Professional Documents

Culture Documents

2010 06 05 11 4 PDF Ad

2010 06 05 11 4 PDF Ad

Uploaded by

qadir728Copyright:

Available Formats

You might also like

- LSMW Cats ImportDocument7 pagesLSMW Cats ImportVanitha DassariNo ratings yet

- (Copy of The Same Is Also Available On Our Website) : IndicationDocument4 pages(Copy of The Same Is Also Available On Our Website) : IndicationajgondalNo ratings yet

- Quantitative Methods: Assignment-1Document4 pagesQuantitative Methods: Assignment-1NIKNISHNo ratings yet

- Construction Program ChartDocument6 pagesConstruction Program ChartdsanandaNo ratings yet

- Data Base Apd PT - CemDocument107 pagesData Base Apd PT - Cemagung ardanNo ratings yet

- Monitoring With ZabbixDocument27 pagesMonitoring With ZabbixMOSC2010No ratings yet

- Monthly Cashflow As C.F.O (12!06!10)Document2 pagesMonthly Cashflow As C.F.O (12!06!10)IbadchishtiNo ratings yet

- MarkitDocument2 pagesMarkitkeika123No ratings yet

- TP PL6 U Py RBWJG JUEDocument1 pageTP PL6 U Py RBWJG JUEVidya Sagar GuptaNo ratings yet

- List of Open Exam 2010Document2 pagesList of Open Exam 2010Rabin JoshiNo ratings yet

- Agenda OrganizadoraDocument108 pagesAgenda OrganizadoraGomez RaulNo ratings yet

- Newsletter 05-21-10Document7 pagesNewsletter 05-21-10yemintun1988No ratings yet

- A CD Cal 2010Document3 pagesA CD Cal 2010deepak111yadavNo ratings yet

- Aravind Petrol Conveyence From Nov MonthDocument8 pagesAravind Petrol Conveyence From Nov MonthShailesh ChiliveriNo ratings yet

- Final Seniority-Addnl EE-31.07.2021Document22 pagesFinal Seniority-Addnl EE-31.07.2021Sandeep WaghNo ratings yet

- Global Mediacom Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesGlobal Mediacom Tbk. (S) : Company Report: January 2017 As of 31 January 2017Dicky L RiantoNo ratings yet

- Fondo de Ahorro PrevisionalDocument7 pagesFondo de Ahorro PrevisionalFerdinand FernandezNo ratings yet

- Status, IPO Bidding Information, IPO Ratings, IPO Grading, IPO Reviews, Grey Market Premiums of IPO's, IPO News and IPO Performance TrackerDocument11 pagesStatus, IPO Bidding Information, IPO Ratings, IPO Grading, IPO Reviews, Grey Market Premiums of IPO's, IPO News and IPO Performance TrackerAbhilasha SrivastavaNo ratings yet

- Announce 201019marDocument4 pagesAnnounce 201019marAzhar HameedNo ratings yet

- Form Four Yearly Scheme of WorkDocument3 pagesForm Four Yearly Scheme of Workwanieda7No ratings yet

- Aman Quant 2Document6 pagesAman Quant 2NIKNISHNo ratings yet

- Upcoming Events June 2010Document4 pagesUpcoming Events June 2010Jayken Liew Yew KeanNo ratings yet

- Astra Otoparts Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesAstra Otoparts Tbk. (S) : Company Report: January 2017 As of 31 January 2017Nyoman ShantiyasaNo ratings yet

- Proposal and Article Schedule For Regeneration of Spinal CordsDocument1 pageProposal and Article Schedule For Regeneration of Spinal CordsTyler SweeneyNo ratings yet

- PCAT CIB TestDatesDocument1 pagePCAT CIB TestDatesYvonne WangNo ratings yet

- Registration: Saturday, April 10, 2010: Independence Day HolidayDocument6 pagesRegistration: Saturday, April 10, 2010: Independence Day HolidayDhaval ShahNo ratings yet

- Lucky Cement LTD., Share Price June, 2010Document2 pagesLucky Cement LTD., Share Price June, 2010Akeel ChoudharyNo ratings yet

- Aum PerformanceDocument3 pagesAum Performancekirang gandhiNo ratings yet

- Total Bangun Persada Tbk. (S) : Company Report: January 2015 As of 30 January 2015Document3 pagesTotal Bangun Persada Tbk. (S) : Company Report: January 2015 As of 30 January 2015Halim RachmatNo ratings yet

