Professional Documents

Culture Documents

Withholding Tax Rate - 195

Withholding Tax Rate - 195

Uploaded by

avishal_jain0 ratings0% found this document useful (0 votes)

6 views1 pageThis document lists the tax treaty rates applicable between various countries, ranging from 7.5% to 20%. It provides the tax percentage for over 50 countries that have established double taxation avoidance agreements to prevent double taxation of income and capital between contracting states.

Original Description:

Original Title

Withholding Tax Rate -195

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document lists the tax treaty rates applicable between various countries, ranging from 7.5% to 20%. It provides the tax percentage for over 50 countries that have established double taxation avoidance agreements to prevent double taxation of income and capital between contracting states.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views1 pageWithholding Tax Rate - 195

Withholding Tax Rate - 195

Uploaded by

avishal_jainThis document lists the tax treaty rates applicable between various countries, ranging from 7.5% to 20%. It provides the tax percentage for over 50 countries that have established double taxation avoidance agreements to prevent double taxation of income and capital between contracting states.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

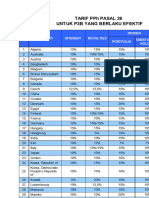

DTAA Rates Applicable for Various Countries.

Country Tax % Country Tax %

Australia 15% Namibia 10%

Austria 10% Nepal 15%

Bangladesh 10% Netherlands 10%

Belarus 10% New Zealand 10%

Belgium 15% Norway 15%

Brazil 15% Oman 10%

Bulgaria 15% Phillippines 15%

Canada 15% Poland 15%

China 10% Portuguese Rep 10%

Cyprus 10% Quatar 10%

Czech Rep 10% Romania 15%

Denmark 15% Russian Fed 10%

Germany 10% Singapore 15%

Finland 10% South Africa 10%

France 10% Spain 15%

Greece 20% Sri Lanka 10%

Hungary 10% Sweden 10%

Indonesia 10% Swiss 10%

Ireland 10% Syria 7.5.%

Israel 10% Tanzania 12.50.%

Italy 15% Thailand 20%

Japan 10% Trinidad&Tobago 10%

Jordan 10% Turkey 15%

Kazakstan 10% Turkmenistan 10%

Kenya 15% U A Emir 12.50.%

Korea 15% U A Repb 20%

Kyrgyz Rep 10% United Kingdom 15%

Libyan Arab 20% USA 15%

Malaysia 10% Uzbekistan 15%

Malta 10% Vietnam 10%

Mangolia 15% Zambia 10%

Maritius 20%

Morocco 10%

You might also like

- TX Text Control WordsDocument2 pagesTX Text Control Wordsritter.sjdNo ratings yet

- Us Index Group Tax Withholding TableDocument2 pagesUs Index Group Tax Withholding TableAnne G.No ratings yet

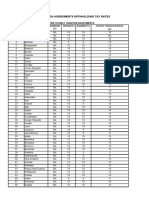

- Ringkasan Tarif P3B: Tax Learning: Tax Resume Ringkasan Tax TreatyDocument2 pagesRingkasan Tarif P3B: Tax Learning: Tax Resume Ringkasan Tax TreatyAchmad MudaniNo ratings yet

- Tarif Tax TreatyDocument2 pagesTarif Tax TreatyJokoWidodo0% (1)

- NO Nation Branch Profit Tax Dividends BPT Rate Exception For SPC Dividends PortfolioDocument4 pagesNO Nation Branch Profit Tax Dividends BPT Rate Exception For SPC Dividends PortfolioSatrio YuliawanNo ratings yet

- Tarif Pasal 26Document2 pagesTarif Pasal 26lelaleria11No ratings yet

- Daftar Tarif P3B IndonesiaDocument2 pagesDaftar Tarif P3B IndonesiaNurul ardiansahNo ratings yet

- Rangkuman Tarif P3BDocument5 pagesRangkuman Tarif P3BJuni PrastyanggaNo ratings yet

- Lampiran Surat Edaran Direktur Jenderal Pajak Nomor SE-2 - PJ.03 - 2008 PDFDocument3 pagesLampiran Surat Edaran Direktur Jenderal Pajak Nomor SE-2 - PJ.03 - 2008 PDFNadya Nurul ImaniNo ratings yet

- All CountriesDocument3 pagesAll CountriesbrnjarcevskiNo ratings yet

- Indiawitharnab CountrywiseDocument5 pagesIndiawitharnab CountrywiseRepublic WorldNo ratings yet

- Tds Rates As Per DtaaDocument3 pagesTds Rates As Per DtaamahiNo ratings yet

- TB 09 - TTLLTPQG - Gia CuocDocument4 pagesTB 09 - TTLLTPQG - Gia Cuocjenny luiNo ratings yet

- Name: Sanju Priya V Roll No: 1811142 Section: BDocument13 pagesName: Sanju Priya V Roll No: 1811142 Section: BSanju VisuNo ratings yet

- Summary of WHT Rates Under Oman Tax Treaties in Force PDFDocument2 pagesSummary of WHT Rates Under Oman Tax Treaties in Force PDFMoneycomeNo ratings yet

- Bang Zone DHLDocument1 pageBang Zone DHLTibhar Team 0520No ratings yet

- Porcentajes Aromas TpaDocument16 pagesPorcentajes Aromas TpaIván FerreteNo ratings yet

- Salatclock Usermanual Citycode Int PDFDocument36 pagesSalatclock Usermanual Citycode Int PDFMounir LazouziaNo ratings yet

- Zone Fan Courier Export Aerian: Tara Zona Tara Zona Tara Zona Tara ZonaDocument2 pagesZone Fan Courier Export Aerian: Tara Zona Tara Zona Tara Zona Tara ZonaFlorinTudoseNo ratings yet

