Professional Documents

Culture Documents

Obama Tax Plan: Montana

Obama Tax Plan: Montana

Uploaded by

The Heritage FoundationCopyright:

Available Formats

You might also like

- Mandate For Leadership Policy RecommendationsDocument19 pagesMandate For Leadership Policy RecommendationsThe Heritage Foundation78% (50)

- EY Content Paper Based AssessmentDocument10 pagesEY Content Paper Based Assessmentcatherine100% (3)

- Obama Tax Plan: WyomingDocument2 pagesObama Tax Plan: WyomingThe Heritage FoundationNo ratings yet

- Obama Tax Plan: VermontDocument2 pagesObama Tax Plan: VermontThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MaineDocument2 pagesObama Tax Plan: MaineThe Heritage FoundationNo ratings yet

- Obama Tax Plan: WashingtonDocument2 pagesObama Tax Plan: WashingtonThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Impact On DCDocument2 pagesObama Tax Plan: Impact On DCThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Rhode IslandDocument2 pagesObama Tax Plan: Rhode IslandThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MississippiDocument2 pagesObama Tax Plan: MississippiThe Heritage FoundationNo ratings yet

- Obama Tax Plan: NebraskaDocument2 pagesObama Tax Plan: NebraskaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: KansasDocument2 pagesObama Tax Plan: KansasThe Heritage FoundationNo ratings yet

- Obama Tax Plan: New MexicoDocument2 pagesObama Tax Plan: New MexicoThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Impact On AlaskaDocument2 pagesObama Tax Plan: Impact On AlaskaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MinnesotaDocument2 pagesObama Tax Plan: MinnesotaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: TennesseeDocument2 pagesObama Tax Plan: TennesseeThe Heritage FoundationNo ratings yet

- Obama Tax Plan: North DakotaDocument2 pagesObama Tax Plan: North DakotaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: OklahomaDocument2 pagesObama Tax Plan: OklahomaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: NevadaDocument2 pagesObama Tax Plan: NevadaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MarylandDocument2 pagesObama Tax Plan: MarylandThe Heritage FoundationNo ratings yet

- Obama Tax Plan: North CarolinaDocument2 pagesObama Tax Plan: North CarolinaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: OregonDocument2 pagesObama Tax Plan: OregonThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Impact On IdahoDocument2 pagesObama Tax Plan: Impact On IdahoThe Heritage FoundationNo ratings yet

- Obama Tax Plan: New JerseyDocument2 pagesObama Tax Plan: New JerseyThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MissouriDocument2 pagesObama Tax Plan: MissouriThe Heritage FoundationNo ratings yet

- Obama Tax Plan: KentuckyDocument2 pagesObama Tax Plan: KentuckyThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Impact On HawaiiDocument2 pagesObama Tax Plan: Impact On HawaiiThe Heritage FoundationNo ratings yet

- Obama Tax Plan: LouisianaDocument2 pagesObama Tax Plan: LouisianaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MichiganDocument2 pagesObama Tax Plan: MichiganThe Heritage FoundationNo ratings yet

- Obama Tax Plan: WisconsinDocument2 pagesObama Tax Plan: WisconsinThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MassachusettsDocument2 pagesObama Tax Plan: MassachusettsThe Heritage FoundationNo ratings yet

- Obama Tax Plan: VirginiaDocument2 pagesObama Tax Plan: VirginiaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: New YorkDocument2 pagesObama Tax Plan: New YorkThe Heritage FoundationNo ratings yet

- Obama Tax Plan: PennsylvaniaDocument2 pagesObama Tax Plan: PennsylvaniaThe Heritage FoundationNo ratings yet

- Spending, Taxes, & Deficits: A Book of Charts: Brian Riedl Senior Fellow, Manhattan Institute October 2020Document100 pagesSpending, Taxes, & Deficits: A Book of Charts: Brian Riedl Senior Fellow, Manhattan Institute October 2020Brian RiedlNo ratings yet

- Extract From 2013 Housing Needs AssessmentDocument8 pagesExtract From 2013 Housing Needs Assessment3x4 ArchitectureNo ratings yet

