Professional Documents

Culture Documents

April 2010: Anager'S Ommentary

April 2010: Anager'S Ommentary

Uploaded by

sidjain89Copyright:

Available Formats

You might also like

- Hancock (2010-03) Momentum - A Contrarian Case For Following The HerdDocument13 pagesHancock (2010-03) Momentum - A Contrarian Case For Following The HerddrummondjacobNo ratings yet

- Fed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro TraderFrom EverandFed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro TraderNo ratings yet

- Treynor Black ModelDocument24 pagesTreynor Black ModelQuy Linh Doan100% (1)

- Subsidiary and Holding CompanyDocument27 pagesSubsidiary and Holding CompanyDhriti SharmaNo ratings yet

- T MKC G R: HE Loba L EportDocument3 pagesT MKC G R: HE Loba L EportMKC GlobalNo ratings yet

- April 2011 CommentaryDocument4 pagesApril 2011 CommentaryMKC GlobalNo ratings yet

- Marshfield Associates LetterDocument3 pagesMarshfield Associates LetterAbcd AbcdNo ratings yet

- Bear Marke - CorrecDocument30 pagesBear Marke - CorrecSoren K. GroupNo ratings yet

- Guru LessonsDocument12 pagesGuru LessonsSergio Olarte100% (1)

- Coronavirus and Its Impact On Global Financial MarketsDocument3 pagesCoronavirus and Its Impact On Global Financial MarketsAnkur ShardaNo ratings yet

- Cloud Alpha Newsletter Sept629Document11 pagesCloud Alpha Newsletter Sept629Pui SanNo ratings yet

- Investment Strategy: Turning Point?Document5 pagesInvestment Strategy: Turning Point?marketfolly.comNo ratings yet

- August 022010 PostsDocument150 pagesAugust 022010 PostsAlbert L. PeiaNo ratings yet

- Advisory PDFDocument12 pagesAdvisory PDFAnonymous Feglbx5No ratings yet

- What To Do in Todays MarketDocument5 pagesWhat To Do in Todays MarketSecure PlusNo ratings yet

- Elliot Wave Theorist June 10Document10 pagesElliot Wave Theorist June 10Mk S Kumar50% (2)

- RJ StoutDocument7 pagesRJ StoutacegacegnikNo ratings yet

- Rhyme and Reason: Dr. G. Terry Madonna and Dr. Michael YounDocument19 pagesRhyme and Reason: Dr. G. Terry Madonna and Dr. Michael Younrichardck61No ratings yet

- Detailed Tables Are Provided in The Appendix at The EndDocument9 pagesDetailed Tables Are Provided in The Appendix at The Endanil1820No ratings yet

- Keywords: Behavioral Finance Arbitrage Psychology Market EfficiencyDocument5 pagesKeywords: Behavioral Finance Arbitrage Psychology Market EfficiencyNazar HussainNo ratings yet

- Spring 2011Document2 pagesSpring 2011gradnvNo ratings yet

- The Stock MarketDocument4 pagesThe Stock MarketBhumika BhardwajNo ratings yet

- Santos, Katrina Cassandra - Special Liquidity IssuesDocument5 pagesSantos, Katrina Cassandra - Special Liquidity IssuesDL SantosNo ratings yet

- The Sell DecisionDocument4 pagesThe Sell DecisionCarl HsiehNo ratings yet

- Goal 651 1157724468StockIdea1Document4 pagesGoal 651 1157724468StockIdea1Raman BasuNo ratings yet

- QBAMCO YourGoldTeeth2 08 2011Document12 pagesQBAMCO YourGoldTeeth2 08 2011cjjjt210No ratings yet

- Thackray Newsletter: - Know Your Buy & Sells A Month in AdvanceDocument11 pagesThackray Newsletter: - Know Your Buy & Sells A Month in AdvancedpbasicNo ratings yet

- 4 Stages of A Bull Market & How To Profit From ItDocument5 pages4 Stages of A Bull Market & How To Profit From ItDineshNo ratings yet

- Mauldin August 8Document10 pagesMauldin August 8richardck61No ratings yet

- Global Economic Prospect AnalysisDocument17 pagesGlobal Economic Prospect AnalysisRezzoNo ratings yet

- KJHKHJGJHGJHGKL LokjlkjlkDocument5 pagesKJHKHJGJHGJHGKL LokjlkjlkKari WilliamsNo ratings yet

- Bahan Presentasi MipmDocument35 pagesBahan Presentasi MipmagustinaNo ratings yet

- First Quarter 2009 - NewsletterDocument6 pagesFirst Quarter 2009 - NewsletterEricNo ratings yet

