Professional Documents

Culture Documents

Sector FM Radio

Sector FM Radio

Uploaded by

prtmCopyright:

Available Formats

You might also like

- Newspaper ReportDocument2 pagesNewspaper ReportSuchismita Bhar BoseNo ratings yet

- 3G Spectrum Auction Results - IndiaDocument7 pages3G Spectrum Auction Results - IndiaAnuj PandeyNo ratings yet

- Telecommunication Sector: By, Cyriac JomyDocument12 pagesTelecommunication Sector: By, Cyriac JomyDeepak RamNo ratings yet

- Session 9 10 Radio Mirchi Entry Into The Kolkata Market StudiesDocument27 pagesSession 9 10 Radio Mirchi Entry Into The Kolkata Market Studiesvishvendra SinghNo ratings yet

- Radio Mirchi 98 (1) .3 FM Its HotDocument32 pagesRadio Mirchi 98 (1) .3 FM Its Hotchitinee100% (1)

- A00114-PDF-EnG Radio Mirchi - Entry Into The Kolkata MarketDocument28 pagesA00114-PDF-EnG Radio Mirchi - Entry Into The Kolkata MarketYourWell WisherNo ratings yet

- The 2G Scam: A Corporate - Political CocktailDocument4 pagesThe 2G Scam: A Corporate - Political CocktailAditya ZananeNo ratings yet

- 3G Economic TimesDocument1 page3G Economic Timeslokesh2983No ratings yet

- Not Original 2G Spectrum Scam-Full Story, Origin, Growth (?) and Modus OperandiDocument6 pagesNot Original 2G Spectrum Scam-Full Story, Origin, Growth (?) and Modus OperandiSweta SaxenaNo ratings yet

- 2008IMS ManthanDocument15 pages2008IMS Manthansajal sahaNo ratings yet

- Case 7 - 8 Radio MirchiDocument27 pagesCase 7 - 8 Radio MirchiRohit RahangdaleNo ratings yet

- Spectrum AuctionDocument3 pagesSpectrum AuctionSubham MazumdarNo ratings yet

- Telecom 4.updatedrsbeditfinalDocument8 pagesTelecom 4.updatedrsbeditfinalannu priyaNo ratings yet

- Idea PreDocument3 pagesIdea Prerohith06No ratings yet

- Radio Industry - India FinalDocument45 pagesRadio Industry - India FinalPavi BhaskaranNo ratings yet

- Private FM Radio-Frequenty Asked QuestionsDocument12 pagesPrivate FM Radio-Frequenty Asked Questionspuneet28vNo ratings yet

- Airtel Zain DealDocument10 pagesAirtel Zain Deallaststop21No ratings yet

- Ficci Annual Report ReviewDocument16 pagesFicci Annual Report ReviewStutiNo ratings yet

- TRAI - A Woeful DownslideDocument4 pagesTRAI - A Woeful DownslideIndiamaticNo ratings yet

- Nhai Invites Bids For The Fifth Bundle of Highway Projects On Tot ModelDocument2 pagesNhai Invites Bids For The Fifth Bundle of Highway Projects On Tot ModelSantosh HiredesaiNo ratings yet

- Introduction To The TopicDocument16 pagesIntroduction To The TopichimanshuNo ratings yet

- 2G Spectrum ScamDocument2 pages2G Spectrum ScamDeepak MishraNo ratings yet

- Unsolved Mystery: 2 GDocument3 pagesUnsolved Mystery: 2 GshubhikaushikNo ratings yet

- 2G - FinalDocument9 pages2G - FinalVinoth KumarNo ratings yet

- Case-CB - Radio MirchiDocument27 pagesCase-CB - Radio MirchiPragya Singh BaghelNo ratings yet

- MoCITs Claims Vs Facts-21 January 2011Document34 pagesMoCITs Claims Vs Facts-21 January 2011Siddharth DhyaniNo ratings yet

- Synopsis: Telecom Sector in IndiaDocument49 pagesSynopsis: Telecom Sector in Indiarabi_kungleNo ratings yet

- Synopsis: Telecom Sector in IndiaDocument50 pagesSynopsis: Telecom Sector in Indiarabi_kungleNo ratings yet

- Spectrum Auction: InnovationDocument2 pagesSpectrum Auction: InnovationARJUN VNo ratings yet

