Professional Documents

Culture Documents

BE Seminar

BE Seminar

Uploaded by

pankajkapseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BE Seminar

BE Seminar

Uploaded by

pankajkapseCopyright:

Available Formats

SEMINAR REPORT: III

Subject: Business Environment

MBA SY Sem III

PANKAJ KAPSE

Roll No: 18

MBA SY Sem III

SRTMUN

Sub Centre LATUR

China FDI rises despite western concerns

over business environment

Foreign Direct Investment (FDI) in China spiked up for 13th straight month in August, despite

complaints from the US and European companies over alleged unfair business environment and

the Chinese government's favors for domestic firms.

FDI to China increased by 1.4 percent to $7.6 billion in August year-on-year, according to the

Ministry of Commerce.

From Jan-Aug, total FDI stood at $65.96 billion, up 18 percent compared with the same period

last year.

According to a recent report from the United Nations (UN), China, which stood second in

attracting FDI globally in 2009, will remain the most attractive destination until the end of 2012.

In 2009, FDI to China stood at $95 billion while the US attracted $130 billion, the UN report

said in July.

On Monday, Chinese Premier Wen Jiabao gave assurance on creating level playing field for

foreign companies in the country. In reply to growing concerns over his policies favoring

domestic companies, he also promised equal treatment for all products made in China in

government procurement.

Last week, the European Union Chamber of Commerce expressed concerns over the barriers for

its members in China, contending that there existed discrimination in enforcing environmental

and labour laws and in certification requirements for market access for foreign firms.

A similar concern was expressed by the US in July over China’s indigenous innovation policy

that supported domestic technologies.

The European and the U.S. trade bodies said that their products are not treated on par with the

local products and the new rules favor domestic companies in government procurement.

Earlier this week, World Bank’s president Robert Zoellick urged both the countries to go

cautiously on trade issues, adding that protection measures were quite dangerous.

With China being the top destination, the FDI globally is estimated to reach $2 trillion by 2012,

according to the UN’s trade and development agency.

Analyst see low-cost labour and domestic market potential as the main reasons behind increasing

FDI flows to China.

The rise of foreign direct investment (FDI)

During the Mao period (1949-1976), China spurned foreign

investment and paid back all its foreign loans (mostly to the Soviet

Union) by 1965.

After taking over economic

policy at the end of 1978,

Deng Xiaoping opened up

China to foreign trade and

investment and in the

early 1980s the first

Special Economic Zones

were set up to absorb

direct investment from

Hong Kong and elsewhere.

During the 1980s, FDI

inflows grew steadily but

remained relatively low,

confined largely to joint

ventures with Chinese

state-owned enterprises.

After the Beijing Massacre

in 1989, western and Japanese companies withheld investment in

China, but the momentum was maintained, partly by a new influx of

capital.

You might also like

- Practice of Direct Material ConsumedDocument4 pagesPractice of Direct Material Consumedi200051 Muhammad HassaanNo ratings yet

- Economic Environment of Business Mini ProjectDocument19 pagesEconomic Environment of Business Mini Projectpankajkapse67% (3)

- Penyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)Document2 pagesPenyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)mainem izzanNo ratings yet

- BE SeminarDocument3 pagesBE SeminarpankajkapseNo ratings yet

- China Going Global Strategy FinalDocument64 pagesChina Going Global Strategy Finalmaarghe87No ratings yet

- Gautam Sen: Post-Reform China and The International EconomyDocument16 pagesGautam Sen: Post-Reform China and The International EconomyPrasanna KumarNo ratings yet

- Index: FDI (Foreign Direct Investement)Document73 pagesIndex: FDI (Foreign Direct Investement)Arvind Sanu MisraNo ratings yet

- Oecd Global Forum On International InvestmentDocument16 pagesOecd Global Forum On International InvestmentGajendra DeshmukhNo ratings yet

- Does Urbanization Promote FDIDocument10 pagesDoes Urbanization Promote FDIsaraNo ratings yet

- Chinese Overseas Investment in The EuropDocument13 pagesChinese Overseas Investment in The EuropSafal AryalNo ratings yet

- Foreign Direct Investment PaperDocument14 pagesForeign Direct Investment PaperJavier Fernandez RodriguezNo ratings yet

- IDFI in ChinaDocument17 pagesIDFI in ChinaSuoh MikotoNo ratings yet

- IBT Lesson 5Document19 pagesIBT Lesson 5De Leon LeizylNo ratings yet

- FDI in China Dullien 2005Document29 pagesFDI in China Dullien 2005Hans Grungilungi ChristianNo ratings yet

