Professional Documents

Culture Documents

Texas State Supreme Court Justice Jesse W. Wainwright 2010 Ethics Form

Texas State Supreme Court Justice Jesse W. Wainwright 2010 Ethics Form

Uploaded by

Texas Watchdog0 ratings0% found this document useful (0 votes)

188 views11 pagesOriginal Title

Texas State Supreme Court Justice Jesse W. Wainwright 2010 ethics form

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

188 views11 pagesTexas State Supreme Court Justice Jesse W. Wainwright 2010 Ethics Form

Texas State Supreme Court Justice Jesse W. Wainwright 2010 Ethics Form

Uploaded by

Texas WatchdogCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 11

“Texas Ethics Commission .0.80x12070_ Austin, Texas 78711-2070 (612)463-5800__ 1-800-225-8506

PERSONAL FINANCIAL STATEMENT FoRM PFS

COVER SHEET

Filed in accordance with chapter 572 of the Government Code. PASE age 1 of 12

For filings required in 2010, covering calendar year ending December 31.2009. Fcccumte

Use FORM PFS - INSTRUCTION GUIDE when completing this form. Ho799

1 NAME "TTL RT. OEFICE USE ONLY)

Hon." Jesse

Dale Wainwright

2 ADDRESS

Di)_(cieok rues Home ADoRESS) ERED WAY 0 4 2010

3. TELEPHONE TREACODE.MUMBER EXTENSION

NUMBER (612) 301-5181

4 REASON

FOR FILING

SRATEMEMT DD canoipate ¢o\care oFFice)

ELECTED OFFICER Justice, Texas Supreme Court (INDICATE OFFICE)

D APPOINTED OFFICER \(NDICATE AGENCY)

Ol executive HEAD \QNDICATE AGENCY)

Cl FORMER OR RETIRED JUDGE SITTING BY ASSIGNMENT

OO STATE PARTY CHAIR (NDICATE PARTY)

O other (INDICATE POSITION)

5 Family members whose financial activity you are reporting (filer must report information about the financial activity ofthe fler's,

‘spouse or dependent children ifthe filer had actual control over that activity):

pone Debra M. Wainwright

DePeNvenr cro 1, Philip Edward Wainwright

2, Joshua William Wainwright

a

In parts 1 through 18, you will disclose your financial activity during the calendar year. In parts 1 through 14, you are

required to disclose not only your own financial activity, but also that of your spouse or a dependent child if you had actual control

‘over that person's financial activity.

u COPY AND ATTACH ADDITIONAL PAGES AS Necessary 451033.

“Texas Ethics Commission P.0.Box 12070 __Austin, Texas 78711-2070 (612)463-5800

1-900-225-8506

(Not APPLICABLE

SOURCES OF OCCUPATIONAL INCOME

PART 1A

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet,

* INFORMATION RELATES TO

® Fier O spouse Cl DEPENDENT CHILD —__

2 EMPLOYMENT

[EMPLOYED BY ANOTHER:

0 setr-emproveo

‘NAME AND ADDRESS OF EMPLOYER / POSITION HELD

C1 (Check it Fler’s Home Address)

State of Texas

Austin, TX 78701

Justice, Texas Supreme Court

NATURE OF OCCUPATION

Judge

INFORMATION RELATES TO

O Fiter & spouse (DEPENDENT CHILD —____

EMPLOYMENT

BB] EMPLOYED By ANOTHER,

CO setrempcoven

NAME AND ADDRESS OF EMPLOYER / POSITION HELD

Dl (Check it Fier's Home Address)

Callaway Golf interactive

9013 Tuscany Way

Building 1, Suite 170

‘Austin, TX78754

Sr. Accountant

"NATURE OF OCCUPATION

E-Commerce

“Texas Ethics Commission P.0. Box 12070

‘Austin, Texas 78711-2070 (12463-5800 1-800-325,8506

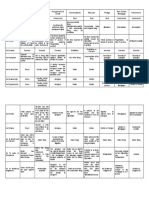

STOCK

1 NoT APPLICABLE

PART 2

INSTRUCTION GUIDE.

