Professional Documents

Culture Documents

Generally Accepted Accounting Principles (GAAP) Is A Term Used To Refer To The Standard

Generally Accepted Accounting Principles (GAAP) Is A Term Used To Refer To The Standard

Uploaded by

Rahul JainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Generally Accepted Accounting Principles (GAAP) Is A Term Used To Refer To The Standard

Generally Accepted Accounting Principles (GAAP) Is A Term Used To Refer To The Standard

Uploaded by

Rahul JainCopyright:

Available Formats

Accounting for marketing managers

GAAP

Generally Accepted Accounting Principles (GAAP) is a term used to refer to the standard

framework of guidelines for financial accounting used in any given jurisdiction which are

generally known as Accounting Standards. GAAP includes the standards, conventions, and

rules accountants follow in recording and summarizing transactions, and in the preparation of

financial statements.

The basic principles underlying GAAP accounting are set forth below.

When preparing financial statements prepared using GAAP, most American corporations and

other business entities use the many rules of how to report business transactions based upon the

various GAAP rules. This provides for consistency in the reporting of companies and businesses

so that financial analysts, banks, shareholders and the SEC can have all reporting companies

preparing their financial statements using the same rules and reporting procedures. The rules and

procedures for reporting under GAAP are complex and have developed over a long period of

time. Currently there are more than 150 "pronouncements" as to how to account for different

types of transactions, ranging from how to report regular income from the sale of goods, and its

related inventory values, to accounting for incentive stock option distributions. By using

consistent principles, all companies reporting under GAAP report these transactions on their

financial statements in a consistent manner.

The various rules and pronouncements come from the Financial Accounting Standards Board

(FASB) which is a no-profit organization that the accounting profession has created to

promulgate the rules of GAAP reporting and to amend the rules of GAAP reporting as occasion

requires. The more recent pronouncements come as Statements of the Financial Accounting

Board (SFAS). Changes in the GAAP rules can carry tremendous impact upon American

business.

Financial Accounting is information that must be assembled and reported objectively. Third-

parties who must rely on such information have a right to be assured that the data are free from

bias and inconsistency, whether deliberate or not. For this reason, financial accounting relies on

certain standards or guides that are called "Generally Accepted Accounting Principles" (GAAP).

Basic Concepts of GAAP

To achieve basic objectives and implement fundamental qualities GAAP has four basic

assumptions, basic principles, and four basic constraints.

Assumptions

Business Entity: assumes that the business is separate from its owners or other

businesses. Revenue and expense should be kept separate from personal expenses.

Swati Singh Page 1

Accounting for marketing managers

Going Concern: assumes that the business will be in operation indefinitely. This

validates the methods of asset capitalization, depreciation, and amortization. Only when

liquidation is certain this assumption is not applicable.

Monetary Unit principle: assumes a stable currency is going to be the unit of record.

The FASB accepts the nominal value of the US Dollar as the monetary unit of record

unadjusted for inflation.

The Time-period principle implies that the economic activities of an enterprise can be

divided into artificial time periods.

Principles derive from tradition, such as the concept of matching.

Principle of regularity: Regularity can be defined as conformity to enforced rules and

laws.

Principle of consistency: This principle states that when a business has once fixed a

method for the accounting treatment of an item, it will enter all similar items that follow

in exactly the same way.

Principle of sincerity: According to this principle, the accounting unit should reflect in

good faith the reality of the company's financial status.

Principle of the permanence of methods: This principle aims at allowing the coherence

and comparison of the financial information published by the company.

Principle of non-compensation: One should show the full details of the financial

information and not seek to compensate a debt with an asset, revenue with an expense,

etc.

Principle of prudence: This principle aims at showing the reality "as is": one should not

try to make things look prettier than they are. Typically, revenue should be recorded only

when it is certain and a provision should be entered for an expense which is probable.

Principle of continuity: When stating financial information, one should assume that the

business will not be interrupted. This principle mitigates the principle of prudence: assets

do not have to be accounted at their disposable value, but it is accepted that they are at

their historical value

Principle of periodicity: Each accounting entry should be allocated to a given period,

and split accordingly if it covers several periods. If a client pre-pays a subscription (or

lease, etc.), the given revenue should be split to the entire time-span and not counted for

entirely on the date of the transaction.