- Dolar TodayDocument80 pagesDolar TodayClaudio ColettaNo ratings yet

- Global Mediacom TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesGlobal Mediacom TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Panca Global Securities TBKDocument3 pagesPanca Global Securities TBKreyNo ratings yet

- Issuer Company Issue Open Issue Close Offer Price (RS.) Issue Type Issue Size (Crore RS.)Document2 pagesIssuer Company Issue Open Issue Close Offer Price (RS.) Issue Type Issue Size (Crore RS.)Bishal HandiqueNo ratings yet

- TIMESHEETDocument1 pageTIMESHEETilovejayaNo ratings yet

- DPMTDocument38 pagesDPMTPunit GauravNo ratings yet

- Attendance - Sheet - Oct 2010Document1 pageAttendance - Sheet - Oct 2010shitalralebhatNo ratings yet

- LSE ExaminationTimetable2010Document20 pagesLSE ExaminationTimetable2010aimran_amirNo ratings yet

- 022STUDocument1 page022STUmaf1otulNo ratings yet

- KIT W7 TimelineDocument1 pageKIT W7 TimelineKitsilano HouseNo ratings yet

- Sailing Schedule: Walrus Shipping Services LLCDocument1 pageSailing Schedule: Walrus Shipping Services LLCsopanam123No ratings yet

- Event Calendar T32010Document4 pagesEvent Calendar T32010Dipesh AcharyaNo ratings yet

- Summary of Po'S For Supplies/Goods MonitoringDocument6 pagesSummary of Po'S For Supplies/Goods MonitoringsarmzNo ratings yet

- Time Schedule As-10 WebsiteDocument12 pagesTime Schedule As-10 WebsiteParth DewanganNo ratings yet

- Schedule Eng202CDocument1 pageSchedule Eng202CAruna DiasNo ratings yet

- Weekly Safety Stat ReportDocument5 pagesWeekly Safety Stat ReportPat HudginsNo ratings yet

- Netcore Solutions Pvt. LTD.: Holiday List - 2010Document1 pageNetcore Solutions Pvt. LTD.: Holiday List - 2010Manish DesaiNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesTXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancepraveen_bietNo ratings yet

- TransilvaniaDocument4 pagesTransilvaniamarius_86roNo ratings yet

- Analyst - Report.29July10 2Document5 pagesAnalyst - Report.29July10 2Rohit SharmaNo ratings yet

- Ntcet 2010161109Document2 pagesNtcet 2010161109liriesNo ratings yet

- Metros Roc 515-517 Mayo 2010Document2 pagesMetros Roc 515-517 Mayo 2010Fernando Cabezas MolinaNo ratings yet

- Academic Calendar Odd Semester2010-2011Document2 pagesAcademic Calendar Odd Semester2010-2011Amit SamdarshiNo ratings yet

- Conversation Formula by BaburamDocument5 pagesConversation Formula by BaburamSudhir KumarNo ratings yet

- Summary of PO's Not Delivered June To August 12,2010Document22 pagesSummary of PO's Not Delivered June To August 12,2010sarmzNo ratings yet

- Kingfisher Winter 2010 PDFDocument36 pagesKingfisher Winter 2010 PDFRussell MendoncaNo ratings yet

- Qualitair Engineers: Sales RegisterDocument3 pagesQualitair Engineers: Sales Registercalvin.bloodaxe4478No ratings yet

- © 2009 Christian Medical College, Vellore. in Service of The Nation Since 1900Document6 pages© 2009 Christian Medical College, Vellore. in Service of The Nation Since 1900vijayshinoNo ratings yet

- I 1 ZCK 8 OKh 71 CC 7 CPDocument2 pagesI 1 ZCK 8 OKh 71 CC 7 CPAvinash SomannaNo ratings yet

- Invoice THE Smart Shop: Jtbkvi Jtbj2VDocument6 pagesInvoice THE Smart Shop: Jtbkvi Jtbj2VMgm KarthikeyanNo ratings yet

2010 06 05 11 4 PDF Ad

2010 06 05 11 4 PDF Ad

Uploaded by

qadir728Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2010 06 05 11 4 PDF Ad

2010 06 05 11 4 PDF Ad

Uploaded by

qadir728Copyright:

Available Formats

Stocks16 to 18.

qxd 05-Jun-10 1:06 PM Page 3

18 BUSINESS RECORDER KARACHI SATURDAY 5 JUNE 2010

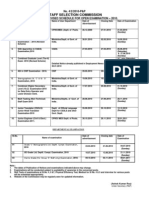

DATES OF CLOSURE OF BOOKS & AGM

> From page 17 16.06.2010 Wednesday 18.06.2010 Firday

Mari Gas Co. 17.06.2010 24.06.2010 24.06.2010(u) — — 17.06.2010 Thursday 21.06.2010 Monday