List each business entity in which you, your spouse, or a dependent child held or acquired stock during the calendar year

{and indicate the category of the number of shares held or acquired. If some or all of the stock was sold, also indicate the

category of the amount of the net gain or loss realized from the sale. For more information, see FORM PFS—

‘When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet,

7 Tae

ew Clear Channel Communications

2 STOCK HELD OR ACQUIRED BY | Bg FLER Di srouse CI DEPENDENT OHILD

3 NUMBER OF SHARES LESSTHAN 100 — [] tooTo499 =] S00 TO 999 1 1.000 To 4.999

15.000 70 9.908

5,000 To 9,999 1 10,000 OR MORE

a NET GA

'FsoLD Freres | tess maw ss.00 C)sso00-s9s50 10000-24080] $25000-0n MORE

ae

BUSINESS ENTITY ee

‘STOCK HELD OR ACQUIRED BY | LI FILER Til spouse TD SePENDENT CHD ___

NUMBER OF SHARES Tus tan too 10070409 CJsoorosee —C] sano To4e00

11 10.000 oR MoRE

IF SOLD NET GAIN

Oinervoss

Bi] Less THAN $5,000

C1s5,000- $9,998} $10,000-$24,999 [1] $25,000-0R MORE

—_—

“Texas Ethics Commission P.0.B0x 12070 ___ Austin, Texas 78711-2070 (512)403-5800___1-800-325-8506

PERSONAL NOTES AND LEASE AGREEMENTS PART 6

(D NoT APPLICABLE

Identify each guarantor of a loan and each person or financial institution to whom you, your spouse, or

‘a dependent child had a total financial liabilty of more than $1,000 in the form of @ personal note or notes or lease

‘agreement at any time during the calendar year and indicate the category of the amount ofthe liability. For more informa

tion, see FORM PFS--INSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 PERSON OR INSTITUTION ‘Wells Fargo Bank

HOLDING NOTE OR

LEASE AGREEMENT

2 LIABILITY OF

By rier Ci bePeNDENT CHILD

3 GUARANTOR

4 AMOUNT C1s1.000-88,999 1} $5,000- 89,909] $10,000-$24,990 [XJ $25,000-OR MORE

PERSON ORINSTITUTION | Student Loan Com

HOLDING NOTE OR

LEASE AGREEMENT

Oe i ruer Cispouse be PeNDENT CHILD

GUARANTOR

‘AMOUNT (1 s1000-54.999 ] $5.000-89.990 7 s10.000-824.099 C] $25.000-0R MORE

PERSON OR INSTITUTION | JP Morgan Chase Bank

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF Bruce Bi spouse C1 bePeNDeNT cHILD

GUARANTOR

etl C1s1.000-s4209 [] $5,000-$9,998 7] $10,000-$24,909 [Rl $25,000-OR MORE

“Texas Ethics Commission P.0.Box 12070 __ Austin, Texas 78711-2070 (612 1469-5000__1-800-925.8506

PERSONAL NOTES AND LEASE AGREEMENTS PART 6

(NOT APPLICABLE

\dentity each guarantor of a loan and each person or financial institution to whom you, your spouse, or

‘a dependent child had a total financial liability of more than $1,000 in the form of a personal note or notes or lease

‘agreement at any time during the calendar year and indicate the category of the amount ofthe liablity. For more informa

tion, see FORM PFS-INSTRUCTION GUIDE

When reporting information about a dependent chilc's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 PERSON OR INSTITUTION | Lexus Financial Services

HOLDING NOTE OR

LEASE AGREEMENT

2

LABILITY OF rue Di souse LC] DePeNDENT CHILD

3 GUARANTOR

4 AMOUNT Cs1.000-s4909 2] s5.000-se.009 1] st0,000- $24,000

“Texas Ethics Commission P.0.Box 12070 __Austin, Texas 78711-2070 (s12)463-5800__ 1-800-325-8606

INTERESTS IN REAL PROPERTY PaRT 7A

1 NOT APPLICABLE

Describe all beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of beneficial interest’ and other specific directions for completing this section, see FORM PFS—

INSTRUCTION GUIDE.

