Professional Documents

Culture Documents

(Rs. in Crore) : Amfi Monthly August 2010 1/4

(Rs. in Crore) : Amfi Monthly August 2010 1/4

Uploaded by

ashish.lath1761Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Rs. in Crore) : Amfi Monthly August 2010 1/4

(Rs. in Crore) : Amfi Monthly August 2010 1/4

Uploaded by

ashish.lath1761Copyright:

Available Formats

706-708, Balarama, Bandra Kurla Complex, Bandra (East), Mumbai 400051.* Tel. (022) 26590243/ 46/ 0382 * Fax.

(022) 26590235/ 0209 * Website: http://www.amfiindia.com

VOLUME X ISSUE V

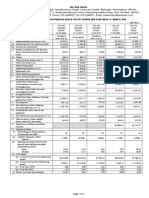

TABLE 1:- MUTUAL FUND DATA FOR THE MONTH - AUGUST 2010 (Rs. in Crore)

SALES - ALL SCHEMES REDEMPTIONS ALL SCHEMES

AVERAGE ASSETS

From Existing UNDER

CATEGORY From New Schemes # Cumulative Cumulative

Schemes Total for the April 2010 April 2010

MANAGEMENT

For the month FOR THE MONTH

month to to

No. Amount Amount August 2010 August 2010

A BANK SPONSORED

I JOINT VENTURES - PREDOMINANTLY INDIAN (2) 1 178 48,628 48,806 256,852 44,448 252,660 46,469

II JOINT VENTURES - PREDOMINANTLY FOREIGN (1) - - 11,018 11,018 45,535 11,468 43,436 4,726

III OTHERS (2) - - 78,634 78,634 374,836 73,063 373,602 66,570

TOTAL 'A' (I+II+III) 1 178 138,280 138,458 677,223 128,979 669,698 117,765

B INSTITUTIONS (1) - - 34,155 34,155 303,514 34,956 309,480 20,891

C PRIVATE SECTOR

I INDIAN (17) 16 4,291 238,646 242,937 1,408,146 231,747 1,382,687 211,292

II FOREIGN (6) $$ 5 1,442 27,039 28,481 89,495 22,693 80,163 53,986

III JOINT VENTURES - PREDOMINANTLY INDIAN (5) 11 3,707 230,643 234,350 1,345,551 223,573 1,313,862 260,536

IV JOINT VENTURES - PREDOMINANTLY FOREIGN (7) - - 28,748 28,748 130,984 28,996 127,637 23,088

TOTAL 'C' (I+II+III+IV) 32 9,440 525,076 534,516 2,974,176 507,009 2,904,349 548,902

GRAND TOTAL (A+B+C) 33 9,618 697,511 707,129 3,954,913 670,944 3,883,527 687,558

Figures for corresponding period of previous year 7 722 917,938 918,660 3,942,993 885,987 3,686,238 749,916

Released on 9.9.2010

Notes:

1. Data is provisional & hence subject to revision.

2. # Only New Schemes where allotment is completed.

3. $$There has been an increase in the number of AMCs to 6, due to inclusion of a new AMC - Pramerica Asset Managers Private Limited

AMFI MONTHLY August 2010 1/4

TABLE 2:- SALES DURING THE MONTH OF AUGUST 2010 - TYPE AND CATEGORY WISE (Rs. in Crore)

2.1 *NEW SCHEMES LAUNCHED (ALLOTMENT COMPLETED)

Open End Close End Interval Fund TOTAL

No.of Schemes Amount No.of Schemes Amount No.of Schemes Amount No.of Schemes Amount

INCOME 3 144 25 7,837 - - 28 7,981

EQUITY 1 178 - - - - 1 178

BALANCED 1 428 - - - - 1 428

LIQUID/MONEY MARKET 1 665 - - - - 1 665

GILT - - - - - - - -

ELSS - EQUITY - - - - - - - -

GOLD ETF 2 366 - - - - 2 366

OTHER ETFs - - - - - - - -

FUND OF FUNDS INVESTING

- - - - - - - -

OVERSEAS

TOTAL 8 1,781 25 7,837 - - 33 9,618

*NEW SCHEMES LAUNCHED :

OPEN END INCOME : Benchmark Short Term Fund; Peerless Short Term Fund and Tarus MIP Advantage Fund.

