Professional Documents

Culture Documents

AAA Memorial Day Weekend Forecast 2016

AAA Memorial Day Weekend Forecast 2016

Uploaded by

WDET 101.9 FMCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Macroeconomics 6th Edition Williamson Test Bank DownloadDocument21 pagesMacroeconomics 6th Edition Williamson Test Bank DownloadDarrell Davis100% (19)

- Detroit Food Metrics ReportDocument42 pagesDetroit Food Metrics ReportWDET 101.9 FM100% (6)

- Gretchen Whitmer DJC Interview TranscriptDocument15 pagesGretchen Whitmer DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Roads 2000 Strategic PlanDocument117 pagesRoads 2000 Strategic PlanMarvin MessiNo ratings yet

- Chapter 16Document10 pagesChapter 16Busiswa MsiphanyanaNo ratings yet

- GGBP Case Study Series - Brazil - Low Carbon City Development Program Rio de JaneiroDocument3 pagesGGBP Case Study Series - Brazil - Low Carbon City Development Program Rio de JaneiroAzman Bin KadirNo ratings yet

- Greens RecipeDocument2 pagesGreens RecipeWDET 101.9 FMNo ratings yet

- PFAS in Drinking WaterDocument2 pagesPFAS in Drinking WaterWDET 101.9 FMNo ratings yet

- Residential Road Program Introduction 2019Document6 pagesResidential Road Program Introduction 2019WDET 101.9 FMNo ratings yet

- IRS Tax Reform Basics For Individuals 2018Document14 pagesIRS Tax Reform Basics For Individuals 2018WDET 101.9 FMNo ratings yet

- Detroit Census MapDocument1 pageDetroit Census MapWDET 101.9 FMNo ratings yet

- Infographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlDocument1 pageInfographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlWDET 101.9 FMNo ratings yet

- GST 4.26.2018Document44 pagesGST 4.26.2018WDET 101.9 FMNo ratings yet

- WDET's Preschool BallotDocument1 pageWDET's Preschool BallotWDET 101.9 FMNo ratings yet

- Black GarlicDocument2 pagesBlack GarlicWDET 101.9 FMNo ratings yet

- HUD False ClaimsDocument3 pagesHUD False ClaimsWDET 101.9 FMNo ratings yet

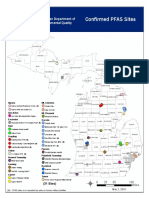

- MDEQ PFAS Contaminated SitesDocument1 pageMDEQ PFAS Contaminated SitesWDET 101.9 FMNo ratings yet

- Boil Water Advisory FAQDocument5 pagesBoil Water Advisory FAQWDET 101.9 FMNo ratings yet

- Combined Detroit Audit Exec Summary 551188 7Document27 pagesCombined Detroit Audit Exec Summary 551188 7WDET 101.9 FMNo ratings yet

- The Global Cheese Market Report 2000 - 2015: PM Food & Dairy Consulting January 2012Document12 pagesThe Global Cheese Market Report 2000 - 2015: PM Food & Dairy Consulting January 2012Izabela MugosaNo ratings yet

- Building Sustainable Film Businesses - The Challenges For IndustryDocument56 pagesBuilding Sustainable Film Businesses - The Challenges For IndustryRohit MehtaNo ratings yet

- Taxation 1 Transcript Part 4 (3 of 3) SyllabusDocument10 pagesTaxation 1 Transcript Part 4 (3 of 3) SyllabuscristiepearlNo ratings yet

- Official Form 206sum: Summary of Assets and Liabilities For Non-IndividualsDocument1 pageOfficial Form 206sum: Summary of Assets and Liabilities For Non-IndividualsReading_EagleNo ratings yet

- A Step-by-Step Guide For Parents: Parent PayDocument3 pagesA Step-by-Step Guide For Parents: Parent Payapi-237606250No ratings yet

- A Study On Labour Welfare Measures in Tamil Nadu State Transport Corporation, Villupuram DivisionDocument8 pagesA Study On Labour Welfare Measures in Tamil Nadu State Transport Corporation, Villupuram DivisioninventionjournalsNo ratings yet

- CWTS2 Community Devt Program ProposalDocument5 pagesCWTS2 Community Devt Program Proposaljennifer.jasmin.phdNo ratings yet

- Managerial Economics MB0042Document8 pagesManagerial Economics MB0042Anonymous UFaC3TyiNo ratings yet

- 15 1Document2 pages15 1raveen007No ratings yet

- BoeingDocument56 pagesBoeingRicky Alvarez0% (1)

- Specifications: PartsDocument1 pageSpecifications: PartsIsaac LopezNo ratings yet

- Me Q-Bank FinalDocument52 pagesMe Q-Bank FinalHemant DeshmukhNo ratings yet

- Workers' Remittances and Economic Growth in The Philippines: July 2007Document17 pagesWorkers' Remittances and Economic Growth in The Philippines: July 2007Floramae PasculadoNo ratings yet

- MOPIN NEW PDF 2 PDFDocument66 pagesMOPIN NEW PDF 2 PDFDivya AvNo ratings yet

- 01 Overview of Accounting PDFDocument18 pages01 Overview of Accounting PDFEdogawa SherlockNo ratings yet

- Managing Competition in City Services: The Case of BarcelonaDocument15 pagesManaging Competition in City Services: The Case of BarcelonaN3N5YNo ratings yet

