Professional Documents

Culture Documents

Budget Assignment

Budget Assignment

Uploaded by

api-248058538Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget Assignment

Budget Assignment

Uploaded by

api-248058538Copyright:

Available Formats

Introduction to Management Accounting

Solutions Manual

Problems: Set A

P9-59A Comprehensive budgeting problem (Learning Objectives 2 & 3)

Requirements

1. Prepare a schedule of cash collections for January, February, and March, and for the quarter

in total.

2. Prepare a production budget.

3. Prepare a direct materials budget.

4. Prepare a cash payments budget for the direct material purchases from Requirement 3.

5. Prepare a cash payments budget for conversion costs.

6. Prepare a cash payments budget for operating expenses.

7. Prepare a combined cash budget.

8. Calculate the budgeted manufacturing cost per unit.

9. Prepare a budgeted income statement for the quarter ending March 31.

Solution:

Given

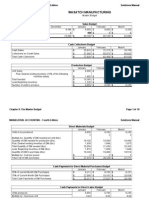

Sales Budget

December

Unit sales

January

7,000

Unit selling price

Total sales Revenue

8,000

10 $

70,000

10

80,000

Req. 1

Cash sales

Credit sales

Total cash collections

Cash Collections Budget

January

February

$24,000

$27,600

$

49,000 $

56,000

$

73,000 $

83,600

Req. 2

unit sales*

Production Budget

January

8,000

Chapter 9: The Master Budget and Responsibility Accounting

February

9,200

Introduction to Management Accounting

Solutions Manual

plus: Desired ending inventory

production need

less: Beginning inventory

Units to produce

2,300

10,300

2000

8,300

2,475

11,675

2,300

9,375

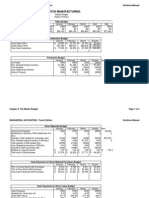

Req. 3

Direct Materials Budget

January

Units to be produced

8,300

x Pounds of DM needed per unit

2

Quantity (pounds) needed for production

16,600

Plus: Desired ending inventory of DM

1,875

Total quantity of (pounds) needed

18,475

Less: Beginning inventory of DM

1,660

Quantity (pounds) needed to purchase

16,815

x Cost per pound

$

2.00 $

Total cost of DM purchases

$33,630

Units to be produced

x Pounds of DM neede per unit

Quantity (pounds) needed for production

Plus: Desired ending inventory of DM

Total Quantity of (pounds) needed

Less: Beginging inventory of DM

Quantity (pounds) needed to purchase

x Cost per pound

Total cost of DM purchases

Req. 4

April

9,700

2

19,400

1,700

21,100

1940

19,160

$

$

2 $

38,320 $

February

9,375

2

18,750

1,970

20,720

1,875

18,845

2.00

$37,690

May

8,500

2

17,000

1,700

18,700

1,600

17,100

2

34,200

Schedule of Expected Cash DisbursementsMaterial Purchases

January

February

December purchases (from Accounts payable)

January purchases

February purchases

March purchases

Total cash payments for direct materials

purchases

$42,400

$6,726

$49,126

Chapter 9: The Master Budget and Responsibility Accounting

$26,904

$7,538

$34,442

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

Introduction to Management Accounting

Solutions Manual

Req. 5

Schedule of Expected Cash DisbursementsConversion Costs

January

February

Variable conversion costs

$9,960

$11,250

Rent (fixed)

$5,000

$5,000

Other fixed MOH

$

3,000 $

3,000

Total payments for conversion costs

$17,960

$19,250

Req. 6

Schedule of Expected Cash Disbursements -- Operating Expenses

January

February

Variable operating expenses

8,000

9,200

Fixed operating epenses

$1,000

$1,000

Total payments for operating expenses

$9,000

$10,200

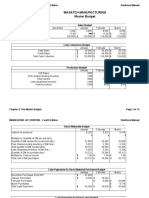

Req. 7

Cash, balance, beginning

Add cash collection

Total cash available

Less cash payments

Direct materials purchases

Conversion costs

Operating expenses

Equipment purchases

Tax payment

Total cash payments

Ending cash balance before financing

Financing:

Borrowings

Repayments

Interest payments

Ending cash balance

Total interest

Combined Cash Budget

January

February

$4,500

$4,414

73,000

83,600

77,500

88,014

49,126

17,960

9,000

5,000

81,086

-3,586

34,442

19,250

10,200

12,000

10,000

85,892

2,122

8,000

2,000

4,414

4,122

$280

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

Req. 8

Budgeted Manufacturing Cost per Unit

Direct materials cost per unit

$4.00

Conversion costs per unit

$1.20

Fixed manufacturing overhead per unit

$0.80

Budgeted cost of manufacturing each unit

$6.00

Req. 9

Silverman Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales

Cost of goods sold *

Gross profit

Operating expenses

Depreciation

Operating income

Less interest expense

Less provisions for income taxes

Net income

271,000

-162,600

108,400

-30,100

-4,800

73,500

-280

-21,966

$51,254

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

(60 min.) P 9-59A

ves 2 & 3)

March, and for the quarter

from Requirement 3.

udget

February

9,200

March

April

9,900

May

9,700

8,500

10 $

10 $

10

10

92,000 $

99,000 $

97,000

85,000

March

Quarter

$29,700

$81,300

$

64,400 $

169,400

$94,100

$

250,700

March

9,900

Quarter

27,100

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

2,425

12,325

2,475

9,850

7,200

34,300

6,775

27,525

March

9,850

2

19,700

1940

21,640

1,970

19,670

$

2.00 $

$39,340

aterial Purchases

March

Solutions Manual

Quarter

27,525

2

55,050

5,785

60,835

1,660

59,175

2.00

$110,660

Quarter

$30,152

$7,868

$33,630

$37,690

$71,320

$38,020

$121,588

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

Introduction to Management Accounting

Solutions Manual

onversion Costs

March

Quarter

$11,820

$33,030

$5,000

$15,000

$

3,000 $

9,000

$19,820

$57,030

erating Expenses

March

9,900

$1,000

$10,900

Quarter

$27,100

$3,000

$30,100

March

$4,122

94,100

98,222

Quarter

$4,500

250,700

255,200

38,020

19,820

10,900

16,000

84,740

13,482

121,588

57,030

30,100

33,000

10,000

251,718

3,482

-9,000

-280

4,202

10,000

-9,000

-280

4,202

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

10

You might also like

- Ebook PDF Construction Accounting Financial Management 3rd Edition PDFDocument41 pagesEbook PDF Construction Accounting Financial Management 3rd Edition PDFpatricia.doll926100% (43)

- Handout: Course Code and Name: Unit Code: Unit TitleDocument10 pagesHandout: Course Code and Name: Unit Code: Unit TitleGabriel ZuanettiNo ratings yet

- Lecture-7 Overhead (Part 1)Document22 pagesLecture-7 Overhead (Part 1)Nazmul-Hassan Sumon100% (2)

- CH 6Document16 pagesCH 6Miftahudin Miftahudin100% (3)

- Master BudgetDocument20 pagesMaster BudgetYsabelle Sacriz100% (1)

- Variable and Absorption CostingDocument38 pagesVariable and Absorption CostingstarlightNo ratings yet

- Owens Stacy Chapter 9 QB CaseDocument20 pagesOwens Stacy Chapter 9 QB Caseapi-248058538No ratings yet

- Relevant Costing-With Highlighted Answer KeyDocument33 pagesRelevant Costing-With Highlighted Answer KeyFlorence Cabotaje100% (5)

- 1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsDocument8 pages1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsMeg sharkNo ratings yet

- Accounting E-Portfolio FinalDocument8 pagesAccounting E-Portfolio Finalapi-310911560No ratings yet

- Budget Project LLDocument10 pagesBudget Project LLapi-220037346No ratings yet

- Managerial Accounting ProjectDocument11 pagesManagerial Accounting Projectapi-271746126No ratings yet

- Master Budget ProjectDocument10 pagesMaster Budget Projectapi-268950886No ratings yet

- Excel Budget Project Tanya MayDocument10 pagesExcel Budget Project Tanya Mayapi-316478827No ratings yet

- Excel Project P9-59aDocument3 pagesExcel Project P9-59aapi-272100463No ratings yet

- ProblemsDocument4 pagesProblemsapi-316770820No ratings yet

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument10 pagesWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-231890132100% (1)

- Wasatch ManufacturingDocument12 pagesWasatch Manufacturingapi-301899907No ratings yet

- TuyjDocument51 pagesTuyjagnesNo ratings yet

- Accounting Chapter 9 Eportfolio ExcelDocument12 pagesAccounting Chapter 9 Eportfolio Excelapi-273030710No ratings yet

- p9-60 PsimasinghDocument8 pagesp9-60 Psimasinghapi-241811190No ratings yet

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-269073570No ratings yet

- Hailey Fernelius ch9 Excel ProjectDocument4 pagesHailey Fernelius ch9 Excel Projectapi-242652884No ratings yet

