Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

37 viewsVerticle Horizental

Verticle Horizental

Uploaded by

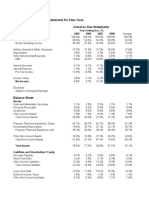

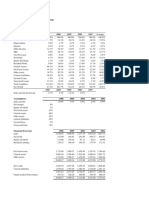

Murtaza HassanThe document provides a vertical and horizontal analysis of Allied Bank's annual report for 2008. The vertical analysis shows the percentage composition of assets and liabilities over the years 2003 to 2008. The horizontal analysis shows the growth in assets, liabilities, equity, and other line items from 2003 to 2008. Key highlights are advances grew by over 500% from 2003 to 2008, while deposits grew over 260% in the same period. Total assets and liabilities grew over 300% and 280% respectively from 2003 to 2008.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Roark Capital - Buyout of Buffalo Wild Wings JaiminDocument30 pagesRoark Capital - Buyout of Buffalo Wild Wings JaiminjaiminNo ratings yet

- Data For Ratio Detective ExerciseDocument1 pageData For Ratio Detective ExercisemaritaputriNo ratings yet

- The Ideology of Modernism - György Lukács PDFDocument18 pagesThe Ideology of Modernism - György Lukács PDFEmilija Nikolić100% (3)

- Test Bank For Operations and Supply Chain Management The Core 1st Canadian Edition by JacobsDocument43 pagesTest Bank For Operations and Supply Chain Management The Core 1st Canadian Edition by Jacobsa852137207No ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- The Financial DetectiveDocument15 pagesThe Financial Detectiveojsimpson90100% (7)

- Commentary of Nussbaum's Compassion and TerrorDocument3 pagesCommentary of Nussbaum's Compassion and TerrorJacob Clift100% (1)

- CH 13 Mod 2 Common Size StatementsDocument2 pagesCH 13 Mod 2 Common Size StatementsAkshat JainNo ratings yet

- Chapter 26: Financial Planning & StrategyDocument3 pagesChapter 26: Financial Planning & StrategyMukul KadyanNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- 2019 2018 2017 2016 2015 AssetsDocument1 page2019 2018 2017 2016 2015 AssetsFaisal RafiqueNo ratings yet

- Finance Detective - Ratio AnalysisDocument2 pagesFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNo ratings yet

- Data For Ratio DetectiveDocument1 pageData For Ratio DetectiveRoyan Nur HudaNo ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocument4 pagesFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNo ratings yet

- AlnassarDocument11 pagesAlnassarFaizanNo ratings yet

- Aamc BS Va-1Document1 pageAamc BS Va-1Jomar CariagaNo ratings yet

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDocument31 pagesFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNo ratings yet

- 2 Financial Statements of Bank - For StudentDocument75 pages2 Financial Statements of Bank - For StudenttusedoNo ratings yet

- Financial Model TemplateDocument30 pagesFinancial Model Templateudoshi_1No ratings yet

- Increase (Decrease) 2019 2018 Amount Percent Sales RevenueDocument6 pagesIncrease (Decrease) 2019 2018 Amount Percent Sales RevenuewennylynNo ratings yet

- Financial Market Analysis. Assig 1Document15 pagesFinancial Market Analysis. Assig 1Wasi MalikNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- Syndicate 3 - Analisa Ratio IndustriDocument5 pagesSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- Use 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsDocument3 pagesUse 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsgraceNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Common-Size Analysis: 7.1 Financial RatiosDocument6 pagesCommon-Size Analysis: 7.1 Financial RatiosQayyumNo ratings yet

- Projection and Valuation Example - SolutionDocument13 pagesProjection and Valuation Example - SolutionPrince Akonor AsareNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Tugas Pertemuan 10 - Sopianti (1730611006)Document12 pagesTugas Pertemuan 10 - Sopianti (1730611006)sopiantiNo ratings yet

- Ratios Tell A StoryDocument3 pagesRatios Tell A StoryJose Arturo Rodriguez AlemanNo ratings yet

