Professional Documents

Culture Documents

Art On Sec. 25 Co

Art On Sec. 25 Co

Uploaded by

Jay PrasadCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ICT 2022 Mentorship NotesDocument4 pagesICT 2022 Mentorship NotesAnto Richards0% (1)

- Conflict of Interest Disclosure Form (Employees) EnglishDocument2 pagesConflict of Interest Disclosure Form (Employees) EnglishAakash amerNo ratings yet

- By: Rakim L. Perez BSBA 3BDocument66 pagesBy: Rakim L. Perez BSBA 3BLovely Rizziah Dajao CimafrancaNo ratings yet

- Crane Hire and Contract Lift-090626 PDFDocument6 pagesCrane Hire and Contract Lift-090626 PDFANIBAL MARQUEZNo ratings yet

- Ntuli 2017 Paper PDFDocument6 pagesNtuli 2017 Paper PDFAyanda NtobelaNo ratings yet

- Virtual Latinos Agency AgreementDocument14 pagesVirtual Latinos Agency AgreementIan GradyNo ratings yet

- Article Writing: GoalsDocument14 pagesArticle Writing: GoalsTanyaNo ratings yet

- IE Project (Manufaturing of Hydrogen Fuel by Electrolysis)Document5 pagesIE Project (Manufaturing of Hydrogen Fuel by Electrolysis)shukeshNo ratings yet

- Modern and Minimal Business Project Proposal MagazineDocument24 pagesModern and Minimal Business Project Proposal MagazineakshayaNo ratings yet

- Semi Final AccountingDocument8 pagesSemi Final AccountingSherryl DumagpiNo ratings yet

- Ankit Singh Academic Docs and PassportDocument13 pagesAnkit Singh Academic Docs and PassportSushant MongaNo ratings yet

- Gen Maths 07Document26 pagesGen Maths 07Sibin G ThomasNo ratings yet

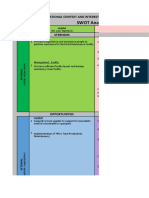

- SWOT Analysis: Organizational Context and Interested Parties Need & ExpectationDocument43 pagesSWOT Analysis: Organizational Context and Interested Parties Need & Expectationamril alrizaNo ratings yet

- Salvador - Kepco-Ilijan Corporation v. CirDocument19 pagesSalvador - Kepco-Ilijan Corporation v. CirAntonio Dominic SalvadorNo ratings yet

- Why We Study ManagmentDocument6 pagesWhy We Study ManagmentAgumas AlehegnNo ratings yet

- Cultural Sensitivity in The WorkplaceDocument22 pagesCultural Sensitivity in The WorkplaceCeasar EstradaNo ratings yet

- Operatorilor EconomiciDocument312 pagesOperatorilor EconomicimadalinaNo ratings yet

- Annual Report On GM MotorsDocument7 pagesAnnual Report On GM Motorsarmeen yousufNo ratings yet

- Doug Ducey and History of Cold Stone CreameryDocument15 pagesDoug Ducey and History of Cold Stone CreameryBarbara EspinosaNo ratings yet

- Z Rahman MergedDocument9 pagesZ Rahman MergedPrinceNo ratings yet

- Unit 8 HP2 - Listening Exercise R3Document3 pagesUnit 8 HP2 - Listening Exercise R3HUY NGUYEN DIEUNo ratings yet

- Garment Manufacturing ProcessDocument54 pagesGarment Manufacturing Processroselyn ayensa100% (1)

- Topic 1.1 - Basic Concept of RisksDocument14 pagesTopic 1.1 - Basic Concept of RisksJamie ZaliNo ratings yet

- SCM Budget BSA2ADocument3 pagesSCM Budget BSA2AKaymark Lorenzo0% (2)

- IC Preliminary Project Execution Plan 11095Document6 pagesIC Preliminary Project Execution Plan 11095Apm FoumilNo ratings yet

