Professional Documents

Culture Documents

Theodore and Catherine M. Mootos v. Commissioner of Internal Revenue, 907 F.2d 142, 1st Cir. (1990)

Theodore and Catherine M. Mootos v. Commissioner of Internal Revenue, 907 F.2d 142, 1st Cir. (1990)

Uploaded by

Scribd Government DocsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Theodore and Catherine M. Mootos v. Commissioner of Internal Revenue, 907 F.2d 142, 1st Cir. (1990)

Theodore and Catherine M. Mootos v. Commissioner of Internal Revenue, 907 F.2d 142, 1st Cir. (1990)

Uploaded by

Scribd Government DocsCopyright:

Available Formats

907 F.

2d 142

Unpublished Disposition

NOTICE: First Circuit Local Rule 36.2(b)6 states unpublished

opinions may be cited only in related cases.

Theodore and Catherine M. MOOTOS, Petitioners, Appellant,

v.

COMMISSIONER OF INTERNAL REVENUE, Respondent,

Appellee.

No. 89-1793.

United States Court of Appeals, First Circuit.

April 23, 1990.

Appeal From: U.S.T.C.

AFFIRMED

Before TORRUELLA, SELYA and CYR, Circuit Judges.

PER CURIAM:

Taxpayers, Theodore and Catherine Mootos, appeal from a decision of the

United States Tax Court. The court had determined that taxpayers had underrepresented their income for the years 1983, 1984 and 1985. Mr. Mootos, the

sole owner and operator of a shoe repair shop, kept no books, business records

or register receipts concerning the fiscal state of his business during these

years.

Taxpayers listed their net income for 1983 as $4600, for 1984 as $4800 and for

1985 as $4500. No other income was reported. The IRS determined that tax

was due on an unreported income of $22,834 for these three years. The

determination was based on the source and application of funds method of

income reconstruction. 1 According to the tax court, this method "is based upon

the assumption that the amount by which the taxpayer's application of funds

exceeds his known sources of income is taxable income absent some showing

by the taxpayer of a nontaxable source." Memorandum Opinion, at 3.

The taxpayers attempted to refute the determination that they owed taxes on

unreported income by averring that their children had contributed money from

their jobs to taxpayers. Also, Mr. Mootos stated that he had an inheritance of

$1500 which he had used as income.

The tax court agreed with the Commissioner's determination that taxpayers

owed income tax for the years 1983-1985 and that the inheritance and the

income from their children, a nontaxable source, did not make up for the excess

application of funds. Such a finding is subject to a "clearly erroneous" standard

on appellate review. Commissioner v. Duberstein [60-2 USTC p 9515], 363

U.S. 278, 291 (1960). Taxpayers, on appeal, raise two issues: (1) the refusal by

the IRS to accept as nontaxable income the earnings of their children and the

money received as an inheritance; and (2) the failure of the IRS to return the

original receipts concerning the inheritance. The brief on appeal consists only

of calculations of their childrens' earnings and a copy of a will. Taxpayers do

not directly dispute the amount of unreported income determined by the

Commissioner or the amount of total taxes due for the period 1983 to 1985.

The decision by the tax court to accept such findings is not clearly erroneous.

See Duberstein, 363 U.S. at 291; Hanover Insurance Co. v. Commissioner [791 USTC p 9366], 598 F.2d 1211, 1220 (1st Cir.), cert. denied, 444 U.S. 915

(1979). The view that the alleged sources of nontaxable income--the childrens'

earnings and the inheritance--could not explain the amount of funds expended

is not clearly wrong. The presumption of correctness of the Commissioner is

not rebutted by taxpayers' recapitulation of their view of the facts.

The decision of the tax court is affirmed.

AFFIRMED.

In the tax court's view the source and application of funds method is an

accepted method for determining income, especially where a taxpayer does not

keep books and records sufficient to show gross income. Memorandum

Opinion, at 3. The taxpayers do not dispute this method

You might also like

- PASVOLSKY-MOULTON 1924 - Russian Debts and Russian ReconstructionDocument252 pagesPASVOLSKY-MOULTON 1924 - Russian Debts and Russian ReconstructionFloripondio1950% (2)

- Philex Mining Vs Cir DigestDocument3 pagesPhilex Mining Vs Cir DigestRyan Acosta100% (2)