- A Federation in Peril Yugoslavia S EconomyDocument21 pagesA Federation in Peril Yugoslavia S EconomySlovenianStudyReferencesNo ratings yet

- Accounts ReceivableDocument9 pagesAccounts ReceivableTrang LeNo ratings yet

- Aimless by Traders Den PH - Free E-BookDocument22 pagesAimless by Traders Den PH - Free E-BookDasellNo ratings yet

- Case Study 1Document5 pagesCase Study 1Frances Mary BareñoNo ratings yet

- CPVDocument5 pagesCPVPrasetyo AdityaNo ratings yet

- Zahar EvaDocument23 pagesZahar EvaEngr Fizza AkbarNo ratings yet

- Overview of The Mega Quarry Proposed by The Highland CompaniesDocument9 pagesOverview of The Mega Quarry Proposed by The Highland CompaniesSTOP THE QUARRYNo ratings yet

- CB Insights - Electric Car RaceDocument36 pagesCB Insights - Electric Car RaceShaleenNo ratings yet

- Performance Update: Fidelity Investments (R) Mutual Funds Investment OptionsDocument10 pagesPerformance Update: Fidelity Investments (R) Mutual Funds Investment OptionsAnonymous RT1MEWoN1eNo ratings yet

- Development of NEC Hong KongDocument8 pagesDevelopment of NEC Hong KongOlay KwongNo ratings yet

AAA Memorial Day Weekend Forecast 2016

AAA Memorial Day Weekend Forecast 2016

Uploaded by

WDET 101.9 FMCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AAA Memorial Day Weekend Forecast 2016

AAA Memorial Day Weekend Forecast 2016

Uploaded by

WDET 101.9 FMCopyright:

Available Formats

Q&A Communication for Memorial Day 2016

Q&A Communication for Memorial Day 2016

What was the variance of forecasted and actual travel for Memorial Day 2015?

Last year, IHS predicted that 37.2 million Americans would travel over the 2015 Memorial

Day holiday period. This forecast represented an increase of 4.7 percent relative to the 35.5

million trips that occurred over the holiday period in 2014.

Spurred by improvements in the economy and higher-than-expected growth in household net

worth, consumer spending increased at a higher level than expected and spurred even higher

travel growth than forecast. Actual 2015 Memorial Day holiday travel was 37.3 million,

which was an increase of five percent relative to 2014. The forecast was within 0.3 percent of

actual 2014 holiday travel.

What were the factors that contributed to the strong increase in Memorial Day holiday

travel last year?

o Lower prices: The consumer price index fell during the second quarter of 2015 for

the first time since 2009. Falling energy prices were a significant driver of that

reduction, with falling gasoline prices leading the way. Food prices remained in line

with those from the year prior, as the May increase was unchanged from May 2014.

Services was the primary sector for rising prices, as both education and medical care

saw prices increase. The lower prices helped spur consumer spending.

o Consumer spending: Consumer spending rose three percent during the quarter,

helped along by rising wages that generated a 4.5 percent increase in personal

income. The rising income and lower prices resulted in a 3.5 percent growth in real

disposable income. The strong income growth enabled steady consumer spending

while also contributing to a rise in the savings rate to five percent. In May, gains in

consumer spending were broad-based, with discretionary spending and autos doing

very well.

o Broad-based overall economic improvements: Real GDP in the second quarter of

2015 was 2.7 percent above Q2 2014, which was the highest growth during the

second quarter of the year since 2010. Beyond just the consumer, housing and nonenergy capital spending also contributed to overall economic growth. The labor

market was equally strong. Payroll employment increased by a monthly average of

251,000 in the second quarterthis is consistent with economic growth of 2.5

percent to three percent. This confirmed that the U.S. expansion was on track and

that the first-quarter weakness was a fluke. The only remaining concerns are that the

labor-force participation is too low and that wage inflation is too weak.

Q&A Communication for Memorial Day 2016

2016 Forecast Review

What is driving the 1.9 percent increase in Memorial Day holiday person-trips this

year?

Economic indicators: The two-tiered nature of the U.S. economy has been evident

in recent dataservice sectors are doing well, but manufacturing is struggling. As a

result, some of the overall economic weakness wont be as relevant toward holiday

travel. The U.S. economy entered spring with positive momentum, reflected in the

March employment report, surveys of purchasing managers, and rallies in financial

and commodity markets. After two quarters of anemic growth, real GDP is

projected to increase at an annualized rate of 2.6 percent in the second quarter.

Growth in real final sales to domestic purchasers will pick up from 1.8 percent in

the first quarter to 3.4 percent this spring. The improvement is broadly based, with

second-quarter rebounds in capital spending, exports and consumer purchases of

vehicles, along with sustained growth in residential investment. Real consumer

spending growth is projected to strengthen from a cautious 1.6 percent pace in the

first quarter to 3.1 percent over the remainder of 2016, supported by solid gains in

employment, real disposable income and household net worth.

The labor market steadily improves: March payroll gains totaled 215,000 jobs,

just a bit over the first-quarter average. The labor force expanded for a sixth

consecutive month and the unemployment rate edged up from 4.9 percent to five

percent, as household employment climbed by 246,000 while the labor force

jumped by 396,000. The best aspect of this sixth straight gain in March was that 70

percent of the labor-force gain came in the prime-aged cohort between 25 and 55

years, and that this groups participation was the highest in more than three years.

The overall labor-force participation rate climbed to 0.6 percentage points above the

low-water mark of last September, to 63 percent.