- EXAMPLE 8.6 Veneer Grades and RepairsDocument2 pagesEXAMPLE 8.6 Veneer Grades and RepairsnickNo ratings yet

- KLMinvoice 04062020Document1 pageKLMinvoice 04062020Jack RobinsonNo ratings yet

- JD Planning EngineerDocument3 pagesJD Planning EngineerAkhil SurendranNo ratings yet

- AFES One Stop Solution For Foundation DesignDocument43 pagesAFES One Stop Solution For Foundation Designhoga_dreamlandNo ratings yet

- Laurus Labs AR FY19Document224 pagesLaurus Labs AR FY19abijith reddyNo ratings yet

Art On Sec. 25 Co

Art On Sec. 25 Co

Uploaded by

Jay PrasadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Art On Sec. 25 Co

Art On Sec. 25 Co

Uploaded by

Jay PrasadCopyright:

Available Formats

L AW

Licenced Companies

Under Section 25 of

Companies Act, 1956

ASHISH MAKHIJA

An association having objects to promote commerce, art, science, religion, charity or

any other useful purpose and not having any profit motive can be registered as non-

profit company under section 25 of the Companies Act, 1956. This section empowers

the Central Government to grant a licence directing that such an association may be

registered as a company with limited liability, without the addition of the words

`Limited’ or `Private Limited’ to its name.

T

he so-called non-profit orga- licence to a company which is pro- A license under this section can

nizations can alternatively posed to be incorporated provided be granted by the Central

be formed as a Public Trust it complies with conditions, as to its Government through four Regional

or a Society under the Societies objects, application of its Directors namely, Regional Director

Registration Act, 1860. The ques- profits/income and distribution of (Eastern Region) at Kolkata,

tion then arises why to form a com- its profits, enumerated as under: - Regional Director (Northern

pany under the Companies Act, Region) at Kanpur, Regional

1956 and simultaneously obtain (i) it is being formed for promotion Director (Western Region) at

licence under Section 25 of the Act, of commerce, art, science, reli- Mumbai and Regional Director

which involves enormous paper- gion, charity or any other use- (Southern Region) at Chennai. The

work and stricter provisions relat- ful object; application for grant of licence is to

ing to maintenance of accounts and (ii) it intends to apply its profits or be made to the Regional Director of

audit? The most obvious answer is other income in promotion of the region, in case of proposed com-

provided by the advantages of hav- its objects; panies in the State where the regis-

ing an incorporated company, (iii) it intends to prohibit payment tered office is proposed to be situ-

namely, independent corporate of dividend to its members. ated and in case of existing compa-

entity, limited liability, perpetual The grant of licence is not only nies in the State where its registered

succession etc. Section 25 compa- restricted to `proposed companies’ office is situated, falls.

nies enjoy greater privileges in the but also extends to `existing compa-

form of concessions allowed under nies’ registered under the Any other useful object

the Act to such companies. Companies Act, 1956. Such exist- The presence of words `any

ing companies must make compli- other useful object’ in Section 25

Statutory provisions ance of the aforestated conditions leads to an inference that a company

Section 25 empowers the through its Memorandum of which is promoted for any useful

Central Government to issue a Association prior to being eligible object other than those specified in

for grant of such a licence.

THE CHARTERED ACCOUNTANT 1241 MAY 2004

L AW

the section namely, promotion of companies cannot earn any profits. Section 263A provides protection to

commerce, art, science, religion or Assigning such a meaning leads to section 25 companies from the applic-

charity shall also be eligible for grant unrealistic and impractical situa- ability of provisions of sections 177,

of licence under the section. The tions, as it would be impossible to 255, 256 & 263 of the Act, if the arti-

question, however, remains what maintain a situation of no profit and cles of such a company provide for

could be considered as `any other no loss. The words `Non-Profit’ or election by ballot of all its directors at

useful object’? The application of `No Profit - No Loss’ essentially sig- each Annual General Meeting. The

cardinal rule of `ejusdem generis’ nify that such companies cannot dis- protection provided by section 263A

provides the answer. According to tribute the profits earned in the form is enumerated as under: -

this rule, when particular words per- of dividends to its members and the

taining to a class, category or genus income/profit earned has to be

are followed by general words, they applied for furtherance of the objects No minimum paid-up capital

are construed as limited to the things for which it has been formed.

