Professional Documents

Culture Documents

Willoughby Budget Table 2008

Willoughby Budget Table 2008

Uploaded by

lakecountyohOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Willoughby Budget Table 2008

Willoughby Budget Table 2008

Uploaded by

lakecountyohCopyright:

Available Formats

CITY OF WILLOUGHBY, OHIO

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR ENDED DECEMBER 31, 2008

At the end of the current fiscal year, the City is able to report positive balances in governmental activities

and the total government categories of net assets. Business-type activities show a net unrestricted deficit

of $2,269,805 which is primarily attributable to liabilities of the Airport fund consisting of amounts that

are due to other funds.

In order to further understand what makes up the changes in net assets for the current year, the following

table gives readers further details regarding the results of activities for the current and prior year.

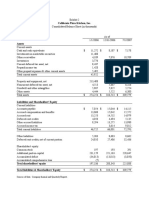

City of Willoughby's Change in Net Assets

Governmental Business-type

Activities Activities Total

2008 2007 2008 2007 2008 2007

Revenues

Program Revenues

Charges for Services 4,797,851 4,802,946 4,801,526 5,273,752 9,599,377 10,076,698

Operating Grants, Contributions & Interest 233,398 118,956 233,398 118,956

Capital Grants & Contributions 287,167 110,980 239,440 247,053 526,607 358,033

General Revenues

Municipal Income Taxes 16,591,292 15,570,705 200,000 16,591,292 15,770,705

Property & Other Local Taxes 4,544,357 4,981,602 4,544,357 4,981,602

Grants & Entitlements 5,342,717 4,797,309 5,342,717 4,797,309

Investment Earnings 733,253 990,190 51,342 53,393 784,595 1,043,583

Miscellaneous 106,277 7,511 14,812 3,012 121,089 10,523

Total Revenues 32,636,312 31,380,199 5,107,120 5,777,210 37,743,432 37,157,409

Expenses

General Government 7,464,343 7,037,479 7,464,343 7,037,479

Security of Persons & Property 14,184,392 13,355,856 14,184,392 13,355,856

Public Health & Welfare 475,828 474,422 475,828 474,422

Community Environment 985,934 1,028,496 985,934 1,028,496

Leisure Time Activities 2,319,489 2,162,931 2,319,489 2,162,931

Transportation 3,526,993 3,316,323 3,526,993 3,316,323

Basic Utility Services 1,648,956 1,517,825 1,648,956 1,517,825

Interest & Fiscal Charges 842,569 879,804 842,569 879,804

Golf Course 992,417 923,882 992,417 923,882

Sewer 5,086,763 4,898,045 5,086,763 4,898,045

Airport 558,209 540,352 558,209 540,352

Total Expenses 31,448,504 29,773,136 6,637,389 6,362,279 38,085,893 36,135,415

Transfers (295,000) (68,000) 295,000 68,000 0 0

Change in Net Assets 892,808 1,539,063 (1,235,269) (517,069) (342,461) 1,021,994

Net Assets Beginning of Year 61,036,153 59,497,090 32,379,735 32,896,804 93,415,888 92,393,894

Net Assets End of Year 61,928,961 61,036,153 31,144,466 32,379,735 93,073,427 93,415,888

Governmental Activities

Income tax in governmental funds shows an increase of 6.55% because of increase in collections as well

as a change in allocation of revenue away from Business-type activity funds.

Property and other local taxes decreased by more than 8% with the change in state law which effectively

eliminated the personal property tax. Grants and entitlements increased by 11.3% and interest earnings

were down 26% in a declining interest rate environment. The overall increase in revenue of 4% is a result

of higher collection of income taxes and an increase in grants and entitlements, including an increase in

estate tax collections.

7

You might also like

- Case 29 Gainesboro Machine Tools CorporationDocument33 pagesCase 29 Gainesboro Machine Tools CorporationUshna100% (1)

- Case 32 - CPK AssignmentDocument9 pagesCase 32 - CPK AssignmentEli JohnsonNo ratings yet

- 2003 Annual ReportDocument19 pages2003 Annual ReportThe Aspen InstituteNo ratings yet

- 012 Flast V Cohen 392 US 83Document2 pages012 Flast V Cohen 392 US 83keith105No ratings yet

- Presentation - 2019 Draft Operating Budget PDFDocument21 pagesPresentation - 2019 Draft Operating Budget PDFAlaskaHighwayNewsNo ratings yet