- William E. Gatlin and Marilyn B. Gatlin, and James M. Winge and Willie B. Winge v. Commissioner of Internal Revenue, 754 F.2d 921, 11th Cir. (1985)Document4 pagesWilliam E. Gatlin and Marilyn B. Gatlin, and James M. Winge and Willie B. Winge v. Commissioner of Internal Revenue, 754 F.2d 921, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- James Petroleum Corporation v. Commissioner of Internal Revenue, 331 F.2d 344, 10th Cir. (1964)Document4 pagesJames Petroleum Corporation v. Commissioner of Internal Revenue, 331 F.2d 344, 10th Cir. (1964)Scribd Government DocsNo ratings yet

- Elaine Yow Girgis v. Commissioner of Internal Revenue, 888 F.2d 1386, 4th Cir. (1989)Document5 pagesElaine Yow Girgis v. Commissioner of Internal Revenue, 888 F.2d 1386, 4th Cir. (1989)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument14 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Taylor, E. v. CIR, 108 F.3d 1388, 10th Cir. (1997)Document12 pagesTaylor, E. v. CIR, 108 F.3d 1388, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument11 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Carolyn G. Wilcox, Formerly Known As Carolyn G. Lietzman v. Commissioner of Internal Revenue, 17 F.3d 1437, 10th Cir. (1994)Document6 pagesCarolyn G. Wilcox, Formerly Known As Carolyn G. Lietzman v. Commissioner of Internal Revenue, 17 F.3d 1437, 10th Cir. (1994)Scribd Government DocsNo ratings yet

- United States v. Robert K. Michaels and Margaret P. Michaels, 840 F.2d 901, 11th Cir. (1988)Document3 pagesUnited States v. Robert K. Michaels and Margaret P. Michaels, 840 F.2d 901, 11th Cir. (1988)Scribd Government DocsNo ratings yet

- United States v. James D'agostino, and Anne Marie D'Agostino, 145 F.3d 69, 2d Cir. (1998)Document7 pagesUnited States v. James D'agostino, and Anne Marie D'Agostino, 145 F.3d 69, 2d Cir. (1998)Scribd Government DocsNo ratings yet

- Corns v. United States, 4th Cir. (1998)Document5 pagesCorns v. United States, 4th Cir. (1998)Scribd Government DocsNo ratings yet

- Elinor W. Manning v. Commissioner of Internal Revenue, 614 F.2d 815, 1st Cir. (1980)Document4 pagesElinor W. Manning v. Commissioner of Internal Revenue, 614 F.2d 815, 1st Cir. (1980)Scribd Government DocsNo ratings yet

- Charles A. Diffendall v. Commissioner of Internal Revenue, 240 F.2d 836, 4th Cir. (1956)Document2 pagesCharles A. Diffendall v. Commissioner of Internal Revenue, 240 F.2d 836, 4th Cir. (1956)Scribd Government DocsNo ratings yet

- Coggin v. Comr. of IRS, 71 F.3d 855, 11th Cir. (1996)Document14 pagesCoggin v. Comr. of IRS, 71 F.3d 855, 11th Cir. (1996)Scribd Government DocsNo ratings yet

- United States v. Kenneth W. Waldeck, 909 F.2d 555, 1st Cir. (1990)Document11 pagesUnited States v. Kenneth W. Waldeck, 909 F.2d 555, 1st Cir. (1990)Scribd Government DocsNo ratings yet

- Green v. CIR, 10th Cir. (1999)Document8 pagesGreen v. CIR, 10th Cir. (1999)Scribd Government DocsNo ratings yet

- Stuart v. United States, 337 F.3d 31, 1st Cir. (2003)Document8 pagesStuart v. United States, 337 F.3d 31, 1st Cir. (2003)Scribd Government DocsNo ratings yet

- Gus Rinehart and Haydee Rinehart v. The United States of America, 429 F.2d 1286, 10th Cir. (1970)Document3 pagesGus Rinehart and Haydee Rinehart v. The United States of America, 429 F.2d 1286, 10th Cir. (1970)Scribd Government DocsNo ratings yet

- Bernard P. McDonough and Alma G. McDonough v. Commissioner of Internal Revenue, 577 F.2d 234, 4th Cir. (1978)Document3 pagesBernard P. McDonough and Alma G. McDonough v. Commissioner of Internal Revenue, 577 F.2d 234, 4th Cir. (1978)Scribd Government DocsNo ratings yet

- 446 Supreme Court Reports Annotated: Commissioner of Internal Revenue vs. Philippine American Life Insurance CoDocument4 pages446 Supreme Court Reports Annotated: Commissioner of Internal Revenue vs. Philippine American Life Insurance CoYrra LimchocNo ratings yet