- East Coast Asset Management (Q4 2009) Investor LetterDocument10 pagesEast Coast Asset Management (Q4 2009) Investor Lettermarketfolly.comNo ratings yet

- 8-15-11 Steady As She GoesDocument3 pages8-15-11 Steady As She GoesThe Gold SpeculatorNo ratings yet

- Benn DoverDocument3 pagesBenn DoverZerohedge100% (2)

- Breakfast With Dave June 12Document7 pagesBreakfast With Dave June 12variantperception100% (1)

- Behavioral Finance: JEL Classification: G14 D81 Keywords: Behavioral Finance Arbitrage Psychology Market EfficiencyDocument13 pagesBehavioral Finance: JEL Classification: G14 D81 Keywords: Behavioral Finance Arbitrage Psychology Market Efficiencylucidhamid200No ratings yet

- X-Factor Report 1/28/13 - Will The Market Ever Correct?Document10 pagesX-Factor Report 1/28/13 - Will The Market Ever Correct?streettalk700No ratings yet

- Basic Points 2007Document455 pagesBasic Points 2007bschwartzieNo ratings yet

- Emp2Document8 pagesEmp2dpbasicNo ratings yet

- Sweetwater Investments News Letter Taxation June 09Document8 pagesSweetwater Investments News Letter Taxation June 09gibbswtrNo ratings yet

- Details of Bull Market Tunr Into A BubbleDocument7 pagesDetails of Bull Market Tunr Into A Bubblesiddev12344321No ratings yet

- Little Good News!: Dr. Marc Faber Market Commentary September 8, 2008Document12 pagesLittle Good News!: Dr. Marc Faber Market Commentary September 8, 2008dhaulNo ratings yet

- Is The Credit Crisis Winding DownDocument8 pagesIs The Credit Crisis Winding DownAnanthNo ratings yet

- Understanding Market CyclesDocument7 pagesUnderstanding Market CyclesAndyNo ratings yet

- Stocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionDocument36 pagesStocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionAlbert L. PeiaNo ratings yet

- Behavioral FinanceDocument13 pagesBehavioral FinanceJaehyun KimNo ratings yet

- "On The Couch,": All Rights Reserved Follow UsDocument8 pages"On The Couch,": All Rights Reserved Follow UsEd WardNo ratings yet

- Stock Market Crash ThesisDocument6 pagesStock Market Crash Thesisrokafjvcf100% (1)

- 10/8/14 Global-Macro Trading SimulationDocument19 pages10/8/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- Market Haven Monthly Newsletter - July 2011Document11 pagesMarket Haven Monthly Newsletter - July 2011MarketHavenNo ratings yet

- Jana Us Research Trip August 2015Document5 pagesJana Us Research Trip August 2015oscar.tianNo ratings yet

- What Does The Market KnowDocument9 pagesWhat Does The Market KnowAnonymous ieu5i6RsqwNo ratings yet

- August 172010 PostsDocument269 pagesAugust 172010 PostsAlbert L. PeiaNo ratings yet

- 10 Rules of InvestingDocument2 pages10 Rules of InvestingSaravanan KNo ratings yet

- The Broyhill Letter: Executive SummaryDocument4 pagesThe Broyhill Letter: Executive SummaryBroyhill Asset ManagementNo ratings yet

- Once in A Blue Moon Sentiment and BreadthDocument7 pagesOnce in A Blue Moon Sentiment and BreadthJuan CalfunNo ratings yet

- Stock Exchange FinalDocument30 pagesStock Exchange Finalkratika29No ratings yet

- Bear Market Day Trading Strategies: Day Trading Strategies, #1From EverandBear Market Day Trading Strategies: Day Trading Strategies, #1Rating: 5 out of 5 stars5/5 (2)

- Chapter 04 HW 04Document4 pagesChapter 04 HW 04Yeni Mulyani0% (1)

- Table of ContentsDocument53 pagesTable of Contentsincharamedia5516No ratings yet

- Research Paper On Forex TradingDocument7 pagesResearch Paper On Forex Tradinggphhfrgkf100% (1)

- Productivity, Quality and Relationship Marketing in Service OperationsDocument18 pagesProductivity, Quality and Relationship Marketing in Service OperationsAhsan MalikNo ratings yet

- Accounting For GrantsDocument16 pagesAccounting For GrantsKamau RobertNo ratings yet

- Is Globalization A Ver Necessary EvilDocument6 pagesIs Globalization A Ver Necessary EvilhhgfNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net WorthAldrin PaguiriganNo ratings yet