OPEN END EQUITY : Canara Robeco Large Cap+ Fund

OPEN END BALANCED : Axis Triple Advantage Fund

OPEN END LIQUITD : Pramerica Liquid Fund

OPEN END GOLD ETF : HDFC Gold Exchange Traded Fund and ICICI Prudential Gold Exchange Traded Fund.

DSP BlackRock FMP - 12M - Series 6, 3M - Series 18 and Series 19; DWS FTF Series 73; Fidelity FMP Series III Plan A and Plan B; Fortis Fixed Term Fund

Series - 18 B and Series - 18 C; HDFC FMP 100D August 2010 (1) - Series XIII, August 2010 (2) - Series XIV, August 2010 (3) - Series XIV, 35D August 2010 (1) -

CLOSE END INCOME : Series XIV and 370D August 2010 (1) - Series XV; ICICI Prudential FMP Series 53 - 3 Years Plan A; IDFC CPOF Series III, IDFC FMP QS-59 and Yearly Series 32;

L & T FMP - I (August 91D A) and (August 125D A); Reliance Fixed Horizon Fund - XV - Series 2, Series 3, Series 7 and Series 8; Tata FMP Series 26 Scheme C.

2.2 EXISTING SCHEMES

Open End Close End Interval Fund TOTAL

No.of Schemes Amount No.of Schemes Amount No.of Schemes Amount No.of Schemes Amount

INCOME 196 147,651 121 ^ 1,050 36 6,607 353 155,308

EQUITY 284 4,750 29 - 1 - 314 4,750

BALANCED 30 632 3 - - - 33 632

LIQUID/MONEY MARKET 53 536,091 - - - - 53 536,091

GILT 36 192 - - - - 36 192

ELSS - EQUITY 36 173 12 - - - 48 173

GOLD ETF 7 199 - - - - 7 199

OTHER ETFs 15 116 - - - - 15 116

FUND OF FUNDS INVESTING

15 50 - - - - 15 50

OVERSEAS

TOTAL 672 689,854 165 1,050 37 6,607 874 697,511

Notes:The change in number of existing schemes is because of the maturity and reclassification of some of the existing schemes.

^ Amount mobilised by new plans launched under existing scheme.

2.3 TOTAL OF ALL SCHEMES

Open End Close End Interval Fund TOTAL

No.of Schemes Amount No.of Schemes Amount No.of Schemes Amount No.of Schemes Amount

INCOME 199 147,795 146 8,887 36 6,607 381 163,289

EQUITY 285 4,928 29 - 1 - 315 4,928

BALANCED 31 1,060 3 - - - 34 1,060

LIQUID/MONEY MARKET 54 536,756 - - - - 54 536,756

GILT 36 192 - - - - 36 192

ELSS - EQUITY 36 173 12 - - - 48 173

GOLD ETF 9 565 - - - - 9 565

OTHER ETFs 15 116 - - - - 15 116

FUND OF FUNDS INVESTING

15 50 - - - - 15 50

OVERSEAS

TOTAL 680 691,635 190 8,887 37 6,607 907 707,129

AMFI MONTHLY August 2010 2/4

Table 3:-

REDEMPTIONS / REPURCHASES DURING THE MONTH OF AUGUST 2010

CATEGORY & TYPE WISE (Rs. in Crore)

Net Inflow / Net Inflow /

Net Inflow /

(Outflow) For the (Outflow) For the

Open End Close End Interval Fund TOTAL (Outflow) For

Year to Date Year to Date

the Month Current Year Previous Year

INCOME 142,381 870 3,477 146,728 16,561 25,371 214,187

EQUITY 7,943 ** (128) 3 7,818 (2,890) (7,613) 7,290

BALANCED 655 7 - 662 398 453 (123)

LIQUID/MONEY MARKET 514,834 - - 514,834 21,922 53,195 37,813

GILT 137 - - 137 55 (182) (2,719)

ELSS - EQUITY 269 31 - 300 (127) (467) 141

GOLD ETFs 51 - - 51 514 774 191

OTHER ETFs 239 - - 239 (123) 396 (25)

FUND OF FUNDS

175 - - 175 (125) (541) -

INVESTING OVERSEAS

TOTAL 666,684 780 3,480 670,944 36,185 71,386 256,755

** Two Close Ended Equity Schemes have become Open Ended during July 2010 and August 2010. Hence, the redemption figures

reported under these schemes in the earlier months have been regrouped under Open Ended Schemes during August 2010,

resulting in negative redemption figures under Close ended Equity Schemes for the current month.

