Professional Documents

Culture Documents

STEPS To Prepare The ADJUSTED Cash Book and Bank Reconciliation Statement

STEPS To Prepare The ADJUSTED Cash Book and Bank Reconciliation Statement

Uploaded by

Josh BissoonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

STEPS To Prepare The ADJUSTED Cash Book and Bank Reconciliation Statement

STEPS To Prepare The ADJUSTED Cash Book and Bank Reconciliation Statement

Uploaded by

Josh BissoonCopyright:

Available Formats

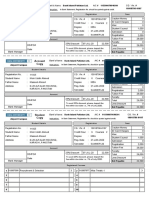

Bank Reconciliation Statement

The objective of Bank Reconciliation Statement is simply to reconcile the bank balance of the

Cash Book with the balance in the Bank Statement.

Terms (errors) for us to be familiar with when preparing a bank reconciliation statement

Unpresented cheques- cheques issued to creditors, but not presented for payment to the

firms bank, till the date of reconciliation

Bank lodgements/ Unrecorded Deposits-cheques received from debtors but not deposited

in the bank account

Credit transfer(direct credit) -money directly deposited in the bank by a debtor/customer

Direct debit(debit transfer)-instructions given to bank to pay an organization directly from

the firms account

Standing order-bank pays directly from the firms accounts, payment like insurance

premium, rent, others

Dishonored cheques-bank cannot accept the firms debtors cheques as the

debtors/customers do not have sufficient funds to pay the firm.

Dividends- received from investment made from other companies.

Bank errors

Business errors

Bank charges-fees charge by the bank for services provided

Bank interest.

STEPS to prepare the ADJUSTED Cash Book and Bank Reconciliation Statement

Step 1: Check opening balances of both Cash Book and Bank Statement to ascertain whether the two balances are

the same;

Step 2: Compare the Cash Books Dr Column (receipts) with the Cr column of Bank Statement, tick all common

items.

Step 3: Compare the Cash Books Cr columns(payments) with the Dr column of Bank Statement, tick all common

item

Step 4: All items unticked in the Bank Statement will be adjusted in the Cash Book and all items unticked in the

Cash Book will be recorded in the Bank Reconciliation Statement. If the items are debited in the bank statement is

credited in the cash book and if credited in the bank statement it is debited in the cash book.

You might also like

- CAPE Arts and DesignDocument207 pagesCAPE Arts and DesignJosh Bissoon100% (2)

- Report On Dutch Bangla BankDocument22 pagesReport On Dutch Bangla BankIshita Israt100% (1)

- Bank Reconciliation IDocument15 pagesBank Reconciliation IImran ZulfiqarNo ratings yet

- Format Debit Bal Bank StatementDocument1 pageFormat Debit Bal Bank StatementMzee KodiaNo ratings yet

- Non Receipt / Delay: Funds LODR Code: Null: SN Document Type Document Name Date TimeDocument1 pageNon Receipt / Delay: Funds LODR Code: Null: SN Document Type Document Name Date TimeVinod KumarNo ratings yet

- Bank Reconciliation Statement Worksheet With HintsDocument1 pageBank Reconciliation Statement Worksheet With Hintsapi-252642432No ratings yet

- Please Take This To Your Local Bank: CIBC International Student PayDocument6 pagesPlease Take This To Your Local Bank: CIBC International Student PaypanikNo ratings yet

- Financial StatementDocument2 pagesFinancial StatementBenwajihNo ratings yet

- FD Circular Letter No 04 2017Document1 pageFD Circular Letter No 04 2017Sharjeel HussainNo ratings yet

- Confidential Financial StatementDocument1 pageConfidential Financial StatementVioleta BusuiocNo ratings yet

- 2021 Audited Financial Statements - CompressedDocument27 pages2021 Audited Financial Statements - CompressedBernewsAdminNo ratings yet

- 6388r13 Uk PC Order FRM FinalDocument2 pages6388r13 Uk PC Order FRM Finalapi-307674357No ratings yet

- International Graduate Financial StatementDocument1 pageInternational Graduate Financial Statementmasoudgh2005No ratings yet

- Internship Report On Credit Policy of Brac Bank LTDDocument54 pagesInternship Report On Credit Policy of Brac Bank LTDwpushpa23No ratings yet

