Professional Documents

Culture Documents

Salestax USA

Salestax USA

Uploaded by

stefanpietzsch32430 ratings0% found this document useful (0 votes)

5 views1 pageThis document outlines state sales tax rates and exemptions for food, prescription drugs, and nonprescription drugs as of January 1, 2010. State sales tax rates range from none in several states to 8.25% in California. Most states exempt prescription drugs and food from sales tax, while some exempt nonprescription drugs and others do not. Exemption policies and the tax rates applied to food vary between states.

Original Description:

Original Title

salestax_USA

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines state sales tax rates and exemptions for food, prescription drugs, and nonprescription drugs as of January 1, 2010. State sales tax rates range from none in several states to 8.25% in California. Most states exempt prescription drugs and food from sales tax, while some exempt nonprescription drugs and others do not. Exemption policies and the tax rates applied to food vary between states.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views1 pageSalestax USA

Salestax USA

Uploaded by

stefanpietzsch3243This document outlines state sales tax rates and exemptions for food, prescription drugs, and nonprescription drugs as of January 1, 2010. State sales tax rates range from none in several states to 8.25% in California. Most states exempt prescription drugs and food from sales tax, while some exempt nonprescription drugs and others do not. Exemption policies and the tax rates applied to food vary between states.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

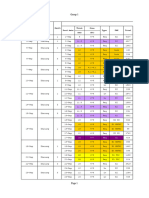

STATE SALES TAX RATES

AND FOOD & DRUG EXEMPTIONS

(As of January 1, 2010)

EXEMPTIONS

Tax Rate Prescription Nonprescription

STATE (percentage) Food (1) Drugs Drugs

ALABAMA 4 *

ALASKA none

ARIZONA 5.6 * *

ARKANSAS 6 2% (4) *

CALIFORNIA (3) 8.25 * *

COLORADO 2.9 * *

CONNECTICUT 6 * * *

DELAWARE none

FLORIDA 6 * * *

GEORGIA 4 * (4) *

HAWAII 4 *

IDAHO 6 *

ILLINOIS 6.25 1% 1% 1%

INDIANA 7 * *

IOWA 6 * *

KANSAS 5.3 *

KENTUCKY 6 * *

LOUISIANA 4 * (4) *

MAINE 5 * *

MARYLAND 6 * * *

MASSACHUSETTS 6.25 * *

MICHIGAN 6 * *

MINNESOTA 6.875 * * *

MISSISSIPPI 7 *

MISSOURI 4.225 1.225% *

MONTANA none *

NEBRASKA 5.5 * *

NEVADA 6.85 * *

NEW HAMPSHIRE none

NEW JERSEY 7 * * *

NEW MEXICO 5 * *

NEW YORK 4 * * *

NORTH CAROLINA 5.75 * (4) *

NORTH DAKOTA 5 * *

OHIO 5.5 * *

OKLAHOMA 4.5 *

OREGON none

PENNSYLVANIA 6 * * *

RHODE ISLAND 7 * * *

SOUTH CAROLINA 6 * *

SOUTH DAKOTA 4 *

TENNESSEE 7 5.5% *

TEXAS 6.25 * * *

UTAH 4.7 1.75% (4) *

VERMONT 6 * * *

VIRGINIA 5.0 (2) 2.5% (2) * *

WASHINGTON 6.5 * *

WEST VIRGINIA 6 3% *

WISCONSIN 5 * *

WYOMING 4 * *

DIST. OF COLUMBIA 6 * * *

* -- indicates exempt from tax, blank indicates subject to general sales tax rate.

Source: Compiled by FTA from various sources.

(1) Some state tax food, but allow a rebate or income tax credit to compensate poor

households. They are: HI, ID, KS, OK, SD, and WY.

(2) Includes statewide local tax of 1.0% in Virginia .

(3) Tax rate may be adjusted annually according to a formula based on balances in the

unappropriated general fund and the school foundation fund.

(4) Food sales are subject to local sales taxes.