Consumer spending should begin to pick up: In 2016, real consumer spending on

nondurable goods is suffering because of weak spending on winter clothing and

home heating needs due to milder temperatures, and because spending on food away

from home is cannibalizing food-at-home spending. The warmer weather, the socalled pump price dividend, and relatively strong employment reports are assisting

restaurant sales. We expect real consumer spending growth to accelerate to a 3.1

percent annual rate in the second quarter and then maintain that pace through the

remaining quarters of the year.

2

Q&A Communication for Memorial Day 2016

Consumer survey readings are weak but some positivity can be found. The

consumer surveys are all down from their year-ago results but all have stabilized in

the past few months. Countering some of the significance of those drops is that the

current conditions and personal finance components of these surveys are closer to

year-ago levels than the aggregate results, a result of an even more pessimistic view

of the future. The weekly Bloomberg Consumer Comfort Index, which measures

only current (not future) conditions, has been steady the past month but at 42.9, but

it is below the 45.4 seen a year ago. The Reuters/University of Michigan Consumer

Sentiment Index has fallen slightly the past two months and is now 6.2 points below

the 95.9 from April 2015. The Conference Board's Consumer Confidence Index has

bounced up and down the past four months with Aprils results falling two points

from March. The index now stands at 94.2 and is just below the 94.3 seen in April

2015.

Consumer Confidence - Conference Board

(Index, 1985=100)

120

100

80

60

40

20

Apr-11

Apr-12

Apr-13

Apr-14

Apr-15

Apr-16

Source: Conference Board

Q1 GDP results: On April 29th, the government released the first estimate of actual

2016 Q1 GDP growth. The growth figure of 0.5 percent was below the already

weak expectations, but Q1 growth has been anemic in five of the past six years.

Consumer spending put in a respectable showing, with 1.9 percent growth, and

contributed the most to first-quarter growth. In most of the past six years (especially

2014 and 2015), weak growth in the first quarter was followed by stronger growth

in subsequent quarters. This year is likely to see a similar pattern. IHS believes that

the recent pullback by consumers is temporary and the expected growth of around

three percent during the rest of the year remains unchanged.

Q&A Communication for Memorial Day 2016

Memorial Day Holiday Travelers 2000-2016

Total Person-Trips

50

30%

44.0

(Million)

34.0

35.9

33.2

34.6

30.9

36.0

35.3

31.6

34.8

34.3

35.1

35.5

35.5

37.3

38.0

20%

30.5

(Percent Change)

40

30

10%

20

0%

10

-10%

-20%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016(F)

Person Trips (left)

% change (right)

Comparison to Historical Average:

Memorial Day holiday travel averaged 34.92 million from 2000 to 2015, while the

post-recession average has been 35.45 million. The 2016 forecast is 7.3 percent

above that post-recession average and 8.9 percent above the average since 2000.

The 2016 forecast of 38 million will be the highest mark since the 2005 spike.

Travel during the Memorial Day holiday period is the most volatile of all the

forecasted holidays. The 2016 forecast will be just the second consecutive year of

growth. Holiday travel spiked in 2005 and naturally declined in 2006 and 2007

leading into two years of recession-driven declines. That four-year stretch of falling

travel is the only time since 2000 that there was more than a two-year trend of travel

growth or decline.

The broad economic fundamentals remain positive but not overwhelming. The driving force

of the economy is the consumers continued willingness to spend. However, coming off of a

strong 2015 travel year, the level of expected consumer spending and confidence will be

enough to boost overall travel, but not at the same level of growth seen in 2015.

Q&A Communication for Memorial Day 2016

Automobile trips will outpace overall travel growth in 2016

Automobile travel will grow at 2.1 percent, slightly above the 1.9 percent in overall travel

growth. As a result, automobile share of travel will increase slightly to 89 percent. This will

be the third straight year of rising share of auto travel and, as a result, the 2016 share will top

the 88.9 percent share seen in 2010. The 2016 auto travel volume of 33.9 million is 13.6

percent above the average since 2000.

Memorial Day Travelers by Automobile, 2000-2016

(Million)

30

40%

37.3

28.0

30.5

30.5

26.9

25.5

28.1

31.0

29.2

30.3

31.0

31.4

31.3

33.2

33.9

20%

26.1

26.4

(Percent Change)

40

20

0%

10

-20%

-40%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016(F)

Person-Trips (left)

% change (right)

Travel by Other modes will increase moderately

Travel by other modes (including bus, rail and cruise) rebounded steadily for a few years

after the recession-driven declines of 2009 and 2010 and seems to have leveled off in the 1.6

million traveler rage. The 2016 forecast for travel via these modes is a 2.3 percent decline

from 2015. The 1.6 million travelers will make up 4.2 percent of all holiday travel. This will

be the second consecutive year in which travel via these modes declines, but 2016 does

remain 5.6 percent above the post-recession average travel volume.

Memorial Day Travelers by Other, 2000-2016

4

3.59

3.47

3.48

50%

3.38 3.43

2.52

25%

2.75

(Million)

2.71

1.92

1.23

1.37

1.52 1.63

1.7

1.64 1.60

-25%

-50%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016(F)

Person-Trips (left)

0%

(Percent Change)

3.08

% change (right)

Q&A Communication for Memorial Day 2016

Air travel volume remains in a holding pattern

Air travel during the Memorial Day holiday will increase for the third consecutive year.