- Financial Forecasting: SIFE Lakehead 2009Document7 pagesFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNo ratings yet

- Characteristics of A Budget: Cash ReceiptsDocument11 pagesCharacteristics of A Budget: Cash ReceiptsMukesh ManwaniNo ratings yet

- Wasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions Manualapi-247933607No ratings yet

- Acct 2020 Excel Budget Problem Student TemplateDocument12 pagesAcct 2020 Excel Budget Problem Student Templateapi-242720692No ratings yet

- Chapter 04 - 12thDocument16 pagesChapter 04 - 12thSarah JamesNo ratings yet

- Budgetery Control & ABCDocument41 pagesBudgetery Control & ABCanupams3No ratings yet

- A 201 Chapter 12Document14 pagesA 201 Chapter 12blackprNo ratings yet

- Wasatch Manufacturing Master BudgetDocument6 pagesWasatch Manufacturing Master Budgetapi-255137286No ratings yet

- Financial PlanDocument54 pagesFinancial PlanTeku ThwalaNo ratings yet

- Chapter+3 the+Adjusting+ProcessDocument61 pagesChapter+3 the+Adjusting+ProcessOrkun Kızılırmak100% (1)

- ACCT504 Case Study 1 The Complete Accounting Cycle-13Document12 pagesACCT504 Case Study 1 The Complete Accounting Cycle-13Mohammad Islam100% (1)

- Abigail Foss - Comprehensive Problem - Master BudgetDocument15 pagesAbigail Foss - Comprehensive Problem - Master Budgetapi-325954956No ratings yet

- Case Study The Complete AccounDocument16 pagesCase Study The Complete Accoundeepak.agarwal.caNo ratings yet

- EportfolioDocument8 pagesEportfolioapi-220792970No ratings yet

- Fa4e SM Ch03Document82 pagesFa4e SM Ch03michaelkwok1No ratings yet

- Week 3Document14 pagesWeek 3John PerkinsNo ratings yet

- Budgetery Control & ABCDocument41 pagesBudgetery Control & ABCRohit ChandakNo ratings yet

- CASH BUDGET PREPARATIONS Lesson Material and Activity SheetsDocument8 pagesCASH BUDGET PREPARATIONS Lesson Material and Activity SheetsLee Arne BarayugaNo ratings yet

- Acct 2020 Excel Budget Problem Student TemplateDocument12 pagesAcct 2020 Excel Budget Problem Student Templateapi-249190933No ratings yet

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument5 pagesWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-284934265No ratings yet

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-239130031No ratings yet

- Danielle Nelson Final Essay QuestionsDocument5 pagesDanielle Nelson Final Essay Questionsapi-408647155100% (1)

- Cash Budgets 2Document9 pagesCash Budgets 2Kopanang LeokanaNo ratings yet

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-242429455No ratings yet

- ACCA MA - Fma Study School Budgeting Part B SolutionsDocument16 pagesACCA MA - Fma Study School Budgeting Part B Solutionsmaharajabby81No ratings yet

- Week 5 - Sept 26-30 - AcctgDocument13 pagesWeek 5 - Sept 26-30 - Acctgmaria teresa aparreNo ratings yet

- NotesDocument40 pagesNotesTicktactoe100% (1)

- Assignment BriefDocument10 pagesAssignment BriefNguyen Dac ThichNo ratings yet

- Anggaran Berdasarkan Fungsi Dan AktivitasDocument42 pagesAnggaran Berdasarkan Fungsi Dan AktivitasAri SuryadiNo ratings yet

- Material BudgetDocument37 pagesMaterial BudgetRahul SardaNo ratings yet

- Excel HomeworkDocument9 pagesExcel Homeworkapi-248528639No ratings yet

- Tori Kallerud Chapter 9 HWDocument12 pagesTori Kallerud Chapter 9 HWapi-325347697No ratings yet

- CHAPTER ELEVEN-Financial PlanDocument54 pagesCHAPTER ELEVEN-Financial PlanWan WanNo ratings yet

- NCERT Class 11 Accountancy Part 2Document296 pagesNCERT Class 11 Accountancy Part 2AnoojxNo ratings yet

- Required: Using The Data Above, Complete The Following Statements and Schedules For The First QuarterDocument6 pagesRequired: Using The Data Above, Complete The Following Statements and Schedules For The First QuarterteferiNo ratings yet

