Professional Documents

Culture Documents

Minister Duncan To Minister Flaherty - FN-HST - May 18 2010

Minister Duncan To Minister Flaherty - FN-HST - May 18 2010

Uploaded by

Jorge Barrera0 ratings0% found this document useful (0 votes)

113 views7 pagesOntario letter to Ottawa on First Nations opposition to HST. Ontario says it is now up to Ottawa to ensure the existing point of sale tax exemption for First Nations remains as rail and highway blockades loom.

Original Title

Minister Duncan to Minister Flaherty - FN-HST - May 18 2010

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOntario letter to Ottawa on First Nations opposition to HST. Ontario says it is now up to Ottawa to ensure the existing point of sale tax exemption for First Nations remains as rail and highway blockades loom.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

113 views7 pagesMinister Duncan To Minister Flaherty - FN-HST - May 18 2010

Minister Duncan To Minister Flaherty - FN-HST - May 18 2010

Uploaded by

Jorge BarreraOntario letter to Ottawa on First Nations opposition to HST. Ontario says it is now up to Ottawa to ensure the existing point of sale tax exemption for First Nations remains as rail and highway blockades loom.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

Seeeeeeee eer cs

Tester [usataetease

‘Toronto ON MTA 1Y7 Tapmio ON MTA IVT

Sere, = ee

Her ee See

MAY 16 2000)

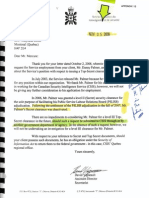

‘The Honourable James M. Flaherty,

ior t franc

apeiron Cane

1a OConnor Steet

tena, oN

Rinogs !

Doar Minish Flaherty

Further to our recent correspondence regarding the Province of Ontario's intention to

‘maintain the current point-of-sale exemption for First Nations, which has existed in

Ontario for almost 30 years, please accept ths leer as a confirmation of Ontario's

{formal request under Article 3 of Annex B to the Canada-Ontario Comprehensive

Integrated Tax Co-ordination Agreement (CITCA) for this exemption to be continued as

‘a federally administered point-of-sale rebate for First Nations under the harmonized

‘sales tax (HST).

‘The CITCA between the Government of Canada and the Government of Ontario allows

{or the designation of a number of Provincial Value Added Tax point-of-sale rebates

‘whose total value shall not exceed five per cent, in aggregate, of the estimated federal

‘Goods and Services Tax (GST) base for Ontario. The proposed point-of-sale rebate for

First Nations would be within five per cent of the GST base for Ontario, even when.

‘existing point-of-sale exemptions are included.

‘As you know, Ontario has repeatedly requested the federal government to administer

the current RST exemption for etatue Indiane undor the HST. To thie end, the

Government of Ontario and the Political Confederacy of the Chiefs of Ontario have

‘entered into a Memorandum of Agreement Concerning a Commitment to Continue the

First Nation Point-of-Sale Exemption under the HST, which | have attached for your

reference,

| would ike to arrange a meeting between senior officials from the Government of

Canada, the Government of Ontario and the Political Confederacy of the Chiefs of

Ontario. The purpose of this meeting is to discuss Ontario's request to maintain its

‘existing point of sale exemption for status Indians and to address any data issues

associated with its implementation for July 1, 2010.

-Joont'd

22+

| would suggest the folowing three dates as possible choices for a tripartite meeting:

May 31%, June 2" and June 7". As the Political Confederacy of the Chiefs of Ontario

has its offices in Tororto, | would propose Toronto as a meeting place. However, if

necessary, we would be willing to accommodate the schedule of your senior officials by

holding the meeting in Ottawa.

‘We would appreciate your attention to this matter, as itis of great importance to both of,

‘our governments and Ontario First Nations.