Principle of Full Disclosure/Materiality: All information and values pertaining to the

financial position of a business must be disclosed in the records.

Swati Singh Page 2

Accounting for marketing managers

Principle of Utmost Good Faith: All the information regarding to the firm should be

disclosed to the insurer before the insurance policy is taken.

Constraints

Objectivity principle: the company financial statements provided by the accountants

should be based on objective evidence.

Materiality principle: the significance of an item should be considered when it is

reported. An item is considered significant when it would affect the decision of a

reasonable individual.

Consistency principle: It means that the company uses the same accounting principles

and methods from year to year.

Prudence principle: when choosing between two solutions, the one that will be least

likely to overstate assets and income should be picked.

Accounting Standards

Accounting Standards in India are issued By the Institute of Chartered Accountant of India

(ICAI). At present there are 30 Accounting Standards issued by ICAI.

Objective of Accounting Standards

Objective of Accounting Standards is to standarize the diverse accounting policies and practices

with a view to eliminate to the extent possible the non-comparability of financial statements and

the reliability to the financial statements.

Accounting Standards Issued by the Institute of Chatered Accountants of India are as

below:

Disclosure of accounting policies:

Valuation Of Inventories:

Cash Flow Statements

Contingencies and events Occurring after the Balance sheet Date

Net Profit or loss For the period, Prior period items and Changes in accounting Policies.

Depreciation accounting.

Construction Contracts.

Revenue Recognition.

Accounting For Fixed Assets.

The Effect of Changes In Foreign Exchange Rates.

Swati Singh Page 3

Accounting for marketing managers

Accounting For Government Grants.

Accounting For Investments.

Accounting For Amalgamation.

Employee Benefits.

Borrowing Cost.

Segment Reporting.

Related Party Disclosures.

Accounting For Leases.

Earning Per Share.

Consolidated Financial Statement.

Accounting For Taxes on Income.

Accounting for Investment in associates in Consolidated Financial Statement.

Discontinuing Operation.

Interim Financial Reporting.

Intangible assets.

Financial Reporting on Interest in joint Ventures.

Impairment Of assets.

Provisions, Contingent, liabilities and Contingent assets.

Financial instrument.

Financial Instrument: presentation.

Financial Instruments, Disclosures and Limited revision to accounting standards.

Cash Flow Statements: Cash flow statement is additional information to user of financial

statement. This statement exhibits the flow of incoming and outgoing cash. This statement

assesses the ability of the enterprise to generate cash and to utilize the cash. This statement is one

of the tools for assessing the liquidity and solvency of the enterprise.

Depreciation Accounting : It is a measure of wearing out, consumption or other loss of value of

a depreciable asset arising from use, passage of time. Depreciation is nothing but distribution of

total cost of asset over its useful life.

Revenue Recognition : The standard explains as to when the revenue should be recognized in

profit and loss account and also states the circumstances in which revenue recognition can be

postponed. Revenue means gross inflow of cash, receivable or other consideration arising in the

course of ordinary activities of an enterprise such as:- The sale of goods, Rendering of Services,

Swati Singh Page 4

Accounting for marketing managers

and Use of enterprises resources by other yeilding interest, dividend and royalties. In other

words, revenue is a charge made to customers / clients for goods supplied and services rendered.

Accounting for Fixed Assets : It is an asset, which is:- Held with intention of being used for the

purpose of producing or providing goods and services. Not held for sale in the normal course of

business. Expected to be used for more than one accounting period.

Accounting for Investments : It is the assets held for earning income by way of dividend,

interest and rentals, for capital appreciation or for other benefits.

Intangible Assets : An Intangible Asset is an Identifiable non-monetary Asset without physical

substance held for use in the production or supplying of goods or services for rentals to others or

for administrative purpose

Provisions, Contingent Liabilities And Contingent Assets : Objective of this standard is to

prescribe the accounting for Provisions, Contingent Liabilitites, Contingent Assets, Provision for

restructuring cost.