- FDI: Its Importance: Foreign Direct InvestmentDocument24 pagesFDI: Its Importance: Foreign Direct InvestmentbhagypowaleNo ratings yet

- I. Importance of Foreign Direct Investment in Pakistan: InternationalDocument21 pagesI. Importance of Foreign Direct Investment in Pakistan: InternationalAmna KarimNo ratings yet

- Foreign Direct Investment Vietnam OverviewDocument20 pagesForeign Direct Investment Vietnam OverviewHuyềnTrang NguyễnNo ratings yet

- Japan'S Current Trends in Foregin Direct Investments FDI 90sDocument3 pagesJapan'S Current Trends in Foregin Direct Investments FDI 90sMaria P. GonzalezNo ratings yet

- Chap 007Document23 pagesChap 007anispidy007No ratings yet

- CHAPTERDocument4 pagesCHAPTERabhaybittuNo ratings yet

- Foreign Direct Investment in China Effects On Growth and Economic PerformanceDocument30 pagesForeign Direct Investment in China Effects On Growth and Economic PerformanceSolitary1909No ratings yet

- Checked ChinaDocument11 pagesChecked ChinaWaqas HussainNo ratings yet

- 79 Tarmidi LepiDocument29 pages79 Tarmidi LepiEdi SuryadiNo ratings yet

- Vishnu FdiDocument102 pagesVishnu FdiVishnuNadarNo ratings yet

- Fdi Impact Iferp Ext - 14273Document4 pagesFdi Impact Iferp Ext - 14273Naresh GuduruNo ratings yet

- Foreign Direct InvestmentDocument5 pagesForeign Direct InvestmentUdit SethiNo ratings yet

- Remodelling of Investment Activity Worldwide Within The World Economic CrisisDocument10 pagesRemodelling of Investment Activity Worldwide Within The World Economic CrisisMihaela NicoaraNo ratings yet

- CHINA Import & ExportDocument15 pagesCHINA Import & ExportShishir BorkarNo ratings yet

- Economic Reform and Development in ChinaDocument51 pagesEconomic Reform and Development in ChinavickyvishwaNo ratings yet

- Impact of FDI in IndiaDocument24 pagesImpact of FDI in IndiaBinoy JoseNo ratings yet

- ChinaDocument30 pagesChinaUsama NaseemNo ratings yet

- First Draft International Finance 2.0Document8 pagesFirst Draft International Finance 2.0VANNDASAMBATH CHHUONNo ratings yet

- Munculnya Dan Evolusi Perusahaan Multinasional Dari Hongkong Dan SingapuraDocument6 pagesMunculnya Dan Evolusi Perusahaan Multinasional Dari Hongkong Dan SingapuraTaufikHidayatNo ratings yet

- Unit Iv: 111 Foreign Direct InvestmentDocument18 pagesUnit Iv: 111 Foreign Direct InvestmentgprapullakumarNo ratings yet

- 2007 11 30 - China SWFDocument3 pages2007 11 30 - China SWFomartinbobanNo ratings yet

- Foreign Direct Investment Bharth Cohesion To EmploymentDocument24 pagesForeign Direct Investment Bharth Cohesion To EmploymentBharath GudiNo ratings yet

- 2 The Extent and Patters of Foreign Direct Investment: by Anil KhadkaDocument38 pages2 The Extent and Patters of Foreign Direct Investment: by Anil KhadkaAnil KhadkaNo ratings yet

- FDI in China VCU200903 StudentsDocument69 pagesFDI in China VCU200903 StudentsaniketbadraNo ratings yet

- Foreign Direct Investment Cohesion To EmploymentDocument25 pagesForeign Direct Investment Cohesion To EmploymentChandan SrivastavaNo ratings yet

- Yasheng Huang - How Did China Take OffDocument25 pagesYasheng Huang - How Did China Take OffJun QianNo ratings yet

- The Impact of Foreign Direct Investment For Economic Growth: A Case Study in Sri LankaDocument21 pagesThe Impact of Foreign Direct Investment For Economic Growth: A Case Study in Sri LankaTanay SoniNo ratings yet

- The Internationalization of Chinese and Indian Firms: Trends, Motivations and Policy ImplicationsDocument8 pagesThe Internationalization of Chinese and Indian Firms: Trends, Motivations and Policy ImplicationsMudit VermaNo ratings yet

