Professional Documents

Culture Documents

Components of Wage System in Human Resource Management

Components of Wage System in Human Resource Management

Uploaded by

bk1_786100%(1)100% found this document useful (1 vote)

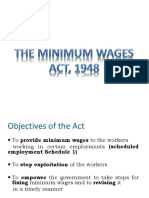

10K views7 pagesThe document discusses India's wage system and components of minimum wages. Key points include: minimum wages need to be fixed in certain industries and fair wage agreements promoted in organized industries; wages should be linked to productivity and cost of living; and a living wage secured for workers to meet basic needs. The Minimum Wages Act of 1948 requires the government to fix minimum wage rates and allow for revisions, and outlines payment of wages, bonuses, overtime rates, and exemptions.

Original Description:

This is a presentation about components of waging system in Human Resource Management.

Original Title

Components of Wage System in Human Resource management

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses India's wage system and components of minimum wages. Key points include: minimum wages need to be fixed in certain industries and fair wage agreements promoted in organized industries; wages should be linked to productivity and cost of living; and a living wage secured for workers to meet basic needs. The Minimum Wages Act of 1948 requires the government to fix minimum wage rates and allow for revisions, and outlines payment of wages, bonuses, overtime rates, and exemptions.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

100%(1)100% found this document useful (1 vote)

10K views7 pagesComponents of Wage System in Human Resource Management

Components of Wage System in Human Resource Management

Uploaded by

bk1_786The document discusses India's wage system and components of minimum wages. Key points include: minimum wages need to be fixed in certain industries and fair wage agreements promoted in organized industries; wages should be linked to productivity and cost of living; and a living wage secured for workers to meet basic needs. The Minimum Wages Act of 1948 requires the government to fix minimum wage rates and allow for revisions, and outlines payment of wages, bonuses, overtime rates, and exemptions.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 7

Wage System in India

•Minimum wages need to be fixed in sweated industries &

fair wage agreements need to be promoted in the more

organized industries.

• Equal pay should be ensured for equal work.

• Wage differentials should be provided.

• Remuneration should be linked to productivity.

• There should be compensation for any rise in the cost of

living.

• Fair wages should be determined over & above minimum

wages with due regard to:

Productivity of labour

The prevailing level of wages

The level of national income & its distribution.

The place of industry in the economy of the country.

• The Supreme Court ruled that an employer who cannot

pay minimum wages has no right to exist. The capacity to

pay becomes a subject of consideration to determine fair

wages.

Wage System in India

Wages should be determined on the basis of the

basic needs of labour.

A living wage should be secured for workers.

Components of Wage System

(Minimum Wages Act,1948)

Fixing of minimum wages: The appropriate government shall fix the minimum

rates of wages payable to employees employed in the industries specified in the

schedule. Revision can take place once in five years. The minimum wage may be

fixed at a ‘time rate’, ‘piece rate’, ‘guaranteed time rate’ & ‘overtime rate’.

Minimum rate of wages: It consists of

A basic rate of wages & a cost of living allowance.

A basic rate of wages & a cost of living allowance & the cash value of the

concessions in respect of supplies of essential commodities of concession rates.

Working hours: The Government has fixed 48 hours per week.

Components of Wage System (Cont)

Overtime: Where an employee works on any day in

excess of the number of hours constituting a normal

day, the employer should pay him the overtime rate as

three times the daily wage.

Employers’ obligation: Once the minimum wages are

fixed or revised according to the procedure, it becomes

the legal obligation of the employers to pay the rates.

They cannot plead the incapacity of the industry to pay.

Exemptions: The government may direct that the

provisions of this Act shall not apply in relation to the

wages payable to disabled employees.

Components of Wage System (Cont)

Content of minimum wages: The Fair Wages

Committee viewed that the minimum wages

must provide not merely for the bare

subsistence of life but also for the preservation

of the worker’s efficiency by providing for

some measure of education, medical aid &

amenities.

Different categories: The Act permits fixation

of different minimum rates of wages for

different classes of work in the same scheduled

employment.

Components of Wage System (Cont)

Payment of minimum bonus: Every employer

shall be bound to pay every employee in respect

of any accounting year a minimum bonus of

8.33% of the salary earned by him in the whole

year.

