Professional Documents

Culture Documents

Detailed Calculation For Refund For FY 2009-2010: Annexure-3

Detailed Calculation For Refund For FY 2009-2010: Annexure-3

Uploaded by

sruhilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Detailed Calculation For Refund For FY 2009-2010: Annexure-3

Detailed Calculation For Refund For FY 2009-2010: Annexure-3

Uploaded by

sruhilCopyright:

Available Formats

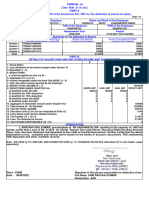

Annexure- 3

Detailed Calculation for Refund for FY 2009-2010

Assessment Year 2010 - 11

As per Form Self

Particulars

16 Assesment

1 Gross Salary

A Salary as per provisions contained in section 17(1) 300130 280231

B Value of perquisite under section 17(2) 2262 2262

C Total salary + Perquisite (A+B) 302393 282494

2 Less: Allowances to the extent exempt under Section 10 6000 6000

3 Balance(1-2) - Chargeable under Head Salary 296392.69 276494

4 Income under head of House Property: 0 0

5 Income from Other Sources - Bank interest 0 0

6 Gross Total income 296393 276494

7 Deduction under chapter VIA (80C) 40907 40907

8 Deduction under chapter VIA (80G) 0 0

9 Total income 255490 235587

10 Total income (Rounded off) 255490 235590

11 Tax on total income 9549 7559

12 Education Cess 286 227

13 Tax Payable (incl. educational cess) 9835.47 7786

14 Tax Deducted at Source by employer 9835 9835

15 Tax Refundable 0 2050

Place: PATA INDRAPAL SINGH

Date : 27.07.2010 PAN : BVPPS6531P

You might also like

- Form (12) Payslip For JNR ExDocument1 pageForm (12) Payslip For JNR Exnikhil kumarNo ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Oisd STD-226Document75 pagesOisd STD-226sruhil82% (11)

- Balance Sheet As at 31St March, 2010 Amount Amount 2009-2010 2008-2009 Rs. P. Rs. P. Sources of FundsDocument4 pagesBalance Sheet As at 31St March, 2010 Amount Amount 2009-2010 2008-2009 Rs. P. Rs. P. Sources of FundsCA Saurav Kumar AgrawalNo ratings yet

- 22-23 CompuDocument6 pages22-23 CompuSUMIT SAURABHNo ratings yet

- (In Crores) : Abstract of ReceiptsDocument1 page(In Crores) : Abstract of Receiptsalok kumarNo ratings yet

- Amit Kumar Mudgal ComputationDocument4 pagesAmit Kumar Mudgal ComputationSHELESH GARGNo ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form 1617052024 112840Document3 pagesForm 1617052024 112840sandeep kumarNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Deductions/recoveries Adjustable in The Book of Treasury/IFMIS S.NoDocument3 pagesDeductions/recoveries Adjustable in The Book of Treasury/IFMIS S.NoHmingsanga HauhnarNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Comp Anubhav Garg 23-24Document5 pagesComp Anubhav Garg 23-24prateek gangwaniNo ratings yet

- Com 2021Document6 pagesCom 2021devesh2408No ratings yet

- COI AY 22-23 Narinder BhatiaDocument4 pagesCOI AY 22-23 Narinder BhatiaAshwani KumarNo ratings yet

- ArDocument1 pageArpruthvirajv150No ratings yet

- 6month Audited ResultsDocument2 pages6month Audited ResultsJessica HarveyNo ratings yet

- Computation 2022Document7 pagesComputation 2022Jyoti TripathiNo ratings yet

- Cuddalore Income - and - Expenditure - ScheduleDocument1 pageCuddalore Income - and - Expenditure - Scheduleheena4647No ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 300000Document4 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 300000ramanNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- TDSWorkings AspxDocument2 pagesTDSWorkings Aspxchandruv29eNo ratings yet