- BudgetChartBook 2022 1Document128 pagesBudgetChartBook 2022 1Team USANo ratings yet

- The Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020Document9 pagesThe Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020go joNo ratings yet

- 2012 New Tax TableDocument1 page2012 New Tax TableHelen BennettNo ratings yet

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsNo ratings yet

- ECO121 - Test 01 - Individual Assignment 01 - PQM UpdatedDocument6 pagesECO121 - Test 01 - Individual Assignment 01 - PQM UpdatedNguyen Thi Thu Phuong (K16HL)No ratings yet

- Kansas Farm Family Living ReportDocument3 pagesKansas Farm Family Living ReportKeri StrahlerNo ratings yet

- Accounting in BusinessesDocument5 pagesAccounting in BusinessesNyesha GarbuttNo ratings yet

- Rate+Sheet+and+Examples 2Document3 pagesRate+Sheet+and+Examples 2mayordrillNo ratings yet

- Today's Market : Springfield Area Local Market Report, Third Quarter 2010Document7 pagesToday's Market : Springfield Area Local Market Report, Third Quarter 2010phatty34No ratings yet

- IPA Research Note May 2024 Per Capita GDP FINALDocument2 pagesIPA Research Note May 2024 Per Capita GDP FINALmrchenendureNo ratings yet

- EBA Case Solution CH 3Document4 pagesEBA Case Solution CH 3Abhinav MukherjeeNo ratings yet

- Employment March 2011Document38 pagesEmployment March 2011Nathan MartinNo ratings yet

- LacprofitandlossstatementDocument3 pagesLacprofitandlossstatementBaris MironNo ratings yet

- Fried TC Tacoma 10-06-14Document27 pagesFried TC Tacoma 10-06-14Brackett427No ratings yet

- Paystub 119316Document1 pagePaystub 119316marcelNo ratings yet

- Nation's Income ExerciseDocument3 pagesNation's Income ExerciseMaybeline Lee100% (1)

- Mark Weisbrot Presentation On "The Scorecard On Development 1960-2016: China and The Global Economic Rebound"Document17 pagesMark Weisbrot Presentation On "The Scorecard On Development 1960-2016: China and The Global Economic Rebound"Center for Economic and Policy Research100% (1)

- Homework For Chapter 10 - AnswersDocument9 pagesHomework For Chapter 10 - AnswersisabelNo ratings yet

- Did The Nation Overdose On Debt?: Economics GroupDocument8 pagesDid The Nation Overdose On Debt?: Economics Groupcliff_kuleNo ratings yet

- Grandview Shopping Center Demographics 2016Document10 pagesGrandview Shopping Center Demographics 2016shaolinbrNo ratings yet

- Jeff 030109Document14 pagesJeff 030109Hummels1000No ratings yet

- TimelyBills Sample Monthly ReportDocument10 pagesTimelyBills Sample Monthly Reportairlton nascimentoNo ratings yet

- 2010 US Govt Financial Report SummaryDocument12 pages2010 US Govt Financial Report SummarytritrantranNo ratings yet

- MECEP Tax Plan Review 10 May 2011Document2 pagesMECEP Tax Plan Review 10 May 2011gerald7783No ratings yet

- Obama’S Wonder Years: 8 Years of Lower Unemployment & Rising Stock MarketsFrom EverandObama’S Wonder Years: 8 Years of Lower Unemployment & Rising Stock MarketsNo ratings yet

- U.S Economy, Construction Industry, and Residential Market Crisis and Recovery, 2000-2019From EverandU.S Economy, Construction Industry, and Residential Market Crisis and Recovery, 2000-2019No ratings yet

- 2018 Index of Military Strength Naval DomainDocument15 pages2018 Index of Military Strength Naval DomainThe Heritage Foundation100% (2)

- 2018 Index of Military Strength JointDocument9 pages2018 Index of Military Strength JointThe Heritage FoundationNo ratings yet

- 2018 Index of Military Strength CyberDocument16 pages2018 Index of Military Strength CyberThe Heritage Foundation100% (2)

- Smith, Weber Letter To Mnuchin Re Russia and Green GroupsDocument6 pagesSmith, Weber Letter To Mnuchin Re Russia and Green GroupsThe Heritage Foundation100% (3)

