Professional Documents

Culture Documents

Tax Card 2011 Withholding Taxes

Tax Card 2011 Withholding Taxes

Uploaded by

Omer JavaidCopyright:

Available Formats

You might also like

- PaystubDocument1 pagePaystubOrbarsNo ratings yet

- 2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Document2 pages2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Doo Soo KimNo ratings yet

- ITF 56 A ProfessionalDocument2 pagesITF 56 A ProfessionalChomba Mwansa100% (1)

- Example - 2: A Bulldozer, Which Has A Service Life of 10 Years, Can Be PurchasedDocument4 pagesExample - 2: A Bulldozer, Which Has A Service Life of 10 Years, Can Be PurchasedNNo ratings yet

- Indian Service TaxDocument13 pagesIndian Service Taxanon_993677No ratings yet

- 4/25/2016 21st MCMC 1Document19 pages4/25/2016 21st MCMC 1ShaniNo ratings yet

- Liability of Service TaxDocument7 pagesLiability of Service TaxkasiriverNo ratings yet

- Service Tax: Aiaims Mms-ADocument31 pagesService Tax: Aiaims Mms-AAbbas Haider NaqviNo ratings yet

- Tax Year 2012 Rates of Tax For Individual Except A Salaried TaxpayerDocument5 pagesTax Year 2012 Rates of Tax For Individual Except A Salaried TaxpayerStyliXh MariamNo ratings yet

- Composition Scheme SEC 10 - GST PDFDocument20 pagesComposition Scheme SEC 10 - GST PDFTushar SinghNo ratings yet

- Taxes and Duties 2009-2010 - Layout 2Document14 pagesTaxes and Duties 2009-2010 - Layout 2Tonino Van WonterghemNo ratings yet

- AssignmentDocument19 pagesAssignmentAyesha ParveenNo ratings yet

- Tax Presentation (Punjab)Document55 pagesTax Presentation (Punjab)Atif IdreesNo ratings yet

- Tax On Rental Income From Property in PakistanDocument8 pagesTax On Rental Income From Property in Pakistansaif RashidNo ratings yet

- Indirec TaxDocument8 pagesIndirec TaxSubashNo ratings yet

- (Division V Income From Property: Substituted by The Finance Act, 2009. The Substituted "Division V" Read As FollowsDocument2 pages(Division V Income From Property: Substituted by The Finance Act, 2009. The Substituted "Division V" Read As Followsmsadhanani3922No ratings yet

- Taxation of Income From Property: TAX YEAR 2013 (1 July 2012 TO 30 June 2013)Document7 pagesTaxation of Income From Property: TAX YEAR 2013 (1 July 2012 TO 30 June 2013)AhmedAliNo ratings yet

- Scale of Professional Fees NewDocument9 pagesScale of Professional Fees NewOwolabi Olusola RajiNo ratings yet

- Provisons On Service TaxDocument37 pagesProvisons On Service TaxSunita NitinNo ratings yet

- I.T.1. Notes What You Need To Know When Filling Your Income Tax Return - Year 2013Document4 pagesI.T.1. Notes What You Need To Know When Filling Your Income Tax Return - Year 2013GabrielNo ratings yet

- TXPKN 2018 Dec Q PDFDocument17 pagesTXPKN 2018 Dec Q PDFYousuf khanNo ratings yet

- F6PKN 2015 Jun QDocument17 pagesF6PKN 2015 Jun QRihamNo ratings yet

- Practice Note No.01/2019 Withholding Tax On Payment For Goods and Services As Per Income Tax Act, Cap 332Document16 pagesPractice Note No.01/2019 Withholding Tax On Payment For Goods and Services As Per Income Tax Act, Cap 332musaNo ratings yet

- Taxation (Pakistan) : Tuesday 3 December 2013Document13 pagesTaxation (Pakistan) : Tuesday 3 December 2013Mashhood AhmedNo ratings yet

- Schedule of Charges Eff From 15.12.2022Document5 pagesSchedule of Charges Eff From 15.12.2022SUMIT PODDARNo ratings yet

- 1035 Withholding TaxDocument8 pages1035 Withholding TaxViren GandhiNo ratings yet