- AccountsDocument135 pagesAccountsChinnam LalithaNo ratings yet

- 6163 ErtigaDocument2 pages6163 ErtigasanjayNo ratings yet

- Past CPA Board On MASDocument5 pagesPast CPA Board On MASzee abadillaNo ratings yet

- Riginal Ronouncements: Statement of Financial Accounting Standards No. 141Document73 pagesRiginal Ronouncements: Statement of Financial Accounting Standards No. 141ctaggart878No ratings yet

- Events of National & International ImportanceDocument328 pagesEvents of National & International Importancebooks4jobs100% (2)

- General Banking LawDocument62 pagesGeneral Banking LawKristine FayeNo ratings yet

- Topic 9 Law of Agency (Part II)Document22 pagesTopic 9 Law of Agency (Part II)AliNo ratings yet

- Barclays Reveals 12.8bn Balance Sheet Hole - FTDocument2 pagesBarclays Reveals 12.8bn Balance Sheet Hole - FTrgrtNo ratings yet

- Vertical and Horizontal Analysis of PidiliteDocument12 pagesVertical and Horizontal Analysis of PidiliteAnuj AgarwalNo ratings yet

- Impairment of Assets NotesDocument23 pagesImpairment of Assets NotesGeorge Buliki100% (1)

- Name: - Score: - Introduction To Economics With Land Reform and Taxation MULTIPLE CHOICE: Choose The Letter of The Best AnswerDocument6 pagesName: - Score: - Introduction To Economics With Land Reform and Taxation MULTIPLE CHOICE: Choose The Letter of The Best AnswerMicahCastroNo ratings yet

- Sources Applications of FundsDocument234 pagesSources Applications of Fundsjananidhanasekaran26No ratings yet

- DocumentDocument2 pagesDocumentAroosh K. MasudNo ratings yet

- Understanding Environmental Scanning: External EnvironmentDocument12 pagesUnderstanding Environmental Scanning: External EnvironmentNikita SangalNo ratings yet

- Discussion 3.2Document4 pagesDiscussion 3.2Ambrish (gYpr.in)No ratings yet

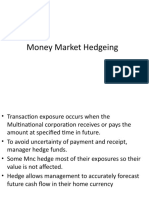

- Money Market HedgeingDocument19 pagesMoney Market HedgeingHussain khawajaNo ratings yet

- SOBHA DEVELOPERS LTD Investor PresentationDocument29 pagesSOBHA DEVELOPERS LTD Investor PresentationSobha Developers Ltd.No ratings yet

- Cotton GinningDocument18 pagesCotton GinningRushlan KhanNo ratings yet

- 107.A Capital Budget Is Used by Management To DetermineDocument123 pages107.A Capital Budget Is Used by Management To Determinemimi supasNo ratings yet

- Business Plan Aldira - Full VersionDocument12 pagesBusiness Plan Aldira - Full VersionNg Shin HieNo ratings yet

- SSC Application BookletDocument20 pagesSSC Application Bookletapi-267268400No ratings yet

April 2010: Anager'S Ommentary

April 2010: Anager'S Ommentary

Uploaded by

sidjain89Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

April 2010: Anager'S Ommentary

April 2010: Anager'S Ommentary

Uploaded by

sidjain89Copyright:

Available Formats

THE MKC GLOBAL REPORT

MANAGER’S COMMENTARY

April 2010

The market does not beat them. They beat themselves, because though they have

brains they cannot sit tight. - Jesse Livermore

As stocks pulled back in January, many investors began to question the sustainability of the asset rally. If

January’s decline was indeed just a pause, how much higher could the markets take us? After all, stocks pulled back

nearly 10% in January, energy prices have largely remained in a trading range since last October, U.S. Treasury

markets have done nothing and some “soft” commodities like sugar and cocoa have reversed course.

Since January’s lows, stocks and many other markets suggest that existing trends will continue for the next

couple of months. The internal strength of the stock market is admirable. The breadth continues to improve, with

multi-decade highs on the advance decline line, a measure of the number of advancing stocks versus declining

ones. Also, energy markets, particularly gasoline prices look ready to breakout to higher levels as do metals such as

copper and gold.