- 2018 Index of Military Strength SpaceDocument11 pages2018 Index of Military Strength SpaceThe Heritage FoundationNo ratings yet

- Merritt TX ComplaintDocument2 pagesMerritt TX ComplaintThe Heritage FoundationNo ratings yet

- 2018 Index of Military Strength Land DomainDocument14 pages2018 Index of Military Strength Land DomainThe Heritage FoundationNo ratings yet

- 2015 Hudson NoticeDocument126 pages2015 Hudson NoticeThe Heritage FoundationNo ratings yet

- Comparing GOP Health Care BillsDocument1 pageComparing GOP Health Care BillsThe Heritage Foundation100% (1)

- Smith, Weber Letter To Mnuchin Re Russia and Green GroupsDocument6 pagesSmith, Weber Letter To Mnuchin Re Russia and Green GroupsThe Heritage Foundation100% (3)

- 2018 Index of Military Strength Air Domain EssayDocument15 pages2018 Index of Military Strength Air Domain EssayThe Heritage FoundationNo ratings yet

- Daleiden TX ComplaintDocument2 pagesDaleiden TX ComplaintThe Heritage FoundationNo ratings yet

- Motion To Dismiss in Bednar Forfeiture CaseDocument4 pagesMotion To Dismiss in Bednar Forfeiture CaseThe Heritage FoundationNo ratings yet

- Meadows Speaker ResolutionDocument2 pagesMeadows Speaker ResolutionFreedomWorksPolicyNo ratings yet

- Secret Service Affidavit For Seizure of Bednar FundsDocument12 pagesSecret Service Affidavit For Seizure of Bednar FundsThe Heritage FoundationNo ratings yet

- Requests For Admission From Kirkland and EllisDocument6 pagesRequests For Admission From Kirkland and EllisThe Heritage FoundationNo ratings yet

- Respondents Motion To Reopen Contested Case RecordDocument17 pagesRespondents Motion To Reopen Contested Case RecordThe Heritage FoundationNo ratings yet

- Order-Straughn Gorman CaseDocument27 pagesOrder-Straughn Gorman CaseThe Heritage FoundationNo ratings yet

- Conservative Action Project MemoDocument7 pagesConservative Action Project MemoThe Heritage FoundationNo ratings yet

- McLellan CaseDocument13 pagesMcLellan CaseThe Heritage FoundationNo ratings yet

- Charles Clarke Forfeiture CaseDocument9 pagesCharles Clarke Forfeiture CaseThe Heritage FoundationNo ratings yet

- Health Insurance Documents From The Franks FamilyDocument7 pagesHealth Insurance Documents From The Franks FamilyThe Heritage FoundationNo ratings yet

- Census Act 1960 (Act 16)Document15 pagesCensus Act 1960 (Act 16)Adam Haida & CoNo ratings yet

- The Canadian IndianDocument348 pagesThe Canadian IndianJan Pran100% (1)

- Japanese Immigrants in BrazilDocument23 pagesJapanese Immigrants in BrazilRene EudesNo ratings yet

- Report v.1.5 Gorakhpur FinalDocument118 pagesReport v.1.5 Gorakhpur FinalED - BankingNo ratings yet

- Density, Distancing, Informal Settlements and The Pandemic - Economic and Political WeeklyDocument5 pagesDensity, Distancing, Informal Settlements and The Pandemic - Economic and Political WeeklyamitdhingraNo ratings yet

- Sample ErrorDocument19 pagesSample ErrorŘüđĥirSiddhamNo ratings yet

- Population EstimationDocument32 pagesPopulation EstimationAbd AliNo ratings yet

- Freshman Geography Lecture 7Document59 pagesFreshman Geography Lecture 7Ethio Unity93% (14)

- Historical Glimpse of Dalongue Elementary SchoolDocument4 pagesHistorical Glimpse of Dalongue Elementary SchoolDaisy De VeraNo ratings yet

- Crosswoods Columbus Comprehensive PlanDocument138 pagesCrosswoods Columbus Comprehensive Planapi-267404258No ratings yet

