Professional Documents

Culture Documents

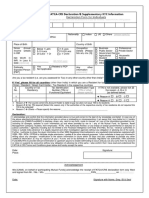

Fatca & Ubo Form

Fatca & Ubo Form

Uploaded by

AshokCopyright:

Available Formats

You might also like

- Certificate of Increase of Capital StockDocument2 pagesCertificate of Increase of Capital StockNarciso Reyes Jr.100% (5)

- W9 FormDocument1 pageW9 FormChris GreeneNo ratings yet

- How to Form a Nonprofit Corporation (National Edition): A Step-by-Step Guide to Forming a 501(c)(3) Nonprofit in Any StateFrom EverandHow to Form a Nonprofit Corporation (National Edition): A Step-by-Step Guide to Forming a 501(c)(3) Nonprofit in Any StateRating: 3.5 out of 5 stars3.5/5 (9)

- IRS Form W-9Document8 pagesIRS Form W-9SAHASec8No ratings yet

- Fatca-Crs - Icici BankDocument8 pagesFatca-Crs - Icici BankSankaram KasturiNo ratings yet

- FATCA Form Individual 061015 V1Document2 pagesFATCA Form Individual 061015 V1sanjay901No ratings yet

- FATCA Declaration HUFDocument7 pagesFATCA Declaration HUFDrAjay SinghNo ratings yet

- Fatca Crs FaqsDocument7 pagesFatca Crs FaqsMathew SimonNo ratings yet

- Sundaram FATCA CRS Form IndividualDocument2 pagesSundaram FATCA CRS Form IndividualAnonymous cXDbOjUr1dNo ratings yet

- FATCA Individual PDFDocument2 pagesFATCA Individual PDFPrathik NamakalNo ratings yet

- Fatca FormDocument1 pageFatca FormGarv BhayanaNo ratings yet

- Fatca Non Individual Form Annexure IIDocument6 pagesFatca Non Individual Form Annexure IIabhijit_bhandurge5011No ratings yet

- FATCA Declaration Non Individuals Retail FinalDocument7 pagesFATCA Declaration Non Individuals Retail FinalmohangboxNo ratings yet

- FATCA Declaration Individual FINALDocument3 pagesFATCA Declaration Individual FINALadvaitNo ratings yet

- FATCA Declaration Individual HUFDocument8 pagesFATCA Declaration Individual HUFmohangboxNo ratings yet

- 9AKIHKTQ FATCAIndividualZerodhapdfDocument2 pages9AKIHKTQ FATCAIndividualZerodhapdfSHOBHA VERMANo ratings yet

- Fatca Declaration Active Trade Channel IslandsDocument6 pagesFatca Declaration Active Trade Channel IslandsLosaNo ratings yet

- Fatca Declaration Non Profit PhilippinesDocument4 pagesFatca Declaration Non Profit PhilippinesAnomieNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJeffery OsbunNo ratings yet

- Self-Certification For Individual - FATCA/CRS Declaration FormDocument3 pagesSelf-Certification For Individual - FATCA/CRS Declaration FormSean MayNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationChristiney Spencer100% (2)

- FATCA Individuals PDFDocument2 pagesFATCA Individuals PDFfordd greenNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationapi-259574251No ratings yet

- FATCA and CRS Annexure For Individual Accounts-V-2Document2 pagesFATCA and CRS Annexure For Individual Accounts-V-2Maksim MikhailNo ratings yet

- FATCADocument2 pagesFATCAORIENNo ratings yet

- Extended KYC Annexure IndividualsDocument2 pagesExtended KYC Annexure IndividualsNarendra Reddy BhumaNo ratings yet

- Fatca Crs Non IndividualDocument1 pageFatca Crs Non IndividualHarsh-AgarwalNo ratings yet

- Specific Instructions: Form W-9 (Rev. 1-2011)Document3 pagesSpecific Instructions: Form W-9 (Rev. 1-2011)mibake0% (1)

- FATCA Declaration Individual HUFDocument7 pagesFATCA Declaration Individual HUFprofessionalassociates97No ratings yet

