Professional Documents

Culture Documents

Balance Sheet

Balance Sheet

Uploaded by

Jhon Salvatierra TOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet

Balance Sheet

Uploaded by

Jhon Salvatierra TCopyright:

Available Formats

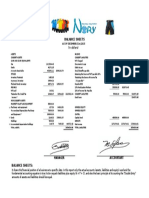

BALANCE SHEET

TO DECEMBER 31st, 2015

(In dollars)

ASSETS

PASSIVE

CURRENT ASSETS

CURRENT LIABILITIES

CASH AND CASH EQUIVALENTS

Cash

Banks

Accounts Receivable

VAT charged

1617204,43

Document payable

41371,25

431591,11

Debts payable

2090166,79

Social benefits payable

STOCKS

VAT income tax payable 30%

Inventory Materials

In-process inventory

1453,85

34784,36

Finished Goods Inventory

68971,76

Income Tax payable 1%

payable 1%

105209,97

PRE-PAID

VAT paid

Loan Tax witholding

103,81

18440,47

219863,05

194,80

1790,00

905,12

24,18

6,72

1105,23

IESS payable

287573,30

Employees profit sharing 15%

358508,05

869970,45

55000,00

55000,00

458590,00

458590,00

Income Tax payable 22%

18544,28

2213921,04

CURRENT LIABILITIES

Bank loans

924970,45

924970,45

NON-CURRENT ASSETS

PROPERTY FACILITIES AND EQUIPMENT

(-) Machinery and equipment

Machinery and Accumulated

and Equipment

(-) Land

Buildings

(-)

Building and Accumulated depreciation

85000,00

637,50

70000,00

84362,50

70000,00

OWNERS EQUITY

OWNERS EQUITY

CAPITAL

280000,00

1108,33

278891,67

Capital stock

7600,00

140,75

BALANCE

7459,25

TOTAL ASSETS.

MANAGER

440713,42

2654634,46

Net Income

1271074,01 1271074,01

TOTAL LIABILITIES

ACCOUNTANT

1729664,01

2654634,46

BALANCE SHEETS:

It shows the financial position of a business at a specific date. In this report only the actual

accounts (assets, liabilities and equity) used and the fundamental accounting equation is

You might also like

- SUADocument5 pagesSUABusi LutaNo ratings yet

- CA Excel .Problem - Set A.BDocument65 pagesCA Excel .Problem - Set A.BStephen McSweeneyNo ratings yet

- FRA AssignmentDocument18 pagesFRA AssignmentPratik GaokarNo ratings yet

- MCB Financial AnalysisDocument28 pagesMCB Financial AnalysisSana KazmiNo ratings yet

- Only Gym's FinanceDocument21 pagesOnly Gym's FinanceJigar PatelNo ratings yet

- Income Statements 2010Document10 pagesIncome Statements 2010Shivam GoelNo ratings yet

- 1balance SheetDocument1 page1balance SheetJhon Salvatierra TNo ratings yet

- Balance SheetsDocument1 pageBalance SheetsJhon Salvatierra TNo ratings yet

- P S M C L .: AK Uzuki Otor Ompany TDDocument5 pagesP S M C L .: AK Uzuki Otor Ompany TDAhmed SiddiquiNo ratings yet

- BS PL Dalmia ShreeDocument4 pagesBS PL Dalmia ShreeAbhishek RawatNo ratings yet

- Kristel Anne Roquero BalisiDocument4 pagesKristel Anne Roquero BalisiKristel Anne Roquero BalisiNo ratings yet

- Balance Sheet (2008) Activa A. Fixed AssetsDocument8 pagesBalance Sheet (2008) Activa A. Fixed AssetsNilay SahaNo ratings yet

- Financial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Document11 pagesFinancial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Sakhamuri Ram'sNo ratings yet

- Total Application of Funds Fixed Assets Fixed AssetsDocument14 pagesTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial - CocaColaDocument45 pagesFinancial - CocaColadung nguyenNo ratings yet

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezNo ratings yet

- TB 2 Dan TB 1Document6 pagesTB 2 Dan TB 1Andita Arum CintyawatiNo ratings yet

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Chapter 23 - Worksheet and SolutionsDocument21 pagesChapter 23 - Worksheet and Solutionsangelbear2577No ratings yet

- Balance Sheet: Aquiles Esquivel Madrazo, IncorporatedDocument1 pageBalance Sheet: Aquiles Esquivel Madrazo, IncorporatedAdriNo ratings yet

- Profit & Loss A/c Expenses IncomeDocument6 pagesProfit & Loss A/c Expenses IncomearavicampNo ratings yet

- PFA Vegetron CaseDocument14 pagesPFA Vegetron CaseKumKum BhattacharjeeNo ratings yet

- ITC Consolidated FinancialsStatement 2015 PDFDocument53 pagesITC Consolidated FinancialsStatement 2015 PDFAbhishek DuttaNo ratings yet

- Financial Reporting & Analysis Mock Test For Mid Term ExaminationDocument6 pagesFinancial Reporting & Analysis Mock Test For Mid Term ExaminationTanuj AroraNo ratings yet

- Macys 2011 10kDocument39 pagesMacys 2011 10kapb5223No ratings yet

- Kashato Shirts - SolutionsDocument18 pagesKashato Shirts - SolutionsAldrian Ala75% (4)

- Toy World CaseDocument9 pagesToy World Casesaurabhsaurs100% (1)

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Jabil Circuit Vertical Analysis (6050)Document12 pagesJabil Circuit Vertical Analysis (6050)Roy OmabuwaNo ratings yet

- Assignment OF Managerial Accounting ONDocument7 pagesAssignment OF Managerial Accounting ONRohitPatialNo ratings yet