- Balance SheetDocument14 pagesBalance SheetIbrahimNo ratings yet

- Finance Term PaperDocument23 pagesFinance Term PaperTawsiq Asef MahiNo ratings yet

- Case Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-ADocument9 pagesCase Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-AHannylen Faye ValenteNo ratings yet

- BNM - Analisis Financiero Estructural Nov 2000 - Oct 2001Document2 pagesBNM - Analisis Financiero Estructural Nov 2000 - Oct 2001gonzaloromaniNo ratings yet

- Ratios Tell A StoryDocument2 pagesRatios Tell A StoryJose Arturo Rodriguez AlemanNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- Financial Performance SpreadsheetDocument4 pagesFinancial Performance SpreadsheetAngel Mae PalasNo ratings yet

- Balance Sheet AnalysisDocument2 pagesBalance Sheet AnalysisAishaNo ratings yet

- Almarai Finance ReportDocument9 pagesAlmarai Finance ReportVikaas GupthaNo ratings yet

- Activity 07 CH14Document4 pagesActivity 07 CH14Dandreb SuaybaguioNo ratings yet

- Financial Modeling Mid-Term ExamDocument17 pagesFinancial Modeling Mid-Term ExamКамиль БайбуринNo ratings yet

- Financial Analysis OrascomDocument11 pagesFinancial Analysis OrascomMahmoud Elyamany100% (1)

- Mcdonalds Balance Sheet - Horizontal AnalysisDocument5 pagesMcdonalds Balance Sheet - Horizontal AnalysisNj DangerNo ratings yet

- TemplateDocument8 pagesTemplateLukmanul HakimNo ratings yet

- ICICI Bank LTD (ICICIBC IN) - by MeasureDocument10 pagesICICI Bank LTD (ICICIBC IN) - by MeasureDahagam SaumithNo ratings yet

- Walt Disney Financial StatementDocument8 pagesWalt Disney Financial StatementShaReyNo ratings yet

- Afs 26 JunDocument8 pagesAfs 26 JunSyed Fakhar AbbasNo ratings yet

- Case 2 - Marriott CorporationDocument29 pagesCase 2 - Marriott CorporationMorten LassenNo ratings yet

- FRA Middle Term Test 1Document3 pagesFRA Middle Term Test 1k21clca1 hvnhNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- Primo BenzinaDocument30 pagesPrimo BenzinaSofía MargaritaNo ratings yet

- Financial Statement Analysis of Yes BankDocument12 pagesFinancial Statement Analysis of Yes BankAjay Suthar100% (1)

- EV B08 Exercise SolutionDocument6 pagesEV B08 Exercise SolutionÚlfar SnæfeldNo ratings yet

- Exhibit 1: Gross Profit 3,597.1Document15 pagesExhibit 1: Gross Profit 3,597.1Rendy Setiadi MangunsongNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Vertical Analysis of The Income StatementDocument2 pagesVertical Analysis of The Income Statementhimelhimel34No ratings yet

- LuxotticaDocument24 pagesLuxotticaValentina GaviriaNo ratings yet

- Atherine S OnfectioneryDocument3 pagesAtherine S OnfectioneryVanshika SinghNo ratings yet

- Assumptions For Forecasting Model: Income StatementDocument9 pagesAssumptions For Forecasting Model: Income StatementRadhika SarawagiNo ratings yet

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

- M.G.Road, HOD Buildgs, Opp - Indira Gandhi MPL - Stadium, Near RTO Office, VIJAYAWADA-520010Document2 pagesM.G.Road, HOD Buildgs, Opp - Indira Gandhi MPL - Stadium, Near RTO Office, VIJAYAWADA-520010Ravindra VarmaNo ratings yet

- Erf FormsDocument2 pagesErf FormsstartonNo ratings yet

- Learning Basic Grammar Book 2 WithDocument9 pagesLearning Basic Grammar Book 2 Withpsycho_psychoNo ratings yet