- FATCA Declaration For Individual FinalDocument2 pagesFATCA Declaration For Individual Finalmmiimc@gmail.comNo ratings yet

- FRM W8DM HRDocument2 pagesFRM W8DM HRmiscribeNo ratings yet

- RBL Fatca Crs Declaration EntitiesDocument2 pagesRBL Fatca Crs Declaration EntitiesAyush BankaNo ratings yet

- Remittance Certificate ChecklistDocument8 pagesRemittance Certificate ChecklistAnuj GuptaNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormYaacov KotlickiNo ratings yet

- Preparing For Fatca Understanding Implications and RequirementsDocument25 pagesPreparing For Fatca Understanding Implications and RequirementsylshihNo ratings yet

- FATCA/CRS Declaration Form - (Individual)Document3 pagesFATCA/CRS Declaration Form - (Individual)ansfaridNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationLogan BairdNo ratings yet

- FATCA Non IndividualDocument6 pagesFATCA Non IndividualMarneni Yallamanda RaoNo ratings yet

- Fatca Crs Self Certification FormDocument6 pagesFatca Crs Self Certification FormMohammed FaisalNo ratings yet

- FATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSDocument2 pagesFATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSOws AnishNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationJude Thomas SmithNo ratings yet

- W9Document4 pagesW9James-heatha GowersNo ratings yet

- Document Pack 9ST99MJR PDFDocument6 pagesDocument Pack 9ST99MJR PDFMohamed Diaa Mortada100% (1)

- Fatca DeclarationDocument3 pagesFatca DeclarationManish ShahNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationGreat Northern Insurance AgencyNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- New Fatca FormDocument3 pagesNew Fatca FormHanh ThuongNo ratings yet

- ASBL - FatcaDocument1 pageASBL - Fatcanitinjain9No ratings yet

- Annexure 1 FATCA-CRS Annexure For Individual AccountsDocument6 pagesAnnexure 1 FATCA-CRS Annexure For Individual AccountsbusuuuNo ratings yet

- Customer ID /account No - : One Input Is MandatoryDocument9 pagesCustomer ID /account No - : One Input Is MandatoryDhavalNo ratings yet

- FATCA Individual Form 21012016Document2 pagesFATCA Individual Form 21012016Aakash SharmaNo ratings yet

- Non IndividualsDocument11 pagesNon IndividualsAther AliNo ratings yet

- W-8ben For CDN Beachbody Coaches SampleDocument1 pageW-8ben For CDN Beachbody Coaches Sampleapi-295933330No ratings yet

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- J.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedFrom EverandJ.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedNo ratings yet

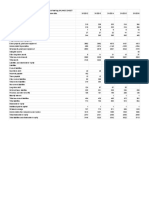

- New Era University: College of AccountancyDocument4 pagesNew Era University: College of AccountancyPeta AkountNo ratings yet

- UK Company Law Share Bankruptcy Void: FactsDocument4 pagesUK Company Law Share Bankruptcy Void: FactsPhúc NgọcNo ratings yet

- CEU Balance SheetDocument1 pageCEU Balance SheetmadhuNo ratings yet

- 2014 - 09 - 19 19 North Goa Mandate Letter PDFDocument2 pages2014 - 09 - 19 19 North Goa Mandate Letter PDFRaman IyerNo ratings yet

- Financial Analysis of MGBDocument8 pagesFinancial Analysis of MGBAr-Rayyan AshNo ratings yet

- NCERT Solutions For Class 12 Accountancy Chapter 1Document71 pagesNCERT Solutions For Class 12 Accountancy Chapter 1Anonymous DirectorNo ratings yet

- Protecting Interest of The Minority ShareholdersDocument4 pagesProtecting Interest of The Minority ShareholdersMohammad Shahjahan Siddiqui100% (1)

- Mva & Eva - MKDocument9 pagesMva & Eva - MKIfa FaizahNo ratings yet

- CSR Mini ProjectDocument8 pagesCSR Mini ProjectVikas PalNo ratings yet

- Analysis of Profit/Loss Account, Balance Sheet, Statement in Changes in Equity and Cash Flow Statement of Any Listed CompanyDocument25 pagesAnalysis of Profit/Loss Account, Balance Sheet, Statement in Changes in Equity and Cash Flow Statement of Any Listed CompanyMuhammad Hassaan AliNo ratings yet