FEDERATION OF TAX ADMINISTRATORS -- FEBRUARY 2010

You might also like

- Solutions Manual - Principles of MicroeconomcisDocument259 pagesSolutions Manual - Principles of MicroeconomcisParin Shah92% (25)

- Steroids Rating ChartDocument2 pagesSteroids Rating Chartthe bungalowvideotapes0% (1)

- JobsFit 2022 Labor Market Information ReportDocument149 pagesJobsFit 2022 Labor Market Information Reported jireh nangcaNo ratings yet

- Protest Letter SampleDocument3 pagesProtest Letter Samplesarah.gleason100% (1)

- ECON+2105+exam +3+study+guide Chapters+6-8 Exam+date+04152015Document56 pagesECON+2105+exam +3+study+guide Chapters+6-8 Exam+date+04152015Likhit NayakNo ratings yet

- SalesDocument1 pageSalesnikithalexNo ratings yet

- 12 Asylum Decision Rates by NationalityDocument5 pages12 Asylum Decision Rates by NationalityNSNo ratings yet

- MinwagunempDocument2 pagesMinwagunemplawroarkNo ratings yet

- Solvex Summer 2022 Offer-Update-30.06.2022Document1,181 pagesSolvex Summer 2022 Offer-Update-30.06.2022cosminaNo ratings yet

- 1st Score Chemistry Sec F 2021 ADDocument4 pages1st Score Chemistry Sec F 2021 ADAntoine MontañoNo ratings yet

- MigrationDocument3 pagesMigrationapi-3696675No ratings yet

- 00 Ic3 Me Tpe CC Notes 2023Document2 pages00 Ic3 Me Tpe CC Notes 2023mendelndemamendelNo ratings yet

- DALLAS COUNTY - Garland ISD - 1994 Texas School Survey of Drug and Alcohol UseDocument4 pagesDALLAS COUNTY - Garland ISD - 1994 Texas School Survey of Drug and Alcohol UseTexas School Survey of Drug and Alcohol UseNo ratings yet

- Final Report Premiers Leadership and Performance December 29 2020 MinDocument22 pagesFinal Report Premiers Leadership and Performance December 29 2020 MinCityNewsTorontoNo ratings yet

- Philippine Inflation RateDocument29 pagesPhilippine Inflation Ratemirika3shirinNo ratings yet

- Migration 2Document3 pagesMigration 2api-3696675No ratings yet

- Home Insurance and Disaster Risk PDFDocument3 pagesHome Insurance and Disaster Risk PDFmagowa6185No ratings yet

- Poverty by NAPCDocument2 pagesPoverty by NAPCVenus T. OyaoNo ratings yet

- Boletín T.5 - o Barroco en Italia e EuropaDocument10 pagesBoletín T.5 - o Barroco en Italia e EuropaDIEGONo ratings yet

- Stats PDFDocument1 pageStats PDFJordan PounceyNo ratings yet

- Appendix C: Mean Years of Schooling by Country, Religion and GenderDocument12 pagesAppendix C: Mean Years of Schooling by Country, Religion and GenderAsmir DoricNo ratings yet

- CompilationDocument4 pagesCompilationapi-26142417No ratings yet

- SR 2015 Births - SR PDFDocument4 pagesSR 2015 Births - SR PDFFeb NamiaNo ratings yet

- Book 1Document1 pageBook 1Adriana BrandasNo ratings yet

- Monthly Fact Sheet April 2021Document4 pagesMonthly Fact Sheet April 2021ALNo ratings yet

- Opioid Mortality: and Selected TrendsDocument7 pagesOpioid Mortality: and Selected TrendsWIS Digital News StaffNo ratings yet

- RIF2017 Jean-Paul Agon EN PDFDocument92 pagesRIF2017 Jean-Paul Agon EN PDFaz2690No ratings yet

- Daftar Hadir Gerak JalanDocument2 pagesDaftar Hadir Gerak JalanMuhammad AlwinNo ratings yet

- Top 20 Tenant DiversificationDocument1 pageTop 20 Tenant DiversificationFrancisco TejeroNo ratings yet

- Dalot Simplle OH2 (2,5X2,5) : Croquis Acier SEC D EC Long N 1 2 3 4 5 6Document3 pagesDalot Simplle OH2 (2,5X2,5) : Croquis Acier SEC D EC Long N 1 2 3 4 5 6KLMNo ratings yet

- 2007 vIRGINIA Crash FactsDocument1 page2007 vIRGINIA Crash Factsapi-27451723No ratings yet

- (ONSrev-cleared) 2020 APIS Statistical Tables - For PR Health - Final - Rev woWQ - ONSFDocument8 pages(ONSrev-cleared) 2020 APIS Statistical Tables - For PR Health - Final - Rev woWQ - ONSFCharls DNo ratings yet

- Season StatsDocument2 pagesSeason StatsJordan PounceyNo ratings yet

- Catalog - Cosuri Craciun 2022Document84 pagesCatalog - Cosuri Craciun 2022Alina ConstantinNo ratings yet

- Peru: A Leader in Mining Exploration?: Geological Potential and Other FactorsDocument21 pagesPeru: A Leader in Mining Exploration?: Geological Potential and Other FactorsWilliam Arenas BustillosNo ratings yet

