Professional Documents

Culture Documents

Cash Distribution Plan

Cash Distribution Plan

Uploaded by

Jose MataloOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Distribution Plan

Cash Distribution Plan

Uploaded by

Jose MataloCopyright:

Available Formats

Cash Distribution Plan

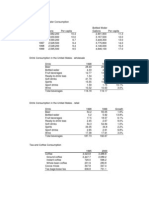

Adams, Peters, and Blake share profits and losses for their APB Partnership in a ratio

of 2:3:5.

When they decide to liquidate, the balance sheet is as follows:

Assets Liabilities and Equities

Cash $ 40,000 Liabilities $ 50,000

Adams, Loan 10,000 Adams, Capital 55,000

Other Assets 200,000 Peters, Capital 75,000

Blake, Capital 70,000

Total Assets $250,000 Total Liabilities & Equities $250,000

Liquidation expenses are expected to be negligible. No interest accrues on loans

with partners after

termination of the business.

Required

Prepare a cash distribution plan for the APB Partnership.

E16-9 Confirmation of Cash Distribution Plan

Refer to the data in exercise E16-8. During the liquidation process for the APB

Partnership, the

following events occurred:

1. During the first month of liquidation, noncash assets with a book value of

$85,000 were sold for

$65,000, and $21,000 of the liabilities were paid.

2. During the second month, the remaining noncash assets were sold for $79,000.

The loan receivable

from Adams was collected, and the rest of the creditors were paid.

3. Cash is distributed to partners at the end of each month.

Required

Prepare a statement of partnership realization and liquidation with a schedule of

safe payments to

partners for the liquidation period

You might also like

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionPierre Heneine86% (7)

- Chapter 14 Solutions ManualDocument56 pagesChapter 14 Solutions ManualDalila Melendez50% (2)

- ACT112.QS2 With AnswersDocument6 pagesACT112.QS2 With AnswersGinie Lyn Rosal89% (9)

- CH 12Document3 pagesCH 12vivien0% (1)

- Honest Tea - Help SpreadsheetDocument12 pagesHonest Tea - Help Spreadsheetvirgin51100% (1)

- MU PLC Annual Report 2002 Financial StatementsDocument21 pagesMU PLC Annual Report 2002 Financial StatementsNurlisaAlnyNo ratings yet

- Piecemeal Distribution TheoryDocument5 pagesPiecemeal Distribution TheoryNitesh Kotian75% (8)

- Accounting II-Review Chapters12,13,14 (8thed)Document10 pagesAccounting II-Review Chapters12,13,14 (8thed)JacKFrost1889No ratings yet

- Chapter 16 Solution ManualDocument54 pagesChapter 16 Solution ManualJose Matalo67% (3)

- Acc 112 RevisionDocument16 pagesAcc 112 RevisionhamzaNo ratings yet

- ACC 407 Week 1 Assignment Partnership ProblemsDocument1 pageACC 407 Week 1 Assignment Partnership ProblemsJose MataloNo ratings yet

- ACC 407 Week 1 Assignment Partnership ProblemsDocument1 pageACC 407 Week 1 Assignment Partnership ProblemsJose MataloNo ratings yet

- Acct 2600 Exam 1 Study SheetDocument8 pagesAcct 2600 Exam 1 Study Sheetapi-236442317No ratings yet

- Quiz 3Document2 pagesQuiz 3halagochristinejeanelle14No ratings yet

- Chapter 2 Partnership LiquidationDocument35 pagesChapter 2 Partnership LiquidationmustafeNo ratings yet

- Tax Problems Questin and Answer CH 21Document8 pagesTax Problems Questin and Answer CH 21DoreenNo ratings yet

- On January 1 The Partners of Van Bakel and Cox: Unlock Answers Here Solutiondone - OnlineDocument1 pageOn January 1 The Partners of Van Bakel and Cox: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Chapter 2 - Advanced AccDocument15 pagesChapter 2 - Advanced AccAsad KhadarNo ratings yet

- DocsDocument10 pagesDocshustice freedNo ratings yet

- Accounting Week 2Document3 pagesAccounting Week 2Erryn M. ParamythaNo ratings yet

- 15 Chapter Partnerships FormationDocument13 pages15 Chapter Partnerships Formationmurtle0% (1)

- Worksheet PartnershipDocument6 pagesWorksheet PartnershipyoseNo ratings yet

- CH 07Document8 pagesCH 07Holly MotleyNo ratings yet

- FA NEW MOCK 2Document8 pagesFA NEW MOCK 2Ujjal ShiwakotiNo ratings yet

- Post Test. A12Document5 pagesPost Test. A12GICHA FEARL GIPALANo ratings yet

- TAKE HOME EXAM Partnership LiquidationDocument22 pagesTAKE HOME EXAM Partnership LiquidationMaria Kathreena Andrea AdevaNo ratings yet

