Professional Documents

Culture Documents

Time Value of Money - The Buy Versus Rent Decision - Student

Time Value of Money - The Buy Versus Rent Decision - Student

Uploaded by

Umer TahirOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Time Value of Money - The Buy Versus Rent Decision - Student

Time Value of Money - The Buy Versus Rent Decision - Student

Uploaded by

Umer TahirCopyright:

Available Formats

Time Value of Money: Buy versus Rent by Sean Cleary and Stephen Foerster, Ivey Publications, August 11,

2014

Question

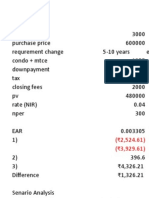

Purchase Price

Legal fees

Deed transfer tax (@3%)

Down Payment (20%)

Total Due at Closing

Amortization Period (Years)

Payment Frequency

Number of Payments remaining

(1)

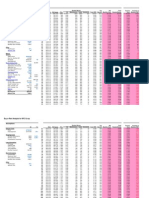

Net FV

PV of Future Net (NPV)

(5b) 10% down, back to 600k, then up 10%

2 years

5 years

10 years

MonthlyMortgage Payments

Monthly Condo Fees

Monthly Taxes

Monthly Repairs etc.

10 years

Funds at Closing

Opportunity Cost of Extra Payments Incl. Funds Used at Initial Closing

Princ OS

4%

(5a) NPV - No Change in Price

2 years

5 years

After 10 Years

Selling Price

Realtor Fees (@5%)

Other Selling fees

Princ OS

Net Proceeds

25

12

Mortgage Amount

Quoted Rate

Eff. Monthly rate

(4) Principal Outstanding

After 2 years

After 5 Years

Initially

600000

2000

1055

300

50

Selling Price

Realtor Fees (@5%)

Other Selling fees

Princ OS

Net Proceeds

Total Monthly Payments if Buy

Monthly Rent

3000

Funds at Closing

Opportunity Cost of Extra Payments Incl. Funds Used at Initial Closing

Net Additional Payments

Net FV

(2)

Monthly Opportunity Costs of

240000 (Closing Costs + Down Pmt)

PV of Future Net (NPV)

(3)

TOTAL Additional Monthly CF "costs"

(5c) Condo price increases 2% annually

2 years

5 years

10 years

Selling Price

Realtor Fees (@5%)

Other Selling fees

Princ OS

Net Proceeds

Funds at Closing

Opportunity Cost of Extra Payments Incl. Funds Used at Initial Closing

Net FV

PV of Future Net (NPV)

(5d) Condo price increases 5% annually

2 years

5 years

10 years

Selling Price

Realtor Fees (@5%)

Other Selling fees

Princ OS

Net Proceeds

Funds at Closing

Opportunity Cost of Extra Payments Incl. Funds Used at Initial Closing

Net FV

PV of Future Net (NPV)

You might also like

- TVM Buy and Rent DecisionDocument4 pagesTVM Buy and Rent DecisionZahid Usman80% (5)

- FA DCF Modelling Test 1Document17 pagesFA DCF Modelling Test 1honeymakrani220% (1)

- Time Value of Money The Buy Versus Rent Decision - SolutionDocument5 pagesTime Value of Money The Buy Versus Rent Decision - Solutioncpsoni62% (13)

- Teaching Note - TIME VALUE OF MONEY - THE BUY VERSUS RENT DECISIONDocument9 pagesTeaching Note - TIME VALUE OF MONEY - THE BUY VERSUS RENT DECISIONANKIT AGARWAL100% (14)

- Time Value of Money The Buy Versus Rent Decision SolutionDocument5 pagesTime Value of Money The Buy Versus Rent Decision SolutionNida KhanNo ratings yet

- The Financial Detective CaseDocument6 pagesThe Financial Detective Caseashwini patilNo ratings yet

- Tme Value of MoneyDocument14 pagesTme Value of MoneyRichaBhartiya100% (2)

- Case Winston & HolmesDocument6 pagesCase Winston & HolmesAmitNo ratings yet

- Chapter - 7 - Solution Hull Option, Futures and Other DerivativesDocument3 pagesChapter - 7 - Solution Hull Option, Futures and Other DerivativesAn Kou0% (1)

- A. Calculate The Initial Investment Associated Wit...Document2 pagesA. Calculate The Initial Investment Associated Wit...avi dotto100% (1)