- 2 InvestmentsDocument4 pages2 InvestmentsAdrian MallariNo ratings yet

- Corporation Law ReviewerDocument3 pagesCorporation Law ReviewerJada WilliamsNo ratings yet

- TheWorld sRichectArabsDocument51 pagesTheWorld sRichectArabsMian Muhammad Shahid SharifNo ratings yet

- Order in The Matter of Sunheaven Agro India LimitedDocument12 pagesOrder in The Matter of Sunheaven Agro India LimitedShyam SunderNo ratings yet

- Chapter 3 Beams 13ed RevisedDocument31 pagesChapter 3 Beams 13ed RevisedEvan AnwariNo ratings yet

- Chap 018Document19 pagesChap 018dbjnNo ratings yet

- International Business Group AssignmentDocument41 pagesInternational Business Group AssignmentTheng OuchNo ratings yet

- Chapter Four: Mcgraw-Hill/IrwinDocument17 pagesChapter Four: Mcgraw-Hill/IrwinJohn ReyNo ratings yet

- Chap 2 3Document36 pagesChap 2 3khayyumNo ratings yet

- Incorporation Test - Grand Father RuleDocument3 pagesIncorporation Test - Grand Father Ruleryan resultsNo ratings yet

- Acccob2 Portfolio - 064025Document7 pagesAcccob2 Portfolio - 064025Clay MaaliwNo ratings yet

- Mark Boucher - 2001 Watching Macro Indicators. The DollarDocument4 pagesMark Boucher - 2001 Watching Macro Indicators. The Dollardavin_zi100% (1)

- Financial Analysis and Python Small TestDocument4 pagesFinancial Analysis and Python Small Testtheodor_munteanuNo ratings yet

- PU - II Constitutional ProvisionsDocument81 pagesPU - II Constitutional ProvisionsNievesAlarconNo ratings yet

- Week 1 Tutorial AnswersDocument7 pagesWeek 1 Tutorial AnswersstvnNo ratings yet

- Raising FinanceDocument17 pagesRaising FinanceJephthah BansahNo ratings yet

- What-If Analysis TemplateDocument18 pagesWhat-If Analysis TemplateDardan DeskuNo ratings yet

- 03 Governance of Family FirmsDocument20 pages03 Governance of Family FirmsFsdaSdsNo ratings yet

- Valuation and Rates of Return: Mcgraw-Hill/IrwinDocument11 pagesValuation and Rates of Return: Mcgraw-Hill/IrwinAhmed ShantoNo ratings yet

Fatca & Ubo Form

Fatca & Ubo Form

Uploaded by

AshokOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fatca & Ubo Form

Fatca & Ubo Form

Uploaded by

AshokCopyright:

Available Formats

FATCA SELF CERTIFICATION FORM

For Individual Applicant / Investors

Category

First Applicant / Guardian

Second Applicant

PAN

Country of Birth

Country of Citizenship / Nationality

[Please specify the country if you hold any

other citizenship than India]

Are you a US Specified Person? (Yes / No)

If Yes, please provide Tax Payer ID.

Country of Tax Residency 1 #

Tax Identification No. 1 %

Country of Tax Residency 2

Tax Identification No. 2

Country of Tax Residency 3

Tax Idenfitication No. 3

# To also include USA, where the individual is a citizen / green card holder of USA

% in case Tax Identification Number is not available, kindly provide functional equivalent

INVESTOR(S) DECLARATION & SIGNATURE(S)

I / We have understood the information requirement of this Form as per the CBDT notifies Rules 114F to 114H and hereby acknowledge and confirm

that the information provided above is/are true and correct to the best of my/our knowledge and belief and provided after consulting necessary tax

professionals. I / We also confirm that I / We have read and understood the Terms and Conditions below and hereby accepts the same. I /

We understand that my personal details as provided / available may be used for CBDT reporting. In case any of the above specified information is

found to be false or untrue or misleading or misrepresenting, I/We am/are aware that I/We may liable for it. I/We also undertake to keep you informed

in writing about any changes / modification to the above information in future and also undertake to provide any other additional information/

documentary proof as may be required at your end.