Provision: It is a liability, which can be measured only by using a substantial degree of

estimation.

Liability: A liability is present obligation of the enterprise arising from past events the settlement

of which is expected to result in an outflow from the enterprise of resources embodying

economic benefits.

Differences between US GAAP and Indian GAAP

Some of these major differences between US GAAP and Indian GAAP which give rise

differences in profit are highlighted hereunder:

Underlying assumptions: Under Indian GAAP, Financial statements are

prepared in accordance with the principle of conservatism which basically means

“Anticipate no profits and provide for all possible losses”. Under US GAAP

conservatism is not considered, if it leads to deliberate and consistent

understatements.

Format/ Presentation of financial statements: Under Indian GAAP, financial

statements are prepared in accordance with the presentation requirements of

Schedule VI to the Companies Act, 1956. On the other hand , financial statements

prepared as per US GAAP are not required to be prepared under any specific

format as long as they comply with the disclosure requirements of US GAAP.

Financial statements to be filed with SEC include

Cash flow statement: Under Indian GAAP (AS 3) , inclusion of Cash Flow

statement in financial statements is mandatory only for companies whose share

are listed on recognized stock exchanges and Certain enterprises whose turnover

Swati Singh Page 5

Accounting for marketing managers

for the accounting period exceeds Rs. 50 crore. Thus , unlisted companies escape

the burden of providing cash flow statements as part of their financial statements.

On the other hand, US GAAP (SFAS 95) mandates furnishing of cash flow

statements for 3 years – current year and 2 immediate preceding years

irrespective of whether the company is listed or not .

Long term Debts: Under US GAAP , the current portion of long term debt is

classified as current liability, whereas under the Indian GAAP, there is no such

requirement and hence the interest accrued on such long term debt in not taken as

current liability.

Extraordinary items, prior period items and changes in accounting policies:

Under Indian GAAP( AS 5) , extraordinary items, prior period items and changes

in accounting policies are disclosed without netting off for tax effects . Under US

GAAP (SFAS 16) adjustments for tax effects are required to be made while

reporting the Prior period Items.

Capital issue expenses: Under the US GAAP, capital issue expenses are required to be

written off when incurred against proceeds of capitals, whereas under Indian GAAP

capital issue expense can be amortized or written off against reserves.

Proposed dividend: Under Indian GAAP , dividends declared are accounted for in the

year to which they relate. For example, if dividend for the FY 1999-2000 is declared in

Sep 2000 , then the corresponding charge is made in 2000-2001 as below the line item

Contrary to this , under US GAAP dividends are reduced from the reserves in the year

they are declared by the Board. Hence in this case under US GAAP , it will be charged

Profit and loss account of 2000-2001 above the line.

Employee benefits: Under Indian GAAP, provision for leave encashment is accounted

based n actuarial valuation. Compensation to employees who opt for voluntary

retirement scheme can be amortized over 60 months. Under US GAAP, provision for

leave encashment is accounted on actual basis. Compensation towards voluntary

retirement scheme is to be charged in the year in which the employees accept the offer.

Loss on extinguishment of debt: Under Indian GAAP, debt extinguishment premiums

are adjusted against Securities Premium Account. Under US GAAP, premiums for early

extinguishment of debt are expensed as incurred.

Swati Singh Page 6

You might also like

- GAAP (Generally Accepted Accounting Principles)Document4 pagesGAAP (Generally Accepted Accounting Principles)Rihana Khatun83% (6)

- Generally Accepted Accounting Principles GAAP NEWDocument4 pagesGenerally Accepted Accounting Principles GAAP NEWdhwaneel100% (1)

- Generally Accepted Accounting PrinciplesDocument12 pagesGenerally Accepted Accounting PrinciplesMARIA ANGELICA100% (2)

- Accountings AssignmentDocument12 pagesAccountings AssignmentDivisha AgarwalNo ratings yet

- Financial AccountingDocument27 pagesFinancial AccountingShreya KanjariyaNo ratings yet