- BSP CampDocument7 pagesBSP CampArleneTalledoNo ratings yet

- Practice QuestionsDocument11 pagesPractice QuestionsMichaella PangilinanNo ratings yet

- Grammar Handbook Parts of SpeechDocument29 pagesGrammar Handbook Parts of SpeechClayton OgilvyNo ratings yet

- Rafi Peer Theater Workshop Strategic PlanDocument11 pagesRafi Peer Theater Workshop Strategic PlanRafiq JafferNo ratings yet

- Rubric For Dramatic ProjectsDocument2 pagesRubric For Dramatic ProjectsReynald CachoNo ratings yet

- Ledger - Upstox 2019Document5 pagesLedger - Upstox 2019Hemant BilliardsNo ratings yet

- FR QB Part 2Document12 pagesFR QB Part 2AkhilNo ratings yet

- PDF Sustainable Banking The Greening of Finance First Edition Edition Jan Jaap Bouma Ebook Full ChapterDocument53 pagesPDF Sustainable Banking The Greening of Finance First Edition Edition Jan Jaap Bouma Ebook Full Chapterbarbara.white983100% (1)

- Ultimate Frisbee HandoutsDocument4 pagesUltimate Frisbee HandoutsTinTin Laud TangcoNo ratings yet

- End of Term Essay - PDF Version - El Alaoui SanaaDocument8 pagesEnd of Term Essay - PDF Version - El Alaoui SanaaallalNo ratings yet

- Final Micro Plan Quality Evaluation, Desk Review and FieldValidation FormsDocument4 pagesFinal Micro Plan Quality Evaluation, Desk Review and FieldValidation Formsmoss4u100% (1)

- Oracle Access Management 11gR2 (11.1.2.x) Frequently Asked Questions (FAQ)Document32 pagesOracle Access Management 11gR2 (11.1.2.x) Frequently Asked Questions (FAQ)madhanNo ratings yet

- Pas 2202008Document27 pagesPas 2202008DirkRabauNo ratings yet

- Question TagsDocument3 pagesQuestion TagsDaniel PenescuNo ratings yet

- Mrais 5TH Imrc Delegate List Goa 2017 2018Document25 pagesMrais 5TH Imrc Delegate List Goa 2017 2018Anonymous dIK4xERPNo ratings yet

- Informal Le!er e Mail Template Client Business Email Normal EmailDocument1 pageInformal Le!er e Mail Template Client Business Email Normal EmailJean-Pierre MwananshikuNo ratings yet

- A401A401M-10 Standard Specification For Steel Wire, Chromium-Silicon AlloyDocument4 pagesA401A401M-10 Standard Specification For Steel Wire, Chromium-Silicon Alloytjt4779No ratings yet

- Socrates A Guide For The Perplexed PDFDocument196 pagesSocrates A Guide For The Perplexed PDFAndres Torres100% (3)

- The Swahili Alphabet and Digraphs For StudyDocument3 pagesThe Swahili Alphabet and Digraphs For Studyquestnvr73100% (1)

- View Invoice - ReceiptDocument1 pageView Invoice - ReceiptashadbolajiNo ratings yet

- De 3.2Document6 pagesDe 3.2minh trungNo ratings yet

- Annales School of History: Its Origins, Development and ContributionsDocument8 pagesAnnales School of History: Its Origins, Development and ContributionsKanchi AgarwalNo ratings yet

- Sample Report For Apprehended Person in Violation of PD 705Document9 pagesSample Report For Apprehended Person in Violation of PD 705benigno100% (2)

- Allen - The Tears of God - Jimmy AllenDocument8 pagesAllen - The Tears of God - Jimmy AllenkyleNo ratings yet

Verticle Horizental

Verticle Horizental

Uploaded by

Murtaza Hassan0 ratings0% found this document useful (0 votes)

37 views2 pagesThe document provides a vertical and horizontal analysis of Allied Bank's annual report for 2008. The vertical analysis shows the percentage composition of assets and liabilities over the years 2003 to 2008. The horizontal analysis shows the growth in assets, liabilities, equity, and other line items from 2003 to 2008. Key highlights are advances grew by over 500% from 2003 to 2008, while deposits grew over 260% in the same period. Total assets and liabilities grew over 300% and 280% respectively from 2003 to 2008.