- Hotel Industry Under GST: CA Mayur ZanwarDocument17 pagesHotel Industry Under GST: CA Mayur ZanwarSOPHIA POLYTECHNIC LIBRARYNo ratings yet

- Income From Property: by NJDocument8 pagesIncome From Property: by NJUmar ZahidNo ratings yet

- Hand BookDocument82 pagesHand Booknmshamim7750No ratings yet

- Service Tax NotesDocument24 pagesService Tax Notesfaraznaqvi100% (1)

- 4) No Deduction Shall Be Allowed For Any Expenditure Incurred by An Employee in Deriving Amounts Chargeable To Tax Under The Head SalaryDocument13 pages4) No Deduction Shall Be Allowed For Any Expenditure Incurred by An Employee in Deriving Amounts Chargeable To Tax Under The Head SalaryAsad Ibrahim KhanNo ratings yet

- TDS Section Nature of Payment Rate of TDS Threshold LimitDocument3 pagesTDS Section Nature of Payment Rate of TDS Threshold LimitBiswajit GhoshNo ratings yet

- F6PKN QPDocument14 pagesF6PKN QPمحمد شمائل چیمہNo ratings yet

- UK TaxDocument15 pagesUK TaxbharatNo ratings yet

- Background: It Is Very Common Practice in The Construction or Infrastructure Related Industries That TheDocument10 pagesBackground: It Is Very Common Practice in The Construction or Infrastructure Related Industries That TheViral BakhadaNo ratings yet

- Salary Taxation and Related Concepts: Malik Faisal Mehmood, ACADocument25 pagesSalary Taxation and Related Concepts: Malik Faisal Mehmood, ACAMalik FaisalNo ratings yet

- Direct Tax BookletDocument24 pagesDirect Tax Bookletmbhartia999No ratings yet

- Service TaxDocument3 pagesService Taxapi-3822396No ratings yet

- Service Tax Rate Chart 01.06.2015Document3 pagesService Tax Rate Chart 01.06.2015ashokkumar1992ashokNo ratings yet

- Excutive Summary of Pakistan Finance Bill 2024-25Document8 pagesExcutive Summary of Pakistan Finance Bill 2024-25Sapience ConsultingNo ratings yet

- f6pkn 2018 Jun QDocument12 pagesf6pkn 2018 Jun QZarnab RazaNo ratings yet

- QFS - Afghan Tax SummaryDocument3 pagesQFS - Afghan Tax SummaryAhmad Nadeem MohammadiNo ratings yet

- Travel by Air ServicesDocument15 pagesTravel by Air ServicesvijaykoratNo ratings yet

- ITC Part I With Practice QuestionsDocument16 pagesITC Part I With Practice QuestionsTushar MadanNo ratings yet

- Income TAX Update OmanDocument5 pagesIncome TAX Update OmanmujeebmuscatNo ratings yet

- Full Length of Module 1 Income Taxation On Individuals PDFDocument35 pagesFull Length of Module 1 Income Taxation On Individuals PDFHermosura ChristineNo ratings yet

- Service Tax Qick RevisionDocument91 pagesService Tax Qick RevisiongouthamNo ratings yet

- 1 Budget Impact 2012-13Document5 pages1 Budget Impact 2012-13Rajkamal TiwariNo ratings yet

- Exemption From Service TaxDocument4 pagesExemption From Service Taxvb_krishnaNo ratings yet

- Amendment Finance Act 2009Document66 pagesAmendment Finance Act 2009Sanjay GuptaNo ratings yet

- Chp 7 - Composition scheme final (1)Document7 pagesChp 7 - Composition scheme final (1)sunraypower2010No ratings yet

- With Holding Tax-CompressedDocument8 pagesWith Holding Tax-CompressedNGANJANI WALTERNo ratings yet

- Composition Levy: Presentation By: Vishal Somai Sr. Faculty of Direct & Indirect TaxDocument19 pagesComposition Levy: Presentation By: Vishal Somai Sr. Faculty of Direct & Indirect TaxTRANSFORMERS PRIMENo ratings yet