- Role of Accounting in SocietyDocument9 pagesRole of Accounting in SocietyAbdul GafoorNo ratings yet

- Assignment On GAAP, AccountingDocument7 pagesAssignment On GAAP, AccountingAsma Hameed67% (3)

- Meaning and Nature of Accounting PrincipleDocument25 pagesMeaning and Nature of Accounting PrincipleVibhat Chabra 225013No ratings yet

- Generally Accepted Accounting Principles (GAAP)Document7 pagesGenerally Accepted Accounting Principles (GAAP)Laxmi GurungNo ratings yet

- Accountancy ManualDocument61 pagesAccountancy ManualAhmad Fauzi MehatNo ratings yet

- A Brief Presentation On AccountingDocument15 pagesA Brief Presentation On AccountingAtish PandaNo ratings yet

- Accounting Concepts and ConventionsDocument2 pagesAccounting Concepts and ConventionsWelcome 1995No ratings yet

- Accountancy Chapter 2: Theory Base of Accounting: Business Entity ConceptDocument6 pagesAccountancy Chapter 2: Theory Base of Accounting: Business Entity ConceptKutty Kiran KumarNo ratings yet

- Structure of AccountingDocument62 pagesStructure of AccountingSyafira AdeliaNo ratings yet

- Accounting Concepts and ConventionsDocument22 pagesAccounting Concepts and ConventionsMishal SiddiqueNo ratings yet

- Accounting Theory PaperDocument23 pagesAccounting Theory PaperChristopher FlynnNo ratings yet

- Principles and Practice of AuditingDocument55 pagesPrinciples and Practice of Auditingdanucandy2No ratings yet

- Accounting As An Information SystemDocument14 pagesAccounting As An Information SystemAimee SagastumeNo ratings yet

- Ch. 1-Fundamentals of Accounting IDocument20 pagesCh. 1-Fundamentals of Accounting IDèřæ Ô MáNo ratings yet

- AFM Question Bank For 16MBA13 SchemeDocument10 pagesAFM Question Bank For 16MBA13 SchemeChandan Dn Gowda100% (1)

- Difference Between Provision and ReserveDocument5 pagesDifference Between Provision and ReserveŚáńtőśh MőkáśhíNo ratings yet

- Accounting ConceptsDocument13 pagesAccounting ConceptsdeepshrmNo ratings yet

- Afm Unit 1 Total NotesDocument26 pagesAfm Unit 1 Total NotesanglrNo ratings yet

- GaapDocument18 pagesGaapsujan BhandariNo ratings yet

- AUDIT BasicDocument10 pagesAUDIT BasicKingo StreamNo ratings yet

- Basic Accounting PrinciplesDocument5 pagesBasic Accounting PrinciplesGracie BulaquinaNo ratings yet

- ACT103 - Module 1Document13 pagesACT103 - Module 1Le MinouNo ratings yet

- CH 8 Financial EthicsDocument21 pagesCH 8 Financial EthicsMadhu Gupta100% (1)

- Wey AP 8e Ch01Document47 pagesWey AP 8e Ch01Bintang RahmadiNo ratings yet

- Acct TutorDocument22 pagesAcct TutorKthln Mntlla100% (1)

- Why Do We Need AccountingDocument4 pagesWhy Do We Need Accountinglaxmi300No ratings yet

- Accounting Notes PDFDocument67 pagesAccounting Notes PDFEjazAhmadNo ratings yet

- Accounting Theory Project 1 - MayaDocument18 pagesAccounting Theory Project 1 - MayaDima AbdulhayNo ratings yet

- Notes On Introduction To AccountingDocument6 pagesNotes On Introduction To AccountingChaaru VarshiniNo ratings yet

- Responsibility AccountingDocument27 pagesResponsibility AccountingZoya KhanNo ratings yet

- Basic Accounting ConceptDocument19 pagesBasic Accounting ConcepttundsandyNo ratings yet

- CS Executive Corporate and Management AccountingDocument17 pagesCS Executive Corporate and Management AccountingSuraj Srivatsav.SNo ratings yet