- Eswatini 2020 Formulation External BudgetFramework NatGov COMESASADC EnglishDocument240 pagesEswatini 2020 Formulation External BudgetFramework NatGov COMESASADC EnglishPanda CoinNo ratings yet

- FinancialDocument68 pagesFinancialImmys Char CharronNo ratings yet

- Langkah Langkah Zahir OkDocument156 pagesLangkah Langkah Zahir OkekachristinerebecaNo ratings yet

- Projected Income Statement of Ayala Land IncorporationDocument2 pagesProjected Income Statement of Ayala Land IncorporationErika May RamirezNo ratings yet

- Audited Financial Statements Airlines 2021Document60 pagesAudited Financial Statements Airlines 2021VENICE OMOLONNo ratings yet

- The WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Document4 pagesThe WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Mohammad Abram MaulanaNo ratings yet

- 08 MWSS2020 - Part1 FSDocument6 pages08 MWSS2020 - Part1 FSGabriel OrolfoNo ratings yet

- 2004 Annual ReportDocument10 pages2004 Annual ReportThe Aspen InstituteNo ratings yet

- Exxon-Mobil-FS-Working-Paper-Comprehensive-Exam-Bianca Camille R. CosaDocument18 pagesExxon-Mobil-FS-Working-Paper-Comprehensive-Exam-Bianca Camille R. CosaBianca Camille RosanesNo ratings yet

- 07-MIAA2021 Part1-Financial StatementsDocument4 pages07-MIAA2021 Part1-Financial StatementsVENICE OMOLONNo ratings yet

- Activity ExcelDocument1 pageActivity ExcelJoshua GuinauliNo ratings yet

- California Pizza Kitchen v3Document12 pagesCalifornia Pizza Kitchen v3xinz1313No ratings yet

- Metodos Flujos de Caja, Ejemplo AltriaDocument5 pagesMetodos Flujos de Caja, Ejemplo AltriaEsteban BustamanteNo ratings yet

- Ottawa County FY24 Proposed BudgetDocument222 pagesOttawa County FY24 Proposed BudgetWXMINo ratings yet

- A Feasibility Study On The Establishment of Housekeeping Recruitment AgencyDocument10 pagesA Feasibility Study On The Establishment of Housekeeping Recruitment AgencyMary Joy SumapidNo ratings yet

- Case 33 California Pizza KitchenDocument10 pagesCase 33 California Pizza KitchenhnooyNo ratings yet

- Blackstone 3 Q21 Supplemental Financial DataDocument20 pagesBlackstone 3 Q21 Supplemental Financial DataW.Derail McClendonNo ratings yet

- Microsoft Financial Data - FY19Q3Document29 pagesMicrosoft Financial Data - FY19Q3trisanka banikNo ratings yet

- AQ - 20230226212627 - Aquila SA EN Consolidated Financial Results Preliminary 2022Document6 pagesAQ - 20230226212627 - Aquila SA EN Consolidated Financial Results Preliminary 2022teoxysNo ratings yet

- Tesla Company AnalysisDocument83 pagesTesla Company AnalysisStevenTsaiNo ratings yet

- Ess 2022 Chapter 5 eDocument9 pagesEss 2022 Chapter 5 eDahamNo ratings yet

- Revenue HistoryDocument1 pageRevenue HistoryjsweigartNo ratings yet

- Tempe FS Final v3Document5 pagesTempe FS Final v3edgsd05No ratings yet

- Wema-Bank-Financial Statement-2019Document33 pagesWema-Bank-Financial Statement-2019john stonesNo ratings yet

- 5 EstadosDocument15 pages5 EstadosHenryRuizNo ratings yet

- ($ in Millions, Unless Othrewise Denoted) : Financial StatementsDocument4 pages($ in Millions, Unless Othrewise Denoted) : Financial Statementsapi-454737634No ratings yet

- BPI Capital Audited Financial StatementsDocument66 pagesBPI Capital Audited Financial StatementsGes Glai-em BayabordaNo ratings yet

- HBL Financial Statements - December 31, 2022Document251 pagesHBL Financial Statements - December 31, 2022Muhammad MuzammilNo ratings yet

- Marta's Financial AspectDocument20 pagesMarta's Financial AspectMarvin GamboaNo ratings yet

- Salon de Elegance FinalDocument35 pagesSalon de Elegance FinalRon Benlheo OpolintoNo ratings yet

- 02 BacarraIN2020 FSDocument9 pages02 BacarraIN2020 FSRichard MendezNo ratings yet

- 07 MalabonCity2018 - Part1 FSDocument8 pages07 MalabonCity2018 - Part1 FSJuan Uriel CruzNo ratings yet

