Professional Documents

Culture Documents

Case Studies

Case Studies

Uploaded by

jdbridgesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Studies

Case Studies

Uploaded by

jdbridgesCopyright:

Available Formats

Northwestern Accelerated CFP Program

January 2010 Start

Retirement Planning, Module 501

Case Studies

1. Peter (age 55) is the sole-owner of Parker Incorporated. This year he expects to make

$150,000 in compensation of which he’d like to save $30,000 in some type of retirement

vehicle. Peter does have one employee, Mary Jane, who has worked with Peter for the

last eight years. Mary Jane works 250 hours each year and makes $3,000 annually. Peter

would prefer not to make any contributions for her if possible.

What type of retirement plan would you recommend to Peter? Why?

2. For the last 12 years, Clark (age 40) has maintained a full time job assembling planes at

Boing, Inc. He is eligible for and contributes $16,500 into the Boing 401(k) plan.

Boing’s matching contribution is $4,125 for the year. On the side, Clark has been

working as a freelance reporter and expects to make $25,000 for the year. His Boing

salary is more than enough to cover his spending needs so he’d like to set up a retirement

plan that will allow him to defer as much of his side income as possible.

What type of retirement plan would you recommend to Clark? Why?

3. Reed (age 55) and Sue (age 53) have spent the last seven years building up a very

successful protection agency (they are married). Their company, FF Inc., has been able

to pay them each $175,000 for the last six years and they expect this to continue for years

to come. They have several large sources of income (mostly royalties) and would have

no problem (and would prefer) sheltering a large portion of their income.

What type of retirement plan would you recommend to Reed and Sue? Why?

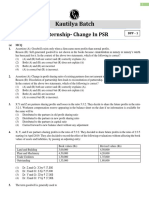

4. Helen is the owner of NKredible, Inc. She is looking to set up a retirement plan to allow

her and her four employees to save towards their own retirement. Because the firm has

been so successful, Helen is willing to provide some additional contributions (if

reasonable and predictable) for the employees. She has polled her employees and has

provided you the following information:

Amount

Annual

Employee Years Employed Expected to

Compensation

Defer

Helen (owner) 12 (full time) $85,000 $10,000

Bob 10 (full time) $35,000 $0

Violet 8 (full time) $30,000 $2,000

Dashiell 6 (full time) $25,000 $0

Jack J 3 (full time) $15,000 $0

What type of retirement plan would you recommend to Helen? Why?

You might also like

- Morris - Breann - Exam #3 Fall 2020Document3 pagesMorris - Breann - Exam #3 Fall 2020Breann MorrisNo ratings yet

- Intermediate Accounting Vol 2 Canadian 2nd Edition Lo Test BankDocument46 pagesIntermediate Accounting Vol 2 Canadian 2nd Edition Lo Test Banklegacycoupablemf2100% (28)

- Exam 3 February 2018, Questions and AnswersDocument6 pagesExam 3 February 2018, Questions and AnswersjohnNo ratings yet

- February Payslip 2023.pdf - 1-2Document1 pageFebruary Payslip 2023.pdf - 1-2Arbaz KhanNo ratings yet

- Assignment - Chapter 5 - Problem 51 (Due 10.11.20)Document1 pageAssignment - Chapter 5 - Problem 51 (Due 10.11.20)Tenaj KramNo ratings yet

- TVM ProblemsDocument4 pagesTVM Problemsshikha_asr2273No ratings yet

- Termination of Employment PolicyDocument9 pagesTermination of Employment PolicyKirubakaran ShanmugamNo ratings yet

- Chapter 12Document50 pagesChapter 12Bunda JuliaNo ratings yet

- PlanningDocument121 pagesPlanningThessaloe B. FernandezNo ratings yet

- Payroll Assignment 7Document2 pagesPayroll Assignment 7RocaHardNo ratings yet

- EmpBen Practice SetDocument1 pageEmpBen Practice SetCassyNo ratings yet

- Chap 6 RevisionDocument3 pagesChap 6 RevisionTên Hay Thế0% (1)