- Generally Accepted Accounting Principles: MMS Semester I by Prof. Megha HemdevDocument20 pagesGenerally Accepted Accounting Principles: MMS Semester I by Prof. Megha HemdevNikita MudrasNo ratings yet

- 413 Block1Document208 pages413 Block1Subramanyam Devarakonda100% (1)

- Accounting Concepts and ConventionsDocument4 pagesAccounting Concepts and ConventionsakhilNo ratings yet

- Chapter 1: Introduction To AccountingDocument17 pagesChapter 1: Introduction To AccountingPALADUGU MOUNIKANo ratings yet

- Creative Accounting: A Literature ReviewDocument13 pagesCreative Accounting: A Literature ReviewthesijNo ratings yet

- Business StudiesDocument15 pagesBusiness Studiestssuru9182No ratings yet

- Introduction To Financial AccountingDocument9 pagesIntroduction To Financial AccountingThai Hoang AnhNo ratings yet

- Accounts 1Document14 pagesAccounts 1Piyush PatelNo ratings yet

- Bcom 3 Audit FinalDocument17 pagesBcom 3 Audit FinalNayan MaldeNo ratings yet

- Managerial Economics MeaningDocument41 pagesManagerial Economics MeaningPaul TibbinNo ratings yet

- The Nature of Accounting Theory and The Development of TheoryDocument6 pagesThe Nature of Accounting Theory and The Development of TheoryEngrAbeer Arif100% (1)

- Fundamentals OF Accounting: Accounting by Meigs, Williams, Haka, BettnerDocument64 pagesFundamentals OF Accounting: Accounting by Meigs, Williams, Haka, BettnerAliya SaeedNo ratings yet

- CH 5 Accounting VeiwpointsDocument12 pagesCH 5 Accounting Veiwpointslenalena123100% (1)

- A 11 Internal Reconstruction of A CompanyDocument18 pagesA 11 Internal Reconstruction of A CompanyDhananjay Pawar50% (2)

- Lecture Slides - Chapter 1 2Document66 pagesLecture Slides - Chapter 1 2Van Dat100% (1)

- GAAP Revenue RecognitionDocument6 pagesGAAP Revenue Recognitionkms6575No ratings yet

- Audit Report: Qualified Opinion Scope LimitationsDocument4 pagesAudit Report: Qualified Opinion Scope LimitationsAnaghaPuranikNo ratings yet

- CMBE 2 - Lesson 1 ModuleDocument11 pagesCMBE 2 - Lesson 1 ModuleEunice AmbrocioNo ratings yet

- Consumer protection The Ultimate Step-By-Step GuideFrom EverandConsumer protection The Ultimate Step-By-Step GuideRating: 5 out of 5 stars5/5 (1)

- MB41 Ans IDocument14 pagesMB41 Ans IAloke SharmaNo ratings yet

- Accounting PrinciplesDocument12 pagesAccounting PrinciplesBalti MusicNo ratings yet

- Assingnment On AccountingDocument5 pagesAssingnment On AccountingAbdul LatifNo ratings yet

- Chapter 6 - Accounting Concepts and PrinciplesDocument19 pagesChapter 6 - Accounting Concepts and PrinciplesRyah Louisse E. ParabolesNo ratings yet

- (Financial Accounting & Reporting 3) : Lecture AidDocument46 pages(Financial Accounting & Reporting 3) : Lecture AidGonzalo Jr. RualesNo ratings yet

- Accounts Ans Jan 2021Document25 pagesAccounts Ans Jan 2021Hemant AherNo ratings yet

- Chapter 15 - Taxation and Corporate IncomeDocument26 pagesChapter 15 - Taxation and Corporate Incomewatts1No ratings yet

- Quiz 9 &10Document17 pagesQuiz 9 &10Uzma Siddiqui100% (1)

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- Security Analysis and Portfolio Management Prof: C.S. Mishra Department of VGSOM Indian Institute of Technology, KharagpurDocument29 pagesSecurity Analysis and Portfolio Management Prof: C.S. Mishra Department of VGSOM Indian Institute of Technology, KharagpurviswanathNo ratings yet