The Companies Amendment Act,

of same kind as those specified.

2000 introduced the concept of mini-

Thus, in construing the words any

other useful object, the objects enu- Exemptions & privileges on mum paid-up capital. Thus all the com-

panies i.e. existing companies as well as

merated contemplate objects that are grant of licence the companies registered after the com-

for the benefit of the society as a mencement of the Companies

Once a license is granted, such

whole. Thus, even promotion of Amendment Act, 2000 were obligated

companies can be formed without the

sports, education, research activities to increase their paid-up capital to the

words `Limited’ or `Private Limited’

etc. would fall under the category of required minimum - Rs. 1 lac for private

as part of their name. The existing

`any other useful object’. limited companies & Rs. 5 lacs for pub-

companies can also take benefit of this

provision and on grant of licence by lic limited companies. The companies

The Non-profit or `No Profit - the Central Government, can proceed registered under Section 25 of the Act

to change its name by omitting the either before or after the commence-

No Loss’ words `Limited’ or `Private Limited’ ment of Companies Amendment Act,

The companies registered under from its name. In addition to the priv- 2000, have, however, been exempted

section 25 of the Act are also known ilege as to non-inclusion of the words from the requirement of minimum

as `Non-Profit’ or `No Profit - No `Limited’ or `Private Limited’ in its paid-up capital. This is a privilege

Loss’ companies. These terms are name, such companies enjoy numer- exclusively for companies registered

often given literal meaning that such ous exemptions under the Act. under section 25 of the Act.

Section Matter Exemption

177 Resolutions put to vote at general meetings to Whole, if the articles provide for election by

be decided on show of hands unless poll is ballot

demanded u/s 179

255 Retirement of directors by rotation Whole, if the articles provide for election by

ballot

256 Ascertainment of directors retiring by rotation Whole, if the articles provide for election by

and filing of vacancies ballot

263 Appointment of directors to be voted on indi- Whole, if the articles provide for election by

vidually ballot

The Central Government, in exercise of the power conferred by sub-section (6) of Section 25 has also granted fol-

lowing exemptions to companies under section 25: -

THE CHARTERED ACCOUNTANT 1242 MAY 2004

L AW

Section Matter Exemption

2(45) Appointment of qualified company secretary In so far as it requires the appointment of an indi-

vidual to perform the duties which may be per-

formed by a secretary under the said Act and any

other administrative duties only if he possesses

the prescribed qualifications

147 Publication of name of company Whole

160(1)(aa) Name of the members, date on which they became Entire

members, they ceased as members since the date

of annual general meeting of the immediately pre-

ceding year

166(2) Holding of Annual General Meeting during busi- Entire provided time, date and place of each

ness hours, not on a public holiday, in the city Annual General Meeting is decided upon before

where the Registered Office of the company is sit- hand by the Board of Directors having regard to

uated the directions, if any, given in this regard by the

company in the general meeting

171(1) Length of notice for calling general meeting A general meeting can be called by giving a

notice of not less than 14 days in writing

193 Recording of minutes within 30 days of conclu- Earlier the section provided for 14 days for

sion of every meeting recording of the minutes. The time period

allowed to section 25 companies was 30 days.

However, Section 193 was amended in 1965 to

allow 30 days to all the companies.