- Report EconomicsDocument10 pagesReport EconomicsAJ GamerNo ratings yet

- The US China Trade War Dominance of Trade or TechnologyDocument7 pagesThe US China Trade War Dominance of Trade or TechnologyunkownNo ratings yet

- China Engaging in The World EconomyDocument2 pagesChina Engaging in The World EconomyAlyanna CabralNo ratings yet

- The Role of Multinational Enterprises in Globalization: An Empirical OverviewDocument32 pagesThe Role of Multinational Enterprises in Globalization: An Empirical OverviewHussnain AliNo ratings yet

- China's Global Investment Strategy-NewDocument32 pagesChina's Global Investment Strategy-NewЮлия ВитеньNo ratings yet

- Foreign Direct Investment (Fdi) : Nature and ScopeDocument4 pagesForeign Direct Investment (Fdi) : Nature and ScopeMaithili DicholkarNo ratings yet

- General Trends in FDIDocument2 pagesGeneral Trends in FDIGabyNo ratings yet

- Hughes - Crony CapitalismDocument7 pagesHughes - Crony CapitalismAntonio JoséNo ratings yet

- Part X - The Dominant Causes of The Credit Crisis: The Threat of China's Bulging ExportsDocument16 pagesPart X - The Dominant Causes of The Credit Crisis: The Threat of China's Bulging ExportsAnchorageInvestmentsNo ratings yet

- Foreign Direct InvestmentDocument11 pagesForeign Direct Investmentmoras990% (1)

- Evolutie 2016-2021Document20 pagesEvolutie 2016-2021alexandrapadurean12No ratings yet

- Hasit Shah June 10, 2014 INBS 562 - Takeaway PaperDocument6 pagesHasit Shah June 10, 2014 INBS 562 - Takeaway PaperHasit ShahNo ratings yet

- The New International Financial SystemDocument10 pagesThe New International Financial SystemSüßeNo ratings yet

- Globalisation of Indian EconomyDocument11 pagesGlobalisation of Indian EconomyK H Irfan HarisNo ratings yet

- Habitat International: Eddie C.M. Hui, Ka Kwan Kevin ChanDocument9 pagesHabitat International: Eddie C.M. Hui, Ka Kwan Kevin Chanit's meNo ratings yet

- Answer To ChinaDocument7 pagesAnswer To ChinaAnkit TejwaniNo ratings yet

- China GroupDocument28 pagesChina GroupAndrew OrbetaNo ratings yet

- Shaping Globalization: New Trends in Foreign Direct InvestmentFrom EverandShaping Globalization: New Trends in Foreign Direct InvestmentNo ratings yet

- LabExercise 4Document1 pageLabExercise 4pankajkapseNo ratings yet

- LabExercise 3Document1 pageLabExercise 3pankajkapseNo ratings yet

- LabExercise 1Document1 pageLabExercise 1pankajkapseNo ratings yet

- Be GD 4Document3 pagesBe GD 4pankajkapseNo ratings yet

- Be Group ExerciseDocument3 pagesBe Group ExercisepankajkapseNo ratings yet

- Be Case 2Document3 pagesBe Case 2pankajkapseNo ratings yet

- Be GD 3Document3 pagesBe GD 3pankajkapseNo ratings yet

- BE SeminarDocument3 pagesBE SeminarpankajkapseNo ratings yet

- Be GD 2Document3 pagesBe GD 2pankajkapseNo ratings yet

- BE SeminarDocument3 pagesBE SeminarpankajkapseNo ratings yet

- Be GD 1Document3 pagesBe GD 1pankajkapseNo ratings yet

- BE SeminarDocument5 pagesBE SeminarpankajkapseNo ratings yet

- Be Case 1Document5 pagesBe Case 1pankajkapseNo ratings yet

- rAJURI sTEEL COMPANY PROFILEDocument59 pagesrAJURI sTEEL COMPANY PROFILEpankajkapse100% (1)

- Seminar Report: I: Subject: Business Environment Mba Sy Sem IiiDocument5 pagesSeminar Report: I: Subject: Business Environment Mba Sy Sem IiipankajkapseNo ratings yet

- Product Life Cycle PLC: Managing PLC For ITC-ScissorsDocument18 pagesProduct Life Cycle PLC: Managing PLC For ITC-ScissorspankajkapseNo ratings yet

- BE SeminarDocument3 pagesBE SeminarpankajkapseNo ratings yet

- BE SeminarDocument3 pagesBE SeminarpankajkapseNo ratings yet

- Bank of India PANKAJDocument3 pagesBank of India PANKAJpankajkapseNo ratings yet