- Project Profile For Goat, Sheep, Cow, Poultry & Fish Farming UnitDocument29 pagesProject Profile For Goat, Sheep, Cow, Poultry & Fish Farming UnitHarishNo ratings yet

- Accounting For Wasting Assets DrillDocument13 pagesAccounting For Wasting Assets DrillRobert Jr.No ratings yet

- Business Law Prac Module 1Document139 pagesBusiness Law Prac Module 1Laura NoelNo ratings yet

- Module 6 - Replacement AnalysisDocument10 pagesModule 6 - Replacement AnalysisHazel NantesNo ratings yet

- Financial Ratio Comparison IT Sector Infosys VS WiproDocument28 pagesFinancial Ratio Comparison IT Sector Infosys VS WiproLOVESH GUPTANo ratings yet

- Valuation Report: Submitted byDocument32 pagesValuation Report: Submitted byUtsab GautamNo ratings yet

- Analysis of Cost EstimationDocument58 pagesAnalysis of Cost Estimationccsreddy100% (3)

- Chapter II: Relevant Information & Decision MakingDocument15 pagesChapter II: Relevant Information & Decision MakingAsteway Mesfin100% (4)

- Financial Statements:: Review, Analysis, and InterpretationDocument5 pagesFinancial Statements:: Review, Analysis, and InterpretationbethNo ratings yet

- Cost APProachDocument40 pagesCost APProachMANNAVAN.T.NNo ratings yet

- Prelim ExaminationDocument9 pagesPrelim ExaminationShannel Angelica Claire RiveraNo ratings yet

- FM - UASM - OM - Siti Diyah Ayu LestariDocument4 pagesFM - UASM - OM - Siti Diyah Ayu LestariSiti Dyah Ayu LNo ratings yet

- KPMG Flash News United Breweries LTD 3Document4 pagesKPMG Flash News United Breweries LTD 3Sardar JunaidNo ratings yet

- Test One Week Before AnnualDocument4 pagesTest One Week Before AnnualGodfreyFrankMwakalingaNo ratings yet

- Exercises in Corporation SolutionsDocument6 pagesExercises in Corporation Solutionsdiane camansagNo ratings yet

- Accounting For Income TaxDocument26 pagesAccounting For Income TaxKelly Ng67% (6)

- Multiple Shift DepreciationDocument10 pagesMultiple Shift DepreciationRanjit Raje100% (3)

- Acceptance-or-Rejection Decisions: Decisions. Managers Encounter Two (2) Types of Capital-Budgeting DecisionsDocument12 pagesAcceptance-or-Rejection Decisions: Decisions. Managers Encounter Two (2) Types of Capital-Budgeting Decisionsstannis69420No ratings yet

- Certified: SAP FICO TrainingDocument15 pagesCertified: SAP FICO TrainingSRIRAM TRIPURANENINo ratings yet

- MS-12 (Capital Budgeting With Investment Risks and Returns)Document18 pagesMS-12 (Capital Budgeting With Investment Risks and Returns)musor.as084No ratings yet

- PROJECT - UpdatedDocument7 pagesPROJECT - UpdatedSuraj GantayatNo ratings yet

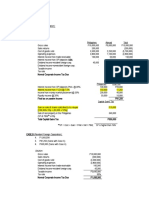

- Trading and Profit & Loss Account FINANCIAL YEAR:-2016-17 Particulars Amount (RS.) Amount (RS.) Particulars Amount (RS.) Amount (RS.)Document8 pagesTrading and Profit & Loss Account FINANCIAL YEAR:-2016-17 Particulars Amount (RS.) Amount (RS.) Particulars Amount (RS.) Amount (RS.)sourav jhaNo ratings yet

- Inventories, Biological Assets, Etc.Document3 pagesInventories, Biological Assets, Etc.Jobelle Candace Flores AbreraNo ratings yet

- Indian Accounting Standards (One Pager)Document29 pagesIndian Accounting Standards (One Pager)sridhartks100% (1)