Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

18 viewsProcedure in Protest Cases - TCC

Procedure in Protest Cases - TCC

Uploaded by

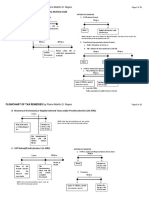

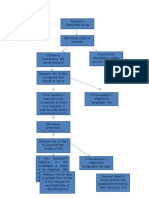

attyaarongocpa9645The document outlines the procedure for protest cases regarding tariffs and customs codes. It begins by stating that the Collector of Customs assesses, liquidates, and collects customs duties. An adversely affected party may then file a written protest within 15 days of payment. A hearing will be conducted within 15 days of receiving the protest, and the collector must decide the case within 30 days of the hearing ending. The process then describes the various steps and options for appeal if a decision is adverse to either party, working its way up from the commissioner to the Court of Tax Appeals to the Supreme Court if necessary.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Tax Remedies SummaryDocument6 pagesTax Remedies Summarypja_14100% (2)

- Flowchart of Tax RemediesDocument3 pagesFlowchart of Tax RemediesPetrovich Tamag50% (4)

- TaxationBarQ26A TaxRemediesDocument32 pagesTaxationBarQ26A TaxRemediesCire Gee100% (2)

- Flowchart Remedies of A TaxpayerDocument2 pagesFlowchart Remedies of A TaxpayerRab Thomas BartolomeNo ratings yet

- Quick Rundown of The Protest ProcedureDocument5 pagesQuick Rundown of The Protest ProcedureYasha Min HNo ratings yet

- Question The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealDocument3 pagesQuestion The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealMowie AngelesNo ratings yet

- Tax Remedies: (Lecture Notes)Document27 pagesTax Remedies: (Lecture Notes)WilsonNo ratings yet

- Summary Appeals: Sajawal BappiDocument3 pagesSummary Appeals: Sajawal BappiKamran RasoolNo ratings yet

- Tax Remedies and IncrementsDocument16 pagesTax Remedies and Incrementscobe.johnmark.cecilioNo ratings yet

- 15 27Document5 pages15 27aljazzerusadNo ratings yet

- Flowchart TaxremDocument6 pagesFlowchart TaxremYohanna J K GarcesNo ratings yet

- Procedures On Issuance of Deficiency Tax AssessmentDocument15 pagesProcedures On Issuance of Deficiency Tax AssessmentmirabelvidalNo ratings yet

- Tax AssessmentDocument11 pagesTax AssessmentRon VillanuevaNo ratings yet

- Jurisdiction of The Court of Tax AppealDocument2 pagesJurisdiction of The Court of Tax AppealJenny JspNo ratings yet

- 180-Day Period On Tax AssessmentDocument6 pages180-Day Period On Tax AssessmentRowie DomingoNo ratings yet

- Tax Flowchart Remedies (Tokie)Document9 pagesTax Flowchart Remedies (Tokie)Tokie TokiNo ratings yet

- TaxationBarQ26A TaxRemediesDocument32 pagesTaxationBarQ26A TaxRemediesjuneson agustinNo ratings yet

- Remedies 1 AssessmentDocument1 pageRemedies 1 AssessmentBetson CajayonNo ratings yet

- Flowchart of Tax RemediesDocument3 pagesFlowchart of Tax RemediesJunivenReyUmadhayNo ratings yet

- Train LawDocument3 pagesTrain LawREVERITA BUGTONGNo ratings yet

- BIR AssessmentDocument2 pagesBIR AssessmentambonulanNo ratings yet

- Tax RemediesDocument8 pagesTax RemediesJade BelenNo ratings yet

- GROUP 1 Tax RemediesDocument6 pagesGROUP 1 Tax RemediesEunice Kalaw VargasNo ratings yet

- Tax RemediesDocument6 pagesTax RemediesArielle CabritoNo ratings yet

- Return of Income - S 114 To 119Document4 pagesReturn of Income - S 114 To 119khanNo ratings yet

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- Second Tax Coursework ATTEMPTEDDocument8 pagesSecond Tax Coursework ATTEMPTEDMAGOMU DAN DAVIDNo ratings yet

- (Tax Refunds & Remedies) : Saint Louis University School of LawDocument5 pages(Tax Refunds & Remedies) : Saint Louis University School of LawSui JurisNo ratings yet

- Tax Finals ReviewerDocument20 pagesTax Finals ReviewerCookie MasterNo ratings yet

- Tax RemediesDocument19 pagesTax Remediesstannis69420No ratings yet

- Tax Finals 1Document1 pageTax Finals 1Sang'gre JoahnaNo ratings yet

- Joshua Razen E. Nolsol BSA 2-2 Assignment No. 6Document14 pagesJoshua Razen E. Nolsol BSA 2-2 Assignment No. 6Mary Christine Formiloza MacalinaoNo ratings yet