- Income Tax Card Tax Year 2015Document3 pagesIncome Tax Card Tax Year 2015Sardar Shahid KhanNo ratings yet

- Annexure 2Document77 pagesAnnexure 2Maheshkumar AmulaNo ratings yet

- Budget 2009 AnalysisDocument10 pagesBudget 2009 AnalysisbeenamallaNo ratings yet

- 18878sm DTL Finalnew Cp1Document28 pages18878sm DTL Finalnew Cp1manisha maniNo ratings yet

- Government of Pakistan Federal Board of Revenue (Revenue Division) No.C.4 (1) ITP/2008-ECDocument19 pagesGovernment of Pakistan Federal Board of Revenue (Revenue Division) No.C.4 (1) ITP/2008-ECAhsan RazaNo ratings yet

- 03.01.2024 Consolidated Ser. ChargesDocument63 pages03.01.2024 Consolidated Ser. ChargesNadeem KhanNo ratings yet

- f6chn 2018 Jun QDocument11 pagesf6chn 2018 Jun QALEX TRANNo ratings yet

- Amendment DirectTax FA2013Document30 pagesAmendment DirectTax FA2013Bharat LuthraNo ratings yet

- TaxationDocument38 pagesTaxationEphraim LopezNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Wa0038.Document3 pagesWa0038.Usman KhanNo ratings yet

- RE RequestDocument2 pagesRE RequestMichelleNo ratings yet

- Balance SheetDocument1 pageBalance Sheetolyad tesfayeNo ratings yet

- GuideStar's IRS Tax Exempt Org Codes PDFDocument5 pagesGuideStar's IRS Tax Exempt Org Codes PDFaleta356No ratings yet

- Mrunal (Economy Q) GDP at Factor Cost and Market Price (GDPFC & GDPMP), NNPFC, NNPMP PrintDocument2 pagesMrunal (Economy Q) GDP at Factor Cost and Market Price (GDPFC & GDPMP), NNPFC, NNPMP PrintAkash Singh Chauhan0% (2)

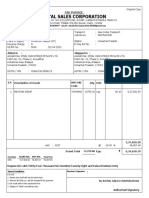

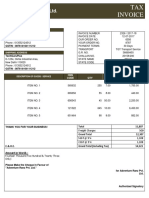

- Royal Sales Corporation: Tax InvoiceDocument2 pagesRoyal Sales Corporation: Tax InvoiceKailash GoyalNo ratings yet

- Tax Homework HelpDocument5 pagesTax Homework Helpbrgdfkvhf100% (1)

- W-9 Tax FormDocument4 pagesW-9 Tax FormMika DjokaNo ratings yet

- Payslip PIL11250 Feb 2024 1741073480458640214 1706890553675Document1 pagePayslip PIL11250 Feb 2024 1741073480458640214 1706890553675Dipankar BarmanNo ratings yet

- Refund of GST For The Period of Oct-Dec 2019-2020 - 20230509 - 0001Document2 pagesRefund of GST For The Period of Oct-Dec 2019-2020 - 20230509 - 0001bangladesh highcommissionNo ratings yet

- Profit and Loss Statement Bank-of-AmericaDocument1 pageProfit and Loss Statement Bank-of-AmericaAdi PutraNo ratings yet

- Problem Set - Deferred TaxesDocument2 pagesProblem Set - Deferred TaxeslykaNo ratings yet

- ISS 0744 CDocument1 pageISS 0744 CVinay RangariNo ratings yet

- ARDENE RSP Information EN - STORESDocument1 pageARDENE RSP Information EN - STORESChahat JauraNo ratings yet

- GST Invoice Format No. 12Document1 pageGST Invoice Format No. 12Arindam ChandaNo ratings yet

- The Basics of Taxes - WorksheetDocument10 pagesThe Basics of Taxes - WorksheetKatherine Dalay Vargas BorbollaNo ratings yet

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocument2 pagesThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECSatha SivamNo ratings yet

- Computation 2023 24Document30 pagesComputation 2023 24Sudhanhshu KumarNo ratings yet

