Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

22 viewsIs The US Building Transmission Fast Enough or Too Fast - Greentech Media

Is The US Building Transmission Fast Enough or Too Fast - Greentech Media

Uploaded by

The PetroglyphFERC Order 679 provided incentives for building new transmission lines to encourage infrastructure investment, address congestion issues, and ensure reliability. It was very successful, with transmission spending growing significantly between 2005-2016. However, questions have been raised about whether the incentives have become excessive or if transmission is being built too quickly. Some regulators and officials argue incentives should be reconsidered to potentially reduce costs to ratepayers. Debate continues around controversial incentives like construction work in progress that shift some risk to customers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Saudization PlanningDocument4 pagesSaudization PlanningSYedZYnAle100% (1)

- HK Kumar Digest of Important LawsDocument233 pagesHK Kumar Digest of Important Lawshello100% (1)

- Varanasi To Delhi P6JM3K: E-TicketDocument3 pagesVaranasi To Delhi P6JM3K: E-TicketArjun SinghNo ratings yet

- Emails Maryboy and Liz ThomasDocument13 pagesEmails Maryboy and Liz ThomasThe PetroglyphNo ratings yet

- 10-23-2017-Elaine Mitchell V Glacier County - State of MontanaDocument25 pages10-23-2017-Elaine Mitchell V Glacier County - State of MontanaThe PetroglyphNo ratings yet

- Tugasan Berkumpulan Valuation Methodology (DDWF 1423) : Nama Pensyarah: Puan DR Noraini Binti RejabDocument27 pagesTugasan Berkumpulan Valuation Methodology (DDWF 1423) : Nama Pensyarah: Puan DR Noraini Binti Rejabhilman afiq100% (1)

- Life Cycle ManagementDocument17 pagesLife Cycle ManagementIsrael DanielNo ratings yet

- Financing U.S PDFDocument2 pagesFinancing U.S PDFtbmiqbalNo ratings yet

- InfrastructureDocument38 pagesInfrastructureMrlichlam Vo100% (1)

- HSR Compilation Report July 2011Document19 pagesHSR Compilation Report July 2011Aaron FukudaNo ratings yet

- Quanta EconDocument5 pagesQuanta EconVickyMagginasNo ratings yet

- Policy and Politics 5 November 2012Document4 pagesPolicy and Politics 5 November 2012CamarguePRNo ratings yet

- Economic Analysis Group Discussion Paper: Russell - Pittman@usdoj - GovDocument32 pagesEconomic Analysis Group Discussion Paper: Russell - Pittman@usdoj - GovDalessandroNo ratings yet

- Land Value Uplift From Light Rail: Cameron K. Murray September 5, 2016Document13 pagesLand Value Uplift From Light Rail: Cameron K. Murray September 5, 2016rupert_j_boothNo ratings yet

- New England Wind Takes A Wild Ride: A Wind Powering America Project Volume 1, Issue 4 - May 2008Document13 pagesNew England Wind Takes A Wild Ride: A Wind Powering America Project Volume 1, Issue 4 - May 2008Northeast Wind Resource Center (NWRC)No ratings yet

- Week of October 17 2011Document5 pagesWeek of October 17 2011bcap-oceanNo ratings yet

- Usa Ferc CommentsDocument9 pagesUsa Ferc CommentsarchaeopteryxgrNo ratings yet

- Ican DraftDocument5 pagesIcan Draftapi-326244223No ratings yet

- The Challenges of Transmission Expansion in The Chilean Power Sector: Market or Central Planning?Document13 pagesThe Challenges of Transmission Expansion in The Chilean Power Sector: Market or Central Planning?Oscar Cabrera ChirreNo ratings yet

- Letter To The Environmental Protection AgencyDocument10 pagesLetter To The Environmental Protection AgencyThe Press-Enterprise / pressenterprise.comNo ratings yet

- Power Engineering: The Complete Career GuideDocument12 pagesPower Engineering: The Complete Career GuideVizireanuAdrianNo ratings yet

- PTC, ITC, or Cash GrantDocument21 pagesPTC, ITC, or Cash GrantNicolas TroussardNo ratings yet

- California High Speed RailwayDocument7 pagesCalifornia High Speed RailwayMorricce KashNo ratings yet

- Nevi Annual Report 2022 2023Document77 pagesNevi Annual Report 2022 2023gustavohuntersNo ratings yet

- SSPB4343: (In United States)Document19 pagesSSPB4343: (In United States)SIVASANGKARY MUNIANDYNo ratings yet

- Regional Greenhouse Gas Initiative Moves Forward - What Does It Mean For Wind Power?Document13 pagesRegional Greenhouse Gas Initiative Moves Forward - What Does It Mean For Wind Power?Northeast Wind Resource Center (NWRC)No ratings yet

- Chapter 6 Transmission DistributionDocument26 pagesChapter 6 Transmission DistributionWeerasak PiraksaNo ratings yet