Signature of Sole/First Applicant

Name of the Sole / First Applicant_________________

Signature of Second Applicant

Name of the Second Applicant_________________

Instruction

Details under FATCA/Foreign Tax Laws: Tax Regulations require us to collect information about each investors tax residency. In certain circumstances (including

if we do not receive a valid self certification form you) we may be obliged to share information on your account with relevant tax authorities. If you have any

question about your tax residency, please contact your tax advisor. Should there be any change in information provided, please ensure you advise us promptly, i.e.,

within 30days.

If you are a US citizen resident or greencard holder, please include United States In the foreign country information field along with your us Tax identification Number.

Foreign Account Tax compliance provisions (commonly known as FATCA) are contained in the US Hire Act 2010.

Note: In case of any doubt or/and for any clarification about your tax residency/any other FATCA aspects,please contact your tax advisor.

FATCA SELF CERTIFICATION FORM

For Non-Individual Applicants / Investors

Details under FATCA/Foreign tax laws (see instructions)

Sr.

No.

Applicant

Category

Is Country of Incorporation / Formation / Tax Residency is in India?

Yes

If no, please specify the Country(ies) of Incorporation / Formation / Tax

residency

No

Sr. No. Country

Tax Residency No.

Other Information

1

Are you a Specified US Person? If yes, please provide Taxpayer Identification No.

We are a financial institution {including an Foreign Financial Institution (FFI)}

(If Yes, please provide the required information)

A. We are a [tick any one]

Yes

No

a. Financial Institution incorporated in India

b. Financial Institution incorporated in another country that has

an intergovernmental agreement (IGA) with the US on FATCA

c. FFI in a country without an IGA that has registered to obtain a GIIN

d. Others________________________________________ [please complete]

B. Global Intermediary Identification Number (GIIN) required if you are

financial institution including FFI

3.

If GIIN not available [tick any one]:

a. Applied for on [_______________________________ ] [insert date]

b. Not required to apply/not obtained for the following reasons:

(i) We are a Non-participating FFI

(ii) We are a Non-reporting India Financial Institution under Annexure II of the

Indian IGA because we are ____________________________________

[please describe]

(iii) We are a Certified deemed-compliant FFI

under U.S. Treasury Regulations

(iv) We are an Exempt beneficial owner under U.S. Treasury Regulations

(v) We have another reason: _____________________________________

[please describe]

4.

We are a listed company

[whose shares are regularly traded on a recognized stock exchange]

Yes

No

If Yes, specify the name of the Stock Exchange(s) where it is traded regularly:

1. ____________________________________________________________

2. ____________________________________________________________

5.

Yes

We are Related Entity / Subsidiary / Controlled by a listed company

No

If Yes, specify the name of the listed company

______________________________________________________________

Specify the name of the Stock Exchange(s) where it is traded regularly:

1. ____________________________________________________________

2. ____________________________________________________________

6.

We are an Active NFFE

Yes

No

If Yes, specify the nature of business

______________________________________________________________

7.

We are an Passive NFFE

(Please fill the Ultimate Beneficial Ownership details under point number 10)

Yes

No

If Yes, please provide:

1. Nature of business: ____________________________________________

2. For all Controlling Persons who are citizens/tax residents/green card holders of

a country other than India [regardless of whether they are also Indian Citizens/

Tax Residents], provide their Name, Address, Taxpayer Identification Number

and Percentage of Holding by filling UBO Form & enclose additionally.

Are you any one of the following

Please Tick:

Participating FFI

Deemed Compliant FFI

Exempt Beneficial Owner

Non-Participating Financial Institution

9.

Unable to confirm my status

(Incase this box is marked as yes, the statement will be taken as default that

applicant is currently unable to confirm FATCA status and will confirm the same in

Future)

Yes

In case of any doubt or/and for any clarification about your organizations tax residency/any other FATCA aspects, please contact your tax advisor.