- Importance of D MDocument3 pagesImportance of D MpankajkapseNo ratings yet

- Final JRD TataDocument65 pagesFinal JRD TatapankajkapseNo ratings yet

- Business The Law - (Pages 749 To 816)Document68 pagesBusiness The Law - (Pages 749 To 816)Tường ĐứcNo ratings yet

- Power in Nigeria:: The Decade of GasDocument8 pagesPower in Nigeria:: The Decade of GasIsmail AdebiyiNo ratings yet

- PSC WV American Water Surcharge 2023Document22 pagesPSC WV American Water Surcharge 2023Shayla KleinNo ratings yet

- Response To CampbellDocument4 pagesResponse To CampbellUrvi VarmaNo ratings yet

- Microeconomics SyllabusDocument3 pagesMicroeconomics SyllabusPaulyne Pascual100% (1)

- Emapnlled Agencies / Firms For Conducting The "Baseline Energy Audit Under PAT Scheme " Sector-WiseDocument6 pagesEmapnlled Agencies / Firms For Conducting The "Baseline Energy Audit Under PAT Scheme " Sector-WiseKBMANAGEMENT HRNo ratings yet

- Kel 10 AF-Tugas Kelompok1Document6 pagesKel 10 AF-Tugas Kelompok1sinuraya12No ratings yet

- Volatile: Strategies For Volatile ViewDocument12 pagesVolatile: Strategies For Volatile ViewAshutosh ChauhanNo ratings yet

- YDS DERS 13 - Tenses Soru ÇözümüDocument5 pagesYDS DERS 13 - Tenses Soru ÇözümüDoruk UlucanNo ratings yet

- Financial Management TransformationDocument2 pagesFinancial Management TransformationIshita MakkerNo ratings yet

- Narula2020 Article PolicyOpportunitiesAndChallengDocument9 pagesNarula2020 Article PolicyOpportunitiesAndChallengrasel miahNo ratings yet

- AS 14 Amalgamation and Absorption ChapterDocument20 pagesAS 14 Amalgamation and Absorption ChapternshklwrNo ratings yet

- 04 Inventory EstimationDocument5 pages04 Inventory EstimationWinnie ToribioNo ratings yet

- THE - LSP: Pt. Lintang DirgantaraDocument17 pagesTHE - LSP: Pt. Lintang DirgantaraTHERON LSPNo ratings yet

- Art. 1164. The Creditor Has A Right To The Fruits of The Thing From The Time The Obligation ToDocument3 pagesArt. 1164. The Creditor Has A Right To The Fruits of The Thing From The Time The Obligation ToKinitDelfinCelestial100% (3)

- FABM 2 Module 1Document16 pagesFABM 2 Module 1Rene Castillo JrNo ratings yet

- IxamBee - Important Chapters of Pupular Books For Phase 2 of RBI Grade B ExamDocument3 pagesIxamBee - Important Chapters of Pupular Books For Phase 2 of RBI Grade B ExamMahima SolankiNo ratings yet

- Strategic Swing Trading (PDFDrive)Document98 pagesStrategic Swing Trading (PDFDrive)geokennyNo ratings yet

- Income Tax Department: Challan ReceiptDocument2 pagesIncome Tax Department: Challan Receiptdebaditya2008No ratings yet

- The Empirical Analysis of Agricultural Exports and Economic Growth in NigeriaDocument10 pagesThe Empirical Analysis of Agricultural Exports and Economic Growth in NigeriaYusif AxundovNo ratings yet

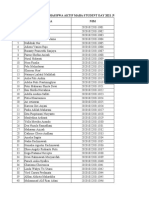

- Daftar Hadir Peserta Maba Student Day 2021 Minggu Ke-5Document55 pagesDaftar Hadir Peserta Maba Student Day 2021 Minggu Ke-5Tiara Arana MaudyNo ratings yet

- Test 4Document2 pagesTest 4KoemiNo ratings yet

- Ace Construction CoDocument2 pagesAce Construction CoNUR FARRAH SYAKIRAH AMRANNo ratings yet

- Project Report On Paper BagsDocument1 pageProject Report On Paper Bagsmr57863% (8)

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaRaquel Villar DayaoNo ratings yet

- Corr Case StudiesDocument5 pagesCorr Case StudiesPrashant ChavanNo ratings yet

- 1st PageDocument1 page1st Pagegullu316No ratings yet

- International Finance 3Document24 pagesInternational Finance 3Rahul BambhaNo ratings yet