Original Description:

Original Title

verticle_horizental

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a vertical and horizontal analysis of Allied Bank's annual report for 2008. The vertical analysis shows the percentage composition of assets and liabilities over the years 2003 to 2008. The horizontal analysis shows the growth in assets, liabilities, equity, and other line items from 2003 to 2008. Key highlights are advances grew by over 500% from 2003 to 2008, while deposits grew over 260% in the same period. Total assets and liabilities grew over 300% and 280% respectively from 2003 to 2008.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

37 views2 pagesVerticle Horizental

Verticle Horizental

Uploaded by

Murtaza HassanThe document provides a vertical and horizontal analysis of Allied Bank's annual report for 2008. The vertical analysis shows the percentage composition of assets and liabilities over the years 2003 to 2008. The horizontal analysis shows the growth in assets, liabilities, equity, and other line items from 2003 to 2008. Key highlights are advances grew by over 500% from 2003 to 2008, while deposits grew over 260% in the same period. Total assets and liabilities grew over 300% and 280% respectively from 2003 to 2008.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Annual Report of Allied Bank for the year 2008 Analysis

Vertical & Horizontal Analysis

20

Vertical Analysis

December 31 2003 2004 2005 2006 2007 2008

Assets

Cash and balances with treasury and other banks 9.5% 8.0% 9.4% 9.8% 9.5% 7.0%

Lending to financial institutions 13.1% 10.4% 3.0% 7.6% 5.8% 4.3%

Investments - net 34.7% 37.0% 23.3% 18.6% 26.2% 22.5%

Advances - net 34.6% 38.4% 57.7% 57.2% 52.6% 58.1%

Operating Fixed assets 2.2% 1.6% 2.5% 2.6% 2.4% 3.0%

Other assets 5.9% 4.6% 4.1% 4.3% 3.6% 5.0%

Total assets - net of provisions 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Liabilities

Customer deposits 97.2% 81.6% 83.8% 81.7% 82.5% 81.1%

Inter bank borrowings 2.3% 8.1% 5.0% 7.3% 7.2% 7.6%

Bills payable 1.5% 1.6% 1.3% 0.9% 1.1% 0.8%

Other liabilities 2.4% 2.1% 2.3% 2.0% 2.3% 3.7%

Sub-ordinated loans 0.0% 0.0% 0.0% 1.0% 0.8% 0.7%

Total Liabilities 103.4% 93.4% 92.4% 93.0% 93.8% 93.9%

Share capital 0.9% 2.8% 2.3% 1.8% 1.7% 1.8%

Reserves 7.3% 3.0% 2.4% 1.9% 1.6% 1.6%

Un - appropriated profit / (loss) -5.5% -4.1% 1.4% 2.2% 2.2% 2.3%

Equity - Tier I -4.1% 6.1% 6.7% 6.4% 5.8% 5.7%

Surplus on revaluation of assets 0.8% 0.5% 0.8% 0.6% 0.5% 0.4%

Total Equity -3.4% 6.6% 7.6% 7.0% 6.2% 6.1%

Horizontal Analysis

December 31 2003 2004 2005 2006 2007 2008

Assets

Cash and balances with treasury and other banks 100.0% 110.0% 160.9% 220.8% 271.4% 229.8%