- Chapter 10 HWDocument6 pagesChapter 10 HWAlysha Harvey EANo ratings yet

- 17 Altprob 7eDocument6 pages17 Altprob 7eAshish BhallaNo ratings yet

- FourfriendsDocument3 pagesFourfriendslexuslukehart2006No ratings yet

- 118 Homework QuestionsDocument3 pages118 Homework QuestionscarlacauntayNo ratings yet

- Sample - Chapter 5 - Problem 51 (Due 10.11.20)Document2 pagesSample - Chapter 5 - Problem 51 (Due 10.11.20)Tenaj KramNo ratings yet

- Fin 517 - Take Home ExamDocument3 pagesFin 517 - Take Home ExamJennifer PearsallNo ratings yet

- Payroll Assignment 7 2021Document2 pagesPayroll Assignment 7 2021RocaHardNo ratings yet

- Law Consulting Sales Pitch by SlidesgoDocument21 pagesLaw Consulting Sales Pitch by SlidesgoAnupriyaNo ratings yet

- Case Study - 1 - Financial PlanningDocument4 pagesCase Study - 1 - Financial PlanningJyoti GoyalNo ratings yet

- PartnershipDocument6 pagesPartnershipMbatutes50% (2)

- Retirement Planning - Final Exam Tuesday, April 7, 2020, 12:00 Noon To 2:00 PM (2.0 Hours)Document17 pagesRetirement Planning - Final Exam Tuesday, April 7, 2020, 12:00 Noon To 2:00 PM (2.0 Hours)Harshi SoniNo ratings yet

- Chap 12 HW Problems TextDocument3 pagesChap 12 HW Problems Textzhouzhu211No ratings yet

- Sample Case StudYDocument11 pagesSample Case StudYArun SahooNo ratings yet

- FINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Document7 pagesFINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Sheikh HasanNo ratings yet

- Stock Valuation Assignment Lpu Review No AnswerDocument5 pagesStock Valuation Assignment Lpu Review No Answerjackie delos santosNo ratings yet

- Investments Quiz 3-Key-1Document6 pagesInvestments Quiz 3-Key-1Hashaam JavedNo ratings yet

- Partnership Formation Quiz Assignment: 1. Partnership Income Allocation-Bonus (3pts)Document3 pagesPartnership Formation Quiz Assignment: 1. Partnership Income Allocation-Bonus (3pts)Ciarwena PangcogaNo ratings yet

- 2010-10-13 142418 HerbertDocument1 page2010-10-13 142418 HerbertSherif ElkadyNo ratings yet

- CasesDocument18 pagesCasesparmendra_singh25No ratings yet

- RETIREMENT PLANNING - Background InformationDocument3 pagesRETIREMENT PLANNING - Background InformationAngelo OdalNo ratings yet

- Practice Test MidtermDocument6 pagesPractice Test Midtermzm05280No ratings yet

- BF Assign1Document3 pagesBF Assign1Mian Shawal67% (3)

- 2020 Assignment 2Document6 pages2020 Assignment 2mohamedNo ratings yet

- Each Year The Schriber Corporation Must Determine How Much ToDocument1 pageEach Year The Schriber Corporation Must Determine How Much ToAmit PandeyNo ratings yet

- Assignment 3 Dividen Policy: Brigham, E.F. and Houston, J.F., 2015. Fundamentals of Financial Management. CengageDocument3 pagesAssignment 3 Dividen Policy: Brigham, E.F. and Houston, J.F., 2015. Fundamentals of Financial Management. CengageHIRA KALEEMNo ratings yet

- HfughreuDocument6 pagesHfughreuPeishi OngNo ratings yet

- Final RevisionDocument9 pagesFinal RevisionVo Phuc An (K17 HCM)No ratings yet

- BA 118.1 17-18 Partnership Assignment 1Document1 pageBA 118.1 17-18 Partnership Assignment 1Acads LangNo ratings yet