- First Global: Sector: Telecom Services SnippetDocument7 pagesFirst Global: Sector: Telecom Services Snippettaurean_chdNo ratings yet

- 3G Auctions Ring Up Rs 67,719cr For GovtDocument4 pages3G Auctions Ring Up Rs 67,719cr For Govtprashant_k005No ratings yet

- Final Ultratech JaypeeDocument15 pagesFinal Ultratech JaypeeKeerthy JNo ratings yet

- How Coke Conquered Rural IndiaDocument7 pagesHow Coke Conquered Rural Indiaashish sawantNo ratings yet

- How Coke Conquered Rural IndiaDocument7 pagesHow Coke Conquered Rural Indiaashish sawantNo ratings yet

- Airtel Report MarketingDocument69 pagesAirtel Report MarketingGursharan Singh Anamika100% (1)

- 3G AuctionDocument3 pages3G AuctionKhushbu UpadhyayNo ratings yet

- Quick Facts: Next Super Power India (March, 2010)Document62 pagesQuick Facts: Next Super Power India (March, 2010)Aman KumarNo ratings yet

- FM RadioDocument12 pagesFM RadioRahul Mangalath0% (2)

- Telecom - in India, Past Present and Future!!Document41 pagesTelecom - in India, Past Present and Future!!pooja sharma100% (2)

- Mobile Pulse Rating Billing and Its Effects On ProfitDocument17 pagesMobile Pulse Rating Billing and Its Effects On Profitpramodh2704No ratings yet

- Spectrum AuctionDocument3 pagesSpectrum AuctionDynamic LevelsNo ratings yet

- Radio MirchiDocument11 pagesRadio Mirchi29vikas100% (6)

- TDOCSCDocument66 pagesTDOCSCUID BackupNo ratings yet

- Telecom Industry: IndiaDocument39 pagesTelecom Industry: IndiaskaleemohdNo ratings yet

- Telecom SectorDocument39 pagesTelecom SectorRashmi GandhiNo ratings yet

- Competition Commission of India: BenchDocument12 pagesCompetition Commission of India: BenchChirag AgrawalNo ratings yet

- Manu/Ta/0061/2016: Equiv Alent Citation: 2017C Omplr43 (C Ompat), I (2017) C Pj1 (Ta)Document11 pagesManu/Ta/0061/2016: Equiv Alent Citation: 2017C Omplr43 (C Ompat), I (2017) C Pj1 (Ta)pbNo ratings yet

- Facts On Indian 3gDocument1 pageFacts On Indian 3gMihir KananiNo ratings yet

- Hindustan Times - Deccan Chronicle - Financial Chronicle - Mail TodayDocument1 pageHindustan Times - Deccan Chronicle - Financial Chronicle - Mail TodayspmkumarNo ratings yet

- Etm 2012 5 14 3Document1 pageEtm 2012 5 14 3prajapati1983No ratings yet

- Infrastructure Finance News March 30 2015 April 05 2015Document3 pagesInfrastructure Finance News March 30 2015 April 05 2015YaIpha NaOremNo ratings yet

- DoordarshanDocument26 pagesDoordarshanShubham MohabeNo ratings yet

- Idea 1Document3 pagesIdea 1mkundan24No ratings yet

- Spectrum Auction Begins Today, Target 5.6 Lac CR: Show-Stopper - 700 MHZ BandDocument3 pagesSpectrum Auction Begins Today, Target 5.6 Lac CR: Show-Stopper - 700 MHZ BandDynamic LevelsNo ratings yet

- Airtel Likely To Buy Loop Mobile: The Economic TimesDocument2 pagesAirtel Likely To Buy Loop Mobile: The Economic TimesspmkumarNo ratings yet

- Tamil Nadu Fisheries University: Nagapattinam - 611 001Document2 pagesTamil Nadu Fisheries University: Nagapattinam - 611 001prtmNo ratings yet

- GACP Trainers ManualDocument26 pagesGACP Trainers ManualprtmNo ratings yet

- Project Profile On Groundnut Oil and Oil Cake ManuafcuringDocument2 pagesProject Profile On Groundnut Oil and Oil Cake ManuafcuringprtmNo ratings yet

- DesktopDocument7 pagesDesktopprtmNo ratings yet

- WWW DeltapageDocument1 pageWWW DeltapageprtmNo ratings yet

- Diagnosis and Treatment of "Ich" or White Spot Disease in FishDocument2 pagesDiagnosis and Treatment of "Ich" or White Spot Disease in FishprtmNo ratings yet