209(4A) Preservation of Books of Account and other The period for preservation of books of account

papers for 8 years and other papers in case of section 25 companies

is 4 years immediately preceding the current year

219 Annual Accounts to be sent to the members at least The annual accounts can be sent not less than 14

21 days before the date of meeting days before the date of the meeting

257 Right of persons other than retiring director to Not to apply to companies whose Articles pro-

stand for directorship vide for voting by ballot

259 Approval of Central Government for increase in Entire

number of directors beyond 12

264(1) Filing of consent of director to act as director Entire

285 Holding of at least one meeting in every three cal- At least one meeting within every six calendar

endar months and at least four meetings in a year months

287 Quorum for Board meetings - 1/3rd of strength of ¼th or 8 whichever is less with minimum 2

Board with minimum of 2

292 Certain powers to be exercised in Board Meetings Power to borrow money, invest funds and make

only like to make calls, issue debentures, borrow loans can be done by circulation

money, invest funds, make loans

299 Disclosure of Interest by a director Not applicable except for contracts to which

297(1) & (3) applies

301 Register of contracts, companies and firms in Applicable for contracts to which Section

which directors are interested 297(1) or (3) applies

303(2) Intimation to Registrar of change in directorship Entire

THE CHARTERED ACCOUNTANT 1243 MAY 2004

L AW

Companies (Auditor’s Report)

Lower registration fee & Order 1998 was not applicable to Conditions for grant of license

exemption from stamping section 25 companies vide Clause under section 25

Another privilege, which such 2(b)(iii) of the said Order. The licence is granted subject to

a company enjoys, is that though fulfillment of various conditions by

such a company can have share cap- Firm can be a member such companies. The conditions, sub-

ital like any other company but the A unique feature of Section 25 ject to which the licence is granted by

registration fees payable is lower as companies is that even a `firm’ can the Central Government, are enumer-

compared to companies not having also be a member of such a com- ated as under: -

a licence under section 25. The fee pany in its own name. It may be (a) That the profit/income earned by

payable is fixed irrespective of the recalled that a firm, not being dis- the company shall be applied by

amount of authorized share capital. tinct and separate from its part- the company for the promotion of

The companies registered under ner(s), cannot hold shares in any its objects;

section 25 of the Act enjoy another company in its own name. But in a (b) That the company by its articles

privilege as these companies are not section 25 company, a firm can shall prohibit distribution of its

required to have their Memorandum & become a member of such a com- profit in the form of dividend,

Articles of Association stamped under pany in its own name. An interest- bonus etc. to its members;

section 39 of Indian Stamp Act, 1899. ing question which arises is (c) That the company shall not alter its

whether a proprietary firm can object clause without the prior

approval of the Central Gover-

Non-application of Companies become a member of such a com-

nment in writing. The licence

pany? This issue is important since

Auditor’s Report Order 2003 many such companies have issued by the Regional Directors

Section 25 companies are enrolled proprietary firms as its normally contains the prohibition

exempt from the applicability of members. This has eventually led to regarding amendment of any

Companies Auditor’s Report Order a situation where an individual clause of Memorandum of

2003 (CARO). CARO was notified being a proprietor of more than one Association without their previ-

by the Central Government on firm has been enrolled as a member ous permission;

12.06.2003 to be applicable for fina- as many times as he has floated the (d) That the company shall not

ncial years ending on or after 1st proprietary firms. This seems to be amend its Articles without the

July, 2003. The Central Government a blatant violation of the privilege permission of the Central

vide its circular no. 32/2003 dated granted to such companies in order Government; and

10th November, 2003 has made it to control the management of the (e) That the company shall not pay

mandatory for financial years end- such companies. The word `firm’ remuneration or other benefit to

ing on or after 1st January, 2004. For has to be given a meaning as any of its members. This is

the financial years ending between defined in Indian Partnership Act, applicable even though they are

1st July, 2003 and 31st December, 1932 as `persons who have entered officers/servants/office bearers.