Lending to financial institutions 100.0% 105.3% 37.6% 124.0% 119.9% 102.8%

Investments - net 100.0% 140.7% 110.3% 115.3% 206.1% 202.9%

Advances - net 100.0% 146.3% 273.5% 354.2% 414.2% 523.8%

Operating Fixed assets 100.0% 98.3% 181.8% 248.3% 290.8% 428.9%

Other assets 100.0% 101.6% 113.6% 155.2% 163.3% 264.4%

Total assets - net of provisions 100.0% 131.8% 163.9% 214.5% 272.4% 312.0%

Liabilities

Customer deposits 100.0% 110.7% 141.3% 180.4% 231.1% 260.4%

Inter bank borrowings 100.0% 470.5% 363.8% 690.9% 860.7% 1042.5%

Bills payable 100.0% 143.0% 138.1% 128.5% 197.1% 166.6%

Other liabilities 100.0% 113.1% 157.7% 180.6% 258.6% 480.5%

Sub-ordinated loans

Total Liabilities 100.0% 119.1% 146.5% 192.9% 247.1% 283.4%

Share capital 100.0% 414.3% 422.2% 422.2% 506.6% 608.0%

Reserves 100.0% 2035.7% 1020.6% 1099.4% 1084.6% 1040.5%

Un - appropriated profit / (loss) 100.0% -97.3% 42.1% 86.4% 107.4% 131.5%

Equity - Tier I 100.0% 194.0% 265.2% 333.3% 378.1% 427.3%

Surplus on revaluation of assets 100.0% 90.3% 182.8% 163.0% 164.3% 173.3%

Total Equity 100.0% 258.0% 366.1% 445.0% 500.1% 562.5%

Blending of skills

and experience 21

is our approach

towards creating

an enabling

environment

You might also like

- Roark Capital - Buyout of Buffalo Wild Wings JaiminDocument30 pagesRoark Capital - Buyout of Buffalo Wild Wings JaiminjaiminNo ratings yet

- Data For Ratio Detective ExerciseDocument1 pageData For Ratio Detective ExercisemaritaputriNo ratings yet

- The Ideology of Modernism - György Lukács PDFDocument18 pagesThe Ideology of Modernism - György Lukács PDFEmilija Nikolić100% (3)

- Test Bank For Operations and Supply Chain Management The Core 1st Canadian Edition by JacobsDocument43 pagesTest Bank For Operations and Supply Chain Management The Core 1st Canadian Edition by Jacobsa852137207No ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- The Financial DetectiveDocument15 pagesThe Financial Detectiveojsimpson90100% (7)

- Commentary of Nussbaum's Compassion and TerrorDocument3 pagesCommentary of Nussbaum's Compassion and TerrorJacob Clift100% (1)

- CH 13 Mod 2 Common Size StatementsDocument2 pagesCH 13 Mod 2 Common Size StatementsAkshat JainNo ratings yet

- Chapter 26: Financial Planning & StrategyDocument3 pagesChapter 26: Financial Planning & StrategyMukul KadyanNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- 2019 2018 2017 2016 2015 AssetsDocument1 page2019 2018 2017 2016 2015 AssetsFaisal RafiqueNo ratings yet

- Finance Detective - Ratio AnalysisDocument2 pagesFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNo ratings yet

- Data For Ratio DetectiveDocument1 pageData For Ratio DetectiveRoyan Nur HudaNo ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocument4 pagesFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNo ratings yet

- AlnassarDocument11 pagesAlnassarFaizanNo ratings yet

- Aamc BS Va-1Document1 pageAamc BS Va-1Jomar CariagaNo ratings yet

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDocument31 pagesFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNo ratings yet

- 2 Financial Statements of Bank - For StudentDocument75 pages2 Financial Statements of Bank - For StudenttusedoNo ratings yet

- Financial Model TemplateDocument30 pagesFinancial Model Templateudoshi_1No ratings yet

- Increase (Decrease) 2019 2018 Amount Percent Sales RevenueDocument6 pagesIncrease (Decrease) 2019 2018 Amount Percent Sales RevenuewennylynNo ratings yet

- Financial Market Analysis. Assig 1Document15 pagesFinancial Market Analysis. Assig 1Wasi MalikNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- Syndicate 3 - Analisa Ratio IndustriDocument5 pagesSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- Use 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsDocument3 pagesUse 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsgraceNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Common-Size Analysis: 7.1 Financial RatiosDocument6 pagesCommon-Size Analysis: 7.1 Financial RatiosQayyumNo ratings yet