- Shri Amit Santwani Ji Computitaon 2023-24Document2 pagesShri Amit Santwani Ji Computitaon 2023-24bhupeshkaushik61No ratings yet

- Compu TationDocument3 pagesCompu TationAbhilash M NairNo ratings yet

- UHBVN Executive Summary FY 2010-11Document46 pagesUHBVN Executive Summary FY 2010-11Neeraj KumarNo ratings yet

- Period: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraDocument6 pagesPeriod: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraNagesh AdumullaNo ratings yet

- Period: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraDocument6 pagesPeriod: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraNagesh AdumullaNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- Computation of Total Income Income From House Property (Chapter IV C) - 50267Document19 pagesComputation of Total Income Income From House Property (Chapter IV C) - 50267ASHISH BHONDENo ratings yet

- BS 31.03.09Document11 pagesBS 31.03.09Leslie FlemingNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Deepak Mittal CompDocument3 pagesDeepak Mittal Compsohanveers254No ratings yet

- Attachment UnlockedDocument3 pagesAttachment Unlockedmbhalani1207No ratings yet

- Form 1619042024 085917Document3 pagesForm 1619042024 085917SODHI SINGHNo ratings yet

- LUCAS, CATHERINE-Agreement - SignedDocument22 pagesLUCAS, CATHERINE-Agreement - Signedcajol527No ratings yet

- COI Narinder Bhatia 22-23Document5 pagesCOI Narinder Bhatia 22-23Ashwani KumarNo ratings yet

- Payslips 4Document1 pagePayslips 4Tech stackNo ratings yet

- Coi Ay 2021-22 Kanta SinghalDocument2 pagesCoi Ay 2021-22 Kanta Singhalprateek gangwaniNo ratings yet

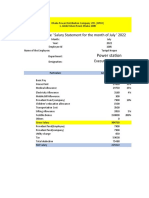

- Tariqul Hoque ' Salary Statement For The Month of July ' 2022Document6 pagesTariqul Hoque ' Salary Statement For The Month of July ' 2022Sadman Rafid FardeenNo ratings yet

- Documents 0Document3 pagesDocuments 0rajindermechNo ratings yet

- K ManaDocument1 pageK Manasuresh kumar gNo ratings yet

- Screenshot 2023-10-11 at 8.38.25 PMDocument1 pageScreenshot 2023-10-11 at 8.38.25 PMkhanversatile4No ratings yet

- BudgetDocument8 pagesBudgetsabhirami34No ratings yet

- Form 1629042024 151129Document2 pagesForm 1629042024 151129UtkarshNo ratings yet

- Computation 2022 23Document3 pagesComputation 2022 23saumyabisht143No ratings yet

- Royan Bonny Anthony - Offer LetterDocument2 pagesRoyan Bonny Anthony - Offer LetterTeresa GilbertNo ratings yet

- Wa0000.Document2 pagesWa0000.anpro1299No ratings yet

- LPC Saima SadiqDocument2 pagesLPC Saima Sadiqlatestever28No ratings yet

- Andhra Pradesh Budget Analysis 2018-19Document24 pagesAndhra Pradesh Budget Analysis 2018-19raja_bez9764No ratings yet

- 2017-18 - Part B - 1Document4 pages2017-18 - Part B - 1getajaykaushalNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- Pay Slip of August 2023Document1 pagePay Slip of August 2023alim.siddiquiNo ratings yet

- Nirmal Todi 2021Document24 pagesNirmal Todi 2021Sujan TripathiNo ratings yet

- PAYSLIP Nov-2022 - NareshDocument3 pagesPAYSLIP Nov-2022 - NareshDharshan RajNo ratings yet

- Form 1626042024 112515Document2 pagesForm 1626042024 112515harshkaliramna2007.hkNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- City Gas DistributionDocument13 pagesCity Gas DistributionsruhilNo ratings yet

- B A SetDocument13 pagesB A Setsruhil100% (1)

- CNG Station Stnd. Ge 118Document112 pagesCNG Station Stnd. Ge 118sruhil50% (2)