- Worksheet 4 CFS Acctg 2Document12 pagesWorksheet 4 CFS Acctg 2Jennifer FabiaNo ratings yet

- Appendix B - Financial Statement For Control 4-1Document1 pageAppendix B - Financial Statement For Control 4-1api-248058538No ratings yet

- Strategic Communications Plan-3Document9 pagesStrategic Communications Plan-3api-248058538No ratings yet

- E - Portfolio Assignment 2Document8 pagesE - Portfolio Assignment 2api-248058538No ratings yet

- Exploring E01 Grader Ir 3Document4 pagesExploring E01 Grader Ir 3api-248058538No ratings yet

- Issue Summary Final 1Document6 pagesIssue Summary Final 1api-248058538No ratings yet

- Stacy Owens: ObjectivesDocument1 pageStacy Owens: Objectivesapi-248058538No ratings yet

- Stacy Owens: ObjectivesDocument1 pageStacy Owens: Objectivesapi-248058538No ratings yet

- Accounting For Factory OverheadDocument27 pagesAccounting For Factory Overheadspectrum_480% (1)

- Abc QuizDocument24 pagesAbc QuizJhunnel LangubanNo ratings yet

- Cariel Jean Donsing Bacc 8a Module 1 PDFDocument33 pagesCariel Jean Donsing Bacc 8a Module 1 PDFMary Anne MosedeilNo ratings yet

- Week 3 ch04Document25 pagesWeek 3 ch04khullarhimani1No ratings yet

- Machining & Manufacturing Cost Estimation, Quotes, and Rates PDFDocument21 pagesMachining & Manufacturing Cost Estimation, Quotes, and Rates PDFkali50No ratings yet

- 1 Churchill v. ConcepcionDocument7 pages1 Churchill v. ConcepcionJoan Dela CruzNo ratings yet

- Answers Homework # 16 Cost MGMT 5Document7 pagesAnswers Homework # 16 Cost MGMT 5Raman ANo ratings yet

- Controlling and Costing MaterialsDocument70 pagesControlling and Costing Materialstotongop100% (1)

- CA Inter Costing Theory Antim Adhyay.Document35 pagesCA Inter Costing Theory Antim Adhyay.gammy7011No ratings yet

- Ch02 - Basic Cost Management ConceptsDocument32 pagesCh02 - Basic Cost Management ConceptsFauziahNo ratings yet

- SAP Product Costing NotesDocument37 pagesSAP Product Costing NotesMuhammad Javed Iqbal100% (1)

- Cost SheetDocument21 pagesCost Sheetniraliparekh27No ratings yet

- Absorption and Variable Costing ReviewDocument13 pagesAbsorption and Variable Costing ReviewRodelLabor100% (1)

- CHAPTER - 12 - Responsibility Accounting - UETDocument16 pagesCHAPTER - 12 - Responsibility Accounting - UETZia UddinNo ratings yet

- Production EngineeringDocument18 pagesProduction EngineeringsabtrexNo ratings yet

- Caf-03 Cma Artt Mock QP With SolDocument16 pagesCaf-03 Cma Artt Mock QP With Solkulhaq29No ratings yet

- Cost Accounting 15th Edition Horngren Test BankDocument60 pagesCost Accounting 15th Edition Horngren Test Bankantiloquyillesivepch100% (34)

- INFOTECH 2: Accounting Information SystemDocument5 pagesINFOTECH 2: Accounting Information SystemMaricris AbadNo ratings yet

- Short and Comprehensive ProblemsDocument3 pagesShort and Comprehensive ProblemsAl-Ameen P. MacabaningNo ratings yet

- Thu Cs CostDocument31 pagesThu Cs CostthulasikNo ratings yet

- Solution Manual - Chapter 6Document11 pagesSolution Manual - Chapter 6psrikanthmbaNo ratings yet

- Activity Based Costing TestDocument4 pagesActivity Based Costing TestARUN AGGARWALNo ratings yet

- 1 Basic Concepts Quiz-MergedDocument50 pages1 Basic Concepts Quiz-MergedsukeshNo ratings yet

- Job Order Costing ExerciseDocument10 pagesJob Order Costing ExerciseMarilyn FernandezNo ratings yet

- Annotated Guide 14 Ifcd Call 2023 enDocument40 pagesAnnotated Guide 14 Ifcd Call 2023 enQiGong .NeurocienciaNo ratings yet

- 20201018194712BN123863105Document7 pages20201018194712BN123863105yogi fetriansyahNo ratings yet