Although it looks like assets can continue to appreciate for another couple of months, this is not a decade

for buy and hold. Looking back at only cyclical bull markets within secular bear markets from the Dow Jones and

Japan’s Nikkei 225 show an interesting perspective on the current situation. The Nikkei was included in this

analysis as their market environment shares strong similarities with ours (quantitative easing, low interest rates

and asset deflation). Over the last 80 years, the average gain in this style environment is about 58% over a period

of about 14.5 months (71% and 17.5 if calculating only the Dow). This places the current rally in the 85th percentile

of all cyclical bull markets in terms of magnitude and about the 50th percentile in terms of duration. Keeping a close

eye on your portfolio and resisting new positions seems prudent at this stage. Within a secular bear market, the

end of a cyclical bull market will be followed by a cyclical bear. These cyclical bear markets tend to be shorter and

less dramatic, averaging about -37% and lasting just over 11 months. Although not as large as their bull market

cousins, it still is not an event one should ride out, if avoidable. Below is a different view of current market

valuations from a PE standpoint, courtesy of Société Générale’s Dylan Grice.

Of all the sectors, the grains seem poised to move the most, and that is to the downside. A popular trade

over the last few months has been to buy grains, like corn and soybeans, due to depressed prices (down 60% from

’08 highs) and record low food inventories around the world. I take issue with both points. First, in my view of

markets, weakness begets weakness and strength, strength. To step in and be a buyer of grains, sector wide price

stability and at least a hint of price appreciation must exist. Until that time, the MKC Global Fund will be short or

absent the market all together. Second, the fact that the world faces low food inventories is interesting but not

info@mkcglobal.com www.mkcglobal.com 206.920.4788

necessarily helpful. Often the fundamentals for a market can argue for a price level very different than the one at

hand. For example, the Financial Times published an article last August explaining the case for lower aluminum

prices due to massive over supplies. Prices moved higher by almost 25% after the article. The fundamentals don’t

always immediately impact market prices, and often prices can react counter-intuitively. Record low food

inventories suggest tight supply and impending price appreciation. Unfortunately, prices have not rallied at all and

instead seem to be gunning for their 2009 lows. The grain markets made incredible runs into 2008, setting all time

price records. Why can’t their prices drop another 25%?

The “soft” commodities include: sugar, cocoa, coffee, cotton, frozen concentrated orange juice, lumber and

rubber. They are vital markets for a portfolio manager as they typically correlate very little to other markets,

providing genuine opportunities to diversify. Throughout 2009 the sector as a whole rallied unanimously. Now,

that consistency is beginning to fray as sugar and cocoa prices have pulled back dramatically. Part of this certainly

can be attributed to a stronger dollar, but to a larger degree it could be a function of investors and traders

beginning to veer away from risky assets. Not many markets are more volatile than orange juice, where prices can

trade up or down 7% in one day.

This transition out of risk could easily be a central theme in the latter half of 2010. As one of my favorite

fund managers, Hugh Hendry explained perfectly:

“… [The markets are] all one trade, there’s no diversification. You’re either in the market or you’re not…If

you find an environment where you can’t diversify, if you find an environment where you have to share the trade

with everyone then the risk is that at an inopportune moment where you might have to exit that trade you find that

everyone is joining you. So, that would be a moment where your capital is in jeopardy.”

January’s decline was the first taste of this risk aversion and liquidation. Often, a market will give

participants multiple exit opportunities. The early ones (like December 2009) are utilized by conservative

institutional organizations and value funds. Aggressive traders look to exit later as the market rally continues and

reaches its momentum high (or low). After this point, conditions become increasingly dangerous and adverse price

action punishes those still involved.

The current market environment is becoming increasingly inconsistent as commodities and stocks begin to

erode their high correlations. If the price action of the last few months is any indication, it looks as if commodities

will stall and decline before equities. As stocks rallied into March making new highs, many commodities struggled.

Commodities in general, but particularly grains, could give the best and earliest entry into a profitable short trade.

The economic fundamentals support this thesis as we find ourselves in a deflationary environment with inflation

seeming to be a remote possibility for some time.

Hopefully, it has been made clear through past commentaries that the MKC Global Fund will not initiate a

position based on any projections or personal opinions. Instead, we follow market prices, letting them show which

direction they want to move. If I forecast, it’s simply an intellectual pursuit. Surfing works the best when one

effortlessly rides the waves toward the shore rather than fighting their natural direction and somehow trying to

ride them out to sea. The same philosophy applies to trading.

Lastly, the misconceptions about interest rates and U.S. Treasuries continue to plague investors. Included is

an article I wrote addressing this market and the dangers of assuming interest rates will rise too soon or

prematurely shorting U.S. Treasuries (or European and Japanese government bonds). This should be a convincing

alternative view.

