Professional Documents

Culture Documents

Completing An Audit - Step by Step

Completing An Audit - Step by Step

Uploaded by

Shu XianOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Completing An Audit - Step by Step

Completing An Audit - Step by Step

Uploaded by

Shu XianCopyright:

Available Formats

Completing an Audit- Step by step

1. Determine Deadline

2. Read LY’s CAF + PAF

3. Obtain F.S( TB, BS, IS & Supporting schedule)

• Let client know early as they may need time to prepare

• Initial analytical review & completing WBS, WIS & lead schedules

* Identify of problems

• Ask client if there are any unusual items item which the a/c entries they are

uncertain

* Client identify for us

• Check wf Khoo on solutions to problems identified (ie. solve the problem upfront)

• Obtain clarification on problems identified by faxing “ Audit Enquiries” to client

• Selection of samples for REC, PAY and other vouching works

• Understanding the clients accounting and filing systems

• Performance of REC, PAY and other vouching works

• Documentation of audit findings, problems and memo writing

• Final analytical review and Memo

• Finalisation of audit ( By way of “self-review” of the audit file)

• Clear Khoo review point

Note: For audit client which we are also the tax agent to obtain

detailed anlaysis:

Gain/loss on sale of PPE

Provision for doubtful debts

Bad debts written off

Misc/ Sundry expenses

Legal & Consultancy fee

Insurance premium

Donation/Gift/Entertainment

Additions/ Disposal from PPE

Tips: To identify problems early, so that client will have sufficient time to solve them.

Problem solving:

Identify problem

. Weigh the solution (reduce everything into double entries)

I. Select the easy solution

Obtain information via the entries into the GL (ie.GL a/c- Journal/PV-Supporting Doc)

Important: Do not pass through immaterial audit adjustment (Unless to tally wf

statement or disclosure). Audit adjustment must have the necessary detail and sufficiently

clear for client to understand).

You might also like

- MNB-00003-29 - User Manual Tait DMR Tier 3Document253 pagesMNB-00003-29 - User Manual Tait DMR Tier 3Sergio100% (1)

- Session 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsDocument55 pagesSession 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsRheneir Mora100% (1)

- Books and Periodicals - XLSX - Simple ReceiptDocument1 pageBooks and Periodicals - XLSX - Simple ReceiptJintu K JosephNo ratings yet

- Statista Report b2b e CommerceDocument103 pagesStatista Report b2b e CommercebNo ratings yet

- Returned Checks Audit Work ProgramDocument4 pagesReturned Checks Audit Work ProgramozlemNo ratings yet

- Approach To Bank Audit DNS 17 18 FinalDocument45 pagesApproach To Bank Audit DNS 17 18 FinalSowmya GuptaNo ratings yet

- Root Cause Analysis PresentationDocument37 pagesRoot Cause Analysis PresentationucheonixNo ratings yet

- PR-FIN-01v02 - Processing of Financial Claims - HODocument22 pagesPR-FIN-01v02 - Processing of Financial Claims - HOJonathan LarozaNo ratings yet

- Q8101 Accounts ExecutiveDocument12 pagesQ8101 Accounts ExecutiveRoshan JainNo ratings yet

- TOPIC SEVEN AUDIT INVESTIGATIONS, RECEIVERSHIP & LIUIDATION March 2024Document48 pagesTOPIC SEVEN AUDIT INVESTIGATIONS, RECEIVERSHIP & LIUIDATION March 2024kiokojuma4No ratings yet

- PR-FIN-02v01 - Processing of Claims - RegionsDocument11 pagesPR-FIN-02v01 - Processing of Claims - RegionsJonathan LarozaNo ratings yet

- 02 Revenue Receipts Cycle Controls and Tests of ControlsDocument31 pages02 Revenue Receipts Cycle Controls and Tests of ControlsRonnelson PascualNo ratings yet

- W.P BSAccount RecDocument2 pagesW.P BSAccount RecnaimaNo ratings yet

- Module 1 Revenue CycleDocument11 pagesModule 1 Revenue CycleNova PringNo ratings yet

- CPA Audit NotesDocument136 pagesCPA Audit NotesRamachNo ratings yet

- M4 Audit of Revevue and Receipt CycleDocument52 pagesM4 Audit of Revevue and Receipt CycleWillowNo ratings yet

- 2010 05 Project Management Principles PDFDocument19 pages2010 05 Project Management Principles PDFSubramanian SaravananNo ratings yet

- AR Europe PreLegal Activities DLP STS-D-2438 Feb 2021Document7 pagesAR Europe PreLegal Activities DLP STS-D-2438 Feb 2021Nico TuscaniNo ratings yet

- Revision Checklist For IGCSE AccountingDocument9 pagesRevision Checklist For IGCSE AccountingAayesha69100% (2)

- A. Planning: Audit ObjectivesDocument5 pagesA. Planning: Audit ObjectivesChinh Le DinhNo ratings yet

- Accounts Payable Purchase To Pay CycleDocument11 pagesAccounts Payable Purchase To Pay Cycleحسين عبدالرحمنNo ratings yet