‘Sincerely,

/ ee

[fhe

ight Duncan

Minister

¢: The Honourable John Wikinson, Minister of Revenue

‘The Honourable Chris Bentley, Minister of Aboriginal Affairs

The Honourable Monique Smith, Minister of Intergovernmental Affairs

‘Angus Toulouse, Ontario Regional Chief

Enclosure

MEMORANDUM OF AGREEMENT CONCERNING A COMMITMENT TO CONTINUE

THE FIRST

NATION POINT OF SALE TAX EXEMPTION UNDER THE HST

BETWEEN

The Government of Ontario (“Ontario”), as represented by the Minister of

Revenue, and the Minister of Aboriginal Affairs

AND:

The Political Confederacy of the Chiefs of Ontario ("Political Confederacy”), as

represented by the Regional Chief, Angus Toulouse

WHEREAS Canada and Ontario have entered into a Canadz-Ontario

Comprehensive Integrated Tax Co-ordination Agreement (“CITCA"), and Canada,

will begin the implementation and administration of the HST effective July ist

2010;

WHEREAS, aside from this Memorandum of Agreement, after June 30, 2010,

Ontario First Nations and those Ontario First Nation people who are defined as an

“indian® under the Indian Act ("First Nation people”) will not have to pay HST on

goods purchased on a reserve, goods purchased off reserve from qualifying

remote stores, and goods purchased off reserve where the goods are delivered to

a reserve by the vender or vendor's agent;

WHEREAS Annex “B” of the CITCA provides Ontario with flexibility to designate

property or services to be eligible for a provincial value added tax ~ point of sale

(PVAT-POS) rebate, subject to certain conditions, which relate to the ability to

determine the amount of the expenditure in the province attributable to the

supply of that property or service;

WHEREAS Ontario currently provides for a point of sale tax exemption under the

Retail Sales Tax (RST) system on the sale of goods to First Nations and First

Nation people in Ontario who are Status Indians, which extends to purchases off

reserve (the exemption Is hereinafter referred to as the “First Nation point-of-sale

tax exemption”);

WHEREAS Ontario First Nations assert that the point of sale tax exemption is

based on thoir treaty and inherent rights;

WHEREAS Ontario asserts that the First Nation point of sale tax exemption is

based on its administrative policy, which provides for a point of sale tax

exemption for goods purchased off a reserve and “self delivered” by a Status

Indian to a reserve;

WHEREAS Ontario and the Political Confederacy may disagree on the basis of

the First Nation point-of-sale tax exemption; however, they are committed to the

Principle of reconciliation and to the continuation of the First Nation point-of-sale

tax exemption under the HST, as the exemption is currently applied in practice in

Ontario under the RST system;

WHEREAS ina letter dated February 1, 2010, from Prime Minister Harper to

Premier McGuinty, the Prime Minister acknowledged Ontario's request to

continue the First Nation point-of-sale tax exemption, and said:

‘The Government of Canada respects Ontario's autonomy to make policy

decisions in its jurisdiction. This includes decisions with respect to the

provincial portion of the HST

WHEREAS the Prime Minister's letter further stated:

The Agreement allows Ontario to introduce rebates under specified conditions,

Including that they can be supported by sufficient data. | understand that

Ontario's current approach would be difficult to accurately measure for the

purpose of determining its impact on provincial revenues. This could in turn

affect the Government of Canada’s ability to make accurate HST payments to the

provinces. Should you wish to continue the exemption, | would encourage your

officials to develop administrative options for addressing these measurement

Issues that are consistent with the terms of the CITCA.

2

WHEREAS officials designated by the Political Confederacy (pursuant to

resolution of the Ontario Chiefs in Assembly) and Ontario officials have been

engaged in a Working Group regarding the First Nation point-of-sale tax

exemption and HST;

WHEREAS the Working Group is working to address the data and measurement

Issues referred to in the Prime Minister's letter of February 1, 2010, and is

developing administrative options, that would accommodate the CITCA, and for

agreement by the federal government, including the current approach of

presenting an Indian status card, as well as a secured card option;

WHEREAS Ontario acknowledges that under the CITCA, it may advise Canada of

its desire to designate particular property or services eligible for a PVAT-POS

rebate under the HST, including the First Nation point-of-sale tax exemption;

WHEREAS, Annox B of the CITCA sets out conditions for providing point of sale

rebates, and because Canada will be administering the HST, it will be necessary

to engage Canada on the data and measurement issues, more particularly for the

purpose of determining the amount of the expenditure in the province attributable

to the supply of the property and service eligible for the PVAT-POS Rebate;

THEREFORE THE PARTIES HEREBY ENTER INTO THIS AGREEMENT AS A

STRONG COMMITMENT TO CONTINUE A FIRST NATION POINT-OF-SALE TAX

EXEMPTION UNDER THE HST.

