Professional Documents

Culture Documents

Contoh Tax Calc

Contoh Tax Calc

Uploaded by

swippyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contoh Tax Calc

Contoh Tax Calc

Uploaded by

swippyCopyright:

Available Formats

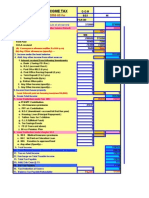

GROSS BASIS

Jan-10

Total Period in 2010 12

This Period 1

Description Amount

Basic Salary 10,000,000

Tax Allowance

Total Gross Salary

Occupation Exp (Biaya Jabatan) (500,000)

Net Income 9,500,000

Net Income Annualized 114,000,000

Tax Exemption (M/1) (18,480,000)

Taxable Income (Rounded) 95,520,000

Income Tax Payable (Annual) 9,328,000

Income Tax Payable up to this period 777,333

Take Home Pay 9,222,667

(Notes : )

1 (Details of Income wich is subject to Income tax art 21 : )

(- Benefit in Cash (I,e : Basic Salary, Meal & Transport Allowance, Overtime, Medical Allowance, etc) )

(- Insurance paid by Employer )

2 (Deduction Allowed : )

(- Occupation Expenses, Deemed by Government 5% from Gross Basic Income & Maximum Rp 500,000/Month )

(- JHT Premium/ Pension Premi wich paid by Employee )

3 (Tax Exemption : )

(Marital Status )

(- Single )

(- Married No Child )

(- Married with 1 Child )

(- Married with 2 Children )

(- Married with 3 Children )

(Notes : Usually woman always calculate as single )

4 (Income Tax Rate Applied )

(Taxable Income Bracket )

(0 - 50 Mio )

(> 50 - 250 Mio )

(> 250 - 500 Mio )

(> 500 Mio )

(NET BASIS )

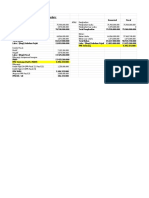

12

1

10,000,000

Err:522

Err:522

(500,000)

Err:522

Err:522

(18,480,000)

Err:522

Err:522

Err:522

Err:522

me, Medical Allowance, etc) )

ncome & Maximum Rp 500,000/Month )

(Tax Exemption )

15,840,000

17,160,000

18,480,000

19,800,000

21,120,000

2,500,000

You might also like

- Oklahoma City Day 1 - Michelle Moore (Forward by Bill Cooper) 1Document1,068 pagesOklahoma City Day 1 - Michelle Moore (Forward by Bill Cooper) 1skalpsoloNo ratings yet

- Practice Problems Ch12 PDFDocument57 pagesPractice Problems Ch12 PDFzoeyNo ratings yet

- Salary Tax CalculatorDocument1 pageSalary Tax Calculatormilan subediNo ratings yet

- Case 1 - Tutor GuideDocument3 pagesCase 1 - Tutor GuideKAR ENG QUAHNo ratings yet

- Grup - Task 4Document6 pagesGrup - Task 4DemastaufiqNo ratings yet

- This Study Resource Was: Chool of Usiness Conomics Otal ArksDocument9 pagesThis Study Resource Was: Chool of Usiness Conomics Otal Arkscsolution0% (2)

- Tutorial 9 - PIT1-Summer 2023-Sample AnswerDocument4 pagesTutorial 9 - PIT1-Summer 2023-Sample Answerkien tran100% (1)

- Financial Management Economics For Finance 2023 1671444516Document36 pagesFinancial Management Economics For Finance 2023 1671444516RADHIKANo ratings yet

- MODULE 3-Short ProblemsDocument5 pagesMODULE 3-Short ProblemsJaimell LimNo ratings yet

- Emailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3Document126 pagesEmailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3chalu account100% (2)

- HW Chapter 20Document2 pagesHW Chapter 20Thư LuyệnNo ratings yet

- Tutorial 9 PIT1 Summer 2023 Sample AnswerDocument6 pagesTutorial 9 PIT1 Summer 2023 Sample Answernewgen2173No ratings yet

- f6vnm 2007 Dec ADocument6 pagesf6vnm 2007 Dec APhạm Hùng DũngNo ratings yet

- August 2010 Economic BriefDocument1 pageAugust 2010 Economic BriefPAHouseGOPNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument14 pagesSolutions To End-Of-Chapter ProblemsTushar MalhotraNo ratings yet