‘When reporting information about a dependent chile's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 HELD OR ACQUIRED BY Mi ruer (spouse (C1 DEPENDENT CHILD

2 STREET ADDRESS

Dror avataoue ‘Austin, TX 78738

Travis

CHECKCIFFILERS HOME ADDRESS

3 DESCRIPTION TRIER OF GTS OR ACRES ANO NAME OF COUNTY ERE LOND

1 ot

Bhiows Travis County

Caceres

I NAMES OF PERSONS Wainwright, Jesse "Dale® (Hon)

RETAINING AN INTEREST

Dwor appucaste

(SEVERED MINERAL INTEREST)

‘Wainwright, Debra (Mrs.)

5 IF SOLD.

Linereaw Cites Tian ss.000 ) $5,000-82,509 [] $10.000-824909 1] $25,000-oR MoRE

Cneross

HELD OR ACQUIRED BY Druer Di spouse (1 DEPENDENT CHILD

{REET ASORESS. NELUONG GT INT Ano STATE

STREET ADDRESS 604 Terrace Hill Road

Cl nor avanasie: ME. Juliet, TN

Di check ir riers Hone anoress | Wilson

SEScaTION ‘NOMGER OF LOTS RASHES AND WHE OF GOORIN WHERE TOOATED

1 ot

iors Wilson County, Tennessee

Dacres

NAMES OF PERSONS Wainwright, Jesse "Dale" (Hon.)

RETAINING AN INTEREST

Di nor appuicasce

(SEVERED MINERAL INTEREST)

Wainwright, Melody (Ms,)

Wainwright, Artenchis Il “Art (Mr.)

IF SOLD

Dneroan CLess THaN $5,000] $5,000-$9.909 [1] $10,000-$24.999 [1] $25,000-0R MORE

Dnertoss:

You might also like

- Elements of Family Law 2nd Ed 2013Document424 pagesElements of Family Law 2nd Ed 2013Nicole100% (3)

- Discovery To CPSDocument16 pagesDiscovery To CPSRaiysa Reece100% (2)

- Administrative Law Moot Problem-2Document2 pagesAdministrative Law Moot Problem-2sandhra100% (2)

- Coburn Safety at Any PriceDocument55 pagesCoburn Safety at Any PriceAaron NobelNo ratings yet

- Donnell Cydney C 00059681 449089 000 2009Document30 pagesDonnell Cydney C 00059681 449089 000 2009Texas WatchdogNo ratings yet

- Texas Court of Appeals Judge District 13 Place 3 Candidate Gregory Thomas Perkes 2010 Ethics FormDocument51 pagesTexas Court of Appeals Judge District 13 Place 3 Candidate Gregory Thomas Perkes 2010 Ethics FormTexas WatchdogNo ratings yet

- Bittick Peggy S 00065283 442341 000 2009Document24 pagesBittick Peggy S 00065283 442341 000 2009Texas WatchdogNo ratings yet

- Dyer Jay 00065504 450424 000 2009Document32 pagesDyer Jay 00065504 450424 000 2009Texas WatchdogNo ratings yet

- Interests in Real Property: 4115 East Lane Houston, TX 77026 Harris County Description 2 Lots - Harris CountyDocument15 pagesInterests in Real Property: 4115 East Lane Houston, TX 77026 Harris County Description 2 Lots - Harris CountyLee Ann O'NealNo ratings yet

- Austin City Council Member Brewster McCracken's Personal Financial Disclosure, Filed April 2009 (Part 2)Document15 pagesAustin City Council Member Brewster McCracken's Personal Financial Disclosure, Filed April 2009 (Part 2)Lee Ann O'NealNo ratings yet