10. UBO declaration:

Name

Country of Tax

residency

Country of Citizenship

Address

(House no., street, city,

country)

Tax identification

Number

(for each country)

UBO Code

(Please refer Instructions)

Holding

Percentage

UBO - 1

UBO - 2

UBO - 3

UBO - 4

A. If UBO is already KYC compliant, KYC complied proof to be enclosed. Else PAN / Tax Payer Identification Number / any other valid identity proof must be attached

B. If any of the UBO is resident / citizen of other than India or citizen/tax resident/green card holder of country [like USA, UK], please provide Taxpayer ID Number/ Social Security

Number [SSN]

C. Submit documentary proof like Shareholding pattern duly self-attested by Authorized Signatory / Company Secretary.

D. If number of UBOs are more than 4, information in the given format can be enclosed in additional sheet(s)

INVESTOR(S) DECLARATION & SIGNATURE(S)

II / We have understood the information requirement of this Form as per the CBDT notifies Rules 114F to 114H and hereby acknowledge and confirm that the

information provided above is/are true and correct to the best of my/our knowledge and belief and provided after consulting necessary tax professionals. I / We also

confirm that I / We have read and understood the Terms and Conditions below and hereby accepts the same. I / We understand that my personal details as provided /

available may be used for CBDT reporting. In case any of the above specified information is found to be false or untrue or misleading or misrepresenting, I/We am/are

aware that I/We may liable for it. I/We also undertake to keep you informed in writing about any changes / modification to the above information in future and also

undertake to provide any other additional information/ documentary proof as may be required at your end.

Signature of the Applicant

Instruction:

Details under FATCA/Foreign Tax Laws: Tax Regulations require us to collect information about each investor's taxresidency. In certain

circumstances (including if we do not receive a valid self-certification from you) we may be obliged to share information on your account with

relevant tax authorities. If you have any questions about your tax residency, please contact your tax advisor. Should there be any change in

information provided, please ensure you advise us promptly. i.e., within 30 days. If you are classified as a passive NFFE for FATCA purposes, please

include in the section relating to Ultimate beneficial Owner (UBO), details of an) specified US persons having controlling interest in the foreign

country information field along with your US Tax Identification Number for FATCA purposes. Foreign Account Tax Compliance provisions (commonly

known as FATCA) are contained in the US Hire Act 2010.

Instructions for UBO

As per the requirements of Anti-Money Laundering related laws and regulatory guidelines on client due diligence and identification of Beneficial Ownership,

investors (other than Individuals) are required to provide details of ultimate beneficiary owner [UBO] and submit appropriate proof of identity of such UBOs. The

beneficial owner has been defined in the circular as the natural person or persons, who ultimately own, control or influence a client and/or persons on whose

behalf a transaction is being conducted, and includes a person who exercises ultimate effective control over a legal person or arrangement.

1. Ultimate Beneficiary Owner [UBO]:

A. For Investors other than individuals or trusts:

(i) The identity of the natural person, who, whether acting alone or together, or through one or more juridical person, exercises control through

ownership or who ultimately has a controlling ownership interest. Controlling ownership interest means ownership of/entitlement to:

more than 25% of shares or capital or profits of the juridical person, where the juridical person is a company;

more than 15% of the capital or profits of the juridical person, where the juridical person is a partnership;

more than 15% of the property or capital or profits of the juridical person, where the juridical person is an unincorporated association or body

of individuals.

(ii) In cases where there exists doubt under clause (i) above as to whether the person with the controlling ownership interest is the beneficial owner or

where no natural person exerts control through ownership interests, the identity of the natural person exercising control over the juridical person

through other means like through voting rights, agreement, arrangements or in any other manner.

(iii) Where no natural person is identified under clauses (i) or (ii) above, the identity of the relevant natural person who holds the position of senior

managing official.

B. For Investors which is a trust:

The identity of the settler of the trust, the trustee, the protector, the beneficiaries with 15% or more interest in the trust and any other natural person

exercising ultimate effective control over the trust through a chain of control or ownership.

C. Exemption in case of listed companies / foreign investors

The client or the owner of the controlling interest is a company listed on a stock exchange, or is a majority-owned subsidiary of such a company, it is

not necessary to identify and verify the identity of any shareholder or beneficial owner of such companies.