Shorting U.S. Treasuries, a Historic Sucker Bet

If forced into a career other than one in finance, researching investor psychology and groupthink would be

of great interest. The thought process for an individual during an investment is complex. The number of emotions

combined with the financial stakes creates a decision-making process worth studying.

info@mkcglobal.com www.mkcglobal.com 206.920.4788

At times, investors can show a remarkable tendency towards herd mentality. This is clearly evident in

several historical markets and since then mainstream investors have tried to capitalize on this behavior via the

popular “contrarian” strategy in investing. Most people feel instinctively drawn to an established opinion, the

consensus. People enjoy positive feedback and the feeling of being validated by the majority who share a similar

opinion. This phenomenon has been well documented and can be seen throughout investment history: The South

Sea Bubble, Tulip Bulb Mania, railroad stocks, gold in 1979, the Tech Bubble, residential real estate, etc. These are

prime examples of investment groupthink. To a lesser extent, this same mentality occurs outside periods of

incredible asset appreciation as well and it is particularly evident right now in regard to the public’s perception of

the United States Treasury market.

The immensely popular investment idea, namely to short U.S. Treasuries, may be the largest sucker bet in

many, many years. Instead, buying longer duration government bonds (U.S, European or Japanese) before the final

stage of an epic 30 year bull market could prove to be one of the smartest trades of the last decade. Although

buying Treasuries may or may not be the best trade in terms of sheer magnitude of price movement, it will prove

to be the essence of investing; finding genuine value in a loathed asset and knowing when to part company with the

crowd. Buying Spring Wheat in 2005 or shorting crude oil in the summer of 2008 may prove more financially

rewarding, but buying government bonds will be more satisfying since very few believe in a potential advance.

In 2009, the debate between inflation and deflation was fierce. Now it seems the general public agrees that

inflation hides around the corner due to massive money printing. Marc Faber enjoyed comparing the United States

to Zimbabwe and stated that “Ben Bernanke appears to have Robert Mugabe as his mentor”. So far, we have seen

little evidence of any inflation; instead on the contrary, prices have been falling. According to Bloomberg the

financial crisis eradicated almost $14.5 trillion dollars in wealth compared to the almost $3 trillion spent in bailout

and stimulus programs. Three trillion has not been nearly enough to cause hyper-inflation in this environment

compared to the contraction in credit and wealth. The monetary base has exploded, but so has reserve bank credit.

The money isn’t getting out to the economy, and the velocity of money (an important component to inflation)

continues to shrink.

David Rosenberg, Chief Economist and Strategist of Gluskin Sheff recently presented some interesting data

in regard to the average U.S. household balance sheet. The data shows that U.S. households own $800 billion in

Treasury notes compared to $3.5 trillion in corporate bonds and municipal paper, $4.6 trillion of consumer goods,

$7.7 trillion of deposits and cash, $18.1 trillion of equities (after the bear market) and $18.2 trillion in residential

real estate (after three years of dropping values). A quick back-of-the-envelope calculation from that data shows

that Treasuries make up less than 2.7% of total household liquid (excluding consumer goods and residential real

estate) assets and less than 1% of total assets. Treasuries are clearly under-owned, especially in the face of another

downturn in equities when investors will demand safe assets.

For many years now, traders and portfolio managers have been salivating at the idea of shorting Japanese

Government Bonds, citing the country’s high debt to GDP ratios and history of quantitative easing. Japan is the real

world proof that U.S. and European government bonds can continue to move significantly higher and yields can

move much lower than anyone thought possible, even in the face of what seems like unsustainable government

debt. JGBs rose to a high in 2003 and that high is about to be challenged again. That high in bond prices saw a

corresponding low in yields of 1.049%. If the yield on U.S. 10 year notes drops to the same level the bond price

would rise to approximately $146.00, a 24% rally from current levels.

Some trades are good enough to assume just from a contrarian standpoint. The basics of a contrarian “play”

is that when everyone moves to one side of the trade, there are so few new buyers (or sellers) to get on board and

maintain the price movement that prices will swing the other way. The case for a contrarian trade in government

bonds is perfectly clear. CNBC and Bloomberg routinely have guests and analysts making their all too common case

for shorting government bonds. The financial gurus (some of which I respect very much) like Jim Rogers, Marc

Faber, Peter Schiff and Nassim Taleb all preach the same trade. In fact, Mr. Taleb recently stated that “every human

should short U.S. Treasuries”, a statement he will most likely regret for some time. Financial magazines such as

Smart Money and Forbes have published feature articles about the Treasury “bubble” and impending high interest

rates. Many financial bloggers and small speculators love this trade as well, typically citing the previous sources for

info@mkcglobal.com www.mkcglobal.com 206.920.4788

their research. Even Pro Shares launched two Ultra-Short Treasury ETFs in early 2008, which would rise in value if

U.S. Treasuries declined. It seems that all components of a contrarian trade exist. At some point all these market

participants will be absolutely correct, government bonds will decline dramatically and interest rates will rise.