Payment of maximum bonus: Where the

allocable surplus exceeds the amount of

minimum bonus payable to the employees, the

employer should be bound to pay every

employee 20% of a month salary.

Components of Wage System (Cont)

Computation of working days: An employee shall

be deemed to have worked on the days on which

he/she had been laid off under an agreement,

standing orders, or the Industrial Disputes Act

was on leave with salary was absent due to

temporary disablement caused by an accident

arising out of.

Special provisions for new establishments: Bonus

shall be payable only in respect of the accounting

year in which the employer derives profit.

You might also like

- Case Time Value of Money-1Document1 pageCase Time Value of Money-1Smonish Kumar0% (1)

- Target CostingDocument36 pagesTarget CostingImran Umar100% (1)

- L-1 Basic ConceptsDocument4 pagesL-1 Basic Conceptskyunki143No ratings yet

- Tax 1 Vthsem Module 1,2, and 3Document97 pagesTax 1 Vthsem Module 1,2, and 3Sahana narayanNo ratings yet

- Chapter - 6 - TaxDocument26 pagesChapter - 6 - TaxAshek AHmedNo ratings yet

- Cost - Vi SemDocument18 pagesCost - Vi SemAR Ananth Rohith BhatNo ratings yet

- Unit 2 Structure of of Options MarketsDocument36 pagesUnit 2 Structure of of Options MarketsTorreus AdhikariNo ratings yet

- Question Income From Salary Solved in ClassDocument4 pagesQuestion Income From Salary Solved in ClassFozle Rabby 182-11-5893No ratings yet

- Uniform Costing and Inter Firm ComparisonDocument11 pagesUniform Costing and Inter Firm ComparisonAjinkya Chinchole100% (1)

- AARTHI - SPDocument15 pagesAARTHI - SPMOHAMMED KHAYYUMNo ratings yet

- Problems On Flexible BudgetDocument3 pagesProblems On Flexible BudgetsafwanhossainNo ratings yet

- Departmentalisation of Overheads: ChapterizationDocument12 pagesDepartmentalisation of Overheads: ChapterizationLovely LeninNo ratings yet

- Walter's Model Formula: Unit - Iv Part - C Problems and SolutionsDocument3 pagesWalter's Model Formula: Unit - Iv Part - C Problems and SolutionsHarihara PuthiranNo ratings yet

- Compensation Unilever CompanyDocument12 pagesCompensation Unilever CompanySamreen Moula BuxNo ratings yet

- 74767bos60492 cp8Document102 pages74767bos60492 cp8Vignesh VigneshNo ratings yet

- Unit IV Budgets & Budgetory ControlDocument19 pagesUnit IV Budgets & Budgetory ControlyogeshNo ratings yet

- Ever Blue Apparel LTDDocument19 pagesEver Blue Apparel LTDRinha MuneerNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Leasing Solution Ca-Final SFM (Full)Document32 pagesLeasing Solution Ca-Final SFM (Full)Pravinn_Mahajan80% (5)

- Impact of CSR On Financial Performance of Top 10 Performing CSR Companies in IndiaDocument7 pagesImpact of CSR On Financial Performance of Top 10 Performing CSR Companies in IndiaSoorajKrishnanNo ratings yet

- Income From Salary QUESTIONSDocument20 pagesIncome From Salary QUESTIONSSiva SankariNo ratings yet

- Accounting Aspects For Mergers and AcquisitionsDocument19 pagesAccounting Aspects For Mergers and AcquisitionsHiral PatelNo ratings yet

- Capital Budgeting - NotesDocument171 pagesCapital Budgeting - NotesSiddharth mehtaNo ratings yet

- Characteristics of Ideal Cost SystemDocument6 pagesCharacteristics of Ideal Cost SystemNikhil Thomas AbrahamNo ratings yet

- Principles of Wage & Salary AdministrationDocument7 pagesPrinciples of Wage & Salary AdministrationPrince MittalNo ratings yet

- Relation Between Roi and Eva-1Document11 pagesRelation Between Roi and Eva-1Jasleen KaurNo ratings yet

- Unit 2: Indian Accounting Standard 34: Interim Financial ReportingDocument28 pagesUnit 2: Indian Accounting Standard 34: Interim Financial ReportingvijaykumartaxNo ratings yet