2003, the Central Government has into partnership with one another Any member working for the

advised all Registrar of Companies are collectively called as a firm’. association has to work in an

to take a lenient view provided, how- Therefore, for a firm, existence of honorary capacity. What can be

ever, either a report in CARO or ear- partnership is a must which is not paid is reimbursement of expe-

lier MAOCARO (Manufacturing possible in case of a proprietary nses, interest on loan, rent for

and other Companies (Auditor’s firm. If such a contention is permit- premises lent to the company.

Report) Order 1988), if applicable, ted, a single person being a propri- However, such payment can be

is attached. CARO expressly etor of two or more firms can form made to a members for services

exempts section 25 companies from a private company under this sec- rendered by them which are not

its applicability vide Clause 2(iii) of tion which does not seem to be the of the kind ordinarily expected to

Para 1 of the Order. Earlier also, intention of the Act. be rendered by him as member,

Manufacturing and other with the previous approval of the

THE CHARTERED ACCOUNTANT 1244 MAY 2004

L AW

Central Government. giving in brief description

of work proposed to be car-

Revocation of licence ried out after incorporation.

● Three copies of the state-

In the event of the company con-

ment specifying the

travening any of the aforestated con-

grounds on which the

ditions, the Central Government has

application is made.

been empowered to revoke the

● Declaration, on a non-judi-

licence so granted. But before revok-

cial stamp paper of appro-

ing the licence, the Central Gover-

priate value duly notarized,

nment shall give a notice in writing

by all the directors of the

of its intention to the company and

company (Prescribed

shall afford an opportunity of being undertaken by the company Performa is given in

heard in opposition to the revocation. etc. The application is to be Annexure V of the

The Central Government is expected made to the concerned Companies Regulation,

to use this power bonafide based on Regional Director enclosing 1956) that he is not of

the principles of natural justice. the following documents: - unsound mind, not an

Upon revocation, the company shall

undischarged insolvent,

cease to enjoy the privileges and ● Three copies of has not applied for adjudi-

exemptions granted under section 25 Memorandum & Articles cation as insolvent, and has

of the Act. It shall also be obliged to of Association duly exe- not been convicted by any

add the words `Limited’ or `Private cuted by the promoters. court, and is not disquali-

Ltd. as the case may be to its name. ● Three copies of list of fied to act as a director.

names, description, addr- ● Declaration, on a non-judi-

Procedure for obtaining License esses of promoters/ direc- cial stamp paper of appro-

The procedure for obtaining tors with the name of orga- priate value duly notarized,

licence from the Central nization in which they are by a Chartered Accountant

Government and subsequent incor- holding responsible posi- or an Advocate of a

poration of the company involves tions. Supreme Court or of a

the following steps: - ● Three copies of statement High Court, an attorney or

(i) Obtain name availability letter showing estimates of a pleader entitled to appear

from the Registrar of future Income & before a High Court or a

Companies after making appli- Expenditure and Balance Company Secretary that

cation in Form 1-A stating the Sheet (for new company). Memorandum & Articles

fact that the company is pro- For existing companies, of Association have been

posed to be registered under besides the estimated drawn up in accordance

section 25 of the Act. Income & Expenditure with the provisions of the

(ii) Make an application for grant of Account and Balance Act and that all the require-

license. The application is to be Sheet, past three years’ ments of the Act and the

made by the promoter(s) in annual accounts, report on rules made there under

case of a proposed company working of the company have been duly complied

and by any director under and a statement showing in with in respect of registra-

authorization of the Board, in detail the assets and liabili- tion or matters incidental

case of an existing company. ties of the company as on or supplementary thereto.

Such an application is to be the date of application or ● Application fee of Rs. 500/-

made on a plain paper and gen- within seven days of that (Revised from Rs. 60/- in

erally contains the background date are also to be attached. July 1999) by way of a

of promoters, activities to be ● Three copies of statement demand draft in favour of

THE CHARTERED ACCOUNTANT 1245 MAY 2004

L AW

Regional Director, (v) Registrar of Companies shall at the time of incorporation of com-

Northern/Eastern/Western/ scrutinize the documents and panies.