Table 4:-

ASSETS UNDER MANAGEMENT AS ON AUGUST 31, 2010

CATEGORY & TYPE WISE (Rs. in Crore)

Open End Close End Interval Fund TOTAL % to Total

INCOME 275,086 46,871 25,364 347,321 49

EQUITY 164,972 14,166 62 179,200 25

BALANCED 17,555 1,226 - 18,781 3

LIQUID/MONEY MARKET 128,843 - - 128,843 18

GILT 3,324 - - 3,324 1

ELSS - EQUITY 22,406 3,192 - 25,598 4

GOLD ETF 2,639 - - 2,639 @

OTHER ETFs 1,427 - - 1,427 @

FUND OF FUNDS

2,533 - - 2,533 @

INVESTING OVERSEAS

TOTAL 618,785 65,455 25,426 709,666 100

@ Less than 1 %.

Table 5:- DATA ON FUND OF FUNDS (DOMESTIC) - AUGUST 2010 (Rs. In Crore)

Assets under

No. of

Sales Redemption Management as on

Schemes

August 31, 2010

Fund of Funds 24 228 92 2,048

Notes :

1. Fund of Funds is a scheme wherein the assets are invested in the existing schemes of mutual funds and hence, the figures indicated herein are included in

tables 1 to 4 and 6. Data on fund of funds is given for information only.

AMFI MONTHLY August 2010 3/4

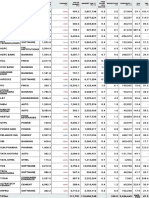

TABLE :6

Average Assets Under Management for the month - August 2010

(Rs. in crore)

Average Assets Average Assets

Under Under

Name of the Asset Management Company Name of the Asset Management Company

Sr. Management for Sr. Management for

No. the month No. the month

A BANK SPONSORED (ii) FOREIGN

1 AIG Global Asset Management Company (India) Private Ltd. 985

(i) JOINT VENTURES - PREDOMINANTLY INDIAN 2 FIL Fund Management Private Ltd. 8239

1 Canara Robeco Asset Management Co. Ltd. 7,917 3 Fortis Investment Management (India) Pvt. Ltd. 4520

2 SBI Funds Management Private Ltd. 38,552 4 Franklin Templeton Asset Management (India) Private Ltd. 39,864

TOTAL …………………………... A (i) 46,469 5 Mirae Asset Global Investments (India) Private Ltd. 277

6 Pramerica Asset Managers Private Limited 101

TOTAL …………………………... C (ii) 53,986

(ii) JOINT VENTURES - PREDOMINANTLY FOREIGN

1 Baroda Pioneer Asset Management Company Limited 4,726 (iii) JOINT VENTURES - PREDOMINANTLY INDIAN

TOTAL …………………………... A (ii) 4,726 1 Birla Sun Life Asset Management Co. Ltd. 64,217

2 DSP BlackRock Investment Managers Private Ltd. 24,153

(iii) OTHERS 3 HDFC Asset Management Co. Ltd. 90,179

1 IDBI Asset Management Ltd. 2,397 4 ICICI Prudential Asset Management Co. Ltd. 68,769

2 UTI Asset Management Company Ltd 64,173 5 Sundaram BNP Paribas Asset Management Company Ltd. 13,218

TOTAL …………………………... A (iii) 66,570 TOTAL …………………………... C (iii) 260,536

TOTAL ……………………………. A (i+ii+iii) 117,765

(iv) JOINT VENTURES - PREDOMINANTLY FOREIGN

B INSTITUTIONS 1 Bharti AXA Investment Managers Private Limited 664

1 LIC Mutual Fund Asset Management Co. Ltd. 20,891 2 HSBC Asset Management (India) Private Ltd. 5,007

TOTAL …………………………... B 20,891 3 ING Investment Management (India) Private Ltd. 1,440

