Professional Documents

Culture Documents

CHP 15

CHP 15

Uploaded by

Czarina CasallaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHP 15

CHP 15

Uploaded by

Czarina CasallaCopyright:

Available Formats

107

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 15: Withholding Taxes

CHAPTER 15

WITHHOLDING TAXES

Problem 14 1 TRUE OR FALSE

1. True

2. True

3. True

4. True

5. False final withholding taxes are not creditable.

6. False the tax is final tax, hence not required to file an income tax return.

7. False Business income is an income earned but not all subject to expanded

withholding tax.

8. True

9. True

10. True

11. True

12. False all payments made by the government are net of withholding taxes.

13. True

14. True

15. True

Problem 14 2

C

Share from the professional partnership (P500,000 x 50%)

Less: Creditable withholding tax (P250,000 x 10%)

Amount received, net of withholding tax

P250,000

25,000

P225,000

Problem 14 3

D

Dividend income (P10 x 10,000)

Less: Withholding tax on dividends income of NRFC (30%)

Dividend income, net of withholding tax

P 100,000

30,000

P 70,000

Problem 14 4

C

Lease income

Less: Withholding tax (P500,000 x 4.5%)

Lease income, net of withholding tax

P 500,000

22,500

P 477,500

Problem 14 5

B

Tax informers fee

Less: Withholding tax (P1,000,000 x 10%)

Tax informers fee, net of withholding tax

P1,000,000

100,000

P 900,000

108

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 15: Withholding Taxes

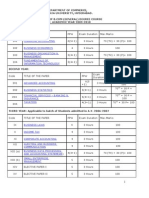

Problem 14 6

a.

b.

c.

d.

SOLUTIONS

Resident Citizen or Resident Alien

1. Interest on bank deposits

a. Peso deposits

b. Dollar account (FCDS)

2. Prize

3. Royalties on books

4. Capital gains on sale of real property

5. Property dividends

6. Compensation from OBU

Nonresident Alien engaged in business

1. Interest on bank deposits

a. Peso deposits

b. Dollar account (FCDS)

2. Prize

3. Royalties on books

4. Capital gains on sale of real property

5. Property dividends

6. Compensation from OBU

Nonresident Alien not engaged in business

1. Interest on bank deposits

a. Peso deposits

b. Dollar account

2. Prize

3. Royalties on books

4. Capital gains on sale of real property

5. Property dividends

6. Compensation from OBU

Domestic Corporation

1. Interest on bank deposits

a. Peso deposits

b. Dollar account

2. Prize

3. Royalties on books

4. Capital gains on sale of property

5. Property dividends

(P 50,000 x 20%)

($ 10,000 x 7.5%)

(P100,000 x 20%)

(P300,000 x 10%)

(P1,000,000 x 6%)

(P120,000 x 10%)

(P400,000 x 15%)

P10,000

$

750

P20,000

P30,000

P60,000

P12,000

P60,000

(P 50,000 x 20%)

P10,000

Exempt

P20,000

P30,000

P60,000

P24,000

P60,000

(P100,000 x 20%)

(P300,000 x 10%)

(P1,000,000 x 6%)

(P120,000 x 20%)

(P400,000 x 15%)

(P 50,000 x 25%)

(P100,000 x 25%)

(P300,000 x 25%)

(P1,000,000 x 6%)

(P120,000 x 25%)

(P400,000 x 15%)

(P 50,000 x 20%)

($ 10,000 x 7.5%)

(P300,000 x 20%)

(P200,000 x 6%)

P12,500

Exempt

P25,000

P75,000

P60,000

P30,000

P60,000

P10,000

$ 750

N/A

P60,000

P12,000

Exempt

109

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 15: Withholding Taxes

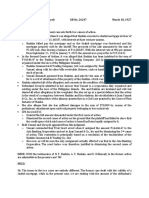

6. Compensation from OBU

e.

f.

Resident Foreign Corporation

1. Interest on bank deposits

a. Peso deposits

b. Dollar account

2. Prize

3. Royalties on books

4. Capital gains on sale of property

5. Property dividends

6. Compensation from OBU

Nonresident Foreign Corporation

1. Interest on bank deposits

a. Peso deposits

b. Dollar account

2. Prize

3. Royalties on books

4. Capital gains on sale of property

5. Property dividends

6. Compensation from OBU

N/A

(P 50,000 x 20%)

($ 10,000 x 7.5%)

(P300,000 x 20%)

(P 50,000 x 30%)

(P100,000 x 30%)

(P300,000 x 30%)

(P120,000 x 30%)

P10,000

$ 750

N/A

P60,000

N/A

Exempt

N/A

P15,000

Exempt

P30,000

P90,000

N/A

P36,000

N/A

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- Solution Manual For Financial Reporting and Analysis 7th Edition by RevsineDocument33 pagesSolution Manual For Financial Reporting and Analysis 7th Edition by Revsinea619353646100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- (Gen) I, II, III Structure and Syllabus For 2008-091Document49 pages(Gen) I, II, III Structure and Syllabus For 2008-091Shuja EraNo ratings yet

- An Overview of Financial Management: Multiple Choice: ConceptualDocument15 pagesAn Overview of Financial Management: Multiple Choice: ConceptualApril Isidro0% (1)

- Chap 005 StudentsDocument24 pagesChap 005 StudentsAlex BenyayevNo ratings yet

- Weston Oil Gas Fund Prospectus PDFDocument34 pagesWeston Oil Gas Fund Prospectus PDFBubune KofiNo ratings yet

- Chapt-12 Income Tax - CorporationsDocument8 pagesChapt-12 Income Tax - Corporationshumnarvios86% (7)

- Chapt-11 Income Tax - IndividualsDocument10 pagesChapt-11 Income Tax - Individualshumnarvios100% (4)

