Professional Documents

Culture Documents

Itrv

Itrv

Uploaded by

mohan11pavan0 ratings0% found this document useful (0 votes)

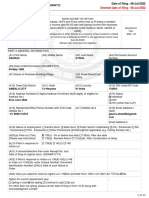

18 views1 pageThis document is an acknowledgement form for an income tax return (ITR) filed for the 2014-15 assessment year. It contains basic identifying information about the taxpayer such as name, address, gender, permanent account number. It also includes financial details from the return like gross total income, deductions, total income, current losses, tax payable, interest payable, taxes paid in advance or through withholding that determine whether any tax is payable or refund is due. The form is to be stamped and signed by the receiving tax official.

Original Description:

juiop

Original Title

itrv

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is an acknowledgement form for an income tax return (ITR) filed for the 2014-15 assessment year. It contains basic identifying information about the taxpayer such as name, address, gender, permanent account number. It also includes financial details from the return like gross total income, deductions, total income, current losses, tax payable, interest payable, taxes paid in advance or through withholding that determine whether any tax is payable or refund is due. The form is to be stamped and signed by the receiving tax official.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageItrv

Itrv

Uploaded by

mohan11pavanThis document is an acknowledgement form for an income tax return (ITR) filed for the 2014-15 assessment year. It contains basic identifying information about the taxpayer such as name, address, gender, permanent account number. It also includes financial details from the return like gross total income, deductions, total income, current losses, tax payable, interest payable, taxes paid in advance or through withholding that determine whether any tax is payable or refund is due. The form is to be stamped and signed by the receiving tax official.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 1

ITR - V

ACKNOWLEDGEMENT

AY 2014-15

Received with thanks from

ITR No.

a return of income in

1 (SAHAJ)

4S (SUGAM)

for assessment year 2014-15, having

the following particulars

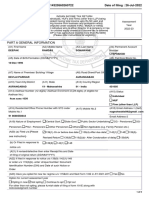

A1

FIRST NAME

A2

MIDDLE NAME

A3

LAST NAME

A4

PERMANENT ACCOUNT NUMBER

A5

SEX

A7

INCOME TAX WARD / CIRCLE

A9

ROAD/STREET

Male

A8

A6 DATE OF BIRTH

Female

FLAT/DOOR/BUILDING

A10 AREA/LOCALITY

A11 TOWN/CITY/DISTRICT

A12 STATE

A14

COUNTRY

Fill only one: filed

A1 PINCODE

On or Before due date - 139(1) After due date - 139(4)

OR in response to notice

139(9)

142(1)

Revised Return- 139(5)

153A / 153Cor

148

92 CD

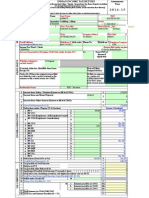

COMPUTATION OF INCOME AND TAX RETURN

B1 Gross Total Income

B1 (

B2 Deductions under Chapter VI-A

B2

B3 Total Income

B3 (

B4 Current Loss if any

B4

B5 Net Tax Payable

B5

B6 Interest Payable

B6

B7 Total Tax and Interest Payable

B7

B8 Total Advance Tax paid

B8

B9 Total Self Assessment Tax Paid

B9

B10 Total TDS Deducted

B10

B11 Total TCS Deducted

B11

B12 Total Prepaid Taxes (B8+B9+B10+B11)

B12

B13 Tax Payable ( B7-B12, If B7 > B12 )

B13

B14 Refund ( B12-B7, If B12 > B7 )

B14

FOR OFFICIAL USE ONLY

STAMP, RECEIPT NO, HERE

Form by Finotax

)

)

SEAL, DATE AND SIGNATURE

OF RECEIVING OFFICIAL

You might also like

- FormDocument4 pagesFormManohj ViswanathanNo ratings yet

- ITR 1 Sahaj in Excel Format For A.Y 2011 12 Financial Year 2010 11Document8 pagesITR 1 Sahaj in Excel Format For A.Y 2011 12 Financial Year 2010 11Modin HorakeriNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument12 pagesITR-3 Indian Income Tax Return: Part A-GENmehtakvijayNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENAvani GadaNo ratings yet

- 2011 - ITR2 - r6Document33 pages2011 - ITR2 - r6Bathina Srinivasa RaoNo ratings yet

- Assessment Year Sahaj Indian Income Tax ReturnDocument1 pageAssessment Year Sahaj Indian Income Tax ReturnAnit SharmaNo ratings yet

- Itr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearDocument7 pagesItr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearVarun ChhabraNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996No ratings yet

- Itr V AcknowledgementDocument1 pageItr V Acknowledgementshivkumara27No ratings yet

- Indian Numbering SystemDocument8 pagesIndian Numbering SystemelangomduNo ratings yet

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvNo ratings yet

- Assessment Year Sahaj Indian Income Tax ReturnDocument7 pagesAssessment Year Sahaj Indian Income Tax Returnrajshri58No ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument10 pagesITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument8 pagesITR-3 Indian Income Tax Return: Part A-GENRahul SharmaNo ratings yet

- Form PDF 340519100221221AVTPC0987CDocument8 pagesForm PDF 340519100221221AVTPC0987Csmadvocate049No ratings yet