- 2016 17 Press StatementDocument19 pages2016 17 Press StatementcharliemopicNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementZuŋɘʀa AɓɗuɭɭʌhNo ratings yet

- Bank Reconciliation StatementDocument1 pageBank Reconciliation StatementAbdul RehmanNo ratings yet

- Exchange of Damaged Euro Banknotes PDFDocument3 pagesExchange of Damaged Euro Banknotes PDFBlessing KatukaNo ratings yet

- Bank Reconcilation Statement Example PDFDocument4 pagesBank Reconcilation Statement Example PDFZara ShoukatNo ratings yet

- Bank Reconciliation Statement - Why & How To Prepare The - Statement PDFDocument2 pagesBank Reconciliation Statement - Why & How To Prepare The - Statement PDFAman KodwaniNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementTalha MahmoodNo ratings yet

- Fees IU PDFDocument1 pageFees IU PDFMOIN UDDIN AHMEDNo ratings yet

- Tutorial 6Document3 pagesTutorial 6Wan LinNo ratings yet

- Bank Reconciliation PDFDocument2 pagesBank Reconciliation PDFFazal Rehman MandokhailNo ratings yet

- Governing Body: International Labour OfficeDocument33 pagesGoverning Body: International Labour OfficeMu Eh HserNo ratings yet

- Sterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Document1 pageSterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Sterling Bank PLCNo ratings yet

- Bill To: Account Summary: Date: Statement # Account Number Page 1 of 1Document1 pageBill To: Account Summary: Date: Statement # Account Number Page 1 of 1Ullah KunNo ratings yet

- A Study On Mobile Banking and Its Impact On Customer's Banking Transactions: A Comparative Analysis of Public and Private Sector Banks in IndiaDocument15 pagesA Study On Mobile Banking and Its Impact On Customer's Banking Transactions: A Comparative Analysis of Public and Private Sector Banks in IndiaHarshit GuptaNo ratings yet

- Internship Report On BankingDocument56 pagesInternship Report On BankingYasir Arafat100% (1)

- 10 Bank Reconciliation Statement-1Document9 pages10 Bank Reconciliation Statement-1Abdul SamadNo ratings yet

- Mkombozi Commercial Bank - Financial Statement Dec - 2019 PDFDocument1 pageMkombozi Commercial Bank - Financial Statement Dec - 2019 PDFMsuyaNo ratings yet

- Meezan BankDocument16 pagesMeezan BankSaifullahMakenNo ratings yet

- Management & Organization (Jamuna Group)Document14 pagesManagement & Organization (Jamuna Group)elenaNo ratings yet

- Learning Guide: Nefas Silk Poly Technic College Accounts and Budget Support Level IiiDocument36 pagesLearning Guide: Nefas Silk Poly Technic College Accounts and Budget Support Level IiiNigussie BerhanuNo ratings yet

- Af As Chapter 8Document18 pagesAf As Chapter 8FarrukhsgNo ratings yet

- Public Bank MalaysiaDocument11 pagesPublic Bank MalaysiaJl LeeNo ratings yet

- Bank ReconciliationDocument3 pagesBank Reconciliationazwan88No ratings yet

- Bank Balance and Book Balance To Corrected Balance FormDocument2 pagesBank Balance and Book Balance To Corrected Balance FormXyza Faye RegaladoNo ratings yet

- Bank Reconciliation StatementDocument18 pagesBank Reconciliation StatementNaveed Asghar JanNo ratings yet

- Thesis On NRBC BankDocument51 pagesThesis On NRBC BankMd Khaled NoorNo ratings yet

- PHI 17A-Dec 2018 PAL Fin Statement 2018Document162 pagesPHI 17A-Dec 2018 PAL Fin Statement 2018makane100% (1)

- Basic Instructions For A Bank Reconciliation Statement PDFDocument4 pagesBasic Instructions For A Bank Reconciliation Statement PDFAman KodwaniNo ratings yet

- Credit Card Terms and Conditions: Info@homecredit - PH)Document8 pagesCredit Card Terms and Conditions: Info@homecredit - PH)Victor Czar AustriaNo ratings yet