1. Ontario and the Political Confederacy agree to work together to press

Canada toward realizing the continuation, under the HST, of the First Nations

point-of-sale tax exemption currently provided under the RST.

2. Ontario agrees to exercise its flexibility under the CITCA ané to take steps

under the CITCA to pursue the continuation of the First Nations point-of-sale tax

‘exemption under the HST, including the following:

+ Ontario shall advise Canada, pursuant to paragraph 3 of Annex B of the

CITCA, of its desire to designate the sale of goods to Indians off reserve as

cligible for a PVAT-POS Rebate effective July 1, 2010 for the purpose of

Continuing the First Nation point of sale exemption; and

+ Subject to the CITCA, Ontario shall take the necessary measures as soon as

possible to give effect to the PVAT-POS Rebates under the HST to ensure the

continuation of the First Nation point-of-sale exemption. The parties agree that

the continuation of the First Nation point-of-sale tax exemption is subject to

federal agreement, and that such agreement cannot be unreasonably withheld

under CITCA

3. Ontario and the Political Confederacy agree to work collaboratively to

address the data and measurement issues referred to in the Prime Minister's

letter of February 1, 2010, and provided for In paragraph 2 of Annex 8 of the

CITCA. In this regard, the parties agree to continue work, and to engage Canada,

for the purpose of determining the amount of the PVAT-POS Rebate in the

province attributable to the First Nation point-of-sale tax exemation under the

HST.

4. Ontario and the Political Confederacy will make it a priority, and make best

efforts within their respective authorities, to ensure that the First Nation point-of-

sale exemption is in place on July 1, 2010. However, in the event that itis not

possible to finalize discussions with Canade and to complete the administrative

measures to continue the First Nation point-of-sale tax exemption prior to July

4st, the parties agree to work on interim measures pending the full restoration

and implementation of the First Nation point-of-sale tax exemption. The objective

of the interim measures is to provide relief while the restoration and

Implementation of the First Nation point of sale exemption Is being finalized.

5. Ontario agrees to provide reasonable resources to the Chiefs of Ontario

Office for the Political Confederacy for the sole purpose of supporting joint

discussion and agreed research outlined above.

6. Ontario and the Poli

ical Confederacy agree to coordinate communications

whenever possible, including communications that will promote a peaceful

resolution of differences, and the Political Confederacy agrees to communicate

the work of the technical table to their respective communities

7. The parties will review progress on these efforts at regular intervals.

8. The Political Confederacy and Ontario acknowledge that the outcome of the

work under this Memorandum of Agreement, including any administrative options

or agreements for the implementation of the First Nation point-of-sale tax

‘exemption, or any interim measures, Is

subject to all necessary approvals, including the approval of the Ontario Chiefs.

In Assembly,

8. This Agreement is without prejudice to both parties and to the Aboriginal

and treaty rights of Ontario First Nations.

SIGNED BY THE RESPECTIVE PARTIES ON THE 3° DAY OF May, 2020

POLITICAL CONFEDERACY: ONTARIO:

fare

GLA LA,

eee ~ wae

Regional Chief Angus Minister Christopher Béatiey

Toulouse

an

ON

; / Minter John Wilkinson

( \

You might also like

- LetterDocument5 pagesLetterJorge BarreraNo ratings yet

- Changes Under The Customs Modernization and Tariff ActDocument20 pagesChanges Under The Customs Modernization and Tariff ActreseljanNo ratings yet

- Update - HST - June 7 Tripartite Meeting of Senior OfficialsDocument3 pagesUpdate - HST - June 7 Tripartite Meeting of Senior OfficialsJorge BarreraNo ratings yet

- InstructionsDocument3 pagesInstructionsSino GeneralNo ratings yet

- 20150120-G. H. Schorel-Hlavka O.W.B. To MR TONY ABBOTT PM-Re Melbourne's East West Link-EtcDocument5 pages20150120-G. H. Schorel-Hlavka O.W.B. To MR TONY ABBOTT PM-Re Melbourne's East West Link-EtcGerrit Hendrik Schorel-HlavkaNo ratings yet

- April 2010 Tax BriefDocument10 pagesApril 2010 Tax BriefAna MergalNo ratings yet

