Professional Documents

Culture Documents

Checking Account

Checking Account

Uploaded by

WLAMORIE77Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Checking Account

Checking Account

Uploaded by

WLAMORIE77Copyright:

Available Formats

A

checking account is a service provided by financial institutions (banks, savings and loans, credit unions,

etc.) which allows individuals and businesses to deposit money and withdraw funds from a federally-

protected account. The terms of a checking account may vary from bank to bank, but in general

a checking account holder can use personal checks in place of cash to pay debts. He or she can also use

electronic debit cards or ATM cards to access individual accounts or make cash withdrawals.

Virtually every bank offers some form of checking account service for their customers. Some may require

a minimal initial deposit before establishing a new account, along with proof of identification and address.

A student or other low-income applicant may opt for a no-frillschecking account which does not charge

fees for the use of personal checks and other services. Others may benefit from interest payments by

maintaining a high minimum balanceeach month. Some states are required by law to provide a

'lifeline' checking account option forsenior citizens and low-income customers. This type

of checking account waives many of the fees banks may charge, such as monthly service fees for low

balances and surcharges for ATM usage.

A typical checking account is handled through careful posting of deposits and withdrawals.

Theaccount holder has a supply of official checks which contain all of the essential routing and mailing

information. When a check is filled out correctly, the recipient treats it the same as cash and completes

the transaction. After this check has been deposited into the recipient's own bank account, a bank worker

files the check electronically and the check writer's bank receives the cancelled check and amount to be

debited (withdrawn) from the check writer'saccount. This process continues for every check written

against an individual checkingaccount.

Owners of a checking account are ultimately responsible for keeping track of their available funds, even

though the bank will routinely issue its own accounting statements. Checks must represent an actual

amount of money contained in the checking account itself. If a check is written for an amount higher than

theavailable balance, the check writer faces numerous fees and possible legal action. The recipient of

the bad check can demand immediate cash payment for the original debt as well as a substantial fee for

the returned check. Some banks will protect checking account holders by making the proper payments

and notifying the check writer that an overdraft has taken place. Most often the bank will recoup their

losses through substantial service charges, so it pays to avoid writing checks when the balance is

unknown.

Most banks have several different methods which allow checking account customers to check their

balances and reconcile their records. Printed monthly statements of debits and credits (deposits) are

mailed to individual account holders. ATM machines offer an option to check the current balance, while

online or phone-in accounts can provide real time updates on which checks have been processed and

which are still outstanding. This information can be compared with the entries recorded in a journal called

a check register.

As long as the account holder maintains accurate financial records, a checking account provides a safe

and efficient way to pay bills and deposit money frompayroll checks and other income sources. A savings

account may pay more interest over time, but a checking account replaces the need for large amounts of

cash to satisfy routine debts such as rent or mortgage payments, credit card bills and utility bills.

compare checking accounts

free business checking accounts

You might also like

- Usaa Bank Open Up@moneymakers2023reallDocument23 pagesUsaa Bank Open Up@moneymakers2023reallysvjsusgsjct56No ratings yet

- Professional Practice Session 1Document23 pagesProfessional Practice Session 1Dina HawashNo ratings yet

- Check Printing TemplateDocument1 pageCheck Printing TemplateJessa Mariz Lecias CalimotNo ratings yet

- Notary Id Verification FormDocument1 pageNotary Id Verification FormSandra BenjaminNo ratings yet

- Chapter 6 StressDocument9 pagesChapter 6 StressSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- 2016 SSS Loan Form PDFDocument4 pages2016 SSS Loan Form PDFAnonymous 1AXVu3Gh67% (6)

- RBC Royal Bank Credit Card AgreementDocument8 pagesRBC Royal Bank Credit Card Agreementmani12390% (1)

- English ReaderDocument10 pagesEnglish ReaderMadhurima BanothNo ratings yet

- All You Need to Know About Payday LoansFrom EverandAll You Need to Know About Payday LoansRating: 5 out of 5 stars5/5 (1)

- Fix Your Credit Score: Add Up To 100 Points in 30 Days or LessFrom EverandFix Your Credit Score: Add Up To 100 Points in 30 Days or LessRating: 1 out of 5 stars1/5 (1)

- Subject: Re: Transfer and Deposit Questions (KMM68047354V38864L0KM)Document1 pageSubject: Re: Transfer and Deposit Questions (KMM68047354V38864L0KM)Barbara RobbinsNo ratings yet

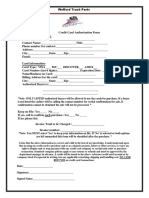

- Credit Card Authorization Form WoffordDocument1 pageCredit Card Authorization Form WoffordRaúl Enmanuel Capellan PeñaNo ratings yet

- Sutton Bank Cardholder Agreement v1.4Document21 pagesSutton Bank Cardholder Agreement v1.4Gina VictoriaNo ratings yet