- Projection and Valuation Example - SolutionDocument13 pagesProjection and Valuation Example - SolutionPrince Akonor AsareNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Tugas Pertemuan 10 - Sopianti (1730611006)Document12 pagesTugas Pertemuan 10 - Sopianti (1730611006)sopiantiNo ratings yet

- Ratios Tell A StoryDocument3 pagesRatios Tell A StoryJose Arturo Rodriguez AlemanNo ratings yet

- Balance SheetDocument14 pagesBalance SheetIbrahimNo ratings yet

- Finance Term PaperDocument23 pagesFinance Term PaperTawsiq Asef MahiNo ratings yet

- Case Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-ADocument9 pagesCase Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-AHannylen Faye ValenteNo ratings yet

- BNM - Analisis Financiero Estructural Nov 2000 - Oct 2001Document2 pagesBNM - Analisis Financiero Estructural Nov 2000 - Oct 2001gonzaloromaniNo ratings yet

- Ratios Tell A StoryDocument2 pagesRatios Tell A StoryJose Arturo Rodriguez AlemanNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- Financial Performance SpreadsheetDocument4 pagesFinancial Performance SpreadsheetAngel Mae PalasNo ratings yet

- Balance Sheet AnalysisDocument2 pagesBalance Sheet AnalysisAishaNo ratings yet

- Almarai Finance ReportDocument9 pagesAlmarai Finance ReportVikaas GupthaNo ratings yet

- Activity 07 CH14Document4 pagesActivity 07 CH14Dandreb SuaybaguioNo ratings yet

- Financial Modeling Mid-Term ExamDocument17 pagesFinancial Modeling Mid-Term ExamКамиль БайбуринNo ratings yet

- Financial Analysis OrascomDocument11 pagesFinancial Analysis OrascomMahmoud Elyamany100% (1)

- Mcdonalds Balance Sheet - Horizontal AnalysisDocument5 pagesMcdonalds Balance Sheet - Horizontal AnalysisNj DangerNo ratings yet

- TemplateDocument8 pagesTemplateLukmanul HakimNo ratings yet

- ICICI Bank LTD (ICICIBC IN) - by MeasureDocument10 pagesICICI Bank LTD (ICICIBC IN) - by MeasureDahagam SaumithNo ratings yet

- Walt Disney Financial StatementDocument8 pagesWalt Disney Financial StatementShaReyNo ratings yet

- Afs 26 JunDocument8 pagesAfs 26 JunSyed Fakhar AbbasNo ratings yet

- Case 2 - Marriott CorporationDocument29 pagesCase 2 - Marriott CorporationMorten LassenNo ratings yet

- FRA Middle Term Test 1Document3 pagesFRA Middle Term Test 1k21clca1 hvnhNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- Primo BenzinaDocument30 pagesPrimo BenzinaSofía MargaritaNo ratings yet

- Financial Statement Analysis of Yes BankDocument12 pagesFinancial Statement Analysis of Yes BankAjay Suthar100% (1)

- EV B08 Exercise SolutionDocument6 pagesEV B08 Exercise SolutionÚlfar SnæfeldNo ratings yet

- Exhibit 1: Gross Profit 3,597.1Document15 pagesExhibit 1: Gross Profit 3,597.1Rendy Setiadi MangunsongNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Vertical Analysis of The Income StatementDocument2 pagesVertical Analysis of The Income Statementhimelhimel34No ratings yet

- LuxotticaDocument24 pagesLuxotticaValentina GaviriaNo ratings yet

- Atherine S OnfectioneryDocument3 pagesAtherine S OnfectioneryVanshika SinghNo ratings yet

- Assumptions For Forecasting Model: Income StatementDocument9 pagesAssumptions For Forecasting Model: Income StatementRadhika SarawagiNo ratings yet

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

- M.G.Road, HOD Buildgs, Opp - Indira Gandhi MPL - Stadium, Near RTO Office, VIJAYAWADA-520010Document2 pagesM.G.Road, HOD Buildgs, Opp - Indira Gandhi MPL - Stadium, Near RTO Office, VIJAYAWADA-520010Ravindra VarmaNo ratings yet