- Taxation LawDocument7 pagesTaxation LawAliNo ratings yet

- 48 - Pay Slip ModelDocument1 page48 - Pay Slip Modeltapanamoria80% (5)

- Payment SlipDocument1 pagePayment SlipBrian OderaNo ratings yet

- Solved Jennifer Is Single and Has The Following Income and ExpensesDocument1 pageSolved Jennifer Is Single and Has The Following Income and ExpensesAnbu jaromiaNo ratings yet

- 2021 GST NBUDocument1 page2021 GST NBUclash with devilNo ratings yet

- MohitDocument1 pageMohitʀɛX々 KratøsNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- RequiredDocument2 pagesRequiredmohitgaba19No ratings yet

- Chapter 2 Multiple ChoiceDocument4 pagesChapter 2 Multiple ChoiceLess Balesoro100% (1)

Tax Card 2011 Withholding Taxes

Tax Card 2011 Withholding Taxes

Uploaded by

Omer JavaidOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Card 2011 Withholding Taxes

Tax Card 2011 Withholding Taxes

Uploaded by

Omer JavaidCopyright:

Available Formats

TY

[Type text]

2011

PROPOSED

TAX CARD

Withholding Taxes

RATE OF TAX ON PAYMENT OF SALARIES [S 149]

Every employer is obliged to withhold tax at average rate while making payments against salary to

employees. The slab rate of such deduction is given in “Tax Card for Salaried Individuals”.

RATE OF TAX ON PAYMENT OF SUPPLIES, SERVICES & CONTRACTS [S 153]

Prescribed persons are obliged to withhold tax at the following rates while making payments against

purchase of supplies, rendering of services & execution of contracts.

SN PAYMENTS UNDER SECTION 153 RATE OF TAX

PAYMENT OF SUPPLIES [S 153(1a)]

1. Supply of Goods: other than supply of cigarette and pharmaceutical products 3.5%

2. Supply of Goods: supply of cigarette 1.0%

3. Supply of Goods: supply of pharmaceutical products 1.0%

PAYMENT OF SERVICES [S 153(1b)]

1. Rendering of Services: other than transport services 6.0%

2. Rendering of Services: rendering of transport services 2.0%

PAYMENT OF CONTRACTS [S 153(1c)]

1. Execution of Contracts: other than a contract for the sale of goods or rendering of services 6.0%

RATE OF TAX ON PAYMENT OF RENT [S 155]

Prescribed persons are obliged to withhold tax at the following rates while making payment for rent of the

property.

SN PAYMENTS UNDER SECTION 155 RATE OF TAX

INDIVIDUAL & AOPs

1. Where the gross amount of rent does not exceed Rs.150,000. Nil

Where the gross amount of rent exceeds Rs.150,000 but does

2. 5% of gross amount exceeding Rs. 150,000.

not exceed Rs.400,000.

Where the gross amount of rent exceeds Rs.400,000 but does 7.50% of the gross amount exceeding

3.

not exceed Rs.1,000,000. Rs. 400,000 plus Rs. 12,500.

Where the gross amount of rent exceeds Rs.1,000,000. 10% of the gross amount exceeding

4.

Rs. 1,000,000 plus Rs. 57,500.

COMPANIES

1. Where the gross amount of rent does not exceed Rs.400,000. 5% of gross amount

Where the gross amount of rent exceeds Rs.400,000 but does 7.50% of the gross amount exceeding

2.

not exceed Rs.1,000,000. Rs. 400,000 plus Rs. 20,000

Where the gross amount of rent exceeds Rs.1,000,000. 10% of the gross amount exceeding

3.

Rs. 1,000,000 plus Rs. 65,000.