- 08 PuertoPrincesaCity2019 Part1 FSDocument7 pages08 PuertoPrincesaCity2019 Part1 FSkQy267BdTKNo ratings yet

- 31 March 2020Document8 pages31 March 2020lojanbabunNo ratings yet

- Statements of Financial Condition: FinancialsDocument23 pagesStatements of Financial Condition: FinancialsMuhar RyanNo ratings yet

- PRC2019 FSDocument4 pagesPRC2019 FSDonaldDeLeonNo ratings yet

- FABM Globe PaperDocument18 pagesFABM Globe PaperJulian AlbaNo ratings yet

- FirstBank Unaudited Half Year Results For Period Ending June 2010Document1 pageFirstBank Unaudited Half Year Results For Period Ending June 2010Kunle AdegboyeNo ratings yet

- SomewhatDocument6 pagesSomewhatPauline VejanoNo ratings yet

- Handout Environmend Green Financial Statements QDocument6 pagesHandout Environmend Green Financial Statements QshamielpeNo ratings yet

- Heritage FoundationDocument22 pagesHeritage FoundationNicolai AquinoNo ratings yet

- Statement of Income and ExpenditureDocument4 pagesStatement of Income and Expendituredeevik thiranNo ratings yet

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkNo ratings yet

- Excel - 13132110014 - Draft Paper Individu - FNT 4A-1Document53 pagesExcel - 13132110014 - Draft Paper Individu - FNT 4A-1Ferian PhungkyNo ratings yet

- Expenses FormatDocument6 pagesExpenses FormatdetailsNo ratings yet

- Nhs England Annual Accounts Report 2019 20Document50 pagesNhs England Annual Accounts Report 2019 20Michel LNo ratings yet

- Advans Ghana Savings and Loans LimitedDocument5 pagesAdvans Ghana Savings and Loans LimitedElson MelekhNo ratings yet

- SGR Calculation Taking Base FY 2019Document17 pagesSGR Calculation Taking Base FY 2019Arif.hossen 30No ratings yet

- Performance Audit of VisitPITTSBURGH 4-11-23Document58 pagesPerformance Audit of VisitPITTSBURGH 4-11-23Heather LangNo ratings yet

- Spyder Student ExcelDocument21 pagesSpyder Student ExcelNatasha PerryNo ratings yet

- IFAC 2018 Financial Statements PDFDocument32 pagesIFAC 2018 Financial Statements PDFsonia JavedNo ratings yet

- AllHome Corp. Annual Report 2023Document4 pagesAllHome Corp. Annual Report 2023maryirishdeocampoNo ratings yet

- Georgia Pacfic by QuarterDocument4 pagesGeorgia Pacfic by QuarterdereddyrajsekharNo ratings yet

- Projected Income StatementDocument3 pagesProjected Income StatementSyeda Nida AliNo ratings yet

- Fin AnalysisDocument16 pagesFin AnalysisMakuna NatsvlishviliNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Mentor Municipal Court TRC 1100215ADocument2 pagesMentor Municipal Court TRC 1100215AlakecountyohNo ratings yet

- Mentor Municipal Court TRC 0302413BDocument2 pagesMentor Municipal Court TRC 0302413BlakecountyohNo ratings yet

- The Savings BookDocument80 pagesThe Savings BooklakecountyohNo ratings yet

- The Jobs BudgetDocument774 pagesThe Jobs BudgetlakecountyohNo ratings yet

- Red State StrategiesDocument2 pagesRed State StrategieslakecountyohNo ratings yet

- Gene Lucci Report 042210Document3 pagesGene Lucci Report 042210lakecountyohNo ratings yet

- Buckeye Institute - Local Salary-EastlakeDocument5 pagesBuckeye Institute - Local Salary-EastlakelakecountyohNo ratings yet

- Willoughby Hills Council Agenda 021810Document1 pageWilloughby Hills Council Agenda 021810lakecountyohNo ratings yet

- Ordinance.2010 27Document3 pagesOrdinance.2010 27lakecountyohNo ratings yet

- Willoughby Hills Council Agenda 02252010Document3 pagesWilloughby Hills Council Agenda 02252010lakecountyohNo ratings yet

- Job - Desc Department Status Status - Desc Pay Freq Annual SalaryDocument5 pagesJob - Desc Department Status Status - Desc Pay Freq Annual SalarylakecountyohNo ratings yet

- SSB 221 Energy BillDocument59 pagesSSB 221 Energy BilllakecountyohNo ratings yet