- Chapt-13 Income Taxes - Partnerships, Estates & TrustsDocument11 pagesChapt-13 Income Taxes - Partnerships, Estates & Trustshumnarvios100% (6)

- Chapt-7 Dealings in PropDocument14 pagesChapt-7 Dealings in Prophumnarvios0% (1)

- Chapt-6 FB TaxDocument8 pagesChapt-6 FB Taxhumnarvios50% (4)

- Chapt-10 Basic Tax PatternsDocument4 pagesChapt-10 Basic Tax Patternshumnarvios100% (3)

- Chapt - 9 LossesDocument3 pagesChapt - 9 LosseshumnarviosNo ratings yet

- Chapt-3 Concepts of IncomeDocument4 pagesChapt-3 Concepts of Incomehumnarvios50% (2)

- Chapt-5 Exclude From Gross IncomeDocument4 pagesChapt-5 Exclude From Gross IncomehumnarviosNo ratings yet

- Chapt-2 Tax AdminDocument7 pagesChapt-2 Tax Admingiopar08100% (1)

- Non-Current Assets Held For Sale and Discontinued OperationsDocument19 pagesNon-Current Assets Held For Sale and Discontinued OperationshumnarviosNo ratings yet

- Chapt-1 Gen. PrinDocument2 pagesChapt-1 Gen. Pringiopar0850% (4)

- Interim Financial Reporting: International Accounting Standard 34Document16 pagesInterim Financial Reporting: International Accounting Standard 34humnarviosNo ratings yet

- Gross Income: Income Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersDocument7 pagesGross Income: Income Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersAnonymous qpUaTkNo ratings yet

- Ifrs 9Document28 pagesIfrs 9ahusain21No ratings yet

- International Financial Reporting Standard 4Document29 pagesInternational Financial Reporting Standard 4PlatonicNo ratings yet

- Ifrs 2Document42 pagesIfrs 2Muhammad UsmanNo ratings yet

- Operating Segments: International Financial Reporting Standard 8Document18 pagesOperating Segments: International Financial Reporting Standard 8humnarviosNo ratings yet

- Related Party Disclosures: International Accounting Standard 24Document12 pagesRelated Party Disclosures: International Accounting Standard 24humnarviosNo ratings yet

- Magdalena Estates Inc Vs RodriguezDocument1 pageMagdalena Estates Inc Vs RodriguezCass ParkNo ratings yet

- Title 24: Previous ChapterDocument48 pagesTitle 24: Previous ChapterShepherd NhangaNo ratings yet

- PR-Akuntansi Manufaktur - RevisiDocument4 pagesPR-Akuntansi Manufaktur - Revisisafira annisaNo ratings yet

- Carandang V Heirs of de GuzmanDocument2 pagesCarandang V Heirs of de GuzmanTriccie Coleen MangueraNo ratings yet

- So Now You Are A Personal RepresentativeDocument2 pagesSo Now You Are A Personal Representativepuchee100% (1)

- Sample Family Financial Plan: Prepared ForDocument22 pagesSample Family Financial Plan: Prepared ForShresth KotishNo ratings yet

- General Banking On FSIBDocument12 pagesGeneral Banking On FSIBMituNo ratings yet

- International Finance ECON 243 - Summer I, 2005 Prof. Steve CunninghamDocument37 pagesInternational Finance ECON 243 - Summer I, 2005 Prof. Steve Cunninghamnitin_usmsNo ratings yet

- Establish A New Commercial BankDocument60 pagesEstablish A New Commercial Bankmamun322No ratings yet

- Property Ampil Accession Charts C 1 1Document3 pagesProperty Ampil Accession Charts C 1 1ChaNo ratings yet

- Government Securities Market-Rbi FaqsDocument87 pagesGovernment Securities Market-Rbi FaqsAbhishek PubbisettyNo ratings yet

- Bay Bitaman Ajil ApplicationDocument29 pagesBay Bitaman Ajil Applicationproffina786No ratings yet

- Aud Rev - Accounts ReceivableDocument4 pagesAud Rev - Accounts ReceivablexjammerNo ratings yet

- Verka PlantDocument51 pagesVerka PlantAshish ChaudhaRyNo ratings yet

- Airtel Bill HimachalDocument1 pageAirtel Bill HimachalAnkush SachdevaNo ratings yet

- Olesen 2012 PDFDocument3 pagesOlesen 2012 PDFKaren KleissNo ratings yet

- Chino Materials Systems Capital Budgeting SolutionDocument12 pagesChino Materials Systems Capital Budgeting Solutionalka murarka100% (1)

- BPI Vs CADocument2 pagesBPI Vs CAmoniquehadjirulNo ratings yet

- Commercial Bank of CeylonDocument12 pagesCommercial Bank of Ceylonpavel4570250% (1)

- All Chapter QuizDocument32 pagesAll Chapter QuizRebecaNo ratings yet

- POWER HOME VANILLA BRE-unlockedDocument2 pagesPOWER HOME VANILLA BRE-unlockedvaraprasadNo ratings yet

- Unit 3Document64 pagesUnit 3Senthil JS0% (1)

- Frsa Module III Problems SolutionsDocument34 pagesFrsa Module III Problems Solutionsaijaz ahmed nagthan01No ratings yet

- Financial SecuritiesDocument5 pagesFinancial SecuritiesVinay SurendraNo ratings yet

- Exercise of Project Financial Appraisal The Hydrolyzed Protein Factory Construction Project 1. Overview of The ProjectDocument3 pagesExercise of Project Financial Appraisal The Hydrolyzed Protein Factory Construction Project 1. Overview of The ProjectNhan Thien NhuNo ratings yet

- Ysmael V HashimDocument2 pagesYsmael V HashimGenevieve Kristine ManalacNo ratings yet