However, the growth will remain muted. The 1.6 percent increase in volume will bring

holiday air travel volume to 2.58 million. The three straight years of growth have resulted in a

2016 forecast that is only 3.2 percent above 2013, representing how slow the growth has

been. Travel volume fell significantly in 2008 during the recession, but it also bounced back

quickly in 2010. Air travel volume has remained steady since then and the 2016 forecast is

1.9 percent below that 2010 bounce-back year.

The latest air travel data (through January 2016) shows that total domestic passenger

enplanements on U.S. airlines increased by five percent in 2015. U.S. airlines have slightly

increased capacity while at the same time slightly increased their load factor from 84.5 to 85

percent.

Memorial Day Travelers by Air, 2000-2016

4

50%

3.6

(Million)

2.9

3.0

2.9

2.7

2.6

2.6

2.1

2.7

2.5

2.5

2.5

2.5

2.6

25%

2.1

1.9

0%

-25%

(Percent Change)

3.2

-50%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016(F)

Person-Trips (left)

% change (right)

What is the impact of gasoline prices on the forecast?

The average price of gasoline has been rising slightly since bottoming out in mid-February

but remains well below the levels seen a year ago. The national average for April was $2.10,

which is 35 cents below the average seen in April 2014, a drop of more than 14 percent.

Americans paid the cheapest quarterly gas prices in twelve years during the first three months

of 2016, according to AAA. Americans have saved $18 billion on gas so far this year

compared to the same period in 2015. Low gas prices are contributing to keeping overall

prices low and combining with rising wages to help boost disposable income.

Q&A Communication for Memorial Day 2016

$5.00

$4.50

$4.00

$3.50

$3.00

$2.50

$2.00

$1.50

$1.00

$0.50

$0.00

$3.79 $3.89

$3.43

$2.85

$2.76 $2.82

$2.44

$2.23

$1.55 $1.40

$1.60

$2.05

$1.79

$3.55 $3.64

$2.10

50%

40%

30%

20%

10%

0%

-10%

-20%

-30%

-40%

-50%

(Percent Change)

Average April Gasoline Prices

National Average Per Gallon Regular Unleaded

2001-2016

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

$ per Gallon (left)

% change (right)

April gasoline prices are emphasized because prices observed several weeks prior to the holiday are likely to

influence holiday travel planning, while actual holiday prices are typically less influential.

7

Q&A Communication for Memorial Day 2016

Addendum 1: US Economic Forecast Summary

Published April 16, 2016

U.S. GDP Analysis: The U.S. economy enters spring with positive momentum, reflected in the March

employment report, surveys of purchasing managers, and rallies in financial and commodity markets. After two

quarters of anemic growth, real GDP is projected to increase at annual rates of 2.6 percent in the second quarter

and 2.7 percent in the third quarter. Growth in real final sales to domestic purchasers will pick up from 1.8 percent

in the first quarter to 3.4 percent this spring, before settling at 3.1 percent in the summer quarter. The

improvement is broadly based, with second-quarter rebounds in capital spending, exports and consumer

purchases of vehicles, along with sustained growth in residential investment. Real consumer spending growth is

projected to strengthen from a cautious 1.6 percent pace in the first quarter to 3.1 percent over the remainder of

2016, supported by solid gains in employment, real disposable income and household net worth.

Nonfarm inventory accumulation remained at an unsustainably high rate in 2015 and early 2016. The process of

bringing inventories into better alignment with sales will be a significant drag on the economy in the near term,

subtracting one percentage point from real GDP growth in the second quarter and 0.3 point in the third quarter.

The natural gas industry is emblematic of the problem. An unusually mild winter has left gas storage inventories

near record highs. Falling gas prices will lead to production cuts, restraining injections into storage during the

spring and summer.

Real business investment in equipment and structures declined in late 2015 and early 2016, pulled down by the

collapse in energy-related investments. As investment in resource industries stabilizes at low levels, overall

capital spending will advance at a five percent annual rate in the middle quarters of 2016, led by business

equipment and commercial construction. Pent-up demand and tight supplies will keep the recovery in residential

construction on track in 2016 and beyond.

Consumer spending, income and confidence: Fourth-quarter real consumer spending growth was revised up

to a 2.4 percent annual rate, from two percent in the second estimate. Our forecast of first-quarter real consumer

spending growth has been lowered to 1.6 percent, from last months three percent rate, mostly due to weakerthan-expected auto sales in March, a significant downward revision to Januarys consumer spending, and

stronger-than expected core consumer prices in February. We expect real consumer spending growth to

accelerate to a 3.1 percent rate in the second quarter and hold there for the remaining quarters of the year.

Recent news on consumer markets has been mixed: Marchs employment report was relatively well received on

wage growth and jobs added to the economy; spending rose only 0.1 percent in February, while Januarys real

spending was revised from a 0.4 percent gain to flat; CPI core prices rose 0.3 percent in January and then again

in February; Marchs auto unit sales were considerably weaker than expected; Marchs University of Michigan

Consumer Sentiment Index retreated, while the Conference Boards Consumer Confidence Index rose 2.2 points

after taking a 3.8-point hit in February; and weekly gasoline prices rose 30 cents per gallon between the last

week of February and the first week of April.