- Clarence H. O'DOnnell and Georgia G. O'DOnnell v. Commissioner of Internal Revenue Service, 726 F.2d 679, 11th Cir. (1984)Document5 pagesClarence H. O'DOnnell and Georgia G. O'DOnnell v. Commissioner of Internal Revenue Service, 726 F.2d 679, 11th Cir. (1984)Scribd Government DocsNo ratings yet

- Smith v. Manning (Two Cases), 189 F.2d 345, 3rd Cir. (1951)Document6 pagesSmith v. Manning (Two Cases), 189 F.2d 345, 3rd Cir. (1951)Scribd Government DocsNo ratings yet

- Fred M. Waring and Virginia Waring v. Commissioner of Internal Revenue, 412 F.2d 800, 3rd Cir. (1969)Document3 pagesFred M. Waring and Virginia Waring v. Commissioner of Internal Revenue, 412 F.2d 800, 3rd Cir. (1969)Scribd Government DocsNo ratings yet

- Part Ii Income Taxation Case DigestsDocument119 pagesPart Ii Income Taxation Case DigestsJoshua CustodioNo ratings yet

- United States v. George W. Vardine, 305 F.2d 60, 2d Cir. (1962)Document9 pagesUnited States v. George W. Vardine, 305 F.2d 60, 2d Cir. (1962)Scribd Government DocsNo ratings yet

- John B. Mathes v. United States, 901 F.2d 1031, 11th Cir. (1990)Document4 pagesJohn B. Mathes v. United States, 901 F.2d 1031, 11th Cir. (1990)Scribd Government DocsNo ratings yet

- Young Motor Company, Inc. v. Commissioner of Internal Revenue, 339 F.2d 481, 1st Cir. (1964)Document3 pagesYoung Motor Company, Inc. v. Commissioner of Internal Revenue, 339 F.2d 481, 1st Cir. (1964)Scribd Government DocsNo ratings yet

- Daniel L. CARROLL and Ingrid N. Carroll, Plaintiffs-Appellees-Cross-Appellants, v. UNITED STATES of America, Defendant-Appellant-Cross - AppelleeDocument21 pagesDaniel L. CARROLL and Ingrid N. Carroll, Plaintiffs-Appellees-Cross-Appellants, v. UNITED STATES of America, Defendant-Appellant-Cross - AppelleeScribd Government DocsNo ratings yet

- Jerry W. Counts and Rae A. Counts v. Commissioner of Internal Revenue, 774 F.2d 426, 11th Cir. (1985)Document3 pagesJerry W. Counts and Rae A. Counts v. Commissioner of Internal Revenue, 774 F.2d 426, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- Rozpad v. Commissioner, 154 F.3d 1, 1st Cir. (1998)Document12 pagesRozpad v. Commissioner, 154 F.3d 1, 1st Cir. (1998)Scribd Government DocsNo ratings yet

- Balabanian v. CIR, 10th Cir. (1999)Document6 pagesBalabanian v. CIR, 10th Cir. (1999)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument6 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Grossman v. Commissioner, IRS, 4th Cir. (1999)Document9 pagesGrossman v. Commissioner, IRS, 4th Cir. (1999)Scribd Government DocsNo ratings yet

- Greene v. Commissioner, IRS, 4th Cir. (1999)Document7 pagesGreene v. Commissioner, IRS, 4th Cir. (1999)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument6 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Muriel Dodge Neeman (Formerly Muriel Dodge) v. Commissioner of Internal Revenue, 255 F.2d 841, 2d Cir. (1958)Document7 pagesMuriel Dodge Neeman (Formerly Muriel Dodge) v. Commissioner of Internal Revenue, 255 F.2d 841, 2d Cir. (1958)Scribd Government DocsNo ratings yet

- Published United States Court of Appeals For The Fourth CircuitDocument16 pagesPublished United States Court of Appeals For The Fourth CircuitScribd Government DocsNo ratings yet

- Goldstein, Baron & Lewis, Chartered v. United States, 995 F.2d 35, 4th Cir. (1993)Document5 pagesGoldstein, Baron & Lewis, Chartered v. United States, 995 F.2d 35, 4th Cir. (1993)Scribd Government DocsNo ratings yet

- United States v. Martin, 4th Cir. (1997)Document6 pagesUnited States v. Martin, 4th Cir. (1997)Scribd Government DocsNo ratings yet

- George Schwarzkopf v. Commissioner of Internal Revenue, 246 F.2d 731, 3rd Cir. (1957)Document5 pagesGeorge Schwarzkopf v. Commissioner of Internal Revenue, 246 F.2d 731, 3rd Cir. (1957)Scribd Government DocsNo ratings yet