- Concept Note Definition of Basic Terms in StatisticsDocument4 pagesConcept Note Definition of Basic Terms in StatisticsReychel LunaNo ratings yet

- The Color of Justice Racial and Ethnic Disparity in State PrisonsDocument25 pagesThe Color of Justice Racial and Ethnic Disparity in State PrisonsAnonymous Hl2zRwNo ratings yet

- Consumer and Industrial Buying Behaviour: Assignment No. 1Document9 pagesConsumer and Industrial Buying Behaviour: Assignment No. 1Manu MnNo ratings yet

- 8 Using Secondary DataDocument15 pages8 Using Secondary DataSAlamNo ratings yet

- 1.1 Constructing and Interpreting Visual Displays of DataDocument13 pages1.1 Constructing and Interpreting Visual Displays of Dataelmoelmoelmo2566No ratings yet

- Spurious VolatilityDocument37 pagesSpurious VolatilityVictor Hugo LontraNo ratings yet

- HEALTH - REAC - 11 - Hospital EmploymentDocument25 pagesHEALTH - REAC - 11 - Hospital EmploymentenfaraujoNo ratings yet

- CH 3 ConDocument3 pagesCH 3 ConPrincess Arielle KintanarNo ratings yet

- 2000 CesusDocument3 pages2000 Cesusapi-280857978No ratings yet

- Tiger ConservationDocument61 pagesTiger ConservationPooja BkNo ratings yet

- William W Marcum and Tennessee FinleyDocument5 pagesWilliam W Marcum and Tennessee FinleyStarfly MelungeonNo ratings yet

- Shs Economics Syllabus V FinalDocument114 pagesShs Economics Syllabus V FinalLeslie N.T. AnnanNo ratings yet

- Slave SurnamesDocument8 pagesSlave SurnamesAnonymous 7QjNuvoCpINo ratings yet

- We Are Not Removing Report by Kirsteen PatonDocument56 pagesWe Are Not Removing Report by Kirsteen PatonRolf Malungo de SouzaNo ratings yet

- Statistics and Probability TGDocument18 pagesStatistics and Probability TGMarissa Almaden CostimianoNo ratings yet

- Economic Base, Employment and Work AreasDocument40 pagesEconomic Base, Employment and Work Areasrevati chandakNo ratings yet

- Proceedings of The 1St Aagbs International Conference On Business Management 2014 Aicobm 2014 1St Edition Jaafar PyemanDocument54 pagesProceedings of The 1St Aagbs International Conference On Business Management 2014 Aicobm 2014 1St Edition Jaafar Pyemankenneth.london798100% (10)

- Primary Vs Secondary DataDocument7 pagesPrimary Vs Secondary DataJacob Toms Nalleparampil0% (1)

- Religious School Enrollment in Pakistan A Look at The Data: Tahir AndrabiDocument41 pagesReligious School Enrollment in Pakistan A Look at The Data: Tahir AndrabiKumar MakanaNo ratings yet

Obama Tax Plan: Montana

Obama Tax Plan: Montana

Uploaded by

The Heritage FoundationCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Obama Tax Plan: Montana

Obama Tax Plan: Montana

Uploaded by

The Heritage FoundationCopyright:

Available Formats

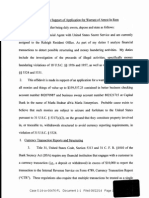

THE EFFECTS OF THE OBAMA TAX PLAN

Montana

President Obama’s tax plan would allow portions TOTAL EMPLOYMENT

of the 2001 and 2003 tax cuts to expire, resulting in Annual Change in Jobs

steep tax hikes beginning in January 2011 for small

2011 2015 2020

businesses and those earning $250,000 or more. 0

The tax hikes would significantly affect the economy

–300

in Montana, most notably in the number of jobs and

change in personal income. –600

–900

Among the results, from 2011 to 2020, the state

–1,200

of Montana would:

• Lose, on average, 2,291 jobs annually. –1,500

• Lose, per household, $6,642 in total disposable

–1,800

personal income.