- Application of The Risk-Based Audit Process Test of Controls and Substantive Tests of Transactions and Details of Balances, and ReportingDocument57 pagesApplication of The Risk-Based Audit Process Test of Controls and Substantive Tests of Transactions and Details of Balances, and ReportingHannah SyNo ratings yet

- Exam TechniqueDocument6 pagesExam TechniqueJaskaran SinghNo ratings yet

- Module 1 - Auditing Assurance CA 1Document6 pagesModule 1 - Auditing Assurance CA 1Merliza JusayanNo ratings yet

- Chapter 6: Audit of Current LiabilityDocument14 pagesChapter 6: Audit of Current LiabilityYidersal DagnawNo ratings yet

- Module 1 Audit Process and Pre EngagementactivitiesDocument7 pagesModule 1 Audit Process and Pre EngagementactivitiesZwivhuya MaimelaNo ratings yet

- Audit of BanksDocument14 pagesAudit of BanksClarisse GonzalesNo ratings yet

- Accounts Receivable - Credit & Collections Audit Program - Auditor Exchange PDFDocument5 pagesAccounts Receivable - Credit & Collections Audit Program - Auditor Exchange PDFgong688665No ratings yet

- Lesson 5 - Audit Planning PDFDocument4 pagesLesson 5 - Audit Planning PDFAllaina Uy BerbanoNo ratings yet

- Sales and Receipts 2023 - SunlearnDocument38 pagesSales and Receipts 2023 - SunlearnJustyneNo ratings yet

- Internal Audit Program Accounts Receivable/Credit & Collections ReviewDocument5 pagesInternal Audit Program Accounts Receivable/Credit & Collections ReviewIrwansyah IweNo ratings yet

- TAU 2 Course Material v2.1Document40 pagesTAU 2 Course Material v2.1sreenathNo ratings yet

- Sindingan - Workshop 2Document10 pagesSindingan - Workshop 2AndreaNo ratings yet

- Focus_Notes_AAA_LW5Document14 pagesFocus_Notes_AAA_LW5davidkmandaNo ratings yet

- How To Conduct An Environmental Audit: Jess Mcangus June 4, 2015Document16 pagesHow To Conduct An Environmental Audit: Jess Mcangus June 4, 2015Jason SpottsNo ratings yet

- Aud Prob ReviewerDocument22 pagesAud Prob ReviewerJoy ConstantinoNo ratings yet

- Module 2 For Acctg 3119 - Auditing and Assurance PrinciplesDocument57 pagesModule 2 For Acctg 3119 - Auditing and Assurance PrinciplesAdeline DelveyNo ratings yet

- 2012 Auditing and Attestation HandoutDocument21 pages2012 Auditing and Attestation Handoutsimply Pretty100% (1)

- CA Inter Audit AddendumDocument11 pagesCA Inter Audit Addendumkedarnathtrip2023ghyNo ratings yet

- Wa0001Document64 pagesWa0001anil khamariNo ratings yet

- Client Ledger V 10Document11 pagesClient Ledger V 10Julieth TeembaNo ratings yet

- CPV Manua CompletelDocument9 pagesCPV Manua CompletelKundan Gurav100% (1)

- Audit MethodologyDocument20 pagesAudit MethodologyVikasAgarwalNo ratings yet

- Audit Program (Expenses)Document1 pageAudit Program (Expenses)Ynnejesor ArugesNo ratings yet

- PR-BC-01v02 - Business CounselingDocument11 pagesPR-BC-01v02 - Business CounselingBrian SardeaNo ratings yet

- Unit - 3: 1.preparation Before The Commencement of AuditDocument12 pagesUnit - 3: 1.preparation Before The Commencement of AuditNaga Raju DudalaNo ratings yet

- Expenditure Cycle:: Report byDocument1 pageExpenditure Cycle:: Report byolganetrixNo ratings yet

- AFS 2023 - Lecture 4 - Sale IIDocument29 pagesAFS 2023 - Lecture 4 - Sale IIKiều TrangNo ratings yet

- Module One Pre-Engagement Activities - Course NotesDocument5 pagesModule One Pre-Engagement Activities - Course NotesGiven RefilweNo ratings yet

- Case 6: Testing The Inventory Procurement SystemDocument50 pagesCase 6: Testing The Inventory Procurement SystemJoHn CarLoNo ratings yet

- Ch-4 Auditing Principles and Practices-IIDocument26 pagesCh-4 Auditing Principles and Practices-IIfiraolmosisabonkeNo ratings yet

- Transaction Processing in The AISDocument20 pagesTransaction Processing in The AISChristlyn Joy BaralNo ratings yet

- Audit Firm Organizational ChartDocument4 pagesAudit Firm Organizational ChartMuhammad Tahir Lecturer at IBLNo ratings yet

- FALLSEM2020-21 CSE4028 ETH VL2020210106085 Reference Material II 22-Oct-2020 Configuration ManagementDocument41 pagesFALLSEM2020-21 CSE4028 ETH VL2020210106085 Reference Material II 22-Oct-2020 Configuration ManagementjleodennisNo ratings yet

- APHC Learning PointsDocument12 pagesAPHC Learning PointsKingsley LimNo ratings yet