The consumer outlook for the next couple of years remains positive. The positive forces affecting consumer

spending are low energy prices, modest consumer price inflation, relatively strong employment growth,

appreciating home values, and rising disposable incomes. Real disposable income is expected to increase 2.8

percent in 2016, 3.2 percent in 2017, and 3.3 percent in 2018. Real consumer spending is expected to grow 2.6

percent in 2016, 3.1 percent in 2017, and 2.8 percent in 2018. In 2016, real consumer spending on nondurable

goods is suffering due to poor clothing and home heating oil spending, due to warmer winter weather and

because spending on food away from home is cannibalizing food-at-home spending.

Q&A Communication for Memorial Day 2016

Business investment spending: The outlook for business investment has soured. Real spending on both

equipment and structures likely fell in both the fourth quarter of 2015 and first quarter of 2016; intellectual

property products, which rarely drops, fell in both the third and fourth quarters. The collapse of oil and gas prices

is part of the story. The strong dollar is another part.

In the energy sector, the bleeding goes on. The weekly rig count, which mirrors investment in mining structures,

has sunk to its lowest level since record keeping began in 1940. Drilling for gas has almost stoppedthe rig

count for natural gas wells was at an all-time low of 88 wells in early April (its peak: 1,606 wells in August 2008).

Prior to the collapse in oil prices, the boom in drilling had had an outsized effect on spending on oil field

equipment, railroads cars, heavy-duty trucks and excavatorsany equipment used intensively in drilling. If there

is silver lining, its that a bottom is at handa prospect made more likely by oil prices rebounding recently.

In the latest forecast, spending on mines and wells which mirrors the rig countdrops at a 55 percent annual

rate in the first quarter, on the heels of a 40 percent fourth-quarter drop. Spending will likely hit bottom sometime

in the second quarter since oil prices have bottomed. Spending on equipment should improve as the temporary

factors holding it back fade. In the forecast, its growth accelerates from 1.8 percent in 2016 to 6.2 percent in

2017, as the drags from the stronger dollar and low energy prices dissipate and companies invest at rates

consistent with an economy growing at a two to three percent rate. Spending on intellectual property products, a

category that is steadier compared with spending on equipment and structures, is expected to make modest

gains in the three to four percent range over 2016-18.

Housing and construction: The housing market made subdued progress in February, with housing starts and

new home sales gaining while existing home sales retreated. The month of February was a mirror image of

January, with the various sectors of the housing market heading in opposite directions from the prior month. The

homebuilder assessment of current sales conditions retreated in February, but the outlook for the next six months

held steady.

In the positive column, contract signings rose in February, so existing home sales in March and April look more

upbeat. Single-family housing starts surpassed the 800,000 pace (annual rate) in February for the first time since

December 2007, and building permits are still running ahead of a year earlier. All these factors point to a bright

start to the spring selling season. In the negative column, inventories remain an issue for the housing market.

Existing homes for sale have declined for nine months in a row. Single-family existing homes for sale have not

seen a lower February level since 1995. With limited purchase options, buyers are holding back, pushing existing

home sales down to a three-month low.

Our outlook is for moderate price increases and expanding new and existing home inventories. We expect starts

to surpass a 1.2-million-unit annualized rate by the end of 2016, and new home sales to swell to more than

600,000 units during 2016, a pace not seen since 2007. Existing home sales should sustain a 5.4 million-unit

average annual rate in 2016.

Private nonresidential construction spending, which has been zigzagging around the $400 billion mark for the last

eight months, fell 1.3 percent in February, after jumping 2.7 percent in January. Month to month, six out of 11

categories of spending decreased, with communication construction showing a whopping 15 percent plunge. The

year-on-year growth rate of nominal nonresidential construction put-in-place, which peaked in July at 16 percent,

slowed from 12.9 percent to 10.6 percent, with the yearly growth rate of manufacturing shriveling from 11.6

percent to 0.5 percent in a single month. This rate topped out at 70 percent in May, and with the exception of

January, declines in recent months are suggestive of a retreat for manufacturing construction. Office,

educational, and amusement and recreation construction continue to post robust gains.

Q&A Communication for Memorial Day 2016

International trade: The dollar is slippingit still has legs, though. Since peaking on January26, the broadbased exchange rate has depreciated 5.1 percent, with the major and other important currencies six percent and

4.4 percent stronger against it, respectively. The Canadian dollar has advanced 10.6 percent since January26,

while the euro is up 5.2 percent. With the U.S. economy still outperforming the majority of the countries it trades

with, the broad real exchange rate is expected to strengthen slightly in the second and third quarters, before then

embarking on a multiyear descent. The dollar is appreciating for two reasons. The main one is that the U.S.

economy is the leader of a slow-moving pack. The second reason is the capital flight to safety. Capital flight has

been a problem in many troubled economies, including China.

In our forecast, exports and imports respond to the stronger dollar over a three-year period, taking small slices off

GDP growth over 12 consecutive quarters, starting in the third quarter of 2016not enough to dent growth much

over the next three years. Net exports percentage-point contribution to economic growth falls off from -0.64 in

2015 to -0.19 in 2016, -0.35 in 2017, and -0.27 point in 2018.

The nominal trade deficit, the headline number in the monthly trade report, has been zigzagging sideways for the

past five years. The real trade deficit, widened in the second half of 2015 sufficiently for net exports to cut growth

by about 0.3 and 0.1 percentage point, respectively, in the third and fourth quarters. It widened for the third

straight month in February and based on that report, we believe that the first-quarter bite off GDP growth from net

exports will be about 0.8 percentage point, instead of the forecasted 0.6 percentage point.