- 10 (F) Dayrit V CruzDocument7 pages10 (F) Dayrit V CruzChristiane Marie BajadaNo ratings yet

- Filed: Patrick FisherDocument13 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- David & Ann Marie Niemela v. United States, 995 F.2d 1061, 1st Cir. (1993)Document12 pagesDavid & Ann Marie Niemela v. United States, 995 F.2d 1061, 1st Cir. (1993)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument8 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Richlands Medical Association v. Commissioner of Internal Revenue, 953 F.2d 639, 4th Cir. (1992)Document10 pagesRichlands Medical Association v. Commissioner of Internal Revenue, 953 F.2d 639, 4th Cir. (1992)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument9 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument11 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Statcon Case Digest July 9, 2013Document4 pagesStatcon Case Digest July 9, 2013Dann NixNo ratings yet

- Siciiid Divis/Iii: Ciiit If Tu AppealsDocument27 pagesSiciiid Divis/Iii: Ciiit If Tu AppealsLeamieRetalesNo ratings yet

- McNichols v. IRS, 13 F.3d 432, 1st Cir. (1993)Document8 pagesMcNichols v. IRS, 13 F.3d 432, 1st Cir. (1993)Scribd Government DocsNo ratings yet

- Cyclone Drilling, Inc., A Wyoming Corporation v. Michael J. Kelley, As District Director of Internal Revenue Service For The Cheyenne District, 769 F.2d 662, 10th Cir. (1985)Document5 pagesCyclone Drilling, Inc., A Wyoming Corporation v. Michael J. Kelley, As District Director of Internal Revenue Service For The Cheyenne District, 769 F.2d 662, 10th Cir. (1985)Scribd Government DocsNo ratings yet

- Betty W. STEELE, Appellant, v. Secretary of The Treasury, Donald REGAN Charles E. Roddy, District Director Internal Revenue Service, AppelleesDocument5 pagesBetty W. STEELE, Appellant, v. Secretary of The Treasury, Donald REGAN Charles E. Roddy, District Director Internal Revenue Service, AppelleesScribd Government DocsNo ratings yet

- The United States of America v. Alfonzo L. Dowell and Vivian T. Dowell, 446 F.2d 145, 10th Cir. (1971)Document5 pagesThe United States of America v. Alfonzo L. Dowell and Vivian T. Dowell, 446 F.2d 145, 10th Cir. (1971)Scribd Government DocsNo ratings yet

- Frank E. & Mildred E. Rickel v. Commissioner of Internal Revenue, 900 F.2d 655, 3rd Cir. (1990)Document19 pagesFrank E. & Mildred E. Rickel v. Commissioner of Internal Revenue, 900 F.2d 655, 3rd Cir. (1990)Scribd Government DocsNo ratings yet

- Rupert Brent Johnson and Ada Marie Johnson v. Leroy Quinn, Commissioner, Department of Finance Government of The Virgin Islands, 821 F.2d 212, 3rd Cir. (1987)Document7 pagesRupert Brent Johnson and Ada Marie Johnson v. Leroy Quinn, Commissioner, Department of Finance Government of The Virgin Islands, 821 F.2d 212, 3rd Cir. (1987)Scribd Government DocsNo ratings yet

- Central Cuba Sugar Co. v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Central Cuba Sugar Co, 198 F.2d 214, 2d Cir. (1952)Document6 pagesCentral Cuba Sugar Co. v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Central Cuba Sugar Co, 198 F.2d 214, 2d Cir. (1952)Scribd Government DocsNo ratings yet

- Albert White and Vivian B. White v. Commissioner of Internal Revenue, 776 F.2d 976, 11th Cir. (1985)Document2 pagesAlbert White and Vivian B. White v. Commissioner of Internal Revenue, 776 F.2d 976, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- United States v. Melot (Billy), 10th Cir. (2014)Document18 pagesUnited States v. Melot (Billy), 10th Cir. (2014)Scribd Government DocsNo ratings yet

- United States Court of Appeals Third CircuitDocument4 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- Alvin Stjernholm and Elsie I. Stjernholm v. Commissioner of Internal Revenue, 933 F.2d 1019, 10th Cir. (1991)Document4 pagesAlvin Stjernholm and Elsie I. Stjernholm v. Commissioner of Internal Revenue, 933 F.2d 1019, 10th Cir. (1991)Scribd Government DocsNo ratings yet

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Parker Excavating v. LaFarge West, 10th Cir. (2017)Document24 pagesParker Excavating v. LaFarge West, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- P FM Credit Policy BriefDocument16 pagesP FM Credit Policy Briefviktor6No ratings yet

