents

CP Listing 12312015

CP Listing 12312015

Uploaded by

Shawn Michael DoluntapOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CP Listing 12312015

CP Listing 12312015

Uploaded by

Shawn Michael DoluntapCopyright:

Available Formats

Page 1 of 3

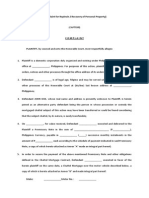

PhilRatings

CREDIT RATED COMMERCIAL PAPER LINES / BONDS/COMPANIES*

Amounts in millions.

As of December 31, 2015

http://www.philratings.com

PRS

ISSUE

AMOUNT

ISSUER/ISSUE

RATING

SEC

APPROVAL

8,000.00

Aaa

Nov-13

25,000.00

Aaa

SEC ORDER NO.

TRANCHE/SERIES

ABOITIZ EQUITY VENTURES, INC.

Corporate Bonds

Due 2020

6,200.00

Due 2023

1,800.00

ABOITIZ EQUITY VENTURES, INC.

Corporate Bonds due in 5-, 7- an 12 years

Bonds due 2020

10,462.00

Aug-15

Bonds due 2022

8,467.00

Aug-15

Bonds due 2027

5,071.00

Aug-15

ABOITIZ POWER CORPORATION

Fixed Rate Bond

10,000.00

Aaa

Series A due 2021

6,600.00

Sep-14

Series A

Series B due 2026

3,400.00

Sep-14

Series B

ABS-CBN CORPORATION

Fixed Rate Bonds due on 2021

6,000.00

ASIA UNITED BANK

AYALA CORPORATION

Issuer Credit Rating

Aaa

Feb-14

Aa (corp.)

Not Applicable

Mar-10

Fixed Rate Putable Bonds due 2017

Multiple Put Bonds due 20211

10,000.00

Aaa

10,000.00

Aaa

Apr-11

Fixed Rate Bonds due 20272

10,000.00

Aaa

Mar-12

Fixed Rate Bonds due 20193

10,000.00

Aaa

Oct-12

15,000.00

Aaa

Not Applicable

AYALA LAND, INC.

Fixed Rate Callable bonds due in 10 & 7 yrs

Due in 2019

9,350.00

Due in 2022

5,650.00

Bonds

Apr-12

Apr-12

21,000.00

Aaa

Due 2024

15,000.00

Jul-13

Due 2020

4,000.00

Oct-13

Due 2033

2,000.00

Bonds due 2025

Oct-13

8,000.00

Aaa

Apr-14

BDO LEASING AND FINANCE, INC.

(formerly PCI Leasing and Finance Corp.)

Short-Term Commercial Paper due Sept. 2015

10,000.00

Dec-15

Short-Term Commercial Paper due Dec. 2015

15,000.00

Dec-15

CEBU HOLDINGS, INC.

Maiden Bonds due 2021

5,000.00

EAST WEST BANKING CORP.

ENERGY DEVELOPMENT CORPORATION

Issuer Credit Rating

Bonds due in 7 and 10 years

Due May 2020

Due May 2023

7,000.00

P

May-14

Not Applicable

Aaa

3,000.00

May-13

4,000.00

Bonds due in 7 years

Due December 4, 2016

Aaa

Aa plus (corp.)

May-13

3,500.00

Aaa

3,500.00

Dec-09

FILINVEST DEVELOPMENT CORPORATION

Bonds due in 10 years

10,000.00

Aaa

Dec-13

Fixed Rate Bonds due 2016

3,000.00

Aaa

Jul-11

Fixed Rate Bonds due 2019

7,000.00

Aaa

Jun-12

7,000.00

Aaa

FILINVEST LAND, INC.

Bonds

due 2020

4,300.00

due 2023

2,700.00

Bonds

Nov-13

Nov-13

7,000.00

Aaa

due 2021

5,300.00

Dec-14

due 2024

1,700.00

Dec-14

* No liability can be accepted for any loss incurred in any way whatsoever by any person relying solely on the information contained herein. PhilRatings makes no representation as to the accuracy and completeness of said data.

Not Applicable

Page 2 of 3

PhilRatings

CREDIT RATED COMMERCIAL PAPER LINES / BONDS/COMPANIES*

Amounts in millions.

As of December 31, 2015

http://www.philratings.com

PRS

ISSUE

AMOUNT

ISSUER/ISSUE

FILINVEST LAND, INC.

8,000.00

RATING

SEC

APPROVAL

SEC ORDER NO.