D. KYC requirements

Beneficial Owner(s) is/are required to comply with the prescribed KYC process as stipulated by SEBI from time to time with any one of the KRA &

submit the same to AMC. KYC acknowledgement proof is to be submitted for all the listed Beneficial Owner(s).

E. Country of Tax Residence and Tax ID number: Tax Regulations require us to collect information about each investors tax residency. In certain

circumstances (including if we do not receive a valid self-certification from you) we may be obliged to share information on your account with relevant

tax authorities. If you have any questions about your tax residency, please contact your tax advisor. Should any information provided change in the

future, please ensure you advise us of the changes promptly. If you are a US citizen or resident, please include United States in this related field along

with your US Tax Identification Number.

F. UBO Codes:

UBO Code Description

UBO-1

Controlling ownership interest of more than 25% of shares or capital or profits of the juridical person [Investor], where the juridical person is

a company

UBO-2

Controlling ownership interest of more than 15% of the capital or profits of the juridical person [Investor], where the juridical person is a

partnership

UBO-3

Controlling ownership interest of more than 15% of the property or capital or profits of the juridical person [Investor], where the juridical

person is an unincorporated association or body of individuals

UBO-4

Natural person exercising control over the juridical person through other means exercised through voting rights, agreement, arrangements

or in any other manner [In cases where there exists doubt under clause 4 (a) above as to whether the person with the controlling ownership

interest is the beneficial owner or where no natural person exerts control through ownership interests]

UBO-5

Natural person who holds the position of senior managing official [In case no natural person cannot be identified as above]

UBO-6

The settlor(s) of the trust

UBO-7

Trustee(s) of the Trust

UBO-8

The Protector(s) of the Trust [if applicable].

UBO-9

The beneficiaries with 15% or more interest in the trust if they are natural person(s)

UBO-10 Natural person(s) exercising ultimate effective control over the Trust through a chain of control or ownership.

You might also like

- Certificate of Increase of Capital StockDocument2 pagesCertificate of Increase of Capital StockNarciso Reyes Jr.100% (5)

- W9 FormDocument1 pageW9 FormChris GreeneNo ratings yet

- How to Form a Nonprofit Corporation (National Edition): A Step-by-Step Guide to Forming a 501(c)(3) Nonprofit in Any StateFrom EverandHow to Form a Nonprofit Corporation (National Edition): A Step-by-Step Guide to Forming a 501(c)(3) Nonprofit in Any StateRating: 3.5 out of 5 stars3.5/5 (9)

- IRS Form W-9Document8 pagesIRS Form W-9SAHASec8No ratings yet

- Fatca-Crs - Icici BankDocument8 pagesFatca-Crs - Icici BankSankaram KasturiNo ratings yet

- FATCA Form Individual 061015 V1Document2 pagesFATCA Form Individual 061015 V1sanjay901No ratings yet

- FATCA Declaration HUFDocument7 pagesFATCA Declaration HUFDrAjay SinghNo ratings yet

- Fatca Crs FaqsDocument7 pagesFatca Crs FaqsMathew SimonNo ratings yet

- Sundaram FATCA CRS Form IndividualDocument2 pagesSundaram FATCA CRS Form IndividualAnonymous cXDbOjUr1dNo ratings yet

- FATCA Individual PDFDocument2 pagesFATCA Individual PDFPrathik NamakalNo ratings yet

- Fatca FormDocument1 pageFatca FormGarv BhayanaNo ratings yet

- Fatca Non Individual Form Annexure IIDocument6 pagesFatca Non Individual Form Annexure IIabhijit_bhandurge5011No ratings yet

- FATCA Declaration Non Individuals Retail FinalDocument7 pagesFATCA Declaration Non Individuals Retail FinalmohangboxNo ratings yet

- FATCA Declaration Individual FINALDocument3 pagesFATCA Declaration Individual FINALadvaitNo ratings yet

- FATCA Declaration Individual HUFDocument8 pagesFATCA Declaration Individual HUFmohangboxNo ratings yet

- 9AKIHKTQ FATCAIndividualZerodhapdfDocument2 pages9AKIHKTQ FATCAIndividualZerodhapdfSHOBHA VERMANo ratings yet