- IRI 12835 Hatia Yesvantpur ExpressDocument1 pageIRI 12835 Hatia Yesvantpur ExpressprtmNo ratings yet

- Pledge On The International Ozone DayDocument1 pagePledge On The International Ozone DayprtmNo ratings yet

- India4 GNDocument4 pagesIndia4 GNprtmNo ratings yet

- IRI 12863 Howrah Yesvantapur ExpressDocument1 pageIRI 12863 Howrah Yesvantapur ExpressprtmNo ratings yet

- Apple - Ipod - Compare Ipod Models and Find The Right One For YouDocument3 pagesApple - Ipod - Compare Ipod Models and Find The Right One For YouprtmNo ratings yet

- Annexure LDocument1 pageAnnexure LprtmNo ratings yet

- Hatchery NormsDocument19 pagesHatchery NormsprtmNo ratings yet

- Discussions On TimeDocument7 pagesDiscussions On TimeRavi Vararo100% (2)

- Ma Ha Grapes StoryDocument14 pagesMa Ha Grapes StoryprtmNo ratings yet

- 2108212Document68 pages2108212prtmNo ratings yet

Sector FM Radio

Sector FM Radio

Uploaded by

prtmCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sector FM Radio

Sector FM Radio

Uploaded by

prtmCopyright:

Available Formats

SECTOR FOCUS: RESURGING FM RADIO

• Phase-II of FM Radio: 338 frequencies for radio stations 91 cities were on block

• The government awards 280 licenses for a total sum of $205 million

• Sun, Adlabs, HT Music, ENIL emerge as the leaders with nationwide footprint

• Government introduces new revenue-sharing model

Radio, once perceived as a dying medium, got a new life with the emergence of FM Radio. The public broadcaster All

India Radio took the lead in introducing FM radio stations in February 1995. In 1999, the government opened up the

industry to private companies. While they established themselves in India’s major cities, they couldn’t build a

profitable business because of the high license fee structure.

The government has now changed the fee structure to make FM radio a more viable business. And it has authorized

the set up of FM radio in 91 cities across the country in a “Phase II” rollout.

As a result, companies ranging from the obvious media ones to unlikely real estate firms, have bid and won Phase II

licences.

FM Radio Phase-II: Radio Revived

FM Radio, so far restricted to a few cities in India, is set to become a nationwide industry.

The Government of India has just concluded the five rounds of bidding for 10-year licenses in

91 cities across the country. The Phase-II bidding process attracted greater interest

compared with the first phase in 1999. Phase I participants, such as New Delhi-based

Living Media India Limited and Mumbai-based Midday Multimedia Limited popularized FM

in large metropolitan cities and paved the way for Phase II.

With the relaxing of the licensing regime, the winners of new licences under Phase II, are

looking to get a slice of the FM market predicted by The IndusView to grow to 125 million

in 2010 from $25 million last year.

FM Radio Phase-II: The Bidding Process

The government had put total 338 frequencies in 91 cities on the block as part of phase-II

compared to 21 licenses (currently operational) allotted in the first phase in 1999, and all the

91 cities were classified in A-plus, A, B, C and D categories. The private FM Radio companies

bidding for these licenses won 280 out of these 338 frequencies offered for a total sum of

$205 million (Rs. 907 crore) of one time entry fee (OTEF). There were no takers for the

remaining 60 frequencies. The government is expected to get $51.3 million (Rs. 227 crore)

more from the migration fee also from the existing players to shift their 21 licenses of first

phase in to Phase II.

A total of 85 private players, not only media companies but also some real estate developers,

were shortlisted for bidding, based on the pre-qualification bids invited in September 2005 by

the Information and Broadcasting Ministry. After the all five rounds of bidding, south India’s

television network Sun Group bidding through its two companies—Kal Radio Private Limited

and South Asia FM Private Limited has managed to win total 67 frequencies. It already has

four operating stations taking the total tally to 71. It will, however, have to give up a good

number of these frequencies due to the maximum 15% restriction. Government norms

stipulate that no individual company should own more than 15% of the total radio stations.

That works out to no more than 45 radio station.