- Cases 3 - Berlin Novanolo G (29123112)Document4 pagesCases 3 - Berlin Novanolo G (29123112)catatankotakkuningNo ratings yet

- Salary Tax Calculator, NepalDocument1 pageSalary Tax Calculator, NepalRajiv SahNo ratings yet

- Assignment 4 - SolutionsDocument2 pagesAssignment 4 - SolutionsEsther LiuNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- 2 GovaccDocument1 page2 Govaccyes yesnoNo ratings yet

- Constructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmDocument5 pagesConstructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmBhavesh MaruNo ratings yet

- Quinn August 2010 Economic BriefDocument1 pageQuinn August 2010 Economic BriefPAHouseGOPNo ratings yet

- Valuing Capital Investment ProjectsDocument13 pagesValuing Capital Investment ProjectsSiddhesh MahadikNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument8 pagesFinancial Statements, Cash Flow, and TaxesRaihan Eibna RezaNo ratings yet

- Board Meeting May 13, 2010 CompensationDocument19 pagesBoard Meeting May 13, 2010 CompensationCFBISDNo ratings yet

- Income-Tax-Calculator 2023-24Document8 pagesIncome-Tax-Calculator 2023-24AlokNo ratings yet

- Self Employed Tax ContributionDocument4 pagesSelf Employed Tax ContributionLe-Noi AndersonNo ratings yet

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDocument5 pagesInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiNo ratings yet

- Finance Homework OCFDocument4 pagesFinance Homework OCFShoaib ShahzadNo ratings yet

- 3.6 Solutions To Classwork Questions On Working CapitalDocument42 pages3.6 Solutions To Classwork Questions On Working CapitalA001AADITYA MALIKNo ratings yet

- AC2101 SemGrp4 Team6Document34 pagesAC2101 SemGrp4 Team6Kwang Yi JuinNo ratings yet

- Financial Plan: Important AssumptionsDocument15 pagesFinancial Plan: Important AssumptionsjehooniesunshineNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Dit Sem V SolnDocument10 pagesDit Sem V Solnmaaz11052020No ratings yet

- Simulasi Corporate TaxDocument9 pagesSimulasi Corporate TaxANDIYANA ANSARNo ratings yet

- It Return BHK 2022-23Document2 pagesIt Return BHK 2022-23Ganesh PawarNo ratings yet

- Old Vs New Tax Rates Regime (6 Cases)Document6 pagesOld Vs New Tax Rates Regime (6 Cases)Jigeesha BhargaviNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document18 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Arjun VermaNo ratings yet

- ALACDocument18 pagesALACshruthisreehkNo ratings yet

- SegmentsDocument5 pagesSegmentsehpubguc1No ratings yet

- Name: Avishchal Shivneel Chand Student ID: S11171687Document3 pagesName: Avishchal Shivneel Chand Student ID: S11171687Avishchal ChandNo ratings yet

- Peter5 QnADocument8 pagesPeter5 QnAAnsong KennedyNo ratings yet

- Q3 2017 PFE Earnings ReleaseDocument38 pagesQ3 2017 PFE Earnings ReleaseSérgioNo ratings yet

- BUSN AssigmentDocument4 pagesBUSN AssigmentMalik Khurram AwanNo ratings yet

- 2 FunctionsDocument17 pages2 FunctionsSalman AhmadNo ratings yet

- NON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationDocument2 pagesNON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationlaskarmohinNo ratings yet

- 2011 Pre-Budget PresentationDocument25 pages2011 Pre-Budget PresentationlabradoreNo ratings yet

- Chapter 2 Financial Statements Cash Flow and TaxesDocument7 pagesChapter 2 Financial Statements Cash Flow and TaxesM. HasanNo ratings yet

- Results For Announcement To The MarketDocument63 pagesResults For Announcement To The MarketTimBarrowsNo ratings yet

- APT Tax AssignmentDocument11 pagesAPT Tax AssignmentMalik JavidNo ratings yet

- PayslipDocument2 pagesPayslipjzeb.gonzales18No ratings yet

- MGT 225 Intermediate Accounting IIDocument6 pagesMGT 225 Intermediate Accounting IIchetna sharmaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Individual & Family Service Revenues World Summary: Market Values & Financials by CountryFrom EverandIndividual & Family Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Activities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandActivities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Direct Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryFrom EverandDirect Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- The Nigeria of My DreamsDocument2 pagesThe Nigeria of My DreamsifelakojaofinNo ratings yet