- Respuesta 3Document2 pagesRespuesta 3j dlbNo ratings yet

- FHLMC Rates On 30-Year Fixed-Rate MortgagesDocument1 pageFHLMC Rates On 30-Year Fixed-Rate Mortgagesapi-25893974No ratings yet

- BEXAR COUNTY - Northside Isd - 1994 Texas School Survey of Drug and Alcohol UseDocument3 pagesBEXAR COUNTY - Northside Isd - 1994 Texas School Survey of Drug and Alcohol UseTexas School Survey of Drug and Alcohol UseNo ratings yet

- DENTON COUNTY - Denton Isd - 1994 Texas School Survey of Drug and Alcohol UseDocument3 pagesDENTON COUNTY - Denton Isd - 1994 Texas School Survey of Drug and Alcohol UseTexas School Survey of Drug and Alcohol UseNo ratings yet

- (2019-03-11) Gustavo Lopetegui - IAPG Houston - Energy in Argentina Investment Opportunities For The International Community - Pub PDFDocument14 pages(2019-03-11) Gustavo Lopetegui - IAPG Houston - Energy in Argentina Investment Opportunities For The International Community - Pub PDFIgnacio LabaquiNo ratings yet

- Wee Course HandicapsDocument2 pagesWee Course HandicapststdaqNo ratings yet

- Detailed Schedule: Philsa Project Gantt ChartDocument2 pagesDetailed Schedule: Philsa Project Gantt Chartdeanangelo santosNo ratings yet

- Fondo ElevenzoneDocument3 pagesFondo ElevenzoneGabriel MendozaNo ratings yet

- EDUCACION ARTISTICA SEGUNDO-A - Per 1Document4 pagesEDUCACION ARTISTICA SEGUNDO-A - Per 1ERIKA MOLINARESNo ratings yet

- Chart Title: CynthiaDocument1 pageChart Title: CynthiaJaqueline VazquezNo ratings yet

- Weebly July 2020Document2 pagesWeebly July 2020api-326815013No ratings yet

- Statistical Tables 0Document11 pagesStatistical Tables 0Jamie Rose BadelNo ratings yet

- Gross National ProductDocument1 pageGross National ProductJoy CaliaoNo ratings yet

- OEE Sanding September 2023Document26 pagesOEE Sanding September 2023achmadNo ratings yet

- LUBBOCK COUNTY - Lubbock ISD - 1994 Texas School Survey of Drug and Alcohol UseDocument4 pagesLUBBOCK COUNTY - Lubbock ISD - 1994 Texas School Survey of Drug and Alcohol UseTexas School Survey of Drug and Alcohol UseNo ratings yet

- Science Year 2 (DLP)Document7 pagesScience Year 2 (DLP)Kima Mohd NoorNo ratings yet

- Finns - Corporate Memberx - CompressedDocument16 pagesFinns - Corporate Memberx - CompressedValens AntonNo ratings yet

- Entrega de Epp: Equipo de Protección PersonalDocument2 pagesEntrega de Epp: Equipo de Protección PersonalJhon Ccanto CarbajalNo ratings yet

- Absen Kehadiran Ekstrakurikuler Siswa T. P 2017/2018: Kehadiran/Tgl KET Minggu I Minggu II Minggu III Minggu IVDocument2 pagesAbsen Kehadiran Ekstrakurikuler Siswa T. P 2017/2018: Kehadiran/Tgl KET Minggu I Minggu II Minggu III Minggu IVAl-Azhar TeboNo ratings yet

- Ice Cream Market Share, Analysis, Size, Trends - Forecast (2018-23)Document4 pagesIce Cream Market Share, Analysis, Size, Trends - Forecast (2018-23)NiketGhelaniNo ratings yet

- Lecture 10 - Wind EnergyDocument93 pagesLecture 10 - Wind EnergyMuhammad AdeelNo ratings yet

- Indexed Irish Equity Fund: Fund Description Fund FactsDocument2 pagesIndexed Irish Equity Fund: Fund Description Fund Factsrowland_smithersNo ratings yet

- Alto Chart PDFDocument1 pageAlto Chart PDF谢重霄No ratings yet

- Alto Chart PDFDocument1 pageAlto Chart PDF谢重霄No ratings yet

- TARRANT COUNTY - Azle Isd - 1994 Texas School Survey of Drug and Alcohol UseDocument3 pagesTARRANT COUNTY - Azle Isd - 1994 Texas School Survey of Drug and Alcohol UseTexas School Survey of Drug and Alcohol UseNo ratings yet