First National Equities 19.06.2010 26.06.2010 26.06.2010(u) — — 18.06.2010 Friday 22.06.2010 Tuesday

JDW Sugar Mills 22.06.2010 28.06.2010 — 14.06.2010 12.5(R) 21.06.2010 Monday 23.06.2010 Wednesday

22.06.2010 Tuesday 24.06.2010 Thursday

ZIL Limited 22.06.2010 28.06.2010 28.06.2010(u) — —

23.06.2010 Wednesday 25.06.2010 Friday

Nestle Pakistan 22.06.2010 28.06.2010 28.06.2010(u) — —

24.06.2010 Thursday 28.06.2010 Monday

Honda Atlas Cars 23.06.2010 30.06.2010 30.06.2010 — Nil 25.06.2010 Friday 29.06.2010 Tuesday

Indications: 28.06.2010 Monday 30.06.2010 Wednesday

(I) Interim Dividend (R) Right Shares (u) Extra ordinary general meeting 29.06.2010 Tuesday 02.07.2010 Friday

(P) Preferenec Shares. (*) Date revised (B) Bonus (F) Final Dividend 30.06.2010 Wednesday 02.07.2010 Friday

NOTES:

Name of company

BOARD MEETINGS Date Time

1) If any necessity arises, the Karachi Stock Exchange reserves the right to alter or vary the above

dates. In case any settlement is postponed for whatsoever reasons, the same shall take place on

Al-Abid Silk Mills Ltd 08.06.2010 3:00 p.m. the next working day.

Invest Capital Investments Bank Ltd 10.06.2010 (Revised) 11:00 a.m.

Bank Holiday (July 1st, 2010)

Invest Capital Investment 10.06.2010 11:00 a.m

Companies Provisionally Listed

—

Trading Commenced From

—

KSE ANNOUNCEMENTS

YEAR Profit/(Loss) EPS ANNUALCLOSURE OF

PROPOSED RIGHT ISSUE ENDED/ DIVIDEND/ Before (Rs) GENERAL SHARE

Company Rate HALF YEARLY/ BONUS/ Taxation MEETING TRANSFER

Pervez Ahmed Securities (at a discount of 50% i.e. Rs 5/- per share) 231.08% COMPANY QUARTERLY RIGHT (Rs. in BOOKS

Asia Insurance Co Ltd. 25% ACCOUNTS million)

Dawood Money Market Fund - - - - - 01.07.2010 to

LAST DATE FOR RENUNCIATION/PAYMENT OF RIGHT 06.07.2010

COMPANY Trading in L/Right Last Date for Last Date of Spot From Premium

w.e.f. Payment/Ren. Trading Dawood Islamic Fund - - - - - 01.07.2010 to

— — — — — — 06.07.2010

Kohat Cement Co. Ltd - - - - 26.06.2010 17.06.2010 to

CLEARING SCHEDULE FOR T+2 SYSTEM FOR (EOGM) + 26.06.2010

THE MONTHS OF JUNE & JULY 2010 Indication:

+ = Kohat Cement Co. – EOGM to be held for election of directors of the company.

TRANSACTION TRANSACTION SETTLEMENT SETTLEMENT

DATE DAY DATE DAY DESPATCH OF DIVIDEND WARRANTS/BONUS SHARE CERTIFICATES

03.06.2010 Thursday 07.06.2010 Monday Company Year Ended/Ending Dividend/Bonus Despatched/Credit on

04.06.2010 Friday 08.06.2010 Tuesday Baluchistan Wheels Ltd 30.06.2010 12.5% Interim 02.06.2010

07.06.2010 Monday 09.06.2010 Wednesday Dividend Warrants

08.06.2010 Tuesday 10.06.2010 Thursday

09.06.2010 Wednesday 11.06.2010 Friday APPLIED FOR EXTENSION TO SECP FOR HOLDING

10.06.2010 Thursday 14.06.2010 Monday

11.06.2010 Friday 15.06.2010 Tuesday OF ANNUAL GENERAL MEETING

14.06.2010 Monday 16.06.2010 Wednesday Name of Company Year Ending Applied for Extension upto

15.06.2010 Tuesday 17.06.2010 Thursday Frontier Ceramics Ltd 30.06.2009 22.06.2010

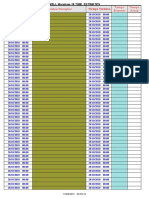

CROSS TRANSACTIONS BETWEEN CLIENT TO CLIENT & FINANCIAL INSTITUTIONS

Member Company Turnover of Shares Rates Member Company Turnover of Shares Rates

Name Name

> From page 17 FDM Capital 12,500 41.00

Foundation Sec. 3,000 298.00 Total / Weighted Avg. Rate 13,500 41.04

Total / Weighted Avg. Rate 17,593 293.22 Concordia Sec. Lotte Pakistan 15,000 8.30