- Agenda 0211Document3 pagesAgenda 0211lakecountyohNo ratings yet

- Fiscal FactDocument6 pagesFiscal FactlakecountyohNo ratings yet

- FEC Disclosure Form 3 For LaTourette For CongressDocument4 pagesFEC Disclosure Form 3 For LaTourette For CongresslakecountyohNo ratings yet

- Electric Bill ExplanationDocument1 pageElectric Bill Explanationlakecountyoh100% (1)

- Media RulesDocument102 pagesMedia RulesTony YeglesNo ratings yet

- Highlights of The North Carolina Public School Budget 2013Document41 pagesHighlights of The North Carolina Public School Budget 2013Nathaniel MaconNo ratings yet

- Pesa 2011 CompleteDocument219 pagesPesa 2011 CompletesnaikjonesNo ratings yet

- IntroductionDocument3 pagesIntroductionMarilou D. BeronioNo ratings yet

- Human Resource Management PracticesDocument8 pagesHuman Resource Management PracticesRavi RajaniNo ratings yet

- More Than A Minimum: The Final ReportDocument54 pagesMore Than A Minimum: The Final ReportResolutionFoundationNo ratings yet

- Booklet OECD Transfer Pricing Guidelines 2017Document24 pagesBooklet OECD Transfer Pricing Guidelines 2017Tommy StevenNo ratings yet

- Coffey ReportDocument37 pagesCoffey ReportCatherine PalermoNo ratings yet

- 2R Financial Utilization ReportDocument2 pages2R Financial Utilization Reportsabah8800No ratings yet

- No More TimeDocument7 pagesNo More TimeJorge Monzó BergéNo ratings yet

- HHS OIG Review of New Jersey's Adoption Assistance Subsidies Submitted For Federal Reimbursement As A Result of Its Contract With Maximus, Inc.Document15 pagesHHS OIG Review of New Jersey's Adoption Assistance Subsidies Submitted For Federal Reimbursement As A Result of Its Contract With Maximus, Inc.Beverly TranNo ratings yet

- The General FundDocument17 pagesThe General FundDecky Firmansyah AsikinNo ratings yet

- Euro Zone Crisis: Ajay Kumar Dinesh Grover Jasdeep Chawla Puneet KaurDocument29 pagesEuro Zone Crisis: Ajay Kumar Dinesh Grover Jasdeep Chawla Puneet KaurNitin ShindeNo ratings yet

- RL 2Document21 pagesRL 2Clark Fabionar SaquingNo ratings yet

- The DBCCDocument3 pagesThe DBCCAgentSkySkyNo ratings yet

- Introduction To The Historical Tables: Structure, Coverage, and ConceptsDocument25 pagesIntroduction To The Historical Tables: Structure, Coverage, and ConceptsimplyingnopeNo ratings yet

- 14th Finance CommissionDocument6 pages14th Finance CommissionPartha SurveNo ratings yet

- Lexington Public Library Letter To CouncilDocument3 pagesLexington Public Library Letter To CouncilLibraryJournalNo ratings yet

- CV Mukul G. AsherDocument49 pagesCV Mukul G. AsherabraNo ratings yet

- Zero Based BudgetingDocument9 pagesZero Based BudgetingAshish KumarNo ratings yet

- Slec502 MeDocument3 pagesSlec502 MeIshu GuptaNo ratings yet

- Fiscal Histories BotswanaDocument26 pagesFiscal Histories Botswanaalicesoares27No ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablesivajyothi1973No ratings yet

- Percent (2) - (Pankaj - Pkj1@gmail - Com)Document4 pagesPercent (2) - (Pankaj - Pkj1@gmail - Com)Balaji GuruNo ratings yet

- Government AccountingDocument10 pagesGovernment AccountingKristin Zoe Newtonxii PaezNo ratings yet

- San Francisco Budget BasicsDocument6 pagesSan Francisco Budget Basicsadmin5057No ratings yet

- Sri Lanka State of The Economy 2015: Economic PerformanceDocument3 pagesSri Lanka State of The Economy 2015: Economic PerformanceIPS Sri LankaNo ratings yet

- Supplemental Budget No. 3, Series 2016 PDFDocument2 pagesSupplemental Budget No. 3, Series 2016 PDFSheena Valenzuela100% (1)

- Full Text: The IG's 54-Page IRS Tax Scandal ReportDocument54 pagesFull Text: The IG's 54-Page IRS Tax Scandal ReportWashington ExaminerNo ratings yet