- Cost Accounting BookDocument148 pagesCost Accounting BookSharma Vishnu100% (2)

- LL Group 5 SectionADocument8 pagesLL Group 5 SectionAAkash PanigrahiNo ratings yet

- Best Manager ReportDocument6 pagesBest Manager ReportShilpa Reddy50% (2)

- International Compensation MGMTDocument30 pagesInternational Compensation MGMTIqbal SyedNo ratings yet

- 1 - Bata Case StudyDocument8 pages1 - Bata Case StudyDeeksha SinghNo ratings yet

- Methods of Price Level AccountingDocument17 pagesMethods of Price Level AccountingKuladeepa KrNo ratings yet

- income From Salary-Problems, Theory and Solutions: by Prof - Augustin AmaladasDocument76 pagesincome From Salary-Problems, Theory and Solutions: by Prof - Augustin AmaladasAnkit Dhyani100% (6)

- Provident FundDocument18 pagesProvident FundRashmi Ranjan Panigrahi100% (1)

- Corporate Tax PlanningDocument21 pagesCorporate Tax Planninggauravbpit100% (3)

- 19732ipcc CA Vol2 Cp3Document43 pages19732ipcc CA Vol2 Cp3PALADUGU MOUNIKANo ratings yet

- Solution 1Document8 pagesSolution 1frq qqrNo ratings yet

- Residential Status Tax IluDocument28 pagesResidential Status Tax IluPriyanka BanthiaNo ratings yet

- GratuityDocument3 pagesGratuityTariq MahmoodNo ratings yet

- Solved ProblemsDocument6 pagesSolved ProblemsVarun DavuluriNo ratings yet

- Economic Value Added: Presented byDocument25 pagesEconomic Value Added: Presented bySachin NagargojeNo ratings yet

- LKAS 19 2021 UploadDocument31 pagesLKAS 19 2021 Uploadpriyantha dasanayake100% (2)

- The Payment of Gratuity Act, 1972Document9 pagesThe Payment of Gratuity Act, 1972martinjazz4uNo ratings yet

- Five Year Plan Wage PolicyDocument31 pagesFive Year Plan Wage Policypoojaarora_10_juneNo ratings yet

- Assignment On TaxationDocument3 pagesAssignment On TaxationJasmeetKaurNo ratings yet

- IT 2 Income From BusinessDocument19 pagesIT 2 Income From BusinessAmith AlphaNo ratings yet

- Problems On LeverageDocument2 pagesProblems On LeverageRituparna Nath100% (2)

- Chapter 7 - Value of Supply - NotesDocument16 pagesChapter 7 - Value of Supply - NotesPuran GuptaNo ratings yet

- MakeORBuy NumericalsDocument6 pagesMakeORBuy Numericalsgurjit20No ratings yet

- E1049217251 12520 1322185717213Document5 pagesE1049217251 12520 1322185717213Sumit PattanaikNo ratings yet

- Corporate AdministrationDocument11 pagesCorporate AdministrationJoshua Stalin Selvaraj100% (1)

- Labour Remuneration SchemesDocument3 pagesLabour Remuneration SchemesAbu Ashraf Quader Iqbal0% (1)

- Chapter 6 Sol PDFDocument81 pagesChapter 6 Sol PDFKrishnaNo ratings yet

- Minimum Wages Act 1948Document35 pagesMinimum Wages Act 1948charvinNo ratings yet

- Government and LegalDocument14 pagesGovernment and LegalDeeksha SrivastavaNo ratings yet

- Wage Policy and Wage Regulation MachineryDocument24 pagesWage Policy and Wage Regulation MachinerySamNo ratings yet

- Law To Fix Minimum WagesDocument23 pagesLaw To Fix Minimum WagesSamuel NissyNo ratings yet

- Minimum Wages RateDocument6 pagesMinimum Wages RateAishwarya SunilkumarNo ratings yet

- A View On Labour Acts in India Your GuideDocument15 pagesA View On Labour Acts in India Your GuideSurender Dhuran PrajapatNo ratings yet

- Financial Examiner - Department of Consumer and Business ServicesDocument7 pagesFinancial Examiner - Department of Consumer and Business ServicesMarshay HallNo ratings yet