ASC ©2010 | A. Salam Jan & Co. Chartered Accountants - Member of AFFILICA International | TAX CARD

You might also like

- PaystubDocument1 pagePaystubOrbarsNo ratings yet

- 2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Document2 pages2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Doo Soo KimNo ratings yet

- ITF 56 A ProfessionalDocument2 pagesITF 56 A ProfessionalChomba Mwansa100% (1)

- Example - 2: A Bulldozer, Which Has A Service Life of 10 Years, Can Be PurchasedDocument4 pagesExample - 2: A Bulldozer, Which Has A Service Life of 10 Years, Can Be PurchasedNNo ratings yet

- Indian Service TaxDocument13 pagesIndian Service Taxanon_993677No ratings yet

- 4/25/2016 21st MCMC 1Document19 pages4/25/2016 21st MCMC 1ShaniNo ratings yet

- Liability of Service TaxDocument7 pagesLiability of Service TaxkasiriverNo ratings yet

- Service Tax: Aiaims Mms-ADocument31 pagesService Tax: Aiaims Mms-AAbbas Haider NaqviNo ratings yet

- Tax Year 2012 Rates of Tax For Individual Except A Salaried TaxpayerDocument5 pagesTax Year 2012 Rates of Tax For Individual Except A Salaried TaxpayerStyliXh MariamNo ratings yet

- Composition Scheme SEC 10 - GST PDFDocument20 pagesComposition Scheme SEC 10 - GST PDFTushar SinghNo ratings yet

- Taxes and Duties 2009-2010 - Layout 2Document14 pagesTaxes and Duties 2009-2010 - Layout 2Tonino Van WonterghemNo ratings yet

- AssignmentDocument19 pagesAssignmentAyesha ParveenNo ratings yet

- Tax Presentation (Punjab)Document55 pagesTax Presentation (Punjab)Atif IdreesNo ratings yet

- Tax On Rental Income From Property in PakistanDocument8 pagesTax On Rental Income From Property in Pakistansaif RashidNo ratings yet

- Indirec TaxDocument8 pagesIndirec TaxSubashNo ratings yet

- (Division V Income From Property: Substituted by The Finance Act, 2009. The Substituted "Division V" Read As FollowsDocument2 pages(Division V Income From Property: Substituted by The Finance Act, 2009. The Substituted "Division V" Read As Followsmsadhanani3922No ratings yet

- Taxation of Income From Property: TAX YEAR 2013 (1 July 2012 TO 30 June 2013)Document7 pagesTaxation of Income From Property: TAX YEAR 2013 (1 July 2012 TO 30 June 2013)AhmedAliNo ratings yet

- Scale of Professional Fees NewDocument9 pagesScale of Professional Fees NewOwolabi Olusola RajiNo ratings yet

- Provisons On Service TaxDocument37 pagesProvisons On Service TaxSunita NitinNo ratings yet

- I.T.1. Notes What You Need To Know When Filling Your Income Tax Return - Year 2013Document4 pagesI.T.1. Notes What You Need To Know When Filling Your Income Tax Return - Year 2013GabrielNo ratings yet

- TXPKN 2018 Dec Q PDFDocument17 pagesTXPKN 2018 Dec Q PDFYousuf khanNo ratings yet

- F6PKN 2015 Jun QDocument17 pagesF6PKN 2015 Jun QRihamNo ratings yet

- Practice Note No.01/2019 Withholding Tax On Payment For Goods and Services As Per Income Tax Act, Cap 332Document16 pagesPractice Note No.01/2019 Withholding Tax On Payment For Goods and Services As Per Income Tax Act, Cap 332musaNo ratings yet

- Taxation (Pakistan) : Tuesday 3 December 2013Document13 pagesTaxation (Pakistan) : Tuesday 3 December 2013Mashhood AhmedNo ratings yet

- Schedule of Charges Eff From 15.12.2022Document5 pagesSchedule of Charges Eff From 15.12.2022SUMIT PODDARNo ratings yet

- 1035 Withholding TaxDocument8 pages1035 Withholding TaxViren GandhiNo ratings yet

- Hotel Industry Under GST: CA Mayur ZanwarDocument17 pagesHotel Industry Under GST: CA Mayur ZanwarSOPHIA POLYTECHNIC LIBRARYNo ratings yet

- Income From Property: by NJDocument8 pagesIncome From Property: by NJUmar ZahidNo ratings yet

- Hand BookDocument82 pagesHand Booknmshamim7750No ratings yet

- Service Tax NotesDocument24 pagesService Tax Notesfaraznaqvi100% (1)