Similarly, Adlabs Films, a part of ADAE Group formed by Anil Ambani who broke away from

the largest private Indian company Reliance Industries, will have to surrender some of their

56 station licences won following the Phase II awards.

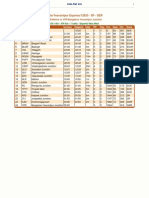

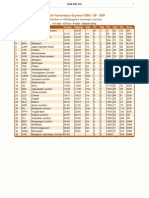

Total Frequencies Frequencies Amount Amount

Category Cities for Bidding Allotted ($ mln) (Rs. Cr)

A-Plus & A

Cities 13 64 54 121.67 538.39

North India 21 76 63 18.93 83.75

East India 17 66 48 4.68 20.7

West India 21 68 62 19.67 87.06

South India 19 64 53 40.00 177.56

Total 91 338 280 205.08 907.46

Round-I of Phase-II: The Big Cities on the Block

58 radio stations spread across 13 cities, including the four metros—Delhi, Mumbai, Kolkata,

Chennai, and other big cities like Bangalore and Hyderabad were on the block in the round

one of the phase-II bidding. 25 companies including HT Music, Adlabs, Radio City and Radio

Today, won 53 stations for $121.5 million (Rs 538 crore). HT Music won frequencies in Mumbai

($6.3 mln or Rs. 28 crore), Delhi ($7.9 mln or Rs. 35 crore), Kolkata ($1.3 mln or Rs. 6 crore)

and Bangalore ($1.3 mln or Rs. 6 crore). The Mumbai bid by HT Music was the highest amount

for any city in the phase-II. ENIL operating under brand name “Radio Mirchi” bagged licenses

for all the seven FM stations that it had bid for in the first round of the Phase II FM radio

bidding held by the I&B ministry on Friday. Adlabs won 7 frequencies including all the four

metros.

Round-II: Northern India

There was fierce competition for licenses in North India. In this round of the bidding, 76

frequencies in 21 cities across seven state - Haryana, Jammu & Kashmir, Uttar Pradesh,

Rajasthan, Uttaranchal, Himachal Pradesh and Punjab, and the union territory of

Chandigarh were on the block. The government earned almost $18.9 million (Rs. 83.75

crore) for 63 successful bids in this zone. Adlab was ahead of others as it won 19 of the

21 cities for which it had bid. In the Northern India, Chandigarh attracted highest bidding

at $3.5 million (Rs. 15.61 crore) by Adlab Films. BAG films and Bhaskar Group (Synergy

Media) emerged leaders in this zone as they won frequencies in most of the cities.

Synergy media won frequencies in six cities, while BAG films won four cities.

Round-III: Eastern India

The government had received 58 bids in eastern zone for 66 frequencies (stations) in 17 cities

including Patna (capital of Bihar), Ranchi (Capital of Jharkhand), Jamshedpur (known as steel

city), Guwahati (the biggest city of Assam famous as The Gateway to the Northeast India ),

Gangtok (capital of Sikkim), Shillong (capital of Meghalaya) and Itanagar (Capital of

Arunachal Pradesh). Out of the total 58 bids, only 48 bids were successful while 10

frequencies remained vacant. This zone yielded only $4.7 million (Rs. 20.70 crore) that was

96% less from the highest license fee of $121.5 million (Rs 538 crore) earned from the A-plus

& A cities. Entertainment Network India (ENIL) that operates under the ‘Radio Mirchi’ brand

was the sole winner for Patna as the other 4 bidders out of the total 5 bids were disqualified.

Adlabs continued to win most of the cities in the eastern zone by winning 15 cities here.

South Asia FM also grabbed 15 licenses in this zone, while BAG Films won only two cities.

Round-IV: Western India

The bidding for the western India comprising five states and one Union Territory saw three

major players emerging as leaders in this region. The government earned revenues of $19.7

million (Rs 87.15 crore) as One Time Entry Fee (OTEF) from 62 successful bids out of 68

frequencies available in this region. The western region saw Adlabs as the highest bidder with

a bid amount of $1.2 million (Rs 5.21 crore) for Indore. South Asia FM, a Sun Group company,

succeeded in 18 out of its 21 bids. Adlabs Films, a part of ADAE Group formed by Anil Ambani,

won 8 frequencies out of 14 it had bid for. The company claims it is happy with the number

because it won the bids in the major cities. Radio Mirchi (ENIL) of Times Group won in all the

nine cities it had bid for. Radio City (MBPL) could win seven frequencies out of the 11 it had

attempted for. Bhaskar promoted Synergy also won six stations out of eight. Other key

players were BAG Info, which won four frequencies out of 12, Pan India, which won three

frequencies out of 11, and Century Communication, which won two frequencies out of 15 it

had bid for. Western India saw the least number of unoccupied frequencies (six), as out of

the 68 frequencies up for bid, only 6 remained vacant. In the A-plus & A category cities 10

frequencies remained vacant, while in the Eastern India the government had to keep 18

frequencies unallotted.