- TVM Buy DecisionDocument5 pagesTVM Buy DecisionGulfam Murtaza100% (2)

- Apple LBO ModelDocument34 pagesApple LBO ModelShawn PantophletNo ratings yet

- Case Study SpreadsheetDocument17 pagesCase Study SpreadsheetExpert Answers100% (1)

- Answers - Cost of Capital Wallmart Inc.Document11 pagesAnswers - Cost of Capital Wallmart Inc.Arslan HafeezNo ratings yet

- Time Value of Money The Buy Versus Rent Decision Student 1Document1 pageTime Value of Money The Buy Versus Rent Decision Student 1Cristhian Javier0% (1)

- Time Value of Money The Buy Versus Rent Decision Solution PDFDocument5 pagesTime Value of Money The Buy Versus Rent Decision Solution PDFMuhammad Ibtehash100% (1)

- CFM Question BankDocument17 pagesCFM Question BankAshish Babu MathewNo ratings yet

- IIMC Casebook 20-21Document105 pagesIIMC Casebook 20-21casanova mr100% (1)

- MoS Porcini Assignment - Group3 - Sec ADocument5 pagesMoS Porcini Assignment - Group3 - Sec AAshish Chauhan100% (1)

- Buy Vs Rent Decision - Case ExerciseDocument6 pagesBuy Vs Rent Decision - Case ExerciseLife saver100% (2)

- Snap Inc FinalDocument35 pagesSnap Inc Finalapi-461693941No ratings yet

- Mercury Athletic FootwearDocument9 pagesMercury Athletic Footwearandy117950% (2)

- Fin544 TUTORIAL and FormulaDocument9 pagesFin544 TUTORIAL and FormulaYumi MayNo ratings yet

- Part 1: Financial ForecastingDocument8 pagesPart 1: Financial ForecastingJustine CruzNo ratings yet

- Buy Vs Rent Decision Assignment Given DataDocument4 pagesBuy Vs Rent Decision Assignment Given DataMOVIES SHOPNo ratings yet

- Buy VS Rent ExcelDocument2 pagesBuy VS Rent ExcelGautam GulatiNo ratings yet

- Time Value of Money The Buy Versus Rent Decision Solution PDFDocument5 pagesTime Value of Money The Buy Versus Rent Decision Solution PDFMuhammad Ibtehash100% (1)

- Time Value of Money: The Buy Versus Rent Decision: InputDocument5 pagesTime Value of Money: The Buy Versus Rent Decision: InputAbdel Kader ChebliNo ratings yet

- Prasanna Chandra Financial ManagementDocument163 pagesPrasanna Chandra Financial ManagementVamsi GunturuNo ratings yet

- Bond ValuationDocument12 pagesBond ValuationvarunjajooNo ratings yet

- CummingmDocument259 pagesCummingmfasanoj5211No ratings yet

- Agent Assist - Real Estate Goal PlannerDocument37 pagesAgent Assist - Real Estate Goal PlannerGail ReevesNo ratings yet

- Buy or Lease and Amortization ScheduleDocument3 pagesBuy or Lease and Amortization ScheduleRowson AkterNo ratings yet

- RuchiDocument28 pagesRuchichowNo ratings yet

- University Tower Sample ComputationDocument4 pagesUniversity Tower Sample ComputationDexter AlilinNo ratings yet

- Buy Vs Rent Analysis For NYC Co-OpDocument9 pagesBuy Vs Rent Analysis For NYC Co-OpJordan BeeberNo ratings yet

- RE 01 03 Office Acquisition Case StudyDocument3 pagesRE 01 03 Office Acquisition Case StudyAnonymous bf1cFDuepPNo ratings yet

- Lending Vs BuyingDocument2 pagesLending Vs BuyingthegeekynoobNo ratings yet

- Case ProjectDocument11 pagesCase Projectapi-251521127No ratings yet

- SwapsDocument29 pagesSwapsDnyaneshNo ratings yet

- Lost Rabbit Final Model 2.1.14Document459 pagesLost Rabbit Final Model 2.1.14the kingfishNo ratings yet