- 4) No Deduction Shall Be Allowed For Any Expenditure Incurred by An Employee in Deriving Amounts Chargeable To Tax Under The Head SalaryDocument13 pages4) No Deduction Shall Be Allowed For Any Expenditure Incurred by An Employee in Deriving Amounts Chargeable To Tax Under The Head SalaryAsad Ibrahim KhanNo ratings yet

- TDS Section Nature of Payment Rate of TDS Threshold LimitDocument3 pagesTDS Section Nature of Payment Rate of TDS Threshold LimitBiswajit GhoshNo ratings yet

- F6PKN QPDocument14 pagesF6PKN QPمحمد شمائل چیمہNo ratings yet

- UK TaxDocument15 pagesUK TaxbharatNo ratings yet

- Background: It Is Very Common Practice in The Construction or Infrastructure Related Industries That TheDocument10 pagesBackground: It Is Very Common Practice in The Construction or Infrastructure Related Industries That TheViral BakhadaNo ratings yet

- Salary Taxation and Related Concepts: Malik Faisal Mehmood, ACADocument25 pagesSalary Taxation and Related Concepts: Malik Faisal Mehmood, ACAMalik FaisalNo ratings yet

- Direct Tax BookletDocument24 pagesDirect Tax Bookletmbhartia999No ratings yet

- Service TaxDocument3 pagesService Taxapi-3822396No ratings yet

- Service Tax Rate Chart 01.06.2015Document3 pagesService Tax Rate Chart 01.06.2015ashokkumar1992ashokNo ratings yet

- Excutive Summary of Pakistan Finance Bill 2024-25Document8 pagesExcutive Summary of Pakistan Finance Bill 2024-25Sapience ConsultingNo ratings yet

- f6pkn 2018 Jun QDocument12 pagesf6pkn 2018 Jun QZarnab RazaNo ratings yet

- QFS - Afghan Tax SummaryDocument3 pagesQFS - Afghan Tax SummaryAhmad Nadeem MohammadiNo ratings yet

- Travel by Air ServicesDocument15 pagesTravel by Air ServicesvijaykoratNo ratings yet

- ITC Part I With Practice QuestionsDocument16 pagesITC Part I With Practice QuestionsTushar MadanNo ratings yet

- Income TAX Update OmanDocument5 pagesIncome TAX Update OmanmujeebmuscatNo ratings yet

- Full Length of Module 1 Income Taxation On Individuals PDFDocument35 pagesFull Length of Module 1 Income Taxation On Individuals PDFHermosura ChristineNo ratings yet

- Service Tax Qick RevisionDocument91 pagesService Tax Qick RevisiongouthamNo ratings yet

- 1 Budget Impact 2012-13Document5 pages1 Budget Impact 2012-13Rajkamal TiwariNo ratings yet

- Exemption From Service TaxDocument4 pagesExemption From Service Taxvb_krishnaNo ratings yet

- Amendment Finance Act 2009Document66 pagesAmendment Finance Act 2009Sanjay GuptaNo ratings yet

- Chp 7 - Composition scheme final (1)Document7 pagesChp 7 - Composition scheme final (1)sunraypower2010No ratings yet

- With Holding Tax-CompressedDocument8 pagesWith Holding Tax-CompressedNGANJANI WALTERNo ratings yet

- Composition Levy: Presentation By: Vishal Somai Sr. Faculty of Direct & Indirect TaxDocument19 pagesComposition Levy: Presentation By: Vishal Somai Sr. Faculty of Direct & Indirect TaxTRANSFORMERS PRIMENo ratings yet

- Income Tax Card Tax Year 2015Document3 pagesIncome Tax Card Tax Year 2015Sardar Shahid KhanNo ratings yet

- Annexure 2Document77 pagesAnnexure 2Maheshkumar AmulaNo ratings yet

- Budget 2009 AnalysisDocument10 pagesBudget 2009 AnalysisbeenamallaNo ratings yet

- 18878sm DTL Finalnew Cp1Document28 pages18878sm DTL Finalnew Cp1manisha maniNo ratings yet