- Energy Policy 2013 To 18Document10 pagesEnergy Policy 2013 To 18Shine BrightNo ratings yet

- National Zev Investment PlanDocument41 pagesNational Zev Investment PlanFred Lamert100% (2)

- The Social Rate of Return On Infrastructure InvestmentsDocument49 pagesThe Social Rate of Return On Infrastructure InvestmentsTony BuNo ratings yet

- Energy Storage Whitepaper Plusappendix Draft For Release - 1Document38 pagesEnergy Storage Whitepaper Plusappendix Draft For Release - 1Travis L BoydNo ratings yet

- Weekly Articles of Interest - 9.1.23Document10 pagesWeekly Articles of Interest - 9.1.23Anthony KownackNo ratings yet

- Reforms Abstracts WebDocument2 pagesReforms Abstracts WebTheNafinaArchiveNo ratings yet

- Economic Regulation of Utility Infrastructure 0Document39 pagesEconomic Regulation of Utility Infrastructure 0Favio MontenegroNo ratings yet

- Clean Energy Services For All: Financing Universal ElectrificationDocument14 pagesClean Energy Services For All: Financing Universal ElectrificationDetlef LoyNo ratings yet

- US Nuclear Power Policy - Nuclear Energy Policy USA - World Nuclear AssociationDocument22 pagesUS Nuclear Power Policy - Nuclear Energy Policy USA - World Nuclear AssociationNGT56No ratings yet

- Literature Review On Power Sector ReformsDocument7 pagesLiterature Review On Power Sector Reformsgrgdazukg100% (1)

- Green Industry AnalysisDocument7 pagesGreen Industry AnalysisTomas AvilaNo ratings yet

- Infrastructure Investment and Jobs Act Section by Section SummaryDocument129 pagesInfrastructure Investment and Jobs Act Section by Section SummaryAlbaraa MohamedNo ratings yet

- Regulated Electricity Utility IndustryDocument7 pagesRegulated Electricity Utility IndustryVivek GoswamiNo ratings yet

- Policy and Politics 8 October 2012Document4 pagesPolicy and Politics 8 October 2012CamarguePRNo ratings yet

- Economics BriefingDocument13 pagesEconomics BriefingKumar SundaramNo ratings yet

- Deployment of Grid-Scale Batteries in The United StatesDocument30 pagesDeployment of Grid-Scale Batteries in The United StatesKirn ZafarNo ratings yet

- US Infrastructure Industry Spending Trends - 30th April 09Document25 pagesUS Infrastructure Industry Spending Trends - 30th April 09pkeranova07No ratings yet

- Updated HSR AffDocument225 pagesUpdated HSR AffDustin PingNo ratings yet

- Indian Power IndustryDocument10 pagesIndian Power IndustryuttamrungtaNo ratings yet

- From Policy To Power: Real Solutions For BC HydroDocument36 pagesFrom Policy To Power: Real Solutions For BC HydroMoveUP, the Movement of United ProfessionalsNo ratings yet

- Alt Energy Policy Update - Stimulus Package - 2009 1 15Document7 pagesAlt Energy Policy Update - Stimulus Package - 2009 1 15Emilio MeraNo ratings yet

- Deloitte HCAS Report - Talent Management &Document16 pagesDeloitte HCAS Report - Talent Management &Jagadeesh RamaswamyNo ratings yet

- Policy and Politics 29 October 2012Document4 pagesPolicy and Politics 29 October 2012CamarguePRNo ratings yet

- 1 s2.0 S136192091630757X AmDocument32 pages1 s2.0 S136192091630757X AmYousup AliNo ratings yet

- High Speed Two (HS2) : Costs and BenefitsDocument13 pagesHigh Speed Two (HS2) : Costs and BenefitsKamran MalikNo ratings yet

- Energy and Power Sector IndiaDocument6 pagesEnergy and Power Sector IndiaPramod kNo ratings yet

- Our B Bottom Line E.: Preprinted D Logo Will G Go HereDocument9 pagesOur B Bottom Line E.: Preprinted D Logo Will G Go HereTiffany RobertsNo ratings yet

- The Development of High Speed Rail in The United States: Issues and Recent EventsDocument35 pagesThe Development of High Speed Rail in The United States: Issues and Recent EventsAwilcox19No ratings yet

- Andrew Zimbalist Report 2005 On Atlantic Yards, For Forest City RatnerDocument44 pagesAndrew Zimbalist Report 2005 On Atlantic Yards, For Forest City RatnerNorman OderNo ratings yet

- Enabling Smart GridDocument12 pagesEnabling Smart Gridamiraj01No ratings yet

- FERC, NERC, and Regional Reliability CouncilsDocument8 pagesFERC, NERC, and Regional Reliability CouncilsDheeraj KumarNo ratings yet