- Financial Statement Analysis Ticker: Periodicity: Annuals Filing: Filing: For The Period Ending 2009-12-30 2010-12-30Document19 pagesFinancial Statement Analysis Ticker: Periodicity: Annuals Filing: Filing: For The Period Ending 2009-12-30 2010-12-30Mohammad ShahraeeniNo ratings yet

- Operating Activities Direct MethodDocument3 pagesOperating Activities Direct MethodGilbert KunongaNo ratings yet

- Purchase or Rent Analysis: Inputs Present Worth AnalysisDocument1 pagePurchase or Rent Analysis: Inputs Present Worth AnalysisCalvin WindoroNo ratings yet

- Renfro Square InvestmentDocument4 pagesRenfro Square InvestmentVurdalack666No ratings yet

- Project 4 - Forecasting Financial StatementsDocument56 pagesProject 4 - Forecasting Financial StatementsTulasi ReddyNo ratings yet

- Cost of Building Interest Rate 10% Loan Period 25Document3 pagesCost of Building Interest Rate 10% Loan Period 25HelplineNo ratings yet

- House Rent Versus Buy Analyzer: DisclaimerDocument10 pagesHouse Rent Versus Buy Analyzer: DisclaimersandrogrNo ratings yet

- Exhibit 6.3 Margin Money For Working CapitalDocument12 pagesExhibit 6.3 Margin Money For Working Capitalanon_285857320No ratings yet

- Excel TemplateDocument48 pagesExcel TemplateigfhlkasNo ratings yet

- Analyse Equip09Document10 pagesAnalyse Equip09Aqeel ChaudhryNo ratings yet

- Financial Model - 225 East 13th Street, New YorkDocument13 pagesFinancial Model - 225 East 13th Street, New YorkAliHaidar85100% (2)

- Answer-Lease Vs BuyDocument2 pagesAnswer-Lease Vs BuyAshwin KumarNo ratings yet

- Assignment 3 Student Copy 3659645125042566Document1 pageAssignment 3 Student Copy 3659645125042566John DembaNo ratings yet

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745No ratings yet

- IAS Changes2Document3 pagesIAS Changes2johnny458No ratings yet

- Purchase or Rent Analysis: Inputs Present Worth AnalysisDocument1 pagePurchase or Rent Analysis: Inputs Present Worth AnalysisheissenriyadhovicNo ratings yet

- Session3 - Introduction To FSDocument3 pagesSession3 - Introduction To FSSahoo SKNo ratings yet

- Asset: Exercise 1. Project Cost and Disbursement Schedule (In Thousand)Document12 pagesAsset: Exercise 1. Project Cost and Disbursement Schedule (In Thousand)kjmarts08No ratings yet

- Balance Sheet Assets LiabilitiesDocument4 pagesBalance Sheet Assets LiabilitiesDivyanshu KumarNo ratings yet

- Pro Forma Financial Statements4Document50 pagesPro Forma Financial Statements4SakibMDShafiuddinNo ratings yet

- Cash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business ManagementDocument20 pagesCash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business Managementaftabkhan21No ratings yet

- Case Study - Leasing VsDocument2 pagesCase Study - Leasing VssaadsaaidNo ratings yet

- HF Calculator (UMI)Document18 pagesHF Calculator (UMI)hasan_siddiqui_15No ratings yet

- Real Estate InvestingDocument32 pagesReal Estate InvestingRudra SinghNo ratings yet

- WhirlpoolDocument8 pagesWhirlpoolUmer TahirNo ratings yet

- FCFF Ni+Dep Netwc CapexDocument4 pagesFCFF Ni+Dep Netwc CapexUmer TahirNo ratings yet

- Cash Flow For Changchun Joint Venture: 1994 1995 1996 1997 Net IncomeDocument3 pagesCash Flow For Changchun Joint Venture: 1994 1995 1996 1997 Net IncomeUmer TahirNo ratings yet

- Personal Information: QuestionnaireDocument3 pagesPersonal Information: QuestionnaireUmer TahirNo ratings yet

- NEW Company: New Company New Company New Company New Company New Company New Company New Company New CompanyDocument1 pageNEW Company: New Company New Company New Company New Company New Company New Company New Company New CompanyUmer TahirNo ratings yet

- Age: Class: Reference No.: 14 - Q1Document2 pagesAge: Class: Reference No.: 14 - Q1Umer TahirNo ratings yet