• See total individual income taxes increase by –2,100

$1,112 million. –2,400

–2,700

Source: Heritage Foundation calculations based on the IHS Global

Insight U.S. macroeconomic model, and data from the U.S. Census –3,000

Bureau and U.S. Department of Labor, Bureau of Labor Statistics.

–2,894

REAL DISPOSABLE INCOME TOTAL INDIVIDUAL INCOME TAXES

Annual Change per Household Annual Change in Millions of Dollars

$137.9

2011 2015 2020

$0 $140

–$100

$120

–$200

$100

–$300

–$400 $80

–$500 $60

–$600

$40

–$700

$20

–$800

–$900 $0

2011 2015 2020

–$840.78

Chart MT • Obama Tax Plan by State heritage.org

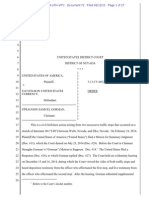

THE EFFECTS OF THE OBAMA TAX PLAN

Change in Employment in Montana

Average Annual Change in Total

Employment, 2011 to 2020, by

Congressional District

Jobs Lost: 800–1,399

Jobs Lost: 1,400–1,599

Jobs Lost: 1,600–1,799

Jobs Lost: 1,800–2,320

State: 2,291 jobs lost annually on average

Source: Heritage Foundation calculations based on the IHS Global Insight U.S. macroeconomic model, and data from the U.S. Census Bureau and U.S.

Department of Labor, Bureau of Labor Statistics.

Map MT • Obama Tax Plan by State heritage.org

You might also like

- Mandate For Leadership Policy RecommendationsDocument19 pagesMandate For Leadership Policy RecommendationsThe Heritage Foundation78% (50)

- EY Content Paper Based AssessmentDocument10 pagesEY Content Paper Based Assessmentcatherine100% (3)

- Obama Tax Plan: WyomingDocument2 pagesObama Tax Plan: WyomingThe Heritage FoundationNo ratings yet

- Obama Tax Plan: VermontDocument2 pagesObama Tax Plan: VermontThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MaineDocument2 pagesObama Tax Plan: MaineThe Heritage FoundationNo ratings yet

- Obama Tax Plan: WashingtonDocument2 pagesObama Tax Plan: WashingtonThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Impact On DCDocument2 pagesObama Tax Plan: Impact On DCThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Rhode IslandDocument2 pagesObama Tax Plan: Rhode IslandThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MississippiDocument2 pagesObama Tax Plan: MississippiThe Heritage FoundationNo ratings yet

- Obama Tax Plan: NebraskaDocument2 pagesObama Tax Plan: NebraskaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: KansasDocument2 pagesObama Tax Plan: KansasThe Heritage FoundationNo ratings yet

- Obama Tax Plan: New MexicoDocument2 pagesObama Tax Plan: New MexicoThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Impact On AlaskaDocument2 pagesObama Tax Plan: Impact On AlaskaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MinnesotaDocument2 pagesObama Tax Plan: MinnesotaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: TennesseeDocument2 pagesObama Tax Plan: TennesseeThe Heritage FoundationNo ratings yet

- Obama Tax Plan: North DakotaDocument2 pagesObama Tax Plan: North DakotaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: OklahomaDocument2 pagesObama Tax Plan: OklahomaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: NevadaDocument2 pagesObama Tax Plan: NevadaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MarylandDocument2 pagesObama Tax Plan: MarylandThe Heritage FoundationNo ratings yet

- Obama Tax Plan: North CarolinaDocument2 pagesObama Tax Plan: North CarolinaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: OregonDocument2 pagesObama Tax Plan: OregonThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Impact On IdahoDocument2 pagesObama Tax Plan: Impact On IdahoThe Heritage FoundationNo ratings yet

- Obama Tax Plan: New JerseyDocument2 pagesObama Tax Plan: New JerseyThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MissouriDocument2 pagesObama Tax Plan: MissouriThe Heritage FoundationNo ratings yet

- Obama Tax Plan: KentuckyDocument2 pagesObama Tax Plan: KentuckyThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Impact On HawaiiDocument2 pagesObama Tax Plan: Impact On HawaiiThe Heritage FoundationNo ratings yet