- Model Bank StatementDocument2 pagesModel Bank StatementhanhNo ratings yet

- Corporation Bank Report FinalDocument61 pagesCorporation Bank Report FinalJasmandeep brarNo ratings yet

- Account Statement 1000013254935Document1 pageAccount Statement 1000013254935Ebrahim MaruNo ratings yet

- Allied Bank (Final)Document21 pagesAllied Bank (Final)affanahmed11167% (3)

- Bank Reconciliation StatementDocument7 pagesBank Reconciliation Statementkshitijraja18No ratings yet

- Bank Reconciliation StatementDocument5 pagesBank Reconciliation StatementxxpinkywitchxxNo ratings yet

- Financial Documentation FormDocument2 pagesFinancial Documentation FormjusttrickingNo ratings yet

- RBS ReportDocument27 pagesRBS ReportElmira GamaNo ratings yet

- Dangila Branch CustomerDocument2 pagesDangila Branch CustomerdagnayeNo ratings yet

- Statement of Account: 863 M. DELA FUENTE SAMPALOC Barangay 452 Sampaloc East Metro ManilaDocument1 pageStatement of Account: 863 M. DELA FUENTE SAMPALOC Barangay 452 Sampaloc East Metro ManilaJayson IbardalozaNo ratings yet

- Sanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017Document3 pagesSanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017Anonymous KAIoUxP7No ratings yet

- Financial Statement 2020 - Corporation of Hamilton 2Document27 pagesFinancial Statement 2020 - Corporation of Hamilton 2Anonymous UpWci5No ratings yet

- Hong Leong BankDocument6 pagesHong Leong Bankfelicia kiuNo ratings yet

- Bank StatementsDocument4 pagesBank StatementshanhNo ratings yet

- Explanation of Bank StatementDocument3 pagesExplanation of Bank StatementMua-tien DonzoNo ratings yet

- Accounting Lesson 1 Bank Reconciliation NotesDocument9 pagesAccounting Lesson 1 Bank Reconciliation NotesKabelo SefaliNo ratings yet

- CHAPTER 9 - Bank ReconciliationDocument14 pagesCHAPTER 9 - Bank ReconciliationMuhammad AdibNo ratings yet

- Financial Accounting Handout 2Document49 pagesFinancial Accounting Handout 2Rhoda Mbabazi ByogaNo ratings yet

- Ma1 QuestionsDocument1 pageMa1 QuestionsJosh BissoonNo ratings yet

- Partnership AccountsDocument2 pagesPartnership AccountsJosh BissoonNo ratings yet

- Bank Rec ExerciseDocument2 pagesBank Rec ExerciseJosh Bissoon0% (1)

- Sixth Form PoemsDocument3 pagesSixth Form PoemsJosh BissoonNo ratings yet

- FAU MC Answer PackDocument4 pagesFAU MC Answer PackJosh BissoonNo ratings yet

- Paper F4, Corporate and Business Law (ENG) and (GLO) : Guide in The Qualifications Resources Section of The ACCA WebsiteDocument1 pagePaper F4, Corporate and Business Law (ENG) and (GLO) : Guide in The Qualifications Resources Section of The ACCA WebsiteJosh BissoonNo ratings yet

- Apr 08, Wednesday Apr 12, Sunday: at atDocument6 pagesApr 08, Wednesday Apr 12, Sunday: at atJosh BissoonNo ratings yet

- Correction of Errors Errors Not Revealed by The Trial BalanceDocument1 pageCorrection of Errors Errors Not Revealed by The Trial BalanceJosh BissoonNo ratings yet

- ACCA f5 Ticket AgentDocument1 pageACCA f5 Ticket AgentJosh BissoonNo ratings yet

- Measurement: FORM 2: Volume of SolidsDocument1 pageMeasurement: FORM 2: Volume of SolidsJosh BissoonNo ratings yet

- Do Not Stare at Me University of HungerDocument3 pagesDo Not Stare at Me University of HungerJosh BissoonNo ratings yet

- Ma1 Examreport d12Document4 pagesMa1 Examreport d12Josh BissoonNo ratings yet

- Secondary StorageDocument27 pagesSecondary StorageJosh Bissoon67% (3)