TRANCHE/SERIES

Aaa

Seven-Year Bonds due 2021

Ten-Year Bonds due 2024

GT CAPITAL HOLDINGS, INC

Bonds

7-year term bonds due 2020

10,000.00

P

10-year term bonds due 2023

Aaa

3,900.00

Feb-13

6,100.00

Fixed Rate Bonds

Feb-13

12,000.00

Aaa

Due 2019

3,000.00

Aug-14

Due 2021

5,000.00

Aug-14

Due 2024

4,000.00

Aug-14

GLOBE TELECOM, INC.

Fixed Rate Bonds due in 2017 and 2019

10,000.00

Due 2017

4,500.00

Due 2019

5,500.00

Fixed Rate Bonds

Aaa

Jun-12

Jun-12

7,000.00

Aaa

Due 2020

4,000.00

Jul-13

Due 2023

3,000.00

Jul-13

HOME FUNDING, INC.

HGC Guaranteed Receivables-Backed Certificate

500.00

Baa plus

Not Applicable

Not Applicable

JG SUMMIT HOLDINGS, INC.

Bonds due in 5.5-, 7- and 10-years

30,000.00

Aaa

Due 2019

24,511.00

Feb-14

Due 2021

5,313.00

Feb-14

Due 2024

176.00

LGU GUARANTEE CORPORATION

MRT III Funding Corporation

Feb-14

Issuer Credit Rating

Aa plus (corp.)

Notes6

Not Applicable

due 2025

US$ 1,197.55

MANILA NORTH TOLLWAYS CORPORATION

A plus

Issuer Credit Rating

Fixed-Rate Bonds

Bonds due 2021

56,356.70

Aaa (corp.)

7,000.00

P

Bonds due 2024

4,400.00

11,500.00

Fixed Rate Putable bonds due 2025

7,000.00

NATIONAL HOME MORTGAGE FINANCE CORP.

Not Applicable

Mar-14

Mar-14

18,500.00

Fixed Rate Putable bonds due 2020

Not Applicable

Aaa

2,600.00

MANILA ELECTRIC COMPANY

Pass-through Tranche 3

Aaa

Dec-13

Dec-13

1,082.00

Not Applicable

Not Applicable

Not Applicable

Not Applicable

Residential Mortgage Backed Securities (Bahay Bonds 1)

8.8 years Scheduled Amortization

Class A

Class B

Residential Mortgage Backed Securities (Bahay Bonds 2)

771.375

Aa

310.898

Baa

603.74

Class A

300.00

Class B

120.00

Aa

Class C

183.74

Baa

PHOENIX PETROLEUM PHILIPPINES, INC.

PHOENIX PETROLEUM PHILIPPINES, INC.

Aa

Issuer Credit Rating

Aa minus (corp.)

Short-term Commercial Paper due Oct. 13, 2015

2,000.00

2 minus

Oct-14

Short-term Commercial Paper due Oct. 13, 2015

1,500.00

2 minus

Feb-15

Aaa(corp.)

Not Applicable

PHILIPPINE SAVINGS BANK

ROBINSONS LAND CORPORATION

Issuer Credit Rating

12,000.00

Aaa

Fixed Rate Bonds due 2022

10,635.00

Feb-15

Fixed Rate Bonds due 2025

1,365.00

Feb-15

* No liability can be accepted for any loss incurred in any way whatsoever by any person relying solely on the information contained herein. PhilRatings makes no representation as to the accuracy and completeness of said data.

Not Applicable

Page 3 of 3

PhilRatings

CREDIT RATED COMMERCIAL PAPER LINES / BONDS/COMPANIES*

Amounts in millions.

As of December 31, 2015

http://www.philratings.com

ISSUE

AMOUNT

ISSUER/ISSUE

PRS

RATING

SEC

APPROVAL

SEC ORDER NO.

TRANCHE/SERIES

SAN MIGUEL BREWERY INC.

Corporate Bonds

2,810.00

Aaa

20,000.00

Aaa

Series C due April 2019

Nov-09

Series C

3,000.00

Apr-12

Series D

10,000.00

7,000.00

Apr-12

Apr-12

Series E

Series F

Corporate Bonds

Series D due 2017

Series E due 2019

Series F due 2022

Corporate Bonds

Series G due 2021

Series H due 2024

12,462.00

2,538.00

15,000.00

Aaa

15,000.00

Aaa

Series G

Series H

SAN MIGUEL BREWERY INC.