- Example of Business PlanDocument101 pagesExample of Business PlanGiffari Rizky RamadhanNo ratings yet

- 2013 Report Card For America's Infrastructure Findings: Energy: Conditions & CapacityDocument7 pages2013 Report Card For America's Infrastructure Findings: Energy: Conditions & CapacityMarco RamosNo ratings yet

- RAP Neme EfficiencyasaTandDresource 2012 Feb 14Document40 pagesRAP Neme EfficiencyasaTandDresource 2012 Feb 14Meral SüzerNo ratings yet

- India Infrastructure: Turnaround Times Time To Log inDocument21 pagesIndia Infrastructure: Turnaround Times Time To Log inchiraghdfcsecNo ratings yet

- In This Issue: Hickenlooper: CNG Is Colorado's FutureDocument5 pagesIn This Issue: Hickenlooper: CNG Is Colorado's Futurea9495No ratings yet

- 1 s2.0 S1361920923000901 MainDocument14 pages1 s2.0 S1361920923000901 MainEagle RyanNo ratings yet

- Piezoelectric Roads 1ACDocument18 pagesPiezoelectric Roads 1ACSamdeet KhanNo ratings yet

- Environmental and Energy Policy and the Economy: Volume 3From EverandEnvironmental and Energy Policy and the Economy: Volume 3Matthew J. KotchenNo ratings yet

- Packet of JR Livestock CaseDocument10 pagesPacket of JR Livestock CaseThe PetroglyphNo ratings yet

- Statement August 22, 2013Document1 pageStatement August 22, 2013The PetroglyphNo ratings yet

- SJC Declaring A State of Local Emergency DraftDocument3 pagesSJC Declaring A State of Local Emergency DraftThe PetroglyphNo ratings yet

- FOIA Response Feb 25 2020 No Title 5Document2 pagesFOIA Response Feb 25 2020 No Title 5The PetroglyphNo ratings yet

- SJCO Comments For Recapture APDsDocument4 pagesSJCO Comments For Recapture APDsThe PetroglyphNo ratings yet

- Understanding True FreedomDocument17 pagesUnderstanding True FreedomThe PetroglyphNo ratings yet

- Steven C BoosDocument3 pagesSteven C BoosThe PetroglyphNo ratings yet

- Cryptobiotic Soil MythDocument7 pagesCryptobiotic Soil MythThe PetroglyphNo ratings yet

- City Letter Check To Redco Oct 2010Document1 pageCity Letter Check To Redco Oct 2010The PetroglyphNo ratings yet

- Asx TRH Paradox Basin Potash Drilling Update State Hole 2 21nov11Document2 pagesAsx TRH Paradox Basin Potash Drilling Update State Hole 2 21nov11The PetroglyphNo ratings yet

- Check For Permit FeesDocument1 pageCheck For Permit FeesThe PetroglyphNo ratings yet

- Appellants Complaint To CountyDocument66 pagesAppellants Complaint To CountyThe PetroglyphNo ratings yet

- Thomas Woods and His Critics, The Austrian vs. Distributist Debate Among CatholicsDocument5 pagesThomas Woods and His Critics, The Austrian vs. Distributist Debate Among CatholicsBartosz VlkNo ratings yet

- Uma Leitura Económica Sobre: Corporate GovernanceDocument19 pagesUma Leitura Económica Sobre: Corporate GovernanceMartinho PedroNo ratings yet

- TRAVEL BILL FORM Chennai Meet PDFDocument3 pagesTRAVEL BILL FORM Chennai Meet PDFINDRESH YadavNo ratings yet

- 22 The Main Characteristic of PPP IsDocument3 pages22 The Main Characteristic of PPP IsSurya ShekharNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeMitzi CatemprateNo ratings yet

- ECS G31T-m7Document30 pagesECS G31T-m7Rodney RibeiroNo ratings yet

- Students' Login & Password For PMS SystemDocument26 pagesStudents' Login & Password For PMS SystemDiana ZholdubaevaNo ratings yet

- RTV#5001761865Document1 pageRTV#5001761865mikpreneurNo ratings yet

- Philippine Trade Policy and StrategiesDocument15 pagesPhilippine Trade Policy and StrategiesRamirez Mark IreneaNo ratings yet

- Mishkin Chapter 7Document32 pagesMishkin Chapter 7everytimeyoulieNo ratings yet

- 3 - Slides-The Financial InstitutionsDocument17 pages3 - Slides-The Financial InstitutionsMuhammad UmarNo ratings yet

- Market 1Document8 pagesMarket 1Kaustav MannaNo ratings yet

- Liste Des Inscrits Etudes Arabes S3 2022-2023Document74 pagesListe Des Inscrits Etudes Arabes S3 2022-2023houdahuditaaNo ratings yet

- List of Qualified Manufacturers Supplierss July 2019 Final DraftDocument49 pagesList of Qualified Manufacturers Supplierss July 2019 Final DraftMohammad Abo AliNo ratings yet