- 9 12 SAT (Afternoon)Document8 pages9 12 SAT (Afternoon)Daryl Noel TejanoNo ratings yet

- for ankiDocument10 pagesfor ankiRuiz, CherryjaneNo ratings yet

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimNo ratings yet

- G.R. No. 175097 Allied Banking Corporation, Petitioner, vs. Commissioner of Internal Revenue, Respondent. Del Castillo, J.Document2 pagesG.R. No. 175097 Allied Banking Corporation, Petitioner, vs. Commissioner of Internal Revenue, Respondent. Del Castillo, J.thelionleo1No ratings yet

- Tax RemediesDocument6 pagesTax RemediesPATRICIA ANGELICA VINUYANo ratings yet

- Cir v. BpiDocument1 pageCir v. BpiluckyNo ratings yet

- W12-Module Penalties and Remedies of The Taxpayer - PPTDocument20 pagesW12-Module Penalties and Remedies of The Taxpayer - PPTDanica VetuzNo ratings yet

- TAX REMEDIES by Sababan Reviewer 2008 EdDocument10 pagesTAX REMEDIES by Sababan Reviewer 2008 EdNayadNo ratings yet

- TAXATION LAW REVIEW. Sababan. 2008 Ed. PPG 181-200: A.The Remedies of The GovernmentDocument9 pagesTAXATION LAW REVIEW. Sababan. 2008 Ed. PPG 181-200: A.The Remedies of The GovernmentRein DrewNo ratings yet

- A. Individuals:: 1. Citizens of The PhilippinesDocument5 pagesA. Individuals:: 1. Citizens of The PhilippinesRaymond FaeldoñaNo ratings yet

- Exercise RemediesDocument9 pagesExercise RemediesJazzd Sy GregorioNo ratings yet

- Appeal Procedure Income TaxDocument45 pagesAppeal Procedure Income Taxtksdrb100% (1)

- QuizzerDocument3 pagesQuizzerRyan Prado AndayaNo ratings yet

- AJJJJJJJJJJJJJJJDocument2 pagesAJJJJJJJJJJJJJJJanthony paduaNo ratings yet

- Appealing BIR Assessment at The CTADocument1 pageAppealing BIR Assessment at The CTAhenzencameroNo ratings yet

- Service Tax Recovery CircularDocument9 pagesService Tax Recovery CircularsrinivaspanchakarlaNo ratings yet

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimNo ratings yet

- Tax Refund/Tax Credit (Sec. 229 Nirc)Document1 pageTax Refund/Tax Credit (Sec. 229 Nirc)MonalieNo ratings yet

- Chapter 18 - Tax Remedies: Multiple Choice - Theory 1Document12 pagesChapter 18 - Tax Remedies: Multiple Choice - Theory 1Emmanuel PenullarNo ratings yet

- Philippine Taxation 101Document2 pagesPhilippine Taxation 101Allan SantosNo ratings yet

- Tax Remidies of The TaxpayerDocument8 pagesTax Remidies of The TaxpayerNikki Coleen SantinNo ratings yet

- Part I. Chapter 8 Taxpayer's RemediesDocument16 pagesPart I. Chapter 8 Taxpayer's RemediesFunyoungNo ratings yet

- Tax Remedies: Statute of Limitation/Prescriptive PeriodDocument3 pagesTax Remedies: Statute of Limitation/Prescriptive PeriodMary Christine Formiloza MacalinaoNo ratings yet

- BarksDocument45 pagesBarksKaye Alyssa EnriquezNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

Procedure in Protest Cases - TCC

Procedure in Protest Cases - TCC

Uploaded by

attyaarongocpa96450 ratings0% found this document useful (0 votes)

18 views2 pagesThe document outlines the procedure for protest cases regarding tariffs and customs codes. It begins by stating that the Collector of Customs assesses, liquidates, and collects customs duties. An adversely affected party may then file a written protest within 15 days of payment. A hearing will be conducted within 15 days of receiving the protest, and the collector must decide the case within 30 days of the hearing ending. The process then describes the various steps and options for appeal if a decision is adverse to either party, working its way up from the commissioner to the Court of Tax Appeals to the Supreme Court if necessary.