Government spending: The federal government budget position barely budged year-over-year in February, to a

$192.6-billion deficit, compared with a $192.4-billion deficit in February 2015. Fiscal 2016 to date, the deficit is

$353 billion, $33.6 billion (8.7 percent) less than for the same period in 2015.

Government receipts rose $29.8 billion (21.3 percent) year-over-year in February. Individual income taxes

accounted for more than 80 percent of the increase. Corporate income taxes fell slightly, and year-to-date remain

12.8 percent lower than the comparable year-earlier period. Federal outlays rose by $30 billion (9.1%) year-overyear in February. Significantly higher outlays for homeland security, interest payments and income security

accounted for two-thirds of the increase. All categories except national defense are higher than in February 2015;

year-to-date, national defense, Medicare and income security are lower than the same period a year earlier.

Outlays for interest saw the largest increase fiscal-year-to-date of any category.

Fiscal-year-to-date, receipts are up 5.3 percent, while outlays are 1.9 percent higher. Looking ahead, we expect

the fiscal 2016 federal budget deficit to increase to $566 billion, 29 percent larger than last year. Outlays are

expected to grow nearly twice as fast as receipts due to the spending and tax packages approved by Congress at

the end of 2015.

Another month of data indicates that state and local governments were not as quick to spend on highways and

streets as originally reported. In our last forecast we expected state and local government spending on structures

to increase at a 30 percent annual rate in the first quarter, as a result of both the FAST Act and favorable

weather. The February data on state and local construction put in place, with more than one-third spent on

highways and streets, suggest growth at less than half that pace in the first quarter, but still solidly ahead of a

year earlier.

Monetary policy, unemployment and inflation: As expected, the Federal Open Market Committee (FOMC)

kept the federal funds rate unchanged at its March 15-16 meeting. The only member to vote against the decision

was Esther L. George, president of the Federal Reserve Bank of Kansas City, who preferred a 25-basis-point

rate increase.

10

Q&A Communication for Memorial Day 2016

Fed officials now expect the benchmark federal funds rate to end the year at 0.875 percent, 50 basis points lower

than their December forecast. This is consistent with two 25-basis-point rate hikes this year, which remains our

forecast. The Fed also lowered the long-run target for the federal funds rate from 3.5 percent to 3.3 percent, and

repeated that it expects that economic conditions will evolve in a manner that will warrant only gradual increases

in the federal funds rate.

Even though the latest projections of the FOMC pointed to two rate hikes this year, Fed chair Janet Yellen

delivered a much more cautious speech at the Economic Club of New York on March 29. She acknowledged the

improvements in financial markets and oil prices, and the slowdown in the dollars appreciation; however, she

added in other respects economic and financial conditions remain less favorable than they did back at the time

of the December FOMC meeting. She said foreign economic growth seems likely to be weaker this year than

previously expected. Interestingly, Yellens comments were in contrast to the views of other committee members

who have been more upbeat about the economic outlook and the pace of interest rate hikes.

Meanwhile, the March employment report showed a solid performance, with a payroll jobs increase of 215,000,

and average hourly earnings growth of 0.3 percent (2.3 percent year-over-year). The unemployment rate rose 0.1

point to five percent in March, but that was because of an increase in the labor force. The labor-force participation

rate inched up, from 62.9 percent to 63 percent. Overall, March was a validation of the Feds view that the U.S.

job market continues to heal and is mostly healthy.

11

Q&A Communication for Memorial Day 2016

Addendum 2: U.S. Regional Executive Summary (Published March 8, 2016)

As predicted, the pullback in energy exploration and investment has hit the top energy-producing states

hard, especially North Dakota and Oklahoma, which have seen rig counts plummet. Coal producers also

have suffered significant job losses, especially West Virginia.

The regions in the South and West continue to show the most robust economic growth, led by the

Pacific division. The South Atlantic division is enjoying a rebound in housing activity due to population

growth, and the Mountain region continues to enjoy booming tourism in several states, outweighing the

slowdown in mining activity in several of its states.

Recently released population data showed that the South and Mountain regions led the country in

population gains from July 2014 to July 2015. We attribute this to the availability of jobs and affordable

housing in these areas. The recovery in the housing market also is allowing more homeowners to move,

as the equity in existing homes becomes more positive.

Regions in the southern and western United States continue to fare the best economically, thanks in part to

above-average population growth. The Pacific (PAC) and South Atlantic (SATL) regions continue to lead in job

growth, as demand for housing generates gains in construction and other services. The Mountain (MTN) states

continue to be a popular destination for people and employers alike, as recreational opportunities help to attract

younger people in particular. The regions tourism sector is also thriving.

On the downside, some regions in the northern and central parts of the country are experiencing slow economic

growth. The West North Central (WNC) and West South Central (WSC) regions continue to suffer from the

severe downturn in oil exploration and production activity in states such as North Dakota, Texas, Oklahoma and

Louisiana. The fallout from low oil prices affects sectors such as natural resources and mining, construction, and

transportation, and lost jobs and incomes in those sectors lead to losses in sectors such as retail and hospitality.

The New England (NENG) and East North Central (ENC) regions are suffering from low rates of population

growth, which ultimately result in lower demand for services along with reduced demand for home construction.

Looking ahead, we expect states in the South and West to continue to outpace the North and East in 2016. The

South Atlantic and Mountain regions will do especially well, with gains in housing activity, leisure and hospitality,

and professional and business services. Weakness in the energy sector will continue to pull down several states,

especially in the first half of the year. After that, year-to-year declines will ease, but energy-dependent states will

still have trouble generating positive momentum until drilling activity resumes. Weak gains in housing activity and

service sectors will stunt the growth of several northern-tier states.