4 JPMorgan Asset Management (India) Private Ltd. 7,756

C PRIVATE SECTOR 5 Morgan Stanley Investment Management Private Ltd. 2,317

(i) INDIAN 6 Principal Pnb Asset Management Co.Private Ltd 5,485

1 Axis Asset Management Company Ltd. 4,055 7 Shinsei Asset Management (India) Pvt. Ltd. 419

2 Benchmark Asset Management Co. Private Ltd. 2,355 TOTAL …………………………... C (iv) 23,088

3 Deutsche Asset Management (India) Private Ltd. 7,809 TOTAL ……………………………. C (i+ii+iii+iv) 548,902

4 Edelweiss Asset Management Limited 225 A+B+C 687,558

5 Escorts Asset Management Ltd. 197

6 IDFC Asset Management Company Private Limited 18,335

7 J.M. Financial Asset Management Private Ltd. 7,109

8 Kotak Mahindra Asset Management Co. Ltd. 26,595

9 L&T Investment Management Limited 3,799

10 Motilal Oswal Asset Management Co. Ltd. 286

11 Peerless Funds Management Co. Ltd. 1,917

12 Quantum Asset Management Co. Private Ltd. 112

13 Reliance Capital Asset Management Ltd. 104,511

14 Religare Asset Management Company Private Limited 10,584

15 Sahara Asset Management Co. Private Ltd. 767

16 Tata Asset Management Ltd. 20,109

17 Taurus Asset Management Co. Ltd. 2,527

TOTAL …………………………... C (i) 211,292

AMFI MONTHLY August 2010 4/4

You might also like

- INS2098 Chapter 1 NoteDocument6 pagesINS2098 Chapter 1 NoteVũ Hồng NgânNo ratings yet

- Accounting and Management Exam - MancosaDocument11 pagesAccounting and Management Exam - MancosaFrancis Mtambo100% (1)

- Jennys FroyoDocument16 pagesJennys FroyoKailash Kumar100% (2)

- No. 42: India's Overall Balance of Payments: Current StatisticsDocument6 pagesNo. 42: India's Overall Balance of Payments: Current StatisticsReuben RichardNo ratings yet

- SataraDocument3 pagesSataranaresh kayadNo ratings yet

- News ICLDocument12 pagesNews ICLAlok DeoriNo ratings yet

- Association of Mutual Funds in India: Released On 07.05.2018 NotesDocument3 pagesAssociation of Mutual Funds in India: Released On 07.05.2018 NotesRachana MakhijaNo ratings yet

- Annexure 7 - Audited Financial Results For The Year Ended March 31 2011Document3 pagesAnnexure 7 - Audited Financial Results For The Year Ended March 31 2011PGurusNo ratings yet

- Audited Financial Results For The Quarter and Financial Year Ended 31st March 2021Document12 pagesAudited Financial Results For The Quarter and Financial Year Ended 31st March 2021Abhilash ABNo ratings yet

- 423 BOD & Budget ForecastDocument19 pages423 BOD & Budget ForecastshariqwaheedNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Association of Mutual Funds in India: Released On 07.12.2017 NotesDocument3 pagesAssociation of Mutual Funds in India: Released On 07.12.2017 NotesPranav ViraNo ratings yet

- Afr Q4fy20Document8 pagesAfr Q4fy20Abhilash ABNo ratings yet

- Eeheeee: EeetleeiDocument6 pagesEeheeee: EeetleeiNishit GolchhaNo ratings yet

- Q2FY22 ResultsDocument16 pagesQ2FY22 ResultsrohitnagrajNo ratings yet

- BED 3 LEVEL 4 - Napolan NHSDocument2 pagesBED 3 LEVEL 4 - Napolan NHSNicole SilorioNo ratings yet

- Bed 1 Financial Plan Fy 2023Document4 pagesBed 1 Financial Plan Fy 2023Whenng LopezNo ratings yet

- Takaful Companies - Overall: ItemsDocument6 pagesTakaful Companies - Overall: ItemsZubair ArshadNo ratings yet

- (Rs. in '000s) Year Ended March 31, 2010 Year Ended March 31, 2009Document27 pages(Rs. in '000s) Year Ended March 31, 2010 Year Ended March 31, 2009Shankar NathNo ratings yet

- 3rd Quarter Report 2018Document1 page3rd Quarter Report 2018Tanzir HasanNo ratings yet

- Thermax Limited: Standalone Audited Financial Results For The Quarter Ended September 30, 2014Document1 pageThermax Limited: Standalone Audited Financial Results For The Quarter Ended September 30, 2014kartiknamburiNo ratings yet

- BED 3 LEVEL 4 - Lala NHSDocument2 pagesBED 3 LEVEL 4 - Lala NHSNicole SilorioNo ratings yet

- (FM) AssignmentDocument7 pages(FM) Assignmentnuraini putriNo ratings yet

- Nps CDDocument1 pageNps CDrakeswar1No ratings yet

- Bed 1 Fy 2019 Financial PlanDocument2 pagesBed 1 Fy 2019 Financial PlanEdelito Zoilo C. EdralindaNo ratings yet