- Auditing Chapter 3Document38 pagesAuditing Chapter 3FarrukhsgNo ratings yet

- Professional Review and Training Center (PRTC)Document25 pagesProfessional Review and Training Center (PRTC)Mark LagsNo ratings yet

- Chapter 4Document29 pagesChapter 4Genanew AbebeNo ratings yet

- STANDARD OF AUDITING SUMMARY REVISION WITH CASE STUDIES UPLOADED ON 11th MAY 2017 636302080328521091 PDFDocument48 pagesSTANDARD OF AUDITING SUMMARY REVISION WITH CASE STUDIES UPLOADED ON 11th MAY 2017 636302080328521091 PDFVinoth AnandNo ratings yet

- Learning Mod 2 CfasDocument15 pagesLearning Mod 2 CfasKristine CamposNo ratings yet

- CH 01Document16 pagesCH 01bingoNo ratings yet

- Auditing The Expenditure CycleDocument35 pagesAuditing The Expenditure CycleodiledemonNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingNo ratings yet

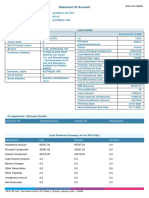

- CIMBClicks TRX History.Document1 pageCIMBClicks TRX History.Shu XianNo ratings yet

- World CardDocument1 pageWorld CardShu XianNo ratings yet

- Book 1Document5 pagesBook 1Shu XianNo ratings yet

- Without YouDocument1 pageWithout YouShu XianNo ratings yet

- AudienceProject Study App and Social Media Usage 2020 PDFDocument60 pagesAudienceProject Study App and Social Media Usage 2020 PDFАнтон МорозовNo ratings yet

- IC 01 Principles of Insurance (Second Edition JaDocument1 pageIC 01 Principles of Insurance (Second Edition Javinaykumar333777No ratings yet

- CLIX2Document2 pagesCLIX2Digi CreditNo ratings yet

- Optima Restore Rate Card Inclusive of Service TaxDocument2 pagesOptima Restore Rate Card Inclusive of Service Taxmksnake77No ratings yet

- Vista-20SE Program ManualDocument8 pagesVista-20SE Program ManualJavier SerenelliNo ratings yet

- Vodafone India - Statement of AccountDocument1 pageVodafone India - Statement of AccountSiva GuptaNo ratings yet

- Nursing Information System TeamDocument22 pagesNursing Information System TeamJustine CruzNo ratings yet

- VivaDocument20 pagesVivaHiren ShahNo ratings yet

- Assigment 2 Network Design For A CompanyDocument5 pagesAssigment 2 Network Design For A Companyhomanhquan1812No ratings yet

- Banking Acronyms and AbbreviationsDocument14 pagesBanking Acronyms and Abbreviationssayan_shuvoNo ratings yet

- Socks5 ProxiesDocument23 pagesSocks5 ProxiesyuknomebrawhNo ratings yet

- Oct 24, Doc 5 (OCR)Document40 pagesOct 24, Doc 5 (OCR)Juan Gaytan50% (2)

- Daily Report MonitoringDocument9 pagesDaily Report MonitoringMaasin BranchNo ratings yet

- J K HKH Ljlukuh Kiljj LJ LJ LJ L LJLKL KHK LKDocument14 pagesJ K HKH Ljlukuh Kiljj LJ LJ LJ L LJLKL KHK LKLe KienNo ratings yet

- Traffice Engineering Using SDNDocument20 pagesTraffice Engineering Using SDNAhsan RiazNo ratings yet

- 7 Asst SGIDocument3 pages7 Asst SGICadet Anuj Singh ChauhanNo ratings yet

- Agent Banking Tariff Poster FinalDocument1 pageAgent Banking Tariff Poster FinalNicholas AmanyaNo ratings yet

- Teldat Dm712-I SNMP AgentDocument36 pagesTeldat Dm712-I SNMP AgentTeodoro SosaNo ratings yet

- Funds Transfers - OverviewDocument7 pagesFunds Transfers - OverviewCajita FelizNo ratings yet

- ACCOUNTINGDocument2 pagesACCOUNTINGantibacterialsoapNo ratings yet

- MM - UNIT 4 Comp PDFDocument21 pagesMM - UNIT 4 Comp PDFMo Rafik khanNo ratings yet

- Purchase Order NO: 1010849367: VendorDocument2 pagesPurchase Order NO: 1010849367: VendorErian Adhi Nur PersadaNo ratings yet

- Individuals Wellness Plan Packages DeluxeDocument2 pagesIndividuals Wellness Plan Packages DeluxeTony Peterz KurewaNo ratings yet

- HSM541 FinalDocument5 pagesHSM541 Finalteekel_1125No ratings yet

- UCC 4 Bank-Banking DefinitionsDocument2 pagesUCC 4 Bank-Banking DefinitionsTheplaymaker508No ratings yet

- Affidavit of Ownership PacketDocument8 pagesAffidavit of Ownership PacketJeremy WebbNo ratings yet

- 5 GBIPlugand Play Guide 2022Document2 pages5 GBIPlugand Play Guide 2022juan.serrallongaNo ratings yet