Professional Documents

Culture Documents

Market Report I-880 Corridor: 2010 - 1 Quarter

Market Report I-880 Corridor: 2010 - 1 Quarter

Uploaded by

api-26303371Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Report I-880 Corridor: 2010 - 1 Quarter

Market Report I-880 Corridor: 2010 - 1 Quarter

Uploaded by

api-26303371Copyright:

Available Formats

2010 | 1st Quarter

MARKET REPORT 49 Stevenson Street, Suite 1025

I-880 CORRIDOR San Francisco, CA 94105

(415) 543-9400 phone

www.cmrealty.com

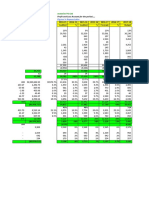

# of Total SF Avail Direct Available Sublease Available Vacancy Rate 1st Qtr Absorption YTD Absorption

Inventory

Bldgs Q4 2009 Q1 2010 Q4 2009 Q1 2010 Q4 2009 Q1 2010 Q4 2009 Q1 2010 Gross Net Gross Net

Alameda

Office Class B 30 1,636,888 460,445 467,405 453,195 460,155 7,250 7,250 28.13% 28.55% 11,424 -1,105 98,803 17,017

Office/Flex 30 1,087,658 308,164 282,940 202,172 188,406 105,992 94,534 28.33% 26.01% 1,914 -3,128 23,302 15,541

60 2,724,546 768,609 750,345 655,367 648,561 113,242 101,784 28.21% 27.54% 13,338 -4,233 122,105 32,558

Berkeley

Office Class B 117 2,833,388 198,319 188,282 181,664 183,929 16,655 4,353 7.00% 6.65% 32,783 1,715 40,914 28,963

Office/Flex 14 627,307 222,356 217,157 162,294 157,095 60,062 60,062 35.45% 34.62% 6,658 -58 95,045 54,200

131 3,460,695 420,675 405,439 343,958 341,024 76,717 64,415 12.16% 11.72% 39,441 1,657 135,959 83,163

Emeryville

Office Class A 6 1,519,503 315,356 283,977 173,849 144,571 141,507 139,406 20.75% 18.69% 39,120 -37,116 4,384 -32,741

Office Class B 27 2,050,836 424,692 409,498 372,271 357,593 52,421 51,905 20.71% 19.97% 51,079 4,667 37,268 6,041

Office/Flex 11 983,990 133,103 149,182 133,103 149,182 0 0 13.53% 15.16% 11,161 4,361 10,121 -18,371

44 4,554,329 873,151 842,657 679,223 651,346 193,928 191,311 19.17% 18.50% 101,360 -28,088 51,773 -45,071

Oakland

Office Class A 28 8,286,260 1,850,503 1,850,503 745,655 1,683,200 87,088 167,303 22.33% 22.33% 161,804 -58,569 174,321 71,377

Office Class B 150 9,505,750 1,806,188 1,806,188 1,649,318 1,649,318 156,870 156,870 19.00% 19.00% 132,188 61,309 93,117 -80,162

Office/Flex 12 475,642 62,288 62,288 18,888 19,200 19,200 43,088 13.10% 13.10% 3,690 -1,310 0 -5,818

190 18,267,652 3,718,979 3,718,979 2,413,861 3,351,718 263,158 367,261 20.36% 20.36% 297,682 1,430 267,438 -14,603

Richmond

Office Class B 1,461,171

51 89,776 191,780 89,776 191,780 0 0 6.14% 13.13% 21,141 19,412 12,500 12,100

Office/Flex 2,458,851

43 615,464 677,140 613,218 664,883 2,246 12,257 25.03% 27.54% 34,536 26,420 142,614 124,419

94 3,920,022 705,240 868,920 702,994 856,663 2,246 12,257 17.99% 22.17% 55,677 45,832 155,114 136,519

CM Commercial I-880 Office & Office/Flex Totals

519 32,927,244 6,486,654 6,586,340 4,795,403 5,849,312 649,291 737,028 19.70% 20.00% 437,218 -43,837 562,672 192,566