- IdCard 2Document1 pageIdCard 2Arham SoganiNo ratings yet

- Electronic Cash1Document4 pagesElectronic Cash1AtharvaNo ratings yet

- CheckDocument2 pagesCheckSpencer BarclayNo ratings yet

- Gift Card With Pin - Numbr - Google SearchDocument1 pageGift Card With Pin - Numbr - Google SearchOluwaseyifunmi RichardNo ratings yet

- Wireless Terminal Placement Program: 9/30/2010 - Build #PF003Document6 pagesWireless Terminal Placement Program: 9/30/2010 - Build #PF003Roger JackNo ratings yet

- Creditcard Payment Internetbanking PDFDocument8 pagesCreditcard Payment Internetbanking PDFbagavan10No ratings yet

- Advanced Carding. CvvRamirezDocument24 pagesAdvanced Carding. CvvRamirezScribdTranslations100% (1)

- CONTRACT of LEASEDocument4 pagesCONTRACT of LEASEMyn Mirafuentes Sta AnaNo ratings yet

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDocument2 pages(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- RHB Plus One Prepaid CardDocument2 pagesRHB Plus One Prepaid CardShalini RamNo ratings yet

- Survey of Popularity of Credit Cards Issued by Different Banks PDFDocument3 pagesSurvey of Popularity of Credit Cards Issued by Different Banks PDFArvindKushwaha100% (1)

- CC Authorization TemplateDocument1 pageCC Authorization TemplateAlfonso Joel V. GonzalesNo ratings yet

- BDO Credit CardDocument5 pagesBDO Credit CardAldrin SorianoNo ratings yet

- Check - A Bill of Exchange Drawn On A Bank Payable On Demand (Sec. 185)Document3 pagesCheck - A Bill of Exchange Drawn On A Bank Payable On Demand (Sec. 185)Caren deLeonNo ratings yet

- Ssi Update TutorialDocument15 pagesSsi Update TutorialMdot ParaNo ratings yet

- Lifestyle: Merchant EstablishmentDocument1 pageLifestyle: Merchant EstablishmentSeshankSkNo ratings yet

- Eop (4Document8 pagesEop (4Andres ChavarrioNo ratings yet

- Foundation Check: Considering The Whole AreaDocument4 pagesFoundation Check: Considering The Whole AreareyNo ratings yet

- USAIDDocument2 pagesUSAIDRWETUTE RAMADHANNo ratings yet

- HOTEL CC Authorization FormDocument1 pageHOTEL CC Authorization FormSacramento SirensNo ratings yet

- Commercial Banking DocumentsDocument3 pagesCommercial Banking DocumentsRandell BuyaweNo ratings yet

- Goods and Services Tax Refund Tutorial PDFDocument27 pagesGoods and Services Tax Refund Tutorial PDFMOHANNo ratings yet

- Moneygram RequestDocument2 pagesMoneygram Requestchhinder13No ratings yet

- Credit Card Payment Authorization Form: Please Complete The Information BelowDocument1 pageCredit Card Payment Authorization Form: Please Complete The Information BelowYeni L CarranzaNo ratings yet

- Guide For First Time DL/ID Applicants: Driver License DivisionDocument33 pagesGuide For First Time DL/ID Applicants: Driver License DivisionMarcus ResendezNo ratings yet

- Can You Send 10000 Through Cash AppDocument3 pagesCan You Send 10000 Through Cash Appnhazel244No ratings yet

- Loan Application FormDocument10 pagesLoan Application FormAlexanderDaviesNo ratings yet

- Our FloridaDocument13 pagesOur FloridaFilip AndrejevicNo ratings yet

- Bussiness Math: Checking AccountDocument4 pagesBussiness Math: Checking AccountMichael OrtizNo ratings yet

- Apr AminiaDocument8 pagesApr AminiaClyde ThomasNo ratings yet

- Visa-Debit FaqDocument3 pagesVisa-Debit FaqraishtNo ratings yet

- Tutorial Apply For Benefits Online TWCDocument28 pagesTutorial Apply For Benefits Online TWCThuy PhamNo ratings yet

- Completed Loan ApplicationDocument9 pagesCompleted Loan ApplicationNoriely Altagracia Paulino RivasNo ratings yet

- MessageDocument3 pagesMessageDavid KisNo ratings yet

- Utah 2023 Unemployment BenefitsDocument49 pagesUtah 2023 Unemployment Benefitsdeemeejay11No ratings yet

- E Wallet 161115013135 PDFDocument79 pagesE Wallet 161115013135 PDFahsan habibNo ratings yet

- Declaration Under Section 194CDocument2 pagesDeclaration Under Section 194Cnaveen pointNo ratings yet

- Fact Sheet Mistaken Internet PaymentsDocument2 pagesFact Sheet Mistaken Internet PaymentsDronadula Venkata Sumanth SumanthNo ratings yet

- Cash Net USA Loan DocumentDocument5 pagesCash Net USA Loan Documentkevin.johnsonloan100% (1)

- Alternative Payment MethodsDocument5 pagesAlternative Payment MethodsDedik DermadyNo ratings yet