They are not wrong, just too early.

Lastly, from a trading standpoint, following the current price trend can often be prudent. Picking tops and

bottoms is dangerous sport and general investors should avoid it at all costs. In managing the portfolio for MKC

Global Investments, we require some degree of a rising market to be a buyer and a declining one to be a seller.

Government bond markets fulfill this requirement as well. Treasuries declined over the last year, but are up over 2,

5, 10, 20 and 30 years. Needless to say, the trend is up. Very few people remember, or have taken the time to look

up what a chart of the 30 year U.S. Treasury bond looked like when it bottomed in 1981. Above is that chart. Note

how it began its bottoming phase with a massive spike down, a retracement of that decline and then the final

largest descent to its ultimate low. Some people may think that the run-up in bonds 14 months ago was the blow-

off stage of the bull market. Instead it actually shares the same qualities with the 1980 price spike that preceded the

final leg down and ultimate turning point instead of marking it. The data indicates that bond prices could make

new highs and not by a token amount either. The rally 14 months ago wasn’t fitting for the finally of a 30 year bull

market. With that said, prices can easily decline for several months or even a year before moving higher. There

may be enough ammunition from eager speculators initiating short positions to subdue any rally or even take us to

2009’s lows before prices ultimately turn higher.

History has shown repeatedly that historic bull markets, lasting for many years, end in capitulation and a

state of euphoria. The government bond markets have not witnessed that stage yet. As a market participant, due to

the complexity of markets, knowing just half of the applicable fundamentals is great when planning a large trade.

Any more is fantastic. For some, a convincing contrarian indication or a strong price trend is valuable and can be

enough in itself to take a position. Right now, for the government bond markets, we are faced with a trade where

the fundamentals, price trend and a strong contrarian component are in place. Buying U.S. Treasuries will be one of

the greatest trades of this generation; do not be seduced into shorting U.S. government bonds too soon.

______________________________________________________

info@mkcglobal.com www.mkcglobal.com 206.920.4788

You might also like

- Hancock (2010-03) Momentum - A Contrarian Case For Following The HerdDocument13 pagesHancock (2010-03) Momentum - A Contrarian Case For Following The HerddrummondjacobNo ratings yet

- Fed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro TraderFrom EverandFed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro TraderNo ratings yet

- Treynor Black ModelDocument24 pagesTreynor Black ModelQuy Linh Doan100% (1)

- Subsidiary and Holding CompanyDocument27 pagesSubsidiary and Holding CompanyDhriti SharmaNo ratings yet

- T MKC G R: HE Loba L EportDocument3 pagesT MKC G R: HE Loba L EportMKC GlobalNo ratings yet

- April 2011 CommentaryDocument4 pagesApril 2011 CommentaryMKC GlobalNo ratings yet

- Marshfield Associates LetterDocument3 pagesMarshfield Associates LetterAbcd AbcdNo ratings yet

- Bear Marke - CorrecDocument30 pagesBear Marke - CorrecSoren K. GroupNo ratings yet

- Guru LessonsDocument12 pagesGuru LessonsSergio Olarte100% (1)

- Coronavirus and Its Impact On Global Financial MarketsDocument3 pagesCoronavirus and Its Impact On Global Financial MarketsAnkur ShardaNo ratings yet

- Cloud Alpha Newsletter Sept629Document11 pagesCloud Alpha Newsletter Sept629Pui SanNo ratings yet

- Investment Strategy: Turning Point?Document5 pagesInvestment Strategy: Turning Point?marketfolly.comNo ratings yet

- August 022010 PostsDocument150 pagesAugust 022010 PostsAlbert L. PeiaNo ratings yet

- Advisory PDFDocument12 pagesAdvisory PDFAnonymous Feglbx5No ratings yet

- What To Do in Todays MarketDocument5 pagesWhat To Do in Todays MarketSecure PlusNo ratings yet

- Elliot Wave Theorist June 10Document10 pagesElliot Wave Theorist June 10Mk S Kumar50% (2)

- RJ StoutDocument7 pagesRJ StoutacegacegnikNo ratings yet

- Rhyme and Reason: Dr. G. Terry Madonna and Dr. Michael YounDocument19 pagesRhyme and Reason: Dr. G. Terry Madonna and Dr. Michael Younrichardck61No ratings yet

- Detailed Tables Are Provided in The Appendix at The EndDocument9 pagesDetailed Tables Are Provided in The Appendix at The Endanil1820No ratings yet

- Keywords: Behavioral Finance Arbitrage Psychology Market EfficiencyDocument5 pagesKeywords: Behavioral Finance Arbitrage Psychology Market EfficiencyNazar HussainNo ratings yet