- Global Cosmetics Industry Prospects 2009 Euromonitor 08 09Document66 pagesGlobal Cosmetics Industry Prospects 2009 Euromonitor 08 09Gaurav Om SharmaNo ratings yet

- Amtex 2010Document13 pagesAmtex 2010ashwinNo ratings yet

- Ch.6 ProblemsDocument6 pagesCh.6 ProblemsRody El KhalilNo ratings yet

- SKDC Rulebook PDFDocument38 pagesSKDC Rulebook PDFSatyam KushwahaNo ratings yet

- Goal Based InvestingDocument2 pagesGoal Based InvestingAjay KumarNo ratings yet

- Progress Audio Script 2Document1 pageProgress Audio Script 2groniganNo ratings yet

- Economics I - BALLB 2014Document6 pagesEconomics I - BALLB 2014PriyankaNo ratings yet

- Harmonized System Codes: 10063020: Top Ten Basmati Rice Importing Countries From Pakistan 2017-18Document2 pagesHarmonized System Codes: 10063020: Top Ten Basmati Rice Importing Countries From Pakistan 2017-18Mehwish IqbalNo ratings yet

- Manufacturing - Beacon Sector Special 2021Document43 pagesManufacturing - Beacon Sector Special 2021Mammen Vergis PunchamannilNo ratings yet

- Managerial AccountingDocument2 pagesManagerial AccountingDeth Santos100% (2)

- Anna JamesDocument15 pagesAnna Jamesapi-186863189No ratings yet

- AcknowledgmentDocument5 pagesAcknowledgmentbern14No ratings yet

Is The US Building Transmission Fast Enough or Too Fast - Greentech Media

Is The US Building Transmission Fast Enough or Too Fast - Greentech Media

Uploaded by

The Petroglyph0 ratings0% found this document useful (0 votes)

22 views5 pagesFERC Order 679 provided incentives for building new transmission lines to encourage infrastructure investment, address congestion issues, and ensure reliability. It was very successful, with transmission spending growing significantly between 2005-2016. However, questions have been raised about whether the incentives have become excessive or if transmission is being built too quickly. Some regulators and officials argue incentives should be reconsidered to potentially reduce costs to ratepayers. Debate continues around controversial incentives like construction work in progress that shift some risk to customers.

Original Description:

Is the US Building

Transmission Fast Enough

or Too Fast?

Original Title

Is the US Building Transmission Fast Enough or Too Fast_ _ Greentech Media

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFERC Order 679 provided incentives for building new transmission lines to encourage infrastructure investment, address congestion issues, and ensure reliability. It was very successful, with transmission spending growing significantly between 2005-2016. However, questions have been raised about whether the incentives have become excessive or if transmission is being built too quickly. Some regulators and officials argue incentives should be reconsidered to potentially reduce costs to ratepayers. Debate continues around controversial incentives like construction work in progress that shift some risk to customers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

22 views5 pagesIs The US Building Transmission Fast Enough or Too Fast - Greentech Media

Is The US Building Transmission Fast Enough or Too Fast - Greentech Media

Uploaded by

The PetroglyphFERC Order 679 provided incentives for building new transmission lines to encourage infrastructure investment, address congestion issues, and ensure reliability. It was very successful, with transmission spending growing significantly between 2005-2016. However, questions have been raised about whether the incentives have become excessive or if transmission is being built too quickly. Some regulators and officials argue incentives should be reconsidered to potentially reduce costs to ratepayers. Debate continues around controversial incentives like construction work in progress that shift some risk to customers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 5

A RT IC L ES: UT I L I TI E S

PREVIOUS ARTICLE

Cellular Smart

Grid: Grid Net,...

NEXT ARTICLE

Landis+Gyr Lands

280,000 Smart...

Is the US Building

Transmission Fast Enough

or Too Fast?

The 2006

federal order

679 giving

incentives for

new lines

may be out

of control.

Herman K. Trabish

July 23, 2012

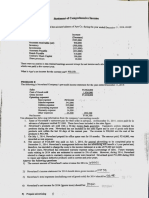

With the approval of Congress, the Federal Energy Regulatory

Commission (FERC) issued an order in 2006 providing an array

of incentives for building new transmission.

FERCs Order 679 seemed like a good idea at the time. Congress

had just passed the landmark Energy Policy Act of 2005 that

opened the door to a lot of new generation capacity -renewable as well as traditional.

And, as the FERC order noted at the time, the U.S. load had

doubled between 1975 and 1998 while its investment in

transmission dropped significantly. Though transmission

infrastructure investment increased after 1998, the FERC order

added, it was still less in 2003 than it had been in 1975.