- Chime Direct DepositDocument1 pageChime Direct DepositLateshia SpencerNo ratings yet

- Terms and Conditions For Online-Payments: Privacy PolicyDocument5 pagesTerms and Conditions For Online-Payments: Privacy PolicyKhush TaterNo ratings yet

- Payroll Tut PT-2Document11 pagesPayroll Tut PT-2otsrNo ratings yet

- USA bank account open upDocument14 pagesUSA bank account open upBas PongsinNo ratings yet

- Activate Your BPI Credit CardDocument3 pagesActivate Your BPI Credit CardAl Patrick Dela CalzadaNo ratings yet

- Proof of IncomeDocument2 pagesProof of IncomeJohn Melby100% (1)

- Introduction To Accounting & Baiscs of JournalDocument227 pagesIntroduction To Accounting & Baiscs of Journaldateraj100% (1)

- Wire Transfer InfoDocument1 pageWire Transfer InfoAleksandr IatsiukNo ratings yet

- Better Covid ThingDocument4 pagesBetter Covid ThingAuguste RiedlNo ratings yet

- Dispute FRAUD Form - 126809900661986 - EncryptedDocument2 pagesDispute FRAUD Form - 126809900661986 - EncryptedJosé Eduardo Tijerina cuestaNo ratings yet

- A Biblical Philosophy of MinistryDocument11 pagesA Biblical Philosophy of MinistryDavid Salazar100% (4)

- T-Systems CPNI Policy Statement - Final 022717 PDFDocument2 pagesT-Systems CPNI Policy Statement - Final 022717 PDFFederal Communications Commission (FCC)No ratings yet

- Frs Whatsapp Chat NotesDocument72 pagesFrs Whatsapp Chat NotesFarai NyaniNo ratings yet

- Drill #1 With RationaleDocument12 pagesDrill #1 With RationaleRellie CastroNo ratings yet

- Clinical Emergency Management Program: Advanced WorkshopDocument4 pagesClinical Emergency Management Program: Advanced WorkshopNataraj ThambiNo ratings yet

- The Quiescent Benefits and Drawbacks of Coffee IntakeDocument6 pagesThe Quiescent Benefits and Drawbacks of Coffee IntakeVikram Singh ChauhanNo ratings yet

- Product Data Sheet Ingenuity Core LRDocument16 pagesProduct Data Sheet Ingenuity Core LRCeoĐứcTrườngNo ratings yet

- Cutoff1 101020 0Document3 pagesCutoff1 101020 0ghi98183No ratings yet

- Term Paper (Dev - Econ-2)Document14 pagesTerm Paper (Dev - Econ-2)acharya.arpan08No ratings yet

- Test Method For DDF ProjectDocument13 pagesTest Method For DDF ProjectrantosbNo ratings yet

- Minimal Stimulation IVF Vs Conventional IVFDocument8 pagesMinimal Stimulation IVF Vs Conventional IVFpolygoneNo ratings yet

- OX App Suite User Guide English v7.6.0Document180 pagesOX App Suite User Guide English v7.6.0Ranveer SinghNo ratings yet

- HNDIT 1022 Web Design - New-PaperDocument6 pagesHNDIT 1022 Web Design - New-Paperravinduashan66No ratings yet

- UnpublishedDocument7 pagesUnpublishedScribd Government DocsNo ratings yet

- 2020 Msce Practical Questions TargetDocument30 pages2020 Msce Practical Questions TargetspinyblessingNo ratings yet

- If ملخص قواعدDocument2 pagesIf ملخص قواعدAhmed GaninyNo ratings yet

- Karriem Provet,: Background of This CaseDocument11 pagesKarriem Provet,: Background of This CaseJustia.comNo ratings yet

- Autocad Layout Tutorial - EhowDocument3 pagesAutocad Layout Tutorial - EhowdidlakiranNo ratings yet

- PROCERA: A New Way To Achieve An All-Ceramic CrownDocument12 pagesPROCERA: A New Way To Achieve An All-Ceramic CrownCúc Phương TrầnNo ratings yet

- For Updates Visit orDocument6 pagesFor Updates Visit orJFJannahNo ratings yet

- Current Affairs October 2013kDocument76 pagesCurrent Affairs October 2013kKanthi Rekha VardhiNo ratings yet

- OutDocument318 pagesOutBet HalNo ratings yet

- Mge 4Document17 pagesMge 4RUPAV TIWARINo ratings yet

- ECON7002: Unemployment and InflationDocument65 pagesECON7002: Unemployment and InflationNima MoaddeliNo ratings yet

- PYF Biennial Conference Vawi 19-NaDocument1 pagePYF Biennial Conference Vawi 19-NaMizoram Presbyterian Church SynodNo ratings yet

- Prop Design PacketDocument8 pagesProp Design Packetapi-236024657No ratings yet

- DoomsdayDocument29 pagesDoomsdayAsmita RoyNo ratings yet