Round-V: Southern India

The last round of bidding for the 64 radio stations in 19 cities in 5 South Indian states

including Kerala, Tamil Nadu, Andhara Pradesh, Karnataka and Pondicherry generated $40

million (Rs. 177 crore) as one time entry fee (OTEF) for the government. The highest bid in

this region was for Kochi, where Adlabs paid $2.3 million (Rs. 10.1 crore). The city-wise

highest contribution of $4.3 million (Rs 19.15 crore) came from the total 3 bids for

Coimbatore. Adlabs won eight out of 19 frequencies in this region.

The Government and the Industry Learnt from Phase-I:

Strict government policies, unviable high license fee and lower advertisement flow led many

companies to leave the FM radio industry after the initial euphoria in 1999. Fewer than 3% of

the Indian ad-spend goes to radio. When 108 frequencies across 40 cities were auctioned in

May 2000, the bids went through the roof as the loopholes in the tender document allowed

people to make bids without any significant obligation to fulfill their promise. The exorbitant

bid amounts and the high annual license fee resulted in only 22 stations getting off the

ground across 12 cities in the Phase-I.

To learn from this experience, the government formed a committee to look in to the issue.

Dr. Amit Mitra, the Secretary General of the prominent industry chamber FICCI (what’s this?),

was appointed the head of the committee. The industry participation in the policy-making

exercise ensured a policy that was good for the government as well as the industry and that

its recommendations would be acceptable to the FM Radio companies. The committee and

the broadcast industry regulator, the Telecom Regulatory Authority of India (TRAI), favored a

shift to a revenue-share license fee regime.

With the change of the policy, government earned more than $200 million (Rs. 900 crore) for

licenses in the Phase-II. In contrast, Phase-I had fetched only $35 million (Rs. 155 crore). Out

of 101 bids that won in the first phase, only 37 could deposit the fee and only 22 licenses

came into operation. Almost all Phase-I participants incurred losses until 2005.

The Phase II licenses, were granted on the basis of one time entry fee (OTEF) along with

annual revenue sharing (against the earlier license fee structure) at the rate of 4% of gross

revenue for the year or 10% of the reserved OTEF for the concerned city. The reserved OTEF

is limited to 25% of the highest bid in that city. Every applicant is allowed to run only one

channel at one city. Foreign Direct Investment (FDI) is permitted up to 20% of paid up equity

of the company holding a license for radio channel. The government has permitted automatic

migration to operational Phase-I players if they clear all the previous dues and pay OTEF

equal to the average of all successful bids under Phase-II in that city.

You might also like

- Newspaper ReportDocument2 pagesNewspaper ReportSuchismita Bhar BoseNo ratings yet

- 3G Spectrum Auction Results - IndiaDocument7 pages3G Spectrum Auction Results - IndiaAnuj PandeyNo ratings yet

- Telecommunication Sector: By, Cyriac JomyDocument12 pagesTelecommunication Sector: By, Cyriac JomyDeepak RamNo ratings yet

- Session 9 10 Radio Mirchi Entry Into The Kolkata Market StudiesDocument27 pagesSession 9 10 Radio Mirchi Entry Into The Kolkata Market Studiesvishvendra SinghNo ratings yet

- Radio Mirchi 98 (1) .3 FM Its HotDocument32 pagesRadio Mirchi 98 (1) .3 FM Its Hotchitinee100% (1)

- A00114-PDF-EnG Radio Mirchi - Entry Into The Kolkata MarketDocument28 pagesA00114-PDF-EnG Radio Mirchi - Entry Into The Kolkata MarketYourWell WisherNo ratings yet

- The 2G Scam: A Corporate - Political CocktailDocument4 pagesThe 2G Scam: A Corporate - Political CocktailAditya ZananeNo ratings yet