Order 679 was intended to encourage transmission

infrastructure investment. It createdincentive-based

(including performance-based) rate treatments for the

transmission of electric energy in interstate commerce by

public utilities. New transmission, the order said, would benefit

consumers by ensuring reliability and reducing the cost of

delivered power by reducing transmission congestion.

It worked. Transmission infrastructure spending, according to

the Edison Electric Institute (EEI), grew from $7.5 billion in 2005

to $10.2 billion in 2010. In its 2011 report, the EEI projected

spending of $54 billion from 2011 to 2014, a 43 percent

increase over spending from 2007 to 2010.

TransmissionHub just reported that spending for the 2012 to

2016 period of close to $23 billion has been applied for under

the Order 679 incentive rate treatment. That, the report said,

would bring 2008 to 2016 total investment to $36.2 billion.

The 2012 incentive rate treatment is estimated at $4.2 billion.

The peak of spending for incentive rate treatment infrastructure

investment through 2016 is expected to come in 2013 at $5.4

billion, followed by $5.2 billion in 2014, $4.5 billion in 2015 and

$3.6 billion in 2016.

Total spending for the new North American transmission

infrastructure that will come on line between 2012 and 2016,

the TransmissionHub report estimated, will be $68.6 billion. The

2012 to 2020 total investment was estimated at $169.7 billion.

Total spending in 2012, for some 3,100 miles of mostly 230kilovolt lines, was projected to approach $7 billion.

Spending was projected to be twice that for both 2013 ($15.4

billion for 5,600 miles of lines) and 2014 ($15.3 billion for 6,100

miles of lines).

Spending in 2015 will double again, TransmissionHub projected,

to $31 billion for 9,700 miles of lines.

North American transmission investment from 2016 to 2020

was projected to be $101.2 billion, with $74.3 billion of the

spending coming from 2016 to 2018.

The leading builders of transmission projects scheduled to go

into service between 2012 and 2016, according to

TransmissionHub, are Edison International (NYSE:EIX) subsidiary

Southern California Edison ($4.9 billion), Dominion Resources

subsidiary Virginia Electric Power ($2.9 billion for 30 projects),

PacificCorp ($2.9 billion), and Exelon (NYSE:EXC)($2.1 billion).

The success of the Order 679 incentives has raised questions.

Representative Edward Markey (D-MA), as Chair of the House

Subcommittee on Energy and Environment in 2009, asked then

FERC Chair Jon Wellinghoff if the program was too big.

More recently regulators have characterized the incentives as

excessive and questioned the lucrative compensation building

transmission infrastructure.

In response, FERC issued a notice of inquiry (NOI) in May 2011

which asked for reform proposals.

Order 679 allowed incentives in the forms of (1) an incentivebased return on equity (ROE), (2) construction work in progress

(CWIP), (3) a hypothetical capital structure, (4) accelerated

depreciation, (5) recovery of prudently incurred costs, (6)

deferred cost recovery or (7) single-issue ratemaking.

Massachusetts Attorney General Martha Coakley filed a

complaint with FERC in September 2011 arguing that the base

ROE for New England transmission should be lowered from

11.14 percent to 9.2 percent. Representative Markey supported

her filing.

Transmission builders like Northeast

Utilities(NYSE:NU),National Grid, andUnited Illuminating,

responded that the New England base ROE meets FERC's just

and reasonable standard.

Other NOI comments from utilities, government and nongovernmental organizations have noted aspects of Order 679

that could be reconsidered. The use of CWIP, which allows

transmission builders to bill ratepayers while the infrastructure

is under construction, is an especially controversial type of

incentive. Opponents say it shifts risk to rate payers. Advocates

say it facilitates new transmission and lower rates by improving

cash flows, debt ratings and capital costs for builders.

TAGS: accelerated depreciation, builders, capital structure, congress,

construction work in progress, cwip, deferred cost recovery, delivered

power, dominion resources, edison electric institute, edison

international, eei, eix, electric energy, energy policy act of 2005

You might also like

- Saudization PlanningDocument4 pagesSaudization PlanningSYedZYnAle100% (1)

- HK Kumar Digest of Important LawsDocument233 pagesHK Kumar Digest of Important Lawshello100% (1)

- Varanasi To Delhi P6JM3K: E-TicketDocument3 pagesVaranasi To Delhi P6JM3K: E-TicketArjun SinghNo ratings yet

- Emails Maryboy and Liz ThomasDocument13 pagesEmails Maryboy and Liz ThomasThe PetroglyphNo ratings yet

- 10-23-2017-Elaine Mitchell V Glacier County - State of MontanaDocument25 pages10-23-2017-Elaine Mitchell V Glacier County - State of MontanaThe PetroglyphNo ratings yet

- Tugasan Berkumpulan Valuation Methodology (DDWF 1423) : Nama Pensyarah: Puan DR Noraini Binti RejabDocument27 pagesTugasan Berkumpulan Valuation Methodology (DDWF 1423) : Nama Pensyarah: Puan DR Noraini Binti Rejabhilman afiq100% (1)