I-880 Gross Absorption by Submarket

I-880 - Office Class A & B Vacancy and Rental Rates 1st Quarter 2010

21.00% $26.00 250,000

$25.32 $25.25 $25.20

18.00% $24.96 $25.08

$24.84 $24.96 $24.96 $24.90

$24.84 $25.00 200,000

Vacancy Rate %

Avg. Asking Rent

15.00%

eet

12 00%

12.00%

Square Fe

150,000

$23.65 $24.00

9.00%

6.00% 100,000

$23.00

10.60%

10.80%

11.40%

12.30%

11.30%

12.10%

20.00%

16.96%

12.40%

11.80%

13.96%

3.00%

50,000

0.00% $22.00

2007 2007 2008 2008 2008 2008 2009 2009 2009 2009 2010

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 0

Alameda Berkeley Emeryville Oakland Richmond

2010 Q1 13,338 39,441 101,360 297,682 55,677

Vacancy Rate Average Asking Rent

You might also like

- NHDC SolutionDocument5 pagesNHDC SolutionShivam Goyal71% (24)

- SaaS Financial Model Template by ChargebeeDocument15 pagesSaaS Financial Model Template by ChargebeeNikunj Borad0% (1)

- Big Box 2 - CarcassonneDocument17 pagesBig Box 2 - CarcassonnewimiuNo ratings yet

- New Heritage Doll CompanDocument9 pagesNew Heritage Doll CompanArima ChatterjeeNo ratings yet

- PC 24 Crystal Class BookDocument55 pagesPC 24 Crystal Class Bookjjannani100% (2)

- Appendix 1: Expenditures of Head Office From Year 01 To Year 10 (Conti..)Document1 pageAppendix 1: Expenditures of Head Office From Year 01 To Year 10 (Conti..)KAshif UMarNo ratings yet

- Activity ExcelDocument1 pageActivity ExcelJoshua GuinauliNo ratings yet

- Elemental Cost Planning Office Mr. Dadan 2019 To 2021 (Summary)Document2 pagesElemental Cost Planning Office Mr. Dadan 2019 To 2021 (Summary)Andi SetyawanNo ratings yet

- Case For Project FinanceDocument21 pagesCase For Project FinanceKARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Budget 2022-2024Document30 pagesBudget 2022-2024Khaled ShangabNo ratings yet

- MSFTDocument83 pagesMSFTJohn wickNo ratings yet

- Updated Fcss Receipts & PaymentsDocument6 pagesUpdated Fcss Receipts & PaymentsMubasar khanNo ratings yet

- Manpower PDFDocument1 pageManpower PDFDexter Jay DomingoNo ratings yet

- Profit & Loss Detail: DescriptionDocument18 pagesProfit & Loss Detail: DescriptionAde PardedeNo ratings yet

- LakeHouse Combined SU 6-28-16 PDFDocument1 pageLakeHouse Combined SU 6-28-16 PDFRecordTrac - City of OaklandNo ratings yet

- Profit & Loss Detail: DescriptionDocument18 pagesProfit & Loss Detail: DescriptionAde PardedeNo ratings yet

- Station P&L Statement 2023 - ALMFS082Document1 pageStation P&L Statement 2023 - ALMFS082mohdawood961No ratings yet

- Appendix 2: Revenue and Expenditures of Chaman BCP From Year 01 To YearDocument1 pageAppendix 2: Revenue and Expenditures of Chaman BCP From Year 01 To YearKAshif UMarNo ratings yet

- 1997-2007 Antioch College BudgetsDocument5 pages1997-2007 Antioch College BudgetsantiochpapersNo ratings yet

- Book 1Document2 pagesBook 1M. Chairil AkromNo ratings yet

- Ganancia (P: - Gastos Fina - Gastos FinaDocument7 pagesGanancia (P: - Gastos Fina - Gastos FinaLAURA SANCHEZ FORERONo ratings yet

- Bed 1 2023Document2 pagesBed 1 2023Liezel GuerraNo ratings yet

- 2019 FS Salary TableDocument56 pages2019 FS Salary TableJose MartinezNo ratings yet

- Actual Expenses Jan To Jun 2019-2020Document1 pageActual Expenses Jan To Jun 2019-2020faizanansar500No ratings yet

- Total m2 Vendidos 3,645 2,271: (Utilidad)Document2 pagesTotal m2 Vendidos 3,645 2,271: (Utilidad)Marcela PeñaNo ratings yet

- As of November 30, 2017: Authorized PositionsDocument1 pageAs of November 30, 2017: Authorized PositionsErik Francis LaurenteNo ratings yet

- The Beer Cafe FOFO - Business Model - JodhpurDocument1 pageThe Beer Cafe FOFO - Business Model - JodhpurTarunNo ratings yet

- BSBFIM601Document16 pagesBSBFIM601WalldecorpakistanNo ratings yet

- Group Assignment 1Document8 pagesGroup Assignment 1Tushar JainNo ratings yet

- Market Report San Francisco: 2010 - 1 QuarterDocument1 pageMarket Report San Francisco: 2010 - 1 Quartera4agarwalNo ratings yet