Corporate Bonds

Series G due 2021

Series H due 2024

12,462.00

2,538.00

SL AGRITECH CORPORATION

SMALL BUSINESS CORPORATION

SM INVESTMENTS CORPORATION

Bonds

Series B due 2016

Series C due 2019

Series D due 2022

Bonds

Series E due May 2021

Series F due May 2024

Issuer Credit Rating

Issuer Credit Rating

16,000.00

Aa (corp.)

Aa minus(corp.)

Apr-14

Apr-14

Not Applicable

Not Applicable

Series G

Series H

Not Applicable

Not Applicable

May-09

Apr-12

Apr-12

Apr-14

May-14

May-14

Series B

Series C

Series D

Sep-14

Sep-14

Sep-14

Series A

Series B

Series C

May-15

May-15

May-15

Series A

Series B

Series C

Aaa

1,000.00

6,000.00

9,000.00

15,000.00

Aaa

11,669.62

3,330.38

Series E

Series F

SM PRIME HOLDINGS, INC.

Bond Issue7

20,000.00

Series A due 2020

Series B due 2021

Series C due 2024

Aaa

15,036.00

2,363.00

2,601.00

SOUTH LUZON TOLLWAY CORPORATION

Fixed Rate Bonds

Series A due 2020

Series B due 2022

Series C due 2025

7,300.00

Aaa

2,400.00

2,400.00

2,500.00

UNION BANK OF THE PHILIPPINES

TOTAL

Issuer Credit Rating

Php

Aaa (corp.)

495,152.44

The 10-year bond issue will have a partial put option (up to 20%) on the fifth year and full put option on the eighth year from issue date.

The 15-year bond issue will be redeemable (in full but not in parts) by the Issuer via call option starting on the tenth (10th) anniversary from issue date and

The seven-year bond issue will be redeemable (in full but not in parts) by the Issuer via call options starting on the fourth (4th) anniversary from issue date

P8.0 Billion Fixed Rate Callable bonds, with an oversubscription option of P7.0 Billion, fixed for 11 years; total amount rated was P15.0 Billion.

Equivalent of P56,356.70 at a rate of P47.06:US$1 (as of December 29, 2015)

every anniversary date thereafter until the fourteenth (14th) anniversary from issue date.

and every anniversary date thereafter unth the sixth (6th) anniversary from issue date.

Debt issue is up to P15Bn, with an oversubscription option of up to P5.0 Billion. The rating was for a total amount of up to P20 billion in

fixed putable bonds, with amounts falling due in 2020 and 2025. The put option may be exercised on the fifth year for the bonds due in 2020

and in the tenth year fir the bonds due in 2025.

Bond issue is P15 Billion, with an oversubscription of up to P10.0 Billion.

* No liability can be accepted for any loss incurred in any way whatsoever by any person relying solely on the information contained herein. PhilRatings makes no representation as to the accuracy and completeness of said data.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Complaint For ReplevinDocument6 pagesComplaint For ReplevinYul Torrefranca Mesa100% (3)

- Terminal ReportDocument7 pagesTerminal ReportShawn Michael DoluntapNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1.importing and Exporting Transaction OKDocument2 pages1.importing and Exporting Transaction OKShawn Michael DoluntapNo ratings yet

- KODALINEDocument12 pagesKODALINEShawn Michael DoluntapNo ratings yet

- P2 102012 01 Installment SalesDocument4 pagesP2 102012 01 Installment SalesShawn Michael DoluntapNo ratings yet

- Law ProjectDocument4 pagesLaw ProjectShawn Michael DoluntapNo ratings yet

- ListDocument2 pagesListShawn Michael DoluntapNo ratings yet

- Schedule 2nd Sem - 4th YearDocument2 pagesSchedule 2nd Sem - 4th YearShawn Michael DoluntapNo ratings yet

- Explain The Concepts of Strategic Intent, Stretch, Leverage, and FitDocument12 pagesExplain The Concepts of Strategic Intent, Stretch, Leverage, and FitShawn Michael DoluntapNo ratings yet

- Capacity Manageme NT: Prepared byDocument23 pagesCapacity Manageme NT: Prepared byShawn Michael DoluntapNo ratings yet

- Fischer - Pship LiquiDocument7 pagesFischer - Pship LiquiShawn Michael DoluntapNo ratings yet

- Chapter 7 Facility LayoutDocument34 pagesChapter 7 Facility LayoutShawn Michael Doluntap100% (1)