- PDF ShoppersDocument43 pagesPDF ShoppersVikrant KarhadkarNo ratings yet

- BSEOutcomeof BM25042023 SignedDocument7 pagesBSEOutcomeof BM25042023 SignedRAVINo ratings yet

- BSE Intimation 27072023 Signed-V1Document9 pagesBSE Intimation 27072023 Signed-V1adityamohanty2206No ratings yet

- SensexDocument1 pageSensexJatin JainNo ratings yet

- Sub Contractor Interim Payment CertificateDocument10 pagesSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- KRONOLOGI ASIA BERHAD (Company No. 1067697-K)Document7 pagesKRONOLOGI ASIA BERHAD (Company No. 1067697-K)TestNo ratings yet

- Realisasi Produksi Dan DT Line 1-4 Tanggal 12-18 Januari 2023Document6 pagesRealisasi Produksi Dan DT Line 1-4 Tanggal 12-18 Januari 2023MaxNo ratings yet

- Outcome of 184th Board Meeting of Axis Bank Limited Held On 26th April 2018 and 27th April 2018 26.04.2018Document80 pagesOutcome of 184th Board Meeting of Axis Bank Limited Held On 26th April 2018 and 27th April 2018 26.04.2018anvesh anveshNo ratings yet

- Monetary Aggregates: M1, M2 and M3: Monetary Statistics Division, Core Statistics DepartmentDocument1 pageMonetary Aggregates: M1, M2 and M3: Monetary Statistics Division, Core Statistics DepartmentTaha ReyanNo ratings yet

- Bed 3 Level 4 - Do PagadianDocument2 pagesBed 3 Level 4 - Do PagadianNicole SilorioNo ratings yet

- ICICI Form-Nl-7-Operating-Expenses-ScheduleDocument2 pagesICICI Form-Nl-7-Operating-Expenses-ScheduleSatyamSinghNo ratings yet

- 7B20N001Document21 pages7B20N001pbNo ratings yet

- UFR For The QTR Ended 30.09.2014-WebsiteDocument4 pagesUFR For The QTR Ended 30.09.2014-WebsiteRavi AgarwalNo ratings yet

- 31 March 2020Document8 pages31 March 2020lojanbabunNo ratings yet

- Rl1Chfilzri (Indlll) LTDDocument4 pagesRl1Chfilzri (Indlll) LTDJigneshNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- SEBI Mar 2010Document2 pagesSEBI Mar 2010reachsubbusNo ratings yet

- Extracted Pages From Walton Hi-Tech Industries Limited Red-Herring Prospectus Dt. 02.01.2020 - Updated - 2Document1 pageExtracted Pages From Walton Hi-Tech Industries Limited Red-Herring Prospectus Dt. 02.01.2020 - Updated - 2Aslam HossainNo ratings yet

- Financial StatementDocument4 pagesFinancial StatementAphrodite ArgennisNo ratings yet

- WWW - Centralbankofindia.co - In: Central OfficeDocument28 pagesWWW - Centralbankofindia.co - In: Central Officesriram TPNo ratings yet

- BED 3 LEVEL 4 - Pagadian City NHSDocument2 pagesBED 3 LEVEL 4 - Pagadian City NHSNicole SilorioNo ratings yet

- 4-Fiscal DevelopmentDocument5 pages4-Fiscal DevelopmentAhsan Ali MemonNo ratings yet

- Q3 2009 UTV Software Communications Financials Uploaded by MediaNamaDocument1 pageQ3 2009 UTV Software Communications Financials Uploaded by MediaNamamixedbagNo ratings yet

- Tarmat Script: The by The The On L4ttDocument5 pagesTarmat Script: The by The The On L4ttShyam SunderNo ratings yet

- 2.0 MR01 - Jan 2015 Total Project Cost - Overall Summary WO Fee FOREX Below TotalDocument1 page2.0 MR01 - Jan 2015 Total Project Cost - Overall Summary WO Fee FOREX Below TotalWilmer Lapa QuispeNo ratings yet

- Digitally Signed by Shweta Shivdhari Singh Date: 2023.11.07 16:45:56 +05'30'Document6 pagesDigitally Signed by Shweta Shivdhari Singh Date: 2023.11.07 16:45:56 +05'30'unstableskNo ratings yet