- Freda L Wolfson Financial Disclosure Report For 2010Document6 pagesFreda L Wolfson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard D Bennett Financial Disclosure Report For 2010Document7 pagesRichard D Bennett Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Austin City Council Member Randi Shade's Personal Financial Disclosure, Filed April 2009Document12 pagesAustin City Council Member Randi Shade's Personal Financial Disclosure, Filed April 2009Lee Ann O'NealNo ratings yet

- Paul G Rosenblatt Financial Disclosure Report For 2010Document7 pagesPaul G Rosenblatt Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William R Furgeson Financial Disclosure Report For 2010Document9 pagesWilliam R Furgeson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harold L Murphy Financial Disclosure Report For 2010Document7 pagesHarold L Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- United States Securities and Exchange Commission Form D Notice of Exempt Offering of SecuritiesDocument7 pagesUnited States Securities and Exchange Commission Form D Notice of Exempt Offering of SecuritiesWilliam HarrisNo ratings yet

- Vanessa D Gilmore Financial Disclosure Report For 2010Document6 pagesVanessa D Gilmore Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William D Quarles JR Financial Disclosure Report For 2010Document6 pagesWilliam D Quarles JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lawrence P Zatkoff Financial Disclosure Report For 2010Document6 pagesLawrence P Zatkoff Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Carol Wheeler - Ethics Complaint vs. Joan Huffman 2015Document8 pagesCarol Wheeler - Ethics Complaint vs. Joan Huffman 2015hearstaustin100% (1)

- Gilbert S Merritt Financial Disclosure Report For 2010Document28 pagesGilbert S Merritt Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Charles N Clevert Financial Disclosure Report For 2010Document6 pagesCharles N Clevert Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Rosemary S Pooler Financial Disclosure Report For 2010Document7 pagesRosemary S Pooler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Eric F Melgren Financial Disclosure Report For 2010Document6 pagesEric F Melgren Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Tucker L Melancon Financial Disclosure Report For 2010Document7 pagesTucker L Melancon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Clarence A Beam Financial Disclosure Report For 2010Document7 pagesClarence A Beam Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Carolyn R Dimmick Financial Disclosure Report For 2010Document6 pagesCarolyn R Dimmick Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Jeffrey S Sutton Financial Disclosure Report For 2010Document8 pagesJeffrey S Sutton Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James C Turk Financial Disclosure Report For 2010Document7 pagesJames C Turk Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Edward C Prado Financial Disclosure Report For 2010Document7 pagesEdward C Prado Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert C Jones Financial Disclosure Report For 2010Document6 pagesRobert C Jones Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Samuel F Biery JR Financial Disclosure Report For 2010Document6 pagesSamuel F Biery JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Claudia Wilken Financial Disclosure Report For 2010Document7 pagesClaudia Wilken Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ethics Comm. Financial DisclosureDocument4 pagesEthics Comm. Financial DisclosureAnonymous twcKq4No ratings yet

- State Sen. Stan Rosenberg SFIDocument19 pagesState Sen. Stan Rosenberg SFIDusty ChristensenNo ratings yet

- Philip M Pro Financial Disclosure Report For 2010Document6 pagesPhilip M Pro Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard A Schell Financial Disclosure Report For 2010Document7 pagesRichard A Schell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- TVLC Voluntary Petition Chapter 11 2016-11-08Document271 pagesTVLC Voluntary Petition Chapter 11 2016-11-08LivermoreParentsNo ratings yet

- Carol E Jackson Financial Disclosure Report For 2010Document6 pagesCarol E Jackson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert B Propst Financial Disclosure Report For 2010Document7 pagesRobert B Propst Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William B Enright Financial Disclosure Report For 2010Document6 pagesWilliam B Enright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Christina C Reiss Financial Disclosure Report For Reiss, Christina CDocument9 pagesChristina C Reiss Financial Disclosure Report For Reiss, Christina CJudicial Watch, Inc.No ratings yet