- Form PDF 717976660131022Document9 pagesForm PDF 717976660131022paridarashmi12No ratings yet

- Itr-V: AcknowledgementDocument1 pageItr-V: AcknowledgementchittiNo ratings yet

- Form PDF 767221760080722Document13 pagesForm PDF 767221760080722Gaurav AtwalNo ratings yet

- Indian Income Tax Return Assessment Year SahajDocument7 pagesIndian Income Tax Return Assessment Year SahajSubrata BiswasNo ratings yet

- Itr 2Document9 pagesItr 2Arvind PaulNo ratings yet

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNo ratings yet

- Itr 3Document58 pagesItr 3Anurag SharmaNo ratings yet

- Form ITR2 2012-2013Document9 pagesForm ITR2 2012-2013N.PalaniappanNo ratings yet

- 2016 Itr4 PR3Document165 pages2016 Itr4 PR3TejasNo ratings yet

- Form PDF 197504840210823Document9 pagesForm PDF 197504840210823jassramgarhia2812No ratings yet

- Return Saifee Hsopital TrustDocument6 pagesReturn Saifee Hsopital TrustAnonymous u6Zg0QhNo ratings yet

- Form PDF 774514440031122Document9 pagesForm PDF 774514440031122krishna salesNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNishant VermaNo ratings yet

- Itr4 PreviewDocument10 pagesItr4 PreviewSK TOYFIK ALINo ratings yet

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocument11 pagesITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranNo ratings yet

- "Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1Document6 pages"Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1hina08855No ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- Income TaxDocument6 pagesIncome TaxKuldeep HoodaNo ratings yet

- Form PDF 114320560260722Document9 pagesForm PDF 114320560260722DeepNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument79 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Form PDF 154129160180523Document8 pagesForm PDF 154129160180523Ritu RajNo ratings yet

- Shug Am 42223Document11 pagesShug Am 42223Daman SharmaNo ratings yet

- Form PDF 432385000170822Document9 pagesForm PDF 432385000170822Khan kingNo ratings yet

- Form PDF 177155750160424Document11 pagesForm PDF 177155750160424dkassociate609No ratings yet

- 2013 Itr1 PR11Document9 pages2013 Itr1 PR11Akshay Kumar SahooNo ratings yet

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- Return ChallanDocument20 pagesReturn Challansyedfaisal_sNo ratings yet

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sNo ratings yet

- Form PDF 798974670130722Document10 pagesForm PDF 798974670130722Rahul AroraNo ratings yet

- Sugam: (Please See Instruction)Document10 pagesSugam: (Please See Instruction)SUBHASH CHANDRANo ratings yet

- KarjDocument1 pageKarjmohan11pavanNo ratings yet

- Resume K.Leela Chaitanya PHONE NO: +91-9000971737Document2 pagesResume K.Leela Chaitanya PHONE NO: +91-9000971737mohan11pavanNo ratings yet

- VBSL Chanakya - Vijayawada VBSL Chanakya - VijayawadaDocument4 pagesVBSL Chanakya - Vijayawada VBSL Chanakya - Vijayawadamohan11pavanNo ratings yet

- Time Table: Day/ Hrs 1 2 B R Wed Thu FRI SATDocument1 pageTime Table: Day/ Hrs 1 2 B R Wed Thu FRI SATmohan11pavanNo ratings yet

- NaveenDocument2 pagesNaveenmohan11pavanNo ratings yet

- Master in Business Administration (MBA) : Phase ONEDocument2 pagesMaster in Business Administration (MBA) : Phase ONEmohan11pavanNo ratings yet

- Venkata Kasiviswanadha Prasad Pokuri, Vijayawada F Y:2014-2015 PAN: AEQPP7623A TRADING ACCOUNT FOR THE PERIOD 01/04/2014 TO 31/03/2015Document4 pagesVenkata Kasiviswanadha Prasad Pokuri, Vijayawada F Y:2014-2015 PAN: AEQPP7623A TRADING ACCOUNT FOR THE PERIOD 01/04/2014 TO 31/03/2015mohan11pavanNo ratings yet

- International Tour To Cambodia January 31,2015 To February 4, 2015Document2 pagesInternational Tour To Cambodia January 31,2015 To February 4, 2015mohan11pavanNo ratings yet

- Statement of Total Income For The Asst. Year 2012-13Document5 pagesStatement of Total Income For The Asst. Year 2012-13mohan11pavanNo ratings yet

- Sales Projection - 5D TheaterDocument2 pagesSales Projection - 5D Theatermohan11pavanNo ratings yet

- Student GuardDocument48 pagesStudent Guardmohan11pavanNo ratings yet

- Voice of Cows - Apr 2013Document16 pagesVoice of Cows - Apr 2013mohan11pavanNo ratings yet

- BaluDocument2 pagesBalumohan11pavanNo ratings yet

- Development of Land in Tuda Application FormDocument13 pagesDevelopment of Land in Tuda Application Formmohan11pavanNo ratings yet

- Compendium: Centrally Sponsored Schemes in Fisheries SectorDocument36 pagesCompendium: Centrally Sponsored Schemes in Fisheries Sectormohan11pavanNo ratings yet