- Partnership Liquidation Practice Problems - W CorrectionsDocument10 pagesPartnership Liquidation Practice Problems - W CorrectionsSarah BalisacanNo ratings yet

- Kasus CH 18 BeamDocument1 pageKasus CH 18 BeamaraNo ratings yet

- CONFRAS LiquidationDocument2 pagesCONFRAS LiquidationMaybelyn DagamiNo ratings yet

- Far Chap 8 SolDocument61 pagesFar Chap 8 SolCaterpillarNo ratings yet

- Multiple Choices and Exercises Chapter 2Document4 pagesMultiple Choices and Exercises Chapter 2Mi Đỗ Thị KhảNo ratings yet

- Partnership ReviewDocument5 pagesPartnership ReviewAirille CarlosNo ratings yet

- Assignment No.2Document5 pagesAssignment No.2mohamed atlamNo ratings yet

- 34923bos24617cp3 4 PDFDocument56 pages34923bos24617cp3 4 PDFRahulNo ratings yet

- Premidterm ExaminationDocument5 pagesPremidterm ExaminationAnne Camille AlfonsoNo ratings yet

- Intacc2 - Assignment 4Document3 pagesIntacc2 - Assignment 4Gray JavierNo ratings yet

- Partnership Liquidation - SeatworkDocument1 pagePartnership Liquidation - SeatworkReymilyn SanchezNo ratings yet

- Financial Statements Types Presentation Limitations UsersDocument20 pagesFinancial Statements Types Presentation Limitations UsersGemma PalinaNo ratings yet

- CH 07Document99 pagesCH 07homeboimartinNo ratings yet

- AssignmentDocument8 pagesAssignmentNitesh AgrawalNo ratings yet

- Introductory Financial Accounting - Mock PaperDocument12 pagesIntroductory Financial Accounting - Mock PaperSuyash DixitNo ratings yet

- Tugas AkuntansiDocument2 pagesTugas AkuntansibadzwowNo ratings yet

- Introduction To Accounting and BusinessDocument54 pagesIntroduction To Accounting and BusinessAje AndiartaNo ratings yet

- Advanced Accounting II AssignmentDocument3 pagesAdvanced Accounting II AssignmentMelkamu Moges100% (2)

- Note 08Document6 pagesNote 08Tharaka IndunilNo ratings yet

- Advanced Accounting Baker Test Bank - Chap016Document55 pagesAdvanced Accounting Baker Test Bank - Chap016donkazotey93% (14)

- Sample Quiz Partnership and CorporationDocument9 pagesSample Quiz Partnership and CorporationKristine Salvador CayetanoNo ratings yet

- Chapter - Partnership Accounts If There Is No Partnership DeedDocument8 pagesChapter - Partnership Accounts If There Is No Partnership DeedVijayasri KumaravelNo ratings yet

- Quizzer (Cash To Inventory Valuation) KeyDocument10 pagesQuizzer (Cash To Inventory Valuation) KeyLouie Miguel DulguimeNo ratings yet

- PartnershipDocument6 pagesPartnershipايهاب غزالةNo ratings yet

- ACC101 Chapter6newxcxDocument18 pagesACC101 Chapter6newxcxAhmed RawyNo ratings yet

- Accit - Assign - Evaluation of Errors and CorrectionsDocument2 pagesAccit - Assign - Evaluation of Errors and CorrectionsReijen InciongNo ratings yet

- Intermidate AssignmentDocument6 pagesIntermidate AssignmentTahir DestaNo ratings yet

- Chap005-Consolidation of Less-Than-Wholly Owned SubsidiariesDocument71 pagesChap005-Consolidation of Less-Than-Wholly Owned Subsidiaries_casals100% (3)

- G1 6.3 Partnership - DissolutionDocument15 pagesG1 6.3 Partnership - Dissolutionsridhartks100% (2)

- Multiple ChoiceDocument18 pagesMultiple ChoiceJonnel Samaniego100% (1)

- Chap 9 PartnershipDocument77 pagesChap 9 PartnershipIvhy Cruz EstrellaNo ratings yet

- Brief Exercises CHAPTER 7Document3 pagesBrief Exercises CHAPTER 7Trang LeNo ratings yet

- ACC 255 08 OutlineDocument9 pagesACC 255 08 Outlineadi zilbrshtiinNo ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- DSDDocument93 pagesDSDnicahNo ratings yet

- Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingFrom EverandBookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingRating: 4 out of 5 stars4/5 (2)

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- J.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleNo ratings yet

- HoyleDocument5 pagesHoyleJose Matalo100% (2)

- CMD Tips & Tricks: 1. Personalize Your Command Prompt (CMD)Document7 pagesCMD Tips & Tricks: 1. Personalize Your Command Prompt (CMD)Jose MataloNo ratings yet

- Par Tern Ship Liquidation CH 16Document31 pagesPar Tern Ship Liquidation CH 16Jasmine Desiree WashingtonNo ratings yet

- ACC 407 Week 1 Assignment Partnership ProblemsDocument1 pageACC 407 Week 1 Assignment Partnership ProblemsJose MataloNo ratings yet

- ACC 407 Week 1 Assignment Partnership ProblemsDocument1 pageACC 407 Week 1 Assignment Partnership ProblemsJose MataloNo ratings yet

- Lupisan BaysaDocument206 pagesLupisan BaysaJoselle Jan Blanco Claudio77% (52)

- Chapter 4 - Allison 97Document8 pagesChapter 4 - Allison 97Googly GooglyNo ratings yet

- Ratio AnalysisDocument37 pagesRatio Analysisvajajayk100% (1)

- Comprehensive Problems:: 1. in Connection With Your Audit of The Financial Statements CHARLES Corporation, You WereDocument20 pagesComprehensive Problems:: 1. in Connection With Your Audit of The Financial Statements CHARLES Corporation, You WereMa. Hazel Donita DiazNo ratings yet

- Abs3 TheoryDocument31 pagesAbs3 TheoryHassenNo ratings yet

- Financial Statement Analysis of Mango CompanyDocument7 pagesFinancial Statement Analysis of Mango CompanyJhodean Arevalo100% (1)

- Ratio Analysis Problems and SolutionsDocument11 pagesRatio Analysis Problems and SolutionsAira Nhaire Cortez MecateNo ratings yet

- DPR PackageDocument29 pagesDPR PackageAbhishek SharmaNo ratings yet

- Fundamentals of Accounting I The Double-Entry Bookkeeping System ACCOUNTING CYCLE: Journalizing - Preparation of Trial Balance I. Conceptual SkillsDocument13 pagesFundamentals of Accounting I The Double-Entry Bookkeeping System ACCOUNTING CYCLE: Journalizing - Preparation of Trial Balance I. Conceptual SkillsericacadagoNo ratings yet

- Ratio Analysis: R K MohantyDocument30 pagesRatio Analysis: R K Mohantybgowda_erp1438No ratings yet

- Nike, Inc. Consolidated Statements of Income Year Ended December 31 (In Millions) 2019 2018Document3 pagesNike, Inc. Consolidated Statements of Income Year Ended December 31 (In Millions) 2019 2018David Rolando García OpazoNo ratings yet

- Gitman Test Bank CH - 11Document44 pagesGitman Test Bank CH - 11Hazem TharwatNo ratings yet

- Adidas Financial ReportDocument17 pagesAdidas Financial ReportGhina Shaikh100% (2)

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewNayan SahaNo ratings yet

- Intacc Chapter 49-50Document17 pagesIntacc Chapter 49-50Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Post-Class Quiz #2Document9 pagesPost-Class Quiz #2Nghi AnNo ratings yet

- Asset Conversion CycleDocument12 pagesAsset Conversion Cyclessimi137No ratings yet

- Pre AssessmentDocument9 pagesPre AssessmentVenkatramana KNo ratings yet

- Kunci Jawaban Pertemuan 3 - AKMDocument6 pagesKunci Jawaban Pertemuan 3 - AKMYulina Bz.No ratings yet

- PIPFADocument36 pagesPIPFAfadosani100% (1)

- Plant and Intangible AssetsDocument51 pagesPlant and Intangible AssetsMULATNo ratings yet

- 1 - Project ReportDocument33 pages1 - Project ReportDeepak kumar KamatNo ratings yet

- Chapter 17 - Consol. Fs Part 2Document6 pagesChapter 17 - Consol. Fs Part 2PutmehudgJasdNo ratings yet

- PAS 7 Statement of Cash FlowsDocument7 pagesPAS 7 Statement of Cash FlowsAbbie Young Dela CruzNo ratings yet

- Vdocuments - MX - Chapter 5 578590693cc3a PDFDocument43 pagesVdocuments - MX - Chapter 5 578590693cc3a PDFAmrita TamangNo ratings yet