- United States District Court District of Puerto RicoDocument8 pagesUnited States District Court District of Puerto RicoEmily RamosNo ratings yet

- 01032018-GST Concept and StatusDocument16 pages01032018-GST Concept and StatusGanesh AnantharamNo ratings yet

- House Hearing, 110TH Congress - Critical Budget Issues Affecting The 2010 CensusDocument36 pagesHouse Hearing, 110TH Congress - Critical Budget Issues Affecting The 2010 CensusScribd Government DocsNo ratings yet

- 20180316-G. H. Schorel-Hlavka O.W.B. To Local Government Review Secretariat-SupplementDocument9 pages20180316-G. H. Schorel-Hlavka O.W.B. To Local Government Review Secretariat-SupplementGerrit Hendrik Schorel-HlavkaNo ratings yet

- GST Concept Status Ason 03062017 PDFDocument15 pagesGST Concept Status Ason 03062017 PDFAarti MoreNo ratings yet

- TIEA Agreement Between Anguilla and United KingdomDocument16 pagesTIEA Agreement Between Anguilla and United KingdomOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- 20140429-G. H .Schorel-Hlavka O.W.B. To MR Tony Abbott PM - Re 'Payable To The Queen' EtcDocument7 pages20140429-G. H .Schorel-Hlavka O.W.B. To MR Tony Abbott PM - Re 'Payable To The Queen' EtcGerrit Hendrik Schorel-HlavkaNo ratings yet

- GST Concept and StatusDocument11 pagesGST Concept and Statusichchhit srivastavaNo ratings yet

- Mandanas v. Ochoa 2018 - G.R. No. 199802Document35 pagesMandanas v. Ochoa 2018 - G.R. No. 199802Hannah Keziah Dela CernaNo ratings yet

- British Coalition Government AgreementDocument7 pagesBritish Coalition Government Agreementrpmackey3334No ratings yet

- SM GSTDocument12 pagesSM GSTPranav TejaNo ratings yet

- Central Sales Tax Act, 1956: (Division B', M.M.S. - I Year)Document13 pagesCentral Sales Tax Act, 1956: (Division B', M.M.S. - I Year)amitbvimsrNo ratings yet

- Tax LawsDocument6 pagesTax LawsHeva AbsalonNo ratings yet

- Tax Incentives 10708Document5 pagesTax Incentives 10708Hib Atty TalaNo ratings yet

- Business Legislation: CBIA Summary ofDocument31 pagesBusiness Legislation: CBIA Summary ofMalvamel G LennonNo ratings yet

- Taxation 1Document27 pagesTaxation 1Elijah MendozaNo ratings yet

- Gstconference NoticeDocument4 pagesGstconference NoticegauravNo ratings yet

- PPSI Vs ChatoDocument4 pagesPPSI Vs ChatoDar CoronelNo ratings yet

- 20190706-PRESS RELEASE MR G. H. Schorel-Hlavka O.W.B. ISSUE - Re The Theft of Our Democracy, Etc, & The Constitution-Supplement 56-AppropriationDocument5 pages20190706-PRESS RELEASE MR G. H. Schorel-Hlavka O.W.B. ISSUE - Re The Theft of Our Democracy, Etc, & The Constitution-Supplement 56-AppropriationGerrit Hendrik Schorel-HlavkaNo ratings yet

- Diaz vs. Secretary of Finance-Value Added Tax (VAT)Document12 pagesDiaz vs. Secretary of Finance-Value Added Tax (VAT)Jepoy Nisperos ReyesNo ratings yet

- Research 22Document26 pagesResearch 22AngelicaNo ratings yet

- ABAKADA vs. ErmitaDocument26 pagesABAKADA vs. ErmitaAngelo CastilloNo ratings yet

- G.R. No. 199802 Mandanas Vs OchoaDocument25 pagesG.R. No. 199802 Mandanas Vs OchoaroigtcNo ratings yet

- Press Release of The Meeting of The Council of Ministers of 06.10.2010Document2 pagesPress Release of The Meeting of The Council of Ministers of 06.10.2010Warren WrightNo ratings yet

- Opinion No. 19 Dated June 22, 2021Document6 pagesOpinion No. 19 Dated June 22, 2021Simeon SuanNo ratings yet