Concordia Sec. Attock Refinery 5,038 91.50 Intermarket Sec. 2,000 9.30

Total / Weighted Avg. Rate 5,038 91.50 Total / Weighted Avg. Rate 17,000 8.42

IGI Finex BYCO Petroleum 13,200 8.70 Concordia Sec. MCB Bank 124,000 173.83

MSMANIAR Fin. 1,000 8.95 Darson Sec. 18,000 183.43

Total / Weighted Avg. Rate 14,200 8.72 Friendly Sec. 1,000,000 174.75

A. Husain Rajabali Bank AL-Habib 2,000 30.40 Total / Weighted Avg. Rate 1,142,000 174.79

Total / Weighted Avg. Rate 2,000 30.40 GMI Capital Sec. Millat Tracktor 10,000 480.00

Rayomund J.H.P. Byramji Central Ins. 296 53.21 Total / Weighted Avg. Rate 10,000 480.00

Total / Weighted Avg. Rate 296 53.21 SAZ Capital Mukhtar Textile 14,000 1.50

FDM Capital Colgate Palmolive 1,000 520.00 Total / Weighted Avg. Rate 14,000 1.50

Total / Weighted Avg. Rate 1,000 520.00 Ismail Iqbal Sec. NIB Bank 5,000 3.50

FDM Capital Dawood Lawrencepur 10,000 49.99 Total / Weighted Avg. Rate 5,000 3.50

Total / Weighted Avg. Rate 10,000 49.99 Concordia Sec. National Bank 15,625 64.45

ACE Sec. Dewan Salman 210,000 1.87 Total / Weighted Avg. Rate 15,625 64.45

Total / Weighted Avg. Rate 210,000 1.87 Pearl Sec. NetSol Technologies 40,000 26.00

Intermarket Sec. Dynea Pak. 218,581 12.01 Total / Weighted Avg. Rate 40,000 26.00

Total / Weighted Avg. Rate 218,581 12.01 Ismail Iqbal Sec. Nishat Mills 15,000 46.00

ACE Sec. E.F.U.Gen.Ins. 2,500 50.17 Concordia Sec. 40,000 42.93

Total / Weighted Avg. Rate 2,500 50.17 Total / Weighted Avg. Rate 55,000 43.76

BMA Capital Engro Corporation 10,000 174.20 MSMANIAR Fin. Oil & Gas Development 500 134.65

ACE Sec. 1,000 179.61 Topline Sec. 10,000 134.00

Mayari Sec. 1,000 179.00 Total / Weighted Avg. Rate 10,500 134.03

FDM Capital 2,100 175.00 Ismail Iqbal Sec. P. S. O. 500 273.00

Ample Sec. 5,000 174.00 Concordia Sec. 23,500 255.55

Total / Weighted Avg. Rate 19,100 174.77 Total / Weighted Avg. Rate 24,000 255.91

Intermarket Sec. Engro Polymer 500 11.91 Adam Sec. P.T.C.L.A 250,000 21.24

Total / Weighted Avg. Rate 500 11.91 Rafi Sec. 37,500 21.98

FDM Capital Fauji Bin Qasim 10,500 26.50 Total / Weighted Avg. Rate 287,500 21.34

Total / Weighted Avg. Rate 10,500 26.50 KASB Sec. Pace (Pakistan) 18,500 3.95

Ismail Iqbal Sec. Fauji Fert. 5,000 102.50 Total / Weighted Avg. Rate 18,500 3.95

FDM Capital 10,000 103.75 Concordia Sec. Pak Oilfields 5,000 214.88

Total / Weighted Avg. Rate 15,000 103.33 FDM Capital 500 217.50

Intermarket Sec. First National Equities 3,749 10.00 SNM Sec. 5,000 218.41

Total / Weighted Avg. Rate 3,749 10.00 M.R.A. Sec. 500 216.25

Intermarket Sec. Genertech Pak. 58,752 1.10 Total / Weighted Avg. Rate 11,000 216.66