12

Q&A Communication for Memorial Day 2016

Home prices continue to rise at a steady pace: Home prices rose by 5.8 percent year-over-year in the fourth

quarter of 2015, a pace consistent with the previous two quarters. Nationally, home prices have nearly recovered

all of the value lost during the housing bust. The Federal Housing Finance Agency (FHFA) reported that their

purchase-only home price index rose to 225.3 in the fourth quarter, just shy of the index's peak of 226.4 in the

second quarter of 2007. Supply constraints have been pushing home prices up faster than the pace of inflation,

though, and the National Association of Realtors reported that supply conditions worsened slightly in the fourth

quarter compared with one year earlier. Months of available supply fell from 4.9 in the final quarter of 2014 to 4.6

in the fourth quarter of 2015. Additionally, stronger rates of household formation and low unemployment continue

to put upward pressure on demand. Finally, the mix of homes sold may be inflating the price measures as well,

as many areas report severely limited supplies of the smaller, less expensive homes typical of first-time home

purchases. With fewer of these homes being sold, the sale of middle and higher-priced homes have an outsized

effect on the index.

All states experienced positive year-on-year home price gains in the fourth quarter. The list of states with the

fastest appreciation was dominated by the West and included Texas and Florida. Population and migration trends

have once again begun to favor the Sun Belt, and the Pacific Northwest has also become a popular destination

for both younger and high-income homebuyers. Five states saw home values rise at a double digit pace in the

fourth quarter: Nevada (up 12.8 percent), Colorado (10.8 percent), Idaho (10.8 percent), Washington (10.6

percent), and Oregon (10.6 percent). Florida was not far behind at 9.4 percent. Hawaii, Utah and Texas rounded

out the top 10. The Northeast contained most of the 10 worst-performing states. Relatively weak population

growth and larger foreclosure inventories have suppressed price growth in that region. Connecticut experienced

the slowest growth, rising just 0.2 percent. Next were Alabama (0.9 percent), New Mexico (1.1 percent), and

Arkansas (1.6 percent). Also among the worst 10 were New Jersey, Maryland, Virginia, New York and the District

of Columbia.

Home prices, FHFA Purchase-Only Index, fourth-quarter 2015

(Percent change from a year earlier)

13

Q&A Communication for Memorial Day 2016

Addendum 3: U.S. and Regional Population and Travel Share Data

Population

(Thousands)

National

United States

Census Divisions

New England

Middle Atlantic

South Atlantic

East North Central

East South Central

West North Central

West South Central

Mountain

Pacific

Travel Volume (Thousands)

Automobile

Air

Other

Total

Share of Population

Automobile

Air

Other

324,265

33,851

2,580

1,601

38,033

10.4%

0.8%

0.5%

11.7%

14,776

41,642

64,118

46,851

18,973

21,250

39,638

23,915

53,103

1,569

4,067

6,455

5,597

1,828

2,871

3,611

2,574

5,281

125

280

513

306

151

125

280

232

569

27

133

202

242

74

247

193

105

380

1,720

4,480

7,170

6,145

2,052

3,244

4,084

2,910

6,229

10.6%

9.8%

10.1%

11.9%

9.6%

13.5%

9.1%

10.8%

9.9%

0.8%

0.7%

0.8%

0.7%

0.8%

0.6%

0.7%

1.0%

1.1%

0.2%

0.3%

0.3%

0.5%

0.4%

1.2%

0.5%

0.4%

0.7%

11.6%

10.8%

11.2%

13.1%

10.8%

15.3%

10.3%

12.2%

11.7%

Census Region definitions:

East North Central (ENC): IL, IN, MI, OH, WI

South Atlantic (SATL): DC, DE, FL, GA, MD, NC, SC, VA, WV

East South Central (ESC): AL, KY, MS, TN

West South Central (WSC): AR, LA, OK, TX

Middle Atlantic (MATL): NJ, NY, PA

West North Central (WNC): IA, KS, MN, MO, ND, NE, SD

Mountain (MTN): AZ, CO, ID, MT, NM, NV, UT, WY

Pacific (PAC): AK, CA, HI, OR, WA

New England (NENG): CT, MA, ME, NH, RI, VT

14

Total

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Macroeconomics 6th Edition Williamson Test Bank DownloadDocument21 pagesMacroeconomics 6th Edition Williamson Test Bank DownloadDarrell Davis100% (19)

- Detroit Food Metrics ReportDocument42 pagesDetroit Food Metrics ReportWDET 101.9 FM100% (6)

- Gretchen Whitmer DJC Interview TranscriptDocument15 pagesGretchen Whitmer DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Roads 2000 Strategic PlanDocument117 pagesRoads 2000 Strategic PlanMarvin MessiNo ratings yet

- Chapter 16Document10 pagesChapter 16Busiswa MsiphanyanaNo ratings yet

- GGBP Case Study Series - Brazil - Low Carbon City Development Program Rio de JaneiroDocument3 pagesGGBP Case Study Series - Brazil - Low Carbon City Development Program Rio de JaneiroAzman Bin KadirNo ratings yet

- Greens RecipeDocument2 pagesGreens RecipeWDET 101.9 FMNo ratings yet

- PFAS in Drinking WaterDocument2 pagesPFAS in Drinking WaterWDET 101.9 FMNo ratings yet