- Spring 2011Document2 pagesSpring 2011gradnvNo ratings yet

- The Stock MarketDocument4 pagesThe Stock MarketBhumika BhardwajNo ratings yet

- Santos, Katrina Cassandra - Special Liquidity IssuesDocument5 pagesSantos, Katrina Cassandra - Special Liquidity IssuesDL SantosNo ratings yet

- The Sell DecisionDocument4 pagesThe Sell DecisionCarl HsiehNo ratings yet

- Goal 651 1157724468StockIdea1Document4 pagesGoal 651 1157724468StockIdea1Raman BasuNo ratings yet

- QBAMCO YourGoldTeeth2 08 2011Document12 pagesQBAMCO YourGoldTeeth2 08 2011cjjjt210No ratings yet

- Thackray Newsletter: - Know Your Buy & Sells A Month in AdvanceDocument11 pagesThackray Newsletter: - Know Your Buy & Sells A Month in AdvancedpbasicNo ratings yet

- 4 Stages of A Bull Market & How To Profit From ItDocument5 pages4 Stages of A Bull Market & How To Profit From ItDineshNo ratings yet

- Mauldin August 8Document10 pagesMauldin August 8richardck61No ratings yet

- Global Economic Prospect AnalysisDocument17 pagesGlobal Economic Prospect AnalysisRezzoNo ratings yet

- KJHKHJGJHGJHGKL LokjlkjlkDocument5 pagesKJHKHJGJHGJHGKL LokjlkjlkKari WilliamsNo ratings yet

- Bahan Presentasi MipmDocument35 pagesBahan Presentasi MipmagustinaNo ratings yet

- First Quarter 2009 - NewsletterDocument6 pagesFirst Quarter 2009 - NewsletterEricNo ratings yet

- East Coast Asset Management (Q4 2009) Investor LetterDocument10 pagesEast Coast Asset Management (Q4 2009) Investor Lettermarketfolly.comNo ratings yet

- 8-15-11 Steady As She GoesDocument3 pages8-15-11 Steady As She GoesThe Gold SpeculatorNo ratings yet

- Benn DoverDocument3 pagesBenn DoverZerohedge100% (2)

- Breakfast With Dave June 12Document7 pagesBreakfast With Dave June 12variantperception100% (1)

- Behavioral Finance: JEL Classification: G14 D81 Keywords: Behavioral Finance Arbitrage Psychology Market EfficiencyDocument13 pagesBehavioral Finance: JEL Classification: G14 D81 Keywords: Behavioral Finance Arbitrage Psychology Market Efficiencylucidhamid200No ratings yet

- X-Factor Report 1/28/13 - Will The Market Ever Correct?Document10 pagesX-Factor Report 1/28/13 - Will The Market Ever Correct?streettalk700No ratings yet

- Basic Points 2007Document455 pagesBasic Points 2007bschwartzieNo ratings yet

- Emp2Document8 pagesEmp2dpbasicNo ratings yet

- Sweetwater Investments News Letter Taxation June 09Document8 pagesSweetwater Investments News Letter Taxation June 09gibbswtrNo ratings yet

- Details of Bull Market Tunr Into A BubbleDocument7 pagesDetails of Bull Market Tunr Into A Bubblesiddev12344321No ratings yet

- Little Good News!: Dr. Marc Faber Market Commentary September 8, 2008Document12 pagesLittle Good News!: Dr. Marc Faber Market Commentary September 8, 2008dhaulNo ratings yet

- Is The Credit Crisis Winding DownDocument8 pagesIs The Credit Crisis Winding DownAnanthNo ratings yet

- Understanding Market CyclesDocument7 pagesUnderstanding Market CyclesAndyNo ratings yet

- Stocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionDocument36 pagesStocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionAlbert L. PeiaNo ratings yet

- Behavioral FinanceDocument13 pagesBehavioral FinanceJaehyun KimNo ratings yet

- "On The Couch,": All Rights Reserved Follow UsDocument8 pages"On The Couch,": All Rights Reserved Follow UsEd WardNo ratings yet

- Stock Market Crash ThesisDocument6 pagesStock Market Crash Thesisrokafjvcf100% (1)

- 10/8/14 Global-Macro Trading SimulationDocument19 pages10/8/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- Market Haven Monthly Newsletter - July 2011Document11 pagesMarket Haven Monthly Newsletter - July 2011MarketHavenNo ratings yet

- Jana Us Research Trip August 2015Document5 pagesJana Us Research Trip August 2015oscar.tianNo ratings yet