- Em BM Am BM CMDocument2 pagesEm BM Am BM CMShawn Michael DoluntapNo ratings yet

- Issues in Understanding CultureDocument26 pagesIssues in Understanding CultureShawn Michael Doluntap100% (11)

- Dubstep SongsDocument2 pagesDubstep SongsShawn Michael DoluntapNo ratings yet

- Jose Rizal in LondonDocument4 pagesJose Rizal in LondonShawn Michael Doluntap60% (5)

- Government and Law: Trixie C. PepitoDocument37 pagesGovernment and Law: Trixie C. PepitoShawn Michael DoluntapNo ratings yet

- HistoryDocument84 pagesHistoryShawn Michael DoluntapNo ratings yet

- NBFC Vs BankDocument5 pagesNBFC Vs Bankmukeshkrishna100% (1)

- Synopsis of Law On PledgeDocument3 pagesSynopsis of Law On PledgeBrian JavierNo ratings yet

- Credit Risk Management For EXIM Bank FinalDocument69 pagesCredit Risk Management For EXIM Bank Finalkhansha ComputersNo ratings yet

- Training ReportDocument73 pagesTraining ReportchameerarandilNo ratings yet

- Last Six Months Current AffairsDocument325 pagesLast Six Months Current AffairsjenisysNo ratings yet

- Chapter 9 Classes and Kinds of CreditDocument15 pagesChapter 9 Classes and Kinds of CreditJonavel Torres MacionNo ratings yet

- Chapter 01-The Business of Banking: Name: Clas S: DateDocument12 pagesChapter 01-The Business of Banking: Name: Clas S: DateLê Đặng Minh ThảoNo ratings yet

- Banks Can Not Lend CreditDocument4 pagesBanks Can Not Lend CreditChristian Comunity100% (1)

- MSE WRSX Group Profile v2 01Document32 pagesMSE WRSX Group Profile v2 01MirnesNo ratings yet

- 5.capital Investment DecisionsDocument2 pages5.capital Investment DecisionsgiselekouassimaNo ratings yet

- Key Facts Statement 4803717Document4 pagesKey Facts Statement 4803717arbazalikhan22334455No ratings yet

- Civ 2 April-OctDocument67 pagesCiv 2 April-OctJunjun AlvarNo ratings yet

- 08-Capital Gain - TY 2019Document19 pages08-Capital Gain - TY 2019jafferyasim100% (1)

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Schiff's Insurance Observer IndexDocument103 pagesSchiff's Insurance Observer IndexExcessCapitalNo ratings yet

- Portic Vs CristobalDocument3 pagesPortic Vs CristobalDeniel Salvador B. MorilloNo ratings yet

- ' 19285537 Mr. Sai Krithik V.: ICICI Pru Savings Suraksha-LPDocument2 pages' 19285537 Mr. Sai Krithik V.: ICICI Pru Savings Suraksha-LPvinothmcakmdNo ratings yet

- Financial Statements From Financial Statements From The Accounting EquationDocument34 pagesFinancial Statements From Financial Statements From The Accounting Equationoussama elNo ratings yet

- Executive Excess 2012 CEO Hands in Uncle Sams PocketDocument50 pagesExecutive Excess 2012 CEO Hands in Uncle Sams PocketPaul GoldsteinNo ratings yet

- Times Leader 07-14-2011Document42 pagesTimes Leader 07-14-2011The Times LeaderNo ratings yet

- CarMax Lending PlatformDocument12 pagesCarMax Lending PlatformEnakshi ManoharNo ratings yet

- Nexus Issue 19-12 Feb. 18/09Document20 pagesNexus Issue 19-12 Feb. 18/09nexusnewspaper100% (5)

- Mishkin 6ce TB Ch14Document28 pagesMishkin 6ce TB Ch14JaeDukAndrewSeoNo ratings yet

- Receivable FinancingDocument5 pagesReceivable FinancingAphol Joyce MortelNo ratings yet

- Personal Property LeaseDocument4 pagesPersonal Property LeaseRocketLawyerNo ratings yet

- Get PDF For Bill ViewDocument4 pagesGet PDF For Bill ViewKrishna8765No ratings yet

- Assignment (Pre-Answers) PDFDocument63 pagesAssignment (Pre-Answers) PDFRussell KeyesNo ratings yet

- FM Ebook - Part 2-Financial ModellingDocument36 pagesFM Ebook - Part 2-Financial ModellingtejaasNo ratings yet