- CombinepdfDocument5 pagesCombinepdfAnant KumarNo ratings yet

- Chapter 5 Controlling Performance Part 1 SlidesDocument12 pagesChapter 5 Controlling Performance Part 1 SlidesMushaisano MudauNo ratings yet

- Interview QuestionsDocument5 pagesInterview QuestionsRonnel Aldin FernandoNo ratings yet

- Hrci Sphri-Exam-Content-Outline 2018 ReadonlyDocument11 pagesHrci Sphri-Exam-Content-Outline 2018 ReadonlyBookcessories FblNo ratings yet

- Management 01 PDFDocument7 pagesManagement 01 PDFMarlboro RedNo ratings yet

- HRM PPT FinalDocument9 pagesHRM PPT FinalKowshik SNo ratings yet

- Mental Health at Workplace PDFDocument51 pagesMental Health at Workplace PDFReach Manam100% (1)

- North South University: Department of Management MGT 351: Human Resource ManagementDocument22 pagesNorth South University: Department of Management MGT 351: Human Resource ManagementTabsir AhmedNo ratings yet

- Ms Material25!9!20 2Document81 pagesMs Material25!9!20 2HyvwkbwNo ratings yet

- Right To Strike and The Role of Judiciary in IndiaDocument5 pagesRight To Strike and The Role of Judiciary in IndiaIJAR JOURNALNo ratings yet

- Features of Payment of Wages ActDocument12 pagesFeatures of Payment of Wages ActDevesh Sharma50% (4)

- SOP DetailsDocument24 pagesSOP DetailsArbaaz KhanNo ratings yet

- 2019 Book TheDeconstructionOfEmploymentADocument353 pages2019 Book TheDeconstructionOfEmploymentASander JunteNo ratings yet

- What Is Employee Separation and Its Two Types? Also Explain That What Actions Can Be Taken by An Organization To Fire The Unwanted Staff? Employee SeparationDocument2 pagesWhat Is Employee Separation and Its Two Types? Also Explain That What Actions Can Be Taken by An Organization To Fire The Unwanted Staff? Employee SeparationFakhira ShehzadiNo ratings yet

- Mohammad Danish AlamDocument4 pagesMohammad Danish AlamAfroj AnsariNo ratings yet

- CH 10 Gender and Issues in The PhilippinesDocument21 pagesCH 10 Gender and Issues in The PhilippinesLouise San Buenaventura100% (1)

- Khitab Habibi: Pinto Waddo, Candolim, Goa 403515 Tel-08322489750Document2 pagesKhitab Habibi: Pinto Waddo, Candolim, Goa 403515 Tel-08322489750Ahmad KhitabNo ratings yet

- Employee Code of Conduct Company PolicyDocument4 pagesEmployee Code of Conduct Company PolicyArindam DasNo ratings yet

- The Power To Choose Bangladeshi Women and Labour MDocument5 pagesThe Power To Choose Bangladeshi Women and Labour MDiego Andrés Riaño PinzónNo ratings yet

- Topic 5 UnemploymentDocument23 pagesTopic 5 Unemploymentlacthien912No ratings yet

- Human Resource Management Unit 4 NotesDocument9 pagesHuman Resource Management Unit 4 Notesdeepangirana1608No ratings yet

- Job Application Letter Sample NursingDocument8 pagesJob Application Letter Sample Nursingtvanfdifg100% (2)

- 1Document2 pages1KeziahNo ratings yet

- Sons of The Soil Theory in RecruitmentDocument1 pageSons of The Soil Theory in Recruitmentmengelhu100% (1)

- Human Resource Management: Dr. Kamal K JainDocument23 pagesHuman Resource Management: Dr. Kamal K JainHARSH VARMANo ratings yet

- Share-Based CompensationDocument4 pagesShare-Based CompensationCamila AlduezaNo ratings yet

- HRM 360Document77 pagesHRM 360api-536471621No ratings yet

- DSSSB Recruitment 2014 Advt No 01-14-8098 Posts Dsssconline Nic inDocument2 pagesDSSSB Recruitment 2014 Advt No 01-14-8098 Posts Dsssconline Nic indharamduttNo ratings yet

- (New) COMMUNITY PARTNER DECKDocument14 pages(New) COMMUNITY PARTNER DECKNatasha AzzahraNo ratings yet