Southern Region and suggest modifications, if any,

payable at the place where to the Regional Director within Income Tax Provisions

the concerned Regional 15 days. The Registrar of

The income earned by Section

Director’s office is situated. Companies can seek the views

25 companies is taxable under the

● Copy of name-availability of District Magistrate of the

provisions of the Income tax Act,

letter issued by the State where the Registered

1961. The income tax return of such

Registrar of Companies. Office of the company is either

companies must be filed in Form-3A

● Documentary evidence in situated or proposed to be situ-

before 31st October every year.

support of addresses of ated about the desirability of

However, such a company can get

promoters. such a company. Regional

itself registered u/s 12A of the

● If the company is being Director can also make a refer-

Income Tax Act and can get the ben-

established at the ence to State Government and

efit of accumulation of its income to

instance/collaboration of can also consult the ministries

some extent for utilization in future

some foreign charitable concerned to determine objec-

years. Such a company can also get

organization, then certified tions, if any, to the grant of

itself registered u/s 80G of the

copy of the charter of that licence.

Income Tax Act and the donor

organization with its trans- (vi) The Regional Director shall

donating the amount to such a com-

lation in English or Hindi, proceed to grant the licence on

pany shall be entitled to a deduction

if the charter is not in being satisfied regarding desir-

to the extent of 50% of the sum

English or Hindi. ability of such companies.

donated from its income. Section

(iii) Within seven days of making The Department of Company

12A(b) of the Income Tax Act pro-

the application, a notice is to be Affairs, in order to facilitate quicker

vides for mandatory audit of

published once in English lan- disposal of applications received for

accounts of such companies pro-

guage in English Newspaper grant of licence under section 25 of

vided the total income without giv-

and once in vernacular lan- the Act, has issued instructions to the

ing effect to the provisions of section

guage in local newspaper cir- Regional Directors to complete all

11 & 12 exceeds Rs. 50000/- in any

culating in the district in which the formalities within a period of

year. The audit report is to be sub-

the registered office is pro- eight weeks from the receipt of the

mitted in Form No. 10B and must be

posed to be situated or is situ- application and to issue the licence

duly signed by a chartered accoun-

ated inviting objections to the applied for within a period of 10 or 12

tant holding certificate of practice.

application for grant of license. weeks of receipt of the application. There are certain restrictions as

The public notice shall be in the to investment of funds by such enti-

prescribed format as given in

Annexure II to the Companies

Procedure for incorporation of ties registered u/s 12A of the Income

Tax Act. The investment by such

Regulations, 1956. Such a Company companies must be made in

notice has to provide minimum Normal procedure for incorpo- approved forms and modes of

21 days for receipt of objec- ration of proposed company is to be investment as specified in Section

tions and the Regional Director followed except that Memorandum 11(5) of the Income Tax Act. All vol-

shall consider all objections of Association and Articles of untary donations received by such a

received by him before grant of Association as approved/modified company are treated as income. Any

licence. by the Regional Director has to be amount applied out of such income

(iv) A copy of the application for printed and submitted to the con- is eligible for deduction be it a rev-

grant of licence is also required cerned Registrar of Companies enue expenditure or a capital expen-

to be submitted to the con- alongwith a copy of the licence diture. However, any donation

cerned Registrar of Companies issued by the Regional Director and received with the intent of forming a

with all enclosures. other documents as normally filed corpus is not treated as income. ■

THE CHARTERED ACCOUNTANT 1246 MAY 2004

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ICT 2022 Mentorship NotesDocument4 pagesICT 2022 Mentorship NotesAnto Richards0% (1)

- Conflict of Interest Disclosure Form (Employees) EnglishDocument2 pagesConflict of Interest Disclosure Form (Employees) EnglishAakash amerNo ratings yet