- Fatca Declaration Active Trade Channel IslandsDocument6 pagesFatca Declaration Active Trade Channel IslandsLosaNo ratings yet

- Fatca Declaration Non Profit PhilippinesDocument4 pagesFatca Declaration Non Profit PhilippinesAnomieNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJeffery OsbunNo ratings yet

- Self-Certification For Individual - FATCA/CRS Declaration FormDocument3 pagesSelf-Certification For Individual - FATCA/CRS Declaration FormSean MayNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationChristiney Spencer100% (2)

- FATCA Individuals PDFDocument2 pagesFATCA Individuals PDFfordd greenNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationapi-259574251No ratings yet

- FATCA and CRS Annexure For Individual Accounts-V-2Document2 pagesFATCA and CRS Annexure For Individual Accounts-V-2Maksim MikhailNo ratings yet

- FATCADocument2 pagesFATCAORIENNo ratings yet

- Extended KYC Annexure IndividualsDocument2 pagesExtended KYC Annexure IndividualsNarendra Reddy BhumaNo ratings yet

- Fatca Crs Non IndividualDocument1 pageFatca Crs Non IndividualHarsh-AgarwalNo ratings yet

- Specific Instructions: Form W-9 (Rev. 1-2011)Document3 pagesSpecific Instructions: Form W-9 (Rev. 1-2011)mibake0% (1)

- FATCA Declaration Individual HUFDocument7 pagesFATCA Declaration Individual HUFprofessionalassociates97No ratings yet

- FATCA Declaration For Individual FinalDocument2 pagesFATCA Declaration For Individual Finalmmiimc@gmail.comNo ratings yet

- FRM W8DM HRDocument2 pagesFRM W8DM HRmiscribeNo ratings yet

- RBL Fatca Crs Declaration EntitiesDocument2 pagesRBL Fatca Crs Declaration EntitiesAyush BankaNo ratings yet

- Remittance Certificate ChecklistDocument8 pagesRemittance Certificate ChecklistAnuj GuptaNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormYaacov KotlickiNo ratings yet

- Preparing For Fatca Understanding Implications and RequirementsDocument25 pagesPreparing For Fatca Understanding Implications and RequirementsylshihNo ratings yet

- FATCA/CRS Declaration Form - (Individual)Document3 pagesFATCA/CRS Declaration Form - (Individual)ansfaridNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationLogan BairdNo ratings yet

- FATCA Non IndividualDocument6 pagesFATCA Non IndividualMarneni Yallamanda RaoNo ratings yet

- Fatca Crs Self Certification FormDocument6 pagesFatca Crs Self Certification FormMohammed FaisalNo ratings yet

- FATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSDocument2 pagesFATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSOws AnishNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationJude Thomas SmithNo ratings yet

- W9Document4 pagesW9James-heatha GowersNo ratings yet

- Document Pack 9ST99MJR PDFDocument6 pagesDocument Pack 9ST99MJR PDFMohamed Diaa Mortada100% (1)

- Fatca DeclarationDocument3 pagesFatca DeclarationManish ShahNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationGreat Northern Insurance AgencyNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- New Fatca FormDocument3 pagesNew Fatca FormHanh ThuongNo ratings yet

- ASBL - FatcaDocument1 pageASBL - Fatcanitinjain9No ratings yet

- Annexure 1 FATCA-CRS Annexure For Individual AccountsDocument6 pagesAnnexure 1 FATCA-CRS Annexure For Individual AccountsbusuuuNo ratings yet

- Customer ID /account No - : One Input Is MandatoryDocument9 pagesCustomer ID /account No - : One Input Is MandatoryDhavalNo ratings yet

- FATCA Individual Form 21012016Document2 pagesFATCA Individual Form 21012016Aakash SharmaNo ratings yet

- Non IndividualsDocument11 pagesNon IndividualsAther AliNo ratings yet

- W-8ben For CDN Beachbody Coaches SampleDocument1 pageW-8ben For CDN Beachbody Coaches Sampleapi-295933330No ratings yet

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- J.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedFrom EverandJ.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedNo ratings yet