- What Does The Market KnowDocument9 pagesWhat Does The Market KnowAnonymous ieu5i6RsqwNo ratings yet

- August 172010 PostsDocument269 pagesAugust 172010 PostsAlbert L. PeiaNo ratings yet

- 10 Rules of InvestingDocument2 pages10 Rules of InvestingSaravanan KNo ratings yet

- The Broyhill Letter: Executive SummaryDocument4 pagesThe Broyhill Letter: Executive SummaryBroyhill Asset ManagementNo ratings yet

- Once in A Blue Moon Sentiment and BreadthDocument7 pagesOnce in A Blue Moon Sentiment and BreadthJuan CalfunNo ratings yet

- Stock Exchange FinalDocument30 pagesStock Exchange Finalkratika29No ratings yet

- Bear Market Day Trading Strategies: Day Trading Strategies, #1From EverandBear Market Day Trading Strategies: Day Trading Strategies, #1Rating: 5 out of 5 stars5/5 (2)

- Chapter 04 HW 04Document4 pagesChapter 04 HW 04Yeni Mulyani0% (1)

- Table of ContentsDocument53 pagesTable of Contentsincharamedia5516No ratings yet

- Research Paper On Forex TradingDocument7 pagesResearch Paper On Forex Tradinggphhfrgkf100% (1)

- Productivity, Quality and Relationship Marketing in Service OperationsDocument18 pagesProductivity, Quality and Relationship Marketing in Service OperationsAhsan MalikNo ratings yet

- Accounting For GrantsDocument16 pagesAccounting For GrantsKamau RobertNo ratings yet

- Is Globalization A Ver Necessary EvilDocument6 pagesIs Globalization A Ver Necessary EvilhhgfNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net WorthAldrin PaguiriganNo ratings yet

- AccountsDocument135 pagesAccountsChinnam LalithaNo ratings yet

- 6163 ErtigaDocument2 pages6163 ErtigasanjayNo ratings yet

- Past CPA Board On MASDocument5 pagesPast CPA Board On MASzee abadillaNo ratings yet

- Riginal Ronouncements: Statement of Financial Accounting Standards No. 141Document73 pagesRiginal Ronouncements: Statement of Financial Accounting Standards No. 141ctaggart878No ratings yet

- Events of National & International ImportanceDocument328 pagesEvents of National & International Importancebooks4jobs100% (2)

- General Banking LawDocument62 pagesGeneral Banking LawKristine FayeNo ratings yet

- Topic 9 Law of Agency (Part II)Document22 pagesTopic 9 Law of Agency (Part II)AliNo ratings yet

- Barclays Reveals 12.8bn Balance Sheet Hole - FTDocument2 pagesBarclays Reveals 12.8bn Balance Sheet Hole - FTrgrtNo ratings yet

- Vertical and Horizontal Analysis of PidiliteDocument12 pagesVertical and Horizontal Analysis of PidiliteAnuj AgarwalNo ratings yet

- Impairment of Assets NotesDocument23 pagesImpairment of Assets NotesGeorge Buliki100% (1)

- Name: - Score: - Introduction To Economics With Land Reform and Taxation MULTIPLE CHOICE: Choose The Letter of The Best AnswerDocument6 pagesName: - Score: - Introduction To Economics With Land Reform and Taxation MULTIPLE CHOICE: Choose The Letter of The Best AnswerMicahCastroNo ratings yet

- Sources Applications of FundsDocument234 pagesSources Applications of Fundsjananidhanasekaran26No ratings yet

- DocumentDocument2 pagesDocumentAroosh K. MasudNo ratings yet

- Understanding Environmental Scanning: External EnvironmentDocument12 pagesUnderstanding Environmental Scanning: External EnvironmentNikita SangalNo ratings yet

- Discussion 3.2Document4 pagesDiscussion 3.2Ambrish (gYpr.in)No ratings yet

- Money Market HedgeingDocument19 pagesMoney Market HedgeingHussain khawajaNo ratings yet

- SOBHA DEVELOPERS LTD Investor PresentationDocument29 pagesSOBHA DEVELOPERS LTD Investor PresentationSobha Developers Ltd.No ratings yet

- Cotton GinningDocument18 pagesCotton GinningRushlan KhanNo ratings yet

- 107.A Capital Budget Is Used by Management To DetermineDocument123 pages107.A Capital Budget Is Used by Management To Determinemimi supasNo ratings yet

- Business Plan Aldira - Full VersionDocument12 pagesBusiness Plan Aldira - Full VersionNg Shin HieNo ratings yet

- SSC Application BookletDocument20 pagesSSC Application Bookletapi-267268400No ratings yet