- Life Cycle ManagementDocument17 pagesLife Cycle ManagementIsrael DanielNo ratings yet

- Financing U.S PDFDocument2 pagesFinancing U.S PDFtbmiqbalNo ratings yet

- InfrastructureDocument38 pagesInfrastructureMrlichlam Vo100% (1)

- HSR Compilation Report July 2011Document19 pagesHSR Compilation Report July 2011Aaron FukudaNo ratings yet

- Quanta EconDocument5 pagesQuanta EconVickyMagginasNo ratings yet

- Policy and Politics 5 November 2012Document4 pagesPolicy and Politics 5 November 2012CamarguePRNo ratings yet

- Economic Analysis Group Discussion Paper: Russell - Pittman@usdoj - GovDocument32 pagesEconomic Analysis Group Discussion Paper: Russell - Pittman@usdoj - GovDalessandroNo ratings yet

- Land Value Uplift From Light Rail: Cameron K. Murray September 5, 2016Document13 pagesLand Value Uplift From Light Rail: Cameron K. Murray September 5, 2016rupert_j_boothNo ratings yet

- New England Wind Takes A Wild Ride: A Wind Powering America Project Volume 1, Issue 4 - May 2008Document13 pagesNew England Wind Takes A Wild Ride: A Wind Powering America Project Volume 1, Issue 4 - May 2008Northeast Wind Resource Center (NWRC)No ratings yet

- Week of October 17 2011Document5 pagesWeek of October 17 2011bcap-oceanNo ratings yet

- Usa Ferc CommentsDocument9 pagesUsa Ferc CommentsarchaeopteryxgrNo ratings yet

- Ican DraftDocument5 pagesIcan Draftapi-326244223No ratings yet

- The Challenges of Transmission Expansion in The Chilean Power Sector: Market or Central Planning?Document13 pagesThe Challenges of Transmission Expansion in The Chilean Power Sector: Market or Central Planning?Oscar Cabrera ChirreNo ratings yet

- Letter To The Environmental Protection AgencyDocument10 pagesLetter To The Environmental Protection AgencyThe Press-Enterprise / pressenterprise.comNo ratings yet

- Power Engineering: The Complete Career GuideDocument12 pagesPower Engineering: The Complete Career GuideVizireanuAdrianNo ratings yet

- PTC, ITC, or Cash GrantDocument21 pagesPTC, ITC, or Cash GrantNicolas TroussardNo ratings yet

- California High Speed RailwayDocument7 pagesCalifornia High Speed RailwayMorricce KashNo ratings yet

- Nevi Annual Report 2022 2023Document77 pagesNevi Annual Report 2022 2023gustavohuntersNo ratings yet

- SSPB4343: (In United States)Document19 pagesSSPB4343: (In United States)SIVASANGKARY MUNIANDYNo ratings yet

- Regional Greenhouse Gas Initiative Moves Forward - What Does It Mean For Wind Power?Document13 pagesRegional Greenhouse Gas Initiative Moves Forward - What Does It Mean For Wind Power?Northeast Wind Resource Center (NWRC)No ratings yet

- Chapter 6 Transmission DistributionDocument26 pagesChapter 6 Transmission DistributionWeerasak PiraksaNo ratings yet

- Energy Policy 2013 To 18Document10 pagesEnergy Policy 2013 To 18Shine BrightNo ratings yet

- National Zev Investment PlanDocument41 pagesNational Zev Investment PlanFred Lamert100% (2)

- The Social Rate of Return On Infrastructure InvestmentsDocument49 pagesThe Social Rate of Return On Infrastructure InvestmentsTony BuNo ratings yet

- Energy Storage Whitepaper Plusappendix Draft For Release - 1Document38 pagesEnergy Storage Whitepaper Plusappendix Draft For Release - 1Travis L BoydNo ratings yet

- Weekly Articles of Interest - 9.1.23Document10 pagesWeekly Articles of Interest - 9.1.23Anthony KownackNo ratings yet

- Reforms Abstracts WebDocument2 pagesReforms Abstracts WebTheNafinaArchiveNo ratings yet

- Economic Regulation of Utility Infrastructure 0Document39 pagesEconomic Regulation of Utility Infrastructure 0Favio MontenegroNo ratings yet

- Clean Energy Services For All: Financing Universal ElectrificationDocument14 pagesClean Energy Services For All: Financing Universal ElectrificationDetlef LoyNo ratings yet

- US Nuclear Power Policy - Nuclear Energy Policy USA - World Nuclear AssociationDocument22 pagesUS Nuclear Power Policy - Nuclear Energy Policy USA - World Nuclear AssociationNGT56No ratings yet

- Literature Review On Power Sector ReformsDocument7 pagesLiterature Review On Power Sector Reformsgrgdazukg100% (1)