- Wee Course HandicapsDocument2 pagesWee Course HandicapststdaqNo ratings yet

- Season StatsDocument1 pageSeason StatsJordan PounceyNo ratings yet

- Kaul 2006 - The New Public FinanceDocument685 pagesKaul 2006 - The New Public FinanceWeimar Quiroga100% (1)

- IB - Post War Italy and The Rise of MussoliniDocument23 pagesIB - Post War Italy and The Rise of MussoliniJoel ComanNo ratings yet

- Salem Abo-Zaid: EducationDocument5 pagesSalem Abo-Zaid: EducationTarun SharmaNo ratings yet

- Unit 2 - Economic EnvironmentDocument50 pagesUnit 2 - Economic EnvironmentVaibhav AggarwalNo ratings yet

- Muhammad Noushad S/O Nazeem Khan 67 Ali Town Raiwind Road LahoreDocument1 pageMuhammad Noushad S/O Nazeem Khan 67 Ali Town Raiwind Road Lahorekhuram4uNo ratings yet

- Governor Refuses To Issue Bonds Approved by Maine CitizensDocument2 pagesGovernor Refuses To Issue Bonds Approved by Maine Citizensgerald7783No ratings yet

- Hoover Digest, 2018, No. 3, SummerDocument192 pagesHoover Digest, 2018, No. 3, SummerHoover Institution100% (3)

- Final Project Priya MallickDocument35 pagesFinal Project Priya MallickKrishnaNo ratings yet

- Indian EconomyDocument3 pagesIndian EconomyadpNo ratings yet

- Cost Sheet & Floor Plan For The Flat 119 & 126Document7 pagesCost Sheet & Floor Plan For The Flat 119 & 126Sasikumar ChakkarapaniNo ratings yet

- Intermediate Macroeconomics: Lecture 11: The Dynamic AS-AD Model, Part OneDocument28 pagesIntermediate Macroeconomics: Lecture 11: The Dynamic AS-AD Model, Part OneAlexRussellNo ratings yet

- Primer For Postal ServiceDocument2 pagesPrimer For Postal ServiceAnn CastroNo ratings yet

- Competition Scenario in Mauritius: Supported By: Consumer Unity & Trust Society (CUTS International)Document51 pagesCompetition Scenario in Mauritius: Supported By: Consumer Unity & Trust Society (CUTS International)rachna357No ratings yet

- METRO OECD Trade ModelDocument1 pageMETRO OECD Trade ModelTrinh VtnNo ratings yet

- A Study On Causes of Fluctuations in The Exchange Rate of INR Vs USDDocument21 pagesA Study On Causes of Fluctuations in The Exchange Rate of INR Vs USDAbilasha YadavNo ratings yet

- Money SupplyDocument7 pagesMoney SupplylulughoshNo ratings yet

- 10.7 Mechanical Theories of The Money SupplyDocument7 pages10.7 Mechanical Theories of The Money SupplyHashifaGemelliaNo ratings yet

- Chapter 6 Economics QuizDocument18 pagesChapter 6 Economics QuizCarmz100% (1)

- Understanding Economic Policy Reform - Dani RodrikDocument33 pagesUnderstanding Economic Policy Reform - Dani RodrikaliaksakalNo ratings yet

- Impact of GST On Revenue of States After 5 YearsDocument5 pagesImpact of GST On Revenue of States After 5 YearsabdullahNo ratings yet

- The United States Empire of Debt: Contact For Comments, EtcDocument9 pagesThe United States Empire of Debt: Contact For Comments, EtcrobertoslNo ratings yet

- Fiscal PolicyDocument21 pagesFiscal PolicyADTYA GUPTANo ratings yet

- Two Aspects of Deficit FinancingDocument5 pagesTwo Aspects of Deficit FinancingQamar AliNo ratings yet

- 0-10 Point Socioeconomic Agenda Ambisyon Natin 2040: Philippine Development PlanDocument2 pages0-10 Point Socioeconomic Agenda Ambisyon Natin 2040: Philippine Development PlanramilgarciaNo ratings yet

- Paper IIDocument294 pagesPaper IIAnkit SinghNo ratings yet

- Inflation - Concept Control of Inflation - Monetary, Fiscal and Direct Measures. - Jharkhand PCS Free NotesDocument4 pagesInflation - Concept Control of Inflation - Monetary, Fiscal and Direct Measures. - Jharkhand PCS Free NotesAmit DungdungNo ratings yet

- Eco OptionalDocument3 pagesEco OptionalSuleman KhanNo ratings yet