Total / Weighted Avg. Rate 58,752 1.10 Concordia Sec. Pakistan Petroleum 12,000 181.30

Ismail Iqbal Sec. Habib Bank 2,611 97.00 Darson Sec. 11,000 186.07

Total / Weighted Avg. Rate 2,611 97.00 FDM Capital 2,000 187.50

HH Misbah Sec. Habib Ins. 1 14.00 Total / Weighted Avg. Rate 25,000 183.89

Total / Weighted Avg. Rate 1 14.00 SNM Sec. Pakistan Reinsurance 8,500 17.50

Invisor Sec. Hub Power 50,000 32.55 Total / Weighted Avg. Rate 8,500 17.50

Total / Weighted Avg. Rate 50,000 32.55 Ghani Osman Sec. SILKBANK 5,000 3.00

FDM Capital Huffaz Pipe 10,000 15.25 ACE Sec. 160,000 3.17

Total / Weighted Avg. Rate 10,000 15.25 Total / Weighted Avg. Rate 165,000 3.16

FDM Capital IGI Insurance 6,000 75.00 Creative Cap. Sec. Safe Mix Con.Prod. 500 8.40

Total / Weighted Avg. Rate 6,000 75.00 Total / Weighted Avg. Rate 500 8.40

Cassim Inv. International Ind. 400,000 56.50 Intermarket Sec. Samba Bank 2,244,308 2.60

Total / Weighted Avg. Rate 400,000 56.50 Total / Weighted Avg. Rate 2,244,308 2.60

MSMANIAR Fin. Invest Capital Bank 1,000 1.03 Concordia Sec. Searle Pak 36,500 58.18

Total / Weighted Avg. Rate 1,000 1.03 Total / Weighted Avg. Rate 36,500 58.18

ACE Sec. Ist.Cap. Sec. Corp. 185,000 6.00 FDM Capital Shell Pak. 4,000 238.00

Total / Weighted Avg. Rate 185,000 6.00 Total / Weighted Avg. Rate 4,000 238.00

Ismail Iqbal Sec. J.O.V.& Co. 2,200 6.70 Intermarket Sec. Sitara Chemical 551 120.57

Total / Weighted Avg. Rate 2,200 6.70 Total / Weighted Avg. Rate 551 120.57

ACE Sec. JS Bank 525,000 3.11 Intermarket Sec. Sui South Gas 5,000 17.68

Total / Weighted Avg. Rate 525,000 3.11 Total / Weighted Avg. Rate 5,000 17.68

A. Husain Rajabali JS Global Capital 2,000 38.75 ACE Sec. TRG Pakistan 100,000 5.06

Total / Weighted Avg. Rate 2,000 38.75 Mayari Sec. 10,000 5.10

Time Sec. Jah. Siddiqui & Co. 5,000 12.08 SAZ Capital 500 5.30

Multiline Sec. 2,500 12.08 Total / Weighted Avg. Rate 110,500 5.06

ACE Sec. 50,000 12.08 FDM Capital Tri-Pack Films 5,000 96.18

Concordia Sec. 55,000 11.50 Total / Weighted Avg. Rate 5,000 96.18

Foundation Sec. 20,000 12.08 Multiline Sec. Wateen Telecom 4,000 6.41

JS Global Cap. 10,000 10.60 Total / Weighted Avg. Rate 4,000 6.41

Total / Weighted Avg. Rate 142,500 11.75 Dawood Equities Worldcall Telecom 5,000 3.60

Intermarket Sec. Karchi Electric Supply 792,622 2.43 Total / Weighted Avg. Rate 5,000 3.60

Total / Weighted Avg. Rate 792,622 2.43

Ismail Iqbal Sec. Kot Addu Power 1,000 41.50 Total Turnover 7,090,477

Rates of Debt Securities

> From page 17 Valuation of Non Rated Debt Securities

73 OLPL/TFC/150108 ORIX LEASING PAKISTAN LTD-TFC (15-01-08) Traded 88.0000 1 AAHL/TFC/230806 AL ABBAS HOLDINGS (PVT) LTD-TFC (23-08-06) Non-Traded 75.0000

74 TRAKKER/TFC/150907 TRAKKER (15-09-07) - PPTFC Non-Traded 99.1288 2 BNL/TFC/301108 BUNNY'S LTD. - TFC (30-11-08) Non-Traded 75.0000

75 WTL/TFC/281106 WORLDCALL TELECOM LTD.TFC (28-11-06) Non-Traded 97.9252 3 CTM/TFC/170604 CRESCENT TEXTILE MILLS LTD-TFC (17-06-04) Non-Traded 75.0000