- The Economic Basis For Government ActivityDocument24 pagesThe Economic Basis For Government Activitydendenlibero100% (2)

- Myanmar - Economic Forecasts - 2017-2020 OutlookDocument8 pagesMyanmar - Economic Forecasts - 2017-2020 OutlookTHAN HANNo ratings yet

- Assessment of Sakala - Pilot PhaseDocument15 pagesAssessment of Sakala - Pilot PhasepsridharpNo ratings yet

- The Boston Tea Party, 1773: Back PrintDocument3 pagesThe Boston Tea Party, 1773: Back Printiwat4No ratings yet

- SRO 586 of 1991Document2 pagesSRO 586 of 1991Abdul QadirNo ratings yet

- Drummond Commission Full ReportDocument562 pagesDrummond Commission Full ReportExaminerLifeNo ratings yet

- Model By-Laws Pack: Model Credit Control and Debt Collection By-Laws Model Water Services By-LawsDocument97 pagesModel By-Laws Pack: Model Credit Control and Debt Collection By-Laws Model Water Services By-LawszbhabhaNo ratings yet

- BudgetBrief2012 PDFDocument90 pagesBudgetBrief2012 PDFIdara Tehqiqat Imam Ahmad RazaNo ratings yet

- 2013fin MS-136Document7 pages2013fin MS-136rvkumar3619690No ratings yet

- Hidden Debt, Hidden Deficits: 2017 Edition: How Pension Promises Are Consuming State and Local BudgetsDocument32 pagesHidden Debt, Hidden Deficits: 2017 Edition: How Pension Promises Are Consuming State and Local BudgetsHoover Institution100% (6)

- Economic Factors Affecting International BusinessDocument25 pagesEconomic Factors Affecting International BusinesscooolashubNo ratings yet

- Rev Regs 16-2005 Sec 4.114-2 As Amended by RR 4-2007Document2 pagesRev Regs 16-2005 Sec 4.114-2 As Amended by RR 4-2007Catherine Rae EspinosaNo ratings yet

- Hal Pay Leave Full Da Clarification Memo.14568-63 Pc1 2011Document2 pagesHal Pay Leave Full Da Clarification Memo.14568-63 Pc1 2011dharanimanasaNo ratings yet

- 6 Ultimate Evaluation TechniquesDocument2 pages6 Ultimate Evaluation TechniquesHow Xin YiNo ratings yet

- American Profligacy and American PowerDocument6 pagesAmerican Profligacy and American Powermatrixclown+scribdNo ratings yet

- Budget AnalysisDocument13 pagesBudget AnalysisRamneet ParmarNo ratings yet

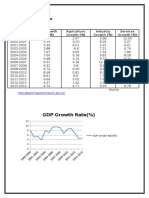

- PH - PH Economic Record Under 6 PresidentsDocument4 pagesPH - PH Economic Record Under 6 Presidentsapi-263174695No ratings yet

- Economics Class 11 Unit 12-Government-FinanceDocument0 pagesEconomics Class 11 Unit 12-Government-Financewww.bhawesh.com.npNo ratings yet

- US Debt Rating DowngradedDocument3 pagesUS Debt Rating DowngradedmonarchadvisorygroupNo ratings yet

- Euro Debt CrisisDocument13 pagesEuro Debt CrisisGajanan KounshaleyNo ratings yet

- Speech Round 2 4-8 7PMDocument7 pagesSpeech Round 2 4-8 7PMCurdledBurritoNo ratings yet

- Notice: Senior Executive Service Performance Review Board MembershipDocument1 pageNotice: Senior Executive Service Performance Review Board MembershipJustia.comNo ratings yet

- CH 13 Macroeconomics KrugmanDocument6 pagesCH 13 Macroeconomics KrugmanMary Petrova100% (2)

- Francia Intermediate Appellate Court, G.R. No. 76749Document5 pagesFrancia Intermediate Appellate Court, G.R. No. 76749Mp CasNo ratings yet

- How Hitler Defied The BankersDocument4 pagesHow Hitler Defied The BankersMd Redhwan Sidd KhanNo ratings yet

- Democratic Socialist Republic of Sri Lanka: Department of Public FinanceDocument5 pagesDemocratic Socialist Republic of Sri Lanka: Department of Public FinancesuntharthiNo ratings yet

- Audit Report 1st July 2016 To 30th June 2017Document350 pagesAudit Report 1st July 2016 To 30th June 2017ION NewsNo ratings yet