- Double Taxation Agreement RatesDocument2 pagesDouble Taxation Agreement RatesNovialita RestutiNo ratings yet

- Preterm Births Per 100 Births 2010: CountryDocument4 pagesPreterm Births Per 100 Births 2010: CountryelsaNo ratings yet

- Barometer 20205Document11 pagesBarometer 20205ahmad ragabNo ratings yet

- Export2 2009Document2 pagesExport2 2009Lynda SchrumpfNo ratings yet

- Data GrafikDocument2 pagesData Grafikgrox2197No ratings yet

- Zone DHL 2018Document1 pageZone DHL 2018Kelly Tan Do BeverageNo ratings yet

- Origin and Destination Countries Zoning Table: Country Zone Country Zone Country Zone Country ZoneDocument2 pagesOrigin and Destination Countries Zoning Table: Country Zone Country Zone Country Zone Country ZoneMinh NguyenNo ratings yet

- DHL RateDocument6 pagesDHL RateJDS JICENo ratings yet

- Countries Joining BRI in Specific YearDocument11 pagesCountries Joining BRI in Specific Yearshubham chauhanNo ratings yet

- Popular Foods Around The World - by - UnfinanceDocument44 pagesPopular Foods Around The World - by - Unfinancevarun.ramchandaniNo ratings yet

- 2020 Global Hunger Index Scores, and Change Since 2000Document21 pages2020 Global Hunger Index Scores, and Change Since 2000lllNo ratings yet

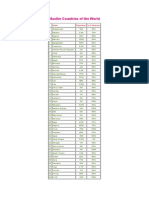

- Muslim Countries of The WorldDocument3 pagesMuslim Countries of The WorldMubashir TariqNo ratings yet

- Corporate Tax Rates 2017-2021Document8 pagesCorporate Tax Rates 2017-2021LM VS81No ratings yet

- BRASIL - Indicadores Econômicos e FinanceirosDocument255 pagesBRASIL - Indicadores Econômicos e Financeirosluiznogueira990No ratings yet

- Grand SlamDocument29 pagesGrand SlamEvik Dwi PriagungNo ratings yet

- Ussmax Jiormax Conejusred Dezer Chrisscarr Erquillo2000 Mendel Esmulet Palmero Indor Pepolacas Pizcolq Vappergun TristeroeDocument2 pagesUssmax Jiormax Conejusred Dezer Chrisscarr Erquillo2000 Mendel Esmulet Palmero Indor Pepolacas Pizcolq Vappergun TristeroeIván FerreteNo ratings yet

- Export 2010Document2 pagesExport 2010Lynda SchrumpfNo ratings yet

- Ielts Academic Top Nationality Frequency 2022Document4 pagesIelts Academic Top Nationality Frequency 2022Anh Trần TrungNo ratings yet

- Ielts General Training Top Nationality Frequency 2022Document4 pagesIelts General Training Top Nationality Frequency 2022Moo YuetyNo ratings yet

- Situatie Infectii Coronavirus (COVID-19) - 15.03.2020 PDFDocument6 pagesSituatie Infectii Coronavirus (COVID-19) - 15.03.2020 PDFDascalu AurelNo ratings yet

- NoodlesDocument19 pagesNoodlesPasliani 06No ratings yet

- TDS Rates Under DTAA Treaties: DividendDocument3 pagesTDS Rates Under DTAA Treaties: DividendRani AryaNo ratings yet

- Fresmith 101 - TFA Percentage RecommendationDocument5 pagesFresmith 101 - TFA Percentage RecommendationAkbar GaniNo ratings yet

- Project 3 IR - Blanca RaventosDocument5 pagesProject 3 IR - Blanca RaventosBLANCA RAVENTOS RIERANo ratings yet

- M Ridho HusaeniDocument16 pagesM Ridho HusaeniRidho HusaeniNo ratings yet

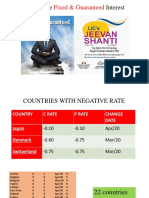

- Life Time Interest: Fixed & GuaranteedDocument47 pagesLife Time Interest: Fixed & Guaranteedkrishna-almightyNo ratings yet

- 1Document1 page1lucky.labialNo ratings yet

- GraphDocument2 pagesGraphShaaf AhmadNo ratings yet

- Duty Matrix India 2023.08Document2 pagesDuty Matrix India 2023.08RamkumarNo ratings yet

- Export ShareDocument1 pageExport Sharebackch9011No ratings yet

- Porcentaje de PaisesDocument9 pagesPorcentaje de PaisesDavid AlexanderNo ratings yet

- Situatie Infectii Coronavirus (COVID-19) - 19.03.2020Document7 pagesSituatie Infectii Coronavirus (COVID-19) - 19.03.2020Alina IancuNo ratings yet

- LBS Getting To Know You Survey ResponsesDocument25 pagesLBS Getting To Know You Survey ResponsesAung Myo KyawNo ratings yet

- Situatie Infectii Coronavirus (COVID-19) - 21.03.2020Document7 pagesSituatie Infectii Coronavirus (COVID-19) - 21.03.2020PAUL GoreanuNo ratings yet

- Situatie Infectii Coronavirus (COVID-19) - 21.03.2020 PDFDocument7 pagesSituatie Infectii Coronavirus (COVID-19) - 21.03.2020 PDFElena GadinaNo ratings yet

- EurostatDocument5 pagesEurostatthepressprojectNo ratings yet

- Government of Pakistan Ministry of Finance and Revenue (Revenue Division)Document12 pagesGovernment of Pakistan Ministry of Finance and Revenue (Revenue Division)qadeerfaziNo ratings yet