76 WTL/TFC/071008 WORLDCALL TELECOM LTD-TFC (07-10-08) Non-Traded 85.9750 4 GHL/TFC/230806 GHANI HOLDING (PVT) LTD-TFC (23-08-06) Non-Traded 75.0000

RATED A-

5 JCL/TFC/101106 JAVEDAN CEMENT LTD-TFC (10-11-06) Non-Traded 75.0000

77 AVH/TFC/300409 AVARI HOTELS-TFC (30-04-09) Non-Traded 93.2223

6 SPL/SUK/190808 SITARA PEROXIDE LTD-SUK (19-08-08) Non-Traded 75.0000

78 ANL/TFC/041207 AZGARD NINE LTD- TFC (04-12-07) PP Non-Traded 92.4307

7 TSH/SUK/260608 THREE STAR HOSIERY SUKUK (25-06-08) Non-Traded 75.0000

79 KASHF/TFC/051107 KASHAF FOUNDATION - TFC (05-11-07) Non-Traded 99.5556

80 SSML/SUK/270907 SHAHMURAD SUGAR MILLS LTD-SUKUK (27-09-07) Non-Traded 95.0908 8 VDL/TFC/301108 VISION DEVELOPERS (PVT) LTD (30-11-08) Non-Traded 75.0000

81 SMEL/TFC/160708 SME LEASING LTD-TFC (16-07-08) Non-Traded 97.1314 Valuation of Non-Performing Debt Securities

RATED BBB+ 1 ATML/SUK/150408 ARZOO TEXTILE MILLS LTD-SUKUK (15-04-08) Non-Traded A/C to NPA

82 QTML/SUK/260908 QUETTA TEXTILE MILLS LTD-SUKUK (26-09-08) Non-Traded 82.9042 2 ANL/TFC/200905 AZGARD NINE LTD- TFC (20-09-05) Non-Traded A/C to NPA

83 SEARL/TFC/090306 SEARLE PAKISTAN LTD-TFC (09-03-06) Non-Traded 97.3079 3 DCL/TFC/ DEWAN CEMENT LTD Non-Traded A/C to NPA

RATED BBB 4 EHL/SUK/311207 EDEN HOUSING LTD.- SUKUK (31-12-07) Non-Traded A/C to NPA

84 TELE/TFC/270505 TELECARD LTD-TFC (27-05-05) Non-Traded 89.7937 5 EHL/SUK/310308 EDEN HOUSING LTD.- SUKUK (31-03-08) Non-Traded A/C to NPA

85 TRIBL/TFC/151105 TRUST INVESTMENT BANK LTD-TFC (15-11-05) Non-Traded 98.3046 6 GCL/TFC/180108 GHARIBWAL CEMENT-TFC (18-01-08) Non-Traded A/C to NPA

86 TRIBL/TFC/040708 TRUST INVESTMENT BANK LTD-TFC (04-07-08) Non-Traded 89.8689 7 KCCL/SUK/131207 KOHAT CEMENT-SUKKUK (20-12-07) Non-Traded A/C to NPA

RATED BBB- 8 MLFC/SUK/031207 MAPLE LEAF SUKUK-(03-12-07) Non-Traded A/C to NPA

---------------------- NIL ----------------------- 9 NAEL/TFC/150507 NEW ALLIED ELECTRONIC (15-05-07) Non-Traded A/C to NPA

Valuation of Rated Non-Investment Grade Debt Securities 10 NAEL/SUK/270707 NEW ALLIED ELECTRONIC - SUKUK (27-07-07) Non-Traded A/C to NPA

11 NAEIL/SUK/031207 NEW ALLIED ELECTRONIC - SUKUK (03-12-07) Non-Traded A/C to NPA

1** FDIBL/TFC/110907 FIRST DAWOOD INVESTMENT BANK LTD. TFC (11-09-07) Non-Traded 70.9689

12 PHO/TFC/311208 PAK HY-OILS LTD-TFC (31-12-08) Non-Traded A/C to NPA

2***SPLC/TFC/130308 SAUDI PAK LEASING COMPANY LTD-TFC (13-03-08) Non-Traded 72.7827

13 SLCL/TFC/280306 SECURITY LEASING CORPORATION LTD-PPTFC (28-03-06) Non-Traded A/C to NPA

3 SLCL/SUK/010607 SECURITY LEASING CORPORATION LTD-SUKKUK (01-06-07) - I Non-Traded 75.0000

14 SGML/TFC/220908 SHAKARGANJ MILLS LTD-TFC (22-09-08) Non-Traded A/C to NPA

4 SLCL/SUK/190907 SECURITY LEASING CORPORATION LTD-SUKKUK (19-09-07) - II Non-Traded 75.0000

** Price has been calculated after apply maximum markup of 300 basis points to the calculated yield

Valuation of Rated Non- Rated Investment Grade Debt Securities as provided under SECPs Circular No.3 of 2010.