- HW3 ProblemDocument1 pageHW3 Problemعبدالله ماجد المطارنه100% (1)

- Why ULIPs Are Better Than FDs NewDocument7 pagesWhy ULIPs Are Better Than FDs Newkirang gandhiNo ratings yet

- Test - Chapter 5Document3 pagesTest - Chapter 5Phương Anh NguyễnNo ratings yet

- OSX ManagerialAccounting Ch11 PPTDocument47 pagesOSX ManagerialAccounting Ch11 PPTDiệp ThanhNo ratings yet

- Instructions: Please Answer Each of The Seven (7) Practice Problems Below. Also, Please AlsoDocument2 pagesInstructions: Please Answer Each of The Seven (7) Practice Problems Below. Also, Please AlsoShameem KhaledNo ratings yet

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyFrom EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyNo ratings yet

- Kap 1 6th Workbook Te CH 11Document38 pagesKap 1 6th Workbook Te CH 11Gurpreet KaurNo ratings yet

- Arvind's Net Worth: Exhibit 1: Before Tax Salary and Other Benefit Details of Mr. Arvind As On 30 May 2018Document2 pagesArvind's Net Worth: Exhibit 1: Before Tax Salary and Other Benefit Details of Mr. Arvind As On 30 May 2018jk kumarNo ratings yet

- Assign 2Document3 pagesAssign 2Abdul Moqeet100% (1)

- Chapter 1 Class ActivityDocument3 pagesChapter 1 Class Activityusman aliNo ratings yet

- Case Study 4 PDFDocument5 pagesCase Study 4 PDFangeliaNo ratings yet

- Sample Exam QuestionsDocument7 pagesSample Exam QuestionsQian LuNo ratings yet

- As 1Document4 pagesAs 1Lê AnhNo ratings yet

- Avast CodesDocument4 pagesAvast CodesS Comm. 2013No ratings yet

- Quiz 1&2 - IiDocument29 pagesQuiz 1&2 - IiJenz Crisha PazNo ratings yet

- Change in PSR 1 PDFDocument6 pagesChange in PSR 1 PDFNavya jainNo ratings yet

- Quiz 101Document1 pageQuiz 101Mohammad Lomondot AmpasoNo ratings yet

- FIN 438 Practice ProblemsDocument5 pagesFIN 438 Practice ProblemstayyabNo ratings yet

- The Big Sho (R) T-Prelim 1-SRCC Business Conclave 2021Document8 pagesThe Big Sho (R) T-Prelim 1-SRCC Business Conclave 2021vishesh jainNo ratings yet

- Finance ProblemsDocument5 pagesFinance Problemsstannis69420No ratings yet

- FIN 3331 Critical Thinking AssignmentDocument3 pagesFIN 3331 Critical Thinking AssignmentHelen Joan BuiNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 11: Dividend and Share Repurchases (Common Questions)Document2 pagesNanyang Business School AB1201 Financial Management Tutorial 11: Dividend and Share Repurchases (Common Questions)asdsadsaNo ratings yet

- FINANCE 6301 Individual Assignment #1 PJM Due February 29, 2016Document3 pagesFINANCE 6301 Individual Assignment #1 PJM Due February 29, 2016Sijo VMNo ratings yet

- Villain City: Photography Jack Bridges Text Anuj DesaiDocument4 pagesVillain City: Photography Jack Bridges Text Anuj DesaijdbridgesNo ratings yet

- Chapter 4 5 6 QADocument9 pagesChapter 4 5 6 QAjdbridgesNo ratings yet

- Chapter 21 QADocument2 pagesChapter 21 QAjdbridgesNo ratings yet

- Insurance Textbook Chapter 1 Answers - 3rdeditionDocument3 pagesInsurance Textbook Chapter 1 Answers - 3rdeditionjdbridgesNo ratings yet

- Insurance Planning Course SyllabusDocument11 pagesInsurance Planning Course SyllabusjdbridgesNo ratings yet