- 3G Economic TimesDocument1 page3G Economic Timeslokesh2983No ratings yet

- Not Original 2G Spectrum Scam-Full Story, Origin, Growth (?) and Modus OperandiDocument6 pagesNot Original 2G Spectrum Scam-Full Story, Origin, Growth (?) and Modus OperandiSweta SaxenaNo ratings yet

- 2008IMS ManthanDocument15 pages2008IMS Manthansajal sahaNo ratings yet

- Case 7 - 8 Radio MirchiDocument27 pagesCase 7 - 8 Radio MirchiRohit RahangdaleNo ratings yet

- Spectrum AuctionDocument3 pagesSpectrum AuctionSubham MazumdarNo ratings yet

- Telecom 4.updatedrsbeditfinalDocument8 pagesTelecom 4.updatedrsbeditfinalannu priyaNo ratings yet

- Idea PreDocument3 pagesIdea Prerohith06No ratings yet

- Radio Industry - India FinalDocument45 pagesRadio Industry - India FinalPavi BhaskaranNo ratings yet

- Private FM Radio-Frequenty Asked QuestionsDocument12 pagesPrivate FM Radio-Frequenty Asked Questionspuneet28vNo ratings yet

- Airtel Zain DealDocument10 pagesAirtel Zain Deallaststop21No ratings yet

- Ficci Annual Report ReviewDocument16 pagesFicci Annual Report ReviewStutiNo ratings yet

- TRAI - A Woeful DownslideDocument4 pagesTRAI - A Woeful DownslideIndiamaticNo ratings yet

- Nhai Invites Bids For The Fifth Bundle of Highway Projects On Tot ModelDocument2 pagesNhai Invites Bids For The Fifth Bundle of Highway Projects On Tot ModelSantosh HiredesaiNo ratings yet

- Introduction To The TopicDocument16 pagesIntroduction To The TopichimanshuNo ratings yet

- 2G Spectrum ScamDocument2 pages2G Spectrum ScamDeepak MishraNo ratings yet

- Unsolved Mystery: 2 GDocument3 pagesUnsolved Mystery: 2 GshubhikaushikNo ratings yet

- 2G - FinalDocument9 pages2G - FinalVinoth KumarNo ratings yet

- Case-CB - Radio MirchiDocument27 pagesCase-CB - Radio MirchiPragya Singh BaghelNo ratings yet

- MoCITs Claims Vs Facts-21 January 2011Document34 pagesMoCITs Claims Vs Facts-21 January 2011Siddharth DhyaniNo ratings yet

- Synopsis: Telecom Sector in IndiaDocument49 pagesSynopsis: Telecom Sector in Indiarabi_kungleNo ratings yet

- Synopsis: Telecom Sector in IndiaDocument50 pagesSynopsis: Telecom Sector in Indiarabi_kungleNo ratings yet

- Spectrum Auction: InnovationDocument2 pagesSpectrum Auction: InnovationARJUN VNo ratings yet

- First Global: Sector: Telecom Services SnippetDocument7 pagesFirst Global: Sector: Telecom Services Snippettaurean_chdNo ratings yet

- 3G Auctions Ring Up Rs 67,719cr For GovtDocument4 pages3G Auctions Ring Up Rs 67,719cr For Govtprashant_k005No ratings yet

- Final Ultratech JaypeeDocument15 pagesFinal Ultratech JaypeeKeerthy JNo ratings yet

- How Coke Conquered Rural IndiaDocument7 pagesHow Coke Conquered Rural Indiaashish sawantNo ratings yet

- How Coke Conquered Rural IndiaDocument7 pagesHow Coke Conquered Rural Indiaashish sawantNo ratings yet

- Airtel Report MarketingDocument69 pagesAirtel Report MarketingGursharan Singh Anamika100% (1)

- 3G AuctionDocument3 pages3G AuctionKhushbu UpadhyayNo ratings yet

- Quick Facts: Next Super Power India (March, 2010)Document62 pagesQuick Facts: Next Super Power India (March, 2010)Aman KumarNo ratings yet

- FM RadioDocument12 pagesFM RadioRahul Mangalath0% (2)

- Telecom - in India, Past Present and Future!!Document41 pagesTelecom - in India, Past Present and Future!!pooja sharma100% (2)