1 DAWH/SUK/180907 DAWOOD HERCULES-SUKUK (18-09-07) Non-Traded 98.0831 *** Price has been calculated after apply maximum markup of 250 basis points to the calculated yield

2 SEL/SUK/160707 SITARA ENERGY LTD-SUKUK (16-07-07) Non-Traded 98.2642 as provided under SECPs Circular No.3 of 2010.

You might also like

- LSMW Cats ImportDocument7 pagesLSMW Cats ImportVanitha DassariNo ratings yet

- (Copy of The Same Is Also Available On Our Website) : IndicationDocument4 pages(Copy of The Same Is Also Available On Our Website) : IndicationajgondalNo ratings yet

- Quantitative Methods: Assignment-1Document4 pagesQuantitative Methods: Assignment-1NIKNISHNo ratings yet

- Construction Program ChartDocument6 pagesConstruction Program ChartdsanandaNo ratings yet

- Data Base Apd PT - CemDocument107 pagesData Base Apd PT - Cemagung ardanNo ratings yet

- Monitoring With ZabbixDocument27 pagesMonitoring With ZabbixMOSC2010No ratings yet

- Monthly Cashflow As C.F.O (12!06!10)Document2 pagesMonthly Cashflow As C.F.O (12!06!10)IbadchishtiNo ratings yet

- MarkitDocument2 pagesMarkitkeika123No ratings yet

- TP PL6 U Py RBWJG JUEDocument1 pageTP PL6 U Py RBWJG JUEVidya Sagar GuptaNo ratings yet

- List of Open Exam 2010Document2 pagesList of Open Exam 2010Rabin JoshiNo ratings yet

- Agenda OrganizadoraDocument108 pagesAgenda OrganizadoraGomez RaulNo ratings yet

- Newsletter 05-21-10Document7 pagesNewsletter 05-21-10yemintun1988No ratings yet

- A CD Cal 2010Document3 pagesA CD Cal 2010deepak111yadavNo ratings yet

- Aravind Petrol Conveyence From Nov MonthDocument8 pagesAravind Petrol Conveyence From Nov MonthShailesh ChiliveriNo ratings yet

- Final Seniority-Addnl EE-31.07.2021Document22 pagesFinal Seniority-Addnl EE-31.07.2021Sandeep WaghNo ratings yet

- Global Mediacom Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesGlobal Mediacom Tbk. (S) : Company Report: January 2017 As of 31 January 2017Dicky L RiantoNo ratings yet

- Fondo de Ahorro PrevisionalDocument7 pagesFondo de Ahorro PrevisionalFerdinand FernandezNo ratings yet

- Status, IPO Bidding Information, IPO Ratings, IPO Grading, IPO Reviews, Grey Market Premiums of IPO's, IPO News and IPO Performance TrackerDocument11 pagesStatus, IPO Bidding Information, IPO Ratings, IPO Grading, IPO Reviews, Grey Market Premiums of IPO's, IPO News and IPO Performance TrackerAbhilasha SrivastavaNo ratings yet

- Announce 201019marDocument4 pagesAnnounce 201019marAzhar HameedNo ratings yet

- Form Four Yearly Scheme of WorkDocument3 pagesForm Four Yearly Scheme of Workwanieda7No ratings yet

- Aman Quant 2Document6 pagesAman Quant 2NIKNISHNo ratings yet

- Upcoming Events June 2010Document4 pagesUpcoming Events June 2010Jayken Liew Yew KeanNo ratings yet

- Astra Otoparts Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesAstra Otoparts Tbk. (S) : Company Report: January 2017 As of 31 January 2017Nyoman ShantiyasaNo ratings yet

- Proposal and Article Schedule For Regeneration of Spinal CordsDocument1 pageProposal and Article Schedule For Regeneration of Spinal CordsTyler SweeneyNo ratings yet

- PCAT CIB TestDatesDocument1 pagePCAT CIB TestDatesYvonne WangNo ratings yet

- Registration: Saturday, April 10, 2010: Independence Day HolidayDocument6 pagesRegistration: Saturday, April 10, 2010: Independence Day HolidayDhaval ShahNo ratings yet