- Obama Tax Plan: LouisianaDocument2 pagesObama Tax Plan: LouisianaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MichiganDocument2 pagesObama Tax Plan: MichiganThe Heritage FoundationNo ratings yet

- Obama Tax Plan: WisconsinDocument2 pagesObama Tax Plan: WisconsinThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MassachusettsDocument2 pagesObama Tax Plan: MassachusettsThe Heritage FoundationNo ratings yet

- Obama Tax Plan: VirginiaDocument2 pagesObama Tax Plan: VirginiaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: New YorkDocument2 pagesObama Tax Plan: New YorkThe Heritage FoundationNo ratings yet

- Obama Tax Plan: PennsylvaniaDocument2 pagesObama Tax Plan: PennsylvaniaThe Heritage FoundationNo ratings yet

- Spending, Taxes, & Deficits: A Book of Charts: Brian Riedl Senior Fellow, Manhattan Institute October 2020Document100 pagesSpending, Taxes, & Deficits: A Book of Charts: Brian Riedl Senior Fellow, Manhattan Institute October 2020Brian RiedlNo ratings yet

- Extract From 2013 Housing Needs AssessmentDocument8 pagesExtract From 2013 Housing Needs Assessment3x4 ArchitectureNo ratings yet

- BudgetChartBook 2022 1Document128 pagesBudgetChartBook 2022 1Team USANo ratings yet

- The Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020Document9 pagesThe Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020go joNo ratings yet

- 2012 New Tax TableDocument1 page2012 New Tax TableHelen BennettNo ratings yet

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsNo ratings yet

- ECO121 - Test 01 - Individual Assignment 01 - PQM UpdatedDocument6 pagesECO121 - Test 01 - Individual Assignment 01 - PQM UpdatedNguyen Thi Thu Phuong (K16HL)No ratings yet

- Kansas Farm Family Living ReportDocument3 pagesKansas Farm Family Living ReportKeri StrahlerNo ratings yet

- Accounting in BusinessesDocument5 pagesAccounting in BusinessesNyesha GarbuttNo ratings yet

- Rate+Sheet+and+Examples 2Document3 pagesRate+Sheet+and+Examples 2mayordrillNo ratings yet

- Today's Market : Springfield Area Local Market Report, Third Quarter 2010Document7 pagesToday's Market : Springfield Area Local Market Report, Third Quarter 2010phatty34No ratings yet

- IPA Research Note May 2024 Per Capita GDP FINALDocument2 pagesIPA Research Note May 2024 Per Capita GDP FINALmrchenendureNo ratings yet

- EBA Case Solution CH 3Document4 pagesEBA Case Solution CH 3Abhinav MukherjeeNo ratings yet

- Employment March 2011Document38 pagesEmployment March 2011Nathan MartinNo ratings yet

- LacprofitandlossstatementDocument3 pagesLacprofitandlossstatementBaris MironNo ratings yet

- Fried TC Tacoma 10-06-14Document27 pagesFried TC Tacoma 10-06-14Brackett427No ratings yet

- Paystub 119316Document1 pagePaystub 119316marcelNo ratings yet

- Nation's Income ExerciseDocument3 pagesNation's Income ExerciseMaybeline Lee100% (1)

- Mark Weisbrot Presentation On "The Scorecard On Development 1960-2016: China and The Global Economic Rebound"Document17 pagesMark Weisbrot Presentation On "The Scorecard On Development 1960-2016: China and The Global Economic Rebound"Center for Economic and Policy Research100% (1)

- Homework For Chapter 10 - AnswersDocument9 pagesHomework For Chapter 10 - AnswersisabelNo ratings yet

- Did The Nation Overdose On Debt?: Economics GroupDocument8 pagesDid The Nation Overdose On Debt?: Economics Groupcliff_kuleNo ratings yet

- Grandview Shopping Center Demographics 2016Document10 pagesGrandview Shopping Center Demographics 2016shaolinbrNo ratings yet

- Jeff 030109Document14 pagesJeff 030109Hummels1000No ratings yet

- TimelyBills Sample Monthly ReportDocument10 pagesTimelyBills Sample Monthly Reportairlton nascimentoNo ratings yet