- DepresiasiDocument139 pagesDepresiasiFachri MunadiNo ratings yet

- Budget Revenue 2017Document44 pagesBudget Revenue 2017Macario Roy Jr AmoresNo ratings yet

- Georgia Pacfic by QuarterDocument4 pagesGeorgia Pacfic by QuarterdereddyrajsekharNo ratings yet

- Budget Format V5 31-1-2017 DELDocument99 pagesBudget Format V5 31-1-2017 DELravindranath_kcNo ratings yet

- Tesla ForecastDocument6 pagesTesla ForecastDanikaLiNo ratings yet

- 1.0 Financial Plan: 1.1. 5-Year Profit & Loss ProjectionDocument3 pages1.0 Financial Plan: 1.1. 5-Year Profit & Loss ProjectionHana AlisaNo ratings yet

- Flow Valuation, Case #KEL778Document20 pagesFlow Valuation, Case #KEL778SreeHarshaKazaNo ratings yet

- Manpower PDFDocument1 pageManpower PDFJoshua John JulioNo ratings yet

- Idea Model TemplateDocument22 pagesIdea Model TemplateNaman MalhotraNo ratings yet

- Wage Scale CBA 2019 2020Document1 pageWage Scale CBA 2019 2020Nicko AcayaNo ratings yet

- Appendix 1: Expenditures of Head Office From Year 01 To Year 10Document1 pageAppendix 1: Expenditures of Head Office From Year 01 To Year 10KAshif UMarNo ratings yet

- 22 RAIN Standard Due Diligence Report Template Jan 09Document4 pages22 RAIN Standard Due Diligence Report Template Jan 09Chowkidar Rahul Srivastava100% (1)

- Dummy 1Document17 pagesDummy 1dafiq kamalNo ratings yet

- Flow Valuation, Case #KEL778Document31 pagesFlow Valuation, Case #KEL778javaid jamshaidNo ratings yet

- Pract.1 y 2Document36 pagesPract.1 y 2Jese LópezNo ratings yet

- The - Model - Class WorkDocument16 pagesThe - Model - Class WorkZoha KhaliqNo ratings yet

- Depreciation Calculatoin As Per Companies Act 2013-14-15Document6 pagesDepreciation Calculatoin As Per Companies Act 2013-14-15ROHIT KUMARNo ratings yet

- Feasib Scratch MunaDocument15 pagesFeasib Scratch Munaapi-3838281No ratings yet

- Plano ISD Possible Teacher Salaries and Raises 2010-11 School YearDocument8 pagesPlano ISD Possible Teacher Salaries and Raises 2010-11 School YearThe Dallas Morning NewsNo ratings yet

- Revenue and Gross Profit Operating Expenses: (Except For Per Share Items) Income StatementDocument16 pagesRevenue and Gross Profit Operating Expenses: (Except For Per Share Items) Income StatementAmna NashitNo ratings yet

- Monitoring Piutang: COA Saldo TB Agustus Tambah Ar Update SeptemberDocument7 pagesMonitoring Piutang: COA Saldo TB Agustus Tambah Ar Update Septemberarkee78No ratings yet

- 5-Year Financial Projection of Operational Expenses: Marian School of San JacintoDocument4 pages5-Year Financial Projection of Operational Expenses: Marian School of San Jacintonorvel19No ratings yet

- Book 1Document3 pagesBook 1Pawan TiwariNo ratings yet

- XXXXXXXXXXXXXXXXXXXXDocument6 pagesXXXXXXXXXXXXXXXXXXXXjdgregorioNo ratings yet

- Fsa 2012 16Document190 pagesFsa 2012 16Muhammad Shahzad IjazNo ratings yet

- Teuer Furniture - Student Supplementary SheetDocument20 pagesTeuer Furniture - Student Supplementary Sheetsergio songuiNo ratings yet

- Projections World Trail-FinalDocument26 pagesProjections World Trail-FinalUppada SareesNo ratings yet

- Manage FinanceDocument11 pagesManage FinanceGurjinder Hanjra100% (2)

- 2.3 Business StatisticsDocument29 pages2.3 Business StatisticsAlexander GonzálezNo ratings yet

- Laboratory Exercises in Astronomy: Solutions and AnswersFrom EverandLaboratory Exercises in Astronomy: Solutions and AnswersNo ratings yet