- Muhammad Umer Tahir CVDocument2 pagesMuhammad Umer Tahir CVUmer TahirNo ratings yet

- ACF (Umer)Document10 pagesACF (Umer)Umer TahirNo ratings yet

- Assignment Brief TaxationsDocument11 pagesAssignment Brief TaxationsUmer TahirNo ratings yet

- VVVV V VV VVVVVVVV !"# $%&' (V###'# $%&' (Document9 pagesVVVV V VV VVVVVVVV !"# $%&' (V###'# $%&' (Shakir GbeckNo ratings yet

- Chapter 2 Chloride ZimbabweDocument15 pagesChapter 2 Chloride ZimbabweKudzai A. ZuroNo ratings yet

- Profile On The Production of Mosaic TilesDocument26 pagesProfile On The Production of Mosaic TilesabateNo ratings yet

- Net Present Value (NPV) : Calculation Methods and FormulasDocument3 pagesNet Present Value (NPV) : Calculation Methods and FormulasmariumNo ratings yet

- Chapter 13 Equity ValuationDocument28 pagesChapter 13 Equity ValuationSakthi PriyadharshiniNo ratings yet

- Chapter 9 - Economic AnalysislDocument13 pagesChapter 9 - Economic AnalysislPDPPPMAT0621 Ruhilin Binti NasserNo ratings yet

- Huaneng Shandong Ruyi (Pakistan) Energy PVTDocument13 pagesHuaneng Shandong Ruyi (Pakistan) Energy PVTHumaira AtharNo ratings yet

- BAII Plus Professional TutorialDocument22 pagesBAII Plus Professional TutorialOladipupo Mayowa PaulNo ratings yet

- Chapter 1 IntroductionDocument60 pagesChapter 1 IntroductionMahamoud HassenNo ratings yet

- Chap 04 Answerkey Test Bank Answer KeyDocument59 pagesChap 04 Answerkey Test Bank Answer KeyQuỳnh Giao TôNo ratings yet

- Course: MBA 546 (International Financial Management) : Independent University, BangladeshDocument15 pagesCourse: MBA 546 (International Financial Management) : Independent University, Bangladeshmohiuddin alamgirNo ratings yet

- Euro 3 Vs Euro 4 AnalysisDocument27 pagesEuro 3 Vs Euro 4 AnalysisSunny DesharNo ratings yet

- Abe 130 Laboratory Exercise 1Document14 pagesAbe 130 Laboratory Exercise 1Kailah BayangosNo ratings yet

- CA 51014 - Strategic Cost Management Capital BudgetingDocument9 pagesCA 51014 - Strategic Cost Management Capital BudgetingMark FloresNo ratings yet

- Capital Budgeting TechniquesDocument60 pagesCapital Budgeting Techniquesaxl11No ratings yet

- Sensitivity AnalysisDocument23 pagesSensitivity AnalysisKamrul Hasan0% (1)

- Capital BudgetingDocument28 pagesCapital BudgetingnishantNo ratings yet

- AJAZ ALI KHAN Secy Coal & Energy Dept. Sindh Govt., Thar CoalDocument19 pagesAJAZ ALI KHAN Secy Coal & Energy Dept. Sindh Govt., Thar CoalHasnain GoharNo ratings yet

- Product Design and Development: Fifth EditionDocument8 pagesProduct Design and Development: Fifth EditionCPNS SuksesNo ratings yet

- Mining Valuation Lesson: Cut-Off Grade Theory and Practice: 04 Dec 2011 Comment: 0Document8 pagesMining Valuation Lesson: Cut-Off Grade Theory and Practice: 04 Dec 2011 Comment: 0davidchaileNo ratings yet

- 81990404234Document2 pages81990404234hailatm27No ratings yet

- Strategic Technology Management - Weeks 5-9-2015Document97 pagesStrategic Technology Management - Weeks 5-9-2015Orabi SaffariniNo ratings yet

- NFJPIA - Mockboard 2011 - MAS PDFDocument7 pagesNFJPIA - Mockboard 2011 - MAS PDFAbigail Faye RoxasNo ratings yet

- CR Sample L6 Module 2 PDFDocument4 pagesCR Sample L6 Module 2 PDFDavid JonathanNo ratings yet

- Risk Analysis in Capital BudgetingDocument40 pagesRisk Analysis in Capital BudgetingNicola Love100% (1)