- Quarterly RPA3Document1 pageQuarterly RPA3chill_migrane_23No ratings yet

- ResultsconbineDocument14 pagesResultsconbineroyston.nazareth20No ratings yet

- Res Oct08Document1 pageRes Oct08narayanan_rNo ratings yet

- Balance of PaymentsDocument9 pagesBalance of PaymentsBhanu Pratap SinghNo ratings yet

- Final2010 PressAddwith CFSDocument1 pageFinal2010 PressAddwith CFStihadaNo ratings yet

- Of Which Software Services Business Services Financial Services Communication ServicesDocument3 pagesOf Which Software Services Business Services Financial Services Communication Servicescapt-cool-chillerNo ratings yet

- Fa I HoecDocument32 pagesFa I HoecBunny SethiNo ratings yet

- BED 3 LEVEL 4 - Pagadian City NCHSDocument2 pagesBED 3 LEVEL 4 - Pagadian City NCHSNicole SilorioNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Valuation Report of Warrp: Company Logo AreaDocument22 pagesValuation Report of Warrp: Company Logo AreaNguyen Khanh HoangNo ratings yet

- Background On: Insurance AccountingDocument5 pagesBackground On: Insurance AccountingSheena Doria de VeraNo ratings yet

- Kepada Yth. /: IrwanDocument1 pageKepada Yth. /: IrwanFebri RahadianNo ratings yet

- E StatementDocument6 pagesE Statementxianchong0803No ratings yet

- Assignment AccDocument47 pagesAssignment Acchakimstars2003No ratings yet

- PRETEST in BUSINESS FINANCE - 100 ITEMS 2ND SEMDocument4 pagesPRETEST in BUSINESS FINANCE - 100 ITEMS 2ND SEMBernardita Sison-CruzNo ratings yet

- Stock KKDocument7 pagesStock KKamir rabieNo ratings yet

- Pilaps & VilsDocument15 pagesPilaps & VilsGwendolyn PansoyNo ratings yet

- HullOFOD11eSolutionsCh04 GEDocument7 pagesHullOFOD11eSolutionsCh04 GEPark GeunhyeNo ratings yet

- Beneish M-Score ModelDocument3 pagesBeneish M-Score ModelyusriNo ratings yet

- Reading Annual ReportsDocument6 pagesReading Annual ReportsAmitNo ratings yet

- Project Report: A Comparative Study of Performance of Top 5 Mutual Funds in IndiaDocument40 pagesProject Report: A Comparative Study of Performance of Top 5 Mutual Funds in India68Rohan ChopraNo ratings yet

- Finance 2 - Chapter 1Document5 pagesFinance 2 - Chapter 1Thomas-Jay DerbyshireNo ratings yet

- Dividend and Managerial Remuneration Adjustments-1Document3 pagesDividend and Managerial Remuneration Adjustments-1Shwetta GogawaleNo ratings yet

- A Comparative Study On Share Price Project ReportDocument53 pagesA Comparative Study On Share Price Project Reportcity cyberNo ratings yet

- Synthesis - AudProb (Q)Document8 pagesSynthesis - AudProb (Q)Anna Gian SobrevillaNo ratings yet

- Ir Reference Document 2007 Sartorius Stedim Biotech PDFDocument161 pagesIr Reference Document 2007 Sartorius Stedim Biotech PDFBrian VasquezNo ratings yet

- 11 The Cost of CapitalDocument43 pages11 The Cost of CapitalMo Mindalano MandanganNo ratings yet

- Fu Wang Food Ltd. - FIN435Document11 pagesFu Wang Food Ltd. - FIN435Shosta VlogNo ratings yet

- INVESTMENTSDocument27 pagesINVESTMENTSJao FloresNo ratings yet

- Absa Bank StatementDocument2 pagesAbsa Bank Statementyarec79954No ratings yet

- Introduction To The Stock Market Part One: AssetDocument3 pagesIntroduction To The Stock Market Part One: AssetkimmoNo ratings yet

- SEBI Bulletin Tables Jan 2024 PDocument89 pagesSEBI Bulletin Tables Jan 2024 PPreeti SureshNo ratings yet

- Chapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFDocument24 pagesChapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFChristian GoNo ratings yet

- Sid Invesco India Tax PlanDocument86 pagesSid Invesco India Tax PlanSubbaiah KotrangadaNo ratings yet

- Topic 3 Mudharabah FinancingDocument9 pagesTopic 3 Mudharabah Financinghgul5275No ratings yet

- Concept Checks EVA DamodaranDocument2 pagesConcept Checks EVA DamodaranKarya BangunanNo ratings yet