- Green Industry AnalysisDocument7 pagesGreen Industry AnalysisTomas AvilaNo ratings yet

- Infrastructure Investment and Jobs Act Section by Section SummaryDocument129 pagesInfrastructure Investment and Jobs Act Section by Section SummaryAlbaraa MohamedNo ratings yet

- Regulated Electricity Utility IndustryDocument7 pagesRegulated Electricity Utility IndustryVivek GoswamiNo ratings yet

- Policy and Politics 8 October 2012Document4 pagesPolicy and Politics 8 October 2012CamarguePRNo ratings yet

- Economics BriefingDocument13 pagesEconomics BriefingKumar SundaramNo ratings yet

- Deployment of Grid-Scale Batteries in The United StatesDocument30 pagesDeployment of Grid-Scale Batteries in The United StatesKirn ZafarNo ratings yet

- US Infrastructure Industry Spending Trends - 30th April 09Document25 pagesUS Infrastructure Industry Spending Trends - 30th April 09pkeranova07No ratings yet

- Updated HSR AffDocument225 pagesUpdated HSR AffDustin PingNo ratings yet

- Indian Power IndustryDocument10 pagesIndian Power IndustryuttamrungtaNo ratings yet

- From Policy To Power: Real Solutions For BC HydroDocument36 pagesFrom Policy To Power: Real Solutions For BC HydroMoveUP, the Movement of United ProfessionalsNo ratings yet

- Alt Energy Policy Update - Stimulus Package - 2009 1 15Document7 pagesAlt Energy Policy Update - Stimulus Package - 2009 1 15Emilio MeraNo ratings yet

- Deloitte HCAS Report - Talent Management &Document16 pagesDeloitte HCAS Report - Talent Management &Jagadeesh RamaswamyNo ratings yet

- Policy and Politics 29 October 2012Document4 pagesPolicy and Politics 29 October 2012CamarguePRNo ratings yet

- 1 s2.0 S136192091630757X AmDocument32 pages1 s2.0 S136192091630757X AmYousup AliNo ratings yet

- High Speed Two (HS2) : Costs and BenefitsDocument13 pagesHigh Speed Two (HS2) : Costs and BenefitsKamran MalikNo ratings yet

- Energy and Power Sector IndiaDocument6 pagesEnergy and Power Sector IndiaPramod kNo ratings yet

- Our B Bottom Line E.: Preprinted D Logo Will G Go HereDocument9 pagesOur B Bottom Line E.: Preprinted D Logo Will G Go HereTiffany RobertsNo ratings yet

- The Development of High Speed Rail in The United States: Issues and Recent EventsDocument35 pagesThe Development of High Speed Rail in The United States: Issues and Recent EventsAwilcox19No ratings yet

- Andrew Zimbalist Report 2005 On Atlantic Yards, For Forest City RatnerDocument44 pagesAndrew Zimbalist Report 2005 On Atlantic Yards, For Forest City RatnerNorman OderNo ratings yet

- Enabling Smart GridDocument12 pagesEnabling Smart Gridamiraj01No ratings yet

- FERC, NERC, and Regional Reliability CouncilsDocument8 pagesFERC, NERC, and Regional Reliability CouncilsDheeraj KumarNo ratings yet

- Example of Business PlanDocument101 pagesExample of Business PlanGiffari Rizky RamadhanNo ratings yet

- 2013 Report Card For America's Infrastructure Findings: Energy: Conditions & CapacityDocument7 pages2013 Report Card For America's Infrastructure Findings: Energy: Conditions & CapacityMarco RamosNo ratings yet

- RAP Neme EfficiencyasaTandDresource 2012 Feb 14Document40 pagesRAP Neme EfficiencyasaTandDresource 2012 Feb 14Meral SüzerNo ratings yet

- India Infrastructure: Turnaround Times Time To Log inDocument21 pagesIndia Infrastructure: Turnaround Times Time To Log inchiraghdfcsecNo ratings yet

- In This Issue: Hickenlooper: CNG Is Colorado's FutureDocument5 pagesIn This Issue: Hickenlooper: CNG Is Colorado's Futurea9495No ratings yet

- 1 s2.0 S1361920923000901 MainDocument14 pages1 s2.0 S1361920923000901 MainEagle RyanNo ratings yet

- Piezoelectric Roads 1ACDocument18 pagesPiezoelectric Roads 1ACSamdeet KhanNo ratings yet

- Environmental and Energy Policy and the Economy: Volume 3From EverandEnvironmental and Energy Policy and the Economy: Volume 3Matthew J. KotchenNo ratings yet

- Packet of JR Livestock CaseDocument10 pagesPacket of JR Livestock CaseThe PetroglyphNo ratings yet

- Statement August 22, 2013Document1 pageStatement August 22, 2013The PetroglyphNo ratings yet

- SJC Declaring A State of Local Emergency DraftDocument3 pagesSJC Declaring A State of Local Emergency DraftThe PetroglyphNo ratings yet