- Lucky Cement LTD., Share Price June, 2010Document2 pagesLucky Cement LTD., Share Price June, 2010Akeel ChoudharyNo ratings yet

- Aum PerformanceDocument3 pagesAum Performancekirang gandhiNo ratings yet

- Total Bangun Persada Tbk. (S) : Company Report: January 2015 As of 30 January 2015Document3 pagesTotal Bangun Persada Tbk. (S) : Company Report: January 2015 As of 30 January 2015Halim RachmatNo ratings yet

- Dolar TodayDocument80 pagesDolar TodayClaudio ColettaNo ratings yet

- Global Mediacom TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesGlobal Mediacom TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Panca Global Securities TBKDocument3 pagesPanca Global Securities TBKreyNo ratings yet

- Issuer Company Issue Open Issue Close Offer Price (RS.) Issue Type Issue Size (Crore RS.)Document2 pagesIssuer Company Issue Open Issue Close Offer Price (RS.) Issue Type Issue Size (Crore RS.)Bishal HandiqueNo ratings yet

- TIMESHEETDocument1 pageTIMESHEETilovejayaNo ratings yet

- DPMTDocument38 pagesDPMTPunit GauravNo ratings yet

- Attendance - Sheet - Oct 2010Document1 pageAttendance - Sheet - Oct 2010shitalralebhatNo ratings yet

- LSE ExaminationTimetable2010Document20 pagesLSE ExaminationTimetable2010aimran_amirNo ratings yet

- 022STUDocument1 page022STUmaf1otulNo ratings yet

- KIT W7 TimelineDocument1 pageKIT W7 TimelineKitsilano HouseNo ratings yet

- Sailing Schedule: Walrus Shipping Services LLCDocument1 pageSailing Schedule: Walrus Shipping Services LLCsopanam123No ratings yet

- Event Calendar T32010Document4 pagesEvent Calendar T32010Dipesh AcharyaNo ratings yet

- Summary of Po'S For Supplies/Goods MonitoringDocument6 pagesSummary of Po'S For Supplies/Goods MonitoringsarmzNo ratings yet

- Time Schedule As-10 WebsiteDocument12 pagesTime Schedule As-10 WebsiteParth DewanganNo ratings yet

- Schedule Eng202CDocument1 pageSchedule Eng202CAruna DiasNo ratings yet

- Weekly Safety Stat ReportDocument5 pagesWeekly Safety Stat ReportPat HudginsNo ratings yet

- Netcore Solutions Pvt. LTD.: Holiday List - 2010Document1 pageNetcore Solutions Pvt. LTD.: Holiday List - 2010Manish DesaiNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesTXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancepraveen_bietNo ratings yet

- TransilvaniaDocument4 pagesTransilvaniamarius_86roNo ratings yet

- Analyst - Report.29July10 2Document5 pagesAnalyst - Report.29July10 2Rohit SharmaNo ratings yet

- Ntcet 2010161109Document2 pagesNtcet 2010161109liriesNo ratings yet

- Metros Roc 515-517 Mayo 2010Document2 pagesMetros Roc 515-517 Mayo 2010Fernando Cabezas MolinaNo ratings yet

- Academic Calendar Odd Semester2010-2011Document2 pagesAcademic Calendar Odd Semester2010-2011Amit SamdarshiNo ratings yet

- Conversation Formula by BaburamDocument5 pagesConversation Formula by BaburamSudhir KumarNo ratings yet

- Summary of PO's Not Delivered June To August 12,2010Document22 pagesSummary of PO's Not Delivered June To August 12,2010sarmzNo ratings yet

- Kingfisher Winter 2010 PDFDocument36 pagesKingfisher Winter 2010 PDFRussell MendoncaNo ratings yet

- Qualitair Engineers: Sales RegisterDocument3 pagesQualitair Engineers: Sales Registercalvin.bloodaxe4478No ratings yet

- © 2009 Christian Medical College, Vellore. in Service of The Nation Since 1900Document6 pages© 2009 Christian Medical College, Vellore. in Service of The Nation Since 1900vijayshinoNo ratings yet

- I 1 ZCK 8 OKh 71 CC 7 CPDocument2 pagesI 1 ZCK 8 OKh 71 CC 7 CPAvinash SomannaNo ratings yet

- Invoice THE Smart Shop: Jtbkvi Jtbj2VDocument6 pagesInvoice THE Smart Shop: Jtbkvi Jtbj2VMgm KarthikeyanNo ratings yet