- Critical Analysis Including Suggestions For ImprovementDocument4 pagesCritical Analysis Including Suggestions For ImprovementAditya DeshmukhNo ratings yet

- Contrato de Impuestos ITALIADocument11 pagesContrato de Impuestos ITALIABIOSTER QUIÑONESNo ratings yet

- The Illegality of The Rivers State Social Services Levy BillDocument3 pagesThe Illegality of The Rivers State Social Services Levy Billeomo_usohNo ratings yet

- ST TH THDocument23 pagesST TH THgaganNo ratings yet

- Diaz v. SOF, GR 193007, 2011Document12 pagesDiaz v. SOF, GR 193007, 2011Santos, CarlNo ratings yet

- Abakada Guro Party List Vs Executive SecretaryDocument8 pagesAbakada Guro Party List Vs Executive SecretaryshelNo ratings yet

- Mandanas v. Ochoa-G.R. No. 199802Document25 pagesMandanas v. Ochoa-G.R. No. 199802Dianne Hannaly AquinoNo ratings yet

- February 19 Solon Seeks Granting of Estate Tax Amnesty To Raise Gov't Revenue CollectionDocument2 pagesFebruary 19 Solon Seeks Granting of Estate Tax Amnesty To Raise Gov't Revenue Collectionpribhor2No ratings yet

- Chapter 2: Tax Laws and Tax AdminstrationDocument7 pagesChapter 2: Tax Laws and Tax AdminstrationRover Ross100% (1)

- Carta de Justicia Federal Sobre Plebiscito PropuestoDocument5 pagesCarta de Justicia Federal Sobre Plebiscito PropuestoEl Nuevo DíaNo ratings yet

- Cross Empowerment in GSTDocument4 pagesCross Empowerment in GSTswanay.mohantyNo ratings yet

- Beth OlothDocument94 pagesBeth OlothStewart Bell100% (2)

- 3PO1 U1L2 PreTest Q1 - General Principles of Taxation - Tax LawsDocument2 pages3PO1 U1L2 PreTest Q1 - General Principles of Taxation - Tax LawsKimberly MartinezNo ratings yet

- Mandanas RulingDocument23 pagesMandanas RulingKarah JaneNo ratings yet

- Garcia Vs Mandanas, G.R. No. 199802, July 03, 2018Document39 pagesGarcia Vs Mandanas, G.R. No. 199802, July 03, 2018Quinciano MorilloNo ratings yet

- DTC Agreement Between Morocco and United StatesDocument30 pagesDTC Agreement Between Morocco and United StatesOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Budget 3Document11 pagesBudget 3तेजस्विनी रंजनNo ratings yet

- Aknowledgement: Nishikant Jha Who Gave Us The Topic of Implication of Central Sales ActDocument25 pagesAknowledgement: Nishikant Jha Who Gave Us The Topic of Implication of Central Sales ActAli ChikteNo ratings yet

- Pacquiao Scores Another Victory - This Time in Tax Court Vs BIRDocument3 pagesPacquiao Scores Another Victory - This Time in Tax Court Vs BIRHayrah LawiNo ratings yet

- 2018 Mandanas - v. - Ochoa - Jr.20181023 5466 1q8746a PDFDocument96 pages2018 Mandanas - v. - Ochoa - Jr.20181023 5466 1q8746a PDFBrian Kelvin PinedaNo ratings yet

- CIAT. Taxation & Tax AdministrationDocument91 pagesCIAT. Taxation & Tax AdministrationCarlos Santillán DelgadoNo ratings yet

- Wal-Mart Puerto Rico, Inc. v. Zaragoza-Gomez, 1st Cir. (2016)Document40 pagesWal-Mart Puerto Rico, Inc. v. Zaragoza-Gomez, 1st Cir. (2016)Scribd Government DocsNo ratings yet

- Mediation at The Court of Tax Appeals (CTA)Document11 pagesMediation at The Court of Tax Appeals (CTA)May YellowNo ratings yet

- En Banc: Petitioner, PresentDocument15 pagesEn Banc: Petitioner, PresentdoookaNo ratings yet

- UU NO.11 Tax Amnesty (English Version)Document20 pagesUU NO.11 Tax Amnesty (English Version)Hutapea_apynNo ratings yet