- 2010 US Govt Financial Report SummaryDocument12 pages2010 US Govt Financial Report SummarytritrantranNo ratings yet

- MECEP Tax Plan Review 10 May 2011Document2 pagesMECEP Tax Plan Review 10 May 2011gerald7783No ratings yet

- Obama’S Wonder Years: 8 Years of Lower Unemployment & Rising Stock MarketsFrom EverandObama’S Wonder Years: 8 Years of Lower Unemployment & Rising Stock MarketsNo ratings yet

- U.S Economy, Construction Industry, and Residential Market Crisis and Recovery, 2000-2019From EverandU.S Economy, Construction Industry, and Residential Market Crisis and Recovery, 2000-2019No ratings yet

- 2018 Index of Military Strength Naval DomainDocument15 pages2018 Index of Military Strength Naval DomainThe Heritage Foundation100% (2)

- 2018 Index of Military Strength JointDocument9 pages2018 Index of Military Strength JointThe Heritage FoundationNo ratings yet

- 2018 Index of Military Strength CyberDocument16 pages2018 Index of Military Strength CyberThe Heritage Foundation100% (2)

- Smith, Weber Letter To Mnuchin Re Russia and Green GroupsDocument6 pagesSmith, Weber Letter To Mnuchin Re Russia and Green GroupsThe Heritage Foundation100% (3)

- 2018 Index of Military Strength SpaceDocument11 pages2018 Index of Military Strength SpaceThe Heritage FoundationNo ratings yet

- Merritt TX ComplaintDocument2 pagesMerritt TX ComplaintThe Heritage FoundationNo ratings yet

- 2018 Index of Military Strength Land DomainDocument14 pages2018 Index of Military Strength Land DomainThe Heritage FoundationNo ratings yet

- 2015 Hudson NoticeDocument126 pages2015 Hudson NoticeThe Heritage FoundationNo ratings yet

- Comparing GOP Health Care BillsDocument1 pageComparing GOP Health Care BillsThe Heritage Foundation100% (1)

- Smith, Weber Letter To Mnuchin Re Russia and Green GroupsDocument6 pagesSmith, Weber Letter To Mnuchin Re Russia and Green GroupsThe Heritage Foundation100% (3)

- 2018 Index of Military Strength Air Domain EssayDocument15 pages2018 Index of Military Strength Air Domain EssayThe Heritage FoundationNo ratings yet

- Daleiden TX ComplaintDocument2 pagesDaleiden TX ComplaintThe Heritage FoundationNo ratings yet

- Motion To Dismiss in Bednar Forfeiture CaseDocument4 pagesMotion To Dismiss in Bednar Forfeiture CaseThe Heritage FoundationNo ratings yet

- Meadows Speaker ResolutionDocument2 pagesMeadows Speaker ResolutionFreedomWorksPolicyNo ratings yet

- Secret Service Affidavit For Seizure of Bednar FundsDocument12 pagesSecret Service Affidavit For Seizure of Bednar FundsThe Heritage FoundationNo ratings yet

- Requests For Admission From Kirkland and EllisDocument6 pagesRequests For Admission From Kirkland and EllisThe Heritage FoundationNo ratings yet

- Respondents Motion To Reopen Contested Case RecordDocument17 pagesRespondents Motion To Reopen Contested Case RecordThe Heritage FoundationNo ratings yet

- Order-Straughn Gorman CaseDocument27 pagesOrder-Straughn Gorman CaseThe Heritage FoundationNo ratings yet

- Conservative Action Project MemoDocument7 pagesConservative Action Project MemoThe Heritage FoundationNo ratings yet

- McLellan CaseDocument13 pagesMcLellan CaseThe Heritage FoundationNo ratings yet

- Charles Clarke Forfeiture CaseDocument9 pagesCharles Clarke Forfeiture CaseThe Heritage FoundationNo ratings yet

- Health Insurance Documents From The Franks FamilyDocument7 pagesHealth Insurance Documents From The Franks FamilyThe Heritage FoundationNo ratings yet

- Census Act 1960 (Act 16)Document15 pagesCensus Act 1960 (Act 16)Adam Haida & CoNo ratings yet

- The Canadian IndianDocument348 pagesThe Canadian IndianJan Pran100% (1)