- Residential Road Program Introduction 2019Document6 pagesResidential Road Program Introduction 2019WDET 101.9 FMNo ratings yet

- IRS Tax Reform Basics For Individuals 2018Document14 pagesIRS Tax Reform Basics For Individuals 2018WDET 101.9 FMNo ratings yet

- Detroit Census MapDocument1 pageDetroit Census MapWDET 101.9 FMNo ratings yet

- Infographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlDocument1 pageInfographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlWDET 101.9 FMNo ratings yet

- GST 4.26.2018Document44 pagesGST 4.26.2018WDET 101.9 FMNo ratings yet

- WDET's Preschool BallotDocument1 pageWDET's Preschool BallotWDET 101.9 FMNo ratings yet

- Black GarlicDocument2 pagesBlack GarlicWDET 101.9 FMNo ratings yet

- HUD False ClaimsDocument3 pagesHUD False ClaimsWDET 101.9 FMNo ratings yet

- MDEQ PFAS Contaminated SitesDocument1 pageMDEQ PFAS Contaminated SitesWDET 101.9 FMNo ratings yet

- Boil Water Advisory FAQDocument5 pagesBoil Water Advisory FAQWDET 101.9 FMNo ratings yet

- Combined Detroit Audit Exec Summary 551188 7Document27 pagesCombined Detroit Audit Exec Summary 551188 7WDET 101.9 FMNo ratings yet

- The Global Cheese Market Report 2000 - 2015: PM Food & Dairy Consulting January 2012Document12 pagesThe Global Cheese Market Report 2000 - 2015: PM Food & Dairy Consulting January 2012Izabela MugosaNo ratings yet

- Building Sustainable Film Businesses - The Challenges For IndustryDocument56 pagesBuilding Sustainable Film Businesses - The Challenges For IndustryRohit MehtaNo ratings yet

- Taxation 1 Transcript Part 4 (3 of 3) SyllabusDocument10 pagesTaxation 1 Transcript Part 4 (3 of 3) SyllabuscristiepearlNo ratings yet

- Official Form 206sum: Summary of Assets and Liabilities For Non-IndividualsDocument1 pageOfficial Form 206sum: Summary of Assets and Liabilities For Non-IndividualsReading_EagleNo ratings yet

- A Step-by-Step Guide For Parents: Parent PayDocument3 pagesA Step-by-Step Guide For Parents: Parent Payapi-237606250No ratings yet

- A Study On Labour Welfare Measures in Tamil Nadu State Transport Corporation, Villupuram DivisionDocument8 pagesA Study On Labour Welfare Measures in Tamil Nadu State Transport Corporation, Villupuram DivisioninventionjournalsNo ratings yet

- CWTS2 Community Devt Program ProposalDocument5 pagesCWTS2 Community Devt Program Proposaljennifer.jasmin.phdNo ratings yet

- Managerial Economics MB0042Document8 pagesManagerial Economics MB0042Anonymous UFaC3TyiNo ratings yet

- 15 1Document2 pages15 1raveen007No ratings yet

- BoeingDocument56 pagesBoeingRicky Alvarez0% (1)

- Specifications: PartsDocument1 pageSpecifications: PartsIsaac LopezNo ratings yet

- Me Q-Bank FinalDocument52 pagesMe Q-Bank FinalHemant DeshmukhNo ratings yet

- Workers' Remittances and Economic Growth in The Philippines: July 2007Document17 pagesWorkers' Remittances and Economic Growth in The Philippines: July 2007Floramae PasculadoNo ratings yet

- MOPIN NEW PDF 2 PDFDocument66 pagesMOPIN NEW PDF 2 PDFDivya AvNo ratings yet

- 01 Overview of Accounting PDFDocument18 pages01 Overview of Accounting PDFEdogawa SherlockNo ratings yet

- Managing Competition in City Services: The Case of BarcelonaDocument15 pagesManaging Competition in City Services: The Case of BarcelonaN3N5YNo ratings yet

- A Federation in Peril Yugoslavia S EconomyDocument21 pagesA Federation in Peril Yugoslavia S EconomySlovenianStudyReferencesNo ratings yet

- Accounts ReceivableDocument9 pagesAccounts ReceivableTrang LeNo ratings yet

- Aimless by Traders Den PH - Free E-BookDocument22 pagesAimless by Traders Den PH - Free E-BookDasellNo ratings yet

- Case Study 1Document5 pagesCase Study 1Frances Mary BareñoNo ratings yet

- CPVDocument5 pagesCPVPrasetyo AdityaNo ratings yet

- Zahar EvaDocument23 pagesZahar EvaEngr Fizza AkbarNo ratings yet

- Overview of The Mega Quarry Proposed by The Highland CompaniesDocument9 pagesOverview of The Mega Quarry Proposed by The Highland CompaniesSTOP THE QUARRYNo ratings yet

- CB Insights - Electric Car RaceDocument36 pagesCB Insights - Electric Car RaceShaleenNo ratings yet

- Performance Update: Fidelity Investments (R) Mutual Funds Investment OptionsDocument10 pagesPerformance Update: Fidelity Investments (R) Mutual Funds Investment OptionsAnonymous RT1MEWoN1eNo ratings yet

- Development of NEC Hong KongDocument8 pagesDevelopment of NEC Hong KongOlay KwongNo ratings yet