- Jaibb Accounting Solution Final Acc and Journal EntriesDocument17 pagesJaibb Accounting Solution Final Acc and Journal EntriesAriful Haque Sajib0% (1)

- Picasso Company Profit and Loss Account AS AT DEC 31, 2013Document3 pagesPicasso Company Profit and Loss Account AS AT DEC 31, 2013Arsalan NadeemNo ratings yet

- 3income Statements Profit Loss SDocument2 pages3income Statements Profit Loss SJhon Salvatierra TNo ratings yet

- Production Account: Value Added, Net / Net Domestic Product External Balance of Goods and ServicesDocument18 pagesProduction Account: Value Added, Net / Net Domestic Product External Balance of Goods and ServicesGuilherme de Castro AbrasNo ratings yet

- 201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFDocument7 pages201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFOmer PashaNo ratings yet

- Recon IT & Network - 2Document23 pagesRecon IT & Network - 2palmkodokNo ratings yet

- Financial Accounting 3 Chapter 10Document36 pagesFinancial Accounting 3 Chapter 10Cloyd Angel C. YamutNo ratings yet

- Final Project Master Budget by Amit ShankarDocument9 pagesFinal Project Master Budget by Amit Shankarapi-242858911No ratings yet

- Profit and Loss AccountDocument1 pageProfit and Loss AccountNidhi AjmeraNo ratings yet

- Sales: Proforma Income StatementDocument2 pagesSales: Proforma Income StatementIshpal SinghNo ratings yet

- Akuntansi Keuangan Lanjutan: Laba Atas Transaksi Antarperusahaan - Persediaan P5-6 DAN P5-7Document5 pagesAkuntansi Keuangan Lanjutan: Laba Atas Transaksi Antarperusahaan - Persediaan P5-6 DAN P5-7doniNo ratings yet

- Balance Sheet: Particulars 2012 2011Document2 pagesBalance Sheet: Particulars 2012 2011Mohamed RiyasNo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Plan de Cuentas: Account Nombre de La Cuenta Account Code BalanceDocument3 pagesPlan de Cuentas: Account Nombre de La Cuenta Account Code BalanceozavalaNo ratings yet

- IT Return IT1 WithAnnexure 23454434Document3 pagesIT Return IT1 WithAnnexure 23454434khurramacaaNo ratings yet

- Financial Statements - chptr4Document1 pageFinancial Statements - chptr4mariachristinaparedes4209No ratings yet

- Template To Calculate Various Ratios Input Data Balance Sheet As On 31.3.2015 and 31.3.2016 31.3.2016 31.3.2015Document3 pagesTemplate To Calculate Various Ratios Input Data Balance Sheet As On 31.3.2015 and 31.3.2016 31.3.2016 31.3.2015Sarah Jane GonzalesNo ratings yet

- Soal Latihan Cash Flow Fix Dan JawabanDocument6 pagesSoal Latihan Cash Flow Fix Dan JawabanInggil Subhan100% (1)

- Heraclitus SolutionDocument2 pagesHeraclitus Solutionrttong24No ratings yet

- Trial BalDocument5 pagesTrial BalArjun RoyNo ratings yet

- Adagio PLC Profit and Loss Account For The Year Ended 31st May 2010Document1 pageAdagio PLC Profit and Loss Account For The Year Ended 31st May 2010zahid_mahmood3811No ratings yet

- Special JournalsDocument14 pagesSpecial JournalsfayenaldNo ratings yet

- QUA05891 SepSalarySlipwithTaxDetailsDocument1 pageQUA05891 SepSalarySlipwithTaxDetailssrajput66No ratings yet

- Particulars 31march2012 Trend% 31 March 2013 Trend%Document4 pagesParticulars 31march2012 Trend% 31 March 2013 Trend%duck786No ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Maruti Balance SHTDocument12 pagesMaruti Balance SHTVishal KumarNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNo ratings yet

- PayrollDocument3 pagesPayrollJhon Salvatierra TNo ratings yet

- PayrollDocument2 pagesPayrollJhon Salvatierra TNo ratings yet

- The Tax Withholding Form Is Used For Withholding Taxes To A Buyer or SellerDocument2 pagesThe Tax Withholding Form Is Used For Withholding Taxes To A Buyer or SellerJhon Salvatierra TNo ratings yet

- Cash Flow StatementsDocument4 pagesCash Flow StatementsJhon Salvatierra TNo ratings yet

- The Tax Witholding Form Is Used For Witholding Taxes To Buying A SellerDocument2 pagesThe Tax Witholding Form Is Used For Witholding Taxes To Buying A SellerJhon Salvatierra TNo ratings yet

- WITHOLDINGDocument2 pagesWITHOLDINGJhon Salvatierra TNo ratings yet

- 5 2withholdingDocument2 pages5 2withholdingJhon Salvatierra TNo ratings yet

- 5 1invoiceDocument1 page5 1invoiceJhon Salvatierra TNo ratings yet

- Income Statements Profit Loss StatementDocument2 pagesIncome Statements Profit Loss StatementJhon Salvatierra TNo ratings yet

- 2general JournalDocument10 pages2general JournalJhon Salvatierra TNo ratings yet

- Accounting JournalDocument6 pagesAccounting JournalJhon Salvatierra TNo ratings yet

- 3inncome Statements ProfitlossDocument2 pages3inncome Statements ProfitlossJhon Salvatierra TNo ratings yet

- 5source DocuemntDocument1 page5source DocuemntJhon Salvatierra TNo ratings yet

- 1balance SheetDocument1 page1balance SheetJhon Salvatierra TNo ratings yet

- Balance SheetsDocument1 pageBalance SheetsJhon Salvatierra TNo ratings yet

- 3income Statements Profit Loss SDocument2 pages3income Statements Profit Loss SJhon Salvatierra TNo ratings yet