Original Description:

Original Title

Procedure in Protest Cases - Tcc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the procedure for protest cases regarding tariffs and customs codes. It begins by stating that the Collector of Customs assesses, liquidates, and collects customs duties. An adversely affected party may then file a written protest within 15 days of payment. A hearing will be conducted within 15 days of receiving the protest, and the collector must decide the case within 30 days of the hearing ending. The process then describes the various steps and options for appeal if a decision is adverse to either party, working its way up from the commissioner to the Court of Tax Appeals to the Supreme Court if necessary.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views2 pagesProcedure in Protest Cases - TCC

Procedure in Protest Cases - TCC

Uploaded by

attyaarongocpa9645The document outlines the procedure for protest cases regarding tariffs and customs codes. It begins by stating that the Collector of Customs assesses, liquidates, and collects customs duties. An adversely affected party may then file a written protest within 15 days of payment. A hearing will be conducted within 15 days of receiving the protest, and the collector must decide the case within 30 days of the hearing ending. The process then describes the various steps and options for appeal if a decision is adverse to either party, working its way up from the commissioner to the Court of Tax Appeals to the Supreme Court if necessary.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

TARIFF AND CUSTOMS CODE REMEDIES

ATTY. AARON DY GO, CPA

PROCEDURE IN PROTEST CASES

Collector of Customs shall assess, liquidate, and collect the customs duties.

The party adversely affected may file a written protest with the collector with 15 days from payment.

Hearing will be conducted within 15 days from receipt of the protest. The collector shall decide the case within 30 days from the termination

of the hearing.

Decision

Decision is adverse to protestant

Decision is adverse to Government

Appeal to the Commissioner within

Review by the Commissioner

15 days from notice

Decision is adverse to protestant

Decision is adverse to the Government

Decision is adverse to the Government

Automatic

Decision is adverse to the protestant

Appeal to CTA Division within

Automatic review by the Secretary of Finance

Automatic review by the Secretary of Finance

30 days from notice.

Appeal to CTA Division within

CTA Division denies the protest

Decision is adverse to the Government,

Decision is adverse to the Government,

File a motion for reconsideration

Decision is final and executory.

Decision is final and executory.

within 15 days from receipt of the

decision

CTA Division denies the protest

Motion for reconsideration is denied.

Appeal to CTA en banc within 15 days

30 days from notice.

File a motion for reconsideration

within 15 days from receipt of the

decision

Motion for reconsideration is denied.

Appeal to CTA en banc within 15 days

TARIFF AND CUSTOMS CODE REMEDIES

ATTY. AARON DY GO, CPA

from receipt of decision.

Decision is adverse to protestant,

Appeal by Certiorari with the SC

within 15 days from notice.

from receipt of decision.

Decision is adverse to protestant,

Appeal by Certiorari with the SC

within 15 days from notice.

You might also like

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Tax Remedies SummaryDocument6 pagesTax Remedies Summarypja_14100% (2)

- Flowchart of Tax RemediesDocument3 pagesFlowchart of Tax RemediesPetrovich Tamag50% (4)

- TaxationBarQ26A TaxRemediesDocument32 pagesTaxationBarQ26A TaxRemediesCire Gee100% (2)

- Flowchart Remedies of A TaxpayerDocument2 pagesFlowchart Remedies of A TaxpayerRab Thomas BartolomeNo ratings yet

- Quick Rundown of The Protest ProcedureDocument5 pagesQuick Rundown of The Protest ProcedureYasha Min HNo ratings yet

- Question The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealDocument3 pagesQuestion The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealMowie AngelesNo ratings yet

- Tax Remedies: (Lecture Notes)Document27 pagesTax Remedies: (Lecture Notes)WilsonNo ratings yet

- Summary Appeals: Sajawal BappiDocument3 pagesSummary Appeals: Sajawal BappiKamran RasoolNo ratings yet

- Tax Remedies and IncrementsDocument16 pagesTax Remedies and Incrementscobe.johnmark.cecilioNo ratings yet

- 15 27Document5 pages15 27aljazzerusadNo ratings yet

- Flowchart TaxremDocument6 pagesFlowchart TaxremYohanna J K GarcesNo ratings yet

- Procedures On Issuance of Deficiency Tax AssessmentDocument15 pagesProcedures On Issuance of Deficiency Tax AssessmentmirabelvidalNo ratings yet

- Tax AssessmentDocument11 pagesTax AssessmentRon VillanuevaNo ratings yet

- Jurisdiction of The Court of Tax AppealDocument2 pagesJurisdiction of The Court of Tax AppealJenny JspNo ratings yet

- 180-Day Period On Tax AssessmentDocument6 pages180-Day Period On Tax AssessmentRowie DomingoNo ratings yet

- Tax Flowchart Remedies (Tokie)Document9 pagesTax Flowchart Remedies (Tokie)Tokie TokiNo ratings yet

- TaxationBarQ26A TaxRemediesDocument32 pagesTaxationBarQ26A TaxRemediesjuneson agustinNo ratings yet

- Remedies 1 AssessmentDocument1 pageRemedies 1 AssessmentBetson CajayonNo ratings yet

- Flowchart of Tax RemediesDocument3 pagesFlowchart of Tax RemediesJunivenReyUmadhayNo ratings yet