- New Era University: College of AccountancyDocument4 pagesNew Era University: College of AccountancyPeta AkountNo ratings yet

- UK Company Law Share Bankruptcy Void: FactsDocument4 pagesUK Company Law Share Bankruptcy Void: FactsPhúc NgọcNo ratings yet

- CEU Balance SheetDocument1 pageCEU Balance SheetmadhuNo ratings yet

- 2014 - 09 - 19 19 North Goa Mandate Letter PDFDocument2 pages2014 - 09 - 19 19 North Goa Mandate Letter PDFRaman IyerNo ratings yet

- Financial Analysis of MGBDocument8 pagesFinancial Analysis of MGBAr-Rayyan AshNo ratings yet

- NCERT Solutions For Class 12 Accountancy Chapter 1Document71 pagesNCERT Solutions For Class 12 Accountancy Chapter 1Anonymous DirectorNo ratings yet

- Protecting Interest of The Minority ShareholdersDocument4 pagesProtecting Interest of The Minority ShareholdersMohammad Shahjahan Siddiqui100% (1)

- Mva & Eva - MKDocument9 pagesMva & Eva - MKIfa FaizahNo ratings yet

- CSR Mini ProjectDocument8 pagesCSR Mini ProjectVikas PalNo ratings yet

- Analysis of Profit/Loss Account, Balance Sheet, Statement in Changes in Equity and Cash Flow Statement of Any Listed CompanyDocument25 pagesAnalysis of Profit/Loss Account, Balance Sheet, Statement in Changes in Equity and Cash Flow Statement of Any Listed CompanyMuhammad Hassaan AliNo ratings yet

- 2 InvestmentsDocument4 pages2 InvestmentsAdrian MallariNo ratings yet

- Corporation Law ReviewerDocument3 pagesCorporation Law ReviewerJada WilliamsNo ratings yet

- TheWorld sRichectArabsDocument51 pagesTheWorld sRichectArabsMian Muhammad Shahid SharifNo ratings yet

- Order in The Matter of Sunheaven Agro India LimitedDocument12 pagesOrder in The Matter of Sunheaven Agro India LimitedShyam SunderNo ratings yet

- Chapter 3 Beams 13ed RevisedDocument31 pagesChapter 3 Beams 13ed RevisedEvan AnwariNo ratings yet

- Chap 018Document19 pagesChap 018dbjnNo ratings yet

- International Business Group AssignmentDocument41 pagesInternational Business Group AssignmentTheng OuchNo ratings yet

- Chapter Four: Mcgraw-Hill/IrwinDocument17 pagesChapter Four: Mcgraw-Hill/IrwinJohn ReyNo ratings yet

- Chap 2 3Document36 pagesChap 2 3khayyumNo ratings yet

- Incorporation Test - Grand Father RuleDocument3 pagesIncorporation Test - Grand Father Ruleryan resultsNo ratings yet

- Acccob2 Portfolio - 064025Document7 pagesAcccob2 Portfolio - 064025Clay MaaliwNo ratings yet

- Mark Boucher - 2001 Watching Macro Indicators. The DollarDocument4 pagesMark Boucher - 2001 Watching Macro Indicators. The Dollardavin_zi100% (1)

- Financial Analysis and Python Small TestDocument4 pagesFinancial Analysis and Python Small Testtheodor_munteanuNo ratings yet

- PU - II Constitutional ProvisionsDocument81 pagesPU - II Constitutional ProvisionsNievesAlarconNo ratings yet

- Week 1 Tutorial AnswersDocument7 pagesWeek 1 Tutorial AnswersstvnNo ratings yet

- Raising FinanceDocument17 pagesRaising FinanceJephthah BansahNo ratings yet

- What-If Analysis TemplateDocument18 pagesWhat-If Analysis TemplateDardan DeskuNo ratings yet

- 03 Governance of Family FirmsDocument20 pages03 Governance of Family FirmsFsdaSdsNo ratings yet

- Valuation and Rates of Return: Mcgraw-Hill/IrwinDocument11 pagesValuation and Rates of Return: Mcgraw-Hill/IrwinAhmed ShantoNo ratings yet