- James C Cacheris Financial Disclosure Report For 2010Document7 pagesJames C Cacheris Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James L Edmondson Financial Disclosure Report For 2010Document6 pagesJames L Edmondson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Royce C Lamberth Financial Disclosure Report For 2010Document6 pagesRoyce C Lamberth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Warren K Urbom Financial Disclosure Report For 2010Document6 pagesWarren K Urbom Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Consuelo M Callahan Financial Disclosure Report For 2010Document7 pagesConsuelo M Callahan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harold D Vietor Financial Disclosure Report For 2010Document6 pagesHarold D Vietor Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageAnnual Registration Renewal Fee Report To Attorney General of CaliforniaagbufzbfNo ratings yet

- John P Bailey Financial Disclosure Report For 2010Document7 pagesJohn P Bailey Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lacey A Collier Financial Disclosure Report For 2010Document6 pagesLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert R Crane Financial Disclosure Report For 2010Document12 pagesRobert R Crane Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert F Kelly Financial Disclosure Report For 2010Document6 pagesRobert F Kelly Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Raymond J Dearie Financial Disclosure Report For 2010Document7 pagesRaymond J Dearie Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Chavez Fernandez.2022 RPTDocument8 pagesChavez Fernandez.2022 RPTThomas JonesNo ratings yet

- William C Canby JR Financial Disclosure Report For 2010Document6 pagesWilliam C Canby JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Anthony W Ishii Financial Disclosure Report For 2010Document6 pagesAnthony W Ishii Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Client Information and Risk Profile Questionnaire: Dresner Financial PlanningDocument15 pagesClient Information and Risk Profile Questionnaire: Dresner Financial PlanningAshish SrivastavaNo ratings yet

- Edward J Davila Financial Disclosure Report For Davila, Edward JDocument9 pagesEdward J Davila Financial Disclosure Report For Davila, Edward JJudicial Watch, Inc.No ratings yet

- Investing Without Borders: How Six Billion Investors Can Find Profits in the Global EconomyFrom EverandInvesting Without Borders: How Six Billion Investors Can Find Profits in the Global EconomyNo ratings yet

- Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global MarketsFrom EverandCurrency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global MarketsRating: 5 out of 5 stars5/5 (1)

- Your Money and Pension ObligationsDocument24 pagesYour Money and Pension ObligationsTexas Comptroller of Public AccountsNo ratings yet

- Inspection ReportsDocument63 pagesInspection ReportsTexas Watchdog100% (1)

- Homeland Security BudgetDocument183 pagesHomeland Security BudgetTexas Watchdog100% (1)

- Cityreferenda DownballotDocument2 pagesCityreferenda DownballotTexas WatchdogNo ratings yet

- Alamo ReportDocument38 pagesAlamo ReportTexas WatchdogNo ratings yet

- Nov 2012 Sample BallotDocument6 pagesNov 2012 Sample BallotMike MorrisNo ratings yet

- Travisco DownballotDocument3 pagesTravisco DownballotTexas WatchdogNo ratings yet

- Stateemployees PercentDocument1 pageStateemployees PercentTexas WatchdogNo ratings yet

- State Employees ChangeDocument2 pagesState Employees ChangeTexas WatchdogNo ratings yet

- Texas State Auditor's Office Report On Emerging Technology FundDocument81 pagesTexas State Auditor's Office Report On Emerging Technology FundThe Dallas Morning NewsNo ratings yet

- State Employees ChangeDocument2 pagesState Employees ChangeTexas WatchdogNo ratings yet

- Full-Time Equivalent State Employees For The Quarter Ending August 31, 2012Document36 pagesFull-Time Equivalent State Employees For The Quarter Ending August 31, 2012Texas WatchdogNo ratings yet

- Texas Appleseed - Ticketing Booklet WebDocument214 pagesTexas Appleseed - Ticketing Booklet WebTexas WatchdogNo ratings yet