- Japanese Immigrants in BrazilDocument23 pagesJapanese Immigrants in BrazilRene EudesNo ratings yet

- Report v.1.5 Gorakhpur FinalDocument118 pagesReport v.1.5 Gorakhpur FinalED - BankingNo ratings yet

- Density, Distancing, Informal Settlements and The Pandemic - Economic and Political WeeklyDocument5 pagesDensity, Distancing, Informal Settlements and The Pandemic - Economic and Political WeeklyamitdhingraNo ratings yet

- Sample ErrorDocument19 pagesSample ErrorŘüđĥirSiddhamNo ratings yet

- Population EstimationDocument32 pagesPopulation EstimationAbd AliNo ratings yet

- Freshman Geography Lecture 7Document59 pagesFreshman Geography Lecture 7Ethio Unity93% (14)

- Historical Glimpse of Dalongue Elementary SchoolDocument4 pagesHistorical Glimpse of Dalongue Elementary SchoolDaisy De VeraNo ratings yet

- Crosswoods Columbus Comprehensive PlanDocument138 pagesCrosswoods Columbus Comprehensive Planapi-267404258No ratings yet

- Concept Note Definition of Basic Terms in StatisticsDocument4 pagesConcept Note Definition of Basic Terms in StatisticsReychel LunaNo ratings yet

- The Color of Justice Racial and Ethnic Disparity in State PrisonsDocument25 pagesThe Color of Justice Racial and Ethnic Disparity in State PrisonsAnonymous Hl2zRwNo ratings yet

- Consumer and Industrial Buying Behaviour: Assignment No. 1Document9 pagesConsumer and Industrial Buying Behaviour: Assignment No. 1Manu MnNo ratings yet

- 8 Using Secondary DataDocument15 pages8 Using Secondary DataSAlamNo ratings yet

- 1.1 Constructing and Interpreting Visual Displays of DataDocument13 pages1.1 Constructing and Interpreting Visual Displays of Dataelmoelmoelmo2566No ratings yet

- Spurious VolatilityDocument37 pagesSpurious VolatilityVictor Hugo LontraNo ratings yet

- HEALTH - REAC - 11 - Hospital EmploymentDocument25 pagesHEALTH - REAC - 11 - Hospital EmploymentenfaraujoNo ratings yet

- CH 3 ConDocument3 pagesCH 3 ConPrincess Arielle KintanarNo ratings yet

- 2000 CesusDocument3 pages2000 Cesusapi-280857978No ratings yet

- Tiger ConservationDocument61 pagesTiger ConservationPooja BkNo ratings yet

- William W Marcum and Tennessee FinleyDocument5 pagesWilliam W Marcum and Tennessee FinleyStarfly MelungeonNo ratings yet

- Shs Economics Syllabus V FinalDocument114 pagesShs Economics Syllabus V FinalLeslie N.T. AnnanNo ratings yet

- Slave SurnamesDocument8 pagesSlave SurnamesAnonymous 7QjNuvoCpINo ratings yet

- We Are Not Removing Report by Kirsteen PatonDocument56 pagesWe Are Not Removing Report by Kirsteen PatonRolf Malungo de SouzaNo ratings yet

- Statistics and Probability TGDocument18 pagesStatistics and Probability TGMarissa Almaden CostimianoNo ratings yet

- Economic Base, Employment and Work AreasDocument40 pagesEconomic Base, Employment and Work Areasrevati chandakNo ratings yet

- Proceedings of The 1St Aagbs International Conference On Business Management 2014 Aicobm 2014 1St Edition Jaafar PyemanDocument54 pagesProceedings of The 1St Aagbs International Conference On Business Management 2014 Aicobm 2014 1St Edition Jaafar Pyemankenneth.london798100% (10)

- Primary Vs Secondary DataDocument7 pagesPrimary Vs Secondary DataJacob Toms Nalleparampil0% (1)

- Religious School Enrollment in Pakistan A Look at The Data: Tahir AndrabiDocument41 pagesReligious School Enrollment in Pakistan A Look at The Data: Tahir AndrabiKumar MakanaNo ratings yet