- Pol 1101 Syllabus Spring 2020Document11 pagesPol 1101 Syllabus Spring 2020bennyNo ratings yet

- Bombastic Words For SPM EssayDocument11 pagesBombastic Words For SPM EssayAmirul Zaki100% (3)

- v3.2 Data Risk Analytics User Guide 3-21-2023Document236 pagesv3.2 Data Risk Analytics User Guide 3-21-2023singhpriyank.psNo ratings yet

- Gastech2008 Macdonald MaguireDocument6 pagesGastech2008 Macdonald Maguire463990305No ratings yet

- Test SheetDocument40 pagesTest Sheetashfaq123No ratings yet

- GG October 2023 FinalDocument3 pagesGG October 2023 Finalapi-250691083No ratings yet

- Trail, G. T. (2018) - Theories of Consumer Behavior - Chapter 2. Seattle, WA: Sport Consumer Research Consultants LLCDocument35 pagesTrail, G. T. (2018) - Theories of Consumer Behavior - Chapter 2. Seattle, WA: Sport Consumer Research Consultants LLCMargoNo ratings yet

- Partnership Law Atty. Macmod: Multiple ChoiceDocument10 pagesPartnership Law Atty. Macmod: Multiple ChoiceJomarNo ratings yet

- Reminiscences of Madame Sidney PrattenDocument121 pagesReminiscences of Madame Sidney PrattenjavisatrianiNo ratings yet

- Envision 2014 Article 3Document9 pagesEnvision 2014 Article 3Kartik KNo ratings yet

- Bharti Airtel in Africa: Case AnalysisDocument5 pagesBharti Airtel in Africa: Case Analysisyash sharmaNo ratings yet

- Curriculum Vitae - Mike Meaney: ProfileDocument3 pagesCurriculum Vitae - Mike Meaney: ProfilemikemeaneyNo ratings yet

- The AchaeansDocument17 pagesThe AchaeansjanouspogiNo ratings yet

- Contract II Assignment 1,1 2024Document6 pagesContract II Assignment 1,1 2024namwinga77No ratings yet

- Chinchilla Cookie Recipe - LY ChinchillasDocument5 pagesChinchilla Cookie Recipe - LY ChinchillasSandy B GuzmánNo ratings yet

- Tague BK Jefferson Capital Systems LLC PDFDocument3 pagesTague BK Jefferson Capital Systems LLC PDFghostgripNo ratings yet

- Scientific Method Test Study Guide2Document4 pagesScientific Method Test Study Guide2Gabriel TaylorNo ratings yet

- Jan Bremmer Initiation Into The Mysteries of The Ancient World PDFDocument260 pagesJan Bremmer Initiation Into The Mysteries of The Ancient World PDFDanilo Bevilacqua100% (1)

- Oracle® Territory Manager: User Guide Release 12.1Document80 pagesOracle® Territory Manager: User Guide Release 12.1Marcelo MestiNo ratings yet

- CatalogueDocument230 pagesCatalogueOsama_Othman01100% (1)

- Unit 6 Filipino Nationalism and Birth of The Nation Date and TimeDocument8 pagesUnit 6 Filipino Nationalism and Birth of The Nation Date and TimeIsabel FlonascaNo ratings yet

- FTS-3 (CODE-B) - QP - Solution 30-03-2020 - E - 0 PDFDocument26 pagesFTS-3 (CODE-B) - QP - Solution 30-03-2020 - E - 0 PDFaleemhakNo ratings yet

- (11 I PM2-Template v3) Requirements - Management - Plan (ProjectName) (Dd-Mm-Yyyy) (VX X)Document11 pages(11 I PM2-Template v3) Requirements - Management - Plan (ProjectName) (Dd-Mm-Yyyy) (VX X)rodrigo lopezNo ratings yet

- 01 Diabetes Mellitus Type2Document39 pages01 Diabetes Mellitus Type2Che HaniffNo ratings yet

- What Is Literature?Document6 pagesWhat Is Literature?MsVerna GingoNo ratings yet

- Portage Manor PresentationDocument19 pagesPortage Manor PresentationWNDUNo ratings yet