- By: Rakim L. Perez BSBA 3BDocument66 pagesBy: Rakim L. Perez BSBA 3BLovely Rizziah Dajao CimafrancaNo ratings yet

- Crane Hire and Contract Lift-090626 PDFDocument6 pagesCrane Hire and Contract Lift-090626 PDFANIBAL MARQUEZNo ratings yet

- Ntuli 2017 Paper PDFDocument6 pagesNtuli 2017 Paper PDFAyanda NtobelaNo ratings yet

- Virtual Latinos Agency AgreementDocument14 pagesVirtual Latinos Agency AgreementIan GradyNo ratings yet

- Article Writing: GoalsDocument14 pagesArticle Writing: GoalsTanyaNo ratings yet

- IE Project (Manufaturing of Hydrogen Fuel by Electrolysis)Document5 pagesIE Project (Manufaturing of Hydrogen Fuel by Electrolysis)shukeshNo ratings yet

- Modern and Minimal Business Project Proposal MagazineDocument24 pagesModern and Minimal Business Project Proposal MagazineakshayaNo ratings yet

- Semi Final AccountingDocument8 pagesSemi Final AccountingSherryl DumagpiNo ratings yet

- Ankit Singh Academic Docs and PassportDocument13 pagesAnkit Singh Academic Docs and PassportSushant MongaNo ratings yet

- Gen Maths 07Document26 pagesGen Maths 07Sibin G ThomasNo ratings yet

- SWOT Analysis: Organizational Context and Interested Parties Need & ExpectationDocument43 pagesSWOT Analysis: Organizational Context and Interested Parties Need & Expectationamril alrizaNo ratings yet

- Salvador - Kepco-Ilijan Corporation v. CirDocument19 pagesSalvador - Kepco-Ilijan Corporation v. CirAntonio Dominic SalvadorNo ratings yet

- Why We Study ManagmentDocument6 pagesWhy We Study ManagmentAgumas AlehegnNo ratings yet

- Cultural Sensitivity in The WorkplaceDocument22 pagesCultural Sensitivity in The WorkplaceCeasar EstradaNo ratings yet

- Operatorilor EconomiciDocument312 pagesOperatorilor EconomicimadalinaNo ratings yet

- Annual Report On GM MotorsDocument7 pagesAnnual Report On GM Motorsarmeen yousufNo ratings yet

- Doug Ducey and History of Cold Stone CreameryDocument15 pagesDoug Ducey and History of Cold Stone CreameryBarbara EspinosaNo ratings yet

- Z Rahman MergedDocument9 pagesZ Rahman MergedPrinceNo ratings yet

- Unit 8 HP2 - Listening Exercise R3Document3 pagesUnit 8 HP2 - Listening Exercise R3HUY NGUYEN DIEUNo ratings yet

- Garment Manufacturing ProcessDocument54 pagesGarment Manufacturing Processroselyn ayensa100% (1)

- Topic 1.1 - Basic Concept of RisksDocument14 pagesTopic 1.1 - Basic Concept of RisksJamie ZaliNo ratings yet

- SCM Budget BSA2ADocument3 pagesSCM Budget BSA2AKaymark Lorenzo0% (2)

- IC Preliminary Project Execution Plan 11095Document6 pagesIC Preliminary Project Execution Plan 11095Apm FoumilNo ratings yet

- EXAMPLE 8.6 Veneer Grades and RepairsDocument2 pagesEXAMPLE 8.6 Veneer Grades and RepairsnickNo ratings yet

- KLMinvoice 04062020Document1 pageKLMinvoice 04062020Jack RobinsonNo ratings yet

- JD Planning EngineerDocument3 pagesJD Planning EngineerAkhil SurendranNo ratings yet

- AFES One Stop Solution For Foundation DesignDocument43 pagesAFES One Stop Solution For Foundation Designhoga_dreamlandNo ratings yet

- Laurus Labs AR FY19Document224 pagesLaurus Labs AR FY19abijith reddyNo ratings yet