- Mobile Pulse Rating Billing and Its Effects On ProfitDocument17 pagesMobile Pulse Rating Billing and Its Effects On Profitpramodh2704No ratings yet

- Spectrum AuctionDocument3 pagesSpectrum AuctionDynamic LevelsNo ratings yet

- Radio MirchiDocument11 pagesRadio Mirchi29vikas100% (6)

- TDOCSCDocument66 pagesTDOCSCUID BackupNo ratings yet

- Telecom Industry: IndiaDocument39 pagesTelecom Industry: IndiaskaleemohdNo ratings yet

- Telecom SectorDocument39 pagesTelecom SectorRashmi GandhiNo ratings yet

- Competition Commission of India: BenchDocument12 pagesCompetition Commission of India: BenchChirag AgrawalNo ratings yet

- Manu/Ta/0061/2016: Equiv Alent Citation: 2017C Omplr43 (C Ompat), I (2017) C Pj1 (Ta)Document11 pagesManu/Ta/0061/2016: Equiv Alent Citation: 2017C Omplr43 (C Ompat), I (2017) C Pj1 (Ta)pbNo ratings yet

- Facts On Indian 3gDocument1 pageFacts On Indian 3gMihir KananiNo ratings yet

- Hindustan Times - Deccan Chronicle - Financial Chronicle - Mail TodayDocument1 pageHindustan Times - Deccan Chronicle - Financial Chronicle - Mail TodayspmkumarNo ratings yet

- Etm 2012 5 14 3Document1 pageEtm 2012 5 14 3prajapati1983No ratings yet

- Infrastructure Finance News March 30 2015 April 05 2015Document3 pagesInfrastructure Finance News March 30 2015 April 05 2015YaIpha NaOremNo ratings yet

- DoordarshanDocument26 pagesDoordarshanShubham MohabeNo ratings yet

- Idea 1Document3 pagesIdea 1mkundan24No ratings yet

- Spectrum Auction Begins Today, Target 5.6 Lac CR: Show-Stopper - 700 MHZ BandDocument3 pagesSpectrum Auction Begins Today, Target 5.6 Lac CR: Show-Stopper - 700 MHZ BandDynamic LevelsNo ratings yet

- Airtel Likely To Buy Loop Mobile: The Economic TimesDocument2 pagesAirtel Likely To Buy Loop Mobile: The Economic TimesspmkumarNo ratings yet

- Tamil Nadu Fisheries University: Nagapattinam - 611 001Document2 pagesTamil Nadu Fisheries University: Nagapattinam - 611 001prtmNo ratings yet

- GACP Trainers ManualDocument26 pagesGACP Trainers ManualprtmNo ratings yet

- Project Profile On Groundnut Oil and Oil Cake ManuafcuringDocument2 pagesProject Profile On Groundnut Oil and Oil Cake ManuafcuringprtmNo ratings yet

- DesktopDocument7 pagesDesktopprtmNo ratings yet

- WWW DeltapageDocument1 pageWWW DeltapageprtmNo ratings yet

- Diagnosis and Treatment of "Ich" or White Spot Disease in FishDocument2 pagesDiagnosis and Treatment of "Ich" or White Spot Disease in FishprtmNo ratings yet

- IRI 12835 Hatia Yesvantpur ExpressDocument1 pageIRI 12835 Hatia Yesvantpur ExpressprtmNo ratings yet

- Pledge On The International Ozone DayDocument1 pagePledge On The International Ozone DayprtmNo ratings yet

- India4 GNDocument4 pagesIndia4 GNprtmNo ratings yet

- IRI 12863 Howrah Yesvantapur ExpressDocument1 pageIRI 12863 Howrah Yesvantapur ExpressprtmNo ratings yet

- Apple - Ipod - Compare Ipod Models and Find The Right One For YouDocument3 pagesApple - Ipod - Compare Ipod Models and Find The Right One For YouprtmNo ratings yet

- Annexure LDocument1 pageAnnexure LprtmNo ratings yet

- Hatchery NormsDocument19 pagesHatchery NormsprtmNo ratings yet

- Discussions On TimeDocument7 pagesDiscussions On TimeRavi Vararo100% (2)

- Ma Ha Grapes StoryDocument14 pagesMa Ha Grapes StoryprtmNo ratings yet

- 2108212Document68 pages2108212prtmNo ratings yet