Professional Documents

Culture Documents

Memo 2

Memo 2

Uploaded by

Shafqat U K NiaziOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Memo 2

Memo 2

Uploaded by

Shafqat U K NiaziCopyright:

Available Formats

Introduction

When a firm is presented with a capital budgeting decision, one of its first tasks

is to determine whether the project will prove to be profitable. The net present

value (NPV), internal rate of return (IRR) and payback period (PB) methods are

the most common approaches to project selection.

By considering all these approaches we chose the Project 2 because in our point

of view this project fulfils the requirements for a firm to invest. The main reason

of choosing this project is its relatively low investment and Mr. de Ville recovers

his investment within two years and it involves relatively low risk. Project 3 is

also acceptable as it has positive NPV and also have payback period of 2 years.

Pay Back Period

Payback periods are typically used when liquidity presents a major concern. If a

company only has a limited amount of funds, they might be able to only

undertake one major project at a time. Therefore, management will heavily focus

on recovering their initial investment in order to undertake subsequent projects.

Net Present Value (NPV)

Accept the project only if its NPV is positive or zero. Reject the project having

negative NPV. While comparing two or more exclusive projects having positive

NPVs, accept the one with highest NPV.

Internal Rate of Return (IRR)

The internal rate of return on an investment or project is the "annualized

effective compounded return rate" or rate of return that makes the net present

value (NPV as NET*1/(1+IRR)^year) of all cash flows (both positive and negative)

from a particular investment equal to zero.

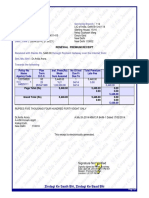

Calculations

Projects

NPV

Payback

IRR

3437431

6 years

30.851%

44371.47

2 years

23.375%

382960.50

2 years

32.49%

1370662

7 years

15.02%

460971

1 year

Implication Of Decision

The examination of the five different projects appraisals presented here has

clearly shown that the various methods involve the risk of misinterpretation. It is

possible to get three different choices using three different methods. And this

may not always match the company's strategy. Adopting the payback rule, we

can select any of these projects because according to demand of owner that

project will be acceptable that have payback period of 3.5 years. Even the

method of internal rate of return viewed on its own provides no reliable results

for an investment decision .The opportunities identified for rendering the other

methods practically useful, indicate that application of the net present value

method is advantageous. The actual investment can be directly compared with a

reference interest rate without making any modifications. Because the capital

value is expressed in monetary units, it is simple to interpret the results. So on

the basis of all these methods we select Project 2 to invest in it.It is a short term

investment and owner would not have to wait for 30 years.it has a payback

period of 2 years which is acceptable. Project 3 is also relatively better project it

also has payback period of 2 years. Also the profitability index of both these

projects shows that we should invest in these projects. While, other projects do

not fulfil the requirements of owner.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Calpine Corp. The Evolution From Project To Corporate FinanceDocument4 pagesCalpine Corp. The Evolution From Project To Corporate FinanceDarshan Gosalia100% (1)

- Taxation SituationalDocument113 pagesTaxation SituationalDaryl Mae Mansay100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project Management Chapter 8 Investment Criteria Question AnswersDocument6 pagesProject Management Chapter 8 Investment Criteria Question AnswersAkm EngidaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancegaurav kumarNo ratings yet

- Strama Chapter 2 - Mission VisionDocument6 pagesStrama Chapter 2 - Mission VisionsaiNo ratings yet

- Mock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-ADocument9 pagesMock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-AKanwar M KaurNo ratings yet

- Third Bridge Forum Interview - Visa Earthport Acquisition Crossborder Payments Outlook - 21219Document12 pagesThird Bridge Forum Interview - Visa Earthport Acquisition Crossborder Payments Outlook - 21219How Xiang NgNo ratings yet

- T10 Government Accounting PDFDocument9 pagesT10 Government Accounting PDFnicahNo ratings yet

- Pdic Frequently Ask QuestionsDocument3 pagesPdic Frequently Ask QuestionsColleen Rose GuanteroNo ratings yet

- Part A: PersonalDocument2 pagesPart A: PersonalkaushikNo ratings yet

- Service TaxDocument15 pagesService TaxMonu TulsyanNo ratings yet

- Operating Budget DiscussionDocument3 pagesOperating Budget DiscussionDavin DavinNo ratings yet

- List of Licensed Insurance Intermediaries Kenya - 2019Document2 pagesList of Licensed Insurance Intermediaries Kenya - 2019Tony MutNo ratings yet

- Money: Unit of ExchangeDocument2 pagesMoney: Unit of ExchangeElla PlacidoNo ratings yet

- Renewal Premium Receipt: Collecting Branch: E-Mail: Phone: Transaction No.: Date (Time) : Servicing BranchDocument1 pageRenewal Premium Receipt: Collecting Branch: E-Mail: Phone: Transaction No.: Date (Time) : Servicing BranchAnirudh AroraNo ratings yet

- Multiple Choice Questions 1 The Random Walk Theory Suggests ADocument2 pagesMultiple Choice Questions 1 The Random Walk Theory Suggests Atrilocksp SinghNo ratings yet

- Irish CorporationDocument3 pagesIrish CorporationAngeline RamirezNo ratings yet

- PFRS 9 - Financial InstrumentDocument3 pagesPFRS 9 - Financial InstrumentErika Panit ReyesNo ratings yet

- Form PDF 197504840210823Document9 pagesForm PDF 197504840210823jassramgarhia2812No ratings yet

- Factsheet GB en Gb00byvxbg82Document9 pagesFactsheet GB en Gb00byvxbg82RocketNo ratings yet

- IND As 104Document33 pagesIND As 104shalu salamNo ratings yet

- Brief History of The ASEAN (1967 Present)Document6 pagesBrief History of The ASEAN (1967 Present)Redmond YuNo ratings yet

- Why Worlds Largest AMCs Not Present in India - August 2023Document12 pagesWhy Worlds Largest AMCs Not Present in India - August 2023manindrag00No ratings yet

- Exercise 1Document4 pagesExercise 1Quang Anh ChuNo ratings yet

- The Influence of Corona Virus Pandemic On The Indian Digital Payments EcosystemDocument11 pagesThe Influence of Corona Virus Pandemic On The Indian Digital Payments EcosystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Test Bank MANA 300 CH04Document8 pagesTest Bank MANA 300 CH04Diego Arturo Jove PradoNo ratings yet

- IPeople Inc - SEC Form 17-C Appointment of New Chief Risk Officer - June 1, 2021Document3 pagesIPeople Inc - SEC Form 17-C Appointment of New Chief Risk Officer - June 1, 2021dawijawof awofnafawNo ratings yet

- IMF Lending: When Can A Country Borrow From The IMF?Document5 pagesIMF Lending: When Can A Country Borrow From The IMF?Ram KumarNo ratings yet

- Final Accounts of Non Profit Organisation Sem 2 ImbaDocument3 pagesFinal Accounts of Non Profit Organisation Sem 2 ImbaBHAVIK RATHODNo ratings yet

- Personal Tariff GuideDocument1 pagePersonal Tariff GuideBUGIBONI SERVICE CENTRENo ratings yet