- OneSheet AVEVA System Platform 2023WhatsNew 22-07.pdf - Coredownload.inlineDocument3 pagesOneSheet AVEVA System Platform 2023WhatsNew 22-07.pdf - Coredownload.inlineFirstface LastbookNo ratings yet

- Poem Analysis PresenationDocument8 pagesPoem Analysis PresenationMunachiNo ratings yet

- You Exec - Timeline Template FreeDocument17 pagesYou Exec - Timeline Template FreeÍcaro Filipe BragaNo ratings yet

- Department of International Trade Promotion PDFDocument693 pagesDepartment of International Trade Promotion PDFMhareen Rose Llavado100% (1)

- The Sea: Edward Bond - His Life, Works and Critical ReceptionDocument60 pagesThe Sea: Edward Bond - His Life, Works and Critical ReceptionImran KhanNo ratings yet

- Division SLM-DIASS-SOCSCI-Week-3Document4 pagesDivision SLM-DIASS-SOCSCI-Week-3pearlNo ratings yet

- Corporation Law CasesDocument22 pagesCorporation Law CasesJessica Joyce PenalosaNo ratings yet

- Justin Jaron Lewis: Divine Gender Transformations in Rebbe Nahman of Bratslav.Document20 pagesJustin Jaron Lewis: Divine Gender Transformations in Rebbe Nahman of Bratslav.jewishstudiesNo ratings yet

- Motion To Vacate Order of DisbarmentDocument28 pagesMotion To Vacate Order of DisbarmentMark A. Adams JD/MBA100% (3)

- How Do You "Design" A Business Ecosystem?: by Ulrich Pidun, Martin Reeves, and Maximilian SchüsslerDocument18 pagesHow Do You "Design" A Business Ecosystem?: by Ulrich Pidun, Martin Reeves, and Maximilian Schüsslerwang raymondNo ratings yet

- Unemployment CourseworkDocument7 pagesUnemployment Courseworkafjwftijfbwmen100% (2)

- Tma 04Document21 pagesTma 04Neil YoungNo ratings yet

- Date: 14 December 2020, Monday Time: 02:00 PM To 04:00 PMDocument7 pagesDate: 14 December 2020, Monday Time: 02:00 PM To 04:00 PMBoRO TriAngLENo ratings yet

- 12 Little Things Our Youth Can Do ToDocument14 pages12 Little Things Our Youth Can Do ToLavina TacobanzaNo ratings yet

- Sports ManagementDocument7 pagesSports ManagementKomal GhiyaNo ratings yet

- Swot Analysis of Revlon IncDocument5 pagesSwot Analysis of Revlon IncSubhana AsimNo ratings yet

- Liston (2) Lafti V Laet (2022) DIFC SCT 024 (16 March 2022)Document3 pagesListon (2) Lafti V Laet (2022) DIFC SCT 024 (16 March 2022)abdeali hazariNo ratings yet

- Hungarian SelftaughtDocument136 pagesHungarian Selftaughtbearinghu100% (11)

- DXN Marketing Sdn. BHD.: Distributor Application FormDocument1 pageDXN Marketing Sdn. BHD.: Distributor Application FormArielNo ratings yet

- Bible QuizDocument2 pagesBible QuizPrudence Chigozie Smart100% (1)

- Elfili Chapter TwoDocument2 pagesElfili Chapter TwoEditha Marie FloresNo ratings yet

- Audit Evidence: 2003 Pearson Education Canada IncDocument80 pagesAudit Evidence: 2003 Pearson Education Canada IncSini LaiNo ratings yet

- 04 Review-1Document1 page04 Review-1agathavillagracia4No ratings yet

- Don Mariano Marcos Memorial State University South La Union Campus Agoo, La UnionDocument14 pagesDon Mariano Marcos Memorial State University South La Union Campus Agoo, La UnionRAVEN O. LARONNo ratings yet

- Invest Your Money SAFELY in These Assets, DESPITE A Volatile Market Akshat Shrivastava - YouTubeDocument1 pageInvest Your Money SAFELY in These Assets, DESPITE A Volatile Market Akshat Shrivastava - YouTubemahesh jayarajNo ratings yet

- Test 1 For Unit 6Document3 pagesTest 1 For Unit 6Hang TruongNo ratings yet

- The Tyranny of Usa Civil InjusticeDocument38 pagesThe Tyranny of Usa Civil InjusticeJoshua J. IsraelNo ratings yet

- 2058 Copyright Acknowledgement Booklet 2019 03 March SeriesDocument10 pages2058 Copyright Acknowledgement Booklet 2019 03 March SeriesTeacher HaqqiNo ratings yet