- In The NewsDocument2 pagesIn The NewsJames Albert ObispoNo ratings yet

- Tax Remedies Under The Nirc (Repaired)Document119 pagesTax Remedies Under The Nirc (Repaired)RSOG PRO6No ratings yet

- Taxation in The PhilippinesDocument12 pagesTaxation in The PhilippinesAdobo Hunter100% (1)

- CHRTRCMPDOCDocument24 pagesCHRTRCMPDOCJorge BarreraNo ratings yet

- Document 3 Palmer Oct. 23, 2005 PDFDocument8 pagesDocument 3 Palmer Oct. 23, 2005 PDFJorge BarreraNo ratings yet

- Document 4 Palmer Oct. 31, 2005 PDFDocument2 pagesDocument 4 Palmer Oct. 31, 2005 PDFJorge BarreraNo ratings yet

- Interim Committee of Parliamentarians On National SecurityDocument32 pagesInterim Committee of Parliamentarians On National SecurityJorge BarreraNo ratings yet

- Document 8 Palmer Nov. 15, 2006 PDFDocument6 pagesDocument 8 Palmer Nov. 15, 2006 PDFJorge BarreraNo ratings yet

- CSiS Nov 5 2008 Letter PDFDocument1 pageCSiS Nov 5 2008 Letter PDFJorge BarreraNo ratings yet

- Daniel Roussy Oct 11 2005 PDFDocument4 pagesDaniel Roussy Oct 11 2005 PDFJorge BarreraNo ratings yet

- Document List PDFDocument27 pagesDocument List PDFJorge BarreraNo ratings yet

- Document 2 Palmer Nov. 30, 2004 PDFDocument4 pagesDocument 2 Palmer Nov. 30, 2004 PDFJorge BarreraNo ratings yet

- Tiffanie Jennings Affidavit PDFDocument15 pagesTiffanie Jennings Affidavit PDFJorge BarreraNo ratings yet

- Document 6 Palmer March 31, 2006 PDFDocument7 pagesDocument 6 Palmer March 31, 2006 PDFJorge BarreraNo ratings yet

- Document 1 Palmer Oct. 19, 2004 PDFDocument2 pagesDocument 1 Palmer Oct. 19, 2004 PDFJorge BarreraNo ratings yet

- Bobby Jack Fowler's Handwritten Appeal of Kidnapping, Attempted Rape Conviction.Document8 pagesBobby Jack Fowler's Handwritten Appeal of Kidnapping, Attempted Rape Conviction.Jorge BarreraNo ratings yet

- Document 7 Palmer July 30 2009 PDFDocument4 pagesDocument 7 Palmer July 30 2009 PDFJorge BarreraNo ratings yet

- List of 65 First Nations Communities Selected by Indian Affairs For Land Privatization StudyDocument2 pagesList of 65 First Nations Communities Selected by Indian Affairs For Land Privatization StudyJorge Barrera100% (3)

- Batchewana First Nation To Repatriate Remains of Ancestors Dug Up and Taken in 1850Document1 pageBatchewana First Nation To Repatriate Remains of Ancestors Dug Up and Taken in 1850Jorge BarreraNo ratings yet

- Draft Indian Affairs Letter To Chiefs Outlining Special Project To Study Privatization of Reserve LandsDocument3 pagesDraft Indian Affairs Letter To Chiefs Outlining Special Project To Study Privatization of Reserve LandsJorge BarreraNo ratings yet

- Nwac Sis Report 2010 LiteDocument57 pagesNwac Sis Report 2010 LitetehaliwaskenhasNo ratings yet

- Dismantle Press ReleaseDocument1 pageDismantle Press ReleaseJorge BarreraNo ratings yet

- Update - HST - June 7 Tripartite Meeting of Senior OfficialsDocument3 pagesUpdate - HST - June 7 Tripartite Meeting of Senior OfficialsJorge BarreraNo ratings yet

- Sharon McIvor Letter To MPsDocument2 pagesSharon McIvor Letter To MPsJorge BarreraNo ratings yet

- Trent University's ARTHUR Interview Truth and ReconciliationDocument5 pagesTrent University's ARTHUR Interview Truth and ReconciliationJorge BarreraNo ratings yet

- Casey RattDocument1 pageCasey RattJorge BarreraNo ratings yet