- FOIA Response Feb 25 2020 No Title 5Document2 pagesFOIA Response Feb 25 2020 No Title 5The PetroglyphNo ratings yet

- SJCO Comments For Recapture APDsDocument4 pagesSJCO Comments For Recapture APDsThe PetroglyphNo ratings yet

- Understanding True FreedomDocument17 pagesUnderstanding True FreedomThe PetroglyphNo ratings yet

- Steven C BoosDocument3 pagesSteven C BoosThe PetroglyphNo ratings yet

- Cryptobiotic Soil MythDocument7 pagesCryptobiotic Soil MythThe PetroglyphNo ratings yet

- City Letter Check To Redco Oct 2010Document1 pageCity Letter Check To Redco Oct 2010The PetroglyphNo ratings yet

- Asx TRH Paradox Basin Potash Drilling Update State Hole 2 21nov11Document2 pagesAsx TRH Paradox Basin Potash Drilling Update State Hole 2 21nov11The PetroglyphNo ratings yet

- Check For Permit FeesDocument1 pageCheck For Permit FeesThe PetroglyphNo ratings yet

- Appellants Complaint To CountyDocument66 pagesAppellants Complaint To CountyThe PetroglyphNo ratings yet

- Thomas Woods and His Critics, The Austrian vs. Distributist Debate Among CatholicsDocument5 pagesThomas Woods and His Critics, The Austrian vs. Distributist Debate Among CatholicsBartosz VlkNo ratings yet

- Uma Leitura Económica Sobre: Corporate GovernanceDocument19 pagesUma Leitura Económica Sobre: Corporate GovernanceMartinho PedroNo ratings yet

- TRAVEL BILL FORM Chennai Meet PDFDocument3 pagesTRAVEL BILL FORM Chennai Meet PDFINDRESH YadavNo ratings yet

- 22 The Main Characteristic of PPP IsDocument3 pages22 The Main Characteristic of PPP IsSurya ShekharNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeMitzi CatemprateNo ratings yet

- ECS G31T-m7Document30 pagesECS G31T-m7Rodney RibeiroNo ratings yet

- Students' Login & Password For PMS SystemDocument26 pagesStudents' Login & Password For PMS SystemDiana ZholdubaevaNo ratings yet

- RTV#5001761865Document1 pageRTV#5001761865mikpreneurNo ratings yet

- Philippine Trade Policy and StrategiesDocument15 pagesPhilippine Trade Policy and StrategiesRamirez Mark IreneaNo ratings yet

- Mishkin Chapter 7Document32 pagesMishkin Chapter 7everytimeyoulieNo ratings yet

- 3 - Slides-The Financial InstitutionsDocument17 pages3 - Slides-The Financial InstitutionsMuhammad UmarNo ratings yet

- Market 1Document8 pagesMarket 1Kaustav MannaNo ratings yet

- Liste Des Inscrits Etudes Arabes S3 2022-2023Document74 pagesListe Des Inscrits Etudes Arabes S3 2022-2023houdahuditaaNo ratings yet

- List of Qualified Manufacturers Supplierss July 2019 Final DraftDocument49 pagesList of Qualified Manufacturers Supplierss July 2019 Final DraftMohammad Abo AliNo ratings yet

- Global Cosmetics Industry Prospects 2009 Euromonitor 08 09Document66 pagesGlobal Cosmetics Industry Prospects 2009 Euromonitor 08 09Gaurav Om SharmaNo ratings yet

- Amtex 2010Document13 pagesAmtex 2010ashwinNo ratings yet

- Ch.6 ProblemsDocument6 pagesCh.6 ProblemsRody El KhalilNo ratings yet

- SKDC Rulebook PDFDocument38 pagesSKDC Rulebook PDFSatyam KushwahaNo ratings yet

- Goal Based InvestingDocument2 pagesGoal Based InvestingAjay KumarNo ratings yet

- Progress Audio Script 2Document1 pageProgress Audio Script 2groniganNo ratings yet

- Economics I - BALLB 2014Document6 pagesEconomics I - BALLB 2014PriyankaNo ratings yet

- Harmonized System Codes: 10063020: Top Ten Basmati Rice Importing Countries From Pakistan 2017-18Document2 pagesHarmonized System Codes: 10063020: Top Ten Basmati Rice Importing Countries From Pakistan 2017-18Mehwish IqbalNo ratings yet

- Manufacturing - Beacon Sector Special 2021Document43 pagesManufacturing - Beacon Sector Special 2021Mammen Vergis PunchamannilNo ratings yet

- Managerial AccountingDocument2 pagesManagerial AccountingDeth Santos100% (2)

- Anna JamesDocument15 pagesAnna Jamesapi-186863189No ratings yet

- AcknowledgmentDocument5 pagesAcknowledgmentbern14No ratings yet