- Night Work and Night Shift Differential (R.a. No. 10151)Document4 pagesNight Work and Night Shift Differential (R.a. No. 10151)Den ZyoNo ratings yet

- Social StratificationDocument17 pagesSocial StratificationAlisha ShabbirNo ratings yet

- Internship Report On Human Resource Department of Courtyard by Marriott - Surat byDocument83 pagesInternship Report On Human Resource Department of Courtyard by Marriott - Surat byRiya KingerNo ratings yet

- Non Compete ClauseDocument3 pagesNon Compete ClauseWhere Did Macky GallegoNo ratings yet

- (Project) Effectiveness of Training and Development - ProgrammeDocument84 pages(Project) Effectiveness of Training and Development - Programmesamarth agarwalNo ratings yet

- Google's - Training, Performance ManagementDocument3 pagesGoogle's - Training, Performance Managementswamy222225076No ratings yet

- ELEM0317ra Manila PDFDocument389 pagesELEM0317ra Manila PDFPhilBoardResults100% (2)

- Nguyễn Lê Khả Anh (Unit 6)Document11 pagesNguyễn Lê Khả Anh (Unit 6)Nguyen Le Kha AnhNo ratings yet

- A Study On Labor Welfare Measures at SAIL (Salem Steel Plant)Document90 pagesA Study On Labor Welfare Measures at SAIL (Salem Steel Plant)Vishu ThakurNo ratings yet

- Questionnaire: Psychological Safety Climate Effect Employee PerformanceDocument2 pagesQuestionnaire: Psychological Safety Climate Effect Employee PerformanceMahnoor ShahbazNo ratings yet

- ACCA AB (F1) Course Notes PDFDocument379 pagesACCA AB (F1) Course Notes PDFSiham SajjadNo ratings yet

- KPMG Final ReportDocument92 pagesKPMG Final ReportFortMacToday100% (1)

- Labor Reviewer - WagesDocument22 pagesLabor Reviewer - WagesMikaela Pamatmat100% (1)

- The O Pen Plan Is Your Friend: by Brian SchwellingerDocument4 pagesThe O Pen Plan Is Your Friend: by Brian SchwellingerMartin R LopezNo ratings yet

- Anna Chernyshova Constance de Patoul Francisco Catarino Irina Malinovskaya Miguel SaraivaDocument21 pagesAnna Chernyshova Constance de Patoul Francisco Catarino Irina Malinovskaya Miguel SaraivaFrancisco CatarinoNo ratings yet

- Deber 1Document4 pagesDeber 1JoselynNo ratings yet

- Macro5118 2017bDocument28 pagesMacro5118 2017bWong Yan LiNo ratings yet

- GAS 11 Reading and WritingDocument52 pagesGAS 11 Reading and WritingEditha FernandezNo ratings yet

- Content0312 ZamDocument102 pagesContent0312 ZamNonoyTaclinoNo ratings yet

- Shipman 2009 Part I - IMWDocument16 pagesShipman 2009 Part I - IMWTong SepamNo ratings yet

- Impact of GST On Logistic Sector in IndiaDocument12 pagesImpact of GST On Logistic Sector in IndiaAshwathej100% (1)

- Mine LegislationDocument2 pagesMine LegislationTeddy Jane Castorico EncendenciaNo ratings yet

- Business Writing SkillsDocument99 pagesBusiness Writing SkillsvijayNo ratings yet

- Safety Welfare KSRTC Final (Recovered)Document106 pagesSafety Welfare KSRTC Final (Recovered)Anonymous QrLiISmpFNo ratings yet

- Paper 1Document109 pagesPaper 1srikanth_ravindra0% (1)

- Second Division June 28, 2017 G.R. No. 214500 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee Michelle Dela Cruz, Decision Peralta, J.Document14 pagesSecond Division June 28, 2017 G.R. No. 214500 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee Michelle Dela Cruz, Decision Peralta, J.Sandra DomingoNo ratings yet