- Office of Inspector General Report On FEMA Handling of Hurricane KatrinaDocument218 pagesOffice of Inspector General Report On FEMA Handling of Hurricane KatrinaTexas WatchdogNo ratings yet

- Loney, Et Al V PeopleDocument2 pagesLoney, Et Al V PeopleWresen AnnNo ratings yet

- Ra 9263Document11 pagesRa 9263leinross100% (1)

- Affidavit of Identity and Written Plea of Not GuiltyDocument1 pageAffidavit of Identity and Written Plea of Not GuiltyMyron BrandwineNo ratings yet

- Law Relating To Electronic Voyeurism in India Eyes Behind The MirrorDocument4 pagesLaw Relating To Electronic Voyeurism in India Eyes Behind The MirrorAKHIL H KRISHNANNo ratings yet

- Negotiable InsDocument88 pagesNegotiable InsKentfhil Mae AseronNo ratings yet

- Worksheet 1 Situation of Children in Conflict With The Law and Children at RiskDocument8 pagesWorksheet 1 Situation of Children in Conflict With The Law and Children at RiskGuyam MalakiNo ratings yet

- Garcia: Objection To SubpoenasDocument4 pagesGarcia: Objection To SubpoenasTony OrtegaNo ratings yet

- Pump Court Costs Reports Updated June 2012 v2Document50 pagesPump Court Costs Reports Updated June 2012 v2chrishadsNo ratings yet

- Constitutional Law 2 Case DigestDocument131 pagesConstitutional Law 2 Case DigestTokie TokiNo ratings yet

- Crl.p. 1294 2023Document2 pagesCrl.p. 1294 2023astonishingeyes26No ratings yet

- Mancuso Cover Letter PDFDocument1 pageMancuso Cover Letter PDFRajni ElNo ratings yet

- Detention Order PDFDocument15 pagesDetention Order PDFNick TanNo ratings yet

- Lucia v. SECDocument32 pagesLucia v. SECCato InstituteNo ratings yet

- Case Digest CocDocument68 pagesCase Digest CocAngel de GuzmanNo ratings yet

- 17 Fraud, Misrepresentation and MistakeDocument15 pages17 Fraud, Misrepresentation and MistakeAbdul Basit MirzaNo ratings yet

- Position Paper NLRCDocument12 pagesPosition Paper NLRCkathleen anne KingNo ratings yet

- Void and Voidable Marriages: (The Family Code of The Philippines)Document2 pagesVoid and Voidable Marriages: (The Family Code of The Philippines)glenda e. calilaoNo ratings yet

- Effects of Absence of Verification and Certificate of Non ForrumshDocument2 pagesEffects of Absence of Verification and Certificate of Non Forrumshmamp05No ratings yet

- Regulating Act 1773Document9 pagesRegulating Act 1773BhoomiNo ratings yet

- BBC News NavigationDocument7 pagesBBC News NavigationTitis Endah PratiwiNo ratings yet

- Corporate Restrucuring Companies Rules, 2019 - 2Document10 pagesCorporate Restrucuring Companies Rules, 2019 - 2PATCO PARCNo ratings yet

- People v. Prince FranciscoDocument2 pagesPeople v. Prince FranciscoKarla BeeNo ratings yet

- Near v. MinnesotaDocument2 pagesNear v. MinnesotaNoreenesse SantosNo ratings yet

- Diaz Vs CaDocument4 pagesDiaz Vs CaSannie RemotinNo ratings yet

- Bangabandh Murder CaseDocument413 pagesBangabandh Murder CaseSultana SharminNo ratings yet

- Distinction On Sales (Law 3)Document2 pagesDistinction On Sales (Law 3)Angelene MangubatNo ratings yet

- 2018 Bar Questions and Answers in Political LawDocument14 pages2018 Bar Questions and Answers in Political LawJanet FabiNo ratings yet

- FINAL Guide To Going Global EmploymentDocument308 pagesFINAL Guide To Going Global EmploymentbandwagoneerNo ratings yet