- Government of Pakistan Federal Board of Revenue (Revenue Division) No.C.4 (1) ITP/2008-ECDocument19 pagesGovernment of Pakistan Federal Board of Revenue (Revenue Division) No.C.4 (1) ITP/2008-ECAhsan RazaNo ratings yet

- 03.01.2024 Consolidated Ser. ChargesDocument63 pages03.01.2024 Consolidated Ser. ChargesNadeem KhanNo ratings yet

- f6chn 2018 Jun QDocument11 pagesf6chn 2018 Jun QALEX TRANNo ratings yet

- Amendment DirectTax FA2013Document30 pagesAmendment DirectTax FA2013Bharat LuthraNo ratings yet

- TaxationDocument38 pagesTaxationEphraim LopezNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Wa0038.Document3 pagesWa0038.Usman KhanNo ratings yet

- RE RequestDocument2 pagesRE RequestMichelleNo ratings yet

- Balance SheetDocument1 pageBalance Sheetolyad tesfayeNo ratings yet

- GuideStar's IRS Tax Exempt Org Codes PDFDocument5 pagesGuideStar's IRS Tax Exempt Org Codes PDFaleta356No ratings yet

- Mrunal (Economy Q) GDP at Factor Cost and Market Price (GDPFC & GDPMP), NNPFC, NNPMP PrintDocument2 pagesMrunal (Economy Q) GDP at Factor Cost and Market Price (GDPFC & GDPMP), NNPFC, NNPMP PrintAkash Singh Chauhan0% (2)

- Royal Sales Corporation: Tax InvoiceDocument2 pagesRoyal Sales Corporation: Tax InvoiceKailash GoyalNo ratings yet

- Tax Homework HelpDocument5 pagesTax Homework Helpbrgdfkvhf100% (1)

- W-9 Tax FormDocument4 pagesW-9 Tax FormMika DjokaNo ratings yet

- Payslip PIL11250 Feb 2024 1741073480458640214 1706890553675Document1 pagePayslip PIL11250 Feb 2024 1741073480458640214 1706890553675Dipankar BarmanNo ratings yet

- Refund of GST For The Period of Oct-Dec 2019-2020 - 20230509 - 0001Document2 pagesRefund of GST For The Period of Oct-Dec 2019-2020 - 20230509 - 0001bangladesh highcommissionNo ratings yet

- Profit and Loss Statement Bank-of-AmericaDocument1 pageProfit and Loss Statement Bank-of-AmericaAdi PutraNo ratings yet

- Problem Set - Deferred TaxesDocument2 pagesProblem Set - Deferred TaxeslykaNo ratings yet

- ISS 0744 CDocument1 pageISS 0744 CVinay RangariNo ratings yet

- ARDENE RSP Information EN - STORESDocument1 pageARDENE RSP Information EN - STORESChahat JauraNo ratings yet

- GST Invoice Format No. 12Document1 pageGST Invoice Format No. 12Arindam ChandaNo ratings yet

- The Basics of Taxes - WorksheetDocument10 pagesThe Basics of Taxes - WorksheetKatherine Dalay Vargas BorbollaNo ratings yet

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocument2 pagesThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECSatha SivamNo ratings yet

- Computation 2023 24Document30 pagesComputation 2023 24Sudhanhshu KumarNo ratings yet

- Taxation LawDocument7 pagesTaxation LawAliNo ratings yet

- 48 - Pay Slip ModelDocument1 page48 - Pay Slip Modeltapanamoria80% (5)

- Payment SlipDocument1 pagePayment SlipBrian OderaNo ratings yet

- Solved Jennifer Is Single and Has The Following Income and ExpensesDocument1 pageSolved Jennifer Is Single and Has The Following Income and ExpensesAnbu jaromiaNo ratings yet

- 2021 GST NBUDocument1 page2021 GST NBUclash with devilNo ratings yet

- MohitDocument1 pageMohitʀɛX々 KratøsNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- RequiredDocument2 pagesRequiredmohitgaba19No ratings yet

- Chapter 2 Multiple ChoiceDocument4 pagesChapter 2 Multiple ChoiceLess Balesoro100% (1)