- Train LawDocument3 pagesTrain LawREVERITA BUGTONGNo ratings yet

- BIR AssessmentDocument2 pagesBIR AssessmentambonulanNo ratings yet

- Tax RemediesDocument8 pagesTax RemediesJade BelenNo ratings yet

- GROUP 1 Tax RemediesDocument6 pagesGROUP 1 Tax RemediesEunice Kalaw VargasNo ratings yet

- Tax RemediesDocument6 pagesTax RemediesArielle CabritoNo ratings yet

- Return of Income - S 114 To 119Document4 pagesReturn of Income - S 114 To 119khanNo ratings yet

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- Second Tax Coursework ATTEMPTEDDocument8 pagesSecond Tax Coursework ATTEMPTEDMAGOMU DAN DAVIDNo ratings yet

- (Tax Refunds & Remedies) : Saint Louis University School of LawDocument5 pages(Tax Refunds & Remedies) : Saint Louis University School of LawSui JurisNo ratings yet

- Tax Finals ReviewerDocument20 pagesTax Finals ReviewerCookie MasterNo ratings yet

- Tax RemediesDocument19 pagesTax Remediesstannis69420No ratings yet

- Tax Finals 1Document1 pageTax Finals 1Sang'gre JoahnaNo ratings yet

- Joshua Razen E. Nolsol BSA 2-2 Assignment No. 6Document14 pagesJoshua Razen E. Nolsol BSA 2-2 Assignment No. 6Mary Christine Formiloza MacalinaoNo ratings yet

- 9 12 SAT (Afternoon)Document8 pages9 12 SAT (Afternoon)Daryl Noel TejanoNo ratings yet

- for ankiDocument10 pagesfor ankiRuiz, CherryjaneNo ratings yet

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimNo ratings yet

- G.R. No. 175097 Allied Banking Corporation, Petitioner, vs. Commissioner of Internal Revenue, Respondent. Del Castillo, J.Document2 pagesG.R. No. 175097 Allied Banking Corporation, Petitioner, vs. Commissioner of Internal Revenue, Respondent. Del Castillo, J.thelionleo1No ratings yet

- Tax RemediesDocument6 pagesTax RemediesPATRICIA ANGELICA VINUYANo ratings yet

- Cir v. BpiDocument1 pageCir v. BpiluckyNo ratings yet

- W12-Module Penalties and Remedies of The Taxpayer - PPTDocument20 pagesW12-Module Penalties and Remedies of The Taxpayer - PPTDanica VetuzNo ratings yet

- TAX REMEDIES by Sababan Reviewer 2008 EdDocument10 pagesTAX REMEDIES by Sababan Reviewer 2008 EdNayadNo ratings yet

- TAXATION LAW REVIEW. Sababan. 2008 Ed. PPG 181-200: A.The Remedies of The GovernmentDocument9 pagesTAXATION LAW REVIEW. Sababan. 2008 Ed. PPG 181-200: A.The Remedies of The GovernmentRein DrewNo ratings yet

- A. Individuals:: 1. Citizens of The PhilippinesDocument5 pagesA. Individuals:: 1. Citizens of The PhilippinesRaymond FaeldoñaNo ratings yet

- Exercise RemediesDocument9 pagesExercise RemediesJazzd Sy GregorioNo ratings yet

- Appeal Procedure Income TaxDocument45 pagesAppeal Procedure Income Taxtksdrb100% (1)

- QuizzerDocument3 pagesQuizzerRyan Prado AndayaNo ratings yet

- AJJJJJJJJJJJJJJJDocument2 pagesAJJJJJJJJJJJJJJJanthony paduaNo ratings yet

- Appealing BIR Assessment at The CTADocument1 pageAppealing BIR Assessment at The CTAhenzencameroNo ratings yet

- Service Tax Recovery CircularDocument9 pagesService Tax Recovery CircularsrinivaspanchakarlaNo ratings yet

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimNo ratings yet

- Tax Refund/Tax Credit (Sec. 229 Nirc)Document1 pageTax Refund/Tax Credit (Sec. 229 Nirc)MonalieNo ratings yet

- Chapter 18 - Tax Remedies: Multiple Choice - Theory 1Document12 pagesChapter 18 - Tax Remedies: Multiple Choice - Theory 1Emmanuel PenullarNo ratings yet

- Philippine Taxation 101Document2 pagesPhilippine Taxation 101Allan SantosNo ratings yet

- Tax Remidies of The TaxpayerDocument8 pagesTax Remidies of The TaxpayerNikki Coleen SantinNo ratings yet

- Part I. Chapter 8 Taxpayer's RemediesDocument16 pagesPart I. Chapter 8 Taxpayer's RemediesFunyoungNo ratings yet

- Tax Remedies: Statute of Limitation/Prescriptive PeriodDocument3 pagesTax Remedies: Statute of Limitation/Prescriptive PeriodMary Christine Formiloza MacalinaoNo ratings yet

- BarksDocument45 pagesBarksKaye Alyssa EnriquezNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)