- Erf FormsDocument2 pagesErf FormsstartonNo ratings yet

- Learning Basic Grammar Book 2 WithDocument9 pagesLearning Basic Grammar Book 2 Withpsycho_psychoNo ratings yet

- BSP CampDocument7 pagesBSP CampArleneTalledoNo ratings yet

- Practice QuestionsDocument11 pagesPractice QuestionsMichaella PangilinanNo ratings yet

- Grammar Handbook Parts of SpeechDocument29 pagesGrammar Handbook Parts of SpeechClayton OgilvyNo ratings yet

- Rafi Peer Theater Workshop Strategic PlanDocument11 pagesRafi Peer Theater Workshop Strategic PlanRafiq JafferNo ratings yet

- Rubric For Dramatic ProjectsDocument2 pagesRubric For Dramatic ProjectsReynald CachoNo ratings yet

- Ledger - Upstox 2019Document5 pagesLedger - Upstox 2019Hemant BilliardsNo ratings yet

- FR QB Part 2Document12 pagesFR QB Part 2AkhilNo ratings yet

- PDF Sustainable Banking The Greening of Finance First Edition Edition Jan Jaap Bouma Ebook Full ChapterDocument53 pagesPDF Sustainable Banking The Greening of Finance First Edition Edition Jan Jaap Bouma Ebook Full Chapterbarbara.white983100% (1)

- Ultimate Frisbee HandoutsDocument4 pagesUltimate Frisbee HandoutsTinTin Laud TangcoNo ratings yet

- End of Term Essay - PDF Version - El Alaoui SanaaDocument8 pagesEnd of Term Essay - PDF Version - El Alaoui SanaaallalNo ratings yet

- Final Micro Plan Quality Evaluation, Desk Review and FieldValidation FormsDocument4 pagesFinal Micro Plan Quality Evaluation, Desk Review and FieldValidation Formsmoss4u100% (1)

- Oracle Access Management 11gR2 (11.1.2.x) Frequently Asked Questions (FAQ)Document32 pagesOracle Access Management 11gR2 (11.1.2.x) Frequently Asked Questions (FAQ)madhanNo ratings yet

- Pas 2202008Document27 pagesPas 2202008DirkRabauNo ratings yet

- Question TagsDocument3 pagesQuestion TagsDaniel PenescuNo ratings yet

- Mrais 5TH Imrc Delegate List Goa 2017 2018Document25 pagesMrais 5TH Imrc Delegate List Goa 2017 2018Anonymous dIK4xERPNo ratings yet

- Informal Le!er e Mail Template Client Business Email Normal EmailDocument1 pageInformal Le!er e Mail Template Client Business Email Normal EmailJean-Pierre MwananshikuNo ratings yet

- A401A401M-10 Standard Specification For Steel Wire, Chromium-Silicon AlloyDocument4 pagesA401A401M-10 Standard Specification For Steel Wire, Chromium-Silicon Alloytjt4779No ratings yet

- Socrates A Guide For The Perplexed PDFDocument196 pagesSocrates A Guide For The Perplexed PDFAndres Torres100% (3)

- The Swahili Alphabet and Digraphs For StudyDocument3 pagesThe Swahili Alphabet and Digraphs For Studyquestnvr73100% (1)

- View Invoice - ReceiptDocument1 pageView Invoice - ReceiptashadbolajiNo ratings yet

- De 3.2Document6 pagesDe 3.2minh trungNo ratings yet

- Annales School of History: Its Origins, Development and ContributionsDocument8 pagesAnnales School of History: Its Origins, Development and ContributionsKanchi AgarwalNo ratings yet

- Sample Report For Apprehended Person in Violation of PD 705Document9 pagesSample Report For Apprehended Person in Violation of PD 705benigno100% (2)

- Allen - The Tears of God - Jimmy AllenDocument8 pagesAllen - The Tears of God - Jimmy AllenkyleNo ratings yet